Global Disposable Poct Devices Market

Market Size in USD Billion

CAGR :

%

USD

37.31 Billion

USD

61.29 Billion

2024

2032

USD

37.31 Billion

USD

61.29 Billion

2024

2032

| 2025 –2032 | |

| USD 37.31 Billion | |

| USD 61.29 Billion | |

|

|

|

|

Disposable Point-of-Care Testing (POCT) Devices Market Size

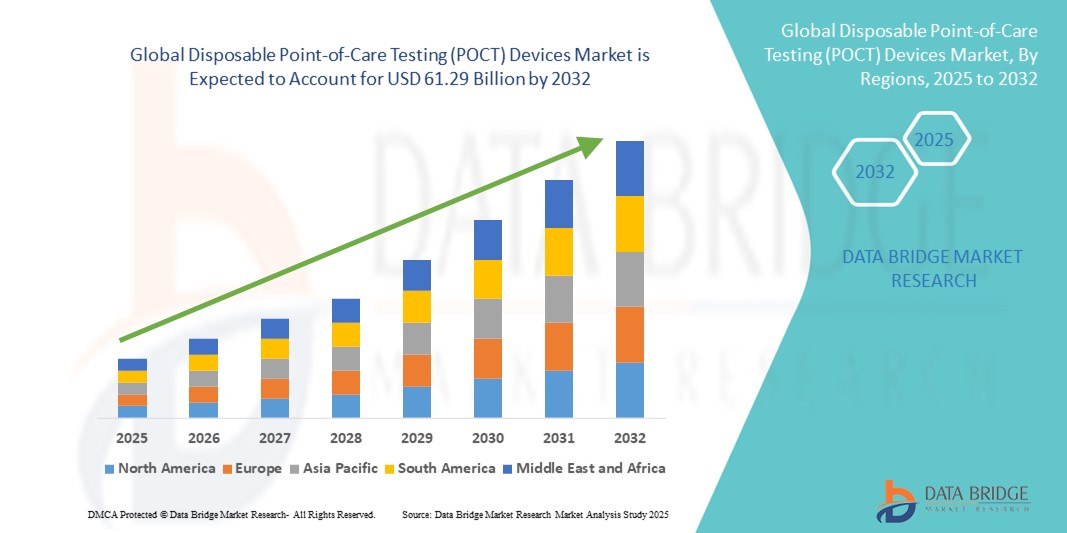

- The global disposable point-of-care testing (POCT) devices market size was valued at USD 37.31 billion in 2024 and is expected to reach USD 61.29 billion by 2032, at a CAGR of 6.40% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic and infectious diseases, coupled with the rising need for rapid diagnostic solutions that can deliver results at the point of care, thereby reducing the reliance on centralized laboratory testing

- Furthermore, growing demand for portable, user-friendly, and cost-effective diagnostic tools in hospitals, clinics, homecare, and remote healthcare settings is establishing Disposable Point-of-Care Testing (POCT) Devices as a preferred diagnostic solution. These converging factors are accelerating the uptake of Disposable POCT Devices, thereby significantly boosting the industry’s growth

Disposable Point-of-Care Testing (POCT) Devices Market Analysis

- Disposable Point-of-Care Testing (POCT) Devices, designed for quick, on-site diagnostics in clinical, home, and emergency settings, are increasingly essential in modern healthcare due to their rapid results, ease of use, and vital role in managing both chronic and acute conditions such as diabetes, cardiovascular issues, and infectious diseases

- The escalating demand for disposable POCT devices is primarily fueled by growing prevalence of chronic diseases, increasing need for decentralized testing, heightened awareness following events such as the COVID-19 pandemic, and greater adoption in home healthcare and rural settings

- North America dominated the disposable point-of-care testing (POCT) devices market with a 35.37% revenue share in 2023, supported by a robust healthcare infrastructure, favorable reimbursement policies, and strong adoption of advanced point-of-care technologies. The U.S. leads the region, with high uptake in hospitals, clinics, and home diagnostics, driven by innovation and supportive diagnostic ecosystems

- Asia-Pacific is the fastest growing region in the disposable point-of-care testing (POCT) devices market, with a projected CAGR exceeding 8%, attributed to increasing investments in healthcare infrastructure, rising incidence of chronic and infectious diseases, and government initiatives promoting decentralized testing in countries such as China and India

