Global Digital Packaging Label Market

Market Size in USD Billion

CAGR :

%

USD

34.12 Billion

USD

90.72 Billion

2025

2033

USD

34.12 Billion

USD

90.72 Billion

2025

2033

| 2026 –2033 | |

| USD 34.12 Billion | |

| USD 90.72 Billion | |

|

|

|

|

Digital Packaging Label Market Size

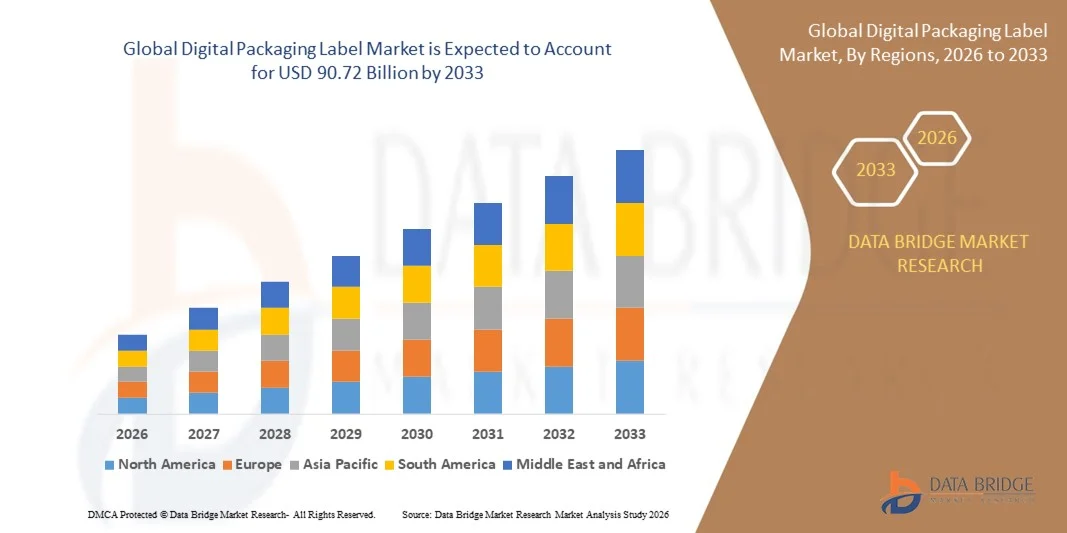

- The global digital packaging label market size was valued at USD 34.12 billion in 2025 and is expected to reach USD 90.72 billion by 2033, at a CAGR of 13.00% during the forecast period

- The market growth is largely fuelled by the rising demand for flexible and customized packaging solutions across food & beverage, healthcare, and personal care industries

- Increasing adoption of smart labeling technologies, including QR codes, NFC tags, and RFID-enabled labels, is driving enhanced consumer engagement and traceability

Digital Packaging Label Market Analysis

- The market is witnessing a shift from traditional label printing to digital technologies, enabling faster production, reduced waste, and cost efficiency

- Integration of digital labels with IoT and smart packaging solutions is improving supply chain management, product authentication, and anti-counterfeit measures

- North America dominated the digital packaging label market with the largest revenue share of 38.50% in 2025, driven by the rising demand for customized, short-run packaging solutions and the adoption of smart labeling technologies across food & beverage, personal care, and pharmaceutical sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global digital packaging label market, driven by expanding consumer markets, growing urbanization, rising disposable incomes, and strong investments in digital printing infrastructure across countries such as China, Japan, and India

- The Inkjet Technology segment held the largest market revenue share in 2025, driven by its high-resolution output, versatility in printing on various substrates, and capability for short-run, on-demand labeling. Inkjet-enabled labeling systems are widely preferred for their speed, cost-effectiveness, and ability to support variable data printing, making them ideal for dynamic packaging needs

Report Scope and Digital Packaging Label Market Segmentation

|

Attributes |

Digital Packaging Label Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Mondi (Austria) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Packaging Label Market Trends

Rise of Smart And Personalized Packaging Labels

- The growing shift toward digital and personalized packaging labels is transforming the packaging industry by enabling real-time customization and on-demand printing. The flexibility and speed of these technologies allow brands to respond quickly to changing consumer preferences, reduce lead times, and minimize waste, enhancing overall operational efficiency

