Global Digital Transformation Of Maritime Freight Market

Market Size in USD Million

CAGR :

%

USD

29.34 Million

USD

59.33 Million

2024

2032

USD

29.34 Million

USD

59.33 Million

2024

2032

| 2025 –2032 | |

| USD 29.34 Million | |

| USD 59.33 Million | |

|

|

|

|

Digital Transformation of Maritime Freight Market Size

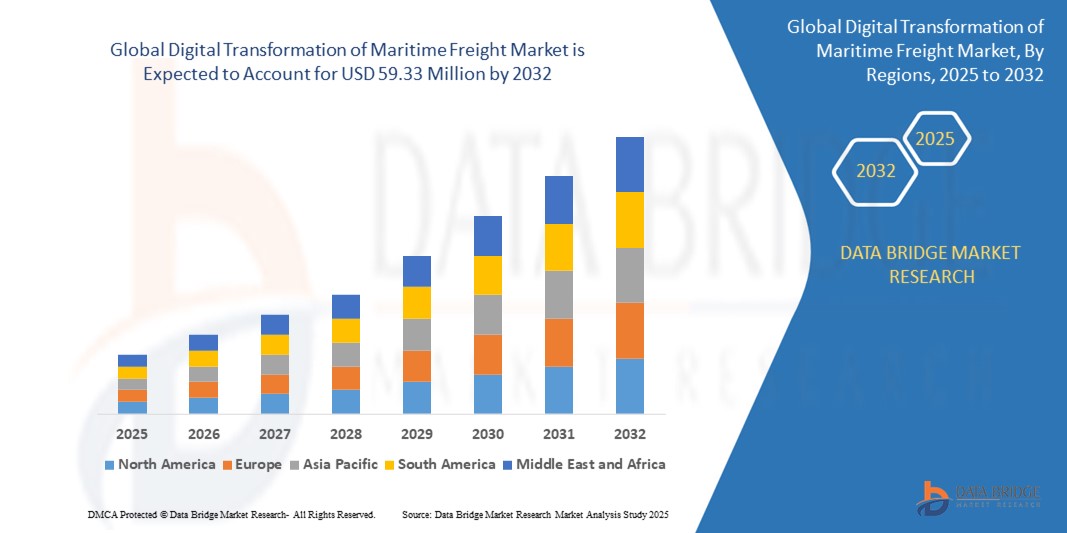

- The global digital transformation of maritime freight market size was valued at USD 29.34 million in 2024 and is expected to reach USD 59.33 million by 2032, at a CAGR of 9.2% during the forecast period

- The market growth is primarily driven by the increasing adoption of digital technologies, such as IoT, AI, and blockchain, in maritime logistics, alongside the need for enhanced operational efficiency, transparency, and sustainability in freight operations

- Rising demand for real-time tracking, automated processes, and cost-effective solutions in the maritime freight industry is positioning digital transformation as a critical enabler for modern supply chain management, significantly boosting industry growth

Digital Transformation of Maritime Freight Market Analysis

- Digital transformation in maritime freight involves the integration of advanced technologies to streamline operations, enhance visibility, and improve decision-making across the maritime supply chain, including ports, terminals, and freight forwarding

- The growing demand for digital solutions is fueled by the need for operational efficiency, reduced carbon emissions, and enhanced supply chain transparency amid increasing global trade volumes

- Asia-Pacific dominated the market with the largest revenue share of 42.5% in 2024, driven by its position as a global trade hub, high adoption of digital technologies in countries such as China and Singapore, and significant investments in port automation and smart logistics solutions

- North America is expected to be the fastest-growing region during the forecast period due to rapid advancements in AI-driven logistics, increasing adoption of cloud-based platforms, and strong government support for digital infrastructure in maritime operations

- The cloud-based segment dominated the largest market revenue share of 68.5% in 2024, driven by its scalability, flexibility, and cost-effectiveness, enabling seamless data access and collaboration across maritime supply chains