- The OTC segment dominated the disposable point-of-care testing (POCT) devices market with a revenue share of 55.6% in 2024, driven by the rising consumer inclination toward self-monitoring and home-based disease management

Report Scope and Disposable Point-of-Care Testing (POCT) Devices Market Segmentation

|

Attributes |

Disposable Point-of-Care Testing (POCT) Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Disposable Point-of-Care Testing (POCT) Devices Market Trends

Enhanced Accessibility and Diagnostic Accuracy Driving Adoption

- A significant and accelerating trend in the global Disposable Point-of-Care Testing (POCT) Devices market is the continuous improvement in accessibility, portability, and diagnostic accuracy of these devices, making them vital for both developed and emerging healthcare systems. The evolution of compact, easy-to-use POCT devices is empowering patients and healthcare providers with real-time diagnostic insights at the bedside, in remote locations, or even at home

- For instance, recent innovations in disposable POCT devices for COVID-19, influenza, and respiratory infections have demonstrated how rapid results directly support infection control, timely treatment, and reduced hospital burden. Companies are increasingly investing in developing single-use test kits with enhanced sensitivity and faster turnaround times

- Advancements in disposable POCT devices also include integrated biosensors and microfluidic technologies that improve precision while reducing the sample size required for testing. This allows for minimally invasive procedures such as finger-prick blood tests while maintaining high levels of diagnostic accuracy

- Furthermore, the growing use of POCT devices in chronic disease management, especially for diabetes and cardiovascular conditions, has accelerated adoption. Portable glucose monitoring strips, disposable cholesterol test kits, and cardiac marker POCT solutions are increasingly relied upon to ensure timely interventions and better patient outcomes

- The seamless integration of disposable POCT devices into digital health platforms and remote patient monitoring systems allows data from test kits to be automatically recorded and transmitted to healthcare providers. This enhances care coordination, reduces diagnostic delays, and supports personalized treatment approaches

- This trend towards more accessible, accurate, and connected POCT solutions is fundamentally reshaping patient expectations for healthcare delivery. Consequently, companies such as Abbott, Roche Diagnostics, and Siemens Healthineers are actively advancing disposable POCT devices with features such as rapid-read analyzers, multiplex testing capabilities, and compatibility with electronic health records (EHRs)

- The demand for Disposable POCT Devices that offer faster, reliable, and patient-friendly diagnostics is rapidly growing across both clinical and homecare settings, as consumers and providers increasingly prioritize convenience, efficiency, and improved healthcare outcomes

Disposable Point-of-Care Testing (POCT) Devices Market Dynamics

Driver

Growing Need Due to Rising Disease Burden and Demand for Rapid Testing

- The increasing prevalence of infectious diseases, chronic conditions, and global health emergencies is a significant driver for the heightened demand for Disposable Point-of-Care Testing (POCT) Devices. Their ability to provide rapid, reliable, and cost-effective diagnostics makes them essential in both clinical and homecare settings

- For instance, during 2023 and 2024, several health authorities and diagnostic companies expanded their portfolios of disposable POCT devices for COVID-19, influenza, and respiratory infections, highlighting the critical role of these tools in outbreak preparedness and patient management. Such developments are expected to fuel industry growth during the forecast period

- As patients and healthcare providers seek quicker diagnostic solutions to reduce delays in treatment, disposable POCT devices offer features such as real-time testing, minimal sample requirements, and ease of use, making them highly effective alternatives to central laboratory testing

- Furthermore, the growing emphasis on personalized and decentralized healthcare is making disposable POCT devices an integral component of modern care systems, with applications ranging from diabetes monitoring to cardiac biomarker detection and infectious disease screening

- The convenience of rapid results, suitability for remote or rural healthcare delivery, and increasing availability of user-friendly test kits are key factors propelling the adoption of disposable POCT devices across both developed and emerging healthcare markets

Restraint/Challenge

Concerns Regarding Accuracy, Regulation, and High Initial Adoption Costs

- Concerns surrounding the accuracy and reliability of certain disposable POCT devices pose a significant challenge to broader market penetration. While laboratory testing remains the gold standard, variations in sensitivity and specificity among POCT kits can limit trust and adoption

