Global Dilators Market

Market Size in USD Billion

CAGR :

%

USD

1.42 Billion

USD

2.76 Billion

2025

2033

USD

1.42 Billion

USD

2.76 Billion

2025

2033

| 2026 –2033 | |

| USD 1.42 Billion | |

| USD 2.76 Billion | |

|

|

|

|

Dilators Market Size

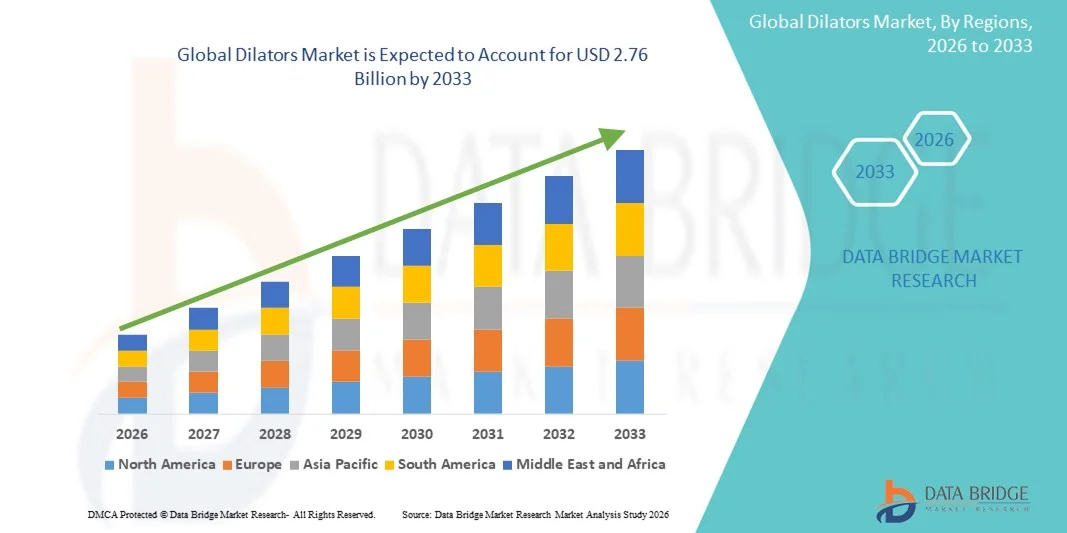

- The global dilators market size was valued at USD 1.42 billion in 2025 and is expected to reach USD 2.76 billion by 2033, at a CAGR of 8.70% during the forecast period

- The global Dilators market is witnessing strong growth driven by increasing prevalence of urological, gynecological, and vascular conditions that require minimally invasive dilation procedures, as well as ongoing technological advancements that improve device safety, precision, and procedural efficiency

- Furthermore, rising demand for advanced, reliable, and easy‑to‑use dilator solutions in hospitals, specialty clinics, and outpatient settings is expanding utilization across diverse clinical applications, significantly boosting the uptake of dilator devices worldwide

Dilators Market Analysis

- Dilators, designed to facilitate minimally invasive dilation procedures in urology, gynecology, and vascular interventions, are increasingly vital components of modern medical practice due to their precision, safety, and ability to improve procedural efficiency across hospitals, specialty clinics, and outpatient settings

- The escalating demand for dilators is primarily fueled by the growing prevalence of chronic conditions requiring dilation procedures, increasing adoption of minimally invasive techniques, and rising awareness among healthcare providers of the advantages of advanced, easy-to-use dilator devices

- North America dominated the dilators market with the largest revenue share of approximately 43.7% in 2025, supported by well‑developed healthcare infrastructure, high procedural volumes, and widespread adoption of advanced medical devices. The U.S. market leads significantly due to strong demand for minimally invasive procedures, extensive reimbursement support, and continuous innovation in dilator technologies

- Asia‑Pacific is projected to be one of the fastest‑growing regions in the Dilators market during the forecast period, driven by increasing healthcare investments, expanding access to quality care, rising prevalence of chronic conditions requiring dilation procedures, and growing awareness of minimally invasive treatment options in countries such as China, Japan, and India

- The Treatment segment accounted for the largest market revenue share of 62.8% in 2025, driven by high demand for dilation procedures across gynecology, gastroenterology, urology, and ENT

Report Scope and Dilators Market Segmentation

|

Attributes |

Dilators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Medtronic (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Dilators Market Trends

