Global Direct Broadcasting Satellite Equipment Market

Market Size in USD Billion

CAGR :

%

USD

24.24 Billion

USD

36.64 Billion

2024

2032

USD

24.24 Billion

USD

36.64 Billion

2024

2032

| 2025 –2032 | |

| USD 24.24 Billion | |

| USD 36.64 Billion | |

|

|

|

|

Direct Broadcasting Satellite Equipment Market Size

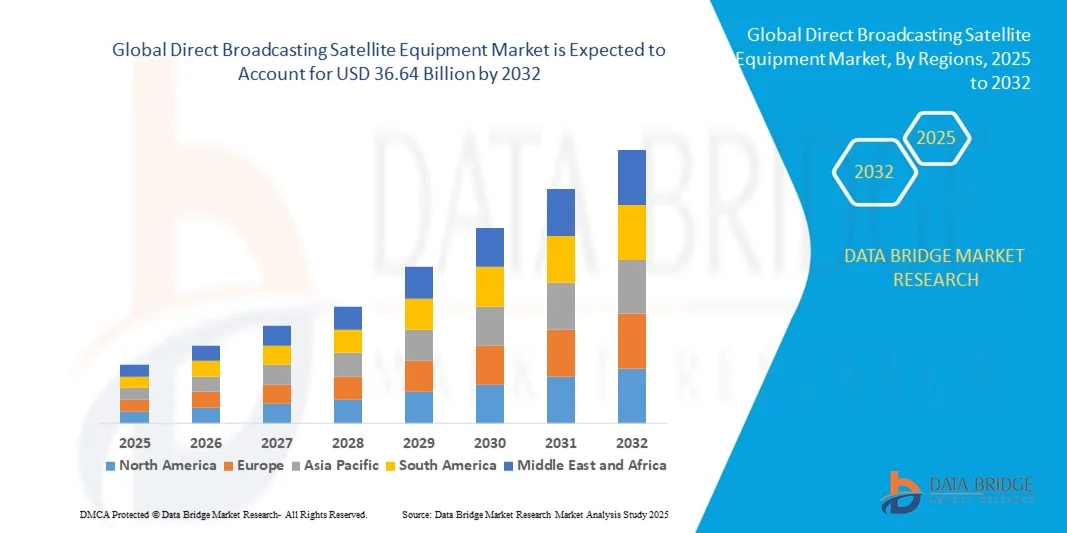

- The global direct broadcasting satellite equipment market size was valued at USD 24.24 billion in 2024 and is expected to reach USD 36.64 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality television services, expanding pay-TV subscriptions, and rising consumer preference for on-demand content across the globe

- In addition, advancements in satellite technology, such as high-throughput satellites (HTS) and compact user terminals, are supporting market expansion by enabling enhanced coverage and improved signal quality

Direct Broadcasting Satellite Equipment Market Analysis

- The market is driven by the increasing need for reliable satellite communication in both urban and remote regions, providing uninterrupted broadcasting services

- In addition, technological innovations in satellite antennas, receivers, and modulators are enhancing the efficiency, performance, and affordability of direct broadcasting satellite equipment, enabling wider consumer reach

- North America dominated the direct broadcasting satellite equipment market with the largest revenue share in 2024, driven by the presence of well-established satellite service providers, growing pay-TV subscriptions, and increasing adoption of high-throughput satellite (HTS) technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global direct broadcasting satellite equipment market, driven by increasing demand for HD and UHD content, rapid deployment of modern satellite technologies, growing middle-class population, and expanding coverage to rural and remote areas

- The dish antennas segment held the largest market revenue share in 2024, driven by the increasing deployment of direct-to-home (DTH) services and the need for reliable signal reception. Dish antennas are critical for receiving high-quality satellite signals and are widely adopted across residential and commercial applications

Report Scope and Direct Broadcasting Satellite Equipment Market Segmentation

|

Attributes |

Direct Broadcasting Satellite Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Direct Broadcasting Satellite Equipment Market Trends

Rise of Advanced Satellite Broadcasting Solutions

The growing adoption of advanced direct broadcasting satellite (DBS) equipment is transforming global broadcasting by enabling high-quality, real-time content delivery. Improved signal reliability and wider coverage allow broadcasters to reach remote and underserved regions, enhancing viewer experience and reducing service interruptions. In addition, enhanced monitoring and control capabilities offered by modern DBS equipment help operators optimize network performance and minimize downtime, further improving service reliability

The increasing demand for high-definition (HD) and ultra-high-definition (UHD) content is accelerating the deployment of high-throughput satellites (HTS) and advanced receiver technologies. These solutions support efficient bandwidth utilization and superior signal quality, making them critical for modern broadcasting networks. The adoption of scalable satellite platforms allows operators to meet growing content demands while controlling operational costs and expanding coverage

The integration of satellite equipment with IP-based platforms and content delivery networks is enabling flexible, on-demand broadcasting services. Operators can now provide interactive services, multi-channel distribution, and personalized content, improving engagement and subscription rates. This convergence also facilitates better analytics, subscriber management, and targeted content delivery, boosting overall operational efficiency

