Global Digital Denture Market

Market Size in USD Billion

CAGR :

%

USD

1.17 Billion

USD

2.13 Billion

2024

2032

USD

1.17 Billion

USD

2.13 Billion

2024

2032

| 2025 –2032 | |

| USD 1.17 Billion | |

| USD 2.13 Billion | |

|

|

|

|

Digital Denture Market Size

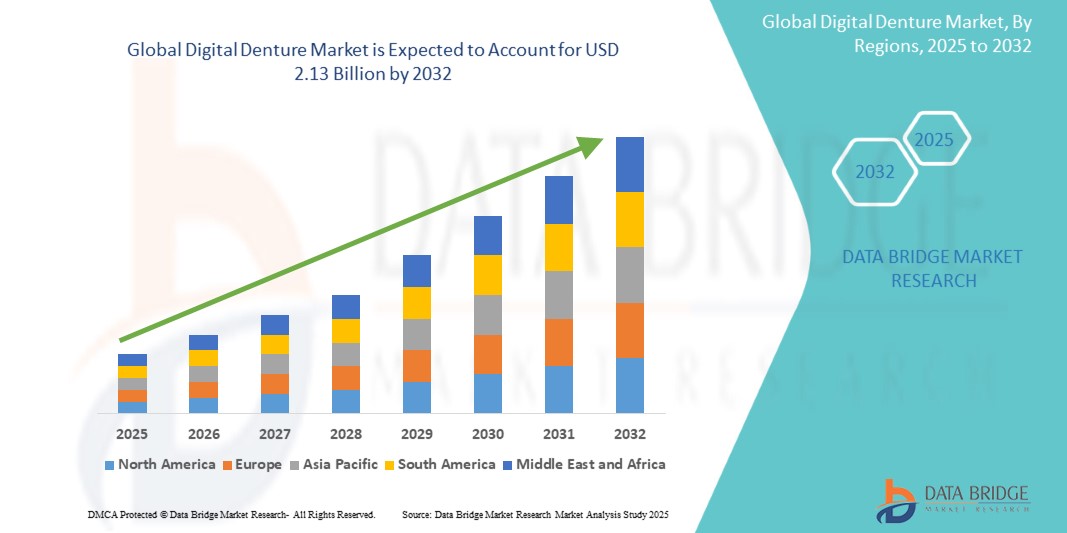

- The global digital denture market was valued at USD 1.17 billion in 2024 and is expected to reach USD 2.13 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.30 % primarily driven by the increasing adoption of advanced dental technologies and growing demand for customized, high-quality dental prosthetics

- This growth is driven by factors such as rising awareness of the benefits of digital denture solutions, advancements in CAD/CAM technology, increasing aging populations, and growing demand for cost-effective, precise, and comfortable dental solutions

Digital Denture Market Analysis

- Digital dentures refer to dentures that are designed, fabricated, and produced using digital technologies such as 3D scanning, computer-aided design (CAD), and computer-aided manufacturing (CAM), offering a more precise and efficient alternative to traditional denture-making methods

- The digital denture market is rapidly growing as dental professionals increasingly adopt digital technologies in the production of dentures. Traditional denture-making methods are being replaced by digital solutions, improving the efficiency and quality of the production process

- Digital dentures offer enhanced precision compared to conventional methods. The use of digital scanning and 3D printing allows for a more accurate fit, reducing the need for adjustments after the denture fitting. This leads to improved patient satisfaction and a reduction in the time spent in the dental chair

- The use of advanced CAD/CAM (computer-aided design/computer-aided manufacturing) technology plays a crucial role in the digital denture market

- For instance, Systems such as 3Shape and Exocad allow dental professionals to design custom dentures with greater detail and accuracy, offering patients a more comfortable experience

- For instance, Digital denture technology is the collaboration between dental labs and manufacturers such as Ivoclar Vivadent, which developed the Ivoclar Digital Denture System. This system integrates scanning, designing, and manufacturing to create highly personalized dentures with faster turnaround times

- As the market grows, more dental clinics and laboratories are investing in digital tools

- For instance, Straumann’s digital denture solutions are gaining popularity among practitioners due to their high-quality results and efficiency, contributing to the market’s expansion

- The technology is also evolving to provide more aesthetic options. Materials such as Ivoclar’s "Denture Teeth" are being used in digital dentures to mimic the look and feel of natural teeth, making the dentures both functional and cosmetically appealing

