Global Digital Film Printing Market

Market Size in USD Billion

CAGR :

%

USD

7.64 Billion

USD

19.47 Billion

2025

2033

USD

7.64 Billion

USD

19.47 Billion

2025

2033

| 2026 –2033 | |

| USD 7.64 Billion | |

| USD 19.47 Billion | |

|

|

|

|

What is the Global Digital Film Printing Market Size and Growth Rate?

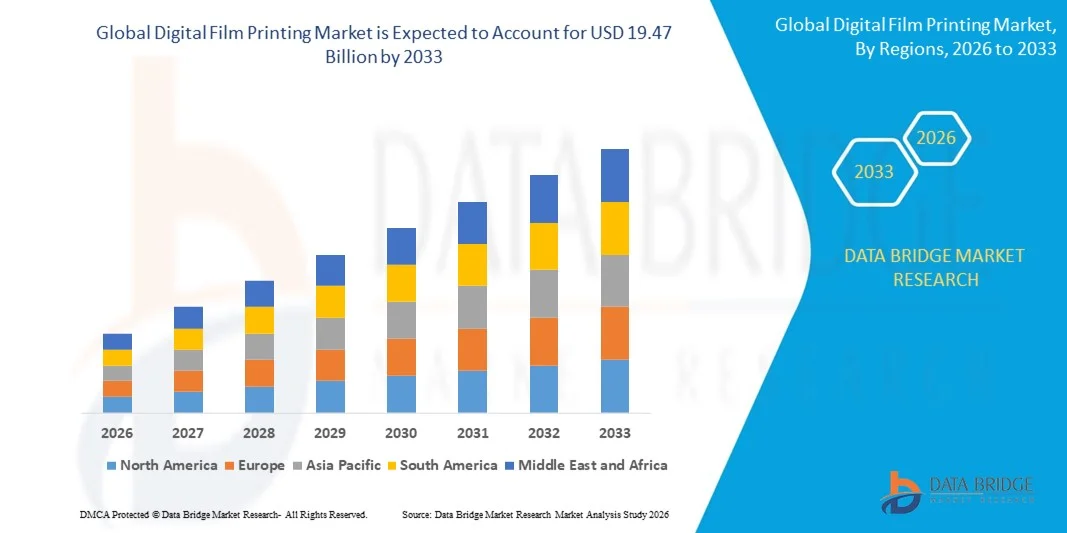

- The global digital film printing market size was valued at USD 7.64 billion in 2025 and is expected to reach USD 19.47 billion by 2033, at a CAGR of 12.40% during the forecast period

- Rising development of packaging and textile industries is a crucial factor accelerating the market growth, also increasing reduction in per unit cost of printing with digital printers, rising adoption of photo printing products and services and shift towards variable data print and customization, rising demand for premium packaging materials from various industries that manufacture cosmetics, alcoholic drinks, and household products

What are the Major Takeaways of Digital Film Printing Market?

- Rising key manufacturers of digital printing films are engaging in the production of direct UV offset printable films, which in turn increases the demand for the product, growing digitization, rising industrialisation technological developments and increasing growth of textile industries and others are the major factors among others boosting the digital film printing market

- Moreover, rising demand from the in-plant market and increasing investment in research and development activities will further create new opportunities for digital film printing market

- Asia-Pacific dominated the digital film printing market with the largest revenue share of 39.1% in 2025, driven by the rapid expansion of the packaging, advertising, and entertainment industries in countries such as China, Japan, South Korea, and India

- North America is projected to witness the fastest growth rate of 9.8% during 2026–2033, driven by expanding digital advertising, flexible packaging, and on-demand printing applications

- The 5–10 Mils segment dominated the market with the largest revenue share of 42.7% in 2025, owing to its optimal balance of flexibility, printability, and durability, making it ideal for packaging labels, promotional films, and industrial applications

Report Scope and Digital Film Printing Market Segmentation

|

Attributes |

Digital Film Printing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Digital Film Printing Market?

