Global Die Cut Lids Market

Market Size in USD Billion

CAGR :

%

USD

2.93 Billion

USD

4.05 Billion

2024

2032

USD

2.93 Billion

USD

4.05 Billion

2024

2032

| 2025 –2032 | |

| USD 2.93 Billion | |

| USD 4.05 Billion | |

|

|

|

|

Die Cut Lids Market Size

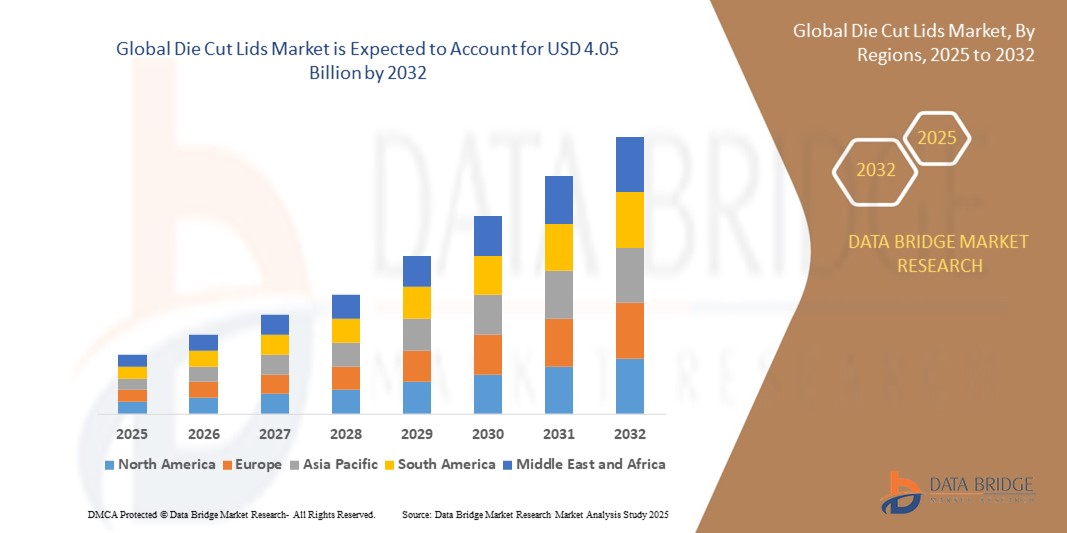

- The global die cut lids market size was valued at USD 2.93 billion in 2024 and is expected to reach USD 4.05 billion by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is primarily driven by the increasing demand for convenient and sustainable packaging solutions in the food and beverage industry, coupled with advancements in packaging technology

- Rising consumer preference for ready-to-eat meals, dairy products, and beverages, along with the need for tamper-evident and user-friendly packaging, is establishing die cut lids as a preferred choice in modern packaging solutions

Die Cut Lids Market Analysis

- Die cut lids, used for sealing cups, trays, bottles, and jars, are critical components in the packaging industry, offering enhanced product protection, extended shelf life, and ease of use in both consumer and industrial applications

- The growing demand for die cut lids is fueled by the rapid expansion of the food and beverage sector, increasing focus on sustainable packaging materials, and the rising popularity of on-the-go consumption

- Asia-Pacific dominated the die cut lids market with the largest revenue share of 42.5% in 2024, driven by robust growth in the food and beverage industry, high population density, and increasing urbanization in countries such as China and India

- North America is expected to be the fastest-growing region during the forecast period due to rising consumer demand for convenient packaging, technological innovations, and a strong presence of key packaging companies

- The aluminum foil segment held the largest market revenue share of 68.8% in 2024, owing to its superior barrier properties against moisture, oxygen, and light, ensuring extended shelf life for products such as dairy, ready-to-eat meals, and pharmaceuticals. Aluminum’s recyclability also aligns with the growing demand for sustainable packaging solutions

Report Scope and Die Cut Lids Market Segmentation

|

Attributes |

Die Cut Lids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Die Cut Lids Market Trends

Increasing Adoption of Sustainable Materials and Advanced Printing Technologies

- The global die cut lids market is experiencing a notable trend toward the use of sustainable materials, such as recyclable aluminum and paper-based lids, driven by growing environmental concerns and consumer demand for eco-friendly packaging

- Advanced printing technologies, such as flexo and gravure printing, are being integrated to enhance the aesthetic appeal and branding opportunities of die cut lids, allowing for high-quality graphics, QR codes, and promotional content

- These technologies enable customization, making die cut lids more attractive to brand owners by providing opportunities for differentiation and consumer engagement through visually appealing packaging

- For instance, companies are leveraging printed die cut lids to include barcodes and promotional codes, enhancing brand visibility and consumer interaction

- The shift toward biodegradable and compostable materials is gaining traction, particularly in the food and beverage sector, aligning with global sustainability goals and regulatory pressures

- This trend is increasing the appeal of die cut lids for environmentally conscious consumers and supporting market growth by addressing sustainability challenges

Die Cut Lids Market Dynamics

Driver

Growing Demand for Convenience Foods and Food Safety

- The rising consumer demand for convenience foods, such as ready-to-eat meals, dairy products, and beverages, is a major driver for the global die cut lids market

