Global Dicamba Herbicide For Cereals And Grains Market

Market Size in USD Billion

CAGR :

%

USD

4.05 Billion

USD

6.86 Billion

2025

2033

USD

4.05 Billion

USD

6.86 Billion

2025

2033

| 2026 –2033 | |

| USD 4.05 Billion | |

| USD 6.86 Billion | |

|

|

|

|

Dicamba Herbicide for Cereals and Grains Market Size

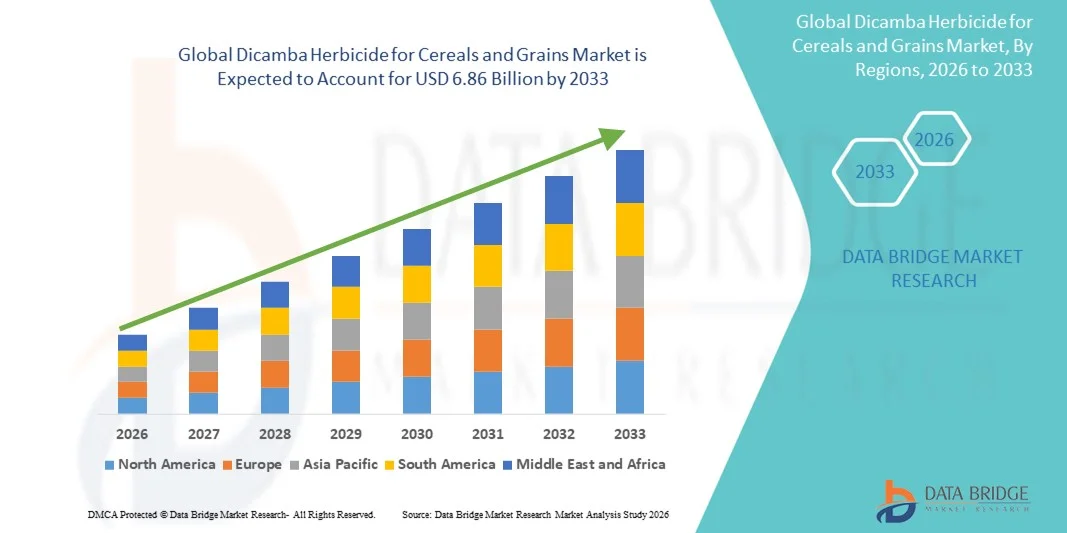

- The global dicamba herbicide for cereals and grains market size was valued at USD 4.05 billion in 2025 and is expected to reach USD 6.86 billion by 2033, at a CAGR of 6.80% during the forecast period

- The market growth is largely fueled by the increasing adoption of modern agricultural practices and precision farming technologies, which emphasize efficient weed management and higher crop yields in cereals and grains

- Furthermore, rising demand for effective post-emergence and pre-emergence herbicide solutions, along with innovations in low-volatility and environmentally safer dicamba formulations, is driving farmers to adopt these products more widely. These factors are accelerating the uptake of dicamba herbicides, thereby significantly boosting the industry’s growth

Dicamba Herbicide for Cereals and Grains Market Analysis

- Dicamba herbicides, providing broadleaf weed control in cereal and grain crops, are increasingly vital components of modern crop protection programs due to their efficacy, versatility in application timing, and compatibility with precision spraying systems

- The escalating demand for dicamba is primarily fueled by the expansion of cereal and grain cultivation globally, growing awareness of integrated weed management practices, and the need for formulations that minimize crop damage while ensuring effective weed suppression

- North America dominated the dicamba herbicide for cereals and grains market with a share of 49.5% in 2025, due to the extensive cultivation of cereals and grains, adoption of advanced farming practices, and high awareness of weed management solutions

- Asia-Pacific is expected to be the fastest growing region in the dicamba herbicide for cereals and grains market during the forecast period due to expanding cereal and grain cultivation, adoption of modern farming practices, and rising awareness about effective weed control in countries such as China, India, and Japan

- Liquid segment dominated the market with a market share of 63% in 2025, due to its ease of application, rapid absorption, and uniform coverage on crops. Farmers prefer liquid formulations for their compatibility with standard spraying equipment and ability to mix with other herbicides or fertilizers, enhancing operational efficiency. The segment also benefits from better efficacy under varying weather conditions, ensuring consistent weed control across large cereal and grain fields. Liquid dicamba is particularly valued for its quick action and ability to target broadleaf weeds effectively, contributing to higher crop yield and reduced labor costs