Rising Adoption of Minimally Invasive and Patient-Friendly Procedures

- A significant and accelerating trend in the global Dilators market is the increasing focus on minimally invasive, patient-friendly interventions. Modern dilators are designed to enhance procedural precision, reduce patient discomfort, and shorten recovery times across a variety of medical specialties

- For instance, single-use and ergonomic dilators are being increasingly adopted in outpatient and office-based procedures, allowing physicians to perform interventions efficiently with lower risk of cross-contamination

- Advanced materials, including flexible polymers and biocompatible alloys, are being incorporated into dilators to improve durability, patient safety, and procedural effectiveness

- Dilators with graduated sizing and enhanced tactile feedback are gaining traction, as they allow clinicians to perform gradual and controlled interventions, improving procedural accuracy

- Minimally invasive dilator systems are being preferred in specialties such as gastroenterology, urology, and gynecology, reflecting growing demand for outpatient procedures and patient-centric care

- Trends toward portable and easy-to-sterilize dilators are increasing adoption in smaller clinics and office-based labs, where space and equipment constraints require efficient tools

- Manufacturers are introducing disposable and hybrid dilator solutions to reduce infection risk while maintaining procedural efficacy

- The integration of imaging-compatible dilators for procedures under fluoroscopy or ultrasound is also becoming common, enhancing clinician confidence and procedural outcomes

- Healthcare providers are increasingly focusing on reducing procedure time, improving patient throughput, and minimizing complications, all of which are driving dilator adoption

- The rising trend of outpatient and minimally invasive procedures is reshaping healthcare delivery models, promoting tools like dilators as essential devices for safe, effective interventions

- Medical education programs are emphasizing hands-on training for dilator use, further encouraging adoption by clinicians

- Consequently, companies are expanding their product portfolios with innovative dilator designs that balance safety, precision, and comfort

Dilators Market Dynamics

Driver

Growing Demand Due to Rising Procedural Volumes and Outpatient Care

- The increasing prevalence of outpatient procedures, minimally invasive surgeries, and office-based interventions is a key driver for the global dilators market

- For instance, the rising number of gastrointestinal, urological, and gynecological procedures is prompting healthcare providers to invest in advanced dilator systems that enhance patient safety and procedural efficiency

- Dilators help clinicians reduce procedure time, improve accuracy, and minimize patient discomfort, driving their adoption in clinical practice

- Furthermore, hospitals and clinics are increasingly adopting single-use dilators to reduce infection risk and streamline sterilization processes, supporting market growth

- Rising awareness among clinicians about patient-centric, minimally invasive procedures is fueling demand for innovative dilator designs

- The growing geriatric population, who often require delicate procedures, is increasing the need for safer and more precise dilators

- Medical tourism and outpatient-focused healthcare delivery models are contributing to higher procedural volumes and subsequent dilator demand

- Expanding healthcare infrastructure in emerging markets is enabling more clinics and office-based labs to procure modern dilators

- Favorable reimbursement policies for minimally invasive procedures also promote adoption of specialized dilators

- Training and adoption initiatives by key players are helping clinicians integrate advanced dilator systems into routine practice

- Increasing preference for outpatient and office-based interventions over hospital procedures further strengthens market growth

- Overall, rising procedural volumes and the shift toward patient-friendly care models are primary drivers of the dilators market

Restraint/Challenge

High Costs and Regulatory Hurdles

- High costs associated with advanced, single-use, or specialty dilators can limit adoption, particularly in small clinics and developing regions

- For instance, in March 2024, a report highlighted that several U.S.-based outpatient clinics delayed adopting imaging-compatible dilators due to high procurement costs and required FDA approvals, demonstrating how financial and regulatory challenges can hinder uptake

- Clinics and healthcare providers may face budget constraints when upgrading to more ergonomic, imaging-compatible, or hybrid dilator systems

- Stringent regulatory approvals and compliance requirements for medical devices, including dilators, can delay product launches and market entry

- Manufacturers must invest in clinical trials and certifications to meet safety and efficacy standards, which increases overall costs

- The availability of low-cost, traditional dilators in certain markets may discourage the adoption of advanced, premium solutions

- Healthcare providers may require training to adopt new dilator systems effectively, which can create a temporary barrier to implementation

- Concerns over procedural complications or clinician unfamiliarity with new dilator technologies can also slow adoption

- Supply chain challenges, including raw material costs and manufacturing constraints, may impact product availability and pricing

- Smaller outpatient clinics may be hesitant to invest in multiple dilator types due to storage or cost considerations

- While innovation is driving efficiency and safety, the upfront investment remains a restraint for price-sensitive facilities

- Addressing these challenges through cost optimization, clinician training programs, and regulatory support will be essential for sustained market growth

- Overcoming financial and regulatory barriers will help manufacturers expand access to innovative dilator systems globally

Dilators Market Scope

The market is segmented on the basis of category, product type, application, end user, and distribution channel.