- The high demand for short-run, customized, and sustainable labels is accelerating the adoption of digital printing solutions, including inkjet, laser, and thermal transfer technologies. These solutions are particularly effective for small and medium enterprises (SMEs) and e-commerce businesses seeking unique packaging designs without large inventory commitments

- The affordability and ease of integration of modern digital labeling systems are making them attractive for routine packaging operations, leading to improved brand differentiation and consumer engagement. Companies benefit from faster turnaround times, reduced production costs, and enhanced traceability

- For instance, in 2023, several global food and beverage manufacturers reported increased operational efficiency and higher customer satisfaction after implementing on-demand digital labels for seasonal promotions and limited-edition packaging

- While digital packaging labels are enhancing product customization and sustainability, their impact depends on continued innovation, software integration, and training. Manufacturers must focus on scalable, versatile solutions to fully capitalize on growing demand

Digital Packaging Label Market Dynamics

Driver

Rising Demand For Customization And Brand Engagement

- Increasing consumer preference for personalized and visually appealing packaging is pushing brands to adopt digital labeling solutions. This trend is driving investment in high-resolution printers, variable data printing, and interactive labeling technologies, enabling manufacturers to produce smaller batch runs efficiently and respond quickly to changing market trends. It also allows brands to create limited-edition or promotional packaging that enhances customer engagement and loyalty

- Companies are increasingly aware of the competitive advantages offered by smart packaging, including product differentiation, improved shelf appeal, and enhanced consumer experience. This awareness has led to widespread adoption across food & beverage, healthcare, and personal care segments, encouraging businesses to integrate advanced software for variable printing, QR codes, and interactive designs that can track consumer behavior and preferences

- Government regulations and industry standards promoting traceability, anti-counterfeiting measures, and eco-friendly packaging solutions are further supporting digital label adoption. Companies benefit from compliance with local and international standards while improving brand transparency, supply chain management, and sustainability credentials

- For instance, in 2022, major European and North American FMCG brands implemented digital labeling to meet stringent regulatory requirements while enhancing brand loyalty and engagement. The move enabled faster packaging updates, reduced inventory waste, and supported dynamic marketing campaigns aligned with consumer trends

- While brand engagement and regulatory support are driving growth, the market requires ongoing investments in software, hardware, and skilled personnel to ensure consistent quality and scalability. Companies must also adopt cloud-based management systems and automated workflow solutions to maintain efficiency in high-demand production environments

Restraint/Challenge

High Cost Of Digital Labeling Equipment And Software Integration

- The high investment required for advanced digital labeling systems, including high-resolution printers, finishing equipment, and software, limits accessibility for smaller manufacturers and startups. Cost remains a significant barrier for widespread adoption, especially in developing regions, where capital expenditure can be prohibitive, delaying digital transformation initiatives

- In many regions, lack of trained personnel and technical expertise to operate and maintain digital label printers further restricts adoption. Inadequate support infrastructure can lead to delays and operational inefficiencies, resulting in lower throughput, inconsistent print quality, and potential product recalls, affecting brand reputation and profitability

- Market penetration is also constrained by inconsistent supply of specialized inks, substrates, and compatible finishing materials, which can impact production continuity and quality. Companies face challenges in sourcing eco-friendly or specialty materials that meet regulatory and consumer expectations, slowing the adoption of fully digital labeling solutions

- For instance, in 2023, SMEs in Southeast Asia reported limited adoption of digital labeling due to high upfront costs and lack of technical support, delaying modernization efforts. Many small manufacturers continued relying on traditional analog methods, which restricted their ability to offer customized, on-demand, or interactive packaging

- While digital printing technologies continue to evolve, addressing cost, training, and supply chain challenges is crucial. Market stakeholders must focus on affordable, easy-to-use solutions, standardized training programs, and strong vendor support networks to accelerate adoption and ensure long-term scalability

Digital Packaging Label Market Scope

The market is segmented on the basis of technology, application, and end-user.

