Global Dicing Tapes Market

Market Size in USD Billion

CAGR :

%

USD

1.74 Billion

USD

3.22 Billion

2025

2033

USD

1.74 Billion

USD

3.22 Billion

2025

2033

| 2026 –2033 | |

| USD 1.74 Billion | |

| USD 3.22 Billion | |

|

|

|

|

Dicing Tapes Market Size

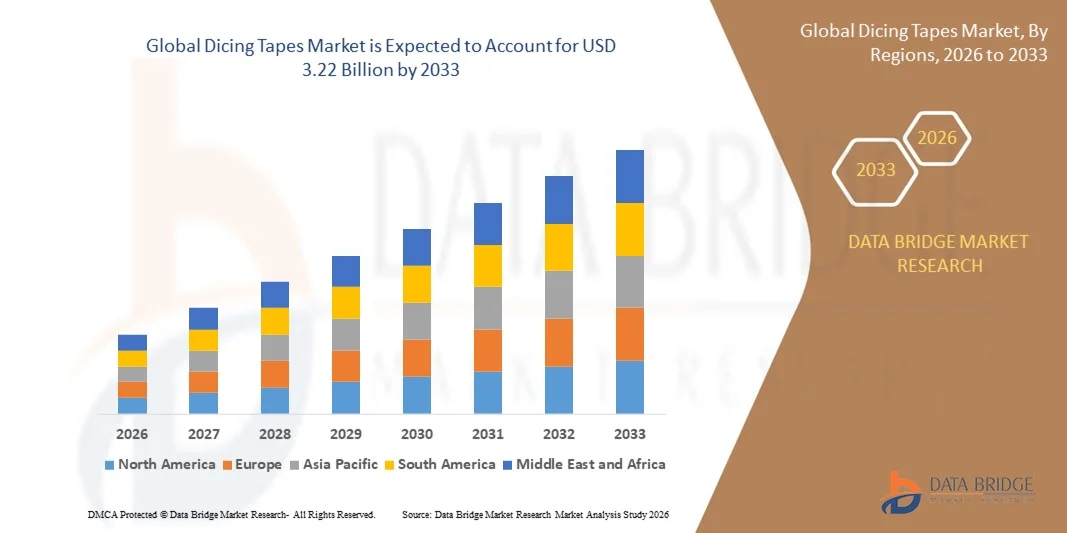

- The global dicing tapes market size was valued at USD 1.74 billion in 2025 and is expected to reach USD 3.22 billion by 2033, at a CAGR of 7.95% during the forecast period

- The market growth is largely fueled by the increasing demand for high-precision semiconductor manufacturing and advanced wafer-level packaging, which requires reliable and high-performance dicing tapes to minimize wafer breakage and improve yield

- Furthermore, rising adoption of ultra-thin wafers, fan-out packaging, and 2.5D/3D semiconductor devices is driving the need for specialized tapes with enhanced adhesion, thermal stability, and clean debonding properties. These converging factors are accelerating the uptake of advanced dicing tapes, thereby significantly boosting the industry's growth

Dicing Tapes Market Analysis

- Dicing tapes, used to secure wafers during cutting, back grinding, and other semiconductor processes, are increasingly critical in both wafer fabrication and advanced packaging due to their role in protecting delicate silicon structures and ensuring process precision

- The escalating demand for dicing tapes is primarily fueled by the rapid growth of semiconductor manufacturing, miniaturization of chips, and increasing complexity of microelectronic devices, as well as the need for high-reliability, low-defect adhesive solutions in wafer-level processes

- Asia-Pacific dominated the dicing tapes market in 2025, due to the region’s expanding semiconductor manufacturing, increasing demand for advanced electronic devices, and a strong presence of wafer fabrication hubs

- North America is expected to be the fastest growing region in the dicing tapes market during the forecast period due to strong demand for high-performance dicing tapes in semiconductor, MEMS, and advanced electronics manufacturing

- Wafer dicing segment dominated the market with a market share of 57.9% in 2025, due to its extensive use in semiconductor wafer singulation processes. Wafer dicing tapes provide strong adhesion during cutting while ensuring clean removal without residue, which is critical for maintaining die integrity. Their compatibility with advanced wafer materials and high-precision dicing equipment further strengthens adoption. The increasing production of integrated circuits and power devices continues to reinforce the dominance of wafer dicing tapes. Manufacturers prefer these tapes due to their consistent performance across varying wafer sizes and thicknesses. This segment benefits from continuous innovations aimed at reducing die chipping and yield loss