- With the growing demand for better-fitting, comfortable, and visually appealing dentures, the digital denture market is seeing a shift towards more widespread adoption of these technologies across global dental practices

Report Scope and Digital Denture Market Segmentation

|

Attributes |

Digital Denture Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

Midmark Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Digital Denture Market Trends

“Increasing Shift from Traditional Denture Manufacturing Methods to Digital Techniques”

- The increasing shift from traditional denture manufacturing methods to digital techniques is a transformative trend in the dental industry. Traditional methods involved manual impressions, wax modeling, and handcrafting, leading to longer production times, potential inaccuracies, and discomfort for patients

- Digital techniques use 3D scanning to capture an accurate representation of the patient’s mouth. This allows for a more precise fit and reduces the likelihood of mistakes compared to manual methods

- For instance, Companies such as 3Shape offer 3D scanning technology that captures highly detailed images of the dental structure

- After scanning, computer-aided design software is used to design the dentures. This software, such as Exocad, allows dental professionals to create custom dentures quickly, with the ability to adjust the design to ensure the best fit and appearance

- The use of 3D printing or milling technologies in the production of dentures significantly speeds up the process

- For instance, Stratasys and Formlabs provide 3D printers that create dental prosthetics with high precision and minimal need for human intervention

- Digital dentures are typically lighter, more durable, and better fitting than those made with traditional methods. Ivoclar Vivadent has developed digital denture systems that provide enhanced aesthetic qualities and a superior fit for patients

- The efficiency of digital techniques leads to faster turnaround times

- For instance, Dental labs that utilize CAD/CAM technology, such as those using Sirona’s CEREC, can reduce production times from weeks to just a few days, improving the overall patient experience

- The shift to digital methods is also improving the workflow in dental clinics and labs. With less time spent on manual steps, practitioners can serve more patients and deliver results faster, leading to increased patient satisfaction and operational efficiency

- As more dental professionals invest in digital tools, traditional methods are becoming less common. Dental practices are increasingly relying on these technologies to meet patient demands for higher-quality, customized dentures with better fit and comfort

Digital Denture Market Dynamics

Driver

“Increasing Demand for Customization and Precision in Dentures”

- Growing demand for customized and precise dentures is a significant driver in the digital denture market, as patients are increasingly seeking more personalized dental solutions. Traditional methods often led to poor fit, discomfort, and the need for frequent adjustments, which digital solutions aim to eliminate

- 3D scanning and computer-aided design software allow dental professionals to create highly personalized dentures tailored to the unique anatomy of each patient's mouth, ensuring a better fit and improved comfort. This customization has made digital dentures particularly appealing for patients seeking a more natural look and better functionality.

- Digital denture solutions significantly reduce production time. 3D printing and milling technologies enable faster manufacturing, allowing for quicker turnaround compared to traditional methods. This not only benefits dental professionals by improving workflow efficiency but also enhances the patient experience by shortening the overall treatment process.

- Enhanced precision in digital denture creation reduces the chances of human error.

- For instance, 3Shape and Exocad are widely used software that help create highly detailed and accurate denture designs. The result is fewer remakes and adjustments, saving both time and cost for dental professionals.

- Cosmetic appeal is another driving factor in the increasing demand for digital dentures. The ability to create dentures that match the natural contours of the patient's mouth and aesthetic preferences has made them more attractive, especially in cases where appearance plays a crucial role.

- As patient satisfaction rises due to more comfortable, durable, and aesthetically pleasing dentures, the market for digitally crafted dentures continues to grow. Technologies such as Ivoclar Vivadent’s digital denture system are improving both the quality and speed of dental prosthetics, leading to higher adoption rates across the dental industry.

- Overall, digital technologies in denture manufacturing are driving market growth by offering solutions that are faster, more accurate, and cost-effective, ultimately reshaping how dentures are produced and enhancing the patient experience

Opportunity

“Expansion of Digital Denture Solutions in Emerging Markets”

- Emerging markets present a significant opportunity for the digital denture market, as digital technologies in dentistry gain global traction. In many developing countries, dental care infrastructure is improving, with a growing awareness of advanced technologies such as digital dentures

- The growing middle class, higher disposable income, and better access to healthcare in emerging markets are contributing to an increased demand for high-quality, yet cost-effective dental solutions. Digital dentures provide an affordable alternative to traditional dentures, as digital methods typically reduce labor costs and material waste

