Global Digital Identity Solution Market

Market Size in USD Billion

CAGR :

%

USD

39.71 Billion

USD

168.49 Billion

2024

2032

USD

39.71 Billion

USD

168.49 Billion

2024

2032

| 2025 –2032 | |

| USD 39.71 Billion | |

| USD 168.49 Billion | |

|

|

|

|

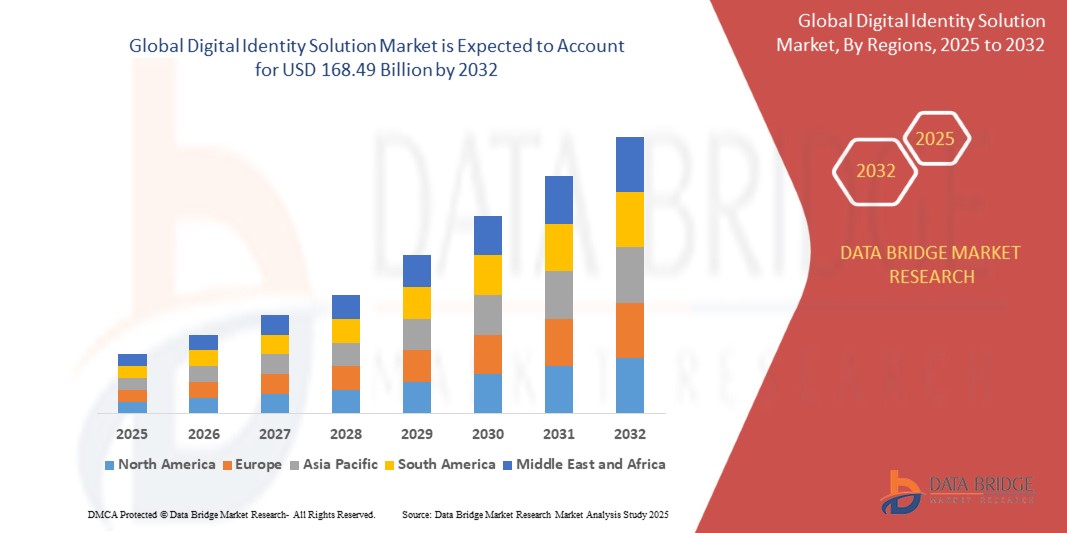

What is the Global Digital Identity Solution Market Size and Growth Rate?

- The global digital identity solution market size was valued at USD 39.71 billion in 2024 and is expected to reach USD 168.49 billion by 2032, at a CAGR of 19.80% during the forecast period

- The digital identity solution market is witnessing significant growth due to rapid innovations such as biometric authentication and blockchain integration. These technologies are reshaping security standards, enhancing user convenience, and reducing identity fraud risks. This evolution fosters trust, streamlines access to services, and empowers businesses with robust digital identity management solutions tools, catalyzing growth in the digital ecosystem

What are the Major Takeaways of Digital Identity Solution Market?

- Consumers expect seamless and convenient access to online services without compromising security. Digital identity solutions provide authentication methods that balance security with user experience

- For instance, facial recognition enables users to unlock smartphones securely with just a glance, offering both convenience and robust security. Such solutions streamline user experience while ensuring stringent authentication measures, meeting the evolving expectations of modern digital consumers

- North America dominated the digital identity solution market with the largest revenue share of 43.01% in 2024, driven by rising adoption of digital identity frameworks across enterprises and government agencies to combat cyber threats and ensure regulatory compliance

- Asia-Pacific (APAC) market is poised to grow at the fastest CAGR of 11.02% from 2025 to 2032, fueled by digitalization initiatives, rising cyber threats, and the adoption of mobile-first identity solutions in China, Japan, and India

- The Centralized segment dominated the digital identity solution market with the largest revenue share of 62.5% in 2024, driven by its widespread adoption in government databases, enterprise systems, and regulated sectors requiring centralized data storage for compliance

Report Scope and Digital Identity Solution Market Segmentation

|

Attributes |

Digital Identity Solution Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Digital Identity Solution Market?

