Global Direct Carrier Billing Platform Market

Market Size in USD Billion

CAGR :

%

USD

128.83 Billion

USD

412.56 Billion

2024

2032

USD

128.83 Billion

USD

412.56 Billion

2024

2032

| 2025 –2032 | |

| USD 128.83 Billion | |

| USD 412.56 Billion | |

|

|

|

|

Direct Carrier Billing Platform Market Size

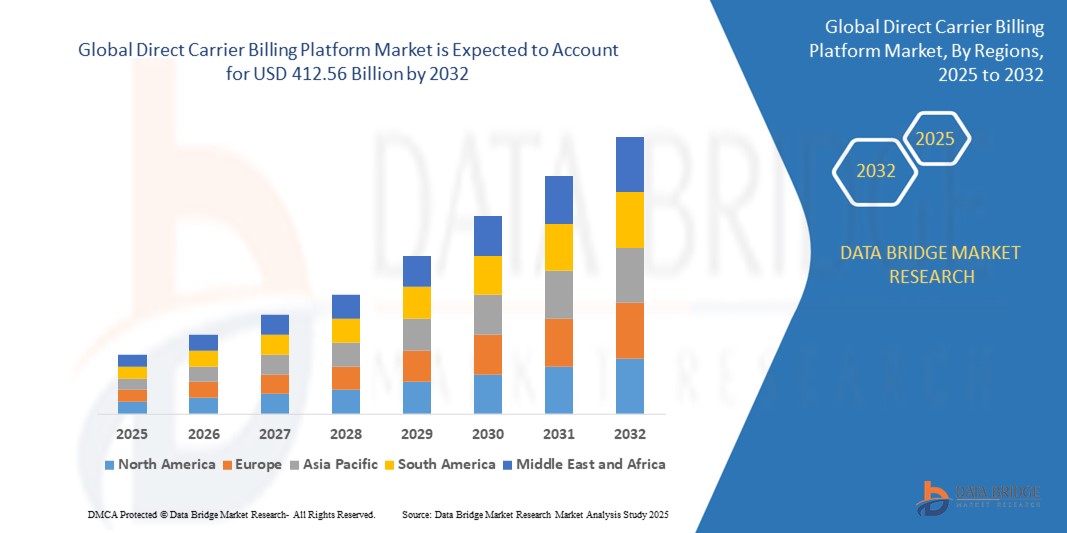

- The global direct carrier billing platform market size was valued at USD 128.83 billion in 2024 and is expected to reach USD 412.56 billion by 2032, at a CAGR of 15.66% during the forecast period

- The market growth is largely fuelled by the increasing smartphone penetration and the rising demand for convenient, secure payment methods that do not require credit cards or bank accounts

- Expansion of digital content and services, such as gaming, streaming, and e-commerce, is driving increased usage of direct carrier billing as a preferred payment solution for seamless transactions

Direct Carrier Billing Platform Market Analysis

- The market is witnessing significant growth due to the increasing adoption of mobile-first services in emerging economies, where traditional banking infrastructure is limited. This trend is driving the demand for seamless and accessible payment solutions

- Technological advancements, such as the integration of biometric authentication and artificial intelligence, are enhancing the security and personalization of direct carrier billing platforms, thereby improving user experience and expanding their appeal

- North America dominates the direct carrier billing (DCB) platform market, holding the largest revenue share of 39.8% in 2024, driven by high smartphone penetration, strong telecom infrastructure, and the rapid adoption of digital content services

- Asia-Pacific region is expected to witness the highest growth rate in the global direct carrier billing platform market, driven by increasing smartphone penetration, expanding digital service consumption, and limited access to traditional banking in emerging economies.

- The software segment held the largest market revenue share of 45% in 2024, driven by the increasing demand for advanced billing solutions that enable seamless transaction processing and integration with mobile networks. Software platforms facilitate real-time payment authorization, fraud detection, and analytics, making them essential for carrier billing operations

Report Scope and Direct Carrier Billing Platform Market Segmentation

|

Attributes |

Direct Carrier Billing Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Direct Carrier Billing Platform Market Trends

“Rise of Mobile-First Payment Solutions Driving Direct Carrier Billing Growth”

- Direct carrier billing platforms are gaining popularity as mobile-first payment methods, especially in areas with limited access to traditional banking

- Consumers prefer quick, convenient, and secure mobile payments that do not require credit cards or bank accounts

- The trend supports digital content purchases, in-app transactions, and subscriptions, boosting mobile commerce growth

- Enhanced security features such as biometric authentication and real-time fraud detection increase consumer trust and adoption

- For instance, companies such as Boku have partnered with major app stores to enable seamless mobile payments worldwide

Direct Carrier Billing Platform Market Dynamic

Driver

“Rising Adoption of Mobile Payments Driving Market Growth”

- The growing use of smartphones and increased internet access, especially in emerging markets, is driving demand for faster and more convenient payment methods

- Direct carrier billing enables users to charge purchases directly to their mobile phone bills, removing the need for credit cards or bank accounts, which benefits unbanked populations

- Expansion in digital content such as apps, games, music, and video streaming fuels the need for mobile-friendly payment solutions

