Global Dicamba Market

Market Size in USD Million

CAGR :

%

USD

650.71 Million

USD

1,222.38 Million

2024

2032

USD

650.71 Million

USD

1,222.38 Million

2024

2032

| 2025 –2032 | |

| USD 650.71 Million | |

| USD 1,222.38 Million | |

|

|

|

|

Dicamba Market Size

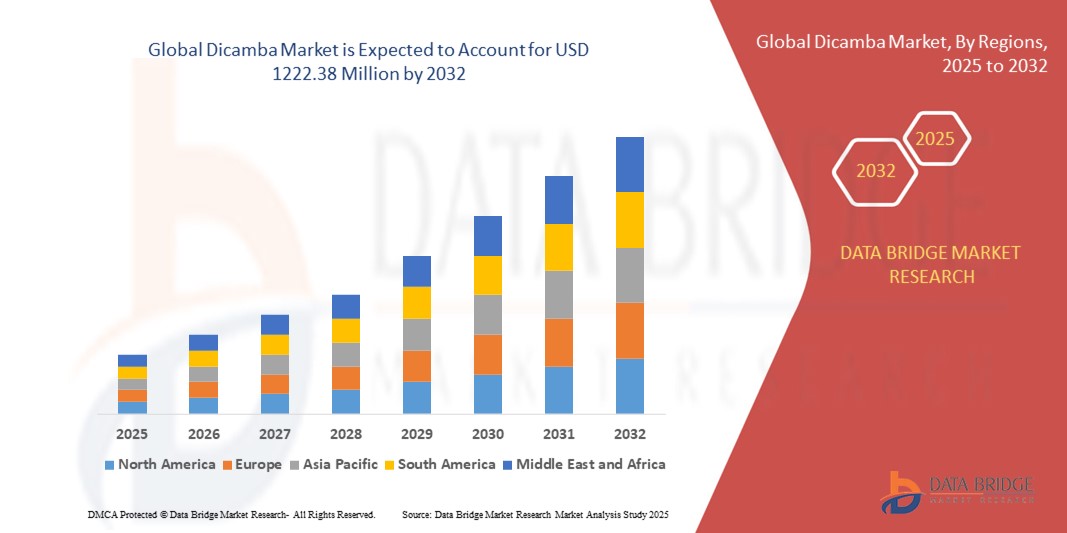

- The global dicamba market size was valued at USD 650.71 million in 2024 and is expected to reach USD 1222.38 million by 2032, at a CAGR of 8.2% during the forecast period

- The market growth is largely fueled by the increasing need for effective weed management solutions in major crop-producing regions, driven by the rise of herbicide-resistant weeds and the growing adoption of modern agricultural practices

- Furthermore, advancements in Dicamba formulations, coupled with regulatory approvals for safer and crop-tolerant applications, are enabling farmers to achieve higher yields and better crop protection. These converging factors are accelerating the adoption of Dicamba herbicides, thereby significantly boosting the market’s growth

Dicamba Market Analysis

- Dicamba is a selective herbicide used primarily to control broadleaf weeds in crops such as soybeans, cereals, and oilseeds. It is available in liquid and dry formulations and can be applied pre-emergence or post-emergence, providing flexibility for different crop management strategies

- The escalating demand for Dicamba is primarily driven by the need for sustainable and efficient weed control solutions, the rise of herbicide-tolerant crop varieties, and growing awareness among farmers about precision agriculture practices that enhance crop yield while minimizing environmental impact

- North America dominated the dicamba market with a share of 49.2% in 2024, due to the extensive cultivation of cereals, grains, and oilseeds, along with increasing awareness of effective weed management solutions

- Asia-Pacific is expected to be the fastest growing region in the dicamba market during the forecast period due to increasing agricultural mechanization, rising crop acreage, and demand for higher crop yields in countries such as China, India, and Japan

- Liquid segment dominated the market with a market share of 64.4% in 2024, due to its ease of application and faster absorption by plants. Liquid Dicamba formulations allow uniform spraying across large agricultural fields, ensuring effective weed control and minimizing crop damage. Farmers often prefer liquid forms due to their compatibility with common spraying equipment and ability to cover extensive areas efficiently. The segment’s dominance is further strengthened by extensive adoption in commercial agriculture and regulatory approvals favoring liquid herbicides. Moreover, liquid Dicamba offers faster onset of action, which is critical for managing resistant weed species and optimizing crop yields

Report Scope and Dicamba Market Segmentation

|

Attributes |

Dicamba Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dicamba Market Trends