AI-Driven Automation and Voice-Enabled Verification

- A significant trend shaping the global digital identity solution market is the integration of artificial intelligence (AI) and voice-enabled authentication to streamline identity verification processes. This convergence enhances security while improving user convenience for both personal and enterprise applications

- For instance, Microsoft’s Azure Active Directory now leverages AI-powered behavioral analytics and voice biometrics to detect anomalies in real time, while IDEMIA has introduced AI-based facial recognition integrated with voice commands for frictionless verification across financial services and border control

- These advancements allow organizations to automate risk assessments, personalize authentication flows, and improve fraud detection. AI adapts dynamically to user behavior, while voice interfaces offer a hands-free and intuitive experience for identity validation

- As businesses and governments move toward fully digital ecosystems, this trend is setting new benchmarks for security and usability in identity management

What are the Key Drivers of Digital Identity Solution Market?

- Rising cybersecurity threats and regulatory mandates (such as GDPR and KYC/AML requirements) are accelerating the adoption of advanced Digital Identity Solutions globally

- For instance, in April 2024, Thales Group launched a cloud-based digital ID platform for governments to enhance e-passport verification, emphasizing compliance with global security standards a move expected to strengthen market growth

- Increasing demand for seamless onboarding in banking, e-commerce, and healthcare, combined with the rise of remote working models, has amplified the need for robust identity verification. These solutions provide multi-factor authentication, biometric security, and fraud prevention, offering a reliable upgrade over traditional credentials

- In addition, the growing emphasis on digital transformation in both public and private sectors, supported by investments in AI, biometrics, and blockchain, is making Digital Identity Solutions a core component of future-ready infrastructure

Which Factor is challenging the Growth of the Digital Identity Solution Market?

- Data privacy concerns and cybersecurity risks associated with centralized identity systems present a significant barrier to adoption. As these solutions rely heavily on cloud and network connectivity, they remain vulnerable to hacking, identity theft, and large-scale data breaches

- For instance, recurring reports of biometric database leaks have created consumer apprehension around sharing sensitive data, impacting trust in digital identity platforms

- Addressing these concerns requires end-to-end encryption, decentralized identity frameworks, and regular system updates. Companies like NEC Corporation and Okta are emphasizing zero-trust architectures and privacy-by-design models to strengthen consumer confidence

- Furthermore, high implementation costs for advanced AI-powered or biometric solutions can limit adoption among SMEs and developing economies. While costs are declining, perceptions of digital ID systems as “premium technology” still slow widespread deployment. Overcoming these hurdles through affordable solutions, regulatory clarity, and consumer education will be essential for sustained market expansion

How is the Digital Identity Solution Market Segmented?

The market is segmented on the basis of identity framework, web type, end-user, offering, solution type, identity type, deployment mode, organization size, and vertical.

• By Identity Framework

On the basis of identity framework, the market is segmented into Centralized and Decentralized. The Centralized segment dominated the digital identity solution market with the largest revenue share of 62.5% in 2024, driven by its widespread adoption in government databases, enterprise systems, and regulated sectors requiring centralized data storage for compliance. Its established infrastructure and lower implementation costs make it the preferred choice for large organizations.

The Decentralized segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by rising concerns over data privacy and the increasing adoption of blockchain-based identity platforms that enable user-controlled credentials and reduced risk of data breaches.

• By Web Type

On the basis of web type, the market is segmented into Web 2 and Web 3. The Web 2 segment held the largest market revenue share of 68.4% in 2024, supported by its dominance in traditional digital platforms such as banking portals, e-commerce websites, and enterprise applications, where centralized identity solutions remain prevalent.

The Web 3 segment is expected to grow at the fastest CAGR, driven by the expansion of decentralized applications (dApps), cryptocurrency exchanges, and NFT platforms, where blockchain-based self-sovereign identities (SSIs) are increasingly in demand.