- Die cut lids enhance food safety by providing tamper-evident seals and robust barriers against moisture, oxygen, and light, ensuring product freshness and extending shelf life

- Government regulations and consumer awareness regarding food hygiene, particularly in regions such as Asia-Pacific, are pushing the adoption of secure packaging solutions such as die cut lids

- The expansion of the food and beverage industry, especially in countries such as China and India, coupled with increasing urbanization and disposable income, is driving demand for die cut lids in applications such as cups and trays

- Manufacturers are increasingly offering die cut lids as standard packaging solutions to meet consumer expectations for convenience and safety, further boosting market growth

Restraint/Challenge

High Production Costs and Environmental Concerns

- The high cost of raw materials, such as aluminum and high-grade plastics, combined with complex manufacturing processes and customization requirements, poses a significant barrier to adoption, particularly in cost-sensitive emerging markets

- Integrating die cut lids into existing packaging systems can be costly and complex, limiting their adoption by smaller manufacturers or in regions with less developed infrastructure

- Environmental concerns related to the disposal of plastic-based die cut lids are a major challenge, as increasing regulatory scrutiny and consumer awareness of plastic waste impact market dynamics

- The fragmented regulatory landscape across countries regarding packaging waste and recycling complicates compliance for manufacturers, potentially deterring market expansion

- These factors can limit market growth, particularly in regions with high environmental awareness or where cost sensitivity is a significant concern

Die Cut Lids market Scope

The market is segmented on the basis of material type, form type, end use, and application.

- By Material Type

On the basis of material type, the global die cut lids market is segmented into paper, aluminum foil, and others. The aluminum foil segment held the largest market revenue share of 68.8% in 2024, owing to its superior barrier properties against moisture, oxygen, and light, ensuring extended shelf life for products such as dairy, ready-to-eat meals, and pharmaceuticals. Aluminum’s recyclability also aligns with the growing demand for sustainable packaging solutions.

The plastic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by advancements in high-grade plastic materials such as PET, which offer flexibility, durability, and compliance with food safety regulations. The increasing adoption of plastic die cut lids in single-serve packaging for convenience foods and beverages further accelerates this segment’s growth.

- By Form Type

On the basis of form type, the global die cut lids market is segmented into reel and pre-cut forms. The pre-cut form segment dominated with a market revenue share of 62.3% in 2024, attributed to its widespread use in high-speed packaging lines for products such as yogurt cups, beverage containers, and ready-to-eat meals. Pre-cut lids offer ease of use and precise fitting, enhancing operational efficiency in food and beverage packaging.

The reel form segment is projected to experience the fastest growth rate from 2025 to 2032, driven by its cost-effectiveness and compatibility with automated packaging systems. The increasing demand for large-scale production in the food and beverage industry, particularly in Asia-Pacific, supports the growth of this segment.

- By End Use

On the basis of end use, the global die cut lids market is segmented into dairy and dairy products, sauces, dips and dressings, meat, poultry and seafood, ready-to-eat meals, coffee, beverages, healthcare applications, and others. The dairy and dairy products segment accounted for the largest market revenue share of 45.2% in 2024, fueled by the high consumption of yogurt, cheese, and other perishable dairy products requiring secure, tamper-evident packaging to ensure freshness and safety. The global dairy industry’s growth, particularly in Asia-Pacific, significantly drives this segment.

The ready-to-eat meals segment is anticipated to witness the fastest growth from 2025 to 2032, propelled by rising consumer demand for convenience foods due to changing lifestyles, urbanization, and increasing disposable incomes. The adoption of die cut lids for secure sealing of meal trays and single-serve packaging supports this segment’s expansion.

- By Application

On the basis of application, the global die cut lids market is segmented into cups, trays, bottles, and jars. The cups segment held the largest market revenue share of 82.0% in 2024, driven by its extensive use in packaging dairy products such as yogurt and beverages such as coffee and juices. The convenience of single-serve cups with peelable die cut lids enhances consumer experience and drives segment growth.

The trays segment is expected to grow at the fastest rate from 2025 to 2032, supported by the increasing popularity of ready-to-eat meals, deli items, and fresh produce packaging. Die cut lids for trays provide tamper-evident seals and ensure product integrity, making them ideal for both food and non-food applications in retail and industrial sectors.

Die Cut Lids Market Regional Analysis

- Asia-Pacific dominated the die cut lids market with the largest revenue share of 42.5% in 2024, driven by robust growth in the food and beverage industry, high population density, and increasing urbanization in countries such as China and India

- Consumers prioritize die cut lids for their ability to ensure product freshness, provide tamper-evident sealing, and enhance branding through customizable printing, particularly in regions with high consumption of packaged foods

- Growth is supported by advancements in lid technology, including sustainable and recyclable materials, alongside rising adoption in both OEM and aftermarket segments for food, beverage, and healthcare applications

Japan Die Cut Lids Market Insight

Japan’s die cut lids market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced lids that enhance product safety and convenience. The presence of major food and beverage manufacturers and the integration of die cut lids in OEM packaging accelerate market penetration. Rising interest in aftermarket customization also contributes to growth.

