Global Display Box Market

Market Size in USD Billion

CAGR :

%

USD

5.39 Billion

USD

8.86 Billion

2024

2032

USD

5.39 Billion

USD

8.86 Billion

2024

2032

| 2025 –2032 | |

| USD 5.39 Billion | |

| USD 8.86 Billion | |

|

|

|

|

What is the Global Display Box Market Size and Growth Rate?

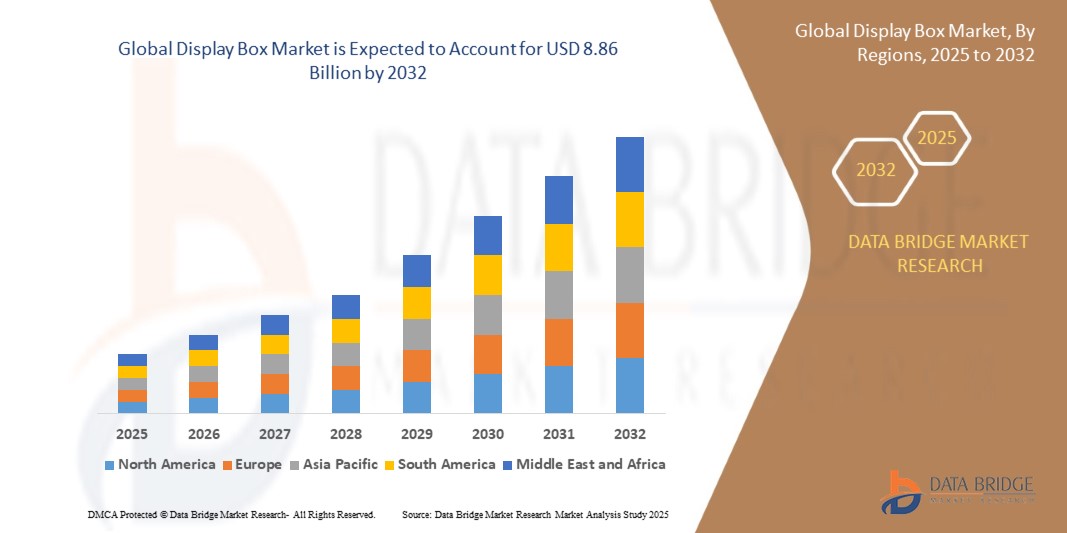

- The global display box market size was valued at USD 5.39 billion in 2024 and is expected to reach USD 8.86 billion by 2032, at a CAGR of 6.40% during the forecast period

- The rising demand for aesthetically appealing, durable, and functional packaging across retail environments is driving the market expansion. Increasing retail activities, particularly in sectors such as cosmetics, food & beverages, and electronics, are creating new growth opportunities

- Moreover, brands are leveraging innovative Display Boxes to enhance product visibility, attract consumers, and support point-of-sale marketing strategies, which significantly contributes to the market’s steady growth trajectory

What are the Major Takeaways of Display Box Market?

- Display Boxes are crucial marketing tools designed to showcase products effectively on retail shelves while also protecting them from damage. Their lightweight structure, customizable designs, and cost-effective production make them highly sought-after across multiple industries

- The growing shift towards sustainable and recyclable packaging materials is further fueling demand for eco-friendly display boxes. In addition, the proliferation of organized retail and increasing consumer inclination towards visually appealing and informative packaging are supporting market development

- As e-commerce and in-store competition intensify, brands are increasingly relying on display boxes to boost customer engagement and brand recall at the point of purchase

- North America held the largest revenue share of 33.17% in the display box market in 2024, driven by the strong presence of retail chains, rapid growth of e-commerce, and high consumer demand for visually appealing packaging

- Asia-Pacific region is expected to grow at the fastest CAGR of 7.4% from 2025 to 2032, led by the rapid expansion of modern retail, rising disposable incomes, and growing demand for brand visibility in densely populated markets

- The paperboard segment dominated the display box market with the largest market revenue share of 48.6% in 2024, owing to its eco-friendly nature, cost-effectiveness, and excellent printability

Report Scope and Display Box Market Segmentation

|

Attributes |

Display Box Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Display Box Market?

“Sustainable and Recyclable Display Solutions Driving Innovation”

- A major trend shaping the global display box market is the increasing emphasis on sustainability, with manufacturers and brands actively shifting towards eco-friendly, recyclable, and biodegradable display materials

- Consumers and retailers alike are becoming more environmentally conscious, pushing the demand for sustainable packaging alternatives that minimize waste without compromising visual appeal. Brands are incorporating recyclable corrugated cardboard, plant-based inks, and modular designs to reduce material usage and simplify recycling

- For instance, DS Smith launched a range of fully recyclable display boxes tailored for fast-moving consumer goods (FMCG), promoting circular economy practices. Similarly, Smurfit Kappa developed eco-friendly retail-ready packaging solutions aimed at reducing carbon footprint and aligning with clients’ sustainability goals

- This trend is reinforced by regulatory mandates in several regions requiring businesses to reduce plastic usage and improve packaging sustainability. Retailers are also favoring suppliers that demonstrate clear environmental stewardship in their display and packaging choices

- Consequently, sustainable display boxes enhance brand image and meet rising customer expectations and legal requirements. This movement toward greener solutions is reshaping innovation strategies across the industry and is such asly to remain a defining force in the display box market's evolution.

