Global Direct Debris Removal Market

Market Size in USD Billion

CAGR :

%

USD

141.70 Billion

USD

2,303.18 Billion

2024

2032

USD

141.70 Billion

USD

2,303.18 Billion

2024

2032

| 2025 –2032 | |

| USD 141.70 Billion | |

| USD 2,303.18 Billion | |

|

|

|

|

Direct Debris Removal Market Size

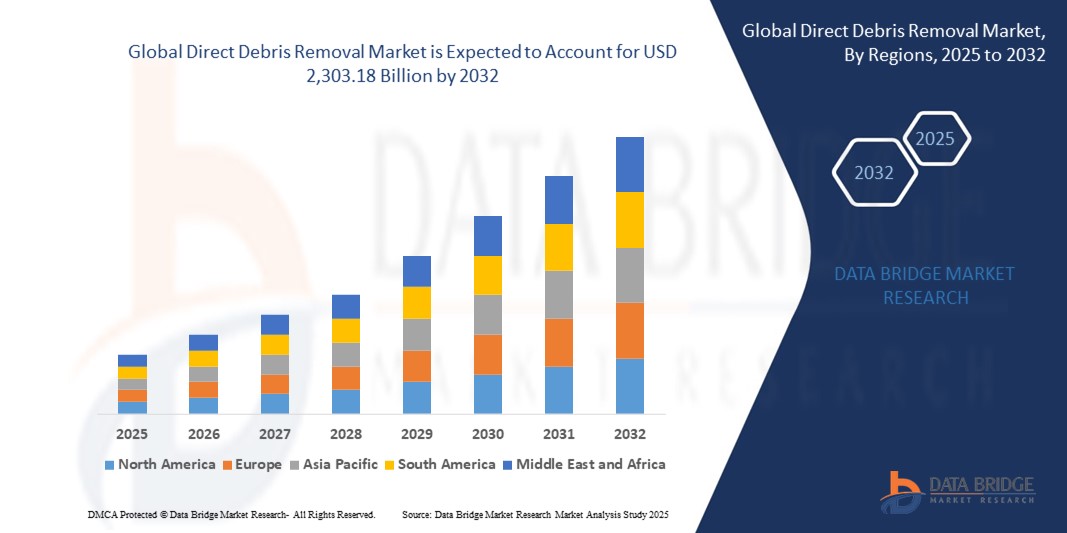

- The global direct debris removal market size was valued at USD 141.70 billion in 2024 and is expected to reach USD 2,303.18 billion by 2032, at a CAGR of 41.70% during the forecast period

- The market growth is largely fuelled by increasing demand for efficient debris and waste management solutions across industrial, municipal, and construction sectors

- Rapid urbanization, large-scale infrastructure projects, and the need for timely cleanup and hazard mitigation are further driving market expansion

Direct Debris Removal Market Analysis

- The global direct debris removal market is witnessing substantial growth due to increasing demand for efficient waste management solutions and rising industrialization

- Technological advancements in debris removal equipment, automation, and robotics are enhancing operational efficiency and reducing labor costs

- North America dominated the direct debris removal market with the largest revenue share of 38.5% in 2024, driven by rapid urbanization, large-scale construction activities, and growing investments in disaster management infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global direct debris removal market, driven by urban expansion, industrialization, and rising awareness of sustainable waste and debris management. Countries such as China, Japan, and South Korea are investing in automated debris collection, AI-driven sorting systems, and advanced machinery to improve efficiency and reduce environmental impact

- The Debris Collection Equipment segment held the largest market revenue share in 2024, driven by its ability to streamline debris collection, reduce labor dependency, and improve operational efficiency at construction and disaster sites. These systems are particularly popular among municipalities and large construction projects that require timely cleanup and enhanced safety

Report Scope and Direct Debris Removal Market Segmentation

|

Attributes |

Direct Debris Removal Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Adoption Of Automated And AI-Enabled Debris Removal Solutions |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Direct Debris Removal Market Trends

Adoption of Advanced Automated and Remote Debris Removal Solutions

• The increasing adoption of automated and remote debris removal systems is transforming the market by enabling faster, safer, and more efficient cleanup operations. These technologies allow real-time debris management in hazardous or hard-to-reach areas, reducing manual labor and operational downtime

• The high demand for rapid debris clearance in urban construction sites, disaster-affected regions, and industrial facilities is driving the deployment of mobile and robotic debris removal platforms. Governments and private organizations are actively investing in such solutions to enhance operational efficiency and safety

• Affordability and ease of integration of modern debris removal technologies are encouraging frequent use across diverse applications, improving productivity and minimizing potential safety hazards. Companies benefit from reduced equipment downtime, lower labor costs, and enhanced compliance with safety standards

• For instance, in 2023, several municipal authorities in North America implemented autonomous debris removal robots for stormwater and flood management, significantly reducing cleanup times and operational risks

