Global Digital Remittance Market

Market Size in USD Billion

CAGR :

%

USD

25.20 Billion

USD

81.48 Billion

2024

2032

USD

25.20 Billion

USD

81.48 Billion

2024

2032

| 2025 –2032 | |

| USD 25.20 Billion | |

| USD 81.48 Billion | |

|

|

|

|

Digital Remittance Market Size

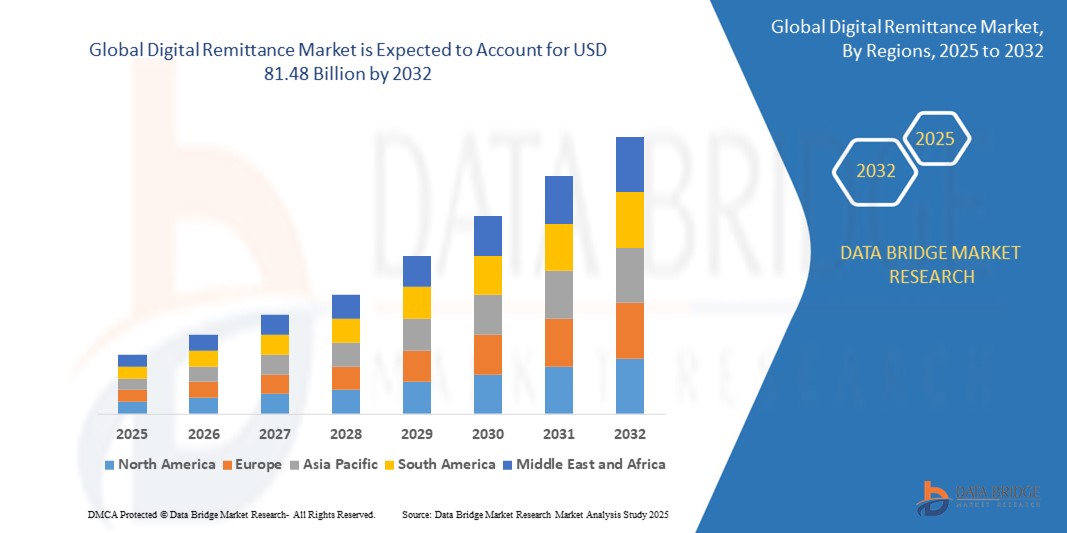

- The global digital remittance market was valued at USD 25.20 billion in 2024 and is expected to reach USD 81.48 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.80%, primarily driven by rapid penetration of smartphones and internet services

- This growth is driven by increasing global migration and the rising need for quick, low-cost, and secure money transfers

Digital Remittance Market Analysis

- The digital remittance market is experiencing rapid growth due to increasing global demand for fast, secure, and cost-effective money transfer solutions. This market is witnessing significant investments driven by advancements in digital payment technologies, rising smartphone and internet penetration, and growing cross-border migration trends fueling the need for accessible remittance services

- The market's growth is fueled by factors such as the surge in mobile banking adoption, increasing financial inclusion initiatives by governments, and the rise of fintech startups offering innovative and transparent digital remittance solutions, making money transfers quicker and more affordable for a wider population

- For instance, in April 2024, MoneyGram International partnered with Tencent Financial Technology to facilitate digital remittances directly to Weixin Pay wallet users in China, showcasing the growing importance of seamless and instant transfer services in enhancing customer convenience

- The digital remittance market is still evolving, but its potential to revolutionize global money transfers and financial ecosystems is immense. As consumers demand faster, more reliable, and user-friendly remittance experiences, the market is expected to expand rapidly in the coming years, with digital platforms, fintech innovators, and cross-border payment networks leading the transformation across the financial services sector

Report Scope and Digital Remittance Market Segmentation

|

Attributes |

Digital Remittance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Digital Remittance Market Trends

“Growing Integration of Blockchain Technology”

- A significant trend in the digital remittance market is the growing integration of blockchain technology, which enhances transparency, security, and speed of cross-border transactions while reducing operational costs and intermediary layers

