Global Direct To Shape Inkjet Printers Market

Market Size in USD Billion

CAGR :

%

USD

3.00 Billion

USD

4.90 Billion

2024

2032

USD

3.00 Billion

USD

4.90 Billion

2024

2032

| 2025 –2032 | |

| USD 3.00 Billion | |

| USD 4.90 Billion | |

|

|

|

|

Direct-to-Shape Inkjet Printers Market Size

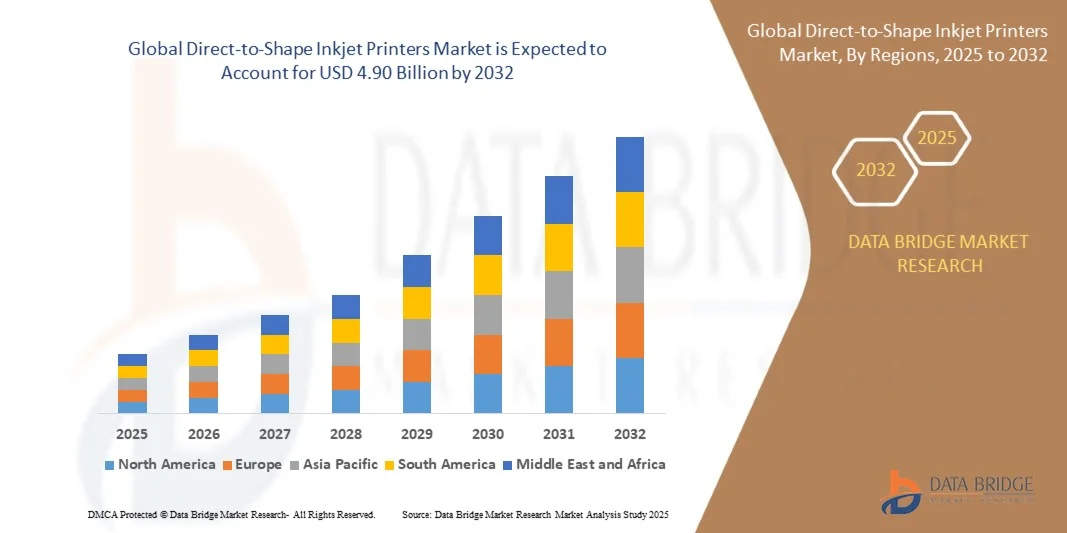

- The global direct-to-shape inkjet printers market size was valued at USD 3.00 billion in 2024 and is expected to reach USD 4.90 billion by 2032, at a CAGR of 6.35% during the forecast period

- The market growth is largely fueled by the increasing adoption of advanced digital printing technologies and rising demand for customized, high-quality packaging solutions across industries such as food and beverages, cosmetics, and pharmaceuticals, driving manufacturers to shift from traditional to digital printing methods

- Furthermore, the growing emphasis on efficient, cost-effective, and sustainable printing operations is propelling the use of direct-to-shape inkjet printers, as they eliminate the need for labels and reduce material waste while providing superior design flexibility and faster turnaround times, thereby significantly boosting market expansion

Direct-to-Shape Inkjet Printers Market Analysis

- Direct-to-shape inkjet printers enable printing directly onto 3D objects such as bottles, cans, and containers without the need for intermediate labels, offering enhanced design versatility and efficiency in production lines across multiple industries

- The rising demand for personalized and on-demand packaging, coupled with ongoing technological advancements in printhead precision, ink formulations, and UV-curable inks, is accelerating market growth as brands increasingly adopt these systems to achieve differentiation and sustainability in their packaging strategies

- North America dominated the direct-to-shape inkjet printers market with a share of in 2024, due to the strong presence of advanced packaging, beverage, and cosmetics industries utilizing direct printing for branding and personalization

- Asia-Pacific is expected to be the fastest growing region in the direct-to-shape inkjet printers market during the forecast period due to rapid industrialization, expanding packaging demand, and the increasing shift toward digital printing technologies in China, Japan, and India