- By Category

On the basis of category, the Dilators market is segmented into Mechanical and Balloon. The Mechanical segment dominated the largest market revenue share of 58.4% in 2025, driven by its long-established use across gynecology, gastroenterology, urology, and ENT procedures. Mechanical dilators are preferred for their high durability, reusability, and precision during dilation, offering clinicians strong control and predictable outcomes. Hospitals and clinics rely heavily on mechanical dilators due to their cost-effectiveness and compatibility with a wide range of procedures. The segment further benefits from consistent demand in high-volume healthcare facilities, especially in developing regions where reusable devices remain essential. Ongoing advancements in material strength and ergonomics support improved clinical efficiency. Their versatility in cervical, urethral, esophageal, and nasal dilation ensures strong adoption across specialties. Increasing awareness of minimally invasive procedures and rising patient flow also support stable consumption. The mechanical category continues to be a core component in routine therapeutic and diagnostic practices globally.

The Balloon segment is anticipated to witness the fastest growth rate of 19.6% from 2026 to 2033, fueled by increasing preference for minimally invasive techniques and reduced tissue trauma during dilation. Balloon dilators offer controlled radial force, making them ideal for esophageal, urethral, and gastrointestinal strictures where precision is critical. Their single-use nature supports sterility and reduces infection risk, attracting strong adoption in modern healthcare settings. Growing prevalence of gastrointestinal diseases, post-surgical strictures, and urological complications further drives demand. Technological advancements such as high-pressure balloon capability, enhanced catheter flexibility, and fluoroscopy-compatible designs are accelerating uptake. Hospitals and specialty clinics increasingly prefer balloon dilators due to reduced procedural complications and faster recovery times. Rising approvals from global regulatory authorities and increasing product launches by leading companies also contribute to rapid growth. Expanding usage in ambulatory care centers and the shift toward outpatient endoscopic procedures enhance the segment’s expansion potential.

- By Product Type

On the basis of product type, the Dilators market is segmented into Cervical Dilators, Nasal Dilators, Urethral Dilators, Esophageal Dilators, Vaginal Dilators, Iris Dilators, Pupillary Dilators, Uterine Dilators, Gynecological Dilators, and Others. The Cervical Dilators segment dominated the largest market revenue share of 26.7% in 2025, driven by high utilization in gynecological procedures such as labor induction, D&C, hysteroscopy, and cervical preparation. Rising global prevalence of reproductive health disorders and increasing demand for minimally invasive gynecological surgeries strengthen segment dominance. Hospitals heavily rely on cervical dilators for routine and emergency procedures, making them essential tools in obstetrics and gynecology departments. Their widespread acceptance among clinicians and strong presence in both reusable and disposable forms further support growth. Increasing awareness of women's health, expanding maternal care infrastructure, and rising procedural volumes contribute significantly to revenue share. Technological improvements, including osmotic dilators offering gradual and controlled dilation, also boost adoption. Growth in fertility clinics and ambulatory care centers ensures consistent demand.

The Esophageal Dilators segment is anticipated to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by the increasing prevalence of conditions such as esophageal strictures, GERD-related narrowing, postoperative complications, and congenital anomalies. Balloon esophageal dilators are gaining strong popularity due to their ability to provide controlled dilation with reduced risk of perforation. Rising demand for endoscopic procedures and growth in gastroenterology centers worldwide support market expansion. Improvements in endoscopic equipment compatibility and growing use of fluoroscopy-guided dilation enhance procedural safety. Healthcare providers increasingly prefer minimally invasive dilation techniques due to shorter recovery times and fewer complications. The growing elderly population with swallowing disorders further accelerates demand. Increased availability of advanced dilation systems, supportive reimbursement structures in many countries, and continuous product innovation strengthen the segment’s rapid growth trajectory.

