Global Dip Microcontroller Socket Market

Market Size in USD Billion

CAGR :

%

USD

1.40 Billion

USD

2.38 Billion

2024

2032

USD

1.40 Billion

USD

2.38 Billion

2024

2032

| 2025 –2032 | |

| USD 1.40 Billion | |

| USD 2.38 Billion | |

|

|

|

|

DIP Microcontroller Socket Market Size

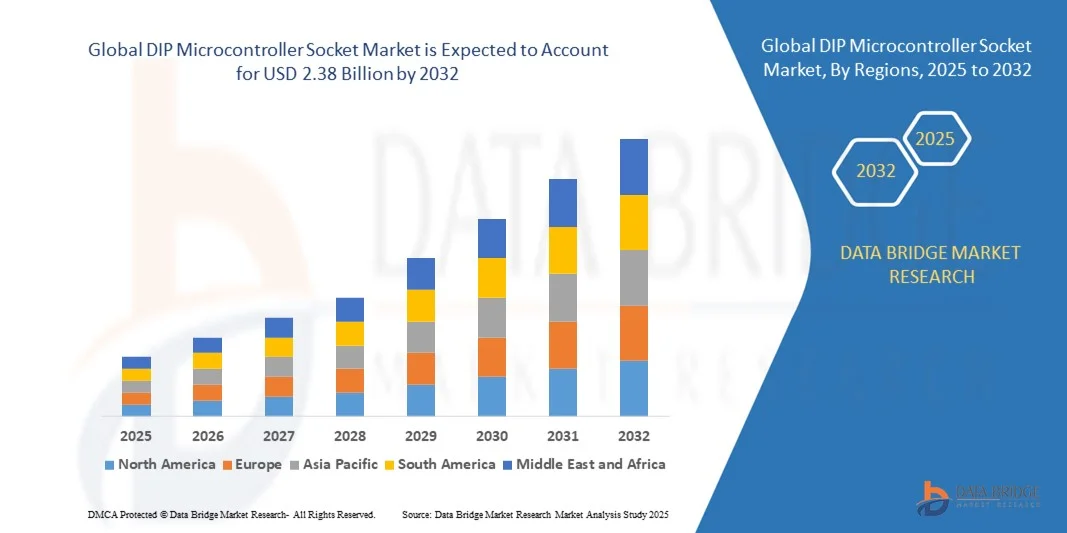

- The global DIP microcontroller socket market size was valued at USD 1.40 billion in 2024 and is expected to reach USD 2.38 billion by 2032, at a CAGR of 6.9% during the forecast period

- The market growth is largely fueled by the rising demand for reliable and high-performance socket solutions used in electronic testing, prototyping, and circuit design. The increasing complexity of microcontrollers in automotive, industrial, and consumer applications is driving the adoption of DIP sockets that provide easy installation, maintenance, and component interchangeability across diverse systems

- Furthermore, the continuous advancement in semiconductor testing and packaging technologies is accelerating the need for precision DIP sockets to enhance testing efficiency and accuracy. These developments are enabling manufacturers to streamline product validation and reduce production time, significantly contributing to the expansion of the DIP microcontroller socket market

DIP Microcontroller Socket Market Analysis

- DIP microcontroller sockets, designed to facilitate secure and removable connections for microcontrollers, play a crucial role in circuit prototyping, device testing, and system maintenance. Their versatility, reusability, and ability to withstand repeated insertions make them a preferred choice in industrial automation, medical devices, and educational electronics

- The growing adoption of automation and embedded systems across industries, combined with the expanding consumer electronics sector, is driving consistent demand for DIP microcontroller sockets. This trend is further supported by advancements in electronic manufacturing and the increasing focus on efficient circuit testing and microcontroller integration across global markets

- North America dominated the DIP microcontroller socket market in 2024, due to the strong presence of semiconductor manufacturers and advanced electronics design infrastructure

- Asia-Pacific is expected to be the fastest growing region in the DIP microcontroller socket market during the forecast period due to rapid industrialization, consumer electronics growth, and the expanding semiconductor industry in China, Japan, South Korea, and India

- Industrial segment dominated the market with a market share of 41.8% in 2024, due to widespread utilization of microcontroller sockets in automation equipment, control systems, and programmable logic controllers. These sockets provide easy replacement and maintenance of microcontrollers in demanding environments, reducing downtime and operational costs. Their durability and reliability in extreme conditions make them ideal for industrial automation and factory systems. Furthermore, continuous innovation in industrial IoT and process control is boosting their deployment across manufacturing and energy sectors

