Market Analysis and Insights Global Digital Insurance Platform Market

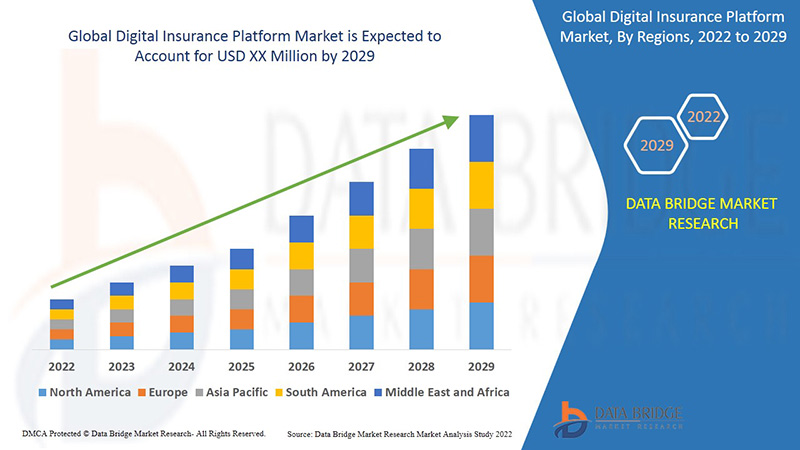

Data Bridge Market Research analyses that the digital insurance platform market will exhibit a CAGR of 13.7% for the forecast period of 2022-2029.

The insurance platform is a collection of websites that provide information about insurance policies as well as other relevant information. The digital insurance platform, in particular, is created and developed to help customers prepare for the challenges posed by quickly evolving technology entering the insurance industry. Consumers can easily get insurance information with the use of digital technology. By focusing on the demands of individual clients and addressing those needs through digital insurance platforms, insurers are able to focus on emerging technology. The digital insurance platform is a piece of software or a technology that assists a business in monitoring, creating, managing, and controlling the digital insurance ecosystem. It assists businesses in incorporating digitization into the insurance process. A digital insurance platform is a piece of software or a technology that allows an insurance company or managing general agent (MGA) to keep track of, manage, and regulate the digital insurance ecosystem. Companies can use digital insurance platforms to incorporate digitization across the insurance process. In the digital insurance ecosystem, these platforms combine diverse modules/silos and heterogeneous systems. Policy implementation, claim management, reinsurance management, regulatory filing, and billing and premium accounting are all examples of these modules or systems. These platforms also provide policyholders with a portal that allows them to view customer databases easily and remotely.

The digital insurance platform market is being driven by the rising adoption of IoT products. The upsurge in the adoption rate of underwater acoustic modems in naval defense is a major factor driving the market's growth. The changing insurer’s focus from product-based to consumer-centric strategies is driving up demand for digital insurance platform equipment market. Other significant factors such as rising awareness amongst insurers towards digital channels, and technological advancement will cushion the growth rate of digital insurance platform market. Furthermore, upsurge in the adoption rate of cloud-based digital solutions by the insurers to obtain the high scalability will accelerate the growth rate of digital insurance platform market for the forecast period mentioned above.

Moreover, increasing awareness amongst insurers to access a broader segment of the market and emerging new markets will boost the beneficial opportunities for the digital insurance platform market growth.

However, difficulties involved in the integration of insurance platforms with legacy systems will act as major retrain and further impede the market's growth. The dearth of skilled workforce will challenge the growth of the digital insurance platform market.

This digital insurance platform market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographical expansions, technological innovations in the market. To gain more info on digital insurance platform market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Digital Insurance Platform Market Scope and Market Size

The digital insurance platform market is segmented on the basis of component, end-user, insurance application, deployment type and organization size. The growth amongst the different segments helps you in attaining the knowledge related to the different growth factors expected to be prevalent throughout the market and formulate different strategies to help identify core application areas and the difference in your target market.

- On the basis of component, digital insurance platform market is segmented into tools and services. Based on service segment, digital insurance platform market is further sub-segmented into managed and professional service. The professional services segment is divided into consulting, implementation and support and maintenance.

