Global Discount Mobile Virtual Network Operator Market

Market Size in USD Billion

CAGR :

%

USD

24.37 Billion

USD

41.56 Billion

2024

2032

USD

24.37 Billion

USD

41.56 Billion

2024

2032

| 2025 –2032 | |

| USD 24.37 Billion | |

| USD 41.56 Billion | |

|

|

|

|

What is the Global Discount Mobile Virtual Network Operator Market Size and Growth Rate?

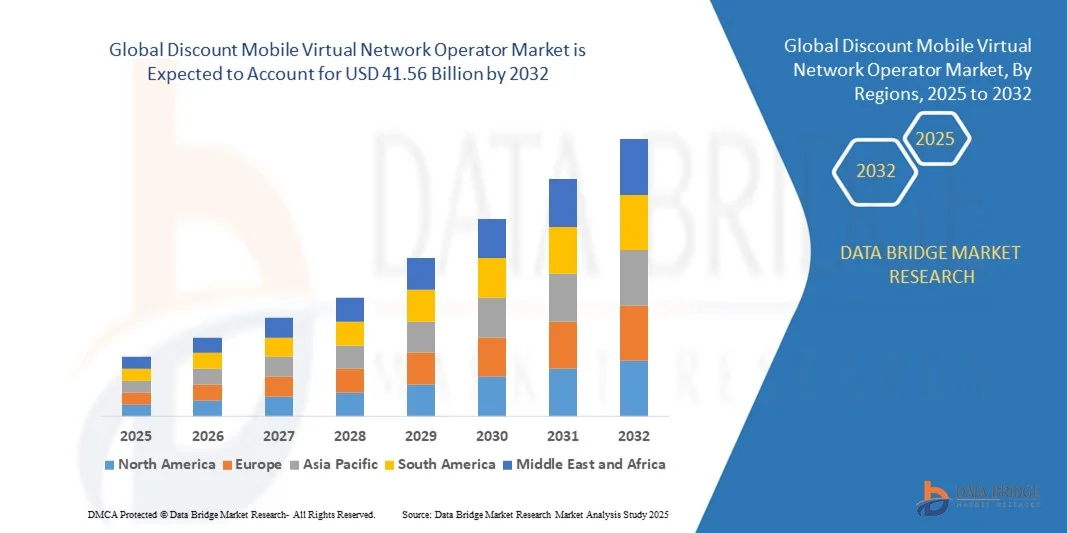

- The global discount mobile virtual network operator market size was valued at USD 24.37 billion in 2024 and is expected to reach USD 41.56 billion by 2032, at a CAGR of 6.90% during the forecast period

- Increasing prevalence of wide consumer base across the globe, rising demand for mobile broadband and smartphones, prevalence of demographic-related customer services, increasing usage of data and value-added services such as live streaming and mobile commerce-based services, easy availability of updated services such as machine-to-machine (M2M) transaction and mobile money are some of the major as well as important factors which will likely to accelerate the growth of the discount mobile virtual network operator market in the projected timeframe

What are the Major Takeaways of Discount Mobile Virtual Network Operator Market?

- Growing number of technological advancements such as cloud-based services along with increasing adoption of internet of things which will further contribute by generating immense opportunities that will led to the growth of the discount mobile virtual network operator market in the above-mentioned projected timeframe

- Lack of awareness along with unavailability of expert personnel which will likely to act as market restraints for the growth of the discount mobile virtual network operator in the above-mentioned projected timeframe. Stringent government rules and regulations which will become the biggest and foremost challenge for the growth of the market

- North America dominated the discount mobile virtual network operator market with the largest revenue share of 38.7% in 2024, driven by the presence of major automakers, advanced manufacturing infrastructure, and the increasing production of electric vehicles and hybrid vehicles

- The Asia-Pacific discount mobile virtual network operator market is projected to grow at the fastest CAGR of 10.82% from 2025 to 2032, driven by rapid digitalization, the expansion of telecom infrastructure, and increasing smartphone adoption

- The Reseller segment dominated the market with a revenue share of 46.8% in 2024, driven by its low entry barriers, minimal infrastructure requirements, and quick deployment capabilities

Report Scope and Discount Mobile Virtual Network Operator Market Segmentation

|

Attributes |

Discount Mobile Virtual Network Operator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Discount Mobile Virtual Network Operator Market?