• While automated and remote solutions are accelerating operational efficiency and safety, their adoption depends on continued innovation, workforce training, and cost management. Manufacturers must focus on customizable, scalable, and easy-to-deploy solutions to fully capitalize on market demand

Direct Debris Removal Market Dynamics

Driver

Increasing Urbanization, Construction Activities, And Disaster Management Needs

• Rapid urbanization and large-scale infrastructure development are generating significant debris, driving the need for efficient debris removal solutions. Municipalities, construction firms, and industrial sites are prioritizing technologies that accelerate cleanup, reduce labor dependency, and enhance site safety. This trend is especially prominent in high-density urban areas where timely debris management prevents operational delays and environmental hazards

• Rising occurrences of natural disasters, industrial accidents, and environmental hazards are creating urgent demand for automated and remote debris removal solutions. Organizations are increasingly investing in robotics, AI-driven machinery, and mobile debris management systems to ensure quick and effective disaster response. These solutions improve recovery times, minimize operational downtime, and protect human resources from hazardous environments

• The growing emphasis on environmentally compliant debris disposal and recycling practices is fueling investments in advanced debris removal technologies. Solutions that integrate waste segregation, recycling, and eco-friendly disposal are gaining traction across construction, industrial, and municipal projects. This not only reduces ecological impact but also aligns with sustainability regulations and corporate social responsibility initiatives

• For instance, in 2022, several metropolitan cities in Asia deployed robotic debris removal systems to manage post-construction and flood debris efficiently. These systems reduced dependency on manual labor, lowered operational costs, and enhanced cleanup speed, allowing municipalities to focus on broader urban maintenance and infrastructure projects

• While urbanization and disaster management are key growth drivers, sustained market expansion requires continuous innovation in robotics, AI-enabled automation, and sensor-based debris monitoring systems. Vendors must also provide scalable, cost-effective solutions adaptable to diverse geographies and operational scales

Restraint/Challenge

High Initial Investment And Technical Complexity

• The upfront costs of advanced automated and remote debris removal systems, including robotics, AI integration, and heavy-duty machinery, remain a significant barrier for small and medium-sized enterprises as well as municipal authorities. Despite potential long-term savings, budget constraints delay adoption, particularly in developing regions where capital allocation is limited

• Installation, operation, and maintenance of complex debris removal systems require trained personnel and technical expertise. Organizations lacking skilled operators face operational inefficiencies, higher risk of equipment damage, and potential safety hazards during deployment, slowing the adoption of advanced technologies

• Supply chain limitations and the inconsistent availability of high-tech components in remote or underdeveloped areas restrict market penetration. These challenges force many organizations to rely on traditional manual methods, which are labor-intensive, time-consuming, and less effective in high-volume debris scenarios

• For instance, in 2023, several municipalities in Sub-Saharan Africa experienced delays in implementing automated debris removal solutions due to high costs, technical complexity, and a shortage of trained operators. This resulted in prolonged reliance on manual cleanup, higher operational expenses, and slower disaster recovery

• In addition, integrating advanced debris removal systems into existing operational workflows poses challenges, especially for large-scale projects with varying debris types. Organizations must balance cost, technical complexity, and operational efficiency to maximize the benefits of automation and ensure reliable, safe, and timely debris management

Direct Debris Removal Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the direct debris removal market is segmented into Debris Collection Equipment, Debris Transportation Vehicles, Debris Processing Machinery, and Others. The Debris Collection Equipment segment held the largest market revenue share in 2024, driven by its ability to streamline debris collection, reduce labor dependency, and improve operational efficiency at construction and disaster sites. These systems are particularly popular among municipalities and large construction projects that require timely cleanup and enhanced safety.

The Debris Transportation Vehicles segment is expected to witness the fastest growth from 2025 to 2032, owing to its capability to move large volumes of debris efficiently across sites. These vehicles reduce manual handling, optimize waste transfer processes, and are ideal for large-scale urban development, industrial, and disaster management projects.

- By Application

On the basis of application, the market is segmented into Construction Sites, Industrial Facilities, Municipalities, and Others. The Construction Sites segment accounted for the largest market revenue share in 2024, driven by ongoing urbanization, infrastructure development, and the need for fast, reliable debris removal to maintain project timelines.

The Municipalities segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing government initiatives to automate waste and debris management, enhance public safety, and improve urban cleanliness and disaster response efficiency.

