Global Disposable Medical Linen Market

Market Size in USD Billion

CAGR :

%

USD

5.16 Billion

USD

8.15 Billion

2025

2033

USD

5.16 Billion

USD

8.15 Billion

2025

2033

| 2026 –2033 | |

| USD 5.16 Billion | |

| USD 8.15 Billion | |

|

|

|

|

Disposable Medical Linen Market Size

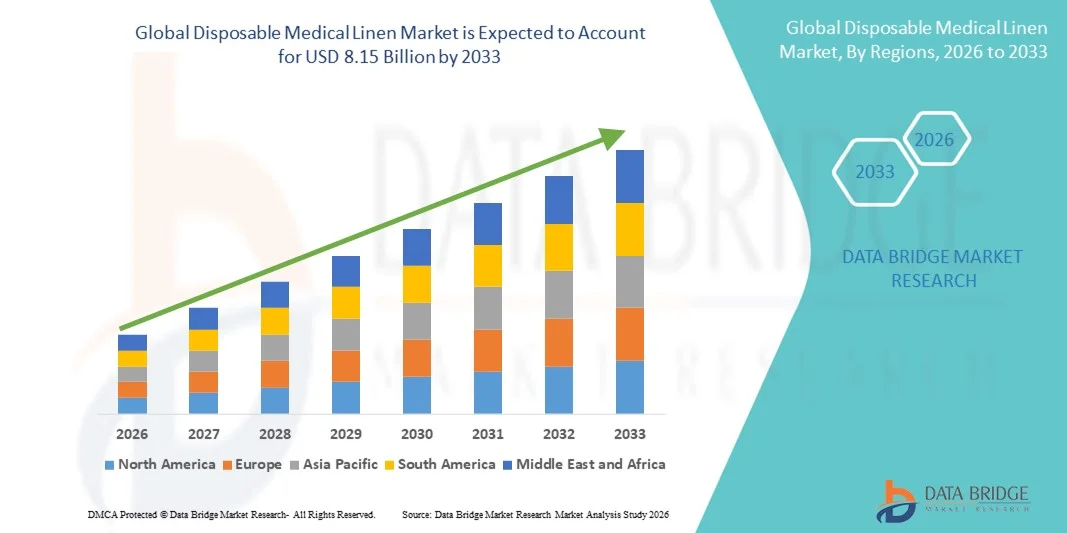

- The global disposable medical linen market size was valued at USD 5.16 billion in 2025 and is expected to reach USD 8.15 billion by 2033, at a CAGR of 5.89% during the forecast period

- The market growth is largely fueled by the rising emphasis on infection prevention and control across healthcare facilities, coupled with increasing surgical volumes and hospital admissions, leading to higher adoption of single-use medical textiles in hospitals and clinics

- Furthermore, growing awareness regarding hospital-acquired infections (HAIs), along with strong demand for hygienic, cost-effective, and time-saving solutions, is establishing disposable medical linen as a preferred alternative to reusable linen. These converging factors are accelerating the uptake of Disposable Medical Linen solutions, thereby significantly boosting the industry’s growth

Disposable Medical Linen Market Analysis

- Disposable medical linen, including single-use bed sheets, gowns, drapes, pillow covers, and blankets, plays a critical role in maintaining hygiene and infection control across hospitals, clinics, and other healthcare settings due to its ability to reduce cross-contamination and eliminate laundering requirements

- The escalating demand for disposable medical linen is primarily driven by the rising incidence of hospital-acquired infections (HAIs), increasing surgical procedures, growing preference for cost-effective single-use products, and stringent healthcare regulations focused on patient and staff safety

- North America dominated the disposable medical linen market with the largest revenue share of 42.3% in 2025, supported by well-established healthcare infrastructure, high healthcare expenditure, strict infection control protocols, and widespread adoption of single-use medical products across hospitals and ambulatory care centers in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region in the disposable medical linen market during the forecast period, registering a projected CAGR of 18.7%, driven by rapid expansion of healthcare facilities, increasing patient volumes, growing medical tourism, and rising awareness of hygiene standards in emerging economies such as China and India

