Global Diagnostic Tests Market

Market Size in USD Billion

CAGR :

%

USD

286.36 Billion

USD

545.94 Billion

2024

2032

USD

286.36 Billion

USD

545.94 Billion

2024

2032

| 2025 –2032 | |

| USD 286.36 Billion | |

| USD 545.94 Billion | |

|

|

|

|

Diagnostic Tests Market Size

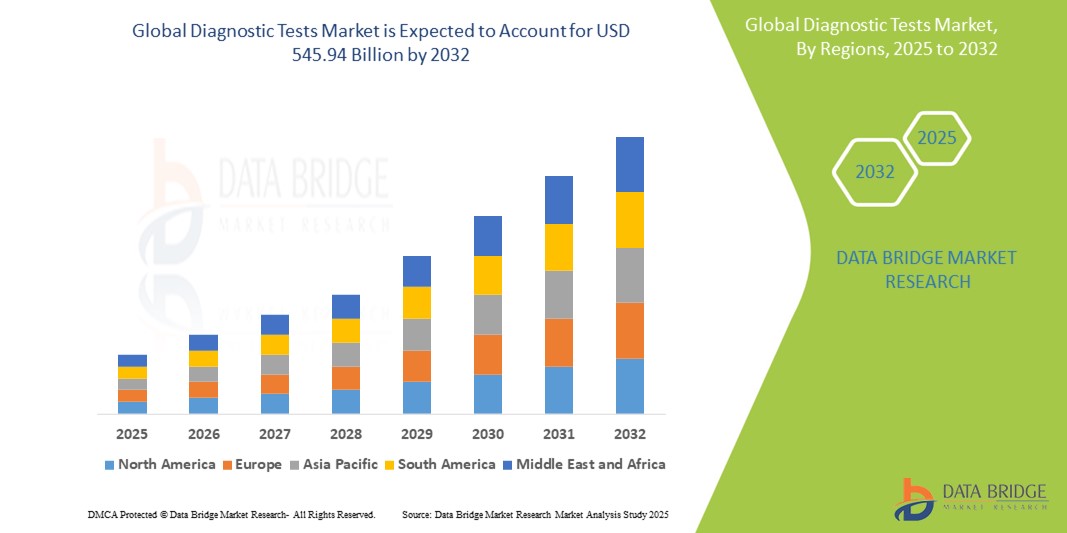

- The global diagnostic tests market size was valued at USD 286.36 billion in 2024 and is expected to reach USD 545.94 billion by 2032, at a CAGR of 8.4% during the forecast period

- The Market expansion is strongly driven by rising prevalence of chronic and infectious diseases, prompting increased demand for early and accurate diagnostic tools across healthcare systems worldwide

- Moreover, technological innovations such as point-of-care testing, AI-integrated diagnostics, and molecular diagnostics are transforming the landscape, enhancing accuracy and accessibility. These trends are intensifying adoption and driving robust growth in the diagnostic tests market

Diagnostic Tests Market Analysis

- Diagnostic tests, offering laboratory-based or point-of-care detection for a range of diseases and conditions, are increasingly vital components of modern healthcare systems in both clinical and home settings due to their enhanced accuracy, rapid results, and seamless integration with digital health platforms

- The escalating demand for diagnostic tests is primarily fueled by the rising global prevalence of chronic and infectious diseases, growing emphasis on early disease detection, and a rising preference for personalized and preventive healthcare solutions

- North America dominated the diagnostic tests market with the largest revenue share of 42.5% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and a strong presence of key industry players, with the U.S. experiencing substantial growth in molecular and genetic testing, particularly in hospitals and specialty clinics, driven by innovations in PCR and next-generation sequencing technologies

- Asia-Pacific is expected to be the fastest growing region in the diagnostic tests market during the forecast period due to increasing healthcare access and rising public and private investments in diagnostic infrastructure

- Routine Tests segment dominated the diagnostic tests market with a market share of 63.82% in 2024, driven by its widespread use in regular health checkups, early disease detection, and chronic disease monitoring across diverse healthcare settings

Report Scope and Diagnostic Tests Market Segmentation

|

Attributes |

Diagnostic Tests Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Diagnostic Tests Market Trends

“Advancements in AI and At-Home Diagnostics Integration”

- A significant and accelerating trend in the global diagnostic tests market is the integration of artificial intelligence (AI) with digital diagnostic platforms and at-home testing solutions, substantially enhancing diagnostic accuracy, speed, and accessibility across various care settings

- For instance, AI-powered platforms such as PathAI and Aidoc assist clinicians by rapidly interpreting complex imaging and pathology data, while at-home diagnostic tools such as Cue Health and LetsGetChecked offer smartphone-enabled testing kits for infectious diseases and general health monitoring

