Global Distillation Systems In Food And Beverage Application Market

Market Size in USD Billion

CAGR :

%

USD

5.20 Billion

USD

6.58 Billion

2024

2032

USD

5.20 Billion

USD

6.58 Billion

2024

2032

| 2025 –2032 | |

| USD 5.20 Billion | |

| USD 6.58 Billion | |

|

|

|

|

Global Distillation Systems in Food and Beverage Application Market Size

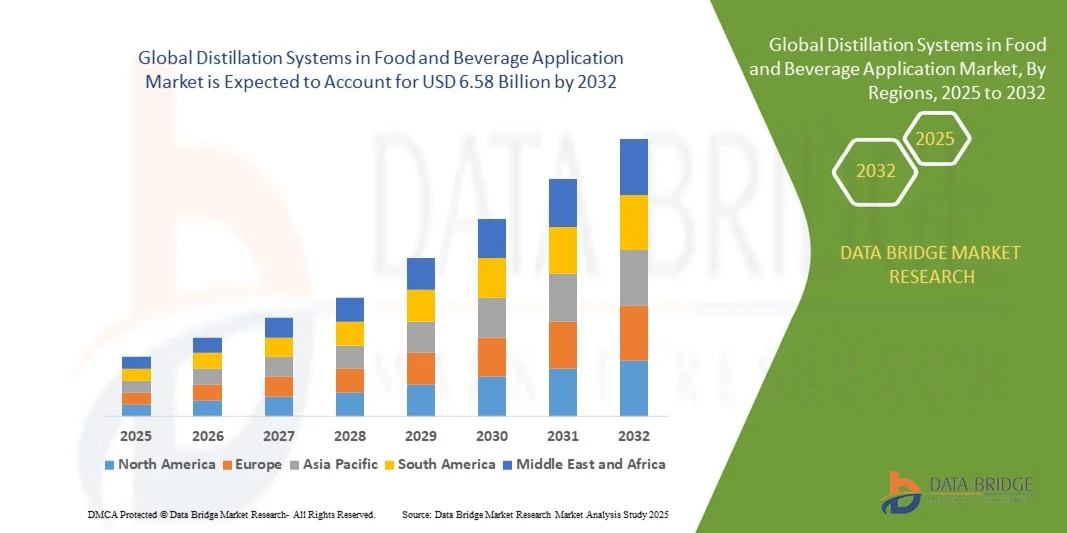

- The global Distillation Systems in Food and Beverage Application Market size was valued at USD 5.20 billion in 2024 and is projected to reach USD 6.58 billion by 2032, growing at a CAGR of 3.00% during the forecast period.

- The market expansion is primarily driven by increasing demand for high-purity ingredients, process optimization, and energy-efficient distillation technologies across the food and beverage sector, supporting enhanced product quality and sustainability.

- In addition, technological advancements in automated distillation units and the adoption of sustainable production processes are encouraging manufacturers to modernize their operations, thereby accelerating market growth and innovation within the industry.

Global Distillation Systems in Food and Beverage Application Market Analysis

- Distillation systems, essential for separating, purifying, and refining liquid mixtures, are increasingly vital components in modern food and beverage processing due to their ability to enhance product quality, ensure consistency, and meet stringent safety and regulatory standards across both large-scale and artisanal production facilities.

- The rising demand for distillation systems is primarily fueled by growing consumption of processed beverages, alcoholic drinks, and functional food ingredients, coupled with manufacturers’ focus on energy efficiency, sustainability, and automation in production operations.

- North America dominated the Global Distillation Systems in Food and Beverage Application Market with the largest revenue share of 34.3% in 2024, attributed to advanced processing infrastructure, strong presence of leading equipment manufacturers, and high adoption of innovative technologies in beverage distilleries and food ingredient production facilities across the U.S. and Canada.

- Asia-Pacific is expected to be the fastest-growing region in the Global Distillation Systems in Food and Beverage Application Market during the forecast period, driven by rapid industrialization, increasing investments in food and beverage manufacturing, and expanding demand for premium alcoholic and non-alcoholic beverages in countries such as China, India, and Japan.