- Countries such as India, China, and Brazil are seeing a rise in the number of dental clinics adopting digital technologies. These technologies, such as CAD/CAM systems and 3D printing, are helping improve the quality and speed of treatments

- For instance, India’s dental sector is increasingly investing in digital tools to offer better services to patients

- The ease of manufacturing and faster turnaround time of digital dentures is another advantage. This allows dental professionals in emerging markets to cater to a larger patient base, including those in rural areas who previously may not have had access to advanced dental solutions

- By offering digital denture solutions, dental professionals in these regions can help meet the growing demand for high-quality prosthetics. This growth presents a major opportunity to address the unmet demand for advanced dental technologies in areas that have been historically underserved

Restraint/Challenge

“High Initial Investment Costs for Digital Equipment”

- One of the major challenges in adopting digital denture technologies is the high initial investment cost required to purchase necessary equipment, such as 3D scanners, CAD/CAM software, and 3D printers. The upfront costs of these digital systems can be prohibitive, especially for small or independent dental practices that may have limited budgets

- The substantial financial commitment involved can make these technologies unaffordable for many practitioners, particularly in regions with lower dental healthcare budgets. This poses a significant barrier to the adoption of digital denture solutions, as many dental clinics may prioritize basic services over the integration of advanced technologies

- Beyond the initial purchase of the equipment, there are additional financial burdens associated with the implementation of digital solutions. These include training costs for dental professionals to learn how to use new systems and the need for ongoing maintenance and software updates.

- For instance, 3Shape and Exocad may require continual upgrades and specialized training, which can further strain a practice’s budget

- Despite the long-term benefits of digital denture solutions—such as improved efficiency, reduced labor costs, and better patient outcomes—many dental practices remain hesitant to invest due to the uncertain return on investment. This is especially true in markets where the demand for digital dentures is still in its early stages, making it difficult to justify the financial outlay

- The financial barrier limits access to advanced digital technologies to larger, well-funded practices and dental laboratories. Smaller clinics or those located in lower-income regions are at a disadvantage, further delaying the widespread adoption of digital denture solutions across the industry

Digital Denture Market Scope

The market is segmented on the basis of type, tools, usability, material and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Tools |

|

|

By Usability |

|

|

By Material |

|

|

By End User |

|

Digital Denture Market Regional Analysis

“North America is the Dominant Region in the Digital Denture Market”

- North America is dominating the Digital Denture market due to its early adoption of advanced technologies, high healthcare standards, and well-established infrastructure

- The presence of key players in the dental technology industry, such as 3Shape, Exocad, and Ivoclar Vivadent, significantly boosts the market's growth in this region. These companies provide cutting-edge solutions for dental professionals, enhancing the adoption of digital technologies

- Dental clinics and laboratories in North America are increasingly turning to digital denture solutions due to their clear advantages over traditional methods. These include enhanced precision, faster production times, and improved patient satisfaction

- The integration of CAD/CAM systems and 3D printing technologies enables dental professionals to create customized dentures with a high level of accuracy, making dentures more comfortable and aesthetically pleasing for patients

- Personalized dental solutions are in high demand, and digital dentures provide a perfect fit and improved comfort, driving the rapid growth of this market in North America.

- Well-developed healthcare infrastructure in North America ensures that digital technologies are easily accessible to dental practitioners, further accelerating market growth

- The region’s ongoing focus on technological innovation and improved patient outcomes strengthens North America's position as the dominant region in the digital denture market

- As more dental clinics adopt digital tools and solutions, North America's digital denture market continues to expand and is expected to remain a leader in this sector for the foreseeable future

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the Digital Denture market, driven by the growing adoption of advanced dental technologies, rising healthcare investments, and increasing dental care awareness

- Countries such as China, India, and Japan are investing heavily in modernizing their dental infrastructures, which includes the integration of digital tools for denture production, significantly driving demand for digital dentures

- As the demand for high-quality dental solutions increases, digital dentures are becoming increasingly sought after due to their ability to provide highly customized and precise fittings, making them more comfortable and aesthetically appealing compared to traditional dentures

- The rise in disposable incomes, especially in emerging markets such as India and Southeast Asia, is driving the demand for better dental care. As the middle class expands, more people are seeking affordable yet high-quality dental solutions, creating an opportunity for digital dentures to become a standard offering in dental clinics across the region

- The adoption of 3D scanning, CAD/CAM technology, and 3D printing allows dental practitioners to offer faster and more efficient services, reducing treatment times and making the dental care process more patient-friendly

- The increasing focus on preventive dental care and growing patient awareness of aesthetics and functionality is contributing to the region's rapid shift towards modern, effective, and patient-friendly denture solutions, fueling the growth of the digital denture market

- With the continuous evolution of dental technology, Asia Pacific is expected to experience even faster growth, further solidifying its position as the fastest-growing market for digital dentures globally

Digital Denture Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Dentsply Sirona Inc. (U.S.)