- By Application

On the basis of application, the Dilators market is segmented into Diagnostic and Treatment. The Treatment segment accounted for the largest market revenue share of 62.8% in 2025, driven by high demand for dilation procedures across gynecology, gastroenterology, urology, and ENT. Therapeutic dilation is essential for treating strictures, obstructions, and abnormalities, making dilators indispensable in routine and complex procedures. Hospitals and clinics increasingly adopt both mechanical and balloon dilators due to their effectiveness in achieving immediate therapeutic results. Rising prevalence of chronic diseases, post-surgical complications, and age-related disorders requiring treatment-related dilation contributes to segment strength. Expanding availability of minimally invasive procedures and growing physician preference for dilation-based interventions further support dominance. Enhanced device safety, wider clinical acceptance, and increasing global treatment volumes ensure consistent market share.

The Diagnostic segment is expected to witness the fastest CAGR of 17.2% from 2026 to 2033, fueled by rising need for dilation during diagnostic imaging and endoscopic evaluations across multiple specialties. Diagnostic dilation is increasingly used in hysteroscopy, cystoscopy, nasal endoscopy, gastroenterology, and urology to ensure clear access and visualization. Growth in outpatient diagnostic procedures and expansion of specialty diagnostic centers strengthen demand. Advancements in diagnostic technologies requiring pre-dilation enhance adoption. Increasing global emphasis on early detection of diseases, coupled with rising patient awareness, drives procedural growth. Additionally, the shift toward minimally invasive diagnostic examinations and expanding insurance coverage for preventive screenings contribute to rapid CAGR.

- By End User

On the basis of end user, the Dilators market is segmented into Hospitals, Healthcare Centers, Clinics, Nursing Homes, and Others. The Hospitals segment dominated the largest market revenue share of 49.3% in 2025, driven by the high volume of surgical and non-surgical dilation procedures performed across multiple departments. Hospitals benefit from advanced infrastructure, specialized physicians, and availability of a broad range of dilators for gynecology, urology, gastroenterology, and ENT procedures. Their increasing patient inflow for emergency and complex cases supports continued dominance. Reusability of mechanical dilators and high adoption of advanced balloon dilators in surgical procedures strengthen market position. Growth in hospital-based minimally invasive surgeries and rising adoption of new technologies further contribute to the largest share.

The Clinics segment is anticipated to witness the fastest CAGR of 18.4% from 2026 to 2033, driven by increasing preference for outpatient care and minimally invasive interventions. Clinics are becoming major providers of gynecological, gastroenterological, and urological dilation procedures due to lower costs and shorter waiting times. Growth in specialty clinics—such as fertility centers, ENT clinics, and gastroenterology units—supports rapid adoption. Rising availability of portable, sterile, and single-use dilators enhances convenience for clinic-based procedures. Increasing patient preference for quick and affordable care and expansion of private healthcare networks across emerging nations further drive high CAGR.

- By Distribution Channel

On the basis of distribution channel, the Dilators market is segmented into Medical Store, E-commerce, Retail, and Others. The Medical Store segment held the largest market revenue share of 41.5% in 2025, driven by strong institutional purchasing and reliable supply chains supporting hospitals, clinics, and nursing homes. Medical stores maintain large inventories and fulfill urgent requirements, making them the preferred procurement source for bulk orders. Their ability to provide certified, authorized, and quality-assured medical devices further strengthens dominance. Stable relationships with healthcare providers and faster delivery cycles increase dependency on this channel.

The E-commerce segment is expected to witness the fastest CAGR of 20.6% from 2026 to 2033, driven by rapid digitalization of medical procurement and increasing preference for online purchasing among clinicians and small healthcare facilities. Online platforms offer wider product variety, easier comparisons, and competitive pricing. Growth in home healthcare, rising adoption of single-use dilators, and improved logistics networks boost online sales. Expanding availability of globally sourced devices through e-commerce further accelerates segment growth.

Dilators Market Regional Analysis

- North America dominated the dilators market with the largest revenue share of approximately 43.7% in 2025

- Supported by a well-established healthcare ecosystem, high procedural volumes, and rapid adoption of advanced minimally invasive devices

- The region’s strong focus on improving patient outcomes, increasing preference for non-surgical dilation procedures, and continuous technological innovation are major contributors to market growth

U.S. Dilators Market Insight

The U.S. dilators market accounted for the largest revenue share within North America in 2025, driven by high demand for minimally invasive diagnostic and therapeutic procedures across gynecology, gastroenterology, urology, and ENT. Strong reimbursement frameworks, high awareness among clinicians, and ongoing development of safer, more precise mechanical and balloon dilators further support the dominance of the U.S. market. Rising prevalence of chronic conditions requiring dilation, such as strictures and obstructions, also significantly fuels market expansion.