Report Scope and Digital Transformation of Maritime Freight Market Segmentation

|

Attributes |

Digital Transformation of Maritime Freight Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Digital Transformation of Maritime Freight Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The Global Digital Transformation of Maritime Freight Market is experiencing a significant trend toward integrating Artificial Intelligence (AI) and Big Data analytics

- These technologies enable advanced processing and analysis of maritime data, providing deeper insights into vessel performance, cargo tracking, and predictive maintenance needs

- AI-powered solutions facilitate proactive decision-making, such as identifying potential operational inefficiencies or equipment failures before they disrupt supply chains

- For instances, companies are developing AI-driven platforms to optimize vessel routes based on real-time weather, port congestion, and fuel efficiency, or to enhance cargo tracking for transparency in logistics

- This trend is enhancing the value of digital transformation solutions, making them increasingly attractive to port operators, shipping companies, and freight forwarders

- AI algorithms analyze vast datasets, including vessel speed, fuel consumption, cargo handling patterns, and supply chain bottlenecks, to drive operational efficiency and sustainability

Digital Transformation of Maritime Freight Market Dynamics

Driver

“Rising Demand for Efficient Supply Chains and Real-Time Tracking”

- The growing demand for streamlined global supply chains, real-time cargo tracking, and transparency in maritime logistics is a major driver for the digital transformation of the maritime freight market

- Digital solutions, such as IoT-enabled sensors and track-and-trace systems, enhance operational efficiency by providing real-time visibility into cargo movement and vessel status

- Government initiatives and international trade agreements, particularly in the Asia-Pacific region, are promoting the adoption of digital technologies to support growing maritime trade

- The proliferation of 5G technology and IoT is enabling faster data transmission and lower latency, supporting advanced applications such as smart port operations and autonomous vessels

- Shipping companies and port operators are increasingly adopting integrated digital platforms to meet customer expectations for faster, more reliable, and eco-friendly freight services

Restraint/Challenge

“High Implementation Costs and Data Security Concerns”

- The high initial investment required for hardware, software, and integration of digital transformation solutions, such as cloud-based platforms and IoT systems, poses a significant barrier, particularly for smaller operators in emerging markets

- Retrofitting existing vessels or port infrastructure with digital technologies can be complex and costly, limiting widespread adoption

- Data security and privacy concerns are a major challenge, as maritime digital systems collect and transmit sensitive data, including cargo details, vessel routes, and operational metrics, raising risks of cyberattacks or data breaches

- The fragmented regulatory landscape across countries, with varying standards for data protection and maritime operations, complicates compliance for global operators

- These factors can deter adoption, especially in regions with high cost sensitivity or heightened awareness of data privacy issues

Digital Transformation of Maritime Freight market Scope

The market is segmented on the basis of deployment, service, software solution, and end user.

- By Deployment

On the basis of deployment, the global digital transformation of maritime freight market is segmented into cloud-based and on-premise. The cloud-based segment dominated the largest market revenue share of 68.5% in 2024, driven by its scalability, flexibility, and cost-effectiveness, enabling seamless data access and collaboration across maritime supply chains. The adoption of cloud computing is fueled by the need for real-time visibility and integration with IoT and analytics platforms.

The on-premise segment is anticipated to witness significant growth from 2025 to 2032, with a CAGR of 12.3%, particularly among organizations prioritizing data security and control, such as large ports and terminals with legacy systems. On-premise solutions offer tailored customization for complex operational needs, supporting compliance with stringent maritime regulations.

- By Service

On the basis of service, the global digital transformation of maritime freight market is segmented into consulting and training, implementation and integration, operation and maintenance, and managed services. The implementation and integration segment dominated the largest market revenue share of 38.0% in 2023, driven by the critical need for seamless integration of digital solutions such as blockchain, AI, and IoT into existing maritime workflows to enhance efficiency and transparency.

The managed services segment is expected to witness the fastest growth rate from 2025 to 2032, with a CAGR of 14.7%, fueled by increasing demand for outsourced IT management, allowing maritime companies to focus on core operations. Managed services ensure continuous system optimization, cybersecurity, and compliance with evolving environmental and trade regulations.

