Global Digital Human Market

Market Size in USD Billion

CAGR :

%

USD

31.50 Billion

USD

625.82 Billion

2024

2032

USD

31.50 Billion

USD

625.82 Billion

2024

2032

| 2025 –2032 | |

| USD 31.50 Billion | |

| USD 625.82 Billion | |

|

|

|

|

Digital Human Market Size

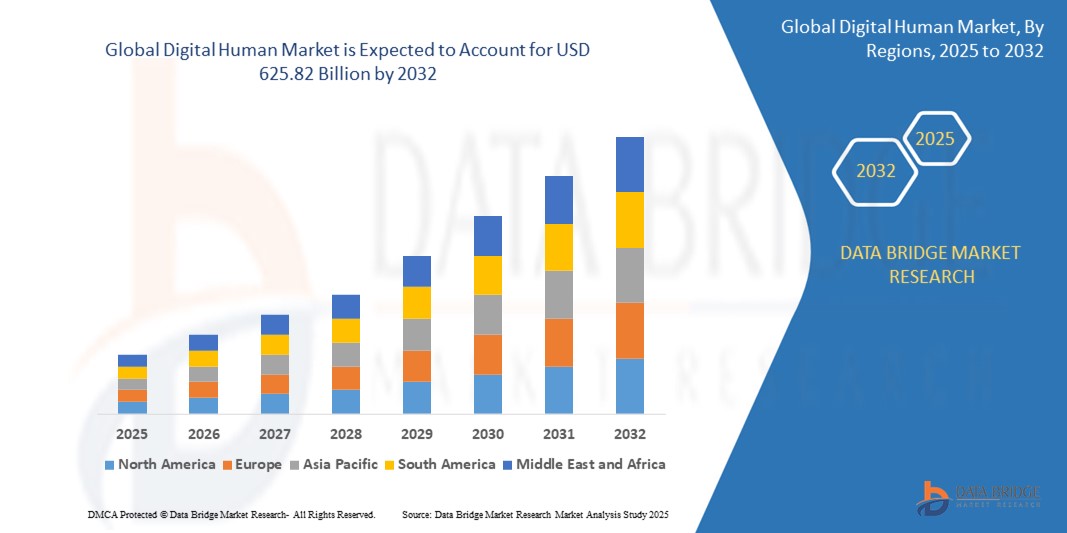

- The global digital human market was valued at USD 31.50 billion in 2024 and is expected to reach USD 625.82 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 45.30%, primarily driven by the anticipated launch of advanced AI-driven platforms

- This growth is driven by factors such as the increasing demand for virtual assistants, integration of AI in customer service, advancements in natural language processing, and growing use of digital humans in healthcare, retail, and entertainment sectors

Digital Human Market Analysis

- Digital humans are AI-powered virtual avatars designed to simulate lifelike human interactions. They are increasingly used across industries such as customer service, healthcare, entertainment, and education to enhance user engagement and automate interactions

- The growing demand for hyper-personalized and emotionally intelligent digital experiences is significantly driving the adoption of digital humans. This demand is further fueled by advancements in natural language processing (NLP), computer vision, and real-time animation technologies. A substantial share of global demand originates from sectors aiming to improve customer satisfaction and operational efficiency through automation

- The North America region stands out as one of the dominant regions in the digital human market, supported by a strong presence of AI technology companies, high digital literacy, and early adoption of emerging technologies

- For instance, U.S.-based tech giants and startups are actively deploying digital human solutions in sectors such as finance, retail, and mental health support. This region not only leads in deployment but also in R&D and innovation within the space

- Globally, digital humans are emerging as a core component of next-generation AI interfaces, often ranking second only to conversational AI bots in terms of enterprise adoption. They play a pivotal role in bridging the gap between human-centric design and automated systems, making interactions more relatable and efficient

Report Scope and Digital Human Market Segmentation

|

Attributes |

Digital Human Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Human Market Trends

“Increased Adoption of Real-Time 3D Rendering and AI-Powered Interactivity”

- One prominent trend in the global digital human market is the growing adoption of real-time 3D rendering combined with AI-powered interactivity to create hyper-realistic and emotionally responsive virtual avatars