- Based on end-users, digital insurance platform market is segmented into insurance companies, third-party administrators and brokers and aggregators.

- Based on insurance application, digital insurance platform market is segmented into automotive and transportation, home and commercial buildings, life and health, business and enterprise, consumer electronics and industrial machines and travel.

- Based on deployment type, digital insurance platform market is segmented into on-premises and cloud.

- Based on organization size, digital insurance platform market is segmented into large enterprises and small and medium-sized enterprises.

Digital Insurance Platform Market Country Level Analysis

The digital insurance platform market is segmented on the basis of component, end-user, insurance application, deployment type and organization size.

The countries covered in the digital insurance platform market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the digital insurance platform market and will continue to flourish its trend of dominance during the forecast period due to the high concentration of large insurance companies in this region. Asia-Pacific is expected to grow during the forecast period of 2022-2029 due to the rise in the level of commercial investment by various industries.

The country section of the digital insurance platform market report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, down-stream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Digital Insurance Platform Market Share Analysis

The digital insurance platform market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to digital insurance platform market.

Some of the major players operating in the digital insurance platform market are Tata Consultancy Services Limited, DXC Technology Company, Infosys Limited, Pegasystems Inc., Appian, Mindtree Ltd., Prima Solutions, FINEOS, Cognizant, Inzura Limited, Cogitate Technology Solutions, Inc., Duck Creek Technologies, Bolt Solutions, Majesco, EIS Group, iPipeline, Inc., Vertafore, Inc., eBaoTech Corporation, IBM, Microsoft, Accenture, Oracle, and SAP SE, among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DIGITAL INSURANCE PLATFORM MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DIGITAL INSURANCE PLATFORM MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL DIGITAL INSURANCE PLATFORM MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 USES CASES

5.1.1 DXC TECHNOLOGY

5.1.2 MICROSOFT

5.1.3 TCS

5.1.4 EIS GROUP

6 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, BY COMPONENTS

6.1 OVERVIEW

6.2 TOOLS

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1. CONSULTING

6.3.2.2. IMPLEMENTATION

6.3.2.3. SUPPORT AND MAINTENACE

7 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, BY END-USER

7.1 OVERVIEW

7.2 INSURANCE COMPANIES

7.3 THIRD-PARTY ADMINISTRATORS

7.4 AGGREGATORS

8 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, BY INSURANCE APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE AND TRANSPORTATION