For instance, in 2023, several satellite operators in Asia-Pacific deployed advanced modulators and video servers to support UHD content delivery, resulting in improved signal stability and enhanced customer satisfaction. These deployments also enabled operators to expand services to underserved rural and semi-urban regions, strengthening market penetration and viewer loyalty

While advanced DBS equipment is driving improved broadcasting quality and network efficiency, its impact depends on continued innovation, regulatory compliance, and investment in infrastructure. Manufacturers must focus on scalable and cost-effective solutions to capitalize on growing global demand. Furthermore, collaboration with service providers and integration with emerging technologies such as 5G and cloud-based platforms will be key to sustaining long-term growth

Direct Broadcasting Satellite Equipment Market Dynamics

Driver

Rising Demand for High-Quality Broadcasting and Expanding Pay-TV Subscriptions

The surge in pay-TV subscriptions and the increasing demand for high-quality broadcasting services are encouraging operators to invest in modern DBS equipment. Services such as HD, UHD, and interactive television are driving the need for reliable and high-performance satellite equipment. In addition, expanding consumer preferences for multi-platform and on-demand content delivery is pushing broadcasters to upgrade infrastructure and invest in advanced satellite solutions

Expanding coverage to remote and rural areas is prompting broadcasters to adopt high-throughput satellites, dish antennas, and advanced receivers, ensuring uninterrupted service and improved signal quality. These deployments also help reduce signal degradation and interference, providing consistent quality to end-users. The trend is further supported by regional initiatives aimed at bridging the digital divide and extending television access to underserved populations

In addition, government initiatives and regulatory support for digital broadcasting infrastructure are promoting investments in advanced satellite technologies and supporting the expansion of broadcasting networks. Policies such as spectrum allocation, subsidies for digital migration, and technical standards for satellite communications create a favorable environment for industry growth. These measures encourage both domestic and international players to invest in robust and compliant DBS solutions

For instance, in 2022, several countries in Latin America launched nationwide digital broadcasting programs, boosting the demand for modulators, encoders, and transmitters across the region. These programs also included initiatives for training technical personnel and upgrading legacy networks, enhancing the overall broadcasting ecosystem and increasing adoption of modern DBS equipment

While technological adoption and regulatory backing are driving the market, operators must also address spectrum management, compatibility with legacy systems, and network scalability to ensure sustainable growth. Continuous innovation, integration with IP networks, and investment in flexible and modular satellite equipment are essential to meet evolving consumer and regulatory demands

Restraint/Challenge

High Capital Investment And Infrastructure Requirements

The high cost of advanced DBS equipment, including high-throughput satellites, modulators, and video servers, limits adoption, particularly for small and mid-sized broadcasters. Capital-intensive infrastructure remains a key barrier to market expansion. In addition, long payback periods and high upfront investment in satellite launch and ground infrastructure can discourage new entrants and constrain growth in price-sensitive markets

In addition, complex installation, integration, and maintenance requirements necessitate skilled personnel and robust technical support, restricting accessibility for new entrants and operators in remote regions. These requirements often involve specialized training, certifications, and ongoing support contracts, increasing operational complexity and costs. The lack of trained technicians in certain regions further slows deployment and limits market penetration

Supply chain challenges for satellite components, including antennas, transmitters, and modulators, can delay deployment and increase operational costs, particularly in developing markets. Disruptions in logistics, import restrictions, and limited local manufacturing capabilities exacerbate these challenges. Operators must carefully plan procurement and inventory management to avoid delays and service interruptions

For instance, in 2023, several African broadcasters faced delays in service rollout due to limited availability of satellite modulators and skilled installation teams. These delays impacted project timelines and increased operational costs, highlighting the importance of localized support and robust supply chain management in the DBS market

While technology continues to advance, addressing cost, infrastructure, and skill-related challenges remains critical. Stakeholders must focus on scalable solutions, modular equipment, and training programs to expand adoption and unlock long-term market potential. Strategic partnerships with technology providers, governments, and training institutes can further mitigate these challenges and enable broader market access

Direct Broadcasting Satellite Equipment Market Scope

The market is segmented on the basis of product and technology

- By Product

On the basis of product, the direct broadcasting satellite equipment market is segmented into dish antennas, amplifiers, switches, video servers, encoders, transmitters and repeaters, modulators, and others. The dish antennas segment held the largest market revenue share in 2024, driven by the increasing deployment of direct-to-home (DTH) services and the need for reliable signal reception. Dish antennas are critical for receiving high-quality satellite signals and are widely adopted across residential and commercial applications.

The video servers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for on-demand content, content storage, and management solutions. Video servers enable broadcasters to deliver multiple channels, personalized content, and advanced features such as time-shifted viewing, making them increasingly popular among operators and service providers.

- By Technology

On the basis of technology, the market is segmented into analog broadcasting and digital broadcasting. The digital broadcasting segment held the largest share in 2024, supported by the global transition from analog to digital satellite broadcasting. Digital broadcasting offers superior picture and sound quality, efficient spectrum usage, and enhanced interactive services.