- These advanced features significantly enhance user experience by enabling digital humans to exhibit lifelike facial expressions, body language, and voice modulation, making interactions feel more natural and engaging

- For instance, next-gen digital human platforms now use deep learning models and 3D volumetric capture to simulate micro-expressions and real-time reactions, which are crucial for use cases like virtual therapy, training simulations, and immersive customer support

- Digital integration also allows seamless cross-platform deployment, enabling digital humans to operate across websites, mobile apps, AR/VR environments, and even physical kiosks, while continuously learning from user interactions

- This trend is revolutionizing the way businesses and organizations interact with users—shifting from static interfaces to dynamic, humanized experiences—ultimately driving higher adoption rates and expanding the role of digital humans across multiple sectors

Digital Human Market Dynamics

Driver

“Growing Demand for Hyper-Personalized and Humanized Digital Interactions”

- The rising demand for hyper-personalized and emotionally intelligent user experiences is significantly contributing to the increased adoption of digital humans across multiple industries, including customer service, retail, education, and healthcare

- As businesses shift toward digital transformation and automation, there's an increasing need to retain a human touch in digital interactions—something digital humans are uniquely positioned to deliver through realistic facial expressions, voice interaction, and real-time responsiveness

- Digital humans enhance engagement, reduce response times, and provide round-the-clock availability, especially in customer-facing roles such as virtual banking assistants, e-commerce support agents, and healthcare companions. These attributes make them a compelling solution for brands looking to elevate user experiences and build stronger emotional connections with their audiences

- Continuous advancements in artificial intelligence, machine learning, and real-time 3D rendering technologies further amplify the capabilities of digital humans—making them more intuitive, adaptable, and scalable across platforms and use cases

For instance,

- In October 2023, Soul Machines, a leader in autonomous digital people, launched an AI-powered digital human platform that enables companies to embed lifelike avatars directly into their websites and applications, capable of learning and adapting to customer behaviors in real-time

- In August 2022, Samsung introduced “Neon,” a project under STAR Labs, which leverages advanced AI and CGI to create digital humans capable of personalized interaction in industries such as hospitality, retail, and entertainment

- As organizations increasingly prioritize customer-centric and immersive digital strategies, the demand for digital humans continues to rise—positioning them as a key driver of next-generation human-computer interaction

Opportunity

“Revolutionizing Human Interaction Through AI and Emotional Intelligence Integration”

- The integration of advanced AI and emotional intelligence (EI) capabilities into digital humans presents a major opportunity to revolutionize human-computer interaction across sectors such as healthcare, education, finance, and entertainment

- AI-powered digital humans can interpret and respond to human emotions through facial expression recognition, voice tone analysis, and behavioral cues—enabling more empathetic and context-aware conversations. This opens doors for applications in therapy, elder care, customer support, and virtual learning environments

- By analyzing real-time data from interactions, digital humans can continuously learn and adapt to user preferences, becoming more effective at delivering personalized experiences while also reducing operational costs for businesses

For instance,

- In March 2024, according to a report by MIT Technology Review, researchers unveiled a next-generation digital human capable of recognizing and responding to over 40 distinct human emotions. These avatars were deployed in mental health settings to support emotional therapy and anxiety management

- In September 2023, Alibaba integrated emotionally responsive digital humans into its virtual shopping assistants, allowing users to receive product recommendations based on facial expressions and spoken preferences, significantly boosting user engagement and satisfaction

- The integration of emotional intelligence into digital humans is expected to drive improved user outcomes, foster trust in digital systems, and enhance accessibility for vulnerable populations such as the elderly, individuals with disabilities, or those in remote areas. These advancements position digital humans as a transformative force in reshaping digital interaction on a global scale

Restraint/Challenge

“High Development and Deployment Costs Hindering Market Penetration”

- The high costs associated with developing and deploying digital human solutions represent a major barrier to widespread adoption, particularly affecting small to medium enterprises (SMEs) and startups

- Digital humans require sophisticated AI algorithms, 3D rendering, motion capture, and real-time processing technologies—all of which demand significant investment in both hardware and software infrastructure