Adoption of Digital Platforms and eSIM Technology

- A major trend driving the global discount mobile virtual network operator (MVNO) market is the integration of digital platforms and eSIM technology to enhance customer onboarding and flexibility. MVNOs are leveraging mobile apps and digital self-service platforms to simplify SIM activation and reduce operational costs

- Companies are increasingly deploying cloud-based network management and AI-driven analytics to improve service personalization and customer retention. For instance, AT&T Intellectual Property (U.S.) has incorporated eSIM-based solutions to enable instant network switching and remote provisioning for users

- In addition, the growing consumer demand for contract-free and low-cost plans is pushing MVNOs to offer online-only models, eliminating physical stores and paper-based processes.

- This trend is reshaping how MVNOs operate by emphasizing agility, cost efficiency, and digital-first customer experiences

- The adoption of digital ecosystems and eSIM integration is expected to strengthen the market by enabling seamless connectivity, reducing churn, and appealing to tech-savvy consumers globally

What are the Key Drivers of Discount Mobile Virtual Network Operator Market?

- The rising demand for affordable mobile connectivity and customized data plans is a major factor fueling the MVNO market growth. These operators attract price-sensitive users by offering flexible tariffs and value-added services without owning network infrastructure.

- For instance, in 2024, Virgin Media (U.K.) expanded its MVNO operations through integrated broadband and mobile bundles, enhancing customer loyalty

- The surge in smartphone penetration and increased mobile data consumption across regions such as India, Japan, and the U.S. also supports market expansion

- Moreover, advancements in 5G technology and partnerships with major telecom carriers enable MVNOs to deliver high-speed data and IoT connectivity at reduced costs

- Together, these drivers are propelling MVNOs to capture a growing share of the telecom market by offering competitive pricing, personalized plans, and enhanced service reliability

Which Factor is Challenging the Growth of the Discount Mobile Virtual Network Operator Market?

- A primary challenge hindering the growth of the MVNO market is the limited network access and dependency on host operators, which often restricts bandwidth and service quality. This dependence makes it difficult for MVNOs to maintain consistent coverage and data speeds

- For instance, Lebara (U.K.) and Lycamobile (U.K.) have faced challenges related to network throttling and wholesale pricing pressures from host carriers

- Another key restraint is thin profit margins, as price competition among MVNOs limits revenue growth and marketing budgets

- In addition, regulatory constraints and complex licensing frameworks in markets such as India and Japan delay new MVNO launches and expansions

- To overcome these barriers, operators are focusing on niche segments such as migrant workers, IoT, and youth customers while forming strategic alliances with network providers to improve profitability and market resilience

How is the Discount Mobile Virtual Network Operator Market Segmented?

The discount mobile virtual network operator market is segmented on the basis of operational model, subscriber, organization size, and category.

- By Operational Model

The market is segmented into Reseller, Service Operator, Full MVNO, and Enhanced Service models. The Reseller segment dominated the market with a revenue share of 46.8% in 2024, driven by its low entry barriers, minimal infrastructure requirements, and quick deployment capabilities. Reseller MVNOs leverage existing networks of major carriers, offering affordable plans tailored to niche consumer bases such as youth, migrants, and budget-conscious users.

The Full MVNO segment is expected to grow at the fastest rate during 2025–2032 due to increasing investments in network infrastructure and the rising trend of digital independence among operators. This model allows MVNOs full control over core network elements, enabling service customization and innovation. The growing adoption of 5G and IoT solutions will further accelerate Full MVNO demand, enhancing flexibility, data management, and user experience across global markets.

- By Subscriber

Based on subscriber type, the market is divided into Consumer and Enterprise segments. The Consumer segment accounted for the largest market share of 71.4% in 2024, fueled by the increasing affordability of prepaid plans, widespread smartphone penetration, and rising digital connectivity among low- and mid-income populations. Consumer MVNOs cater to personalized needs with localized offerings, family bundles, and flexible payment structures.

The Enterprise segment is projected to register the fastest CAGR from 2025 to 2032, driven by the surge in IoT-based connectivity, telematics, and remote workforce management solutions. As industries increasingly adopt connected devices and private networks, enterprise-focused MVNOs are gaining traction for their tailored data plans and secure communication frameworks. The segment’s rapid expansion underscores the growing integration of mobile connectivity into enterprise digital transformation initiatives globally.

