Global Disabled Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

4.53 Billion

USD

11.15 Billion

2024

2032

USD

4.53 Billion

USD

11.15 Billion

2024

2032

| 2025 –2032 | |

| USD 4.53 Billion | |

| USD 11.15 Billion | |

|

|

|

|

Disabled Vehicle Market Size

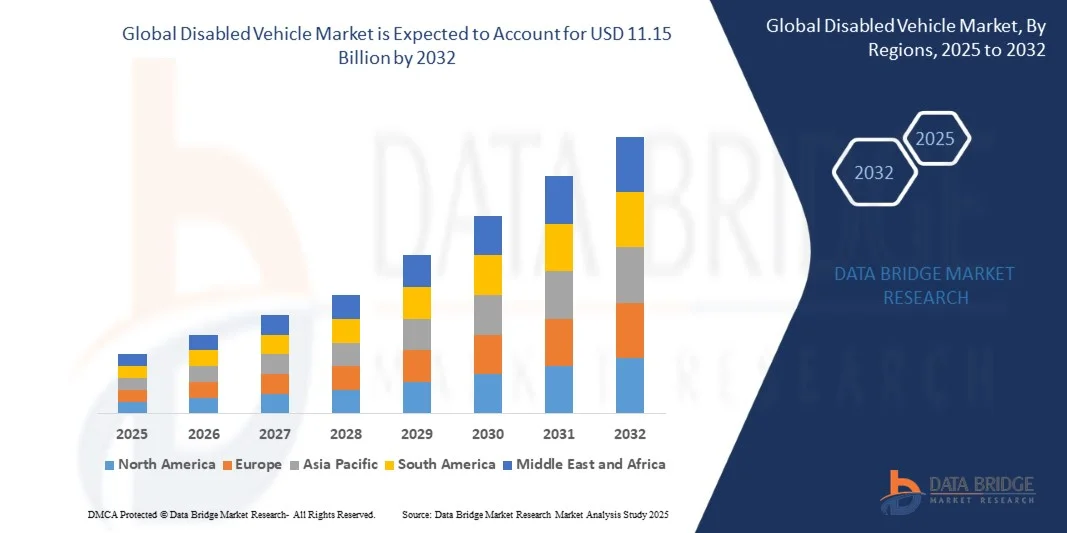

- The global disabled vehicle market size was valued at USD 4.53 billion in 2024 and is expected to reach USD 11.15 billion by 2032, at a CAGR of 11.92% during the forecast period

- The market growth is largely fuelled by the increasing adoption of mobility solutions for people with disabilities, rising awareness about accessible transportation, and supportive government policies and incentives

- Growing technological advancements in adaptive vehicle systems, electric and hybrid disabled vehicles, and customized mobility aids are further accelerating market expansion

Disabled Vehicle Market Analysis

- The market is witnessing a shift towards electric and hybrid disabled vehicles due to environmental concerns, government subsidies, and lower operational costs, which enhance adoption across regions

- The rising demand for specialized features such as hand controls, wheelchair lifts, and automated entry systems is driving innovation and customization within the market

- North America dominated the disabled vehicle market with the largest revenue share of 38.5% in 2024, driven by increasing awareness of inclusive transportation, supportive government policies, and a growing demand for accessible mobility solutions across residential and commercial sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global disabled vehicle market, driven by rapid industrialization, increasing demand for adaptive and wheelchair-accessible vehicles, and technological advancements in vehicle modification and customization

- The physical disability segment held the largest market revenue share in 2024, driven by the high demand for vehicles equipped with adaptive controls, hand-operated systems, and ergonomic modifications that enable safe and independent mobility for physically challenged individuals. Vehicles designed for cognitive and sensory disabilities are also witnessing growing adoption due to innovations in assistive technology, smart sensors, and automation that enhance usability, comfort, and safety for diverse user groups

Report Scope and Disabled Vehicle Market Segmentation

|

Attributes |

Disabled Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Disabled Vehicle Market Trends

“Increasing Adoption of Mobility Solutions for Differently-Abled Individuals”

- The growing focus on accessible transportation is transforming the disabled vehicle market by enabling safe, comfortable, and independent mobility. Vehicles equipped with adaptive controls and assistive technologies allow users to commute efficiently, enhancing their overall quality of life. This trend is further reinforced by innovations in automated driving aids, ergonomic seating, and digital interface systems, providing a seamless travel experience for differently-abled individuals across diverse regions. Rising urbanization and awareness campaigns are also encouraging greater adoption, allowing manufacturers to explore new product lines and service models, expanding market reach while improving inclusivity and mobility solutions globally