- By Software Solution

On the basis of software solution, the global digital transformation of maritime freight market is segmented into booking, vessel scheduling, loading/unloading, and delivery. The booking segment dominated the largest market revenue share of 41.0% in 2024, driven by the widespread adoption of e-booking platforms that automate freight reservations, enhance customer personalization, and streamline payment processes through cloud-based technologies.

The vessel scheduling segment is anticipated to experience the fastest growth rate of 15.2% from 2025 to 2032, propelled by advancements in AI-driven scheduling tools, such as ECDIS and automated port calls, which optimize vessel routes and reduce operational delays. These solutions address the growing need for dynamic capacity allocation and empty container repositioning.

- By End User

On the basis of end user, the global digital transformation of maritime freight market is segmented into ports and terminals, warehouses, and maritime freight forwarders. The ports and terminals segment dominated the market revenue share of 47.5% in 2024, driven by the critical role of digital solutions in managing high cargo volumes, optimizing berth allocation, and enhancing port operations through real-time data and automation.

The maritime freight forwarders segment is expected to witness rapid growth of 16.8% from 2025 to 2032, fueled by the increasing globalization of trade and demand for integrated logistics solutions. Digital platforms enable freight forwarders to offer real-time shipment tracking, automated documentation, and optimized routing, improving customer satisfaction and operational efficiency

Digital Transformation of Maritime Freight Market Regional Analysis

- Asia-Pacific dominated the market with the largest revenue share of 42.5% in 2024, driven by its position as a global trade hub, high adoption of digital technologies in countries such as China and Singapore, and significant investments in port automation and smart logistics solutions

- Consumers and stakeholders prioritize digital solutions for enhancing operational efficiency, real-time cargo tracking, and regulatory compliance, particularly in regions with high trade volumes and complex logistics networks

- Growth is supported by advancements in technologies such as AI, IoT, blockchain, and cloud-based platforms, alongside increasing adoption in ports, terminals, and freight forwarding operations

U.S. Digital Transformation of Maritime Freight Market Insight

The U.S. digital transformation of maritime freight market is expected to witness significant growth, fueled by strong demand for cloud-based solutions and advanced analytics in maritime logistics. The trend towards automation, predictive maintenance, and real-time vessel tracking boosts market expansion. Major ports and shipping companies’ focus on digital integration and compliance with environmental regulations further enhances market growth.

Europe Digital Transformation of Maritime Freight Market Insight

The Europe market is expected to witness significant growth, supported by stringent regulatory requirements for sustainability and safety, such as IMO 2020 and the European Green Deal. Stakeholders seek digital solutions that optimize vessel scheduling, improve port efficiency, and reduce emissions. Countries such as Germany, France, and the Netherlands show substantial uptake due to smart port initiatives and advanced maritime infrastructure.

U.K. Digital Transformation of Maritime Freight Market Insight

The U.K. market is expected to witness rapid growth, driven by the need for efficient port operations and enhanced supply chain visibility in urban and international trade hubs. Increased adoption of cloud-based platforms and AI-driven analytics supports real-time decision-making and compliance with environmental standards. The growing focus on digital freight forwarding and smart logistics further accelerates market expansion.

Germany Digital Transformation of Maritime Freight Market Insight

Germany is expected to witness strong growth in the digital transformation of maritime freight, attributed to its leadership in maritime innovation and advanced port management systems. Stakeholders prioritize technologies such as blockchain for secure documentation and IoT for real-time monitoring to enhance operational efficiency and reduce costs. Integration of digital solutions in premium shipping operations and aftermarket services supports sustained market growth.

Asia-Pacific Digital Transformation of Maritime Freight Market Insight

The Asia-Pacific region dominated the global digital transformation of maritime freight market share of 83.35 in 2024, driven by expansive maritime trade, significant port infrastructure investments, and rapid digital adoption in countries such as China, Singapore, and Japan. Increasing demand for real-time tracking, automated booking systems, and energy-efficient solutions boosts market growth. Government initiatives promoting smart ports and sustainable logistics further encourage the adoption of advanced digital technologies.