- By Organization Size

The Discount MVNO market is categorized into Small and Medium-Sized Enterprises (SMEs) and Large Enterprises. The Large Enterprises segment held the dominant market share of 59.2% in 2024, attributed to the extensive use of MVNO solutions for large-scale workforce communication, mobile device management, and cross-border connectivity. Their ability to negotiate large data contracts and integrate advanced 5G and IoT technologies further enhances operational efficiency.

The SMEs segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing adoption of low-cost mobile data and cloud-based solutions. SMEs are leveraging MVNO partnerships to optimize communication costs and enhance scalability in emerging economies. The segment’s expansion reflects the rising role of affordable digital services in supporting small businesses’ transition toward hybrid and remote working models.

- By Category

The market is bifurcated into Postpaid MVNO and Prepaid MVNO categories. The Prepaid MVNO segment dominated the market with a revenue share of 63.5% in 2024, owing to its strong presence in developing economies and among price-sensitive consumers seeking flexibility and no-contract plans. The model’s popularity is driven by low financial risk, easy onboarding, and the proliferation of eSIM-based prepaid solutions.

Conversely, the Postpaid MVNO segment is projected to be the fastest-growing during 2025–2032, supported by the rising adoption of premium 5G data plans and value-added services such as streaming, cloud storage, and international roaming. This segment’s growth is also fueled by increased consumer loyalty programs and bundled offers targeting long-term users. The transition toward digital billing and automated payment systems is further enhancing postpaid service efficiency, positioning it as a key growth frontier for MVNO operators globally.

Which Region Holds the Largest Share of the Discount Mobile Virtual Network Operator Market?

- Europe dominated the discount mobile virtual network operator market with the largest revenue share of 37.9% in 2024, driven by the region’s robust telecom infrastructure, high smartphone penetration, and widespread adoption of digital communication services. The presence of leading MVNOs and MNO partnerships across countries such as the U.K., Germany, France, and Spain has further fueled market expansion

- Increasing consumer demand for affordable mobile connectivity, combined with supportive government regulations promoting competition and network sharing, has strengthened Europe’s leadership in the MVNO landscape

- Moreover, the region’s growing focus on 5G integration, IoT connectivity, and flexible prepaid offerings is fostering innovation and strategic collaborations among service providers, consolidating Europe’s position as the global hub for MVNO development

Germany Discount Mobile Virtual Network Operator Market Insight

The Germany market accounted for a significant share in 2024, driven by the presence of established players and rising demand for cost-effective mobile connectivity solutions. German consumers’ preference for flexible, contract-free plans is encouraging the proliferation of discount MVNOs. Strong partnerships between telecom giants such as Deutsche Telekom and local MVNOs have bolstered the country’s service diversity. Furthermore, the ongoing development of 5G infrastructure and integration of IoT applications across industries are fueling market advancement. Germany’s continued investments in digital transformation and cross-network interoperability are expected to reinforce its leading role in Europe’s MVNO sector.

France Discount Mobile Virtual Network Operator Market Insight

The France market is experiencing steady growth, supported by the competitive pricing strategies of operators such as Free Mobile and NRJ Mobile. The government’s emphasis on expanding rural connectivity and enhancing digital inclusivity is providing new growth avenues for MVNOs. Increasing consumer awareness of low-cost mobile options and the surge in online SIM activations have strengthened France’s market position. As 5G coverage expands and demand for high-speed internet rises, French MVNOs are diversifying their data and entertainment bundles, improving user engagement and retention across key consumer segments.

Which Region is the Fastest Growing Region in the Discount Mobile Virtual Network Operator Market?

The Asia-Pacific discount mobile virtual network operator market is projected to grow at the fastest CAGR of 10.82% from 2025 to 2032, driven by rapid digitalization, the expansion of telecom infrastructure, and increasing smartphone adoption. The region’s large unserved population and growing preference for affordable data plans are fostering significant MVNO growth in emerging economies such as China, India, and Japan.