The analog broadcasting segment is expected to witness steady growth during the forecast period, driven by regions and applications where legacy analog systems are still in operation. Analog solutions continue to be relevant for certain remote areas and cost-sensitive deployments, maintaining a consistent demand for specific satellite equipment.

Direct Broadcasting Satellite Equipment Market Regional Analysis

- North America dominated the direct broadcasting satellite equipment market with the largest revenue share in 2024, driven by the presence of well-established satellite service providers, growing pay-TV subscriptions, and increasing adoption of high-throughput satellite (HTS) technologies

- Service providers in the region highly value the reliability, coverage, and advanced signal processing capabilities offered by modern DBS equipment, enabling uninterrupted broadcasting and enhanced customer satisfaction

- This widespread adoption is further supported by robust infrastructure, high technological penetration, and the growing demand for premium content delivery services, establishing North America as a key hub for DBS equipment deployment

U.S. Direct Broadcasting Satellite Equipment Market Insight

The U.S. DBS equipment market captured the largest revenue share in North America in 2024, fueled by rapid adoption of digital broadcasting services and expanding pay-TV and direct-to-home (DTH) subscriptions. Broadcasters are increasingly prioritizing advanced satellite technologies such as modulators, video servers, and high-throughput antennas to ensure signal quality and reliability. The growing integration of DBS equipment with IP-based content delivery networks and on-demand streaming platforms is significantly contributing to market expansion.

Europe Direct Broadcasting Satellite Equipment Market Insight

The Europe DBS equipment market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the transition from analog to digital broadcasting and stringent regulatory standards for signal quality. Rising urbanization, expansion of DTH services, and growing demand for HD and UHD content are fostering the adoption of advanced DBS equipment. The region is witnessing notable growth across residential, commercial, and government broadcasting applications, with modern satellite systems being integrated into both new deployments and network upgrades.

U.K. Direct Broadcasting Satellite Equipment Market Insight

The U.K. DBS equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of digital and high-definition broadcasting. In addition, government-led initiatives to expand digital TV coverage and enhance signal quality are encouraging broadcasters to upgrade satellite infrastructure. The U.K.’s focus on content accessibility and interactive broadcasting services, alongside a mature pay-TV market, is expected to continue stimulating market growth.

Germany Direct Broadcasting Satellite Equipment Market Insight

The Germany DBS equipment market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing investments in digital broadcasting infrastructure and demand for high-quality signal delivery. Germany’s emphasis on technological advancement, regulatory compliance, and energy-efficient broadcasting solutions is promoting adoption, particularly in residential and commercial broadcasting networks. Integration of modern modulators, encoders, and receivers is also becoming increasingly prevalent, supporting advanced broadcasting services.

Asia-Pacific Direct Broadcasting Satellite Equipment Market Insight

The Asia-Pacific DBS equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing digital TV penetration in countries such as China, Japan, and India. Growing consumer demand for HD and UHD content, supported by government initiatives promoting digital broadcasting, is driving the adoption of DBS equipment. Furthermore, APAC’s emergence as a manufacturing hub for satellite components is enhancing affordability and accessibility, enabling wider deployment of DBS solutions.

Japan Direct Broadcasting Satellite Equipment Market Insight

The Japan DBS equipment market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high-tech infrastructure, advanced broadcasting networks, and strong consumer demand for high-quality TV services. Adoption of modern DBS equipment is supported by integration with IP networks, interactive services, and UHD broadcasting capabilities. The aging population and demand for convenient, reliable content delivery are also likely to boost market growth in residential and commercial sectors.

China Direct Broadcasting Satellite Equipment Market Insight

The China DBS equipment market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapid urbanization, expanding middle class, and high technological adoption. China is one of the largest markets for satellite-based broadcasting services, with strong domestic manufacturers supplying cost-effective equipment. Government initiatives promoting smart cities, DTH expansion, and digital broadcasting infrastructure are key factors driving the growth of DBS equipment in China.

Direct Broadcasting Satellite Equipment Market Share

The Direct Broadcasting Satellite Equipment industry is primarily led by well-established companies, including:

- Cisco (U.S.)

- Telefonaktiebolaget LM Ericsson (U.S.)

- Evertz Microsystems (U.S.)

- EVS Broadcast Equipment (U.S.)

- Grass Valley (U.S.)

- Harmonic Inc. (U.S.)

- Clyde Broadcast Technology Ltd (U.K.)

- Sencore Inc. (U.S.)

- Eletec (U.S.)

- ACORDE Technologies S.A. (U.K.)

- AVL India Private Limited (U.S.)

- ETL Systems Ltd (U.K.)

- Global Invacom (U.S.)

- Arris International (U.S.)

- RFE Broadcast (U.K.)

- Beamr Imaging Ltd. (U.S.)

- Newtec (U.S.)

- DATUM SYSTEMS (U.S.)

- Comtech Telecommunications Corp. (U.S.)

- Wellav Technologies Ltd. (U.S.)

- AnaCom, Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Direct Broadcasting Satellite Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Direct Broadcasting Satellite Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Direct Broadcasting Satellite Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.