Report Scope and DIP Microcontroller Socket Market Segmentation

|

Attributes |

DIP Microcontroller Socket Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

DIP Microcontroller Socket Market Trends

Integration of DIP Sockets in Advanced Testing and Prototyping

- The global DIP (Dual In-line Package) microcontroller socket market is evolving with growing integration into advanced testing, prototyping, and educational applications that demand reliable and flexible connectivity solutions. DIP sockets continue to serve as essential interfaces for easily inserting and replacing microcontrollers during circuit development, debugging, and functional evaluation processes

- For instance, companies such as 3M, Aries Electronics, and Mill-Max Manufacturing Corp. have introduced high-precision, low-profile DIP socket solutions designed to support testing requirements in automotive electronics, industrial automation, and embedded system design. These products provide secure connectivity while minimizing insertion force and contact resistance

- The resurgence of hands-on electronics education and the rise of hobbyist prototyping platforms such as Arduino and Raspberry Pi have reinforced the use of DIP sockets for experimental circuit builds. Their convenient plug-in design supports iterative testing and component replacement without permanent soldering, making them preferred tools for R&D laboratories and academic institutions

- Increasing demand for modular circuit designs in IoT devices, aerospace systems, and robotics further supports DIP socket adoption in environments emphasizing design flexibility and component interchangeability. They enable more efficient prototyping, faster iteration cycles, and cost-effective testing of different microcontroller configurations

- DIP sockets also find renewed relevance in legacy equipment maintenance and industrial control systems, where through-hole components are still favored for their mechanical robustness and straightforward serviceability. These advantages make them a stable choice for niche applications requiring durable electrical interfaces

- The growing integration of DIP microcontroller sockets in prototyping and testing workflows underscores their lasting value despite rapid miniaturization trends in electronics. They remain a practical and essential bridge between design flexibility, reliability, and cost-control engineering

DIP Microcontroller Socket Market Dynamics

Driver

Rising Demand for Reliable Socket Solutions in Electronics

- The increasing need for durable and high-quality electrical interconnects in electronic devices and testing systems is a major driver of the DIP microcontroller socket market. With industries focusing on faster prototyping and reduced time-to-market, the use of reliable sockets for chip evaluation and functional testing has become indispensable

- For instance, Enplas and Wells Electronic Technology have developed advanced DIP microcontroller sockets featuring high-temperature-resistant housings, precision contact pins, and stable retention mechanisms. These designs ensure superior electrical performance during repeated insertions, reducing the risk of wear or signal loss in laboratory and production environments

- In industrial and consumer electronics manufacturing, sockets provide critical flexibility for microcontroller calibration, firmware updates, and diagnostic processes. Their use eliminates repeated desoldering, protecting PCB integrity and improving testing efficiency across multiple product cycles

- The increasing complexity of embedded systems and electronic control units in automotive, medical, and aerospace applications requires socket solutions capable of consistent performance under dynamic environmental conditions. Enhanced materials and spring-loaded contact technology are addressing these reliability demands effectively

- With prototype testing and short-run production becoming vital to electronics innovation, manufacturers and developers are embracing DIP sockets as cost-effective and high-precision components that enhance circuit adaptability and lifetime usability

Restraint/Challenge

Competition from Miniaturized Surface-Mount Technologies

- The growing shift toward miniaturized and surface-mount technologies (SMT) is a primary challenge limiting the broader adoption of DIP microcontroller sockets. Compact SMT packaging supports smaller device footprint, higher signal integrity, and improved automated assembly—attributes critical to next-generation electronic product design

- For instance, the integration of microcontrollers in compact IoT devices, wearable electronics, and portable instrumentation increasingly relies on QFN (Quad Flat No-lead) or BGA (Ball Grid Array) formats that eliminate the need for traditional DIP sockets. This technological shift reduces socket-compatible design demand in high-volume applications

- Furthermore, surface-mount assembly processes provide enhanced electrical performance and lower production costs through automated pick-and-place systems. As SMT adoption becomes global industry standard, through-hole packages and their corresponding sockets are steadily being phased out from commercial-scale electronics manufacturing

- DIP sockets also present size and pin-count limitations, making them less suited for high-density circuits and advanced microcontrollers requiring tight spacing and complex routing. Their compatibility is mainly restricted to older or specialized component architectures