Report Scope and Dicing Tapes Market Segmentation

|

Attributes |

Dicing Tapes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dicing Tapes Market Trends

Growing Adoption of Ultra-Thin and Advanced Packaging Wafers

- A significant trend in the dicing tapes market is the increasing use of ultra-thin wafers and advanced packaging technologies such as fan-out wafer-level packaging (FOWLP) and 2.5D/3D integration. These applications demand high-precision, reliable dicing tapes that prevent wafer breakage and maintain structural integrity during cutting and back grinding processes

- For instance, Nitto Denko and Lintec supply high-performance dicing tapes for ultra-thin wafers that enable manufacturers to maintain high yields while processing delicate silicon structures. Such tapes ensure stability and adhesion across temperature variations, which is critical for modern semiconductor fabrication

- The adoption of advanced packaging is rising rapidly as semiconductor manufacturers pursue higher chip density and miniaturization, requiring tapes capable of supporting complex wafer geometries and multilayered structures. This positions dicing tapes as essential materials in high-end wafer processing and assembly lines

- The market is also seeing innovation in UV-curable and silicon-free adhesive tapes that reduce residue and simplify debonding, enhancing throughput and product reliability. These specialized tapes are increasingly preferred for high-volume semiconductor fabs where precision and speed are critical

- Industries focusing on MEMS, LEDs, and automotive electronics are expanding their use of dicing tapes to support delicate wafer handling, precise dicing, and back grinding processes. This is shaping a stronger preference for tapes that offer both mechanical protection and process efficiency

- The market is witnessing robust growth in high-performance semiconductor manufacturing, where reliable dicing tapes contribute to reducing defect rates, minimizing material waste, and enabling scalable production of complex devices. This trend is reinforcing the essential role of dicing tapes across wafer fabrication and advanced packaging ecosystems

Dicing Tapes Market Dynamics

Driver

Rising Demand for High-Precision Semiconductor Manufacturing

- The growing reliance on high-precision semiconductor fabrication is driving the demand for advanced dicing tapes that offer stable adhesion, clean debonding, and resistance to thermal and mechanical stresses. These tapes are critical in ensuring wafer integrity and yield optimization during cutting, thinning, and back grinding operations

- For instance, Furukawa Electric and Sumitomo Bakelite provide specialized tapes for ultra-thin wafers and fan-out packaging, enabling semiconductor manufacturers to maintain consistent performance in high-volume production environments. Such solutions enhance process reliability and reduce defect rates across complex wafer geometries

- The rise in miniaturization and higher layer counts in chips is increasing the need for tapes that support delicate handling and precise dicing. Manufacturers are prioritizing adhesive solutions that can cope with thinner wafers and more intricate device architectures

- Increased investment in R&D for next-generation semiconductor materials and packaging is reinforcing the adoption of specialized tapes that can support advanced processes. This sustained focus on high-precision manufacturing continues to drive growth in the dicing tapes market

- Growing expectation for low-defect, high-yield wafer processing is strengthening this driver, as manufacturers require tapes that combine performance, reliability, and ease of use to meet stringent production standards

Restraint/Challenge

Managing Material Costs and Performance Trade-Offs

- The dicing tapes market faces challenges due to the high cost of specialized adhesive materials, UV-curable formulations, and advanced backing substrates that are required for ultra-thin wafer processing. These materials increase production costs and affect the overall pricing of high-performance dicing tapes

- For instance, Lintec and Nitto Denko use advanced polymer backings and high-precision adhesives in their tapes, which require costly raw materials and sophisticated manufacturing techniques. This increases cost pressures while balancing performance requirements

- Maintaining the trade-off between adhesion strength, debonding ease, and residue-free performance is technically challenging, as improving one attribute may compromise another. Manufacturers must optimize formulations to deliver balanced performance across wafer types and process conditions

- The reliance on specialized production facilities and precision equipment adds complexity to scaling high-volume tape manufacturing while maintaining consistent quality. This limits flexibility and can restrict rapid market expansion

- Market players continue to face pressure to reduce costs while meeting growing demand for high-performance tapes that support advanced packaging and ultra-thin wafers. These challenges collectively impact profit margins and necessitate continuous innovation in material science and manufacturing efficiency

Dicing Tapes Market Scope

The market is segmented on the basis of type, coating, strength, backing material, product, application, and thickness.