- By Technology

On the basis of technology, the global digital packaging label market is segmented into Inkjet Technology, Electrophotography, and Others. The Inkjet Technology segment held the largest market revenue share in 2025, driven by its high-resolution output, versatility in printing on various substrates, and capability for short-run, on-demand labeling. Inkjet-enabled labeling systems are widely preferred for their speed, cost-effectiveness, and ability to support variable data printing, making them ideal for dynamic packaging needs.

The Electrophotography segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its precision, scalability, and compatibility with high-volume production lines. Electrophotography technology is particularly popular among large-scale manufacturers for producing consistent, high-quality labels with complex graphics and variable content across multiple packaging formats.

- By Application

On the basis of application, the market is segmented into Boxes, Cans, Bottles, and Others. The Boxes segment held the largest market revenue share in 2025, due to its widespread use in food & beverage, personal care, and consumer goods packaging. Digital labels on boxes enable easy customization, variable data printing, and enhanced brand visibility, meeting evolving consumer demands and regulatory compliance.

The Bottles segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the growing demand for customized labeling in beverages, pharmaceuticals, and personal care products. Bottle labeling benefits from digital printing’s precision, high-resolution graphics, and flexibility for limited edition and promotional packaging.

- By End-User

On the basis of end-user, the market is segmented into Food and Beverages, Personal Care, Pharmaceuticals, Electronics Goods, and Others. The Food and Beverages segment dominated in 2025, driven by the need for traceability, regulatory compliance, and attractive, personalized packaging. Manufacturers are increasingly adopting digital labels to enhance consumer engagement and maintain brand differentiation in competitive markets.

The Pharmaceuticals segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for anti-counterfeit labeling, serialization, and regulatory compliance. Digital labeling ensures high accuracy, traceability, and flexibility for small-batch or specialty pharmaceutical products, supporting patient safety and supply chain integrity.

Digital Packaging Label Market Regional Analysis

- North America dominated the digital packaging label market with the largest revenue share of 38.50% in 2025, driven by the rising demand for customized, short-run packaging solutions and the adoption of smart labeling technologies across food & beverage, personal care, and pharmaceutical sectors

- Companies in the region are increasingly leveraging high-resolution inkjet and electrophotography systems to enhance product differentiation, improve traceability, and comply with regulatory standards

- The widespread integration of digital printing with supply chain management and e-commerce platforms is further supporting market growth and operational efficiency

U.S. Digital Packaging Label Market Insight

The U.S. digital packaging label market captured the largest revenue share in 2025 within North America, fueled by rapid adoption of on-demand printing, personalized packaging, and interactive label solutions. Food & beverage and pharmaceutical manufacturers are increasingly implementing digital labels for regulatory compliance, anti-counterfeit measures, and enhanced consumer engagement. The growth is further supported by advanced printing infrastructure, high investment in automation, and the rising focus on sustainable packaging solutions.

Europe Digital Packaging Label Market Insight

The Europe digital packaging label market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent labeling regulations, sustainability initiatives, and increasing demand for personalized and short-run packaging. Growing urbanization and the popularity of premium and limited-edition products are encouraging manufacturers to adopt digital labeling for brand differentiation. The adoption is notable across food & beverage, personal care, and pharmaceutical sectors, with digital labels enabling efficient production, traceability, and improved consumer engagement.

U.K. Digital Packaging Label Market Insight

The U.K. digital packaging label market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising trend of e-commerce packaging, sustainability awareness, and demand for product personalization. Retailers and manufacturers are increasingly using digital labels to improve supply chain traceability and brand visibility. The U.K.’s robust infrastructure for printing technology, along with strong consumer preference for interactive and limited-edition packaging, is expected to accelerate market growth.

Germany Digital Packaging Label Market Insight

The Germany digital packaging label market is expected to witness the fastest growth rate from 2026 to 2033, fueled by strict food safety regulations, demand for high-quality printing, and sustainability initiatives. Manufacturers are adopting digital labeling technologies to enhance product differentiation, comply with EU labeling standards, and improve operational efficiency. The presence of advanced printing infrastructure and focus on innovation in packaging solutions is further supporting market expansion across multiple end-use sectors.