- These expenses, which can run into hundreds of thousands or even millions of dollars for fully interactive, high-fidelity digital humans, create a substantial entry barrier, making it difficult for smaller organizations to participate in the market

For instance,

- In January 2025, according to a white paper published by Soul Machines Ltd., one of the leading concerns among developers and business stakeholders is the financial burden involved in integrating emotionally responsive digital humans into existing platforms. The report noted that while digital humans offer immense potential across sectors like retail, healthcare, and finance, the high initial costs often delay or deter deployment, especially in resource-constrained environments

- As a result, this financial constraint can lead to a slower rate of innovation and adoption in key sectors, including education and public services, where budget limitations are prevalent. The gap between large tech firms and smaller players may widen, ultimately restraining the overall expansion and democratization of the global digital human market

Digital Human Market Scope

The market is segmented on the basis of type and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By End user |

|

Digital Human Market Regional Analysis

“North America is the Dominant Region in the Digital Human Market”

- North America leads the global digital human market, attributed to its strong technological foundation, early adoption of artificial intelligence, and the presence of major industry players such as Soul Machines, Microsoft, and IBM

- The U.S. holds a significant share owing to high demand for AI-powered customer service agents, virtual influencers, and digital brand ambassadors across industries like retail, banking, and healthcare

- Robust investment in AI research, favorable government initiatives supporting digital innovation, and the integration of digital humans in enterprise solutions further drive market growth

- In addition, the region benefits from widespread internet penetration, a tech-savvy population, and advanced infrastructure that supports high-fidelity digital rendering and real-time interactivity, collectively enhancing adoption and market expansion

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is anticipated to experience the fastest growth in the digital human market, fueled by rapid digital transformation, increasing adoption of AI-driven technologies, and expanding internet connectivity across emerging economies

- Countries such as China, Japan, South Korea, and India are becoming key growth engines due to their booming tech industries, rising demand for immersive customer experiences, and supportive government initiatives promoting AI innovation

- Japan and South Korea, known for their technological advancements, are leading in the development and integration of lifelike digital humans across sectors such as entertainment, retail, and public services. Japan, in particular, is pioneering humanoid robotics and virtual companions, contributing significantly to regional growth

- In China and India, the vast population, growing e-commerce sector, and increasing use of digital assistants and virtual influencers in marketing and education are accelerating adoption. Investment from local tech giants and increasing collaborations with international AI firms are further enhancing the regional digital human ecosystem

Digital Human Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Soul Machines (New Zealand)

- Digital Domain (U.S.)

- UneeQ (New Zealand)

- Microsoft (U.S.)

- Hour One (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Reallusion Inc. (U.S.)

- Meta Platforms, Inc. (U.S.)

- Xsens Technologies B.V. (Netherlands)

- Daz Productions Inc. (U.S.)

- Colossyan (Location not specified)

- NVIDIA Corporation (U.S.)

- IBM Corporation (U.S.)

- Google LLC (U.S.)

- 15. Amazon Web Services (AWS) (U.S.)

Latest Developments in Global Digital Human Market

- In July 2023, UneeQ, a leader in digital human technology, proudly announced the launch of its innovative SDK. This groundbreaking tool significantly streamlines the integration of AI-powered digital humans into digital environments—particularly in augmented and virtual reality experiences, including Apple’s Vision Pro

- In October 2024, e& UAE announced the launch of its groundbreaking team of human-digital advisors at Gitex Global 2024. Each advisor features a unique personality, representing different nationalities living in the UAE. This marks a significant milestone in the region’s telecommunications industry

- In September 2024, at the 2024 Tencent Global Digital Ecosystem Summit, Tencent Cloud, the cloud arm of the global tech giant Tencent, announced a strategic partnership with the S.M.A.R.T Entrepreneurship Club—a group committed to connecting business needs with leading AI solutions and fostering international collaborations that deliver value for all stakeholders

- In December 2024, NVIDIA Corporation announced its collaboration with a leading automotive manufacturer to integrate AI-powered digital humans as in-car virtual assistants. These assistants offer real-time guidance, entertainment, and a personalized experience, marking a significant step in the convergence of AI and automotive technology