- The bed linen segment dominated the market with the largest revenue share of 44.6% in 2025, driven by its extensive use across hospitals, nursing care facilities, and diagnostic centers for inpatient and long-term care

Report Scope and Disposable Medical Linen Market Segmentation

|

Attributes |

Disposable Medical Linen Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Disposable Medical Linen Market Trends

Enhanced Convenience Through Infection Control and Operational Efficiency

- A significant and accelerating trend in the global disposable medical linen market is the growing emphasis on infection prevention, operational efficiency, and compliance with stringent healthcare hygiene standards. Hospitals and healthcare facilities are increasingly shifting from reusable linens to disposable alternatives to reduce the risk of hospital-acquired infections (HAIs) and streamline laundering processes

- For instance, single-use disposable bed sheets, surgical drapes, and patient gowns are widely adopted in operating rooms and intensive care units to ensure sterility and minimize cross-contamination risks during high-volume procedures

- Advancements in nonwoven fabric technology are enabling manufacturers to develop disposable medical linens that offer improved absorbency, breathability, and patient comfort while maintaining cost-effectiveness. For example, spunbond–meltblown–spunbond (SMS) materials are increasingly used to provide fluid resistance and durability in surgical linens

- The integration of disposable medical linens into broader hospital infection control protocols supports standardized hygiene practices across departments. These products help healthcare providers reduce turnaround time between patients, particularly in emergency and outpatient settings, thereby improving workflow efficiency

- This trend toward safer, more efficient, and hygienic patient care solutions is reshaping procurement strategies within healthcare facilities. Consequently, companies such as Mölnlycke and Medline Industries are expanding their disposable linen portfolios to cater to the rising demand for high-performance, single-use medical textiles

- The demand for disposable medical linen is growing steadily across hospitals, ambulatory surgical centers, and diagnostic clinics, as healthcare providers increasingly prioritize patient safety, regulatory compliance, and operational convenience

Disposable Medical Linen Market Dynamics

Driver

Rising Focus on Infection Control and Increasing Healthcare Procedures

- The increasing focus on preventing hospital-acquired infections, coupled with the rising number of surgical and diagnostic procedures globally, is a major driver boosting demand for disposable medical linen

- For instance, in March 2024, several large hospital networks in Europe and North America reported expanded adoption of single-use surgical drapes and bed linens as part of updated infection prevention guidelines, reinforcing demand for disposable solutions

- As healthcare providers seek to enhance patient safety and meet strict regulatory requirements, disposable medical linens offer clear advantages such as reduced contamination risk, consistent hygiene standards, and elimination of laundering-related variability

- Furthermore, the growing number of outpatient procedures and day-care surgeries is increasing the need for cost-effective, ready-to-use linen solutions that support fast patient turnover and efficient facility management

- The convenience of disposables, including reduced labor costs, lower water and energy consumption, and simplified inventory management, is further accelerating their adoption across both public and private healthcare facilities

Restraint/Challenge

Environmental Concerns and Cost Sensitivity

- Environmental concerns associated with medical waste generation present a significant challenge to the disposable medical linen market, as healthcare facilities and regulators increasingly focus on sustainability and waste reduction

- For instance, growing regulatory scrutiny in regions such as Europe regarding single-use medical products has encouraged hospitals to reassess procurement strategies and explore recyclable or biodegradable disposable linen options

- Addressing these concerns requires manufacturers to invest in eco-friendly materials, sustainable manufacturing processes, and recyclable product designs, which can increase production costs. In addition, the relatively higher recurring expense of disposable linens compared to reusable alternatives can be a barrier for budget-constrained healthcare facilities, particularly in developing regions

- While innovations in biodegradable nonwovens and waste management practices are emerging, the perceived trade-off between cost, sustainability, and performance continues to influence purchasing decisions

- Overcoming these challenges through material innovation, sustainability initiatives, and cost optimization will be critical for ensuring long-term growth and wider adoption of disposable medical linen solutions globally

Disposable Medical Linen Market Scope

The market is segmented on the basis of product, end user, and distribution channel.