Increasing Adoption of Genetically Modified (GM) Crops Resistant

- The adoption of dicamba-tolerant genetically modified crops is growing rapidly as farmers seek more effective solutions to manage resistant weeds. By enabling direct use of dicamba, these crops increase crop yields while promoting efficient land utilization and better weed control across large farming areas

- For instance, Bayer AG has been at the forefront of promoting dicamba-tolerant soybean and cotton varieties that work synergistically with dicamba herbicides. This integration significantly improves weed management while helping farmers reduce crop loss and ensure higher productivity

- The rising prevalence of herbicide-resistant weeds such as Palmer amaranth and waterhemp has created urgent need for alternative herbicide systems. Dicamba, with its broad-spectrum control, offers farmers an effective resistance-management tool within integrated weed-control strategies

- In addition, global agricultural practices are shifting toward crop systems that offer sustainability and efficiency. Dicamba-resistant GM crops allow for fewer passes of herbicide spraying, reducing fuel usage, labor, and emissions while improving farm efficiency and profitability

- The adoption of dicamba is also supported by increasing cultivation of GM crops in markets across North and South America, which have become key regions driving commercial demand. Rising approvals for dicamba-resistant crops in new geographies are further reinforcing growth momentum

- Together, these are shaping the dicamba market as farmers embrace efficient solutions to meet rising global food demand. The future of dicamba adoption is closely tied to GM crop expansion and the ongoing fight against evolving weed resistance

Dicamba Market Dynamics

Driver

Innovations in Application Methods and Formulations

- Technological advancements in dicamba formulations and application methods are improving performance while addressing challenges such as herbicide drift and volatilization. New solutions allow farmers to achieve higher application precision and minimize risks to non-target crops and the environment

- For instance, BASF introduced dicamba formulations with lower volatility and improved stability to reduce unintended drift onto surrounding crops. These innovations are helping farmers apply dicamba more effectively while adhering to stricter regulatory requirements

- The growing use of advanced spraying technologies supports optimized herbicide delivery. Precision spraying, buffer-zone regulations, and drift-reduction nozzles are enhancing farmers’ ability to safely integrate dicamba into weed control strategies with improved efficiency

- In addition, rising adoption of tank-mix strategies with complementary herbicides is boosting dicamba’s effectiveness. This approach improves resistance management while extending the lifecycle of dicamba as a viable weed-control option in high-demand markets

- The emphasis on improved formulations and integrated weed-control systems highlights dicamba’s adaptability. As innovations continue to address safety and efficiency concerns, these developments will solidify dicamba’s role in sustainable agricultural practices and reinforce market growth prospects

Restraint/Challenge

Environmental Impact of Herbicides

- One of the key challenges limiting dicamba adoption is its association with environmental impact, particularly concerns around drift, volatilization, and unintended damage to neighboring vegetation. Dicamba’s mobility raises issues for ecosystems and adjacent farms that do not use GM crops

- For instance, there have been reported lawsuits in the United States involving farmers who experienced crop losses attributed to dicamba drift from neighboring fields. Companies such as Bayer have faced scrutiny and legal challenges related to this environmental concern

- Such incidents have led to heightened regulatory restrictions around use timing, buffer zones, and spraying conditions. Compliance with these guidelines often increases complexity for farmers and constrains the adoption of dicamba-based solutions in sensitive agricultural areas

- In addition, broader societal concerns about herbicide dependence and biodiversity loss continue to influence public sentiment. Non-governmental organizations and consumer awareness campaigns are pushing for sustainable alternatives, adding further pressure on industry players

- Addressing these environmental concerns requires innovations in safer formulations, stronger farmer education, and stricter compliance frameworks. The ability of companies and farmers to navigate these challenges will be pivotal in determining the long-term future of the dicamba market

Dicamba Market Scope

The market is segmented on the basis of form, time of application, and crop type.

- By Form

On the basis of form, the Dicamba market is segmented into liquid and dry. The liquid segment dominated the largest market revenue share of 64.4% in 2024, owing to its ease of application and faster absorption by plants. Liquid Dicamba formulations allow uniform spraying across large agricultural fields, ensuring effective weed control and minimizing crop damage. Farmers often prefer liquid forms due to their compatibility with common spraying equipment and ability to cover extensive areas efficiently. The segment’s dominance is further strengthened by extensive adoption in commercial agriculture and regulatory approvals favoring liquid herbicides. Moreover, liquid Dicamba offers faster onset of action, which is critical for managing resistant weed species and optimizing crop yields.