- AI in diagnostics enables features such as predictive analytics, real-time result interpretation, and clinical decision support, improving diagnostic precision and reducing turnaround times. Some platforms also adapt and learn from patient data to refine testing recommendations, enhancing personalized care

- The integration of AI with remote testing devices facilitates decentralized diagnostics, empowering users to self-monitor conditions such as diabetes, cholesterol, or infections with minimal clinical intervention. Test results can be seamlessly shared with healthcare providers through connected apps or telehealth platforms

- This trend is driving the development of intelligent diagnostic ecosystems, where wearable sensors, AI algorithms, and mobile diagnostics converge to offer proactive and personalized healthcare monitoring

- The demand for AI-enhanced, user-friendly diagnostic tools is rapidly growing in both clinical and home settings, as healthcare systems shift toward early detection, patient empowerment, and scalable digital health solutions.

Diagnostic Tests Market Dynamics

Driver

“Rising Demand Due to Increasing Chronic Diseases and Preventive Healthcare Focus”

- The growing global burden of chronic and infectious diseases, combined with a strong shift toward preventive healthcare practices, is a key driver for the rising demand for diagnostic tests across clinical and home-based settings

- For instance, in March 2024, Roche Diagnostics launched new high-throughput PCR platforms aimed at faster screening of chronic illnesses and infectious agents, enhancing diagnostic accessibility and efficiency. Such advancements by leading players are expected to fuel market expansion in the coming years

- As healthcare systems prioritize early detection and timely intervention to reduce disease burden and treatment costs, diagnostic tests have become essential tools for screening, monitoring, and disease management across all age groups

- Furthermore, the rising emphasis on personalized medicine, driven by innovations in genomics and biomarker testing, is positioning diagnostics as a central component of tailored treatment plans

- The convenience and accuracy of modern diagnostic technologies, along with their ability to deliver actionable insights in real time, are encouraging both patients and providers to adopt regular testing. The growing availability of rapid, user-friendly tests and mobile-enabled diagnostics is also widening access in remote and underserved regions

Restraint/Challenge

“Data Privacy Concerns and High Cost of Advanced Diagnostic Technologies”

- Growing concerns over data privacy and the secure handling of sensitive health information pose a significant challenge to the broader adoption of advanced diagnostic solutions, particularly those integrated with AI or cloud-based platforms

- For instance, several regulatory bodies, including HIPAA in the U.S. and GDPR in the EU, have introduced stringent guidelines on patient data usage and storage, requiring diagnostic companies to implement robust cybersecurity and compliance frameworks

- Ensuring secure data transmission, storage, and patient consent management is essential for gaining user trust. Companies are increasingly investing in encryption technologies and blockchain-based systems to enhance data security in diagnostics

- In addition, the high cost of cutting-edge diagnostic technologies such as next-generation sequencing (NGS), molecular assays, and AI-based platforms limits access, especially in low- and middle-income countries and among underinsured populations. While basic tests remain affordable, advanced solutions often involve substantial equipment and operational costs

- Bridging these gaps through regulatory harmonization, cost-effective innovation, and scalable infrastructure will be key to expanding diagnostic access and maintaining sustainable growth across diverse healthcare environments.

Diagnostic Tests Market Scope

The market is segmented on the basis of type, component, technology, mode of testing, application, sample type, testing site, testing type, age group, end user, and distribution channel.

- By Type

On the basis of type, the diagnostic tests market is segmented into routine tests and specialized tests. The routine tests segment dominated the market with the largest market revenue share of 63.82% in 2024, driven by their widespread usage for common health assessments and cost-effectiveness. Routine tests are widely used across various healthcare settings due to their standardization and efficiency in early disease detection and monitoring.

Specialized tests are anticipated to witness the fastest growth rate during the forecast period, fueled by advancements in personalized medicine and increasing demand for precise diagnostics in complex diseases

- By Component

On the basis of components, the market is segmented into services and products. The services segment held the largest market share in 2024, due to the rising demand for diagnostic testing services in hospitals and diagnostic centers.

The products segment is expected to witness fastest growth during forecast period, driven by innovations in diagnostic reagents, instruments, and consumables essential for various testing procedures.

- By Technology

On the basis of technology, the market is segmented into immunoassay-based, PCR-based, next-generation sequencing, spectroscopy-based, chromatography-based, microfluidics, and others. Immunoassay-based technology dominated the market in 2024, due to its high sensitivity and broad application in detecting biomarkers.

CR-based technology is expected to exhibit the fastest growth during forecast period, driven by its critical role in molecular diagnostics and infectious disease detection, especially post-pandemic.

