Global Digital Signage In Healthcare Market

Market Size in USD Billion

CAGR :

%

USD

6.83 Billion

USD

13.03 Billion

2024

2032

USD

6.83 Billion

USD

13.03 Billion

2024

2032

| 2025 –2032 | |

| USD 6.83 Billion | |

| USD 13.03 Billion | |

|

|

|

|

Digital Signage in Healthcare Market Size

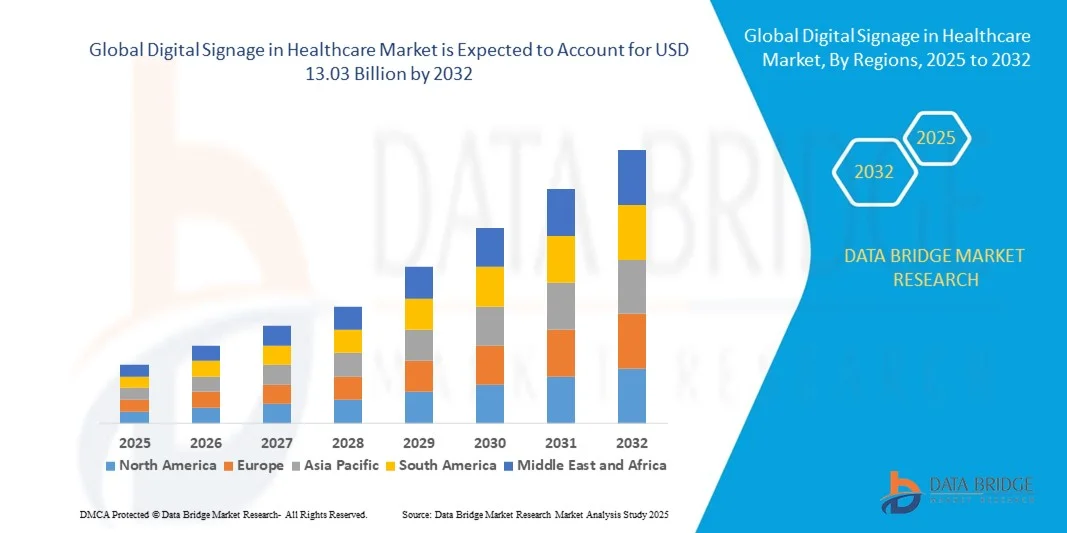

- The global digital signage in healthcare market size was valued at USD 6.83 billion in 2024 and is expected to reach USD 13.03 billion by 2032, at a CAGR of 8.4% during the forecast period

- The market growth is largely fuelled by the increasing adoption of digital communication systems in hospitals and clinics for patient engagement, real-time information dissemination, and operational efficiency

- Rising demand for interactive and personalized content, including wayfinding systems, appointment updates, and health awareness campaigns, is further driving market expansion

Digital Signage in Healthcare Market Analysis

- The market is witnessing a shift toward interactive and touchscreen-enabled signage that improves patient experience and engagement while reducing staff workload

- Adoption of digital signage for telemedicine, health monitoring alerts, and educational campaigns is contributing to the overall efficiency of healthcare facilities and improving patient outcomes

- North America dominated the digital signage in healthcare market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of smart hospital technologies, focus on patient engagement, and rising investments in healthcare infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global digital signage in healthcare market, driven by rapid urbanization, rising disposable incomes, government initiatives for smart hospitals, and growing adoption of advanced display solutions in emerging economies such as China, Japan, and South Korea

- The hardware segment held the largest market revenue share in 2024, driven by the increasing deployment of interactive displays, video walls, and kiosks across hospitals and clinics. Hardware solutions often offer high durability, reliability, and easy integration with hospital IT systems, making them the preferred choice for large healthcare facilities

Report Scope and Digital Signage in Healthcare Market Segmentation

|

Attributes |

Digital Signage in Healthcare Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Digital Signage in Healthcare Market Trends

Increasing Adoption Of Interactive And Smart Digital Signage Solutions

- The growing adoption of interactive and smart digital signage is transforming healthcare facilities by enabling real-time communication, patient engagement, and information dissemination. These systems enhance the overall patient experience and streamline internal operations, improving workflow efficiency and reducing waiting times

- The high demand for personalized patient communication and wayfinding solutions is accelerating the deployment of touchscreen kiosks, digital boards, and mobile-integrated signage. These tools are particularly effective in large hospitals and clinics where guiding patients efficiently is critical, helping reduce confusion and improve service delivery

- The affordability and scalability of modern digital signage solutions are making them attractive for healthcare facilities of all sizes. Institutions benefit from dynamic content updates and targeted messaging without incurring high maintenance or operational costs, which ultimately enhances patient satisfaction and operational efficiency

- For instance, in 2023, several hospitals across Europe and North America implemented interactive digital signage for patient education and navigation, resulting in improved engagement, reduced operational inefficiencies, and better adherence to hospital protocols