The dry segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for pre-mixed, ready-to-use formulations that reduce storage and handling challenges. Dry formulations offer longer shelf life, ease of transport, and reduced risk of spillage or environmental contamination. Smallholder farmers and regions with limited spraying infrastructure are increasingly adopting dry Dicamba products for convenience and safety. In addition, innovations in granular and water-dispersible dry formulations are enhancing efficacy and broadening application opportunities across diverse crops.

- By Time of Application

On the basis of time of application, the Dicamba market is segmented into post-emergence and pre-emergence. The post-emergence segment dominated the largest market revenue share in 2024, driven by its effectiveness in controlling broadleaf weeds after crop germination. Post-emergence Dicamba applications allow farmers to target specific weed growth stages without affecting established crops, making it a preferred choice for cereals, oilseeds, and forage crops. Its precision application and compatibility with modern spraying technologies contribute to better crop yield and operational efficiency. The segment also benefits from widespread regulatory approvals and farmer familiarity with timing-based application practices.

The pre-emergence segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing awareness of early-stage weed management to prevent competition with crops. Pre-emergence Dicamba helps in establishing a clean field at the start of the crop season, reducing labor and post-emergence intervention costs. The development of controlled-release formulations and safer application technologies is further boosting adoption. Moreover, pre-emergence use aligns with sustainable agricultural practices by reducing repeated herbicide sprays and minimizing environmental impact.

- By Crop Type

On the basis of crop type, the Dicamba market is segmented into cereals and grains, oilseeds and pulses, pastures & forage crops, and others. The cereals and grains segment dominated the largest market revenue share in 2024, as these crops are highly susceptible to broadleaf weeds that affect yield and quality. Farmers prioritize Dicamba applications for wheat, maize, and rice cultivation due to its proven efficacy and ability to protect crop productivity. The dominance of this segment is further reinforced by extensive cultivation areas, government incentives for crop protection, and consistent adoption of integrated weed management practices.

The oilseeds and pulses segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by rising global demand for soybeans, peanuts, and pulses. Dicamba’s selective herbicidal action supports high-yield cultivation of these crops while managing resistant weed species. Adoption is further fueled by innovations in crop-safe Dicamba formulations and the integration of herbicide-tolerant crop varieties. Increasing awareness among farmers about yield optimization and cost-effective weed management is also contributing to the rapid growth of Dicamba use in oilseeds and pulses.

Dicamba Market Regional Analysis

- North America dominated the dicamba market with the largest revenue share of 49.2% in 2024, driven by the extensive cultivation of cereals, grains, and oilseeds, along with increasing awareness of effective weed management solutions

- Farmers in the region prioritize Dicamba for its proven efficacy in controlling broadleaf weeds and its compatibility with modern agricultural practices, enhancing crop yield and operational efficiency

- This widespread adoption is further supported by advanced agricultural infrastructure, high mechanization, and strong research and development initiatives, establishing Dicamba as a preferred herbicide for large-scale farming operations

U.S. Dicamba Market Insight

The U.S. Dicamba market captured the largest revenue share in 2024 within North America, fueled by the adoption of herbicide-tolerant crops and integrated weed management practices. Farmers are increasingly relying on Dicamba to manage resistant weed species in soybeans, maize, and cotton fields. The growing emphasis on precision agriculture, coupled with advanced spraying technologies, is driving effective and targeted application of Dicamba. In addition, regulatory approvals for crop-safe Dicamba formulations and the presence of leading agrochemical manufacturers further strengthen market growth in the country.

Europe Dicamba Market Insight

The Europe Dicamba market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing adoption of modern crop protection solutions and demand for higher agricultural productivity. The focus on sustainable farming practices and regulatory support for selective herbicides is fostering Dicamba adoption. European farmers are increasingly incorporating Dicamba into pre- and post-emergence weed management programs to protect cereals, oilseeds, and pulses. Growth is particularly observed in countries with large-scale commercial agriculture and advanced mechanization.

U.K. Dicamba Market Insight

The U.K. Dicamba market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the need for efficient weed control and rising demand for improved crop yields. Concerns regarding herbicide-resistant weeds and the emphasis on maintaining high-quality cereal and oilseed crops encourage farmers to adopt Dicamba. The U.K.’s focus on sustainable and precision farming, combined with favorable regulatory frameworks, is expected to continue supporting market expansion.