- Rising demand for specialized vehicles in urban and rural areas is accelerating the adoption of modified cars, vans, and wheelchair-accessible vehicles. These solutions are particularly effective in regions where conventional public transportation is not disability-friendly. Governments and private institutions are increasingly introducing incentive schemes, subsidies, and grants to promote accessible transport, while insurance companies are also providing tailored coverage options for adaptive vehicles. In addition, rising societal awareness about inclusivity and mobility rights is encouraging organizations to integrate accessible vehicle solutions into corporate and public transport fleets, supporting broader social participation and improving quality of life for disabled users

- The ease of customization and availability of retrofit solutions are making disabled vehicles attractive for both individual users and institutional fleets. Manufacturers benefit from broader market reach and increased consumer trust due to improved user experience and safety. The modularity of modern vehicle modifications, including hand controls, wheelchair lifts, and adaptive seating, allows for cost-efficient upgrades and rapid deployment in diverse geographies. Moreover, partnerships with rehabilitation centers, healthcare providers, and fleet operators are fostering awareness and adoption, helping companies scale operations and enhance service networks while meeting the growing demand for inclusive mobility solutions across emerging and developed markets

- For instance, in 2023, several mobility service providers in Europe introduced wheelchair-accessible vans with advanced safety features, improving transportation accessibility for differently-abled passengers and boosting service adoption. These vehicles featured enhanced stability, automated ramps, and user-friendly interfaces, which significantly reduced travel difficulties and improved safety during commutes. In addition, real-time tracking, digital booking, and support services integrated into these vehicles provided convenience and reliability, creating a model for service-oriented accessibility. Such initiatives are encouraging private and public stakeholders globally to adopt similar mobility solutions, ultimately increasing market penetration and fostering sustainable growth in the disabled vehicle sector

- While the adoption of disabled vehicles is increasing, continued innovation in vehicle design, safety features, and user-friendly controls is critical to sustain market growth and enhance inclusivity. Continuous research into lightweight materials, smart control systems, and autonomous assistive technologies is helping manufacturers create more adaptable and affordable solutions. Public-private collaborations and government-backed programs are also essential to expand infrastructure, training, and support services, ensuring that accessibility reaches underserved areas. By addressing these technological, regulatory, and social factors, the disabled vehicle market can achieve higher adoption rates, improve user satisfaction, and significantly contribute to global mobility inclusivity

Disabled Vehicle Market Dynamics

Driver

“Rising Awareness of Inclusive Transportation and Supportive Government Policies”

- Growing awareness of the mobility needs of differently-abled individuals is pushing governments and private operators to prioritize accessible vehicle solutions. Policy initiatives, subsidies, and tax incentives are accelerating market adoption and innovation. Governments are also mandating accessibility standards for public transport and private fleets, encouraging manufacturers to integrate adaptive features in new vehicle models. Enhanced public awareness campaigns and collaborations with disability organizations further reinforce adoption, making accessible mobility a key consideration for urban planning and fleet operations, thereby creating long-term growth opportunities for manufacturers and service providers globally

- Consumers and organizations are increasingly recognizing the benefits of modified vehicles in terms of independence, safety, and convenience. This has led to higher adoption among private users, healthcare institutions, and transport services catering to differently-abled individuals. Employers and service providers are also realizing that inclusive transport improves workforce participation and customer satisfaction, driving corporate investment in accessible vehicles. Training programs for drivers and fleet operators on safe handling of adaptive vehicles are further enhancing confidence in deployment, thereby creating a supportive ecosystem that fosters market growth, operational efficiency, and social inclusivity

- Support from NGOs, disability associations, and community programs is strengthening infrastructure for accessible transportation. Awareness campaigns and partnerships with vehicle manufacturers are further promoting adoption in underserved regions. Initiatives such as mobility workshops, financing support, and advocacy for adaptive vehicle integration in public systems help bridge gaps between technology availability and end-user accessibility. These coordinated efforts facilitate faster adoption of disabled vehicles, expand market opportunities in rural and urban areas, and enhance overall mobility services for differently-abled populations while supporting social and economic inclusion

- For instance, in 2022, the U.K. government expanded grants for wheelchair-accessible vehicles, leading to a significant increase in fleet upgrades among taxi operators and healthcare providers. These grants reduced acquisition costs, enabled fleet operators to incorporate modern adaptive technologies, and enhanced service reliability for disabled passengers. The initiative also encouraged private manufacturers to invest in product innovation and customization, which further stimulated the regional market. Similar policy-driven interventions in other countries are likely to replicate this success, creating opportunities for global market expansion and widespread accessibility adoption

- While awareness and policy support drive market growth, there remains a need to improve last-mile vehicle customization, affordability, and maintenance services to ensure widespread adoption and sustained market expansion. Continuous support for innovation in adaptive controls, vehicle ergonomics, and digital mobility aids is essential. Partnerships between governments, private manufacturers, and NGOs are critical to develop standardized solutions that are cost-effective, safe, and widely available, ultimately maximizing accessibility, market penetration, and long-term industry sustainability

