Global Display Monitor Market

Market Size in USD Billion

CAGR :

%

USD

147.30 Billion

USD

279.20 Billion

2024

2032

USD

147.30 Billion

USD

279.20 Billion

2024

2032

| 2025 –2032 | |

| USD 147.30 Billion | |

| USD 279.20 Billion | |

|

|

|

|

Display Monitor Market Size

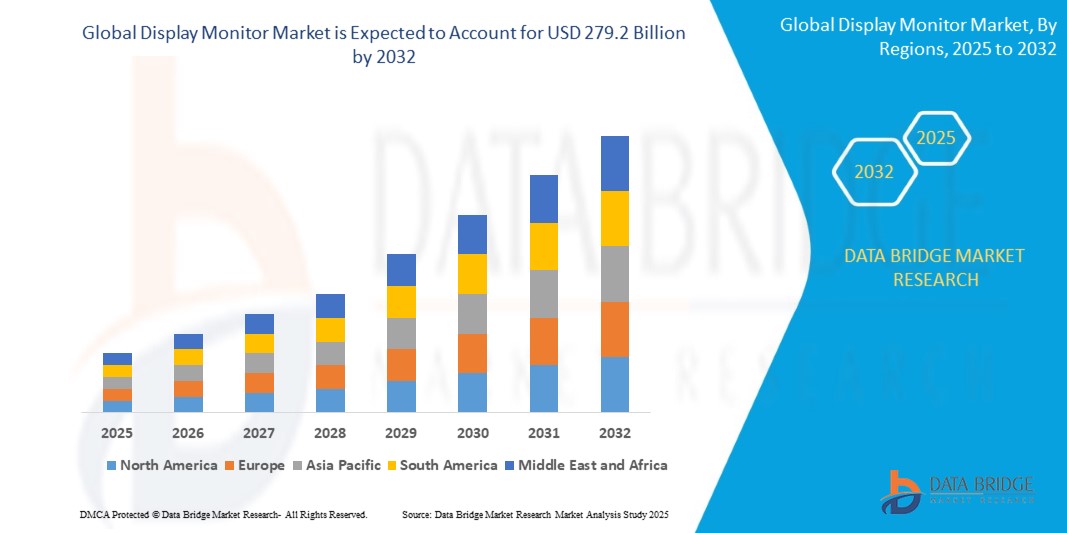

- The Global Display Monitor Market was valued at USD 147.3 billion in 2024 and is projected to reach USD 279.2 billion by 2032, growing at a CAGR of 9.56% during the forecast period.

- Growth is driven by rising demand for high-resolution and large-format displays, increased remote work and e-learning penetration, and the growing popularity of gaming monitors with high refresh rates and adaptive sync technologies.

Display Monitor Market Analysis

- Display monitors are essential in consumer electronics, gaming, business operations, healthcare diagnostics, and education. The surge in hybrid work models, content creation, and esports has led to greater demand for ergonomic, high-performance monitors.

- Monitors with 4K resolution, curved designs, and higher refresh rates (144Hz and above) are gaining strong traction among gamers and digital professionals.

- Panel technologies like OLED and IPS are growing in popularity due to superior color accuracy, contrast ratios, and viewing angles, especially in professional and creative industries

- The rise of touchscreen monitors, USB-C displays, and portable monitors is enabling flexibility and multi-device connectivity, meeting modern consumer and enterprise demands.

- Eco-friendly designs, energy-efficient certifications, and low blue light technologies are also influencing purchasing decisions as health and sustainability become priorities.

Report Scope and Display Monitor Market Segmentation

|

Attributes |

Display Monitor Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Display Monitor Market Trends

Immersive Visuals, Energy Efficiency, and AI-Driven Display Intelligence

- Growth in Curved and Ultrawide Displays: There is rising demand for 34”+ ultrawide and 21:9 curved monitors, particularly for gaming, financial trading, and multitasking professionals, offering greater screen real estate and immersion.

- Expansion of 4K and OLED Technology: The transition from FHD to 4K UHD and adoption of OLED and mini-LED panels continue to expand, offering vibrant colors, deeper contrast, and pixel-perfect clarity for creators and consumers alike.

- Integration of AI and Smart Features: AI-enabled monitors can auto-adjust brightness, enhance color profiles based on application, and even offer real-time eye tracking, creating a more adaptive and personalized viewing experience.