- To address these challenges, manufacturers are focusing on hybrid and low-profile socket designs compatible with both DIP and SMT layouts for testing and prototyping. While SMT continues to dominate mass production, DIP sockets remain strategically valuable for prototyping, legacy maintenance, and research applications, ensuring their continued niche relevance in the evolving electronics ecosystem

DIP Microcontroller Socket Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the DIP Microcontroller Socket Market is segmented into Dual Inline Package (DIP), Ball Grid Array (BGA), Quad Flat Package (QFP), System On Package (SOP), and Small Outline Integrated Circuit (SOIC). The Dual Inline Package (DIP) segment dominated the market with the largest revenue share in 2024, driven by its cost-effectiveness, simplicity, and widespread use in prototyping and educational electronics. DIP sockets are easy to mount and replace, offering enhanced serviceability and flexibility for circuit testing and modifications. Their robust design and compatibility with breadboards and through-hole PCBs make them highly preferred by designers and small-scale manufacturers. The demand also remains strong in legacy systems and low-volume production environments where easy component interchangeability is essential.

The Ball Grid Array (BGA) segment is anticipated to witness the fastest growth rate from 2025 to 2032, propelled by the increasing demand for high-performance and miniaturized electronic devices. BGA sockets offer superior electrical and thermal performance due to shorter connection paths and better heat dissipation, making them suitable for advanced microcontrollers used in computing and telecommunications. The growing adoption of BGA packages in high-density circuits and complex embedded systems enhances their market potential. Their ability to support higher pin counts and efficient signal transmission further drives their use in modern industrial and consumer electronics applications.

- By Application

On the basis of application, the DIP Microcontroller Socket Market is segmented into Industrial, Consumer Electronics, Automotive, Medical Devices, and Military & Defense. The Industrial segment dominated the market in 2024 with the largest revenue share of 41.8%, driven by widespread utilization of microcontroller sockets in automation equipment, control systems, and programmable logic controllers. These sockets provide easy replacement and maintenance of microcontrollers in demanding environments, reducing downtime and operational costs. Their durability and reliability in extreme conditions make them ideal for industrial automation and factory systems. Furthermore, continuous innovation in industrial IoT and process control is boosting their deployment across manufacturing and energy sectors.

The Automotive segment is projected to record the fastest CAGR from 2025 to 2032, attributed to the growing integration of microcontrollers in advanced driver-assistance systems (ADAS), infotainment, and powertrain control modules. Automotive manufacturers are adopting socket-based solutions for testing and programming applications during production to enhance flexibility and efficiency. The rising trend of connected and electric vehicles further supports the demand for microcontroller sockets in automotive electronics. These sockets facilitate easy updates and diagnostics, ensuring enhanced reliability and faster assembly processes in modern automotive manufacturing.

DIP Microcontroller Socket Market Regional Analysis

- North America dominated the DIP microcontroller socket market with the largest revenue share in 2024, driven by the strong presence of semiconductor manufacturers and advanced electronics design infrastructure

- The region benefits from high investments in R&D and the demand for reliable, easily replaceable components in industrial automation and computing applications

- The market is further supported by robust demand from consumer electronics, automotive, and aerospace sectors that rely on socket-based microcontroller configurations for testing and prototyping

U.S. DIP Microcontroller Socket Market Insight

The U.S. DIP microcontroller socket market captured the largest revenue share in 2024 within North America, fueled by significant adoption in industrial automation, embedded system design, and educational electronics. The country’s strong focus on electronics innovation, supported by key players such as TE Connectivity and Mill-Max Manufacturing, is driving continuous demand for DIP sockets. Moreover, the ongoing expansion of the IoT ecosystem and testing environments in R&D labs supports market growth across both commercial and academic domains.

Europe DIP Microcontroller Socket Market Insight

The Europe DIP microcontroller socket market is projected to grow steadily throughout the forecast period, driven by advancements in industrial automation and the proliferation of smart manufacturing practices. The region’s focus on sustainability and energy-efficient systems increases the adoption of sockets that enable easy maintenance and reduced electronic waste. High demand from automotive electronics and precision engineering sectors across Germany, France, and Italy further supports regional expansion, with a rising preference for sockets compatible with advanced circuit designs.

U.K. DIP Microcontroller Socket Market Insight

The U.K. DIP microcontroller socket market is anticipated to witness notable growth, driven by the increasing presence of electronics startups, R&D institutions, and automation system integrators. The government’s initiatives promoting digital innovation and smart industry solutions are encouraging the use of microcontroller sockets for rapid prototyping and electronic testing. The country’s strong academic and engineering base also supports consistent demand for DIP sockets in educational and research laboratories.