What are the Key Drivers of Display Box Market?

- The rapid growth of the retail sector, especially in emerging economies, along with the increasing need for eye-catching, cost-effective point-of-purchase solutions, is a key driver of the display box market

- As brick-and-mortar retail competes with e-commerce, brands are investing in visually appealing display boxes to stand out on shelves and influence buyer decisions. For instance, in March 2024, International Paper introduced a new customizable corrugated display line to help retailers improve shelf visibility and brand storytelling

- In addition, the growing trend of experiential retailing is prompting brands to use display boxes for packaging and as interactive marketing tools. The demand is further fueled by the expansion of organized retail and the need for space-saving and easy-to-assemble packaging

- Display Boxes are especially popular in supermarkets, convenience stores, and pharmacies, where shelf impact is crucial. The ability to combine protection, promotion, and ease of handling into a single solution makes display boxes a preferred packaging choice

- Moreover, the rise of private label brands and increasing product launches across sectors such as cosmetics, electronics, and FMCG are contributing to the rising need for differentiated in-store marketing, further accelerating market growth

Which Factor is challenging the Growth of the Display Box Market?

- One of the primary challenges facing the display box market is the fluctuation in raw material prices, particularly paper and board, which directly impacts production costs and profit margins. Volatility in the global pulp supply chain, driven by geopolitical tensions, environmental regulations, and rising energy costs, creates uncertainty for manufacturers

- For instance, in early 2024, multiple European packaging companies reported price hikes due to increased pulp and transport costs. These surges force producers to either absorb costs or pass them on to customers, which can reduce competitiveness

- Moreover, small and medium-sized businesses often struggle to maintain price stability, hindering long-term contracts. Another concern is the limited durability of Display Boxes in environments with high humidity or heavy handling, where plastic or metal alternatives are sometimes preferred

- In addition, while sustainable materials are in demand, their higher cost can be prohibitive for budget-conscious brands, especially in developing regions. The challenge lies in balancing sustainability, visual appeal, and affordability

- Overcoming these hurdles will require material innovation, cost-effective supply chain strategies, and broader adoption of high-performance, eco-friendly materials that can withstand varying retail conditions without compromising aesthetics or structural integrity

How is the Display Box Market Segmented?

The market is segmented on the basis of material type, end-use industry, and printing technology.

• By Material Type

On the basis of material type, the display box market is segmented into plastic, paperboard, metal, and glass. The paperboard segment dominated the display box market with the largest market revenue share of 48.6% in 2024, owing to its eco-friendly nature, cost-effectiveness, and excellent printability. Paperboard is widely used in retail-ready packaging and point-of-sale displays due to its lightweight and customizable features. Brands increasingly prefer paperboard display boxes as they align with sustainability goals and offer vibrant visual appeal, enhancing product presentation and consumer engagement.

The plastic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its durability, transparency, and moisture resistance. Plastic display boxes are particularly favored in electronics and cosmetics sectors, where product visibility and protection are critical.

• By End Use Industry

On the basis of end-use industry, the display box market is segmented into food and beverage, cosmetics, electronics, and pharmaceuticals. The food and beverage segment held the highest market revenue share in 2024, accounting for 36.9%, supported by the rising demand for attractive packaging in supermarkets, convenience stores, and retail chains. Display boxes in this sector serve both protective and promotional functions, enabling better brand visibility and impulse buying.

The cosmetics segment is anticipated to register the fastest CAGR during the forecast period, driven by increasing demand for premium and visually striking packaging. Luxury and mid-range cosmetic brands are leveraging custom display boxes to highlight product features and align with their branding strategies.

• By Printing Technology

On the basis of printing technology, the display box market is segmented into digital printing, flexographic printing, and offset printing. The offset printing segment dominated the market with the largest revenue share of 42.1% in 2024, due to its high image quality, consistent results, and suitability for high-volume production. Offset printing is often preferred for producing large batches of display boxes with precise color matching and sharp visuals, especially in the food and retail industries.

The digital printing segment is expected to witness the fastest CAGR from 2025 to 2032. Digital printing offers flexibility for short runs, customization, and quicker turnaround times, making it an attractive option for promotional campaigns, limited-edition packaging, and rapidly changing product lines.

Which Region Holds the Largest Share of the Display Box Market?