- Sustainability and Blue Light Reduction: Consumers increasingly prioritize TÜV-certified low blue light monitors, flicker-free technologies, and energy-saving display modes to reduce eye strain and electricity usage.

- Rise of Portable and Dual-Screen Monitors: With the growth of hybrid and remote work, USB-C portable displays and snap-on second screens are becoming popular among professionals needing productivity on-the-go.

Display Monitor Market Dynamics

Driver

Rising Demand for High-Performance Displays in Gaming, Work, and Content Creation

- The gaming industry’s explosive growth has boosted demand for high-refresh rate, low latency displays, especially among esports professionals and enthusiasts.

- Remote work and digital content creation require high-resolution monitors with color precision, ergonomic adjustability, and multi-monitor support.

- The increasing availability of affordable 4K and curved monitors is helping consumers upgrade from legacy screens, accelerating the replacement cycle globally.

- Healthcare, education, and command centers are adopting advanced monitors for medical imaging, interactive learning, and real-time data visualization, boosting demand for professional-grade displays.

Restraint/Challenge

Supply Chain Volatility and High Costs of Advanced Display Technologies

- Global chip shortages and logistics bottlenecks have impacted the timely availability and pricing of key monitor components, including display controllers and panel substrates.

- High production costs for OLED and mini-LED panels limit mass-market penetration, especially in price-sensitive regions.

- Fragmented compatibility between legacy GPUs and modern high-refresh rate monitors can cause underutilization of features, especially among non-technical consumers.

- Environmental disposal and e-waste regulation compliance create challenges for manufacturers handling aging monitor stock or facilitating take-back programs.

Display Monitor Market Scope

The market is segmented based on screen size, panel type, refresh rate, resolution, application, and sales channel, reflecting a wide array of use cases and technologies.

- By Screen Size

21–25 inches held the largest market share in 2025 due to their versatility in home, office, and education setups. Above 30 inches is the fastest-growing segment, driven by demand for ultrawide and curved displays in gaming, finance, and multitasking workstations.

- By Panel Type

LED panels dominate the market owing to their cost-effectiveness, energy efficiency, and wide availability. OLED and IPS LCDs are rapidly gaining traction in professional and high-end consumer segments for enhanced visual quality.

- By Refresh Rate

60Hz monitors remain widely used for general office and consumer tasks. 144Hz and above are growing fastest, particularly among gamers and creative professionals needing smoother rendering and reduced motion blur.

- By Resolution

Full HD (1080p) monitors dominate in 2025 due to affordability and compatibility across applications. 4K and above is the fastest-growing resolution type, increasingly adopted in design, entertainment, and data-intensive workflows.

- By Application

Business & Commercial applications account for the largest share due to widespread deployment in offices, command centers, and point-of-sale systems. The gaming segment is expanding rapidly due to esports, competitive gaming, and demand for high-performance displays.

- By Sales Channel

Offline channels currently lead due to business purchases and consumer preference for physical testing. Online sales are accelerating due to better pricing, detailed specifications, and post-COVID digital buying behavior shifts.

Display Monitor Market Regional Analysis

- North America dominates the market in 2025 due to high gaming participation, remote work prevalence, and presence of key OEMs and enterprise buyers. U.S. businesses are also adopting advanced display solutions for data visualization and virtual collaboration.

- Europe is a mature yet growing market driven by creative professionals, healthcare modernization, and gaming communities in Germany, the U.K., and France. Sustainability and energy efficiency certifications play a strong role in consumer purchasing behavior.

- Asia-Pacific is the fastest-growing region, with rising demand from tech-savvy youth, online education, and hardware upgrades across India, China, Japan, and South Korea. APAC also benefits from being a global manufacturing hub for monitors.

- Middle East & Africa (MEA) is witnessing steady growth, supported by digitization programs in the GCC and increased deployment of monitors in government, education, and healthcare sectors.

- South America, particularly Brazil and Argentina, is expanding in the mid-range and entry-level monitor segments, driven by remote learning, telehealth, and gaming café expansions.

United States

The U.S. holds the largest market share in 2025 due to high adoption in gaming, creative industries, and home offices. Demand is particularly strong for OLED, 4K, and dual-monitor setups.