Report Scope and Dicamba Herbicide for Cereals and Grains Market Segmentation

|

Attributes |

Dicamba Herbicide for Cereals and Grains Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dicamba Herbicide for Cereals and Grains Market Trends

Adoption of Low-Volatility, Safer Dicamba Formulations

- A significant trend in the dicamba herbicide for cereals and grains market is the increasing adoption of low-volatility and environmentally safer formulations, driven by the need to minimize drift, reduce crop damage, and comply with stricter regulatory standards. These formulations are enhancing farmer confidence and enabling broader use across cereal and grain crops, positioning dicamba as a key solution for effective weed management

- For instance, BASF’s ultra low-volatility dicamba products and Albaugh’s Dicamba HD 5 offer improved stability under varying environmental conditions, providing reliable performance while addressing safety concerns. Such products are encouraging growers to integrate dicamba more widely into pre-emergence and post-emergence weed control programs

- The adoption of advanced dicamba formulations is rising in major cereal-producing regions where precision spraying techniques are increasingly implemented. This integration ensures targeted application, minimizes wastage, and enhances crop yield and quality

- Farmers are progressively replacing older dicamba products with these safer options, reflecting a broader shift towards sustainable and technology-driven crop protection practices

- The market is witnessing strong uptake in regions where regulatory compliance and environmental stewardship are critical factors, establishing dicamba as a preferred herbicide in modern agriculture

- Growing awareness among agronomists and farmers about the benefits of safer, low-drift formulations is further accelerating adoption, fostering long-term market growth and driving competition among agrochemical companies

Dicamba Herbicide for Cereals and Grains Market Dynamics

Driver

Growth of Modern Farming and Precision Agriculture

- The growing adoption of modern farming practices and precision agriculture is a key driver for dicamba herbicide demand, as farmers seek efficient, targeted weed control solutions to enhance crop productivity. These methods emphasize optimized application timing, dosage control, and minimal environmental impact, making dicamba a critical component of integrated crop management

- For instance, Nufarm’s WeedMaster XHL and other advanced dicamba products are increasingly used with precision spraying systems, allowing farmers to reduce herbicide wastage while improving efficacy. This synergy between formulation technology and precision equipment supports higher adoption rates and better yield outcomes

- The expansion of mechanized and digitally monitored farming operations is further reinforcing the importance of dicamba as an essential herbicide for cereals and grains

- The rising demand for sustainable and high-efficiency weed management solutions is pushing farmers to adopt dicamba in combination with modern agronomic practices

- The increasing emphasis on maximizing cereal and grain yields while minimizing environmental risks ensures continued growth for dicamba herbicides in global agricultural markets

Restraint/Challenge

Regulatory Restrictions on Dicamba Use

- The dicamba herbicide for cereals and grains market faces challenges due to stringent regulations and legal restrictions on over-the-top (OTT) applications, which limit the timing, formulation, and usage methods of dicamba products. Compliance with these rules is essential to prevent crop damage, environmental impact, and legal penalties

- For instance, regulatory actions in the U.S. have required companies such as BASF and Albaugh to introduce low-volatility formulations and limit certain applications to specific crops and growth stages, which constrains market flexibility

- Farmers must navigate complex usage guidelines, which can slow adoption rates and impact sales volume of traditional dicamba products

- Restrictions also affect the distribution and marketing strategies of agrochemical companies, requiring increased investment in compliance and training programs for end users

- These regulatory hurdles continue to challenge the widespread and unrestricted use of dicamba herbicides, influencing market dynamics and requiring companies to innovate safer, compliant solutions to sustain growth

Dicamba Herbicide for Cereals and Grains Market Scope

The market is segmented on the basis of physical form, time of application, and formulation.

- By Physical Form

On the basis of physical form, the dicamba herbicide for cereals and grains market for cereals and grains is segmented into liquid and dry. The liquid segment dominated the market with the largest revenue share of 63% in 2025, driven by its ease of application, rapid absorption, and uniform coverage on crops. Farmers prefer liquid formulations for their compatibility with standard spraying equipment and ability to mix with other herbicides or fertilizers, enhancing operational efficiency. The segment also benefits from better efficacy under varying weather conditions, ensuring consistent weed control across large cereal and grain fields. Liquid dicamba is particularly valued for its quick action and ability to target broadleaf weeds effectively, contributing to higher crop yield and reduced labor costs.

The dry segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing adoption in regions with limited water availability and mechanized application systems. Dry formulations, such as granules or powders, offer longer shelf life and simplified storage, reducing logistical challenges for distributors and farmers. Their controlled release properties enable gradual weed suppression, minimizing crop stress while maintaining effective coverage. The segment’s growth is also supported by innovations in dust-free granules that enhance safety and reduce off-target movement.

