Global Difethialone Market

Market Size in USD Million

CAGR :

%

USD

210.31 Million

USD

299.08 Million

2025

2033

USD

210.31 Million

USD

299.08 Million

2025

2033

| 2026 –2033 | |

| USD 210.31 Million | |

| USD 299.08 Million | |

|

|

|

|

What is the Global Difethialone Market Size and Growth Rate?

- The global difethialone market size was valued at USD 210.31 million in 2025 and is expected to reach USD 299.08 million by 2033, at a CAGR of4.50% during the forecast period

- Rising prevalence of pest-related diseases coupled with surging rodent population is one of the major factors fostering growth in the demand for difethialone. Rising demand for pest control coupled with increasing adoption of integrated pest management (IPM) practices will further create lucrative growth opportunities for the difethialone market

What are the Major Takeaways of Difethialone Market?

- Growth and expansion of the agricultural sector will also propel growth in the demand for difethialones. Rising crops damages and economic loss due to rodents will further induce growth in the demand for difethialone

- Rising focus of the manufacturers on the development of non-toxic and third-generation anticoagulants coupled with increased initiatives by the government to spread awareness will also act as important market growth determinants

- Rising demand for difethialones from emerging or developing economies is another market growth opportunity. Increased focus of the manufacturers to develop natural ingredients based pesticides will further multiply the demand for difethialones in the future

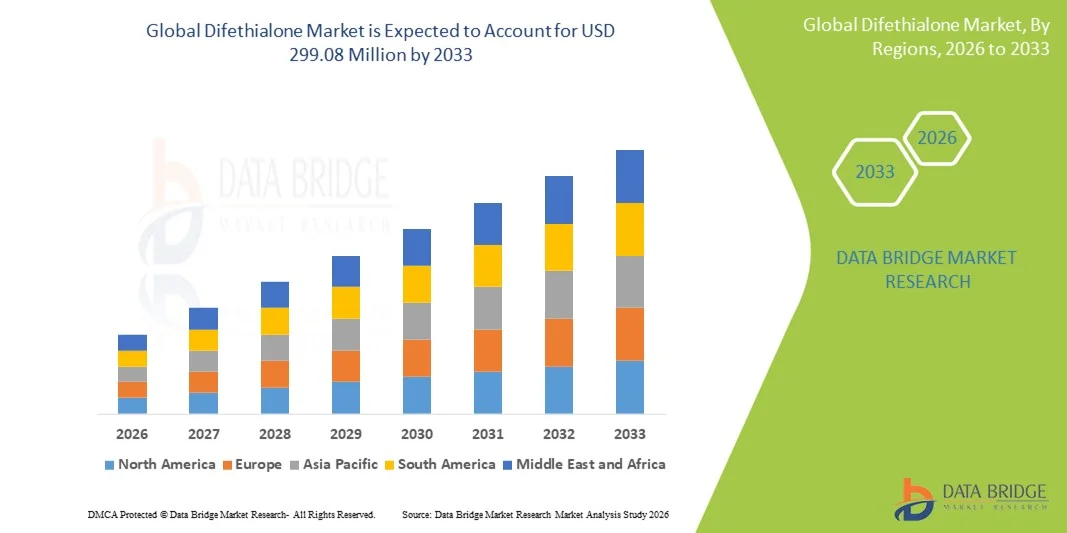

- North America dominated the difethialone market with a 36.14% revenue share in 2025, driven by high demand for effective rodent control in agriculture, food storage, urban infrastructure, and industrial facilities across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, fueled by rapid urbanization, rising agricultural output, and increasing awareness of rodent-borne health risks in China, India, Japan, South Korea, and Southeast Asia

- The Non-anticoagulants segment dominated the market with a 52.3% share in 2025, driven by their widespread use in general pest control applications, lower toxicity concerns, and regulatory preference in sensitive environments such as urban areas and food storage facilities

Report Scope and Difethialone Market Segmentation

|

Attributes |

Difethialone Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Difethialone Market?