- Desktop Metal (U.S.)

- Carima (South Korea)

- Straumann Group (Switzerland)

- Amann Girrbach AG (Austria)

- Shandong Huge Dental Material Corporation (China)

- Planmeca Group (Finland)

- Kulzer GmbH (Germany)

- Modern Dental Group (Hong Kong)

- BEGO GmbH & Co. KG (Germany)

- Jiangsu Weiyun Artificial Intelligence Co., Ltd (China)

- Medit Corp. (South Korea)

- Neoss AG (Switzerland)

- Planet DDS (U.S.)

- Stratasys Ltd. (Israel)

- DWS Systems SRL (Italy)

- GC Corporation (Japan)

- Ivoclar Vivadent AG (Liechtenstein)

- Asiga (Australia)

- Durr Dental Company (Germany)

- 3D Systems Corporation (U.S.)

- Midmark Corporation (U.S.)

Latest Developments in Global Digital Denture Market

- In November 2024, Modern Dental Group acquired the Top 1 Dental Laboratory in Thailand, further solidifying its leadership in the digital denture market. This acquisition enhances the company’s manufacturing capabilities and allows it to offer customized, precise dentures to a broader customer base in Southeast Asia. By leveraging the lab's infrastructure and expertise, Modern Dental Group aims to improve production efficiency and meet the rising demand for high-quality dental prosthetics. This strategic move is expected to increase the company’s market share, drive the adoption of digital denture technologies, and set new standards in the industry. Ultimately, it will contribute to the rapid growth of the digital denture market in the region, improving patient satisfaction and accelerating the evolution of dental care in Southeast Asia

- In February 2022, Dentsply Sirona announced its latest strategic steps to further drive its growth in the digital dentistry market. The company outlined plans to accelerate its product innovation, enhance its digital solutions, and expand its reach globally, particularly through strategic partnerships and acquisitions. This initiative is aimed at strengthening Dentsply Sirona's position in the dental technology sector, focusing on integrating advanced digital solutions such as CAD/CAM, 3D imaging, and software innovations. The development will benefit the company by enhancing its product portfolio and improving access to cutting-edge dental solutions for both dental professionals and patients. The impact on the market will be significant, as Dentsply Sirona's efforts will accelerate the adoption of digital dentistry, improve treatment efficiency, and set new standards for high-quality dental care worldwide

- In September 2023, Straumann Group announced the acquisition of Allied Star, a leading provider of digital dental solutions. This strategic acquisition is aimed at strengthening Straumann's position in the digital denture market and expanding its portfolio of innovative dental technologies. By integrating Allied Star’s advanced CAD/CAM systems and 3D printing technologies, Straumann seeks to enhance its capabilities in offering high-quality, customized dental prosthetics. This move will benefit the company by broadening its market reach, particularly in digital denture production, and allowing it to offer more precise, efficient, and patient-specific solutions. The impact on the market is expected to be significant, as the acquisition will accelerate the adoption of digital dental solutions, setting new industry standards and improving patient care globally, particularly in prosthetic dentistry

- In February 2023, Dentsply Sirona and A-dec expanded their collaboration by integrating Primescan Connect into A-dec’s delivery systems. This strategic partnership aims to enhance the integration of digital dentistry solutions and provide seamless workflows for dental professionals. By embedding Primescan Connect, a cutting-edge intraoral scanner, into A-dec’s systems, the collaboration ensures enhanced precision, efficiency, and improved patient outcomes. The move benefits Dentsply Sirona by extending the reach of its digital solutions and strengthening its position in the digital dentistry market. The impact on the market is significant as it accelerates the adoption of digital technologies in dental practices, streamlining procedures, reducing treatment times, and enhancing the overall patient experience. This integration reflects a broader trend of increasing demand for innovative, connected dental technologies to improve both clinical and operational efficiencies globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.