Global Digital Shipyard Market

Market Size in USD Billion

CAGR :

%

USD

1.39 Billion

USD

5.64 Billion

2024

2032

USD

1.39 Billion

USD

5.64 Billion

2024

2032

| 2025 –2032 | |

| USD 1.39 Billion | |

| USD 5.64 Billion | |

|

|

|

|

Digital Shipyard Market Size

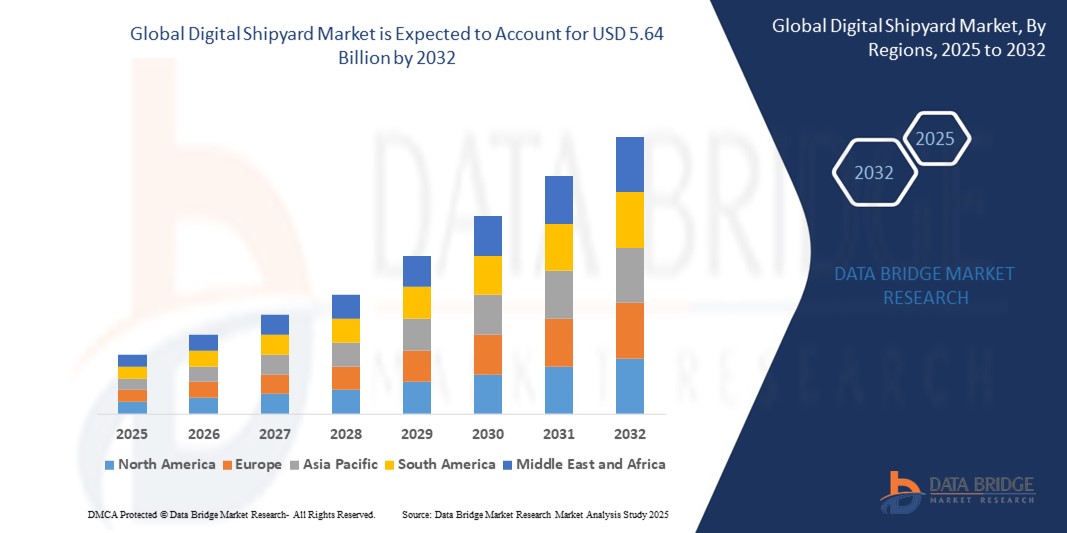

- The global digital shipyard market size was valued at USD 1.39 billion in 2024 and is expected to reach USD 5.64 billion by 2032, at a CAGR of 19.10% during the forecast period

- The market growth is driven by the increasing adoption of advanced digital technologies, such as digital twins, AI, and IIoT, in shipbuilding, which enhance efficiency, reduce costs, and improve operational accuracy

- Rising demand for automation, real-time data analytics, and sustainable shipbuilding practices is positioning digital shipyards as a critical component of modern maritime industries, accelerating market expansion

Digital Shipyard Market Analysis

- Digital shipyards leverage advanced technologies to streamline ship design, construction, maintenance, and operations, offering enhanced productivity, cost-efficiency, and integration with smart maritime ecosystems

- The surge in demand is fueled by the growing need for efficient shipbuilding processes, increasing global trade, and rising defense budgets for modernized naval fleets

- Asia-Pacific dominated the digital shipyard market with the largest revenue share of 42.5% in 2024, driven by the presence of major shipbuilding nations such as China, South Korea, and Japan, high investments in maritime infrastructure, and rapid adoption of digital technologies

- Europe is expected to be the fastest-growing region during the forecast period, propelled by increasing investments in smart shipbuilding technologies, stringent environmental regulations, and a focus on sustainable maritime solutions

- The commercial shipyards segment dominated the largest market revenue share of 51.6% in 2024, driven by the increasing demand for new ships and repairs due to expanding global maritime trade and tourism

Report Scope and Digital Shipyard Market Segmentation

|

Attributes |

Digital Shipyard Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Digital Shipyard Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global digital shipyard market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced data processing, offering deeper insights into shipyard operations, vessel performance, and predictive maintenance requirements

- AI-powered digital shipyard solutions facilitate proactive problem-solving, identifying potential issues before they result in costly delays or equipment failures