- UV curable inks segment dominated the market with a market share of 47.3% in 2024, due to their superior adhesion on diverse substrates and rapid curing capability under UV light. These inks offer excellent durability, resistance to scratching and fading, and environmental advantages due to low VOC emissions. Their ability to produce high-quality, vibrant prints on materials such as glass, metal, and plastic makes them the preferred choice for premium packaging and promotional applications. The demand is further supported by the growing adoption of sustainable printing practices and the shift toward energy-efficient curing systems in industrial production lines

Report Scope and Direct-to-Shape Inkjet Printers Market Segmentation

|

Attributes |

Direct-to-Shape Inkjet Printers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Direct-to-Shape Inkjet Printers Market Trends

“Integration of Automation and Robotics in Direct-to-Shape Printing”

- The global direct-to-shape (DTS) inkjet printers market is witnessing strong growth as automation and robotics become integral to printing processes across packaging, consumer goods, and beverage industries. This integration is revolutionizing the printing landscape by enabling fast, precise, and customizable printing directly onto three-dimensional objects such as bottles, cans, and containers without traditional labels or adhesives

- For instance, companies such as Heidelberg and Tonejet have developed robotic-assisted DTS printing systems that enhance accuracy and speed by automating object handling, alignment, and surface scanning. These innovations improve print consistency and reduce manual intervention, allowing manufacturers to reduce waste and optimize production cycles

- The integration of robotics and vision-based control technologies supports high-resolution, full-color printing across complex shapes and textures, expanding design possibilities for brand differentiation. Automation also facilitates seamless printing on multiple substrates, from plastics and glass to metals and ceramics, meeting the needs of diverse industries

- Industry 4.0-driven initiatives, including IoT-enabled machine monitoring and predictive maintenance, are further boosting operational efficiency in high-volume DTS printing environments. These technologies ensure real-time performance tracking, minimizing downtime and enabling data-driven workflow optimization

- The ability to combine automation with DTS technologies is empowering manufacturers to achieve greater production flexibility and speed, essential for short-run and personalized packaging production. These capabilities align with growing consumer demand for unique, eco-friendly, and digitally customized product presentation

- As production automation scales globally, automated direct-to-shape printing is emerging as a key innovation driving the convergence of digital printing, robotics, and packaging design. This transformation supports cost-effective, on-demand, and sustainable packaging strategies within highly competitive manufacturing sectors

Direct-to-Shape Inkjet Printers Market Dynamics

Driver

“Rising Demand for Customized and On-Demand Packaging”

- The shift toward customized, on-demand, and digital printing is a major driver of the direct-to-shape inkjet printers market. Brands across food, beverage, cosmetics, and household products are leveraging DTS technology to create personalized packaging that enhances visual appeal and consumer engagement

- For instance, companies such as Coca-Cola and Heineken have implemented DTS systems to print limited-edition and region-specific designs directly onto cans and bottles. Such applications eliminate the need for pre-printed labels and allow rapid adaptation to market campaigns and product variations

- The expansion of e-commerce and premium product categories has amplified the demand for highly differentiated packaging. DTS printing offers flexibility for both mass customization and small-batch production, enabling manufacturers to meet changing tastes without additional labeling or die-cutting costs

- The ability to print high-resolution graphics on various shapes and materials supports brand storytelling and reduces the environmental impact of label waste. Combined with faster turnaround times, these advantages make DTS an ideal solution for smart and sustainable packaging production

- As consumer expectations for individualization and environmentally responsible packaging grow, DTS inkjet printing technology will remain critical in facilitating agile, personalized, and brand-centric manufacturing strategies

Restraint/Challenge

“High Cost of Advanced Printing Equipment”

- The high acquisition and operational costs of direct-to-shape inkjet printers represent a significant restraint for market adoption, particularly among small and mid-sized packaging manufacturers. The precision engineering, UV-curable inks, robotics integration, and advanced software required for DTS systems contribute to elevated capital expenditures