- Telecom operators and service providers are partnering to broaden payment options and enhance the reach of carrier billing platforms

- Enhanced security features such as biometric authentication and fraud detection are building consumer trust, with companies such as Boku partnering with major app stores to facilitate secure mobile payments

Restraint/Challenge

“Complex Regulatory Environment and Fraud Risks Limit Market Growth”

- Navigating diverse and complex regulatory requirements across regions creates operational challenges and slows market expansion

- Compliance with financial regulations, data privacy laws, and consumer protection rules demands significant resources from telecom operators and platform providers

- Fraud risk is a major concern, as unauthorized transactions billed to mobile accounts can lead to disputes, chargebacks, and loss of consumer trust

- Smaller companies struggle to implement advanced security measures, while larger firms must continuously invest in fraud prevention technologies to counter evolving threats

- High costs for maintaining secure and compliant systems act as barriers to growth, limiting scalability and broader adoption of direct carrier billing platforms

Direct Carrier Billing Platform Market Scope

The market is segmented on the basis of component, type, features, authentication type, platform, and end use.

- By Component

On the basis of component, the direct carrier billing platform market is segmented into hardware, software, and services. The software segment held the largest market revenue share of 45% in 2024, driven by the increasing demand for advanced billing solutions that enable seamless transaction processing and integration with mobile networks. Software platforms facilitate real-time payment authorization, fraud detection, and analytics, making them essential for carrier billing operations.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the rising need for managed services, customer support, and customized billing solutions, especially among small and medium-sized enterprises seeking to optimize mobile payment experiences.

- By Type

On the basis of type, the direct carrier billing platform market is segmented into limited direct carrier billing, pure direct carrier billing, MSISDN forwarding, PIN or MO base window, and others. Pure direct carrier billing accounted for the largest market revenue share of 40% in 2024, supported by its widespread adoption in digital content purchases and in-app payments due to its convenience and user-friendly experience.

The MSISDN forwarding segment is expected to witness the fastest growth rate from 2025 to 2032, as it offers improved security and verification methods, making it popular among telecom operators and service providers.

- By Features

On the basis of features, the direct carrier billing platform market is segmented into pre-defined window, PIN defined, mobile originated, mobile terminated, and others. The mobile originated segment held the largest market share 38% in 2024, owing to its facilitation of consumer-initiated transactions that enhance user control and convenience.

The PIN defined segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing security concerns and demand for authentication measures to prevent unauthorized transactions.

- By Authentication Type

On the basis of authentication type, the direct carrier billing platform market is segmented into single factor authentication and two-factor authentication. Single factor authentication dominated the market by holding share of 60% in 2024 due to its simplicity and speed, which appeals to a broad consumer base. This method allows quick and easy access, making it popular among users who prioritize convenience over complex security measures. Its widespread use is supported by many service providers opting for this streamlined authentication process.

The two-factor authentication segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by stricter regulatory requirements and heightened focus on fraud prevention. This method provides an added layer of security by combining something the user knows with something they have, significantly reducing the risk of unauthorized access. Increasing awareness among consumers and businesses about cybersecurity is further accelerating its adoption.

- By Platform

On the basis of platform, the direct carrier billing platform market is segmented into Windows, Android, and iOS. Android segment held the largest market share of 55% in 2024, supported by its wide user base globally and compatibility with numerous carrier billing applications. The open-source nature of Android and the availability of diverse device options contribute to its dominant position. In addition, many telecom operators and app developers prioritize Android due to its extensive reach across various regions.

The iOS segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing adoption of iPhones and demand for secure mobile payment options among premium users. Apple’s continuous investment in privacy features and secure payment technologies such as Face ID and Touch ID enhances user trust. Moreover, the growing ecosystem of apps supporting carrier billing on iOS devices is contributing to this expansion.

- By End Use

On the basis of end use, the direct carrier billing platform market is segmented into apps and games, online media, and others. The apps and games segment accounted for the largest market revenue share of 50% in 2024, fuelled by the booming mobile gaming industry and the preference for easy in-app purchase options. The surge in mobile gaming and frequent microtransactions create strong demand for direct carrier billing as a convenient payment solution. This segment continues to drive growth as developers and platforms seek seamless monetization methods.

The online media segment is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding consumption of streaming services, music, and digital content across mobile devices. The rise of subscription-based models and increasing mobile internet accessibility are key factors supporting this trend. In addition, partnerships between media providers and carrier billing platforms enable seamless payment experiences, encouraging more users to adopt direct carrier billing for digital content purchases.

Direct Carrier Billing Platform Market Regional Analysis

- North America dominates the direct carrier billing (DCB) platform market, holding the largest revenue share of 39.8% in 2024, driven by high smartphone penetration, strong telecom infrastructure, and the rapid adoption of digital content services

- Consumers are increasingly favouring DCB for its ease of use, security, and ability to facilitate payments without credit cards

- The region’s leadership is further supported by the popularity of app stores, subscription-based media platforms, and gaming services

- Continuous investments by telecom operators and digital service providers in enhancing DCB capabilities also play a vital role

U.S. Direct Carrier Billing Platform Market Insight

The U.S. accounted for 82.3% of the North American market in 2024, fuelled by high consumer engagement in mobile gaming, digital media, and OTT content. The growing trend of cashless transactions and the demand for secure, frictionless payments continue to push DCB adoption. Major players such as Boku and T-Mobile are actively innovating in the space, enabling seamless integration with digital ecosystems. Strong partnerships with streaming platforms and mobile app providers reinforce the market’s expansion.