- For instance, high-profile reports of inconsistent performance in some rapid COVID-19 POCT kits made healthcare providers and regulators more cautious about widespread deployment, creating a barrier for acceptance in critical clinical decisions

- Addressing these concerns through stricter regulatory approvals, robust clinical validation, and continuous product improvements is crucial for building confidence among healthcare professionals and patients. Companies such as Abbott, Roche, and Siemens Healthineers have emphasized strong clinical data and regulatory certifications to strengthen market credibility

- In addition, the relatively high initial cost of advanced disposable POCT systems, compared to traditional diagnostic methods, can be a barrier to adoption in price-sensitive regions. While simpler glucose strips or pregnancy kits are affordable, more sophisticated POCT solutions for cardiac or oncology biomarkers often come with higher costs

- Although prices are gradually decreasing due to technological innovation and scaling, the perceived expense of advanced POCT devices can still hinder adoption, particularly in low-resource healthcare settings

- Overcoming these challenges through cost optimization, expanded insurance coverage, and wider training of healthcare workers will be vital for sustained market growth

Disposable Point-of-Care Testing (POCT) Devices Market Scope

The market is segmented on the basis of product, technology, prescription mode, and end user.

- By Product

On the basis of product, the market is segmented into glucose monitoring devices, cardiometabolic monitoring products, infectious disease testing products, coagulation monitoring products, pregnancy and fertility testing products, hematology testing products, drugs-of-abuse testing products, fecal occult testing products, cholesterol testing products, and others. The glucose monitoring devices segment accounted for the largest revenue share of 38.2% in 2024, driven by the rising prevalence of diabetes worldwide and the need for regular self-monitoring. Continuous demand for disposable glucose strips and portable glucose meters in both developed and emerging economies reinforces this segment’s dominance. Public health campaigns promoting early detection of diabetes, coupled with reimbursement support in several countries, have further bolstered adoption. In addition, the integration of glucose monitoring devices with digital health platforms for real-time data tracking is strengthening patient engagement. The convenience of home-based testing, along with advancements in non-invasive glucose sensors, continues to support consistent market growth.

The infectious disease testing products segment is expected to register the fastest CAGR of 15.4% from 2025 to 2032, fueled by the increasing incidence of viral and bacterial outbreaks such as COVID-19, influenza, tuberculosis, and HIV. Rapid diagnostic kits offering accurate results within minutes are becoming essential in hospital emergency rooms, community health centers, and home-based care. Government initiatives and investments in infectious disease preparedness are further driving adoption, especially in low-resource settings. The growing emphasis on early detection, combined with technological innovations such as multiplexed testing platforms, is enhancing the segment’s growth prospects. In addition, the rising awareness of infection control and patient safety protocols is creating sustained demand. The segment’s expansion is also supported by the need for decentralized diagnostics, particularly in rural and semi-urban areas where laboratory infrastructure is limited.

- By Technology

On the basis of technology, the market is segmented into dipsticks, lateral flow assays, molecular diagnostics, microfluidics, immunoassays, and others. The lateral flow assays segment dominated the market with a revenue share of 41.7% in 2024, owing to its simplicity, cost-effectiveness, and rapid results. These devices are widely adopted for applications including pregnancy testing, glucose monitoring, and infectious disease detection, especially in resource-limited settings. Their ease of use without specialized training makes them ideal for home and point-of-care testing. Lateral flow tests are also preferred in emergency and outpatient settings due to their portability and quick turnaround times. Government and NGO programs promoting community health screening have further reinforced the segment’s adoption. The widespread availability of lateral flow kits across retail and online channels has also contributed to market dominance.

The molecular diagnostics segment is projected to grow at the fastest CAGR of 16.2% from 2025 to 2032, driven by technological advancements in nucleic acid amplification, PCR, and microfluidic platforms. Molecular POCT devices provide high sensitivity and specificity, particularly for detecting complex infectious diseases such as HIV, HPV, and COVID-19 variants. Integration into hospital laboratories and mobile testing units enables real-time pathogen detection and outbreak management. Rising demand for accurate diagnostics in critical care and pandemic preparedness programs is further accelerating growth. Continuous miniaturization and automation of molecular testing platforms are enhancing accessibility and efficiency. In addition, the increasing adoption of personalized medicine and precision diagnostics is expanding the segment’s global footprint.