Germany

Germany leads the European market in commercial displays, graphic design monitors, and energy-efficient panels. EU policies and local innovation drive OLED and sustainability-focused purchasing.

India

India is a fast-growing market due to a surge in remote work, online learning, and affordable monitor brands. Adoption of portable and USB-C monitors is also accelerating.

China

China leads in monitor manufacturing and is expanding domestically with demand for gaming displays, curved screens, and high-refresh productivity monitors in urban centers.

Brazil

Brazil's market is growing with demand for cost-effective FHD and IPS monitors, especially in education, retail, and public sector digitization projects.

Display Monitor Market Share

The Display Monitor industry is primarily led by well-established companies, including:

- Honeywell International Inc. (U.S.)

- ABB Ltd. (Switzerland)

- Schneider Electric SE (France)

- Rockwell Automation, Inc. (U.S.)

- Yokogawa Electric Corporation (Japan)

- Aspen Technology, Inc. (U.S.)

- Siemens AG (Germany)

- Emerson Electric Co. (U.S.)

- General Electric Company (GE Digital) (U.S.)

- Valmet Corporation (Finland)

Latest Developments in Global Display Monitor Market

- In April 2025, Dell Technologies launched its UltraSharp 32” 6K monitor with IPS Black technology, targeting creative professionals with enhanced color depth, contrast, and true-to-life detail rendering.

- March 2025, Samsung Electronics introduced a new Odyssey Neo G9 curved mini-LED monitor with a 240Hz refresh rate and 1ms response time, aimed at high-end gamers and immersive simulation users.

- February 2025, LG Electronics expanded its Ergo Dual Monitor lineup, offering height-adjustable arms, USB-C docking, and AI-based brightness optimization for ergonomic and productivity-driven workplaces.

- January 2025, ASUS debuted the ProArt Display PA32UCR-K, a 32” 4K HDR display with Delta E<1 color accuracy, catering to professional colorists, photographers, and video editors.

- December 2024, HP Inc. announced a new series of energy-efficient business monitors certified with EPEAT Gold and TCO 9.0, reflecting its commitment to sustainable IT infrastructure and workplace health.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DISPLAY MONITOR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DISPLAY MONITOR MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DISPLAY MONITOR MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 REGULATORY FRAMEWORK