Rising Demand for Customization, Efficiency, and High-Quality Print Outputs

- The digital film printing market is witnessing a significant shift toward high-resolution, fast, and cost-effective printing technologies, driven by increasing demand for personalized packaging, labels, and decorative films across industries such as consumer goods, automotive, and electronics. Manufacturers are innovating with inkjet, UV, and laser-based printing systems to enhance precision, color fidelity, and production efficiency

- For instance, companies such as Canon, Xerox Corporation, and Roland Corporation have introduced advanced Digital Film Printing solutions capable of high-speed, multi-layer printing and customizable designs for commercial and industrial applications

- Growing adoption of digital workflows and on-demand printing is enabling shorter lead times, reduced waste, and greater operational flexibility, particularly in packaging and labeling applications

- Integration of automation, IoT-enabled monitoring, and AI-driven color management systems is transforming production efficiency and quality control in film printing operations

- Sustainability initiatives, including low-solvent inks, recyclable films, and energy-efficient printers, are gaining momentum globally, aligning with regulatory and corporate ESG goals

- As industries increasingly demand faster turnaround, high customization, and eco-friendly production, the expansion of Digital Film Printing applications in packaging, signage, and specialty films is expected to remain the defining trend shaping market growth

What are the Key Drivers of Digital Film Printing Market?

- Rising demand for personalized packaging, branding, and high-resolution decorative films is driving the adoption of Digital Film Printing globally

- For instance, in 2025, Shutterfly, Inc. and Snapfish expanded their digital printing portfolios to provide high-quality, customizable prints for consumer and commercial markets

- The growth of e-commerce, promotional products, and specialty labels is fueling the need for shorter production runs, cost-effective customization, and rapid delivery, which digital printing addresses efficiently

- Technological innovations, including UV curing, solvent-free inks, and high-speed roll-to-roll systems, are enhancing print quality, durability, and production efficiency

- Increasing regulatory emphasis on sustainable packaging, recyclable films, and low-emission inks is further driving adoption of digital film printing solutions

- As packaging, advertising, and specialty film applications expand across regions such as North America, Europe, and Asia-Pacific, the Digital Film Printing market is poised for steady growth, supported by innovation and environmental compliance

Which Factor is Challenging the Growth of the Digital Film Printing Market?

- High initial investment costs for advanced digital printing equipment, combined with maintenance and specialized training requirements, remain significant challenges

- For instance, supply chain disruptions in ink and film raw materials during 2024–2025 delayed deliveries and increased operational costs for global printers

- Intense competition from traditional flexographic and offset printing technologies creates pricing pressures, especially in large-volume commercial printing

- Rapid technological evolution requires continuous upgrades, making it difficult for small and medium players to maintain competitiveness

- Compatibility issues with different film substrates and limitations in printing certain specialty materials may restrict adoption in some industrial applications

- To overcome these challenges, key players are investing in R&D, equipment leasing models, sustainable inks, and process automation, ensuring long-term market stability, high-quality output, and customer satisfaction

How is the Digital Film Printing Market Segmented?

The market is segmented on the basis of thickness, material, films type, printing type, and end-use industry.

- By Thickness

On the basis of thickness, the digital film printing market is segmented into Below Five Mils, 5–10 Mils, 10–15 Mils, and Above 15 Mils. The 5–10 Mils segment dominated the market with the largest revenue share of 42.7% in 2025, owing to its optimal balance of flexibility, printability, and durability, making it ideal for packaging labels, promotional films, and industrial applications. Films in this thickness range offer superior handling, easy lamination, and consistent color reproduction, which is critical for high-quality printing.

The Above 15 Mils segment is expected to register the fastest CAGR from 2026 to 2033, driven by increasing demand in heavy-duty packaging, industrial films, and specialty applications where higher mechanical strength, tear resistance, and stability are required. Continuous innovations in extrusion and coating technologies are enabling high-quality prints on thicker films, supporting adoption across packaging, automotive, and electronics industries globally.

- By Material

On the basis of material, the digital film printing market is segmented into Polyester, PVC/Cast Vinyl PSA, Polystyrene, Polypropylene, Polyethylene, Polyamide, and Others. The Polyester segment dominated the market with a revenue share of 38.9% in 2025, attributed to its excellent dimensional stability, chemical resistance, and high optical clarity, making it suitable for labels, decorative films, and flexible packaging. Polyester films support high-resolution printing and are compatible with both inkjet and laser technologies, driving their widespread use.

The Polypropylene segment is expected to grow at the fastest CAGR during 2026–2033, fueled by the rising adoption of sustainable, lightweight, and recyclable films for packaging applications. Advancements in barrier properties, print adhesion, and gloss control are enhancing polypropylene’s applicability, particularly in food, beverage, and healthcare packaging industries.

- By Film Type

On the basis of film type, the digital film printing market is segmented into Clear and Matte films. The Clear film segment dominated the market with a revenue share of 46.2% in 2025, owing to its superior transparency, brightness, and color fidelity, which are critical for premium labels, packaging, and decorative applications. Clear films allow high-contrast, vivid printing, making them ideal for consumer products and branding.