- While digital signage is enhancing patient communication and hospital operations, its impact depends on continued technological innovation, integration with hospital management systems, and staff training. Manufacturers must focus on customizable, interoperable solutions to fully capitalize on this growing demand

Digital Signage in Healthcare Market Dynamics

Driver

Rising Need For Enhanced Patient Engagement And Efficient Hospital Communication

- Increasing focus on patient-centric care and the importance of effective communication is driving the adoption of digital signage in healthcare facilities. Interactive displays provide timely information, reduce confusion, and improve overall patient experience, encouraging healthcare providers to invest in such solutions. These displays also enable targeted health education, appointment reminders, and multi-language support, enhancing accessibility for diverse patient populations

- Healthcare institutions and administrators are recognizing the operational benefits of digital signage, such as better crowd management, real-time alerts, and improved workflow efficiency. These advantages support adoption across large hospitals, clinics, and diagnostic centers. In addition, signage solutions help reduce staff workload by providing self-service information points, improving overall operational productivity

- Government initiatives and private sector programs promoting digital transformation in healthcare are further boosting demand. Regulatory encouragement for smart hospital technologies is driving investments in integrated signage systems. Incentives for adopting patient safety and smart facility management systems also encourage healthcare facilities to upgrade from static signage to dynamic, digital solutions

- For instance, in 2022, several healthcare networks in Asia implemented digital signage for patient education and emergency alerts, enhancing communication efficiency and improving patient outcomes. These deployments also facilitated smoother visitor management and reduced miscommunication during high-traffic periods in hospitals

- While the driver of enhanced patient engagement is strong, the market still requires innovation in display interactivity, integration with hospital IT systems, and content management for broader adoption. Continuous software updates, multi-platform integration, and advanced analytics are crucial to maximize the value of digital signage for hospital administrators

Restraint/Challenge

High Cost Of Advanced Digital Signage Solutions And Integration Challenges

- The high cost of interactive and large-format digital signage limits adoption among small and mid-sized healthcare facilities. Price remains a significant barrier, especially for cost-sensitive hospitals in developing regions. In addition, budget constraints often prevent upgrades or expansions, forcing many facilities to rely on outdated or static display solutions

- Limited technical expertise and IT infrastructure in certain hospitals constrain the effective deployment and operation of advanced signage systems. Lack of trained personnel to manage software and hardware components delays integration. Hospitals may also face challenges in maintaining consistent uptime and troubleshooting technical issues without dedicated IT support

- Integrating digital signage with existing hospital information systems can be complex, requiring additional software, network upgrades, and ongoing support. This increases deployment costs and time-to-market for new solutions. Compatibility issues between legacy systems and modern signage solutions can further complicate implementation, requiring custom development or middleware

- For instance, in 2023, several mid-sized hospitals in North America reported delays in implementing interactive signage due to software compatibility and integration issues, highlighting the need for robust support and scalable solutions. These delays often resulted in postponed patient engagement initiatives and underutilization of purchased digital signage assets

- While technology continues to advance, addressing cost, integration, and operational challenges remains critical. Market stakeholders must focus on user-friendly systems, scalable deployments, and interoperable solutions to unlock long-term market potential. In addition, partnerships with specialized service providers can help hospitals overcome installation and maintenance hurdles, ensuring optimal system performance

Digital Signage in Healthcare Market Scope

The market is segmented on the basis of offering, type, technology, and location.

- By Offering

On the basis of offering, the digital signage in healthcare market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share in 2024, driven by the increasing deployment of interactive displays, video walls, and kiosks across hospitals and clinics. Hardware solutions often offer high durability, reliability, and easy integration with hospital IT systems, making them the preferred choice for large healthcare facilities.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for dynamic content management, real-time updates, and analytics-enabled communication. Software platforms allow hospitals to remotely control displays, schedule content, and integrate emergency alerts, enhancing operational efficiency and patient engagement.

- By Type

On the basis of type, the market is segmented into video walls, video screens, transparent LED screens, digital posters, kiosks, and others. Video screens held the largest share in 2024, driven by their versatility and ability to deliver high-quality content across multiple hospital environments. Video walls are expected to grow rapidly, providing large-format, high-impact displays for waiting areas, lobbies, and emergency departments.

The transparent LED screen and digital poster segments is expected to witness the fastest growth rate from 2025 to 2032 due to enhanced visual appeal, interactive capabilities, and support for real-time messaging. Kiosks are increasingly deployed for patient check-ins, wayfinding, and self-service, boosting their market growth across healthcare facilities.

- By Technology

On the basis of technology, the market is segmented into LCD, LED, and projection. LCD technology dominated in 2024 owing to its high resolution, cost-effectiveness, and wide adoption in hospital corridors, waiting areas, and consultation rooms. LED-based solutions are expected to grow at the fastest rate, driven by energy efficiency, high brightness, and suitability for large-format installations.

Projection-based signage is expected to witness the fastest growth rate from 2025 to 2032 for flexible and large-scale deployments, supporting dynamic messaging, patient notifications, and public health campaigns in spacious areas such as auditoriums and atriums.