China Die Cut Lids Market Insight

China holds the largest share of the Asia-Pacific die cut lids market, propelled by rapid urbanization, rising food and beverage consumption, and increasing demand for secure packaging solutions. The country’s growing middle class and focus on convenience foods support the adoption of advanced die cut lids. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

U.S. Die Cut Lids Market Insight

The U.S. smart lock market is expected to witness significant growth, fueled by strong demand for ready-to-eat meals and dairy products, coupled with growing consumer awareness of food safety and hygiene. The trend towards convenience foods and stringent packaging regulations further boosts market expansion. The integration of die cut lids in both OEM and aftermarket applications creates a robust market ecosystem.

Europe Die Cut Lids Market Insight

The Europe die cut lids market is expected to witness significant growth, supported by regulatory emphasis on food safety and sustainability. Consumers seek lids that provide secure sealing while maintaining product freshness. Growth is prominent in both new packaging installations and retrofit projects, with countries such as Germany and France showing significant uptake due to rising environmental concerns and urban consumption trends.

U.K. Die Cut Lids Market Insight

The U.K. market for die cut lids is expected to witness rapid growth, driven by demand for enhanced food preservation and aesthetic packaging in urban and suburban settings. Increased interest in sustainable packaging solutions and rising awareness of food safety benefits encourage adoption. Evolving regulations balancing lid functionality with compliance further influence consumer choices.

Germany Die Cut Lids Market Insight

Germany is expected to witness rapid growth in the die cut lids market, attributed to its advanced food processing and packaging sector and high consumer focus on product safety and sustainability. German consumers prefer technologically advanced lids that extend shelf life and support eco-friendly initiatives. The integration of these lids in premium food products and aftermarket applications supports sustained market growth.

Die Cut Lids Market Share

The die cut lids industry is primarily led by well-established companies, including:

- Av Concepts (U.S.)

- Dart Container Corporation (U.S.)

- Georgia-Pacific (U.S.)

- Amcor plc (Switzerland)

- Huhtamäki Oyj (Finland)

- Greiner Packaging International GmbH (Austria)

- Frugalpac Limited (U.K.)

- James Cropper plc (U.K.)

- Berry Global Inc. (U.S.)

- Pactiv LLC (U.S.)

- Genpak, LLC (U.S.)

- ConverPack, Inc. (U.S.)

- Eco-Products, Inc. (U.S.)

- Churchill Container (U.K.)

- WinCup (U.S.)

- Airlite Plastics (U.S.)

What are the Recent Developments in Global Die Cut Lids Market?

- In June 2024, Winpak Ltd. unveiled a new eco-friendly die-cut lid, reinforcing its commitment to sustainable packaging solutions. This innovative product is designed to reduce environmental impact while maintaining high performance in food protection and shelf appeal. The launch responds to increasing consumer and industry demand for biodegradable, recyclable, and renewable-content materials in packaging. Winpak’s new lid format complements its broader portfolio of recycle-ready and lightweight packaging technologies, supporting circular economy principles and responsible supply chain practices

- In June 2024, Smurfit Kappa and WestRock finalized their merger, officially forming Smurfit WestRock, now one of the world’s largest paper packaging companies. This strategic union combines their extensive global operations and complementary portfolios, significantly enhancing their market presence across 42 countries. While the merger spans broad packaging categories, it is expected to notably influence the die-cut lids segment, especially in paper-based solutions, by consolidating resources, streamlining innovation, and expanding sustainable offerings

- In March 2024, Sealed Air Corporation introduced a new line of recyclable die-cut lids, reinforcing its commitment to sustainable packaging innovation. These lids are designed to meet growing industry and consumer demand for eco-friendly solutions, offering enhanced barrier properties, durability, and visual appeal while supporting a circular economy. The launch aligns with Sealed Air’s broader sustainability goals, including reducing plastic waste and improving recyclability across its product portfolio

- In January 2024, Amcor announced a major expansion of its thermoforming production capacity in North America, specifically targeting the healthcare sector. The initiative includes the installation of automated, state-of-the-art equipment at its Oshkosh, Wisconsin facility, enabling customers to source thermoforms and companion die-cut lids from a single location. This strategic move is designed to streamline manufacturing and distribution, enhance operational efficiency, and support the growing demand from medical, pharmaceutical, and consumer health segments. The expansion underscores Amcor’s commitment to being a growth partner in sustainable and high-performance packaging

- In May 2022, Aluflexpack AG completed the acquisition of an 80% stake in Teko, a leading Turkish provider of flexible packaging solutions for the dairy and beverage sectors. This strategic move enhances Aluflexpack’s capabilities in producing die-cut lids and expands its footprint across Turkey and neighboring regions, complementing its existing pharmaceutical packaging operations. The acquisition supports Aluflexpack’s growth ambitions in the MENA region, leveraging Teko’s strong market position and production expertise to meet rising demand for premium, sustainable packaging

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Die Cut Lids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Die Cut Lids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Die Cut Lids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.