- By Prescription Mode

On the basis of prescription mode, the market is segmented into Prescription-Based and OTC. The OTC segment held the largest revenue share of 55.6% in 2024, driven by growing consumer preference for self-monitoring and home-based testing. Products such as pregnancy kits, cholesterol testing devices, and glucose monitors are increasingly accessible via retail pharmacies and online platforms, allowing patients to conduct tests without visiting healthcare facilities. Rising health awareness, affordability, and ease of use further strengthen the dominance of OTC devices. The convenience of rapid, point-of-care diagnostics also promotes adherence and early detection. Government initiatives supporting preventive healthcare programs enhance the segment’s adoption. Moreover, the availability of telehealth support for interpreting results increases patient confidence in self-testing.

The prescription-based segment is expected to register the fastest CAGR of 12.8% from 2025 to 2032, fueled by the need for physician-supervised diagnostic solutions for complex applications such as coagulation monitoring, cardiometabolic testing, and advanced infectious disease detection. Regulatory emphasis on diagnostic accuracy and clinical oversight drives the adoption of prescription-based POCT devices. Hospitals and specialty clinics prefer prescription-based solutions for high-risk patients to reduce misdiagnosis. The trend toward precision medicine and physician-guided monitoring is boosting demand for this segment. Integration with hospital electronic health records (EHR) enhances data management and patient tracking. Advanced analytical capabilities in prescription-based devices further strengthen their market potential.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, homecare, research laboratories, ambulatory care centers, and others. The Hospitals segment dominated the market with the largest revenue share of 47.3% in 2024, driven by the high patient volumes, complex clinical cases, and need for immediate results in emergency and critical care units. Hospitals benefit from trained staff, integration with electronic health records, and disposable kits for infection control, which consolidate their dominance. Hospitals also serve as central hubs for both acute and chronic condition management. In addition, the adoption of advanced POCT devices in hospital settings supports workflow efficiency and patient safety.

The homecare segment is projected to register the fastest CAGR of 14.7% from 2025 to 2032, fueled by the rising demand for decentralized testing and patient empowerment. Patients increasingly rely on digital health platforms, smartphone-compatible POCT devices, and remote monitoring tools to manage chronic conditions such as diabetes and cardiovascular diseases at home. Homecare reduces hospital visits, lowers healthcare costs, and enhances convenience. Telemedicine integration and remote patient support services are further accelerating adoption. Growing awareness about preventive healthcare and chronic disease management contributes to the rapid growth of home-based testing.

Disposable Point-of-Care Testing (POCT) Devices Market Regional Analysis

- North America dominated the disposable point-of-care testing (POCT) devices market with a 35.37% revenue share in 2023, underpinned by its highly advanced healthcare infrastructure, strong reimbursement frameworks, and early adoption of innovative diagnostic technologies

- The increasing prevalence of lifestyle-related chronic diseases, rising incidence of infectious outbreaks, and strong patient preference for rapid and reliable diagnostic solutions have firmly established North America as the global leader in this industry

- The region also benefits from the presence of top diagnostic manufacturers, high R&D spending, and a favorable regulatory environment that accelerates innovation and commercialization of POCT products

U.S. Disposable POCT Devices Market Insight

The U.S. disposable point-of-care testing (POCT) devices accounted for the largest share within North America, driven by its robust diagnostic ecosystem, strong government support for early disease detection, and rapidly expanding adoption of decentralized testing solutions. High demand for self-testing kits, rapid uptake of molecular POCT platforms, and an emphasis on digital integration for real-time monitoring are fueling growth. Moreover, increasing partnerships between diagnostic companies, healthcare providers, and telemedicine platforms are reshaping the U.S. POCT landscape by enabling faster, more patient-centric care.

Canada Disposable POCT Devices Market Insight

The Canada disposable point-of-care testing (POCT) devices, is steadily growing as healthcare policies focus on improving access to timely diagnostics across rural and underserved regions. A rising prevalence of diabetes, respiratory conditions, and cardiovascular diseases is creating strong demand for easy-to-use POCT devices. Government-backed initiatives to expand preventive healthcare and growing consumer awareness about home-based testing are further driving adoption. In addition, collaborations with international diagnostic firms and investment in local manufacturing are accelerating the availability of cost-effective POCT solutions in Canada.