- In March 2025, Meta Platforms announced the launch of its advanced AI Digital Avatar platform at the AI Future Summit. This platform empowers companies to create hyper-realistic, interactive digital humans for customer service, virtual retail, and education. The avatars feature enhanced emotional intelligence and multilingual support, making them ideal for diverse global applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DIGITAL HUMAN MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DIGITAL HUMAN MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 MULTIVARIATE MODELLING

2.2.5 TOP TO BOTTOM ANALYSIS

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 VENDOR SHARE ANALYSIS

2.2.8 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.9 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DIGITAL HUMAN MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES ANALYSIS

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 VALUE CHAIN ANALYSIS

5.5 COMPANY COMPARITIVE ANALYSIS

5.6 PATENT ANALYSIS

5.7 USE CASES

6. GLOBAL DIGITAL HUMAN MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 INTERACTIVE DIGITAL HUMAN AVATAR

6.3 NON-INTERACTIVE DIGITAL HUMAN AVATAR

7. GLOBAL DIGITAL HUMAN MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ARTIFICIAL INTELLIGENCE (AI)

7.3 NATURAL LANGUAGE PROCESSING

7.4 3D SCANNING

7.5 3D MODELLING

7.6 NATURAL LANGUAGE GENERATION

8. GLOBAL DIGITAL HUMAN MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 VIRTUAL AGENTS

8.3 VIRTUAL CHARACTERS

8.4 VIRTUAL INFLUENCERS

8.5 VIRTUAL ASSISTANTS

8.6 VIRTUAL COMPANIONS

9. GLOBAL DIGITAL HUMAN MARKET, BY END USER

9.1 OVERVIEW

9.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

9.2.1 BY TYPE

9.2.1.1. FINANCIAL ADVISOR

9.2.1.2. VIRTUAL BANKING ASSISTANT

9.2.2 BY PRODUCT TYPE

9.2.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.2.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.3 IT AND TELECOMMUNICATION

9.3.1 BY TYPE

9.3.1.1. VIRTUAL TECHNICAL SUPPORT

9.3.1.2. CUSTOMER SERVICE ASSISTANT

9.3.2 BY PRODUCT TYPE

9.3.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.3.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.4 RETAIL

9.4.1 BY TYPE

9.4.1.1. VIRTUAL SHOPPING ASSISTANT

9.4.1.2. PRODUCT DEMONSTRATION

9.4.2 BY PRODUCT TYPE

9.4.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.4.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.5 HEALTH

9.5.1 BY TYPE

9.5.1.1. VIRTUAL COACHES

9.5.1.2. TRAINING SIMULATION

9.5.2 BY PRODUCT TYPE

9.5.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.5.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.6 AUTOMOTIVE

9.6.1 BY TYPE

9.6.1.1. VEHICLE SAFETY SIMULATION

9.6.1.2. VIRTUAL SHOWROOM ASSISTANT

9.6.1.3. TRAINING

9.6.1.4. VEHICLE INTERFACES

9.6.1.5. AUTONOMOUS VEHICLE TESTING

9.6.1.6. DRIVER MONITORING SIMULATION

9.6.1.7. HUMAN FACTOR ANALYSIS

9.6.2 BY PRODUCT TYPE

9.6.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.6.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.7 ENTERTAINMENT

9.7.1 BY TYPE

9.7.1.1. VIRTUAL REALITY

9.7.1.2. INTERATIVE STORY TELLING

9.7.1.3. MOVIES AND TV SHOWS

9.7.1.4. MUSIC VIDEOS

9.7.1.5. LIVE PERFORMANCES

9.7.1.6. OTHERS

9.7.2 BY PRODUCT TYPE

9.7.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.7.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.8 ADVERTISEMENT

9.8.1 BY TYPE

9.8.1.1. COMMERCIALS

9.8.1.2. PRODUCT LAUNCHES

9.8.1.3. BRAND ENDROSEMENTS

9.8.1.4. SOCIAL MEDIA CAMPAIGN

9.8.1.5. INFLUENCER MARKETING

9.8.2 BY PRODUCT TYPE

9.8.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.8.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.9 GAMING