- For instances, companies are developing AI-driven platforms that analyze real-time data to optimize shipbuilding processes, improve resource management, and ensure compliance with maritime regulations

- This trend enhances the value proposition of digital shipyard systems, making them increasingly attractive to both commercial and military shipyard operators

- AI algorithms can analyze extensive datasets, including production efficiency, equipment performance, and supply chain logistics, to streamline operations and reduce waste

Digital Shipyard Market Dynamics

Driver

“Rising Demand for Advanced Shipbuilding Technologies and Sustainability”

- Increasing demand for advanced shipbuilding technologies, such as digital twins, IoT, and automation, is a major driver for the global digital shipyard market

- Digital shipyard systems enhance operational efficiency by enabling features such as real-time monitoring, virtual prototyping, and predictive maintenance

- Government initiatives, particularly in regions such as Europe with stringent environmental regulations, are driving the adoption of digital shipyards to support eco-friendly ship designs and green manufacturing practices

- The proliferation of Industrial Internet of Things (IIoT) and advancements in cloud computing are further enabling the expansion of digital shipyard applications, offering faster data processing and seamless collaboration across stakeholders

- Shipbuilders are increasingly integrating factory-fitted digital solutions as standard or optional features to meet industry demands for efficiency, sustainability, and regulatory compliance

Restraint/Challenge

“High Implementation Costs and Cybersecurity Concerns”

- The substantial initial investment required for hardware, software, and integration of digital shipyard systems can be a significant barrier, particularly for small and medium shipyards in emerging markets

- Retrofitting existing shipyards with advanced digital technologies, such as digital twins or robotic process automation, can be complex and costly

- Cybersecurity and data privacy concerns pose a major challenge, as digital shipyard systems collect and transmit sensitive operational and vessel data, raising risks of breaches or misuse

- The fragmented regulatory landscape across countries regarding data security, storage, and usage complicates compliance for global shipyard operators and technology providers

- These factors may deter adoption, particularly in regions with high cost sensitivity or where awareness of cybersecurity risks is elevated

Digital Shipyard market Scope

The market is segmented on the basis of shipyard type, technology, capacity, process, digitalization level, and end use.

- By Shipyard Type

On the basis of shipyard type, the global digital shipyard market is segmented into commercial shipyards and military shipyards. The commercial shipyards segment dominated the largest market revenue share of 51.6% in 2024, driven by the increasing demand for new ships and repairs due to expanding global maritime trade and tourism. The adoption of digital technologies such as AI, IoT, and digital twins enhances efficiency in commercial shipbuilding, further fueling this segment's dominance.

The military shipyards segment is expected to witness robust growth from 2025 to 2032, propelled by rising defense budgets, geopolitical tensions, and the need for advanced naval vessels equipped with cutting-edge technologies for modernization.

- By Technology

On the basis of technology, the global digital shipyard market is segmented into augmented and virtual reality (AR and VR), digital twin and simulation, additive manufacturing, artificial intelligence and big data analytics, robotic process automation, industrial internet of things (IIoT), cybersecurity, blockchain, cloud computing, and master data management. The artificial intelligence and big data analytics segment dominated with a 24.2% market revenue share in 2024, as these technologies enable shipyards to optimize operations, enhance predictive maintenance, and improve resource management.

The digital twin and simulation segment is projected to grow at the fastest rate from 2025 to 2032, with a CAGR of approximately 20.4%, driven by its ability to create virtual replicas for precise planning, error reduction, and real-time performance monitoring.

- By Capacity

On the basis of capacity, the global digital shipyard market is segmented into small shipyards, medium shipyards, and large shipyards. The medium shipyards segment held the largest market revenue share of approximately 40% in 2024, as they cater to the demand for customized vessels in industries such as offshore support and coastal transportation, leveraging digital tools for efficient design and construction.

The large shipyards segment is anticipated to experience the fastest growth from 2025 to 2032, with a CAGR of around 22.4%, due to their ability to handle complex, high-value projects such as cruise ships and mega-container carriers, supported by advanced technologies such as AI, IoT, and robotics.