Europe Disposable POCT Devices Market

The Europe disposable point-of-care testing (POCT) devices is projected to witness substantial growth in the Disposable POCT Devices market over the forecast period, supported by strict healthcare regulations, a well-developed public health system, and rising emphasis on preventive medicine and early diagnostics. Increasing healthcare expenditure, coupled with rapid technological innovation, is creating a favorable environment for the adoption of POCT devices across hospitals, clinics, pharmacies, and homecare. The push for sustainability and the integration of digital health tools with diagnostic solutions are further shaping the European market.

U.K. Disposable POCT Devices Market Insight

The U.K. disposable point-of-care testing (POCT) devices is experiencing rapid expansion in the POCT devices market due to strong consumer preference for at-home diagnostics, heightened concerns regarding chronic and infectious diseases, and government programs encouraging preventive healthcare. The growing popularity of glucose monitoring kits, fertility diagnostics, and infectious disease test kits is driving demand. In addition, the U.K.’s robust e-commerce and pharmacy networks are making POCT devices more accessible, while digital integration with mobile apps and telehealth services is further strengthening adoption.

Germany Disposable POCT Devices Market Insight

The Germany disposable point-of-care testing (POCT) devices represents one of Europe’s largest and most advanced POCT markets, supported by its strong focus on innovation, sustainability, and digital transformation in healthcare. Hospitals and clinics are increasingly adopting advanced POCT solutions for real-time monitoring, while consumers are showing growing interest in home-based diagnostic devices for diabetes and cardiac conditions. The integration of POCT devices with electronic health records and connected healthcare systems is enhancing efficiency, while demand for eco-friendly, accurate, and affordable solutions is shaping purchasing preferences in the German market.

Asia Pacifice Disposable POCT Devices Market Insight

The Asia-Pacific disposable point-of-care testing (POCT) devices is the fastest-growing region in the Disposable POCT Devices market, projected to expand at a CAGR exceeding 8% between 2025 and 2032, fueled by rising healthcare investments, rapid urbanization, and government-led initiatives to improve accessibility of diagnostics in underserved areas. The region’s increasing burden of chronic and infectious diseases, coupled with an expanding middle-class population and growing technological capabilities, is driving significant uptake of POCT solutions. Asia-Pacific is also emerging as a major manufacturing hub, offering affordable and scalable diagnostic devices for both domestic and international markets.

China Disposable POCT Devices Market Insight

The China disposable point-of-care testing (POCT) devices market held the largest share of the Asia-Pacific market in 2023, supported by its expanding middle class, rising healthcare spending, and extensive government policies focused on strengthening primary and preventive care. Rapid urbanization and the widespread adoption of smart healthcare solutions are fueling demand for POCT devices across hospitals, diagnostic labs, and homecare settings. In addition, China’s robust domestic manufacturing sector ensures affordability and wide availability, while initiatives promoting smart cities and digital health ecosystems are accelerating integration of connected POCT technologies.

India Disposable POCT Devices Market Insight

The India disposable point-of-care testing (POCT) devices market is projected to record the fastest CAGR in the region, fueled by a high disease burden, particularly in diabetes, cardiovascular, and infectious conditions. Expanding healthcare infrastructure, combined with government programs promoting decentralized testing in rural areas, is driving adoption of affordable POCT solutions. Consumer preference for easy-to-use self-testing kits, coupled with the rise of mobile health and telemedicine platforms, is transforming the Indian diagnostic landscape. The increasing involvement of private players and partnerships with global diagnostic companies are further boosting growth.

Disposable Point-of-Care Testing (POCT) Devices Market Share

The disposable point-of-care testing (POCT) Devices industry is primarily led by well-established companies, including:

- Danaher Corporation (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- BD (U.S.)

- Trinity Biotech Ireland (Ireland)

- Cardinal Health (U.S.)

- Thermo Fisher Scientific (U.S.)

- Chembio Diagnostics, Inc. (U.S.)

- Meridian Bioscience, Inc. (U.S.)

- Sekisui Diagnostics (U.S.)