- By Time of Application

On the basis of time of application, the market is segmented into post-emergence and pre-emergence. The post-emergence segment held the largest market revenue share in 2025, driven by its ability to control weeds after crop emergence, providing farmers with flexibility to manage unexpected weed outbreaks. Post-emergence dicamba herbicides are widely preferred for their effectiveness against resistant weed species and capacity to be combined with other crop protection measures for enhanced results. The segment also benefits from advanced formulations that reduce crop injury while ensuring optimal weed mortality. Farmers value post-emergence application for improving overall crop health and maximizing yield potential during critical growth stages.

The pre-emergence segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing adoption in integrated weed management strategies. Pre-emergence dicamba application helps in preventing early weed competition, ensuring healthier crop establishment and reducing the need for multiple post-emergence treatments. For instance, companies such as BASF are innovating pre-emergence solutions that enhance soil persistence and targeted activity. The segment’s growth is further supported by increasing awareness among farmers of cost-saving and time-efficient weed management practices.

- By Formulation

On the basis of formulation, the dicamba herbicide for cereals and grains market for cereals and grains is segmented into salt and acid. The salt formulation segment dominated the market with the largest revenue share in 2025, driven by its enhanced water solubility, stability, and compatibility with various spray equipment. Salt-based dicamba is preferred for its rapid uptake by weeds and minimal crop phytotoxicity, providing consistent results across different soil types. The segment also benefits from easy integration with tank mixes, allowing farmers to optimize herbicide programs efficiently. Farmers increasingly rely on salt formulations for superior control of broadleaf weeds while maintaining crop safety.

The acid formulation segment is anticipated to witness the fastest growth from 2026 to 2033, fueled by rising demand for more concentrated and potent dicamba solutions in specialized applications. Acid-based formulations often require lower application volumes, offering cost efficiency and reduced environmental runoff. For instance, companies such as Corteva are developing acid formulations with improved volatilization control and enhanced weed selectivity. The segment’s growth is also supported by increasing adoption among farmers seeking targeted and high-efficacy herbicide solutions for cereals and grains.

Dicamba Herbicide for Cereals and Grains Market Regional Analysis

- North America dominated the dicamba herbicide for cereals and grains market with the largest revenue share of 49.5% in 2025, driven by the extensive cultivation of cereals and grains, adoption of advanced farming practices, and high awareness of weed management solutions

- Farmers in the region highly value the efficacy, reliability, and ease of application offered by dicamba herbicides, enabling better crop yields and reduced labor costs

- This widespread adoption is further supported by well-established agricultural infrastructure, access to modern spraying equipment, and government support for precision farming techniques, establishing dicamba as a preferred herbicide for cereals and grains

U.S. Dicamba Herbicide for Cereals and Grains Market Insight

The U.S. dicamba herbicide for cereals and grains market captured the largest revenue share in North America in 2025, fueled by large-scale cereal and grain production and increasing demand for effective post-emergence and pre-emergence weed control. Farmers prioritize herbicides that enhance yield quality and crop health while managing resistant weeds. The growing use of precision spraying systems, coupled with robust R&D by companies such as BASF and Corteva, further drives adoption, while government programs promoting sustainable farming and integrated weed management reinforce market growth.

Europe Dicamba Herbicide for Cereals and Grains Market Insight

The Europe dicamba herbicide for cereals and grains market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing adoption of modern farming techniques, stringent crop protection regulations, and growing demand for cereals and grains. Farmers are adopting formulations that offer efficient weed suppression with minimal crop impact, supporting both yield and sustainability goals. The market is witnessing growth across large-scale commercial farms and smallholder operations integrating advanced herbicide solutions into their crop management programs.

U.K. Dicamba Herbicide for Cereals and Grains Market Insight

The U.K. dicamba herbicide for cereals and grains market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising awareness of crop protection and the need for higher cereal and grain yields. Farmers are increasingly adopting post-emergence dicamba to manage resistant weeds effectively, while the country’s robust agricultural infrastructure and precision spraying practices continue to drive market expansion across both commercial and smallholder farms.

Germany Dicamba Herbicide for Cereals and Grains Market Insight

The Germany dicamba herbicide for cereals and grains market is expected to expand at a considerable CAGR during the forecast period, driven by precision agriculture initiatives, sustainable farming practices, and increased awareness about effective weed management. Farmers are integrating dicamba formulations into crop protection programs for cereals and grains to ensure consistent yield quality, while growing adoption of modern spraying technologies supports broader market penetration across commercial and large-scale farms.