- By Mode Of Testing

On the basis of mode of testing, the market is segmented into prescription-based testing and OTC (over-the-counter) testing. Prescription-based testing held the larger market share in 2024, as it is widely used in clinical settings requiring professional supervision.

However, OTC testing is expected witness fastest growth during forecast period, due to increased consumer awareness, demand for convenience, and technological advancements enabling accurate home testing kits.

- By Application

On the basis of application, the market is segmented into oncology, cardiology, orthopedics, gastroenterology, gynecology, neurology, odontology, and others. Oncology accounted for the largest share in 2024, due to the rising prevalence of cancer and the need for early detection and monitoring.

Cardiology and other chronic disease-related diagnostic tests are expected to witness fastest growth, supported by increasing healthcare expenditure and aging populations.

- By Sample Type

On the basis of sample type, the market is segmented into blood, urine, saliva, sweat, hair, and others. Blood samples dominated the market in 2024, owing to their reliability and widespread use in various diagnostic tests.

Saliva and urine testing are expected to witness fastest growth from 2025 to 2032, as non-invasive alternatives, enhancing patient compliance and ease of sample collection.

- By Testing Site

On the basis of testing sites are the market is segmented into laboratory-based testing and at-home testing. Laboratory-based testing held the majority share in 2024, due to the availability of advanced equipment and professional expertise.

However, at-home testing is expected to witness fastest growth during forecast period, driven by consumer demand for convenience and rapid results, supported by technological advances.

- By Testing Type

On the basis of testing types the market is segmented into biochemistry, hematology, microbiology, histopathology, and others. Biochemistry dominated the market in 2024, due to its comprehensive role in diagnosing metabolic, organ function, and other systemic diseases.

Microbiology testing is expected to witness fastest growth during forecast period due to, the ongoing need for infectious disease management.

- By Age

On the basis of age, the market is segmented into geriatric, adult, and pediatric age groups. The adult segment held the largest share in 2024, owing to the higher disease burden and frequent need for diagnostics.

The pediatric segment is expected to grow at faster CAGR in 2025 to 2032, due to increased awareness and screening for congenital and infectious diseases in children.

- By End User

On the basis of end user, the market is segmented into hospitals, diagnostic centers, ambulatory surgical centers (ASCs), specialty clinics, homecare, blood banks, research labs & institutes, and others. Hospitals and diagnostic centers dominated the market with the highest revenue share in 2024, as they are primary facilities for diagnostic testing services.

The homecare segment is expected to witness fastest growth during forecast period, as home-based diagnostic services and telehealth expand globally.

- By Distribution Channel

On the basis of distribution channels, the market is segmented into direct tenders, retail sales, and online sales. Direct tenders dominated the market in 2024, due to bulk procurement by healthcare institutions.

Online sales are witnessing rapid growth during forecast period, driven by e-commerce expansion and increasing consumer preference for direct purchase of home diagnostic kits.

Diagnostic Tests Market Regional Analysis

- North America dominated the diagnostic tests market with the largest revenue share of 42.5% in 2024, driven by advanced healthcare infrastructure, high healthcare spending, and a strong presence of key industry players

- Consumers in the region highly value the accuracy, speed, and convenience offered by advanced diagnostic technologies, including molecular and genetic testing

- This widespread adoption is further supported by strong government initiatives, rising awareness of preventive healthcare, and increasing prevalence of chronic diseases, establishing diagnostic tests as an essential component of modern healthcare across hospitals, diagnostic centers, and homecare settings

U.S. Diagnostic Tests Market Insight

The U.S. diagnostic tests market captured the largest revenue share of 79% in North America in 2024, driven by advanced healthcare infrastructure and widespread adoption of cutting-edge diagnostic technologies. Rising awareness of preventive healthcare and chronic disease management fuels demand for routine and specialized diagnostic tests. Increasing integration of AI and digital health tools in diagnostics, coupled with a strong focus on personalized medicine, further accelerates market growth. The presence of major diagnostic companies and growing home-based testing options also contribute to the expanding U.S. market.

Europe Diagnostic Tests Market Insight

The Europe diagnostic tests market is projected to grow steadily, driven by stringent regulatory frameworks and rising healthcare expenditure. The region’s aging population and high prevalence of chronic diseases increase demand for early and accurate diagnostics. Increasing investments in molecular diagnostics and expanding reimbursement policies support adoption across hospitals and diagnostic centers. Furthermore, government initiatives promoting digital healthcare and integration of diagnostic tests into preventive health programs fuel the European market.