Growing Demand for Efficient and Long-Acting Rodenticides in Agricultural and Urban Pest Control

- The difethialone market is witnessing strong adoption due to its high potency, long-lasting effectiveness, and ability to control resistant rodent populations in agricultural, residential, and industrial areas

- Manufacturers are developing advanced formulations such as bait blocks, pellets, and ready-to-use gel applications for safer handling and targeted rodent control

- Rising preference for eco-friendly and low-toxicity rodenticides is prompting companies to integrate Difethialone into integrated pest management (IPM) programs to minimize environmental impact

- For instance, leading suppliers such as BASF, Bayer, UPL, Syngenta, and PelGar International are introducing improved formulations with enhanced palatability and controlled release

- Increasing awareness about effective rodent control in urban infrastructure, warehouses, and farms is driving higher adoption globally

- With growing demand for efficient rodent management and safer handling, Difethialone is becoming a key chemical in pest control strategies

What are the Key Drivers of Difethialone Market?

- Rising need for highly effective rodenticides to manage rodents that cause crop damage, property loss, and disease transmission

- For instance, in 2025, companies such as BASF, Bayer, and Syngenta enhanced their Difethialone product portfolio with improved bait formulations for agricultural and urban applications

- Expansion of urbanization, warehousing, food processing units, and agricultural storage facilities is boosting demand for reliable rodent control solutions across North America, Europe, and Asia-Pacific

- Regulatory emphasis on safer and eco-friendly rodenticides is encouraging adoption of Difethialone over traditional anticoagulants

- Increasing rodent resistance to older anticoagulants drives preference for Difethialone due to its potent and long-acting nature

- Supported by R&D investments in novel formulations, global adoption of Difethialone is expected to maintain steady growth

Which Factor is Challenging the Growth of the Difethialone Market?

- Stringent government regulations on rodenticide toxicity and environmental safety limit the types and concentrations of difethialone that can be used

- For instance, regulatory restrictions in the U.S., U.K., and EU on anticoagulant rodenticides have required reformulation and compliance testing by companies such as BASF and Bayer

- Public concerns regarding secondary poisoning of wildlife and pets reduce acceptance of high-potency rodenticides

- Limited awareness among small-scale farmers and urban users regarding safe and effective application practices slows adoption

- Competition from alternative rodent control methods such as traps, electronic repellents, and natural predators creates market pressure

- To overcome these challenges, companies are focusing on safer bait designs, compliance with environmental standards, and awareness campaigns for effective difethialone use

How is the Difethialone Market Segmented?

The market is segmented on the basis of type, application, and end user.

- By Type

On the basis of type, the difethialone market is segmented into Non-anticoagulants and Anticoagulants. The Non-anticoagulants segment dominated the market with a 52.3% share in 2025, driven by their widespread use in general pest control applications, lower toxicity concerns, and regulatory preference in sensitive environments such as urban areas and food storage facilities. Non-anticoagulant formulations offer rapid efficacy against rodent populations and are widely adopted across agricultural fields, warehouses, and residential spaces due to ease of handling and minimal secondary poisoning risk. Their suitability for integrated pest management programs and compatibility with modern dispensing systems further strengthens their market position. The Anticoagulants segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising demand for long-term rodent control in commercial, industrial, and high-density urban environments. Increasing adoption of multi-feed and slow-acting formulations to manage resistant rodent populations is driving growth in this segment.

- By Application

On the basis of application, the market is segmented into Pellets, Sprays, and Powders. The Pellets segment dominated the market with a 46.7% share in 2025, owing to their ease of deployment, long shelf life, and ability to target rodent populations efficiently across diverse environments. Pellets are preferred in agricultural fields, warehouses, and commercial sites as they allow controlled dosing, minimize wastage, and are compatible with automated dispensing systems. The Sprays segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for immediate rodent eradication in urban centers, residential areas, and sensitive environments where surface coverage and rapid action are essential. Advanced spray formulations that provide extended residual activity and reduced environmental contamination are further boosting adoption.

- By End User

On the basis of end user, the difethialone market is segmented into Agricultural Fields, Warehouses, Urban Centres, Residential, and Commercial. The Agricultural Fields segment dominated the market with a 44.2% share in 2025, as Difethialone is extensively used to protect crops from rodent damage, safeguard stored grains, and minimize yield loss. Its targeted action, safety profile, and compatibility with integrated pest management programs make it the preferred solution among farmers and agro-industrial operators. The Urban Centres segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by increasing rodent infestations in densely populated cities, rising hygiene standards, and the expansion of municipal pest control initiatives. The segment benefits from growing awareness of rodent-borne diseases and adoption of advanced delivery systems such as automated bait stations and smart monitoring technologies.