- By Process

On the basis of process, the global digital shipyard market is segmented into research and development, design and engineering, manufacturing and planning, maintenance and support, and training and simulation. The manufacturing and planning segment accounted for the largest market revenue share of approximately 35% in 2024, driven by the adoption of advanced manufacturing technologies, automation, and product lifecycle management (PLM) solutions that streamline production and reduce costs.

The research and development segment is expected to witness the fastest growth from 2025 to 2032, as it drives innovation through technologies such as AI, digital twins, and AR/VR, enabling shipyards to meet evolving industry demands and sustainability goals.

- By Digitalization Level

On the basis of digitalization level, the global digital shipyard market is segmented into fully digital shipyard, semi digital shipyard, and partially digital shipyard. The semi digital shipyard segment held the largest market revenue share of approximately 45% in 2024, offering a balanced approach that integrates traditional shipbuilding with modern digital technologies, making it cost-effective and accessible for many shipyards.

The fully digital shipyard segment is projected to grow at the fastest rate from 2025 to 2032, with a CAGR of 23.3%, driven by the increasing adoption of IIoT, AR, and digital twins for end-to-end digital transformation in shipbuilding.

- By End Use

On the basis of end use, the global digital shipyard market is segmented into implementation, upgrades, and services. The implementation segment dominated with a market revenue share of approximately 50% in 2024, as it involves the initial deployment of digital technologies such as AI, IoT, and automation, which are critical for transforming traditional shipbuilding processes.

The services segment is expected to witness the fastest growth from 2025 to 2032, driven by the rising demand for specialized consulting services to tailor digital solutions to shipyards’ operational needs, ensuring efficiency and sustainability.

Digital Shipyard Market Regional Analysis

- Asia-Pacific dominated the digital shipyard market with the largest revenue share of 42.5% in 2024, driven by the presence of major shipbuilding nations such as China, South Korea, and Japan, high investments in maritime infrastructure, and rapid adoption of digital technologies

- The market is propelled by the adoption of advanced technologies such as artificial intelligence (AI), digital twins, and the Industrial Internet of Things (IIoT), which enhance operational efficiency and reduce costs

- Growth is further supported by rising maritime trade, increasing environmental concerns for sustainable shipbuilding, and the integration of digital solutions in both commercial and military shipyards

Japan Digital Shipyard Market Insight

Japan’s digital shipyard market is expected to witness significant growth, driven by a strong preference for high-quality, technologically advanced solutions such as digital twins and automation. The presence of major shipbuilding companies and the integration of digital technologies in OEM vessels accelerate market penetration. Growing interest in aftermarket upgrades and a focus on safety and efficiency further contribute to market expansion.

China Digital Shipyard Market Insight

China holds the largest share of the Asia-Pacific digital shipyard market, propelled by rapid urbanization, rising vessel ownership, and strong demand for advanced technologies such as AI, IoT, and blockchain. The country’s growing middle class and focus on smart maritime solutions drive the adoption of digital shipyard technologies. Robust domestic manufacturing capabilities and competitive pricing enhance market accessibility and growth.

U.S. Digital Shipyard Market Insight

The U.S. digital shipyard market is expected to witness significant growth, fueled by substantial investments in digital infrastructure and advanced technologies such as AI, digital twins, and robotics. Strong demand from the defense sector, particularly for naval vessel modernization, and growing adoption in commercial shipyards drive market expansion. The trend toward automation and real-time data analytics, coupled with government support for cybersecurity and sustainability, further accelerates growth.

Europe Digital Shipyard Market Insight

The European digital shipyard market is expected to witness the fastest growth rate, driven by investments in upgrading shipyard infrastructure and a focus on sustainable shipbuilding practices. Countries such as Germany and France are leading the adoption of technologies such as digital twins, automation, and IoT to enhance efficiency and meet environmental regulations. The emphasis on safety, energy efficiency, and advanced manufacturing techniques supports growth in both new vessel construction and retrofit projects.

U.K. Digital Shipyard Market Insight

The U.K. market for digital shipyards is expected to experience significant growth, driven by increasing demand for advanced technologies that improve operational efficiency and sustainability in shipbuilding. The adoption of AR/VR, digital twins, and robotic process automation (RPA) is rising, particularly in commercial and military shipyards. Evolving maritime regulations and a focus on reducing carbon footprints are encouraging the integration of eco-friendly digital solutions.