- Blockchain-powered remittance platforms offer real-time tracking, lower transaction fees, and increased trust among users, making them increasingly popular among individuals and businesses seeking efficient international money transfers

- For instance, in March 2024, TerraPay partnered with Alfardan Exchange to leverage its advanced digital payment infrastructure, reflecting the industry’s focus on innovative technologies such as blockchain to optimize remittance services

- This trend is revolutionizing the digital remittance sector by driving the adoption of decentralized finance (DeFi) solutions, encouraging regulatory reforms, and opening new avenues for seamless, borderless financial transactions across global markets

Digital Remittance Market Dynamics

Driver

“Expansion of Mobile Wallet and Fintech Solutions”

- The rapid expansion of mobile wallets and fintech platforms is significantly driving the growth of the digital remittance market. Mobile-first financial solutions provide users with convenient, fast, and cost-effective ways to send and receive money globally, especially in underbanked and emerging regions

- Digital remittance service providers are increasingly partnering with mobile payment platforms to tap into vast user bases, offering seamless integration of cross-border transfers directly within digital wallets

- The growing fintech ecosystem is fueling innovation in digital remittance services by enabling real-time payments, lower transaction costs, and enhanced financial inclusion, particularly for migrant workers and rural populations

For instance,

- In March 2024, TerraPay partnered with Alfardan Exchange to leverage mobile-based digital payment infrastructure, strengthening cross-border remittance offerings in the Middle East

- In February 2024, Seven Bank Ltd. collaborated with Digital Wallet Corporation to enhance international remittance services for foreign residents in Japan through mobile-driven platforms

- In October 2023, Mbank partnered with LuLu Exchange to offer digital remittances and account deposits through mobile-first solutions, showcasing the growing emphasis on mobile banking integration

- The increasing reliance on mobile wallets and fintech innovations is expected to significantly accelerate the growth of the digital remittance market, helping service providers reach broader audiences and enhance transaction efficiency across global corridors

Opportunity

“Expansion into Emerging Markets and Underbanked Regions”

- The growing internet penetration and smartphone adoption in emerging economies present a massive opportunity for the digital remittance market. Populations in these regions are increasingly seeking accessible, low-cost financial services to send and receive money across borders

- Digital remittance providers can expand their presence by offering localized, easy-to-use mobile solutions that cater specifically to underbanked communities, thereby bridging the financial inclusion gap

- Strategic partnerships with local banks, mobile network operators, and fintech companies can further strengthen market entry and build trust among first-time users in emerging markets

For instance,

- In April 2024, MoneyGram International partnered with Tencent Financial Technology to facilitate digital remittances directly to Weixin Pay users in China, expanding reach in one of the world's largest emerging digital payment markets

- In October 2023, IndusInd Bank collaborated with Viamericas Corporation to enhance digital inward remittance services for Non-Resident Indians (NRIs) in the U.S., focusing on efficient fund transfers to India’s underbanked segments

- In September 2023, Esewa Money Transfer continued its “Mero Digital Desh” campaign to promote digital remittances in Nepal, educating users about the benefits of formal and digital transfer methods

- As emerging markets continue to digitize and prioritize financial inclusion, digital remittance providers who strategically invest in these regions are likely to see substantial growth opportunities, tapping into millions of new customers in the next few years

Restraint/Challenge

“High Competition and Market Saturation”

- The digital remittance market is becoming increasingly crowded, with numerous established financial institutions, fintech startups, and tech giants vying for market share. This intense competition is putting pressure on profit margins and making customer acquisition more difficult and expensive

- Providers must continuously innovate with better user experiences, lower transaction fees, faster settlement times, and broader coverage to differentiate themselves in a saturated marketplace

- The commoditization of basic remittance services forces companies to move beyond traditional offerings by integrating value-added services such as digital wallets, loyalty programs, and cross-platform financial products to retain users

For instance,

- In March 2024, Western Union announced a major digital transformation strategy, expanding its mobile app features and enhancing real-time payout capabilities to maintain its leadership in an increasingly competitive landscape

- In July 2024, Wise (formerly TransferWise) launched a multi-currency account targeting both consumers and businesses to stand out in the crowded digital payments and remittance space