Which Region Holds the Largest Share of the Difethialone Market?

- North America dominated the difethialone market with a 36.14% revenue share in 2025, driven by high demand for effective rodent control in agriculture, food storage, urban infrastructure, and industrial facilities across the U.S. and Canada. Increasing awareness of rodent-borne diseases, property damage prevention, and stricter regulatory compliance is further boosting adoption of Difethialone-based solutions

- Leading companies in North America are launching advanced bait formulations, ready-to-use gel, and eco-friendly blocks to strengthen market position and provide safer, highly effective rodent control solutions. Continuous investment in pest management R&D and integration with sustainable agricultural practices drives long-term market growth

- Strong regulatory frameworks, high adoption of integrated pest management (IPM) programs, and well-established distribution networks further reinforce regional market leadership

U.S. Difethialone Market Insight

The U.S. is the largest contributor in North America, supported by rising agricultural production, urban pest control initiatives, and growing demand from food processing and storage facilities. Difethialone is increasingly used to control resistant rodent populations and reduce secondary poisoning risks. Presence of leading manufacturers, advanced distribution channels, and robust R&D in eco-friendly rodenticides further boosts market adoption.

Canada Difethialone Market Insight

Canada contributes significantly to regional growth, driven by expanding agricultural operations, food storage warehouses, and government-supported pest management programs. Adoption of safe and effective rodenticides, including Difethialone, in urban and rural areas is rising, with growing interest in environmentally responsible formulations enhancing market penetration.

Asia-Pacific Difethialone Market

Asia-Pacific is projected to register the fastest CAGR of 9.47% from 2026 to 2033, fueled by rapid urbanization, rising agricultural output, and increasing awareness of rodent-borne health risks in China, India, Japan, South Korea, and Southeast Asia. Growing demand for high-efficacy rodenticides in food storage, grain silos, and industrial facilities is further driving adoption.

China Difethialone Market Insight

China leads the Asia-Pacific region due to high agricultural production, widespread grain storage infrastructure, and strong government initiatives promoting pest control in urban and rural areas. Manufacturers are introducing safer, high-efficacy Difethialone formulations to meet local regulatory standards and large-scale market demand.

Japan Difethialone Market Insight

Japan shows steady growth, supported by stringent food safety regulations, rising awareness of rodent-borne diseases, and adoption of integrated pest management programs. Urban pest control demand and preference for eco-friendly, low-toxicity rodenticides drive sustained market adoption.

India Difethialone Market Insight

India is emerging as a key growth hub, driven by increasing grain storage facilities, food processing industries, and urban pest control needs. Rising awareness about resistant rodent populations and adoption of long-acting, safe rodenticides such as Difethialone supports rapid market expansion.

South Korea Difethialone Market Insight

South Korea contributes significantly due to strong demand for rodent control in urban areas, food processing units, and industrial facilities. Growing focus on sustainable pest management and adoption of highly effective difethialone formulations drives long-term market growth.

Which are the Top Companies in Difethialone Market?

The difethialone industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Bayer AG (Germany)

- trc-canada.com (Canada)

- Alta Scientific Ltd. (Canada)

- Crescent Chemical Co., Inc. (U.S.)

- J & K SCIENTIFIC Ltd. (U.K.)

- Shandong XiYa Chemical Technology Co., LTD (China)

- Syngenta AG (Switzerland)

- UPL (India)

- Liphatech, Inc. (U.S.)

- Eaton (U.S.)

- NEOGEN Corporation (U.S.)

- PelGar International (U.K.)

- SenesTech, Inc. (U.S.)

- Bell Labs. (U.S.)

- IMPEX EUROPA S.L. (Spain)

- Rentokil Initial plc (U.K.)

- The Terminix International Company Limited (U.S.)

- Ecolab (U.S.)

- Anticimex (Sweden)

- Rollins, Inc. (U.S.)

- Truly Nolen of America (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.