Europe Direct Carrier Billing Platform Market Insight

The Europe is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for secure digital payments and regulatory frameworks encouraging alternative payment models. DCB is gaining traction in countries with lower credit card usage, where mobile-first transactions dominate. High smartphone usage, along with the increase in consumption of digital content across mobile devices, fuels market growth. Telecom operators are expanding DCB coverage across entertainment, transportation, and utility payment segments.

U.K. Direct Carrier Billing Platform Market Insight

The U.K. is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing mobile content purchases and the rising adoption of subscription services. Consumers value the convenience and security of carrier billing, especially for low-ticket purchases such as streaming, gaming, and transport services. The regulatory environment supporting secure mobile transactions and high mobile internet penetration contribute to this trend. Strategic alliances between telecoms and digital merchants continue to expand DCB offerings in the market.

Germany Direct Carrier Billing Platform Market Insight

The Germany’s DCB platform market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for secure and convenient digital transactions. With consumers seeking seamless mobile payment options, DCB is emerging as a preferred solution for recurring subscriptions and app purchases.

The presence of leading telecoms and high smartphone adoption enhance the potential for growth. Moreover, integration of DCB with value-added services, such as online media and cloud gaming, is expected to further boost adoption.

Asia-Pacific Direct Carrier Billing Platform Market Insight

The Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, driven by rising smartphone adoption, expanding digital services, and limited access to traditional banking in many areas. DCB serves as a vital enabler of financial inclusion across countries such as India, Indonesia, and the Philippines. Government-backed digital initiatives and a tech-savvy youth population are key to growth. The region also benefits from strong telecom infrastructure and local players offering localized content and billing options.

Japan Direct Carrier Billing Platform Market Insight

The Japan is expected to witness the fastest growth rate from 2025 to 2032, driven by high-tech consumer behaviour and strong telecom partnerships. The country’s large mobile user base, combined with high usage of mobile media and games, makes it a fertile ground for DCB adoption. Advanced digital ecosystems and the popularity of mobile streaming and gaming services further fuel demand. Telecoms are also exploring DCB for services beyond entertainment, including transportation and retail.

China Direct Carrier Billing Platform Market Insight

The China held the largest revenue share in Asia-Pacific in 2024, supported by a massive mobile user base, widespread use of mobile wallets, and a digitally active population. DCB is emerging as a complementary payment option alongside dominant platforms such as WeChat Pay and Alipay. Strong domestic app ecosystems, government support for digital payment innovation, and rapid urbanization continue to support DCB growth. Local telecoms and digital service providers are heavily investing in enhancing carrier billing infrastructure and coverage.

Direct Carrier Billing Platform Market Share

The Direct Carrier Billing Platform industry is primarily led by well-established companies, including:

- Google LLC (U.S.)

- Microsoft (U.S.)

- Fortumo (Estonia)

- Bango.net Limited (U.K.)

- NETWORLD MEDIA GROUP (U.S.)

- DOCOMO Digital (Japan)

- Boku Inc. (U.S.)

- txtNation Limited (U.K.)

- Adpay.net.in (India)

- Mobiyo (Turkey)

- TELENITY (U.S.)

- ZONG (Pakistan)

- HIGHCO (France)

- NTH Mobile (U.S.)

- DIMOCO (Austria)

- Analysys Mason (U.K.)

- Lateral Profiles Limited (U.K.)

- Upstream (Greece)

- Swisscom Ltd (Switzerland)

- Tigo Tanzania (Tanzania)

Latest Developments in Global Direct Carrier Billing Platform Market

- In September 2023, Informa Tech hosted the Global Carrier Billing and Mobile Payments Summit at Novotel Amsterdam City, bringing together telecom operators, merchants, and industry leaders. The event highlighted current market trends, alternative payment methods, and emerging technologies while encouraging partnerships to unlock new opportunities within direct carrier billing and mobile money sectors

- In March 2023, T-Mobile achieved a technological milestone by collaborating with Ericsson, Nokia, Qualcomm Technologies, and Samsung to aggregate four mid-band spectrum channels on its standalone 5G network. The company also expanded Voice over New Radio services to four U.S. cities, improving 5G performance and customer experience

- In February 2023, T-Mobile partnered with Amazon to integrate its 5G Advanced Network Solutions with AWS cloud services. This alliance allows businesses to quickly deploy scalable 5G edge computing applications, enhancing operational efficiency through advanced connectivity and cloud technology

- In February 2022, Centili joined forces with ZEE5 Global to enable carrier billing for streaming services on Zain Bahrain and Zain Saudi Arabia networks. This partnership improved access to South Asian entertainment by allowing customers to pay through mobile billing, reflecting the growing integration of digital content and mobile payment solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.