Germany Dicamba Market Insight

The Germany Dicamba market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced agricultural infrastructure, technological adoption, and increasing awareness of effective weed management practices. Germany’s emphasis on sustainability and productivity encourages the use of selective herbicides such as Dicamba in cereals, oilseeds, and forage crops. Integration with precision spraying technologies and crop rotation strategies is further boosting adoption across both commercial and smallholder farms.

Asia-Pacific Dicamba Market Insight

The Asia-Pacific Dicamba market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing agricultural mechanization, rising crop acreage, and demand for higher crop yields in countries such as China, India, and Japan. Government initiatives promoting modern crop protection solutions, coupled with growing awareness of herbicide-resistant weeds, are accelerating Dicamba adoption. The region is emerging as a key market due to affordable formulations, rising adoption among smallholder farmers, and increasing investment in high-efficiency spraying technologies

Japan Dicamba Market Insight

The Japan Dicamba market is gaining momentum due to the country’s focus on sustainable agriculture and precision farming technologies. Farmers are increasingly applying Dicamba in cereals and forage crops to manage broadleaf weeds effectively. The integration of modern spraying equipment and crop-safe formulations is boosting efficiency and reducing crop damage. In addition, the aging farmer population is driving demand for easy-to-apply, reliable herbicide solutions that minimize labor intensity.

China Dicamba Market Insight

The China Dicamba market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid agricultural modernization, expanding crop acreage, and high adoption of herbicide-tolerant crops. Dicamba is widely used in cereals, oilseeds, and pulses to manage resistant weeds and improve yields. The push for increased food security, coupled with government support for crop protection technologies and domestic production of cost-effective Dicamba formulations, is propelling market growth in China.

Dicamba Market Share

The dicamba industry is primarily led by well-established companies, including:

- Bayer AG (Germany)

- BASF (Germany)

- Corteva (U.S.)

- Nufarm (Australia)

- Albaugh LLC (U.S.)

- ADAMA Group (Israel)

- Dow (U.S.)

- Syngenta (Switzerland)

- UPL Ltd (India)

- Alligare LLC (U.S.)

- FMC Corporation (U.S.)

- Mey Corporation (U.S.)

- Drexel Chemical Co (U.S.)

- Helena Agri-Enterprises, LLC (U.S.)

Latest Developments in Global Dicamba Market

- In July 2025, the U.S. Environmental Protection Agency (EPA) proposed re-registering three dicamba-based herbicides—XtendiMax, Engenia, and Tavium—for year-round use on genetically modified soybeans and cotton. This move follows previous court rulings that halted their use due to concerns over herbicide drift and environmental impact. The proposal introduces strict mitigation measures, including temperature thresholds, buffer zones, and drift-reduction practices, to ensure safer application. This development is expected to stabilize the U.S. Dicamba market by allowing continued adoption for controlling herbicide-resistant weeds while balancing regulatory compliance. It also encourages manufacturers and farmers to invest in advanced application equipment and training programs to meet the new guidelines

- In May 2024, Bayer proposed a revised dicamba label that removes over-the-top application on soybean crops. This adjustment aims to reduce drift-related crop damage and address environmental concerns, significantly impacting weed management strategies for soybean farmers. By limiting application methods, the change encourages farmers to adopt more precise, targeted spraying techniques, which could increase demand for modern spraying equipment and improved formulation technologies. This regulatory move is expected to enhance the long-term sustainability and reliability of dicamba as a key herbicide in U.S. agriculture

- In February 2024, the EPA issued an Existing Stocks Policy permitting the use of over-the-top dicamba formulations on soybeans and cotton for the 2024 season. This policy followed a court ruling that had invalidated the EPA's previous approval, allowing farmers to legally utilize existing herbicide stocks while maintaining crop protection. The measure provided short-term continuity for weed management practices, preventing disruptions in soybean and cotton production. It also highlighted the market’s dependence on regulatory clarity, influencing planting and herbicide procurement decisions across major U.S. agricultural regions

- In November 2023, Bayer introduced advancements in dicamba herbicide formulations designed to enhance crop protection while minimizing off-target drift. These innovations focused on improved chemical stability, application technologies, and stewardship practices to ensure effective weed control with reduced environmental impact. The development strengthened market confidence in dicamba products by addressing long-standing concerns regarding drift and crop safety. It also promoted adoption among farmers seeking high-efficiency, low-risk herbicide solutions, supporting broader acceptance in both large-scale commercial and smaller farming operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dicamba Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dicamba Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dicamba Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.