Germany Digital Shipyard Market Insight

Germany is expected to witness rapid growth in the digital shipyard market, attributed to its advanced shipbuilding industry and high consumer demand for innovative technologies. German shipyards prioritize solutions such as digital twins and simulation software to optimize design, reduce waste, and enhance energy efficiency. The integration of these technologies in premium vessel manufacturing and aftermarket services supports sustained market growth, aligning with sustainability goals.

Digital Shipyard Market Share

The digital shipyard industry is primarily led by well-established companies, including:

- Siemens (Germany)

- Dassault Systèmes (France)

- AVEVA Group PLC (U.K.)

- Accenture (Ireland)

- SAP (Germany)

- BAE Systems (U.K.)

- Hexagon (Sweden)

- Altair Engineering, Inc. (U.S.)

- Wärtsilä (Finland)

- Inmarsat Global Limited (U.K.)

- IFS (Sweden)

- Pemamek (Finland)

- Aras (U.S.)

- Kreyon Systems (India)

- SSi People (U.S.)

- KUKA AG (Germany)

- iBASE-t (U.S.)

- PROSTEP AG (Germany)

- KRANENDONK (Netherlands)

- Damen Shipyards (Netherlands)

What are the Recent Developments in Global Digital Shipyard Market?

- In April 2025, Alphabet's Digital Labs, an Indian startup, advanced its efforts to revolutionize shipbuilding by developing Digital Twin Technology tailored for maritime infrastructure. Their proprietary “3D Engineering Twins” leverage high-fidelity simulations and virtual modeling to detect and correct design flaws early in the development cycle. This approach enables substantial cost and time savings by optimizing construction workflows and reducing rework. The technology supports real-time collaboration across stakeholders and aligns with the broader Shipyard 4.0 transformation, integrating digital intelligence into ship design, assembly, and lifecycle management

- In June 2024, Seatrium Limited partnered with M1, Singapore’s first digital network operator, to accelerate digital transformation across its shipyards using 5G connectivity. The collaboration, formalized through a Memorandum of Understanding, aims to establish “Smart Yards” equipped with ultra-high-speed networks that support real-time applications such as AI-driven analytics, digital twin simulations, and IoT-enabled monitoring. Building on a 2022 pilot project, the initiative will enhance remote operations, improve workforce efficiency, and may expand into cybersecurity and surveillance solutions. This marks a pivotal step in Seatrium’s strategy to modernize maritime infrastructure

- In November 2023, ABS and Seatrium Limited achieved a major milestone in offshore asset monitoring by awarding the ABS SMART (SHM) Notation to the ADMARINE 686, the world’s first Self-Elevating Drilling Unit (SEDU) to receive this designation. The notation recognizes the unit’s ability to monitor and analyze key structural elements using a physics-based digital twin developed in collaboration with TCOMS. Enabled by an industrial IoT platform, the system provides real-time data from rig to shore, allowing predictive diagnostics and enhanced safety. This breakthrough sets a new benchmark for smart technologies in maritime operations

- In June 2021, Drydocks World, a leading marine and offshore services provider based in Dubai, launched a comprehensive digital transformation initiative built on the IFS Cloud platform. The project aims to modernize core systems for asset management and enterprise resource planning, streamlining operations and improving customer service. By consolidating existing technologies and integrating emerging tools such as RFID, augmented reality, and robotics, Drydocks World is laying the groundwork for a fully digital shipyard. The transformation enhances transparency, automation, and real-time data usage—empowering employees and optimizing decision-making across the organization

- In February 2021, Damen Shipyards Group entered a strategic alliance with Sea Machines Robotics to explore the integration of collision avoidance functionality aboard Damen vessels. The partnership supports Damen’s long-term strategy focused on digitalization, sustainability, and operational excellence. As part of its Smart Ship R&D program, Damen began testing Sea Machines’ SM300 autonomous-command and remote-helm control system, which uses AI-driven sensors and COLREG-based algorithms to enhance navigation safety. The collaboration also enables digital twin modeling and remote monitoring, paving the way for increased autonomy and smarter vessel operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.