U.K. Diagnostic Tests Market Insight

The U.K. diagnostic tests market is expected to witness robust growth, supported by national health strategies emphasizing early disease detection and preventive care. Rising patient awareness and government funding for advanced diagnostic technologies drive market expansion. The U.K.’s developed healthcare system and growing home testing adoption, especially amid the rise of OTC diagnostic tests, contribute to steady demand. Moreover, the expansion of telehealth services facilitates greater access to diagnostic solutions

Germany Diagnostic Tests Market Insight

The Germany’s diagnostic tests market is anticipated to grow significantly, fueled by a strong healthcare infrastructure and growing investments in research and innovation. The country’s focus on precision medicine and increasing demand for next-generation sequencing and molecular diagnostics drive the market. Rising chronic disease burden and supportive reimbursement policies promote adoption in hospitals and specialty clinics. Emphasis on data security and regulatory compliance aligns with consumer expectations, strengthening market growth.

Asia-Pacific Diagnostic Tests Market Insight

The Asia-Pacific diagnostic tests market is poised to register the fastest CAGR during the forecast period, propelled by rapid urbanization, increasing healthcare expenditure, and growing awareness of early disease detection. Expanding healthcare infrastructure in countries such as China, India, and Japan, along with rising prevalence of lifestyle diseases, drives demand for routine and specialized tests. Government initiatives to improve healthcare access and digital health adoption further enhance market penetration. The region also benefits from cost-effective manufacturing and growing home-based testing.

Japan Diagnostic Tests Market Insight

The Japan’s diagnostic tests market is expanding steadily, driven by a high aging population requiring advanced diagnostics for chronic disease management. The country’s focus on integrating diagnostic testing with smart healthcare systems and IoT devices boosts adoption. Rising government support for healthcare innovation and preventive medicine programs stimulates growth. Demand for non-invasive and rapid diagnostic tests is increasing, especially in geriatric care and oncology.

India Diagnostic Tests Market Insight

The India accounted for the largest market revenue share in Asia-Pacific in 2024, owing to expanding healthcare infrastructure and increased focus on preventive healthcare. Rising middle-class population, urbanization, and government healthcare schemes drive demand for accessible diagnostic services. The growing presence of private diagnostic centers and rising penetration of affordable diagnostic technologies promote market expansion. In addition, increasing awareness of early disease diagnosis and telemedicine growth contribute to India’s rapidly developing diagnostic tests market.

Diagnostic Tests Market Share

The diagnostic tests industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthineers AG (Germany)

- Danaher Corporation (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- BIOMÉRIEUX (France)

- QIAGEN (Netherlands)

- Sysmex Corporation (Japan)

- Ortho Clinical Diagnostics (U.S.)

- Hologic, Inc. (U.S.)

- Cepheid (U.S.)

- Illumina, Inc. (U.S.)

- Genomic Health, Inc. (U.S.)

- Myriad Genetics, Inc. (U.S.)

- DiaSorin S.p.A. (Italy)

- THERADIAG (France)

- Exact Sciences Corporation (U.S.)

- Beckman Coulter, Inc. (U.S.)

What are the Recent Developments in Global Diagnostic Tests Market?

- In September 2024, researchers from the University of Chicago's Pritzker School of Molecular Engineering and UCLA's Samueli School of Engineering unveiled a novel diagnostic system that integrates a field-effect transistor with a paper-based analytical cartridge. This hybrid biosensor, enhanced by machine learning algorithms, demonstrated over 97% accuracy in measuring cholesterol levels in serum samples. The innovation combines the high sensitivity of transistor-based detection with the affordability and simplicity of paper-based tests, potentially revolutionizing at-home diagnostics for various health conditions

- In September 2024, ARCpoint Inc. expanded its collaboration with MD Care Group by enhancing its Application Programming Interface (API) to allow telehealth practitioners to order diagnostic tests directly through ARCpoint's MyARCpointLabs platform. This integration streamlines the process for virtual healthcare providers to facilitate diagnostic testing, thereby improving patient access to timely and convenient health assessments

- In August 2024, Qiagen and AstraZeneca announced the expansion of their partnership to develop companion diagnostics for chronic diseases beyond oncology. Utilizing Qiagen's QIAstat-Dx platform, the collaboration aims to create genotyping assays that can identify patients suitable for targeted therapies during routine clinical evaluations, marking a significant step towards personalized medicine in chronic disease management

- In June 2024, BioAI, a biotech firm specializing in artificial intelligence applications, partnered with Genomic Testing Cooperative to develop AI-driven digital pathology solutions. The collaboration focuses on creating genomic biomarker screening algorithms and assays, enhancing clinical research and diagnostic applications through advanced computational tools

- In June 2024, the World Health Organization (WHO) joined forces with ASEAN member states during a regional consultative meeting in Thailand to enhance access to quality diagnostic testing. The initiative aimed to support the development and implementation of National Essential Diagnostics Lists (NEDLs), ensuring that essential diagnostic tests are available and accessible across Southeast Asia

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.