The Matte film segment is projected to register the fastest CAGR from 2026 to 2033, driven by growing demand for glare-free, textured, and aesthetically enhanced finishes in premium packaging, product labels, and decorative films. Continuous improvements in surface coating and ink adhesion technologies are expanding the use of matte films across retail, electronics, and industrial applications.

- By Printing Type

On the basis of printing type, the digital film printing market is segmented into Laser Printable Films and Inkjet Printable Films. The Inkjet Printable Films segment dominated the market with the largest share of 52.5% in 2025, attributed to its versatility, high-resolution capabilities, and compatibility with short-run, on-demand production processes. Inkjet films support rapid customization and color fidelity, making them suitable for packaging, labels, and promotional applications.

The Laser Printable Films segment is expected to exhibit the fastest CAGR during 2026–2033, fueled by increasing adoption in commercial printing, industrial labeling, and secure document applications. Advancements in laser-compatible coatings, enhanced heat resistance, and durability are driving laser film usage globally.

- By End-Use Industry

On the basis of end-use industry, the digital film printing market is segmented into Packaging and Non-Packaging applications. The Packaging segment dominated the market with a revenue share of 57.1% in 2025, driven by the rising demand for high-quality, customizable labels, flexible packaging, and promotional films across food, beverage, personal care, and healthcare industries. Packaging applications prioritize print clarity, barrier performance, and durability, which digital film printing efficiently provides.

The Non-Packaging segment is expected to register the fastest CAGR from 2026 to 2033, fueled by growing adoption in industrial applications, decorative films, signage, and specialty labeling. Technological advancements in printable films, coatings, and inks are enabling non-packaging applications to expand across automotive, electronics, and construction sectors.

Which Region Holds the Largest Share of the Digital Film Printing Market?

- Asia-Pacific dominated the digital film printing market with the largest revenue share of 39.1% in 2025, driven by the rapid expansion of the packaging, advertising, and entertainment industries in countries such as China, Japan, South Korea, and India. The region’s growing adoption of digitalization, e-commerce packaging, and customized promotional printing has accelerated demand for advanced digital film printing solutions

- Local and global manufacturers are heavily investing in high-quality printable films, eco-friendly inks, and smart printing technologies to enhance productivity and reduce production waste

- Furthermore, government initiatives supporting sustainable printing, industrial automation, and technological innovation are reinforcing Asia-Pacific’s leadership position in the global digital film printing market

China Digital Film Printing Market Insight

China represents the largest share of the Asia-Pacific digital film printing market, attributed to its strong manufacturing ecosystem, high-volume packaging demand, and technological innovation. The nation’s expanding consumer goods and e-commerce sectors are driving large-scale use of polyester and polypropylene printable films. Domestic companies are focusing on eco-friendly inks, automated print systems, and high-resolution imaging to improve quality and efficiency. Continuous R&D investment and export-oriented production have strengthened China’s dominance across the regional and global supply chains.

India Digital Film Printing Market Insight

India’s digital film printing market is growing rapidly, supported by industrial expansion, film production, and FMCG packaging growth. The government’s “Make in India” initiative and rising investments in digital printing infrastructure are encouraging local production. Increasing adoption of cost-effective polypropylene and PVC-based films in advertising, label printing, and commercial packaging applications is fueling market expansion. Domestic manufacturers are also emphasizing sustainability, recyclability, and advanced ink compatibility to enhance competitiveness across the Asia-Pacific region.

North America Digital Film Printing Market Insight

North America is projected to witness the fastest growth rate of 9.8% during 2026–2033, driven by expanding digital advertising, flexible packaging, and on-demand printing applications. Rising demand for short-run printing, variable data printing, and high-resolution imaging in the U.S. and Canada is propelling regional market growth. Continuous advancements in UV-curable inks, laser printing, and polymer-based films are improving performance and reducing environmental impact. Increasing emphasis on sustainable packaging and automation in film printing workflows continues to boost North America’s market expansion.

U.S. Digital Film Printing Market Insight

The U.S. dominates the North American market, supported by strong demand from media, packaging, and commercial printing sectors. The country is witnessing rising adoption of inkjet and laser printable films due to their high precision, durability, and compatibility with modern digital printers. Key companies are investing in smart printing technologies, recyclable materials, and sustainable production systems to align with green printing initiatives. Strategic collaborations among major players are enhancing the U.S.’s position as a global hub for innovation in digital film printing.

Canada Digital Film Printing Market Insight

Canada contributes steadily to the North American digital film printing market, driven by its growing retail packaging, labeling, and advertising applications. The nation’s focus on eco-friendly printing solutions, digital transformation, and sustainable packaging materials is supporting long-term market growth. Expanding industrial printing facilities and increasing adoption of polyester and cast vinyl films are strengthening Canada’s competitive edge. Ongoing investments in technological upgrades and recycling infrastructure are enhancing production efficiency and positioning Canada as a key regional player.