- For instance, high-end DTS printers from manufacturers such as Fujifilm Dimatix and Xerox require substantial investment due to sophisticated printheads, automated surface preparation, and curing systems. These costs often limit accessibility for low-volume production facilities or emerging markets with budget constraints

- Maintenance and calibration of multi-axis robotic arms and vision-guided printing modules add further expenses. Complex printing surfaces and color management requirements also drive the need for skilled operators and technical support, increasing total cost of ownership

- In addition, ink costs associated with UV and solvent-based formulations remain higher than those used in conventional label printing. Limited economies of scale for niche packaging runs may restrict profitability, especially for companies transitioning from analog to digital printing

- Reducing these costs through modular system design, energy-efficient printing components, and material standardization will be key to expanding the market reach of DTS printers. As equipment prices decline and automation technologies mature, adoption is expected to become more widespread across industries seeking high-value, customized packaging solutions

Direct-to-Shape Inkjet Printers Market Scope

The market is segmented on the basis of ink type, substrate type, application type, and end use.

- By Ink Type

On the basis of ink type, the Direct-to-Shape Inkjet Printers market is segmented into solvent-based, water-based, and UV curable inks. The UV curable inks segment dominated the market with the largest market revenue share of 47.3% in 2024, driven by their superior adhesion on diverse substrates and rapid curing capability under UV light. These inks offer excellent durability, resistance to scratching and fading, and environmental advantages due to low VOC emissions. Their ability to produce high-quality, vibrant prints on materials such as glass, metal, and plastic makes them the preferred choice for premium packaging and promotional applications. The demand is further supported by the growing adoption of sustainable printing practices and the shift toward energy-efficient curing systems in industrial production lines.

The water-based inks segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising environmental concerns and stringent regulations on solvent emissions. These inks are gaining traction across the food and beverage and personal care sectors due to their non-toxic composition and suitability for direct contact packaging. In addition, advancements in water-based ink formulations have improved print quality and drying speed, expanding their compatibility with porous and semi-porous materials. The increasing focus of manufacturers on eco-friendly printing technologies is expected to accelerate the adoption of water-based inks in the coming years.

- By Substrate Type

On the basis of substrate type, the market is segmented into plastic, glass, metal, paper, wood, and fabric. The plastic segment dominated the market in 2024 with the largest revenue share, primarily due to its extensive usage in packaging and promotional applications across consumer goods, cosmetics, and beverages. Direct printing on plastic eliminates the need for labels, reducing production costs and improving recyclability. Its smooth surface allows for high-resolution, full-color designs that enhance brand appeal, while compatibility with UV curable inks supports durable and scratch-resistant finishes. The widespread use of PET and HDPE bottles in the beverage industry continues to drive demand for direct-to-shape printing on plastics.

The glass segment is projected to witness the fastest CAGR from 2025 to 2032, driven by the increasing adoption of premium packaging in cosmetics, spirits, and gourmet food products. Glass offers a high-end aesthetic that complements vibrant, detailed prints achievable with UV curable inks. For instance, companies are increasingly using direct inkjet printing on glass bottles to create personalized designs and limited-edition packaging for product differentiation. The rise in luxury product consumption and advancements in adhesion promoters for glass substrates are expected to support strong growth in this segment.

- By Application Type

On the basis of application type, the market is segmented into bottles, cans, drums, tubes, folding cartons, bags, and trays. The bottles segment dominated the market in 2024 with the largest revenue share, attributed to its high usage across beverage, cosmetic, and household product industries. Direct printing on bottles offers a seamless and durable alternative to labels, enhancing product appeal and reducing material waste. The integration of high-speed UV inkjet systems enables efficient printing on curved and irregular bottle surfaces, supporting mass customization and rapid production turnaround. Growing consumer preference for visually distinctive packaging further drives demand for direct-to-shape printing on bottles.

The cans segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for personalized and limited-edition packaging in the food and beverage industry. Direct inkjet printing allows brands to create intricate graphics and seasonal designs directly on metal surfaces without the need for pre-printed sleeves. For instance, beverage manufacturers are leveraging this technology for short-run marketing campaigns and event-specific packaging. The rising use of aluminum cans for sustainable packaging and ongoing innovations in adhesion and curing technologies are expected to propel this segment’s expansion.