8.3 HOME AND COMMERCIAL BUILDINGS

8.4 LIFE AND HEALTH

8.5 BUSINESS AND ENTERPRISE

8.6 CONSUMER ELECTRONICS AND INDUSTRIAL MACHINES

8.7 TRAVEL

8.8 OTHERS

9 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, BY DEPLOYMENT TYPE

9.1 OVERVIEW

9.2 ON-PREMISES

9.3 CLOUD

10 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, BY ORGANISATION SIZE

10.1 OVERVIEW

10.2 LARGE ENTERPRISE

10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

11 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, BY REGION

11.1 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1.1 NORTH AMERICA

11.1.1.1. U.S.

11.1.1.2. CANADA

11.1.1.3. MEXICO

11.1.2 EUROPE

11.1.2.1. GERMANY

11.1.2.2. FRANCE

11.1.2.3. U.K.

11.1.2.4. ITALY

11.1.2.5. SPAIN

11.1.2.6. RUSSIA

11.1.2.7. TURKEY

11.1.2.8. BELGIUM

11.1.2.9. NETHERLANDS

11.1.2.10. SWITZERLAND

11.1.2.11. REST OF EUROPE

11.1.3 ASIA PACIFIC

11.1.3.1. JAPAN

11.1.3.2. CHINA

11.1.3.3. SOUTH KOREA

11.1.3.4. INDIA

11.1.3.5. AUSTRALIA

11.1.3.6. SINGAPORE

11.1.3.7. THAILAND

11.1.3.8. MALAYSIA

11.1.3.9. INDONESIA

11.1.3.10. PHILIPPINES

11.1.3.11. REST OF ASIA PACIFIC

11.1.4 SOUTH AMERICA

11.1.4.1. BRAZIL

11.1.4.2. ARGENTINA

11.1.4.3. REST OF SOUTH AMERICA

11.1.5 MIDDLE EAST AND AFRICA

11.1.5.1. SOUTH AFRICA

11.1.5.2. EGYPT

11.1.5.3. SAUDI ARABIA

11.1.5.4. U.A.E

11.1.5.5. ISRAEL

11.1.5.6. REST OF MIDDLE EAST AND AFRICA

11.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.2 COMPANY SHARE ANALYSIS: EUROPE

12.3 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12.4 MERGERS & ACQUISITIONS

12.5 NEW PRODUCT DEVELOPMENT & APPROVALS

12.6 EXPANSIONS

12.7 REGULATORY CHANGES

12.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, SWOT ANALYSIS

14 GLOBAL DIGITAL INSURANCE PLATFORM MARKET, COMPANY PROFILE

14.1 IBM

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 GEOGRAPHIC PRESENCE

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 MICROSOFT

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 GEOGRAPHIC PRESENCE

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 ACCENTURE

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 GEOGRAPHIC PRESENCE

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 ORACLE

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 GEOGRAPHIC PRESENCE

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 SAP

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 GEOGRAPHIC PRESENCE

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 TCS

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 GEOGRAPHIC PRESENCE

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENTS

14.7 COGNIZANT

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 GEOGRAPHIC PRESENCE

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENTS

14.8 DXC TECHNOLOGY

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 GEOGRAPHIC PRESENCE

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENTS

14.9 INFOSYS

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 GEOGRAPHIC PRESENCE

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENTS

14.1 PEGASYSTEMS

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 GEOGRAPHIC PRESENCE

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENTS

14.11 APPAIN

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENTS

14.12 MINDTREE

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 GEOGRAPHIC PRESENCE

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENTS

14.13 PRIMA SOLUTIONS

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 GEOGRAPHIC PRESENCE

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENTS

14.14 FINEOS

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 GEOGRAPHIC PRESENCE

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENTS

14.15 BOLT SOLUTIONS

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 GEOGRAPHIC PRESENCE

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 MAJESCO

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 GEOGRAPHIC PRESENCE

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENTS

14.17 EIS GROUP

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 GEOGRAPHIC PRESENCE

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 COGITATE

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 GEOGRAPHIC PRESENCE

14.18.4 PRODUCT PORTFOLIO

14.18.5 RECENT DEVELOPMENTS

14.19 INZURA

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 GEOGRAPHIC PRESENCE

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.2 DUCK CREEK TECHNOLOGIES

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 GEOGRAPHIC PRESENCE

14.20.4 PRODUCT PORTFOLIO

14.20.5 RECENT DEVELOPMENTS

14.21 VERTAFORE

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 GEOGRAPHIC PRESENCE

14.21.4 PRODUCT PORTFOLIO

14.21.5 RECENT DEVELOPMENTS

14.22 INTERNET PIPELINE

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 GEOGRAPHIC PRESENCE

14.22.4 PRODUCT PORTFOLIO

14.22.5 RECENT DEVELOPMENTS

14.23 EBAOTECH

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 GEOGRAPHIC PRESENCE

14.23.4 PRODUCT PORTFOLIO

14.23.5 RECENT DEVELOPMENTS

14.24 STONERIVER

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 GEOGRAPHIC PRESENCE

14.24.4 PRODUCT PORTFOLIO

14.24.5 RECENT DEVELOPMENTS

14.25 RGI

14.25.1 COMPANY SNAPSHOT

14.25.2 REVENUE ANALYSIS

14.25.3 GEOGRAPHIC PRESENCE

14.25.4 PRODUCT PORTFOLIO

14.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

15 RELATED REPORTS

16 QUESTIONNAIRE

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.