Restraint/Challenge

“High Cost of Modified Vehicles and Limited Availability in Emerging Regions”

- The high price of disabled vehicles, including modifications and adaptive equipment, restricts adoption among individual users and small transport operators. These costs often limit market penetration in price-sensitive regions. Expensive retrofitting options and specialized components further increase acquisition and maintenance costs, discouraging potential buyers. Financial constraints in emerging economies limit access to accessible transportation, slowing adoption rates despite growing awareness of mobility needs

- In many emerging markets, there is a lack of trained personnel for vehicle modifications and maintenance. The absence of specialized service centers and limited supply chains reduces accessibility and reliability of disabled vehicle solutions. Lack of technical support and limited training for mechanics and operators leads to delays in vehicle readiness, reducing trust in adaptive mobility services and hindering widespread market penetration

- Market growth is also constrained by inconsistent infrastructure, such as wheelchair-accessible ramps and parking, particularly in rural or underdeveloped areas. This limits the practical usability of disabled vehicles and reduces consumer confidence. Poor road conditions, inadequate charging facilities for electric adaptive vehicles, and insufficient public transport integration further exacerbate accessibility challenges, making full adoption difficult without coordinated infrastructure development

- For instance, in 2023, several mobility agencies in India reported delays in delivery and service of wheelchair-accessible vehicles due to supply chain and customization challenges, restricting adoption among end-users. Limited availability of essential components such as lifts, ramps, and adaptive seating slowed fleet upgrades and affected service reliability, demonstrating the impact of logistical and operational barriers on market expansion

- While vehicle design and accessibility technologies continue to evolve, addressing affordability, technical support, and infrastructure limitations is crucial to unlock the full potential of the global disabled vehicle market. Strategic collaborations between manufacturers, service providers, and governments, along with investment in skill development and infrastructure, are necessary to ensure equitable access, enhance user experience, and drive long-term sustainable growth in the disabled vehicle sector

Disabled Vehicle Market Scope

The disabled vehicle market is segmented on the basis of type of disability, vehicle type, usage, and regulation compliance.

• By Type of Disability

On the basis of type of disability, the disabled vehicle market is segmented into physical disability, cognitive disability, sensory disability, and multiple disabilities. The physical disability segment held the largest market revenue share in 2024, driven by the high demand for vehicles equipped with adaptive controls, hand-operated systems, and ergonomic modifications that enable safe and independent mobility for physically challenged individuals. Vehicles designed for cognitive and sensory disabilities are also witnessing growing adoption due to innovations in assistive technology, smart sensors, and automation that enhance usability, comfort, and safety for diverse user groups.

The multiple disabilities segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by integrated solutions that combine adaptive controls, voice commands, and accessibility aids. These vehicles provide comprehensive support for users with combined physical and cognitive limitations, offering enhanced independence and convenience while improving market demand across residential, healthcare, and public transport sectors.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into adaptive vehicles, wheelchair-accessible vehicles, specialized vans, and modified cars. Wheelchair-accessible vehicles held the largest share in 2024 due to their widespread use in hospitals, mobility service providers, and personal transportation. Adaptive vehicles and modified cars are rapidly gaining traction, especially in regions emphasizing inclusive mobility solutions and government incentive programs.

The specialized vans segment is expected to witness the fastest growth rate from 2025 to 2032, driven by demand for fleet solutions by healthcare, educational, and transport institutions. Vans equipped with lifts, ramps, and advanced safety features are increasingly preferred for transporting multiple passengers with mobility challenges, supporting efficient operations and enhanced comfort.

• By Usage

On the basis of usage, the market is segmented into personal use, public transport, and commercial use. Personal use dominated the market in 2024, supported by rising awareness of accessible transportation and demand for independent mobility among differently-abled individuals. Public transport and commercial use are witnessing growth due to integration of accessible vehicles in taxi fleets, paratransit services, and mobility programs for institutions.

The commercial use segment is expected to witness the fastest growth rate from 2025 to 2032, driven by service providers and logistics companies incorporating modified vehicles to enhance inclusivity and comply with accessibility regulations. Vehicles for commercial use are increasingly equipped with adaptive technology, GPS tracking, and digital monitoring systems, creating new opportunities for fleet operators.

• By Regulation Compliance

On the basis of regulation compliance, the market is segmented into standard compliance, advanced safety features, and accessibility standards. The standard compliance segment held the largest share in 2024, driven by mandatory accessibility requirements and government regulations for safe commuting of differently-abled individuals. Vehicles meeting accessibility standards and equipped with advanced safety features such as automated lifts, anti-slip flooring, and emergency communication systems are gaining preference across developed and emerging markets.