China Discount Mobile Virtual Network Operator Market Insight

The China market held the largest share within Asia-Pacific in 2024, supported by government initiatives encouraging private enterprises to operate as MVNOs. Companies such as China Unicom and China Telecom are actively partnering with virtual operators to extend coverage and affordability. The rise in digital payment integration, eSIM adoption, and AI-powered customer management platforms are reshaping the Chinese MVNO landscape. With the growing push for 5G connectivity and rural network expansion, China is set to remain a dominant player in the regional market.

India Discount Mobile Virtual Network Operator Market Insight

The India market is expected to witness the highest CAGR across Asia-Pacific, driven by expanding mobile penetration, favorable regulatory reforms, and rising demand for affordable communication services in urban and rural areas. Increasing partnerships between telecom providers and MVNO startups are creating new business opportunities. The government’s focus on Digital India initiatives and expanding broadband access further support market growth. India’s young, tech-savvy population and growing use of digital wallets and OTT services are such asly to propel continued adoption of low-cost MVNO solutions.

Japan Discount Mobile Virtual Network Operator Market Insight

The Japan market continues to expand steadily, supported by growing demand for low-cost data services and flexible plans among consumers. Major MVNOs such as KDDI Corporation and Asahi Net, Inc. are investing in 5G service offerings and network virtualization to enhance connectivity. In addition, the country’s advanced telecom infrastructure and emphasis on IoT integration are creating new revenue streams for enterprise-focused MVNOs. As Japan progresses toward widespread 5G deployment, the market is expected to see robust growth in both consumer and enterprise segments.

Which are the Top Companies in Discount Mobile Virtual Network Operator Market?

The discount mobile virtual network operator industry is primarily led by well-established companies, including:

- Virgin Media (U.K.)

- DataXoom (U.S.)

- Lebara (U.K.)

- KDDI CORPORATION (Japan)

- Asahi Net, Inc. (Japan)

- FRiENDi (Oman)

- Boost Mobile (U.S.)

- Lycamobile (U.K.)

- Tesco Mobile (U.K.)

- Airvoice Wireless (U.S.)

- ASDA (U.K.)

- Giffgaff (U.K.)

- Kajeet, Inc. (U.S.)

- Voiceworks BV (Netherlands)

- Ting (U.S.)

- Red Pocket Mobile (U.S.)

- Consumer Cellular, Inc. (U.S.)

- Lyca Mobile India (India)

- AT&T Intellectual Property (U.S.)

- IBM Corporation (U.S.)

What are the Recent Developments in Global Discount Mobile Virtual Network Operator Market?

- In October 2024, FRiENDi Mobile entered a long-term agreement with Vodafone Oman to migrate nearly 800,000 customers to Vodafone’s advanced 5G network, beginning in December 2024. This collaboration aims to deliver higher data speeds, improved coverage, and enhanced reliability for FRiENDi Mobile users, marking a significant technological leap in Oman’s MVNO sector. The initiative is expected to strengthen Vodafone Oman’s market presence and accelerate 5G adoption across the country

- In November 2023, Tesco Mobile Ireland introduced a new referral program to reward both referrers and new customers, encouraging greater customer advocacy. Operating in Ireland since 2013 with over 1 million subscribers and 99% network coverage, the company aims to expand its user base and improve brand engagement through this program. This strategic move positions Tesco Mobile to strengthen its competitive foothold in Ireland’s growing MVNO market

- In January 2023, T-Mobile formed a partnership with Nextbase, a leading smart car dash-cam provider, to integrate IQ dash-cams with network connectivity. The collaboration enables over-the-air updates, real-time video streaming, and instant notifications, enhancing user safety and convenience. This alliance highlights T-Mobile’s commitment to leveraging IoT innovations and expanding its role in connected vehicle ecosystems

- In December 2022, Charter announced plans to develop hybrid fiber/coax (HFC) networks with an investment of USD 100 per neighborhood. The initiative aims to enhance multi-gig network plans, strengthen its Wi-Fi infrastructure, and expand its MVNO partnership with Verizon Wireless using CBRS spectrum. This strategic investment underlines Charter’s focus on building robust digital connectivity and future-ready broadband networks

- In December 2022, Grover collaborated with Gigs, a telecom-as-a-service platform provider, to launch mobile virtual network operations and eSIM services across the U.S. and Europe. The partnership allows Grover to offer flexible, data-driven subscription plans catering to modern digital consumers. This expansion marks Grover’s entry into telecom innovation and strengthens its presence in the global connectivity ecosystem

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.