5.2 PORTERS FIVE FORCES ANALYSIS

5.3 PESTEL ANALYSIS

5.4 VALUE CHAIN ANALYSIS

5.5 TECHNOLOGY ANALYSIS

6 GLOBAL DISPLAY MONITOR MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 LCD

6.2.1 TN

6.2.2 STN

6.2.3 TFT

6.2.4 IPS

6.2.5 OTHERS

6.3 LED

6.4 OLED

6.5 AMOLED

6.6 QLED

6.7 MICROLED

6.8 OTHERS

7 GLOBAL DISPLAY MONITOR MARKET, BY ASPECT RATIO

7.1 OVERVIEW

7.2 12/30/1899 16:09:00

7.3 12/30/1899 21:09:00

7.4 12/30/1899 04:03:00

7.5 12/31/1899 08:09:00

7.6 OTHERS

8 GLOBAL DISPLAY MONITOR MARKET, BY RESOLUTION

8.1 OVERVIEW

8.2 1080P

8.3 1440P

8.4 2K

8.5 4K

8.6 OTHERS

9 GLOBAL DISPLAY MONITOR MARKET, BY REFRESH RATE

9.1 OVERVIEW

9.2 60 HZ

9.3 90 HZ

9.4 120 HZ

9.5 144 HZ

9.6 240 HZ

9.7 OTHERS

10 GLOBAL DISPLAY MONITOR MARKET, BY INPUT TYPE

10.1 OVERVIEW

10.2 USB-C

10.3 DISPLAYPORT

10.4 HDMI

10.5 THUNDERBOLT

10.6 VGA

10.7 DVI

11 GLOBAL DISPLAY MONITOR MARKET, BY PANEL SIZE

11.1 OVERVIEW

11.2 UNDER 22.9 INCHES

11.3 23-26.9 INCHES

11.4 27-41.9 INCHES

11.5 ABOVE 42 INCHES

12 GLOBAL DISPLAY MONITOR MARKET, BY END USER

12.1 OVERVIEW

12.2 CONSUMER ELECTRONICS

12.2.1 BY TECHNOLOGY

12.2.1.1. LCD

12.2.1.2. LED

12.2.1.3. OLED

12.2.1.4. AMOLED

12.2.1.5. QLED

12.2.1.6. MICROLED

12.2.1.7. OTHERS

12.3 SPORTS AND ENTERTAINMENT

12.3.1 BY TECHNOLOGY

12.3.1.1. LCD

12.3.1.2. LED

12.3.1.3. OLED

12.3.1.4. AMOLED

12.3.1.5. QLED

12.3.1.6. MICROLED

12.3.1.7. OTHERS

12.4 TRANSPORTATION

12.4.1 BY TECHNOLOGY

12.4.1.1. LCD

12.4.1.2. LED

12.4.1.3. OLED

12.4.1.4. AMOLED

12.4.1.5. QLED

12.4.1.6. MICROLED

12.4.1.7. OTHERS

12.5 RETAIL

12.5.1 BY TECHNOLOGY

12.5.1.1. LCD

12.5.1.2. LED

12.5.1.3. OLED

12.5.1.4. AMOLED

12.5.1.5. QLED

12.5.1.6. MICROLED

12.5.1.7. OTHERS

12.6 HOSPITALITY AND BFSI

12.6.1 BY TECHNOLOGY

12.6.1.1. LCD

12.6.1.2. LED

12.6.1.3. OLED

12.6.1.4. AMOLED

12.6.1.5. QLED

12.6.1.6. MICROLED

12.6.1.7. OTHERS

12.7 INDUSTRIAL AND ENTERPRISE

12.7.1 BY TECHNOLOGY

12.7.1.1. LCD

12.7.1.2. LED

12.7.1.3. OLED

12.7.1.4. AMOLED

12.7.1.5. QLED

12.7.1.6. MICROLED

12.7.1.7. OTHERS

12.8 EDUCATION

12.8.1 BY TECHNOLOGY

12.8.1.1. LCD

12.8.1.2. LED

12.8.1.3. OLED

12.8.1.4. AMOLED

12.8.1.5. QLED

12.8.1.6. MICROLED

12.8.1.7. OTHERS

12.9 HEALTHCARE

12.9.1 BY TECHNOLOGY

12.9.1.1. LCD

12.9.1.2. LED

12.9.1.3. OLED

12.9.1.4. AMOLED

12.9.1.5. QLED

12.9.1.6. MICROLED

12.9.1.7. OTHERS

12.1 MILITARY

12.10.1 BY TECHNOLOGY

12.10.1.1. LCD

12.10.1.2. LED

12.10.1.3. OLED

12.10.1.4. AMOLED

12.10.1.5. QLED

12.10.1.6. MICROLED

12.10.1.7. OTHERS

12.11 DEFENSE AND AEROSPACE

12.11.1 BY TECHNOLOGY

12.11.1.1. LCD

12.11.1.2. LED

12.11.1.3. OLED

12.11.1.4. AMOLED

12.11.1.5. QLED

12.11.1.6. MICROLED

12.11.1.7. OTHERS

12.12 OTHERS

13 GLOBAL DISPLAY MONITOR MARKET, BY REGION

GLOBAL DISPLAY MONITOR MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

13.2 EUROPE

13.2.1 GERMANY

13.2.2 FRANCE

13.2.3 U.K.

13.2.4 ITALY

13.2.5 SPAIN

13.2.6 RUSSIA

13.2.7 TURKEY

13.2.8 BELGIUM

13.2.9 NETHERLANDS

13.2.10 NORWAY

13.2.11 FINLAND

13.2.12 SWITZERLAND

13.2.13 DENMARK

13.2.14 SWEDEN

13.2.15 POLAND

13.2.16 REST OF EUROPE

13.3 ASIA-PACIFIC

13.3.1 JAPAN

13.3.2 CHINA

13.3.3 SOUTH KOREA

13.3.4 INDIA

13.3.5 AUSTRALIA

13.3.6 SINGAPORE

13.3.7 THAILAND

13.3.8 MALAYSIA

13.3.9 INDONESIA

13.3.10 PHILIPPINES

13.3.11 TAIWAN

13.3.12 VIETNAM

13.3.13 REST OF ASIA PACIFIC

13.4 SOUTH AMERICA

13.4.1 BRAZIL

13.4.2 ARGENTINA

13.4.3 COLOMBIA

13.4.4 REST OF SOUTH AMERICA

13.5 MIDDLE EAST AND AFRICA

13.5.1 SOUTH AFRICA

13.5.2 EGYPT

13.5.3 SAUDI ARABIA

13.5.4 U.A.E

13.5.5 ISRAEL

13.5.6 OMAN

13.5.7 BAHRAIN

13.5.8 KUWAIT

13.5.9 QATAR