Asia-Pacific Dicamba Herbicide for Cereals and Grains Market Insight

The Asia-Pacific dicamba herbicide for cereals and grains market is poised to grow at the fastest CAGR during 2026–2033, fueled by expanding cereal and grain cultivation, adoption of modern farming practices, and rising awareness about effective weed control in countries such as China, India, and Japan. Government initiatives promoting agricultural mechanization and crop protection solutions, coupled with increased availability of cost-effective dicamba herbicides, are driving adoption among both small and large-scale farmers, while growing agricultural modernization is further supporting market growth.

Japan Dicamba Herbicide for Cereals and Grains Market Insight

The Japan dicamba herbicide for cereals and grains market is gaining momentum due to limited arable land, a strong focus on crop productivity, and adoption of technologically advanced farming solutions. Farmers are increasingly utilizing post-emergence dicamba for effective weed management, while precision spraying equipment and eco-friendly formulations support higher efficiency and safety. The combination of high-tech agriculture and increasing demand for cereals and grains is fueling steady market growth across both commercial and residential farms.

China Dicamba Herbicide for Cereals and Grains Market Insight

The China dicamba herbicide for cereals and grains market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to large-scale cereal and grain farming, rapid adoption of modern agronomic practices, and strong domestic herbicide production. Farmers are prioritizing formulations that provide broad-spectrum weed control and efficiency in both pre-emergence and post-emergence applications. Government support for agricultural modernization, alongside major domestic manufacturers, is propelling adoption, making China the leading market for dicamba herbicides in the region.

Dicamba Herbicide for Cereals and Grains Market Share

The dicamba herbicide for cereals and grains industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Corteva (U.S.)

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta (Switzerland)

- Nufarm US (U.S.)

- Helena Agri-Enterprises, LLC (U.S.)

- The Andersons, Inc. (U.S.)

- Albaugh, LLC (U.S.)

- Alligare, LLC (U.S.)

- Shanghai AgroChina Chemical Co., Ltd. (China)

Latest Developments in Global Dicamba Herbicide for Cereals and Grains Market

- In July 2025, BASF filed a proposed registration with the United States Environmental Protection Agency (EPA) for new dicamba-based herbicide products targeting broadleaf weed control in dicamba-tolerant crops. This initiative is expected to re-enable large-scale use of dicamba under stricter safety and environmental guidelines, reinforcing BASF’s position as a market leader. By offering formulations designed for enhanced crop safety and reduced volatility, BASF is likely to regain farmer confidence and expand its adoption across major cereal and grain-growing regions in the U.S., directly impacting market growth and competitive dynamics

- In March 2025, Nufarm Ltd. registered a new dicamba-based herbicide, WeedMaster XHL, adding a high-performance solution to its existing portfolio. This registration strengthens Nufarm’s market presence by providing farmers with an effective tool for both pre-emergence and post-emergence weed management in cereals and grains. The product’s advanced formulation aims to improve weed control efficiency while reducing crop stress, increasing operational convenience for farmers, and enhancing Nufarm’s competitiveness in regions with high cereal cultivation

- In February 2025, BASF launched an upgraded “ultra low-volatility” dicamba formulation engineered for improved stability under high-temperature and low-humidity conditions, while minimizing drift. This innovation addresses both environmental concerns and regulatory restrictions, offering growers a safer, more reliable application method. The product’s performance advantages are expected to accelerate adoption among farmers seeking consistent weed control in challenging climates, potentially boosting BASF’s market share and reinforcing its reputation for sustainable, technologically advanced herbicides

- In February 2024, following a legal ruling that vacated prior registrations for over-the-top dicamba use, the EPA issued an “Existing Stocks Order” allowing limited sale and distribution of existing dicamba products. Leading companies such as BASF leveraged this period to emphasize their next-generation low-volatility formulations, highlighting compliance and safety benefits. This regulatory shift temporarily constrained market supply, increased demand for newly registered products, and incentivized innovation, shaping the competitive landscape and encouraging farmers to adopt safer and more effective dicamba solutions

- In January 2023, Albaugh LLC introduced Dicamba HD 5 and Dicamba DMA Salt 5 after securing regulatory approval in the U.S. These launches expanded Albaugh’s portfolio and provided farmers with more versatile, effective options for broadleaf weed management in cereals and grains. By offering formulations designed for improved solubility, rapid uptake, and enhanced crop safety, Albaugh strengthened its position in the North American market, increased accessibility for growers, and contributed to more efficient, higher-yielding cereal and grain production

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.