- By Location

On the basis of location, the market is segmented into out-store and in-store. In-store digital signage accounted for the largest market share in 2024, driven by the adoption of displays in patient waiting areas, emergency departments, and outpatient clinics for real-time communication and health awareness campaigns.

Out-store signage is expected to witness the fastest growth rate from 2025 to 2032, supporting wayfinding, outdoor announcements, parking guidance, and community health notifications. These displays enhance patient engagement while improving operational visibility and hospital outreach programs.

Digital Signage in Healthcare Market Regional Analysis

- North America dominated the digital signage in healthcare market with the largest revenue share of 38.5% in 2024, driven by increasing adoption of smart hospital technologies, focus on patient engagement, and rising investments in healthcare infrastructure

- Hospitals and clinics in the region highly value interactive displays, video walls, and kiosks for enhancing communication, improving workflow efficiency, and providing real-time information to patients and staff

- This widespread adoption is further supported by advanced IT infrastructure, high healthcare expenditure, and initiatives to digitize patient experience, establishing digital signage as a critical tool in modern healthcare facilities

U.S. Digital Signage in Healthcare Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, fueled by rapid implementation of interactive displays and integrated communication solutions in hospitals and diagnostic centers. Healthcare providers are prioritizing enhanced patient experience through real-time updates, emergency alerts, and wayfinding systems. The growing preference for connected healthcare solutions, coupled with government initiatives promoting digital hospital transformation, further drives market growth.

Europe Digital Signage in Healthcare Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, driven by regulatory support for patient safety, increasing hospital modernization projects, and rising demand for efficient communication systems. Adoption is particularly high in urban healthcare centers and multi-specialty hospitals. European hospitals are leveraging digital signage to improve patient flow, reduce waiting times, and enhance operational efficiency across both public and private healthcare facilities.

U.K. Digital Signage in Healthcare Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing investments in smart hospital solutions and emphasis on patient-centric care. Concerns over efficient communication, real-time alerts, and enhanced patient experience are encouraging hospitals to implement digital signage solutions. The U.K.’s adoption of advanced IT infrastructure, along with a robust healthcare ecosystem, continues to stimulate market expansion.

Germany Digital Signage in Healthcare Market Insight

The Germany market is expected to witness the fastest growth rate from 2025 to 2032, fueled by technological advancements in hospital communication systems and growing awareness of patient engagement solutions. Hospitals are increasingly integrating digital signage with electronic health records and workflow management systems to optimize operations. Germany’s focus on innovation and efficiency in healthcare promotes the deployment of video walls, kiosks, and interactive screens across clinical and administrative areas.

Asia-Pacific Digital Signage in Healthcare Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising healthcare expenditure, rapid urbanization, and government initiatives promoting digital healthcare. Countries such as China, Japan, and India are witnessing increased implementation of digital signage in hospitals, clinics, and diagnostic centers. As APAC becomes a manufacturing and technology hub, affordability and accessibility of advanced digital signage solutions are expanding, enabling broader adoption across public and private healthcare facilities.

Japan Digital Signage in Healthcare Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s advanced healthcare infrastructure, high technology adoption, and focus on patient convenience. Hospitals and eldercare facilities are implementing interactive displays and kiosks for real-time communication, wayfinding, and patient education. Japan’s aging population further drives demand for accessible, easy-to-use signage solutions across both clinical and non-clinical settings.

China Digital Signage in Healthcare Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the government’s push for smart hospitals, increasing hospital modernization, and rapid urbanization. Hospitals and healthcare networks are implementing digital signage for patient information, emergency alerts, and operational management. The availability of cost-effective solutions and domestic manufacturers providing scalable systems are key factors propelling market growth in China.

Digital Signage in Healthcare Market Share

The Digital Signage in Healthcare industry is primarily led by well-established companies, including:

- SHARP CORPORATION (Japan)

- SAMSUNG (South Korea)

- SONY INDIA (India)

- LG Electronics (South Korea)

- Exceptional 3D, Inc. (U.S.)

- OMNIVEX CORPORATION (Canada)

- Panasonic Corporation (Japan)

- Scala (U.S.)

- E Ink Holdings Inc. (Taiwan)

- Daktronics, Inc. (U.S.)

- Cisco Systems, Inc. (U.S.)

- DEEPSKY CORPORATION LTD. (Japan)

- AU Optronics Corp (Taiwan)

- Barco (Belgium)

- Christie Digital Systems USA, Inc. (U.S.)

- Intuiface (Canada)

- BenQ (Taiwan)

- Sharp NEC Display Solutions of America, Inc. (U.S.)

- Sharp Electronics Corporation (U.S.)

- BrightSign, LLC (U.S.)

- Intel Corporation (U.S.)

- Keywest Technology, Inc. (U.S.)

- Microsoft (U.S.)

- WinMate Inc. (Taiwan)

- Hitachi, Ltd. (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Digital Signage In Healthcare Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Digital Signage In Healthcare Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Digital Signage In Healthcare Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.