9.9.1 BY TYPE

9.9.1.1. PLAYABLE CHARACTERS

9.9.1.2. NON-PLAYABLE CHARACTERS (NPC)

9.9.2 BY PRODUCT TYPE

9.9.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.9.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.10 EDUCATION

9.10.1 BY TYPE

9.10.1.1. VIRTUAL TUTOR

9.10.1.2. LANGUAGE INSTRUCTION

9.10.2 BY PRODUCT TYPE

9.10.2.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.10.2.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.11 TRANSPORTATION

9.11.1 BY PRODUCT TYPE

9.11.1.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.11.1.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.12 HOSPITALITY

9.12.1 BY PRODUCT TYPE

9.12.1.1. INTERACTIVE DIGITAL HUMAN AVATAR

9.12.1.2. NON-INTERACTIVE DIGITAL HUMAN AVATAR

9.13 OTHERS

10. GLOBAL DIGITAL HUMAN MARKET, BY REGION

10.1 GLOBAL DIGITAL HUMAN MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1.1 NORTH AMERICA

10.1.1.1. U.S.

10.1.1.2. CANADA

10.1.1.3. MEXICO

10.1.2 EUROPE

10.1.2.1. GERMANY

10.1.2.2. FRANCE

10.1.2.3. U.K.

10.1.2.4. ITALY

10.1.2.5. SPAIN

10.1.2.6. RUSSIA

10.1.2.7. TURKEY

10.1.2.8. BELGIUM

10.1.2.9. NETHERLANDS

10.1.2.10. SWITZERLAND

10.1.2.11. SWEDEN

10.1.2.12. DENMARK

10.1.2.13. POLAND

10.1.2.14. REST OF EUROPE

10.1.3 ASIA PACIFIC

10.1.3.1. JAPAN

10.1.3.2. CHINA

10.1.3.3. SOUTH KOREA

10.1.3.4. INDIA

10.1.3.5. AUSTRALIA AND NEW ZEALAND

10.1.3.6. SINGAPORE

10.1.3.7. THAILAND

10.1.3.8. MALAYSIA

10.1.3.9. INDONESIA

10.1.3.10. PHILIPPINES

10.1.3.11. TAIWAN

10.1.3.12. VIETNAM

10.1.3.13. REST OF ASIA PACIFIC

10.1.4 SOUTH AMERICA

10.1.4.1. BRAZIL

10.1.4.2. ARGENTINA

10.1.4.3. REST OF SOUTH AMERICA

10.1.5 MIDDLE EAST AND AFRICA

10.1.5.1. SOUTH AFRICA

10.1.5.2. EGYPT

10.1.5.3. SAUDI ARABIA

10.1.5.4. U.A.E

10.1.5.5. ISRAEL

10.1.5.6. KUWAIT

10.1.5.7. QATAR

10.1.5.8. REST OF MIDDLE EAST AND AFRICA

10.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

11. GLOBAL DIGITAL HUMAN MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 MERGERS & ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT & APPROVALS

11.7 EXPANSIONS

11.8 REGULATORY CHANGES

11.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12. GLOBAL DIGITAL HUMAN MARKET, SWOT ANALYSIS

13. GLOBAL DIGITAL HUMAN MARKET, COMPANY PROFILE

13.1 UNREAL ENGINE (EPIC GAMES, INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 UNEEQ

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 SYNTHESIA LIMITED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 DIDIMO INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 IFLYTEK CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 UNITY TECHNOLOGIES

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 MICROSOFT

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 NVIDIA CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 HOUR ONE

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.10 INWORLD AI

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 DEEPBRAIN AI.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 SOUL MACHINES

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 TENCENT CLOUD

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 BORN DIGITAL

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 WEHUMANS

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 D-ID

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 DYXNET

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 NTT DATA

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 UNITH

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.20 ONE QUEXT

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14. RELATED REPORTS

15. QUESTIONNAIRE

16. ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.