The advanced safety features segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by technological advancements, increasing government mandates, and rising consumer awareness about safety, reliability, and ease of use. Integration of smart sensors, adaptive controls, and IoT-enabled monitoring systems is enhancing vehicle functionality, user experience, and market expansion globally.

Disabled Vehicle Market Regional Analysis

- North America dominated the disabled vehicle market with the largest revenue share of 38.5% in 2024, driven by increasing awareness of inclusive transportation, supportive government policies, and a growing demand for accessible mobility solutions across residential and commercial sectors

- Consumers and institutions in the region highly value the safety, comfort, and convenience offered by vehicles equipped with adaptive controls, wheelchair-accessible features, and assistive technologies

- This widespread adoption is further supported by high disposable incomes, advanced infrastructure, and strong policy frameworks promoting mobility for differently-abled individuals, establishing disabled vehicles as a preferred solution for both private and institutional use

U.S. Disabled Vehicle Market Insight

The U.S. disabled vehicle market captured the largest revenue share in North America in 2024, fueled by rising investments in mobility services, technological advancements in adaptive vehicle features, and growing public awareness regarding inclusive transportation. Consumers are increasingly prioritizing vehicles that ensure independence, safety, and convenience for physically and cognitively challenged individuals. The expanding trend of wheelchair-accessible vans, specialized adaptive vehicles, and retrofit solutions, combined with government grants and subsidies, further drives market growth. Moreover, partnerships between mobility service providers and manufacturers are significantly contributing to the adoption of innovative, user-friendly vehicles.

Europe Disabled Vehicle Market Insight

The Europe disabled vehicle market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by supportive regulations, government incentives, and the increasing need for safe, inclusive mobility solutions. Rising urbanization and adoption of accessible public transport systems are fostering the demand for modified cars, specialized vans, and adaptive vehicles. European consumers and healthcare institutions are drawn to the enhanced comfort, safety, and operational efficiency these vehicles provide. The region is witnessing strong growth across personal, public transport, and commercial applications, with disabled vehicles being integrated into both new fleets and existing transportation systems.

U.K. Disabled Vehicle Market Insight

The U.K. disabled vehicle market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising home-to-work mobility requirements, growing awareness of accessible transportation, and a desire for independent commuting options. Safety concerns, ease of travel, and government-funded mobility schemes are encouraging both private users and service providers to adopt wheelchair-accessible and modified vehicles. The U.K.’s established automotive and mobility infrastructure, along with robust healthcare and transport programs, is expected to continue stimulating market growth.

Germany Disabled Vehicle Market Insight

The Germany disabled vehicle market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing investments in mobility solutions for differently-abled individuals and the adoption of advanced adaptive vehicle technologies. Germany’s well-developed road infrastructure, emphasis on safety, and focus on sustainable, user-friendly vehicle design promote the adoption of modified cars and accessible vans. Integration with smart transport services and compliance with advanced safety standards is becoming increasingly prevalent, meeting the expectations of residential, commercial, and public transport users.

Asia-Pacific Disabled Vehicle Market Insight

The Asia-Pacific disabled vehicle market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and increasing awareness of mobility solutions in countries such as China, Japan, and India. The region’s inclination toward inclusive transportation, coupled with government programs promoting accessibility and subsidies for adaptive vehicles, is boosting adoption. Furthermore, as APAC emerges as a manufacturing hub for specialized and modified vehicles, affordability and availability of disabled vehicles are expanding to a wider consumer base.

Japan Disabled Vehicle Market Insight

The Japan disabled vehicle market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s aging population, high-tech culture, and increasing focus on convenient, safe transportation for differently-abled individuals. Demand is being driven by the growing number of accessible homes and connected transport services integrating adaptive vehicles with other mobility solutions. Moreover, Japanese consumers and institutions are favoring innovative wheelchair-accessible vans and modified cars, enhancing overall mobility, safety, and independence for users across personal, public, and commercial applications.

China Disabled Vehicle Market Insight

The China disabled vehicle market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rapid urbanization, and increasing government initiatives promoting accessible transportation. China is emerging as a significant market for wheelchair-accessible vehicles, adaptive vans, and specialized cars, catering to both private and public transport needs. The push toward inclusive mobility solutions, coupled with the growth of domestic manufacturers and affordable adaptive vehicle options, is driving widespread adoption across residential, commercial, and institutional sectors.

Disabled Vehicle Market Share

The Disabled Vehicle industry is primarily led by well-established companies, including:

- Renault (France)

- Subaru (Japan)

- Ford Motor (U.S.)

- Daimler (Germany)

- General Motors (U.S.)

- Mazda (Japan)

- BMW (Germany)

- Hyundai (South Korea)

- Kia (South Korea)

- Tesla (U.S.)

- FCA (Italy)

- Volkswagen (Germany)

- Honda (Japan)

- Toyota (Japan)

- Nissan (Japan)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.