- By Product

On the basis of product, the Disposable Medical Linen market is segmented into bed linen, surgical and hygiene linen, liveries, and others. The bed linen segment dominated the market with the largest revenue share of 44.6% in 2025, driven by its extensive use across hospitals, nursing care facilities, and diagnostic centers for inpatient and long-term care. Disposable bed sheets, pillow covers, and mattress covers are widely adopted to reduce hospital-acquired infections (HAIs) and eliminate laundering costs. High patient turnover in hospitals significantly increases consumption. Growing emphasis on hygiene and infection prevention protocols further supports demand. The segment benefits from rising hospitalization rates and aging populations globally. In addition, bed linen is frequently replaced, leading to high volume demand. Increased use during pandemics and outbreaks reinforced adoption. The availability of cost-effective nonwoven materials also supports dominance. Strong procurement by public and private hospitals contributes to revenue stability. Regulatory guidelines promoting single-use linens further drive uptake. The segment is well established in developed healthcare systems. Continuous product innovation improves absorbency and comfort. These factors collectively sustain market leadership.

The surgical and hygiene linen segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by rising surgical volumes and growing focus on sterile operating environments. Products such as surgical drapes, gowns, and hygiene sheets are increasingly preferred due to their role in infection control. The shift toward disposable solutions over reusable textiles in operating rooms accelerates growth. Rising outpatient and minimally invasive procedures boost demand. Increasing awareness of cross-contamination risks supports adoption. Growth in ambulatory surgical centers further fuels consumption. Expanding healthcare infrastructure in emerging economies contributes significantly. Technological advancements in breathable and fluid-resistant materials enhance product acceptance. Rising healthcare expenditure supports procurement. Regulatory standards for surgical safety promote usage. Emergency preparedness and stockpiling also aid growth. Demand is strong across both developed and developing regions. These factors position the segment as the fastest growing.

- By End User

On the basis of end user, the Disposable Medical Linen market is segmented into hospitals, diagnostic centers, nursing care facilities, and standalone clinics. The hospitals segment dominated the market with a revenue share of 62.9% in 2025, owing to high patient admissions and large-scale consumption of disposable linens across multiple departments. Hospitals use disposable linens extensively in inpatient wards, ICUs, operating rooms, and emergency units. Strict infection control policies encourage single-use products. High surgical volumes further increase demand for disposable surgical linens. The segment benefits from continuous replacement cycles and bulk procurement. Growing hospital infrastructure globally supports market dominance. Rising prevalence of chronic diseases increases hospital stays, boosting consumption. Government investments in public hospitals strengthen demand. Private hospital expansion also contributes significantly. Compliance with hygiene regulations reinforces adoption. Hospitals prefer disposable linens to reduce laundry costs and labor. The availability of customized linen solutions further supports usage. These factors collectively sustain hospital dominance.

The standalone clinics segment is projected to grow at the fastest CAGR of 18.3% from 2026 to 2033, driven by the rapid expansion of outpatient care and day-care procedures. Clinics increasingly adopt disposable linens to maintain hygiene standards while minimizing operational costs. Rising patient preference for outpatient services supports growth. Disposable linens eliminate the need for on-site laundry infrastructure. Increasing number of private clinics in urban areas fuels demand. Growth in cosmetic, dental, and minor surgical clinics further accelerates adoption. Clinics prioritize convenience and infection prevention. Cost-effective disposable solutions enhance affordability. Growing healthcare access in emerging economies supports expansion. Regulatory emphasis on cleanliness in clinics boosts uptake. Rising medical tourism also contributes. Increasing awareness of HAIs encourages use. These drivers position standalone clinics as the fastest-growing end-user segment.