- OraSure Technologies, Inc. (U.S.)

- Quidel Corporation (U.S.)

- Siemens Healthineers AG (Germany)

- Nova Biomedical (U.S.)

- EKF Diagnostics Holdings plc (U.K.)

- Beckman Coulter, Inc. (U.S.)

- Bayer AG (Germany)

- BIOMÉRIEUX (France)

- Johnson & Johnson and its affiliates (U.S.)

Latest Developments in Global Disposable Point-of-Care Testing (POCT) Devices Market

- In April 2021, Abbott began nationwide shipping of the BinaxNOW COVID-19 Ag Self Test for over-the-counter, non-prescription home use in the United States after receiving FDA Emergency Use Authorization (EUA). This milestone expanded access to disposable at-home antigen testing through retail channels, enabling consumers to perform rapid COVID-19 detection without visiting healthcare facilities. The move marked one of the first large-scale rollouts of disposable POCT devices for home diagnostics in the U.S. market

- In December 2021, Roche received FDA Emergency Use Authorization for the Roche COVID-19 At-Home Test (OTC). This authorization allowed frequent self-testing using disposable lateral-flow cassette devices, significantly enhancing accessibility of POCT diagnostics for households and contributing to early detection and isolation efforts during ongoing pandemic surges

- In April 2022, InspectIR Systems achieved FDA EUA for its COVID-19 Breathalyzer, becoming the first FDA-authorized breath-based diagnostic test for SARS-CoV-2. This innovation broadened the spectrum of rapid point-of-care testing options beyond traditional swab-based formats, introducing a novel, non-invasive disposable POCT modality for real-time viral detection

- In May 2022, Labcorp received FDA EUA for its Seasonal Respiratory Virus RT-PCR Direct-to-Consumer (DTC) Test, covering COVID-19, influenza, and RSV. The test incorporated at-home self-collection with mail-in processing, marking the first FDA authorization of a multi-analyte, direct-to-consumer POCT solution. This development represented a major step toward more comprehensive disposable testing options for multiple respiratory infections

- In February 2023, Lucira Health secured the first FDA EUA for an OTC at-home combination test capable of detecting and differentiating influenza A/B and COVID-19 within a single-use device. Delivering results in approximately 30 minutes, this advancement reinforced the role of disposable POCT devices in multi-pathogen detection and significantly improved convenience for consumers during flu seasons coinciding with COVID-19 outbreaks

- In June 2023, Cue Health obtained FDA De Novo marketing authorization for the Cue COVID-19 Molecular Test for both home and point-of-care use. This was the first COVID-19 home test authorized through the traditional premarket review pathway, moving beyond EUA status. The milestone highlighted the regulatory transition of POCT devices from temporary pandemic-driven approvals to long-term integration into healthcare and consumer markets

- In November 2023, ACON Laboratories’ Flowflex COVID-19 Antigen Home Test became the first OTC COVID-19 antigen test to complete the traditional FDA premarket review process and achieve full clearance for marketing, rather than relying solely on EUA. This established Flowflex as a benchmark for quality and reliability in disposable POCT devices, reinforcing consumer trust in at-home diagnostics

- In October 2024, Healgen Scientific gained FDA De Novo marketing authorization for its Rapid Check COVID-19/Flu A&B Antigen Test, making it the first at-home combination flu and COVID antigen test authorized outside of emergency use provisions. This milestone significantly expanded the utility of disposable POCT devices for seasonal and pandemic respiratory illnesses, meeting rising demand for dual-detection solutions

- In May 2025, ACON Laboratories announced FDA 510(k) clearance for the Flowflex Plus COVID-19 + Flu A/B Home Test, which had initially been distributed under EUA in July 2024. This clearance expanded the availability of multi-analyte, disposable POCT antigen combo tests in the U.S. market, further strengthening the role of affordable, consumer-friendly diagnostics in everyday healthcare

- In June 2025, the U.S. FDA updated its public listings of authorized at-home OTC COVID-19 diagnostic tests as well as its roster of tests granted full marketing authorization. This reflected the ongoing regulatory shift from emergency use authorizations to traditional clearance pathways, marking an important transition for the global Disposable POCT Devices Market as it stabilizes beyond the pandemic era

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.