Europe Dilators Market Insight

The Europe dilators market is projected to grow at a robust CAGR during the forecast period, supported by advanced clinical infrastructure, strict medical device standards, and increasing adoption of minimally invasive techniques across hospitals and specialty clinics. Growing prevalence of gastrointestinal and gynecological conditions, along with rising demand for safe dilation tools in both diagnostic and treatment procedures, is strengthening market growth throughout the region.

U.K. Dilators Market Insight

The U.K. dilators market is expected to register strong growth, driven by increasing preference for minimally invasive procedures, rising awareness of early diagnosis, and consistent investment in modern medical equipment. Growing prevalence of gynecological and gastrointestinal disorders and the presence of advanced healthcare facilities are further encouraging the adoption of both mechanical and balloon dilators in hospitals and clinics.

Germany Dilators Market Insight

The Germany dilators market is projected to expand at a substantial CAGR, supported by the country’s technologically advanced medical sector and high emphasis on precision-based therapeutic procedures. Strong adoption of innovative, patient-safe dilation tools across gynecology, urology, and gastroenterology, along with growing demand for eco-conscious and efficient medical devices, is accelerating market penetration in both public and private healthcare institutions.

Asia-Pacific Dilators Market Insight

The Asia-Pacific dilators market is expected to grow at the fastest CAGR of around 24% during 2026–2033, driven by increasing healthcare investments, expanding access to quality treatment, and a growing patient pool suffering from disorders requiring dilation procedures. Rising demand for minimally invasive methods, improving hospital infrastructure, and government support for medical device modernization in China, India, and Japan are key drivers of rapid market expansion.

Japan Dilators Market Insight

The Japan dilators market is gaining strong momentum due to the country’s advanced medical technology environment, rising demand for precise and minimally invasive procedures, and growing healthcare needs of an aging population. Increased focus on safe, efficient, and patient-friendly dilators across gynecology, gastroenterology, and urology is fostering consistent market growth.

China Dilators Market Insight

China dilators market captured the largest revenue share in the Asia-Pacific Dilators market in 2025, supported by rapid urbanization, strong healthcare investments, and expanding adoption of advanced medical devices. Rising prevalence of digestive and reproductive health disorders, coupled with high procedural volumes, is increasing the demand for both mechanical and balloon dilators. The presence of leading domestic manufacturers and the availability of cost-efficient devices further accelerate market growth.

Dilators Market Share

The Dilators industry is primarily led by well-established companies, including:

• Medtronic (U.S.)

• Boston Scientific Corporation (U.S.)

• Cook Medical (U.S.)

• Stryker Corporation (U.S.)

• BD (U.S.)

• Olympus Corporation (Japan)

• Teleflex Incorporated (U.S.)

• Medline Industries (U.S.)

• Cardinal Health (U.S.)

• Mercury Medical (U.S.)

• Sklar Surgical Instruments (U.S.)

• Purple Surgical (U.K.)

• Pratt Medical (U.S.)

• MedGyn Products (U.S.)

• Coloplast (Denmark)

• CooperSurgical (U.S.)

• Smiths Medical (U.K.)

• Hollister Incorporated (U.S.)

• Romsons (India)

• Suntech Medical (China)

Latest Developments in Global Dilators Market

- In May 2021, Merit Medical Endotek announced the commercial launch of the Elation5™ multi-stage esophageal balloon dilator (the first 5-stage dilation balloon marketed to expand the treatment range on a single balloon)

- In December 2021, Diversatek Healthcare launched the Viper 3-Stage balloon dilators (fixed-wire and wire-guided versions) for dilation of GI stricture

- In April–June 2022, Acutus announced a definitive agreement to sell its left-heart access portfolio (which includes the AcQCross transseptal dilator systems) to Medtronic, with Medtronic beginning distribution/transition activity later in 2022 — a material consolidation of transseptal dilator assets

- In February 2022, Medtronic announced the launch/clearance of NuVent — a balloon dilation device for Eustachian tube dilation (an instance of major device makers expanding into specialized dilation/balloon technologies)

- In June 2023, BIOTRONIK introduced the Oscar multifunctional peripheral catheter that includes an extendable dilator component as part of the device design (noting device designs that integrate a dilator element with access/support catheters)

- In February 2023, Diversatek Healthcare completed the acquisition of G-Flex (GFE do Brasil) — adding ~250 SKUs (including endoscopy/dilation products) to its portfolio and expanding distribution for dilator/balloon products globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.