Direct Debris Removal Market Regional Analysis

• North America dominated the direct debris removal market with the largest revenue share of 38.5% in 2024, driven by rapid urbanization, large-scale construction activities, and growing investments in disaster management infrastructure

• Municipalities and private enterprises in the region are increasingly adopting advanced debris removal technologies to improve operational efficiency, safety, and regulatory compliance

• This widespread adoption is further supported by high capital expenditure budgets, technological readiness, and the increasing need for eco-friendly debris processing, establishing North America as a key market for debris removal solutions

U.S. Direct Debris Removal Market Insight

The U.S. direct debris removal market captured the largest revenue share in 2024 within North America, fueled by the growing demand for automated and AI-enabled debris collection and processing systems. Organizations are prioritizing operational efficiency and rapid disaster response, while municipalities focus on reducing labor dependency and environmental impact. The adoption of smart waste management solutions, coupled with regulatory initiatives for construction site safety and environmental compliance, is further driving market expansion.

Europe Direct Debris Removal Market Insight

The Europe direct debris removal market is expected to witness the fastest growth from 2025 to 2032, primarily driven by stringent environmental regulations and increasing urban redevelopment projects. The demand for advanced debris collection, transportation, and processing solutions is rising to ensure efficient waste management and minimize ecological impact. European governments and private construction companies are actively investing in automated systems to meet sustainability and safety standards across construction, industrial, and municipal applications.

U.K. Direct Debris Removal Market Insight

The U.K. direct debris removal market is expected to witness the fastest growth from 2025 to 2032, driven by extensive infrastructure projects, urban modernization, and a strong emphasis on disaster preparedness. Local authorities are increasingly adopting robotic and AI-enabled debris management systems to reduce labor costs, improve operational efficiency, and ensure compliance with environmental regulations. The country’s robust industrial and construction sectors, along with favorable government incentives, are expected to stimulate market growth.

Germany Direct Debris Removal Market Insight

The Germany direct debris removal market is expected to witness the fastest growth from 2025 to 2032, fueled by the country’s focus on sustainable construction practices and advanced industrial automation. German municipalities and enterprises are investing in innovative debris collection and processing machinery that enhance safety, speed, and efficiency. Integration of digital monitoring systems and AI-driven operations is becoming increasingly prevalent, aligning with Germany’s emphasis on technological advancement and environmental responsibility.

Asia-Pacific Direct Debris Removal Market Insight

The Asia-Pacific direct debris removal market is expected to witness the fastest growth from 2025 to 2032, driven by rapid urbanization, industrialization, and frequent natural disasters in countries such as China, Japan, and India. The region’s growing construction activities, coupled with government initiatives promoting smart city projects and disaster management systems, are driving the adoption of automated and AI-enabled debris removal solutions. Furthermore, APAC is emerging as a manufacturing hub for advanced debris removal equipment, increasing affordability and accessibility for a wider market.

Japan Direct Debris Removal Market Insight

The Japan direct debris removal market is expected to witness the fastest growth from 2025 to 2032 due to the country’s high frequency of natural disasters, urban density, and advanced technological adoption. Japanese municipalities and industrial facilities are investing in robotic debris collection and AI-integrated processing systems to ensure quick and efficient response. The market is further supported by government incentives for disaster preparedness and eco-friendly waste management practices, which are encouraging widespread adoption across residential, commercial, and municipal applications.

China Direct Debris Removal Market Insight

The China direct debris removal market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s rapid urbanization, large-scale infrastructure projects, and industrial growth. China’s emphasis on smart city initiatives, environmental compliance, and disaster management is boosting demand for advanced debris collection, transportation, and processing equipment. Strong domestic manufacturing capabilities and the availability of cost-effective solutions are key factors propelling the expansion of the direct debris removal market across construction, industrial, and municipal sectors.

Direct Debris Removal Market Share

The Direct Debris Removal industry is primarily led by well-established companies, including:

- Clean Harbors (U.S.)

- Veolia Environment (France)

- Stericycle (U.S.)

- Republic Services (U.S.)

- Heritage-Crystal Clean (U.S.)

- HWS Garbage (U.S.)

- ADS Waste Holdings (U.S.)

- Shanghai Chengtou Holding (China)

- China Everbright Group (China)

- Sound Environmental Resources (U.S.)

Latest Developments in Global Direct Debris Removal Market

- In April 2024, Clean Harbors launched a new line of advanced debris collection equipment, aimed at enhancing operational efficiency and minimizing environmental impact. The equipment streamlines debris handling processes, reduces labor dependency, and accelerates cleanup operations, making it particularly beneficial for large-scale construction and municipal projects. This development is expected to drive greater adoption of automated debris solutions, setting new standards for efficiency and sustainability in the market

- In November 2021, Veolia Environment introduced a pilot program for smart waste management solutions in urban areas, designed to optimize debris removal workflows and improve resource utilization. The program leverages IoT-enabled monitoring, predictive analytics, and automated scheduling to reduce operational costs and enhance service reliability. By demonstrating improved debris management efficiency and environmental compliance, this initiative is anticipated to encourage wider implementation of smart debris removal technologies across cities globally

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.