Asia-Pacific Digital Packaging Label Market Insight

The Asia-Pacific digital packaging label market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, increasing demand for packaged consumer goods, and technological adoption in countries such as China, Japan, and India. The region is witnessing strong growth in short-run and on-demand label printing, supported by rising consumer awareness of product authenticity, traceability, and personalization. Additionally, government initiatives promoting digitization in manufacturing and packaging are encouraging the adoption of digital labeling solutions.

Japan Digital Packaging Label Market Insight

The Japan digital packaging label market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high technological adoption, demand for precision printing, and focus on premium and personalized packaging. The market is driven by food & beverage, pharmaceutical, and cosmetics manufacturers adopting digital labels for traceability, regulatory compliance, and interactive branding. Integration of digital labels with smart packaging and IoT-enabled devices is further supporting market expansion.

China Digital Packaging Label Market Insight

The China digital packaging label market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s large manufacturing base, rapid urbanization, and growing consumer demand for personalized and safe packaging. Digital labeling adoption is increasing across food & beverage, personal care, and pharmaceutical sectors for short-run production, regulatory compliance, and anti-counterfeit purposes. The strong presence of domestic printing technology providers and rising e-commerce penetration are key factors driving market growth in China.

Digital Packaging Label Market Share

The Digital Packaging Label industry is primarily led by well-established companies, including:

• Mondi (Austria)

• Graphic Packaging International, LLC (U.S.)

• Sonoco Products Company (U.S.)

• Weber Packaging Solutions (U.K.)

• Xerox Corporation (U.S.)

• Amcor plc (Australia)

• Xeikon (Belgium)

• Reel Appeal (U.S.)

• Constantia Flexibles (Austria)

• HP Development Company, L.P. (U.S.)

• XYMOPrint (U.K.)

• Quad/Graphics, Inc. (U.S.)

• Belmont Packaging Limited (U.K.)

• Traco Packaging (U.S.)

• Tetrapak (Sweden)

• Eastman Kodak Company (U.S.)

• BLUE LABEL PACKAGING COMPANY (U.S.)

• Coveris (Austria)

• A B Graphic International Ltd. (U.K.)

• DuPont (U.S.)

Latest Developments in Global Digital Packaging Label Market

- In October 2023, DS Smith plc inaugurated its 'R8' Research & Development and Innovation Centre in the U.K. The facility focuses on accelerating packaging solution development through collaboration with customers and partners, driving innovation, sustainability, and faster time-to-market for advanced fulfillment solutions across Europe

- In October 2023, Smurfit Kappa Group expanded its Design2Market Factory across Europe, replicating its innovative testing and adaptation facility in Germany, Italy, Poland, and the U.K. This initiative allows customers to trial packaging solutions on a small scale, reducing time-to-market and improving product launch success rates

- In July 2023, CCL Industries Inc. acquired Creaprint S.L., a specialist in in-mould label (IML) production based in Alicante, Spain. This acquisition expands CCL’s European manufacturing footprint, enabling increased production capacity and innovative label solutions for both local and international clients

- In March 2023, Smurfit Kappa Group invested USD 6.91 million in a Gopfert HBL 2.1m color printer in the U.K. The investment enhances print quality, material handling, and production efficiency, supporting advanced packaging solutions and increasing capacity for premium European clients

- In August 2022, Amcor plc opened its latest Innovation Center in Jiangyin, China. The center focuses on sustainable packaging technologies and advanced material science, driving innovation and growth in the Asia Pacific packaging market while supporting environmentally friendly solutions

- In September 2022, WestRock Company expanded its corrugated printing capabilities by installing an HP PageWide T1190 Press. The addition enables high-speed, high-quality printing, supporting customized packaging solutions and enhancing operational efficiency, which strengthens its competitive position in North American and global markets

- In May 2021, CCL Industries introduced the world’s first HP Indigo 35K Digital Press in Montreal, Canada. The press supports high-definition printing, security inks, and variable data printing, enhancing multi-layered brand protection and customized packaging solutions for health, personal care, and folding carton markets

- In January 2021, DS Smith plc installed an EFI Nozomi C18000 Plus digital printer at its Lisbon, Portugal plant. This system allows fully customized, high-resolution packaging with photographic-quality printing, shorter delivery times, and enhanced service offerings for customers in Portugal and Spain, improving market responsiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Digital Packaging Label Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Digital Packaging Label Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Digital Packaging Label Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.