- By End Use

On the basis of end use, the market is segmented into food and beverages, pharmaceuticals, personal care and cosmetics, chemicals, industrial, and others. The food and beverages segment dominated the market with the largest share in 2024, driven by the sector’s high packaging volumes and increasing adoption of direct-to-container printing for branding and regulatory compliance. The technology enables quick design changes and high-speed printing on bottles, cans, and cartons, supporting product differentiation and reducing inventory waste. In addition, UV curable and water-based inks offer food-safe, durable, and visually appealing results suitable for various packaging materials. The growing trend toward sustainable and recyclable packaging further amplifies the demand in this segment.

The personal care and cosmetics segment is projected to register the fastest CAGR from 2025 to 2032, owing to increasing brand competition and a shift toward premium, aesthetic packaging solutions. Direct-to-shape inkjet printing provides flexibility in small-batch production and customization, aligning with the industry’s emphasis on personalized product designs. For instance, cosmetic brands are adopting UV curable inkjet printers to print intricate graphics directly onto glass and plastic containers for luxury appeal. The growing preference for eco-friendly packaging and the need for innovative visual presentation are key factors fueling growth in this segment.

Direct-to-Shape Inkjet Printers Market Regional Analysis

- North America dominated the direct-to-shape inkjet printers market with the largest revenue share in 2024, driven by the strong presence of advanced packaging, beverage, and cosmetics industries utilizing direct printing for branding and personalization

- The region’s manufacturers are adopting these printers to enhance product appeal through high-quality, full-color printing on containers and packaging materials

- The growing focus on reducing labeling costs and waste is accelerating the adoption of digital printing technologies across various industrial sectors, making North America a key hub for innovation in direct-to-shape printing

U.S. Direct-to-Shape Inkjet Printers Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, driven by strong demand from beverage, personal care, and food packaging industries. Manufacturers are increasingly using direct printing for short-run, customized packaging to attract consumers and improve brand differentiation. The integration of UV curable inks and automated printing systems enables high-speed, durable, and visually striking designs. The presence of leading packaging technology providers and growing investment in smart manufacturing further strengthen the country’s dominance in this market.

Europe Direct-to-Shape Inkjet Printers Market Insight

The Europe Direct-to-Shape Inkjet Printers market is projected to grow at a substantial CAGR during the forecast period, driven by stringent sustainability standards and the growing preference for recyclable and label-free packaging solutions. European manufacturers are increasingly using digital printing to achieve flexibility in design and production without compromising on quality or compliance. The market’s growth is supported by advancements in UV curable ink formulations and automation technologies that enable faster, cleaner, and more efficient operations.

U.K. Direct-to-Shape Inkjet Printers Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the strong adoption of digital packaging technologies in the beverage and cosmetics sectors. Manufacturers are leveraging direct-to-shape printing for personalization and small-batch production to cater to changing consumer preferences. The country’s focus on eco-friendly packaging and the shift toward waste-free production processes are further enhancing the demand for direct inkjet printing systems.

Germany Direct-to-Shape Inkjet Printers Market Insight

The Germany market is expected to expand at a considerable CAGR during the forecast period, driven by the nation’s emphasis on industrial automation and innovation in sustainable packaging. The strong manufacturing base and technological expertise in precision engineering are accelerating the adoption of high-performance direct-to-shape printers. German companies are also investing in UV and water-based printing solutions to ensure compliance with environmental regulations while maintaining superior print quality.

Asia-Pacific Direct-to-Shape Inkjet Printers Market Insight

The Asia-Pacific market is poised to register the fastest CAGR during 2025–2032, fueled by rapid industrialization, expanding packaging demand, and the increasing shift toward digital printing technologies in China, Japan, and India. The region’s large-scale production of consumer goods and cosmetics is driving adoption of direct-to-shape printers for efficient, high-volume, and cost-effective decoration. Government-led digitalization initiatives and growing investments in automation are further supporting regional growth.