- North America held the largest revenue share of 33.17% in the display box market in 2024, driven by the strong presence of retail chains, rapid growth of e-commerce, and high consumer demand for visually appealing packaging

- Brands across the region prioritize eye-catching, shelf-ready packaging to attract consumer attention and drive impulse buying in competitive retail environments

- The region's mature packaging industry, combined with innovation in printing technologies and sustainability trends, continues to reinforce North America's leadership in the market

U.S. Display Box Market Insight

The U.S. accounted for the largest share of the display box market in North America in 2024, fueled by increasing demand for shelf-ready packaging in supermarkets, mass merchandisers, and club stores. High emphasis on brand differentiation, retail visibility, and recyclable materials supports continued investment in innovative display box solutions.

Europe Display Box Market Insight

The Europe display box market is projected to grow at a notable CAGR over the forecast period, driven by rising environmental awareness, regulatory pressure for sustainable packaging, and a strong demand for corrugated display units. The expansion of organized retail and preference for in-store promotional packaging are further boosting market penetration.

U.K. Display Box Market Insight

The U.K. display box market is expected to grow steadily, propelled by growing use of point-of-sale (POS) displays in retail stores and supermarkets. Rising consumer demand for premium packaged goods and the shift towards eco-friendly packaging formats are encouraging businesses to invest in creative and functional display box solutions.

Germany Display Box Market Insight

Germany is witnessing a significant rise in display box usage due to its advanced printing infrastructure, increasing demand for recyclable packaging, and strong retail sector. The country's focus on eco-conscious product presentation and industrial-grade corrugated solutions makes it a key player in the European market.

Which Region is the Fastest Growing Region in the Display Box Market?

Asia-Pacific region is expected to grow at the fastest CAGR of 7.4% from 2025 to 2032, led by the rapid expansion of modern retail, rising disposable incomes, and growing demand for brand visibility in densely populated markets. Increased urbanization and the booming FMCG sector are accelerating the adoption of display packaging across key markets such as China, India, and Southeast Asia.

Japan Display Box Market Insight

Japan’s display box market is growing steadily, supported by the expansion of retail chains, innovation in compact and sustainable packaging, and increasing use of corrugated POS displays for cosmetics, food, and electronics. Japanese consumers’ preference for neat, organized product presentations is boosting demand across retail formats.

China Display Box Market Insight

China led the Asia-Pacific display box market in 2024, driven by its booming consumer goods sector, growth in convenience stores, and the rise of in-store promotions. Domestic manufacturers are rapidly adopting advanced printing and folding techniques, making display boxes more cost-effective, customizable, and eco-friendly for mass retail use.

Which are the Top Companies in Display Box Market?

The display box industry is primarily led by well-established companies, including:

- Sappi (South Africa)

- Clondalkin Group (Netherlands)

- International Paper (U.S.)

- Graphic Packaging International (U.S.)

- Glenroy (U.S.)

- Sealed Air (U.S.)

- Sonoco Products (U.S.)

- Pregis (U.S.)

- Amcor (Switzerland)

- Berry Global (U.S.)

- WestRock (U.S.)

- Morris Packaging (U.S.)

- Smurfit Kappa (Ireland)

- Mondi (U.K.)

- DS Smith (U.K.)

- Packaging Corporation of America (U.S.)

- Proactive Packaging & Display (U.S.)

- C&B Display Packaging Inc. (U.S.)

- Rio Grande (U.S.)

- Production Packaging Innovations (U.S.)

What are the Recent Developments in Global Display Box Market?

- In August 2024, Smurfit Westrock introduced shelf-ready beer boxes designed to enhance product visibility on crowded supermarket shelves, reduce moisture exposure, and encourage repeat purchases. This innovation is expected to significantly boost brand presence and consumer engagement

- In June 2023, Staedtler collaborated with Panther Display to create an eye-catching display unit made of corrugated board, featuring a 3-D rosette element that adds to its thematic and promotional appeal. This initiative strengthens their visual merchandising strategy, especially for seasonal and themed campaign

- In June 2023, British packaging company Falcomer Print & Packaging launched new packaging solutions for Navy Professional’s beauty and skincare products, which included a secondary carton and countertop display units. This launch reflects the company's efforts to offer premium display solutions tailored to the cosmetics industry

- In June 2023, Staedtler and Panther Display also launched another creative corrugated board display targeted at younger audiences, designed to spark joy and creativity in drawing, painting, and handicrafts. This product effectively combines functionality with emotional appeal, enhancing consumer connection

- In January 2023, Premier Paper acquired WBC, a London-based retail display and packaging company, aiming to expand its offerings into value-added and complementary markets. This strategic move enables Premier Paper to enhance its capabilities and extend its market reach

- In April 2021, Hood Container Corporation acquired Sonoco Display and Packaging, a North Carolina-based company, to broaden its product portfolio and strengthen its U.S. market presence. This acquisition supports Hood Container’s long-term growth and service expansion goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Display Box Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Display Box Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Display Box Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.