- By Type

On the basis of type, the dicing tapes market is segmented into wafer dicing and back grinding. The wafer dicing segment dominated the market with the largest revenue share of 57.9% in 2025, driven by its extensive use in semiconductor wafer singulation processes. Wafer dicing tapes provide strong adhesion during cutting while ensuring clean removal without residue, which is critical for maintaining die integrity. Their compatibility with advanced wafer materials and high-precision dicing equipment further strengthens adoption. The increasing production of integrated circuits and power devices continues to reinforce the dominance of wafer dicing tapes. Manufacturers prefer these tapes due to their consistent performance across varying wafer sizes and thicknesses. This segment benefits from continuous innovations aimed at reducing die chipping and yield loss.

The back grinding segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising demand for ultra-thin wafers in advanced packaging. Back grinding tapes are essential for protecting wafer surfaces during thinning processes. Growth is driven by trends toward miniaturization and lightweight electronic components. These tapes offer controlled adhesion and easy debonding, improving process efficiency. Expanding use in memory chips and logic devices accelerates demand. Ongoing advancements in grinding technologies further enhance segment growth prospects.

- By Coating

On the basis of coating, the dicing tapes market is segmented into double sided and single sided. The single sided segment dominated the market in 2025, owing to its widespread usage in standard wafer dicing applications. Single sided tapes offer reliable adhesion to wafers while maintaining process simplicity and cost efficiency. Their ease of handling and compatibility with automated dicing systems support large-scale semiconductor manufacturing. These tapes are preferred for high-volume production environments due to stable performance. Consistent adhesion strength helps reduce wafer movement during cutting. This reliability drives sustained dominance across foundries and OSAT facilities.

The double sided segment is projected to register the fastest growth from 2026 to 2033, driven by its use in complex and multi-step fabrication processes. Double sided coatings provide enhanced fixation for delicate wafers during advanced processing. Demand rises from applications requiring temporary bonding and repositioning. These tapes support improved alignment accuracy and process flexibility. Growth in advanced packaging and heterogeneous integration fuels adoption. Manufacturers increasingly select double sided tapes to meet stringent processing requirements.

- By Strength

On the basis of strength, the market is segmented into tensile strength, adhesive strength, and elongation. The adhesive strength segment dominated the market in 2025, as maintaining secure wafer fixation during dicing is critical to prevent die shift and damage. High adhesive strength ensures stable performance under high-speed cutting conditions. Semiconductor manufacturers prioritize tapes that balance strong hold with clean debonding. This characteristic directly impacts yield and throughput efficiency. Strong adhesion supports compatibility with various wafer materials. As a result, adhesive strength remains the primary selection criterion.

The elongation segment is expected to grow at the fastest pace during the forecast period, driven by the need to reduce stress and cracking in ultra-thin wafers. High elongation properties allow tapes to absorb mechanical stress during processing. This is increasingly important for advanced nodes and fragile substrates. Demand is fueled by next-generation semiconductor designs. Improved elongation enhances overall wafer protection. These benefits contribute to accelerated growth.

- By Backing Material

On the basis of backing material, the dicing tapes market is segmented into PET, PVC, EVA, and PO. PET dominated the market in 2025 due to its excellent dimensional stability and resistance to deformation during high-speed dicing. PET-backed tapes provide consistent thickness control and smooth cutting performance. Their durability supports repeated processing steps. Compatibility with UV and non-UV adhesives further enhances adoption. Semiconductor manufacturers favor PET for precision applications. This drives its leading market position.

PO is anticipated to witness the fastest growth from 2026 to 2033, supported by its flexibility and improved environmental profile. PO materials offer good mechanical properties while reducing contamination risks. Rising emphasis on sustainable materials boosts demand. These backings perform well in advanced semiconductor processes. Their adaptability to evolving tape designs accelerates growth. Increased R&D investment supports wider adoption.