China Direct-to-Shape Inkjet Printers Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, supported by its strong manufacturing ecosystem and high packaging production capacity. The demand for direct printing on plastic bottles, glass containers, and metal cans is growing rapidly, particularly in the food and beverage and cosmetics sectors. Domestic equipment manufacturers are offering cost-effective, high-speed UV inkjet printers, contributing to the country’s leading position in the regional market.

Japan Direct-to-Shape Inkjet Printers Market Insight

Japan is witnessing steady growth in the market, driven by the country’s focus on technological precision, quality, and product aesthetics. The adoption of direct-to-shape printing in premium packaging and personal care products is gaining traction due to the ability to achieve detailed, high-resolution graphics. Japan’s demand for sustainable and efficient printing technologies is encouraging manufacturers to adopt UV curable and water-based ink systems, positioning the market for consistent expansion.

Direct-to-Shape Inkjet Printers Market Share

The direct-to-shape inkjet printers industry is primarily led by well-established companies, including:

- Xerox Holdings Corporation (U.S.)

- Heidelberger Druckmaschinen AG (Germany)

- Mimaki Europe B.V. (Netherlands)

- Xaar plc. (U.K.)

- Koenig & Bauer AG (Germany)

- Roland DG Corporation (Japan)

- HP Inc. (U.S.)

- Velox Ltd. (Israel)

- Epson America, Inc. (U.S.)

- INX International Ink Co. (U.S.)

- LogoJET (U.S.)

- Tonejet Limited Inc. (U.K.)

- ISIMAT GmbH Siebdruckmaschinen (Germany)

- Omso S.p.A. (Italy)

- Engineered Printing Solutions (U.S.)

- Jet Inks Private Limited (India)

- Needham Inks Ltd. (U.K.)

- TOYO INK CO., LTD. (Japan)

- Color Resolutions International (U.S.)

- Nazdar (U.S.)

- Royal Inks & Equipments Pvt. Ltd. (India)

Latest Developments in Global Direct-to-Shape Inkjet Printers Market

- In July 2025, Sun Chemical Corporation showcased its advanced range of digital printing inks and technologies for industrial and packaging applications at the FuturePrint 2025 exhibition in São Paulo. The company introduced UV curable and water-based inks optimized for direct-to-shape printing on diverse substrates including glass, metal, and plastics. This initiative highlights a major step toward sustainable, high-performance printing that aligns with evolving environmental standards. The development is strengthening supply chain integration, driving greater adoption of DTS systems globally through improved ink compatibility and durability

- In June 2025, Seiko Epson Corporation introduced its Direct to Shape Printing System at Automatica 2025 in Munich, marking its first overseas exhibition and the start of full-scale global commercialization. The solution allows high-precision inkjet printing directly onto 3D objects, catering to industries seeking customized, label-free, and cost-efficient decoration. This launch represents a significant milestone in Epson’s expansion strategy, positioning the company as a key innovator in industrial digital printing while propelling worldwide adoption of DTS technology

- In April 2025, the FuturePrint TECH 2025 event held in Valencia spotlighted advancements in direct-to-shape printing technologies and their application across packaging and consumer goods sectors. The event gathered global technology providers, equipment manufacturers, and brand owners to demonstrate next-generation DTS systems capable of high-speed, full-color decoration. The focus on DTS innovation during this event amplified market visibility and spurred partnerships aimed at developing eco-friendly, automated, and design-flexible printing solutions

- In September 2024, Epson completed the acquisition of Fiery LLC, a renowned provider of workflow automation and digital front-end software for printing systems. This strategic move strengthened Epson’s ability to deliver integrated DTS printing ecosystems combining hardware precision with intelligent color and job management. The acquisition enhances operational efficiency and customization capabilities for industrial users, enabling faster, smarter, and more reliable DTS printing solutions that meet the growing demand for digital packaging transformation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Direct To Shape Inkjet Printers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Direct To Shape Inkjet Printers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Direct To Shape Inkjet Printers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.