- By Distribution Channel

On the basis of distribution channel, the Disposable Medical Linen market is segmented into wholesale, retail, and online. The wholesale segment dominated the market with a revenue share of 55.7% in 2025, driven by bulk purchasing by hospitals and large healthcare facilities. Wholesale distributors offer cost advantages through volume discounts and long-term supply contracts. Hospitals prefer wholesalers for consistent supply and standardized products. The segment benefits from strong relationships between manufacturers and institutional buyers. Efficient logistics and inventory management support dominance. Public healthcare procurement often relies on wholesale channels. The ability to meet large-scale demand enhances reliability. Wholesalers also provide customized packaging solutions. Strong penetration in developed healthcare markets reinforces leadership. Stable demand ensures recurring revenue streams. Supply chain integration further strengthens the segment. Reduced per-unit cost benefits buyers. These factors maintain wholesale dominance.

The online segment is expected to grow at the fastest CAGR of 21.4% from 2026 to 2033, driven by increasing digitalization of healthcare procurement. Online platforms offer convenience, price transparency, and wider product availability. Small clinics and diagnostic centers increasingly rely on e-commerce for flexible ordering. Growth of B2B healthcare marketplaces accelerates adoption. Faster delivery and subscription-based models enhance appeal. Online channels reduce dependency on intermediaries. Increasing internet penetration supports expansion in emerging markets. Manufacturers are strengthening direct-to-customer online sales. Pandemic-driven shifts toward digital purchasing sustained growth. Competitive pricing attracts cost-sensitive buyers. Improved logistics infrastructure supports reliability. Growing trust in online medical suppliers boosts confidence. These trends position online channels as the fastest growing.

Disposable Medical Linen Market Regional Analysis

- North America dominated the disposable medical linen market with the largest revenue share of 42.3% in 2025, supported by well-established healthcare infrastructure, high healthcare expenditure, and strict infection prevention and control protocols across healthcare facilities

- Hospitals and ambulatory care centers in the U.S. and Canada widely adopt disposable medical linen to reduce hospital-acquired infections (HAIs), eliminate laundering costs, and comply with regulatory hygiene standards

- The region’s strong focus on patient safety, high surgical volumes, and preference for single-use medical products continues to reinforce sustained demand for disposable bed linen, surgical linen, and hygiene products

U.S. Disposable Medical Linen Market Insight

The U.S. disposable medical linen market accounted for the largest share of the North American Disposable Medical Linen market in 2025, contributing nearly 81% of the regional revenue, driven by high hospitalization rates and a large number of surgical procedures performed annually. The widespread presence of advanced hospitals, ambulatory surgical centers, and nursing care facilities fuels consistent demand. Strict CDC and hospital infection control guidelines strongly favor disposable linen over reusable alternatives. Rising prevalence of chronic diseases and an aging population further increase inpatient admissions. In addition, strong purchasing power and bulk procurement agreements support large-scale adoption. Growth in outpatient and day-care procedures also contributes to market expansion.

Europe Disposable Medical Linen Market Insight

The Europe disposable medical linen market is expected to grow at a steady CAGR during the forecast period, driven by stringent healthcare regulations and rising emphasis on infection control across hospitals and clinics. Increasing surgical volumes and expansion of public healthcare systems support demand. Countries across Western Europe are shifting toward single-use medical textiles to reduce cross-contamination risks. The presence of universal healthcare coverage ensures stable procurement of disposable medical supplies. Growth in elderly population and long-term care facilities further boosts consumption. Sustainability-focused innovations in biodegradable disposable linen are also gaining traction across the region.

U.K. Disposable Medical Linen Market Insight

The U.K. disposable medical linen market is anticipated to grow at a moderate CAGR, supported by increasing patient admissions within the NHS and rising surgical procedures. Strong focus on hygiene compliance and infection prevention in public hospitals drives adoption. Growing use of disposable linen in diagnostic centers and outpatient clinics contributes to demand. The expansion of private healthcare facilities also supports market growth. Cost efficiency and reduced reliance on laundering infrastructure are key adoption drivers. In addition, emergency preparedness and stockpiling of disposable medical supplies reinforce demand stability.