- By Product

On the basis of product, the market is segmented into silicon free adhesive films, UV curable dicing type, and non UV curable dicing type. UV curable dicing tapes dominated the market in 2025, driven by their ability to significantly reduce adhesion after UV exposure. This feature allows easy and residue-free die removal. UV curable tapes improve yield by minimizing die damage. They are widely used in high-density semiconductor packaging. Compatibility with automated UV systems supports efficiency. These advantages secure their dominant position.

Silicon free adhesive films are expected to grow at the fastest rate over the forecast period, owing to rising concerns over silicon contamination. These films are preferred in sensitive semiconductor applications. Growth is driven by stricter quality requirements and advanced device architectures. Silicon free solutions enhance reliability and cleanliness. Their use expands in memory and logic chip manufacturing. This drives strong future growth.

- By Application

On the basis of application, the market is segmented into package dicing, wafer dicing, resin substrate manufacturing, adhesive control needs, glass, and ceramics. Wafer dicing dominated the market in 2025 due to its fundamental role in semiconductor device fabrication. High demand from consumer electronics and automotive semiconductors supports growth. Wafer dicing applications require precise adhesion and clean debonding. These requirements favor advanced dicing tapes. Continuous increase in wafer production reinforces dominance. This segment remains central to market demand.

Glass and ceramics applications are projected to grow at the fastest rate from 2026 to 2033, driven by expanding use in advanced electronics and display technologies. These materials require specialized tapes with controlled adhesion. Growth in power electronics and sensors supports adoption. Dicing tapes help manage brittle material handling. Advancements in material processing accelerate demand. This leads to rapid segment expansion.

- By Thickness

On the basis of thickness, the dicing tapes market is segmented into below 85 microns, 85–125 microns, 126–150 microns, and above 150 microns. The 85–125 microns segment dominated the market in 2025, driven by its balanced performance across standard wafer processing applications. This thickness range offers optimal adhesion and mechanical support. It is widely compatible with existing dicing equipment. Manufacturers prefer it for consistent yield outcomes. Stable performance across wafer sizes reinforces dominance. This segment remains the industry standard.

Below 85 microns is expected to witness the fastest growth during the forecast period, fueled by rising demand for ultra-thin wafers. Thinner tapes reduce overall wafer stack height and stress. They support advanced packaging and miniaturized devices. Adoption increases in memory and logic chips. Continuous innovation in thin tape technology accelerates growth. This positions the segment for rapid expansion.

Dicing Tapes Market Regional Analysis

- Asia-Pacific dominated the dicing tapes market with the largest revenue share in 2025, driven by the region’s expanding semiconductor manufacturing, increasing demand for advanced electronic devices, and a strong presence of wafer fabrication hubs

- The region’s cost-effective production landscape, rising investments in semiconductor equipment, and growing exports of electronic components are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of dicing tapes in wafer processing and microelectronics applications

China Dicing Tapes Market Insight

China held the largest share in the Asia-Pacific dicing tapes market in 2025, owing to its status as a global leader in semiconductor manufacturing and wafer fabrication. The country's strong industrial base, favorable government policies supporting high-tech manufacturing, and extensive export capabilities for electronic components are major growth drivers. Demand is also bolstered by ongoing investments in advanced packaging and microelectronics for both domestic and international markets.

India Dicing Tapes Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by a rapidly growing electronics manufacturing sector, increasing semiconductor fabrication, and rising investments in wafer processing infrastructure. Government initiatives promoting electronics and semiconductor self-reliance are strengthening the demand for high-quality dicing tapes. In addition, a surge in exports of electronic devices and growing R&D capabilities in semiconductor materials are contributing to robust market expansion.

Europe Dicing Tapes Market Insight

The Europe dicing tapes market is expanding steadily, supported by stringent quality standards, high demand for precision adhesive tapes in semiconductor manufacturing, and growing investments in advanced packaging technologies. The region places strong emphasis on reliability, environmental compliance, and high-performance materials, particularly in wafer dicing and microelectronics applications. The increasing adoption of UV-curable and silicon-free adhesive tapes is further enhancing market growth.

Germany Dicing Tapes Market Insight

Germany’s dicing tapes market is driven by its leadership in precision electronics manufacturing, strong semiconductor industry heritage, and export-oriented production model. The country has well-established R&D networks and collaborations between academic institutions and electronic manufacturers, fostering continuous innovation in dicing tape materials and technology. Demand is particularly strong for use in wafer dicing, back grinding, and advanced packaging processes.