13.5.10 REST OF MIDDLE EAST AND AFRICA

13.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

14 GLOBAL DISPLAY MONITOR MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL DISPLAY MONITOR MARKET, SWOT AND DBMR ANALYSIS

16 GLOBAL DISPLAY MONITOR MARKET, COMPANY PROFILE

16.1 AU OPTRONICS CORP.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 GEOGRAPHIC PRESENCE

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 E INK HOLDINGS INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 GEOGRAPHIC PRESENCE

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 VIEWSONIC CORPORATION

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 GEOGRAPHIC PRESENCE

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 HANNSTAR DISPLAY CORPORATION

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 GEOGRAPHIC PRESENCE

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 JAPAN DISPLAY INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 GEOGRAPHIC PRESENCE

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 KENT DISPLAYS, INC.

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 GEOGRAPHIC PRESENCE

16.6.4 PRODUCT PORTFOLIO

16.6.5 RECENT DEVELOPMENTS

16.7 LG ELECTRONICS

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 GEOGRAPHIC PRESENCE

16.7.4 PRODUCT PORTFOLIO

16.7.5 RECENT DEVELOPMENTS

16.8 NEC DISPLAY SOLUTIONS

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 GEOGRAPHIC PRESENCE

16.8.4 PRODUCT PORTFOLIO

16.8.5 RECENT DEVELOPMENTS

16.9 SAMSUNG

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 GEOGRAPHIC PRESENCE

16.9.4 PRODUCT PORTFOLIO

16.9.5 RECENT DEVELOPMENTS

16.1 SONY CORPORATION.

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 GEOGRAPHIC PRESENCE

16.10.4 PRODUCT PORTFOLIO

16.10.5 RECENT DEVELOPMENTS

16.11 INNOLUX CORPORATION

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 GEOGRAPHIC PRESENCE

16.11.4 PRODUCT PORTFOLIO

16.11.5 RECENT DEVELOPMENTS

16.12 SHARP CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 GEOGRAPHIC PRESENCE

16.12.4 PRODUCT PORTFOLIO

16.12.5 RECENT DEVELOPMENTS

16.13 PANASONIC CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 GEOGRAPHIC PRESENCE

16.13.4 PRODUCT PORTFOLIO

16.13.5 RECENT DEVELOPMENTS

16.14 BARCO

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 GEOGRAPHIC PRESENCE

16.14.4 PRODUCT PORTFOLIO

16.14.5 RECENT DEVELOPMENTS

16.15 TOSHIBA INTERNATIONAL CORPORATION

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 GEOGRAPHIC PRESENCE

16.15.4 PRODUCT PORTFOLIO

16.15.5 RECENT DEVELOPMENTS

16.16 HISENSE

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 GEOGRAPHIC PRESENCE

16.16.4 PRODUCT PORTFOLIO

16.16.5 RECENT DEVELOPMENTS

16.17 BENQ

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 GEOGRAPHIC PRESENCE

16.17.4 PRODUCT PORTFOLIO

16.17.5 RECENT DEVELOPMENTS

16.18 ACER INC.

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 GEOGRAPHIC PRESENCE

16.18.4 PRODUCT PORTFOLIO

16.18.5 RECENT DEVELOPMENTS

16.19 TCL

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 GEOGRAPHIC PRESENCE

16.19.4 PRODUCT PORTFOLIO

16.19.5 RECENT DEVELOPMENTS

16.2 BOE TECHNOLOGY GROUP CO., LTD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 GEOGRAPHIC PRESENCE

16.20.4 PRODUCT PORTFOLIO

16.20.5 RECENT DEVELOPMENTS

16.21 SKYWORTH INDIA ELECTRONICS PVT LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 GEOGRAPHIC PRESENCE

16.21.4 PRODUCT PORTFOLIO

16.21.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Global Display Monitor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Display Monitor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Display Monitor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.