Germany Disposable Medical Linen Market Insight

Germany disposable medical linen market is expected to witness consistent growth in the Disposable Medical Linen market due to its advanced healthcare system and high healthcare spending. Hospitals prioritize disposable linen to comply with strict hygiene and sterilization standards. Rising surgical procedures and expanding hospital infrastructure support consumption. The presence of well-developed medical supply distribution networks enhances accessibility. Increasing adoption in nursing care facilities driven by an aging population further fuels demand. Germany’s emphasis on quality and performance standards supports the use of high-grade disposable medical textiles.

Asia-Pacific Disposable Medical Linen Market Insight

The Asia-Pacific Disposable Medical Linen market is expected to grow at the fastest CAGR of 18.7% during the forecast period, driven by rapid expansion of healthcare infrastructure and increasing patient volumes. Rising investments in hospitals, ambulatory surgical centers, and diagnostic facilities significantly boost demand. Growing medical tourism in countries such as India and Thailand increases consumption of disposable medical linen. Improving awareness of hygiene and infection control standards accelerates adoption. The region also benefits from cost-effective manufacturing and expanding healthcare access in emerging economies.

Japan Disposable Medical Linen Market Insight

Japan’s disposable medical linen market is growing steadily due to its aging population and high demand for inpatient and long-term care services. Hospitals and elderly care facilities increasingly prefer disposable linen to minimize infection risks. High standards of hygiene and patient safety support consistent adoption. Rising surgical procedures related to age-associated conditions further drive demand. Japan’s strong healthcare reimbursement system ensures stable procurement. In addition, disaster preparedness and emergency healthcare planning contribute to stockpiling of disposable medical supplies.

China Disposable Medical Linen Market Insight

China disposable medical linen market accounted for the largest revenue share within Asia-Pacific in 2025, driven by rapid expansion of hospitals and rising healthcare utilization. Government investments in healthcare infrastructure and public hospitals significantly support market growth. Increasing awareness of infection prevention and hygiene standards accelerates the shift toward disposable linen. Growth in surgical volumes and outpatient procedures further boosts demand. Expansion of private hospitals and diagnostic centers contributes to consumption. In addition, China’s strong domestic manufacturing base enhances product availability and affordability, supporting widespread adoption.

Disposable Medical Linen Market Share

The Disposable Medical Linen industry is primarily led by well-established companies, including:

• 3M Company (U.S.)

• Medline Industries, Inc. (U.S.)

• Cardinal Health, Inc. (U.S.)

• Kimberly-Clark Corporation (U.S.)

• Mölnlycke Health Care AB (Sweden)

• Halyard Health, Inc. (U.S.)

• Paul Hartmann AG (Germany)

• Ahlstrom-Munksjö (Finland)

• Ansell Limited (Australia)

• Berry Global Inc. (U.S.)

• Superior Group of Companies (U.S.)

• Priontex GmbH (Germany)

• Medica Europe BV (Netherlands)

• Narendra Surgical (India)

• Universal Textile Technologies (India)

Latest Developments in Global Disposable Medical Linen Market

- In June 2023, 3M launched a new range of antimicrobial barrier disposable surgical gowns and related medical linens featuring advanced protection against bacterial contamination, leading to increased demand in North America and Europe due to heightened infection control protocols

- In August 2024, Manjushree Spntek introduced a unique collection of hybrid nonwovens tailored for chemotherapy gowns and protective medical textiles, offering superior barrier protection and comfort for healthcare workers during hazardous drug handling, and meeting ASTM safety standards

- In April 2024, Medline Industries implemented an AI-powered quality control system in its disposable medical textile production lines, significantly reducing defects and improving production efficiency for disposable gowns, drapes, and bandages globally

- In March 2025, Kimberly-Clark Corporation announced a strategic partnership with Freudenberg Medical Nonwovens to co-develop next-generation barrier nonwoven fabrics for medical disposable textiles, aiming to improve protection performance and sustainability

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.