Germany DIP Microcontroller Socket Market Insight

The Germany DIP microcontroller socket market is expected to expand significantly due to the nation’s leadership in industrial and automotive electronics. The country’s strong manufacturing base, combined with its emphasis on innovation and reliability, fosters the adoption of robust socket designs suitable for high-performance microcontrollers. Increased demand from automotive testing, robotics, and control systems further contributes to Germany’s market dominance within Europe.

Asia-Pacific DIP Microcontroller Socket Market Insight

The Asia-Pacific DIP microcontroller socket market is projected to grow at the fastest CAGR from 2025 to 2032, driven by rapid industrialization, consumer electronics growth, and the expanding semiconductor industry in China, Japan, South Korea, and India. The region’s role as a global electronics manufacturing hub significantly boosts the adoption of DIP and other socket types for prototyping, assembly, and testing applications. Increasing government investments in electronics manufacturing and R&D infrastructure further propel market expansion.

China DIP Microcontroller Socket Market Insight

The China DIP microcontroller socket market accounted for the largest share in Asia-Pacific in 2024, attributed to the country’s vast electronics manufacturing base and cost-efficient production ecosystem. The strong presence of local component manufacturers and the rapid expansion of IoT and consumer electronics devices drive demand. Furthermore, China’s ongoing efforts to strengthen its domestic semiconductor capabilities are expected to sustain long-term growth in the DIP socket market.

Japan DIP Microcontroller Socket Market Insight

The Japan DIP microcontroller socket market is experiencing significant growth, driven by the country’s focus on miniaturization, precision engineering, and automation. The high adoption of microcontroller sockets in robotics, automotive electronics, and industrial machinery supports market advancement. In addition, Japan’s emphasis on research-driven innovation and its demand for high-reliability components are fostering greater adoption of durable and efficient DIP socket designs.

DIP Microcontroller Socket Market Share

The DIP microcontroller socket industry is primarily led by well-established companies, including:

- Aries Electronics (U.S.)

- Mill-Max Mfg. Corp. (U.S.)

- Samtec, Inc. (U.S.)

- CnC Tech, LLC (U.S.)

- Sensata Technologies Inc. (U.S.)

- STMicroelectronics (Switzerland)

- WELLS-CTI Inc. (U.S.)

- Loranger International Corp. (U.S.)

- 3M (U.S.)

- Enplas Corporation (Japan)

- Johnstech (U.S.)

- Molex, LLC (U.S.)

- TE Connectivity (Switzerland)

- Win Way Technology Ltd. (Taiwan)

- Intel Corporation (U.S.)

- Hon Hai Precision Industry Co., Ltd. (Taiwan)

- Plastronics (U.S.)

- Chupond Precision Co. Ltd. (Taiwan)

- Yamaichi Electronics Co. Ltd. (Japan)

- Texas Instruments (U.S.)

Latest Developments in Global DIP Microcontroller Socket Market

- In January 2024, Aries Electronics introduced a new series of high-density DIP test sockets aimed at enhancing microcontroller characterization and testing efficiency for semiconductor manufacturers. This development is expected to strengthen the company’s position in the testing solutions segment, as the improved socket design supports faster validation and reliability analysis, driving wider adoption in advanced semiconductor production lines

- In November 2023, Mill-Max launched an expanded range of low-profile DIP sockets tailored for compact industrial control systems, emphasizing enhanced vibration resistance and space optimization. This innovation is anticipated to boost demand within automation and control applications, where durability and efficient board integration are critical for long-term operational stability

- In September 2023, a leading automotive Tier 1 supplier selected Samtec’s custom-designed DIP programming sockets for its next-generation vehicle control unit development, highlighting the product’s long-term reliability and precision. This collaboration reinforces Samtec’s presence in the automotive electronics sector and reflects the increasing reliance on robust socket solutions to support the development and testing of complex automotive systems

- In July 2023, TE Connectivity showcased its advanced material innovations for DIP sockets, focusing on superior thermal management to ensure reliable operation of microcontrollers in high-temperature environments. This advancement positions TE Connectivity as a key innovator in thermal-resistant socket solutions, catering to the evolving performance requirements of industrial and automotive electronics

- In April 2023, Enplas reported a significant surge in demand for its high-reliability DIP sockets from the medical device industry, driven by stricter testing standards and regulatory compliance requirements. This growth underscores the expanding use of interchangeable socket-based microcontrollers in critical medical applications, where precision, safety, and component reliability are paramount

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.