U.K. Dicing Tapes Market Insight

The U.K. market is supported by a mature electronics and semiconductor industry, growing efforts to localize supply chains post-Brexit, and increasing demand for specialty dicing and adhesive tapes. With rising focus on R&D, academic-industry partnerships, and investments in niche microelectronics production, the U.K. continues to play a significant role in high-precision dicing tape applications.

North America Dicing Tapes Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by strong demand for high-performance dicing tapes in semiconductor, MEMS, and advanced electronics manufacturing. A focus on miniaturization, wafer-level packaging, and growing reliance on precision adhesive solutions are boosting demand. In addition, rising reshoring of semiconductor fabrication and increasing collaboration between electronics manufacturers and material suppliers are supporting market expansion.

U.S. Dicing Tapes Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive semiconductor and electronics industry, strong R&D infrastructure, and significant investment in high-precision adhesive tape production. The country’s focus on innovation, regulatory compliance, and advanced wafer-level manufacturing is encouraging the adoption of silicon-free and UV-curable dicing tapes. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Dicing Tapes Market Share

The dicing tapes industry is primarily led by well-established companies, including:

- Sumitomo Bakelite Co., Ltd (Japan)

- Daest Coating India Pvt Ltd (India)

- AI Technology, Inc. (U.S.)

- Denka Company Limited (Japan)

- ULTRON SYSTEMS, INC (U.S.)

- Pantech Tape Co., Ltd (South Korea)

- NITTO DENKO CORPORATION (Japan)

- QES GROUP OF COMPANIES (U.S.)

- NIPPON PULSE MOTOR Co., Ltd (Japan)

- LINTEC Corporation (Japan)

- Mitsui Chemicals, Inc (Japan)

- Loadpoint (U.S.)

- Shenzhen Xinst Technology Co., Ltd (China)

- Solar Plus Company (U.S.)

Latest Developments in Global Dicing Tapes Market

- In November 2025, the semiconductor plasma dicing tape segment experienced significant momentum due to the introduction of high‑adhesion and UV‑curable tapes that enhance wafer yield and reduce breakage during precision dicing processes. This development has strengthened adoption across advanced packaging, MEMS, and LED production lines, enabling manufacturers to improve process efficiency, reduce material waste, and maintain higher quality standards, which is fueling confidence in next‑generation dicing tape technologies

- In June 2025, Lintec Corporation entered into a strategic partnership with Wah Lee to co‑develop and market high‑temperature resistant wafer dicing tapes and adhesive products. This collaboration has reinforced Lintec’s position in the Asia‑Pacific semiconductor supply chain and addressed the rising demand for specialized materials capable of supporting advanced node wafers and high thermal processing. The partnership is accelerating innovation, enabling faster deployment of reliable dicing solutions, and expanding the market reach of both companies

- In March 2025, Nitto Denko launched a new ultra‑thin wafer dicing tape series designed specifically for 300 mm silicon wafers, offering enhanced peel strength and minimized wafer breakage. This product introduction has improved processing yields for high‑volume foundries and packaging fabs, enabling more efficient manufacturing of advanced semiconductor devices. It has also reinforced Nitto Denko’s leadership in the high-performance dicing tape market, driving adoption among fabs that prioritize precision and reliability

- In December 2024, Sumitomo Bakelite secured a multi‑year supply agreement with a leading 300 mm semiconductor fabrication facility for wafer dicing tapes. This contract reflects increasing reliance on high-performance tape solutions in high-throughput manufacturing environments, highlighting the importance of consistent quality and reliability. The deal also underscores the market’s growth trajectory and the competitive advantage of suppliers who can meet the stringent technical requirements of advanced semiconductor processes

- In April 2024, Furukawa Electric introduced its F‑DICE™ 8000P tape optimized for ultra-thin silicon wafers (≤25 µm) used in fan‑out packaging applications. The tape provides cleaner debonding and reduced wafer warpage, supporting higher process efficiency and lower defect rates. This launch has accelerated adoption among major OSAT providers for next-generation AI chips, demonstrating how product innovation in dicing tapes is directly shaping market demand and enabling advanced semiconductor manufacturing processes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dicing Tapes Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dicing Tapes Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dicing Tapes Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.