Japan Digital Transformation of Maritime Freight Market Insight

Japan’s market is expected to witness rapid growth due to strong demand for high-quality digital solutions that enhance vessel scheduling, cargo handling, and regulatory compliance. The presence of major shipping companies and advanced technological infrastructure accelerates market penetration. Rising interest in AI and IoT for predictive maintenance and route optimization also contributes to growth.

China Digital Transformation of Maritime Freight Market Insight

China holds the largest share of the Asia-Pacific digital transformation of maritime freight market, propelled by rapid port expansion, increasing trade volumes, and strong government support for digitalization. The country’s focus on smart logistics and integration of technologies such as blockchain and AI supports the adoption of advanced digital solutions. Competitive domestic software providers and high maritime activity enhance market accessibility.

Digital Transformation of Maritime Freight Market Share

The digital transformation of maritime freight industry is primarily led by well-established companies, including:

- IBM Corp (U.S.)

- SAP SE (Germany)

- Oracle Corporation (U.S.)

- ATOS SE (France)

- Hexaware Technologies Limited (India)

- ABB (Switzerland)

- Tech Mahindra Limited (India)

- KINTETSU WORLD EXPRESS, Inc. (Japan)

- Advantech Co., Ltd. (Taiwan)

- Mindtree Limited (India)

- 3Gtms, LLC (U.S.)

- Hapag-Lloyd AG (Germany)

- Accenture plc (Ireland)

- Robert Bosch GmbH (Germany)

- CEVA Logistics (Switzerland)

- AB Electrolux (Sweden)

- Telefonaktiebolaget LM Ericsson (Sweden)

- A.P. Moller – Maersk (Denmark)

- SAMSUNG (South Korea)

What are the Recent Developments in Global Digital Transformation of Maritime Freight Market?

- In September 2024, Sinay, a French Blue Tech company, acquired SafeCube, a digital container tracking software initially developed by Michelin and Sigfox. This strategic move strengthens Sinay’s ocean freight tracking capabilities, integrating SafeCube’s advanced technology into its portfolio. The acquisition enhances visibility and control over cargo movements, offering a comprehensive suite of solutions for global supply chain management. Sinay aims to drive digital innovation in maritime logistics, improving efficiency and transparency

- In September 2024, EUROGATE Container Terminal Hamburg, in partnership with CONROO, launched GATE PASS, a fully digital verification system for truck drivers. This innovation replaces the traditional analog trucker card, streamlining entry and exit procedures while enhancing security and efficiency. The system integrates mobile-based authentication, reducing paperwork and wait times. Initially deployed at EUROGATE Hamburg, the rollout is set to expand to Bremerhaven, Wilhelmshaven, and other terminals. By digitizing trucker verification, EUROGATE aims to modernize port logistics and improve supply chain transparency

- In August 2024, Hapag-Lloyd launched Live Position, a real-time container tracking tool designed to enhance visibility and risk mitigation in global shipping. More than two-thirds of its dry container fleet is now equipped with IoT tracking devices, providing GPS location, temperature monitoring, and vibration alerts throughout the journey. This innovation ensures door-to-door transparency, allowing customers to track shipments across ships, rail, and trucks. The system integrates ETA predictions and data-driven decision-making, optimizing supply chain efficiency

- In May 2024, the Port of Halifax launched a multi-million-dollar digitalization project to enhance container terminal operations. This initiative includes a Data Integration Hub (DIH), designed to streamline maritime, rail, and cargo transport information for real-time monitoring and optimized vessel turnover. The project, supported by Transport Canada’s National Trade Corridors Fund, aims to improve supply chain efficiency through advanced analytics and digital infrastructure. Key features include business intelligence dashboards, truck appointment systems, and remote reefer monitoring

- In June 2023, HMM, a leading global shipping company, partnered with CargoX to introduce an integrated electronic bill of lading (eBL) service. This collaboration enhances global trade efficiency by accelerating the digitalization of critical shipping documents and workflows. The CargoX Platform enables secure, immutable transactions recorded on a public ledger, ensuring transparency and fraud prevention. HMM customers can now generate, transfer, and process eBLs seamlessly, reducing paperwork and improving supply chain reliability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.