- In January 2025, Revolut entered new markets in Latin America and Southeast Asia, intensifying competition for regional players by offering fee-free remittance options for specific corridors

- As competition heats up, digital remittance providers must find innovative ways to deliver superior value propositions, build brand loyalty, and expand into underserved niches to survive and thrive in the rapidly maturing market

Digital Remittance Market Scope

The market is segmented on the basis of type, channel, and end use.

|

Segmentation |

Sub-Segmentation |

|

By Type

|

|

|

By Channel

|

|

|

By End Use |

|

Digital Remittance Market Regional Analysis

“North America is the Dominant Region in the Digital Remittance Market”

- North America is leading the global digital remittance market, driven by the high penetration of digital banking services, widespread smartphone usage, and the strong presence of major financial institutions and fintech companies offering cross-border payment solutions

- The U.S. plays a pivotal role in the expansion of digital remittance, with leading companies such as PayPal, Western Union, and Remitly continuously innovating and investing in faster, more secure, and low-cost remittance technologies

- Government support for financial inclusion, advancements in blockchain and real-time payment infrastructures, and strategic partnerships between traditional banks and digital platforms further strengthen the region’s dominance, improving accessibility, transparency, and efficiency for users

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is expected to experience the highest growth in the digital remittance market, driven by rapid financial digitization, increasing smartphone adoption, and rising demand for convenient, low-cost money transfer services among migrant workers

- The region’s expanding middle-class population, growing urbanization, and initiatives promoting financial inclusion across countries such as India, China, and the Philippines are further boosting the adoption of digital remittance solutions

- Governments and private players in Asia-Pacific are heavily investing in digital payment ecosystems, enhancing cross-border payment frameworks, and encouraging collaborations between fintech companies and traditional banks, accelerating the adoption and accessibility of digital remittance services

Digital Remittance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Papaya Global (U.K.)

- DigitalWallet (Japan)

- Nium Pte. Ltd (Singapore)

- MoneyGram (U.S.)

- PayPal Holdings, Inc. (U.S.)

- Continental Exchange Solutions, Inc. (U.S.)

- TransferGo Ltd. (U.K.)

- Wise Payments Limited (U.K.)

- Western Union Holdings, Inc. (U.S.)

- WorldRemit (U.K.)

- Remitly, Inc. (U.S.)

- Revolut Ltd (U.K.)

- OzForex Limited (Australia)

- Flywire (U.S.)

- Viamericas Corporation (U.S.)

- TNG (Hong Kong)

- Alipay (China)

- WeChat Pay (China)

Latest Developments in Global Digital Remittance Market

- In April 2024, MoneyGram International partnered with Tencent Financial Technology to enable digital remittances directly to Weixin Pay wallet users in China, allowing consumers to send money seamlessly through MoneyGram's online platform and strengthening its presence in the Asia-Pacific remittance market

- In March 2024, TerraPay, a global cross-border payments network, collaborated with Alfardan Exchange to integrate TerraPay’s advanced digital payment infrastructure with Alfardan Exchange’s strong market presence, enhancing cross-border remittance solutions and expanding digital financial services globally

- In February 2024, Seven Bank Ltd. entered into a partnership with Digital Wallet Corporation, the provider of Smiles Mobile Remittance, aiming to improve international remittance services for foreign residents in Japan, marking a significant step towards digital financial inclusion in the region

- In October 2023, IndusInd Bank established a strategic partnership with Viamericas Corporation to relaunch the Indus Fast Remit (IFR) platform, enhancing digital inward remittance services for Non-Resident Indians (NRIs) in the U.S., and boosting efficient money transfers between the two countries

- In October 2023, Mbank collaborated with LuLu Exchange to offer digital remittances and account deposits to its customers, leveraging LuLu Exchange’s remittance-as-a-service and open banking platforms, and strengthening digital transaction capabilities in the Middle East

- In September 2023, Esewa Money Transfer continued its "Mero Digital Desh" initiative under the leadership of Fintech company F1Soft Group to promote formal remittance and raise awareness about the benefits of sending money through digital channels, contributing to the formalization of the remittance sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.