• By End-User

On the basis of end-user, the market is segmented into Enterprise and Individual. The Enterprise segment dominated with a revenue share of 71.2% in 2024, attributed to rising adoption in BFSI, healthcare, and government sectors for securing employee and customer identities through advanced verification solutions.

The Individual segment is projected to witness the fastest CAGR due to increasing demand for personal digital identity wallets, biometric-enabled smartphones, and secure access for online services.

• By Offering

On the basis of offering, the market is segmented into Solution and Services. The Solution segment held the largest share of 64.9% in 2024, driven by demand for core identity management tools such as multi-factor authentication (MFA) and identity verification platforms.

The Services segment, including consulting and managed services, is expected to expand rapidly as enterprises increasingly outsource identity management to specialized providers.

• By Solution Type

On the basis of solution type, the market is segmented into Authentication, Identity Verification, Identity Lifecycle Management, and Others. The Authentication segment captured the largest share of 42.3% in 2024, supported by growing implementation of biometric and passwordless authentication methods to strengthen cybersecurity.

The Identity Verification segment is expected to grow at the fastest pace, propelled by rising KYC and AML compliance needs in BFSI and digital onboarding processes across e-commerce and telecom.

• By Identity Type

On the basis of identity type, the market is segmented into Biometric and Non-Biometric. The Biometric segment dominated with a revenue share of 57.8% in 2024, fueled by increasing use of facial recognition, fingerprint scanning, and voice biometrics for enhanced security and user convenience.

The Non-Biometric segment, though slower-growing, continues to gain traction in low-cost applications and emerging markets due to its affordability.

• By Deployment Mode

On the basis of deployment mode, the market is segmented into On-Premise and Cloud. The Cloud segment held the largest share of 61.6% in 2024, driven by scalability, reduced infrastructure costs, and the growing adoption of SaaS-based identity platforms.

The On-Premise segment remains relevant for highly regulated industries requiring stringent control over sensitive data.

• By Organization Size

On the basis of organization size, the market is segmented into Large Enterprises and Small and Medium Enterprises (SMEs). The Large Enterprises segment dominated with 66.9% share in 2024, owing to higher budgets for advanced identity solutions and regulatory compliance requirements.

The SMEs segment is projected to exhibit the fastest CAGR, boosted by affordable cloud-based identity tools and rising cybersecurity awareness among smaller businesses.

• By Vertical

On the basis of vertical, the market is segmented into Banking, Financial Services, and Insurance (BFSI), IT and Telecommunication, Government and Defense, Retail and E-Commerce, Healthcare, Energy and Utilities, Media and Entertainment, Travel and Hospitality, Gaming, and Others. The BFSI segment accounted for the largest share of 24.7% in 2024, driven by stringent KYC/AML regulations and the need for fraud prevention in digital transactions.

The Healthcare segment is expected to witness the fastest growth, fueled by the rising adoption of digital health records and telemedicine requiring robust identity verification.

Which Region Holds the Largest Share of the Digital Identity Solution Market?

- North America dominated the digital identity solution market with the largest revenue share of 43.01% in 2024, driven by rising adoption of digital identity frameworks across enterprises and government agencies to combat cyber threats and ensure regulatory compliance

- Businesses and consumers in the region increasingly value advanced authentication methods such as biometrics and multi-factor authentication, along with seamless integration of digital identities into financial services, healthcare, and cloud platforms

- Strong technology infrastructure, supportive regulations like CCPA and HIPAA, and the presence of leading solution providers position North America as a hub for innovation in digital identity management

U.S. Digital Identity Solution Market Insight

The U.S. dominated North America’s revenue share in 2024, fueled by heightened cybersecurity threats and accelerated digital transformation across industries. Enterprises are rapidly deploying identity verification and lifecycle management platforms to secure remote workforces and digital transactions. The proliferation of cloud services, combined with government initiatives such as the National Strategy for Trusted Identities in Cyberspace (NSTIC), continues to drive market growth. Furthermore, integration of biometric authentication in banking, healthcare, and e-commerce platforms strengthens the U.S. leadership position.