Europe Digital Film Printing Market Insight

Europe continues to hold a substantial share of the global digital film printing market, driven by demand from the automotive, cosmetics, and consumer goods packaging industries. Countries such as Germany, the U.K., France, and Italy are focusing on premium-quality, recyclable films with superior printability. The region’s strict environmental regulations and emphasis on low-VOC inks and sustainable substrates are accelerating adoption of eco-friendly digital film printing solutions across industries.

Germany Digital Film Printing Market Insight

Germany leads Europe’s digital film printing market, supported by advanced engineering, strong printing infrastructure, and a focus on high-precision applications. The country’s industrial sector increasingly relies on polyester and polypropylene films for technical labeling and packaging. Continuous innovation in printing machinery, ink formulations, and coating technologies is reinforcing Germany’s dominance in Europe’s premium digital printing segment.

U.K. Digital Film Printing Market Insight

The U.K. market is witnessing steady growth driven by advertising, film production, and digital packaging expansion. Increasing investments in sustainable printing practices, matte-finish films, and UV-curable inks are shaping market evolution. Local companies are focusing on reducing waste, improving color consistency, and enhancing surface durability, aligning with the country’s environmental goals. The rising adoption of on-demand and personalized printing continues to strengthen the U.K.’s share in the European Digital Film Printing market.

Which are the Top Companies in Digital Film Printing Market?

The digital film printing industry is primarily led by well-established companies, including:

- Cimpress (U.S.)

- Snapfish (U.S.)

- Digitalab (U.S.)

- Mpix (U.S.)

- Perion Network Ltd (Israel)

- Eastman Kodak Company (U.S.)

- Shutterfly, Inc. (U.S.)

- Bay Photo Lab (U.S.)

- AdorPix LLC (U.S.)

- ProDPI (U.S.)

- Xerox Corporation (U.S.)

- Canon India Pvt Ltd (India)

- Avery Dennison Corporation (U.S.)

- HEXIS S.A. (France)

- KPMF Limited (U.K.)

- DUNMORE (U.S.)

- Achilles (U.K.)

- CONSTANTIA (Austria)

- Drytac Corporation (U.S.)

- THE GRIFF NETWORK (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Roland Corporation (Japan)

- Seiko Epson Corporation (Japan)

- Ricoh (Japan)

- Toshiba India Pvt. Ltd (India)

What are the Recent Developments in Global Digital Film Printing Market?

- In April 2025, Mimaki Engineering announced its first UV-DTF printer, the UJV300DTF-75, expanding the scope of customization for sign graphics, interiors, and everyday products. The UV-curable Direct-to-Film printer leverages advanced transfer technology to deliver high-value decorative applications with superior precision and efficiency. This launch strengthens Mimaki’s presence in the digital customization and specialty printing market

- In February 2025, Seiko Epson Corporation launched the SC-G6000, its first Direct-to-Film (DTFilm) printer, marking its official entry into the DTFilm printing segment. The roll-to-roll printer enables high-quality transfers on various fabrics through Epson’s trusted inkjet technology, ensuring versatile and efficient textile production. This product launch reinforces Epson’s strategic move toward expanding its textile printing portfolio globally

- In January 2025, Seiko Epson Corporation introduced the SureColor G-Series, featuring its first wide-format Direct-to-Film (DTF) printer, the SureColor G6070. Designed for garment decorators and print professionals, the G6070 ensures reliable, cost-effective, and low-maintenance operations while supporting a wide range of fabric types. This development highlights Epson’s growing commitment to innovation and scalability in the garment printing sector

- In September 2024, Roland DG Corporation unveiled the TY-300 Direct-to-Film (DTF) production transfer printer in Japan, with plans for global market expansion. The TY-300 gained rapid popularity in the decorated apparel industry for its ability to print complex, high-quality designs on diverse fabrics such as cotton, polyester, denim, and nylon. This launch solidifies Roland DG’s position as a key innovator in textile and apparel printing technology

- In September 2024, Caldera, a subsidiary of Dover, launched a Direct-to-Film (DTF) printing software solution optimized for digital textile printing workflows. The solution simplifies DTF image preparation, enabling high-quality output without the need for specialized technical expertise. This innovation enhances Caldera’s reputation as a leader in smart software solutions for digital print management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Digital Film Printing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Digital Film Printing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Digital Film Printing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.