Europe Digital Identity Solution Market Insight

The Europe market is projected to expand at a substantial CAGR during the forecast period, driven by stringent regulations such as GDPR and the eIDAS framework that mandate secure identity management. The region’s push toward cross-border digital identity interoperability fosters adoption across banking, government services, and travel industries. Growing demand for privacy-focused, decentralized identity solutions is particularly prominent, with significant uptake in residential, commercial, and industrial applications.

U.K. Digital Identity Solution Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, propelled by the Digital Identity and Attributes Trust Framework introduced by the government to standardize identity solutions. Increasing cybercrime and the need for secure e-commerce transactions are key growth drivers. Enterprises and consumers are embracing biometric and cloud-based identity solutions to enhance security and streamline digital onboarding processes.

Germany Digital Identity Solution Market Insight

The Germany market is expected to grow considerably due to rising adoption of privacy-centric and eco-conscious identity platforms. Germany’s emphasis on secure digital infrastructure and its leadership in Industry 4.0 initiatives are driving demand across manufacturing, automotive, and enterprise sectors. The preference for on-premise deployments and blockchain-based digital identities aligns with the country’s focus on data sovereignty and compliance.

Which Region is the Fastest Growing Region in the Digital Identity Solution Market?

Asia-Pacific (APAC) market is poised to grow at the fastest CAGR of 11.02% from 2025 to 2032, fueled by digitalization initiatives, rising cyber threats, and the adoption of mobile-first identity solutions in China, Japan, and India. Affordable cloud-based solutions and government-backed digital ID programs, such as India’s Aadhaar and China’s eID, are boosting mass adoption.

Japan Digital Identity Solution Market Insight

The Japan market is accelerating due to a tech-savvy population and government efforts to integrate digital IDs into public services. High adoption of biometric authentication in banking, healthcare, and corporate sectors complements Japan’s push toward smart city initiatives. The aging population further drives demand for secure, user-friendly authentication systems.

China Digital Identity Solution Market Insight

The China market accounted for the largest share in APAC in 2024, driven by rapid urbanization, an expanding middle class, and strong government support for national digital identity infrastructure. Domestic players dominate the supply of biometric and AI-powered solutions, enabling competitive pricing and widespread accessibility. The rise of smart cities and digital payment ecosystems continues to propel market expansion.

Which are the Top Companies in Digital Identity Solution Market?

The digital identity solution industry is primarily led by well-established companies, including:

- NEC Corporation (Japan)

- Thales (France)

- Okta (U.S.)

- Cisco Systems, Inc. (U.S.)

- IDEMIA (France)

- Oracle (U.S.)

- Microsoft (U.S.)

- IBM (U.S.)

- Avanade Inc. (U.S.)

- SAMSUNG (South Korea)

- Smartmatic (U.S.)

- OneSpan (U.S.)

- TELUS International (Canada)

- AU10TIX (Israel)

- iProov (U.K.)

- Ontology (China)

- Worldcoin (U.S.)

- Energy Web (Switzerland)

- Syntizen Technologies Pvt. Ltd. (India)

- Alethea AI (U.S.)

What are the Recent Developments in Global Digital Identity Solution Market?

- In May 2023, iProov collaborated with Wultra to launch a suite of biometric solutions for digital banking, aimed at improving security and enhancing user experience, marking a significant step toward strengthening trust in financial services

- In March 2023, Thales joined forces with the Finnish police to create advanced digital ID and biometric travel credentials, bolstering digital identity verification and border security, underscoring the company’s commitment to secure cross-border mobility

- In January 2023, CyberArk Software Ltd. introduced its locally-hosted CyberArk Identity Security Platform in Indonesia, supporting data sovereignty compliance and enhancing cybersecurity for regional organizations, reinforcing the importance of localized identity protection

- In November 2022, ForgeRock launched a cloud-native digital identity governance solution that integrates its platforms to streamline identity and access management, ultimately improving organizational productivity and driving efficiency in digital identity operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.