- The column shells segment dominated the market with the largest revenue share of 38.5% in 2024, driven by their crucial role as the primary structural element of distillation systems, ensuring operational stability and efficiency.

Report Scope and Global Distillation Systems in Food and Beverage Application Market Segmentation

|

Attributes |

Distillation Systems in Food and Beverage Application Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• GEA Group AG (Germany) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Distillation Systems in Food and Beverage Application Market Trends

Technological Advancements and Automation in Distillation Processes

- A significant and accelerating trend in the Global Distillation Systems in Food and Beverage Application Market is the increasing integration of automation, digital monitoring, and AI-driven process optimization in distillation operations. This convergence of technologies is enhancing efficiency, precision, and energy savings in food and beverage manufacturing.

- For instance, GEA Group AG has introduced automated distillation solutions equipped with real-time process monitoring and digital control systems, enabling producers to achieve consistent purity levels and improved operational efficiency. Similarly, Alfa Laval offers smart distillation units with integrated sensors and predictive maintenance features to reduce downtime and improve sustainability performance.

- AI integration in modern distillation systems enables features such as adaptive process control, predictive analytics for equipment maintenance, and automated energy management. For example, advanced software solutions can analyze temperature and pressure data to optimize separation efficiency and minimize energy consumption during operation.

- The seamless integration of distillation systems with Industrial Internet of Things (IIoT) platforms allows centralized control over entire production lines. Through a unified interface, operators can manage distillation parameters, monitor product quality, and synchronize operations with upstream and downstream processes, leading to a more connected and efficient production ecosystem.

- This trend toward intelligent, automated, and data-driven distillation systems is fundamentally transforming manufacturing practices across the food and beverage industry. Consequently, companies such as Praj Industries Ltd. and Sulzer Ltd. are developing next-generation, AI-enabled distillation technologies featuring remote control, predictive diagnostics, and advanced energy recovery mechanisms.

- The demand for smart and automated distillation systems is growing rapidly across both established and emerging markets, as food and beverage producers increasingly prioritize operational efficiency, quality assurance, and sustainable production practices.

Global Distillation Systems in Food and Beverage Application Market Dynamics

Driver

Growing Demand Driven by Product Purity, Efficiency, and Sustainability Needs

- The increasing emphasis on product purity, process efficiency, and sustainable production across the global food and beverage industry is a major driver for the rising demand for advanced distillation systems.

- For instance, in March 2024, GEA Group AG introduced an upgraded range of energy-efficient distillation systems designed for beverage producers, incorporating heat recovery technologies to significantly reduce operational energy consumption. Such innovations by key market players are expected to accelerate industry growth in the coming years.

- As food and beverage manufacturers focus on meeting stringent quality and safety standards, distillation systems offer reliable solutions for achieving consistent ingredient purification and flavor refinement, providing a critical edge over conventional separation technologies.

- Furthermore, the growing adoption of automation, digital monitoring, and sustainability-driven manufacturing practices is making advanced distillation systems an integral part of modern processing plants, offering seamless integration with upstream and downstream production equipment.

- The advantages of reduced energy use, lower production costs, and improved product quality are key factors propelling the adoption of distillation systems in both established and emerging markets. Additionally, the increasing demand for premium alcoholic beverages, natural extracts, and functional food ingredients further supports market expansion.

Restraint/Challenge

High Capital Investment and Energy Consumption Concerns

- The high initial cost associated with installing advanced distillation systems, along with their energy-intensive operation, remains a key challenge to widespread adoption—particularly among small and medium-sized food and beverage producers.

- For instance, many traditional distillation units require substantial capital expenditure for setup, maintenance, and operation, making it difficult for smaller manufacturers to justify large-scale investments.

- Addressing these challenges through modular system designs, energy recovery solutions, and process optimization technologies is essential for improving cost efficiency and accessibility. Companies such as Alfa Laval and Sulzer Ltd. are developing low-energy, high-efficiency distillation systems equipped with advanced heat exchangers to tackle these issues.

- Moreover, environmental concerns linked to high energy usage and carbon emissions in conventional distillation processes are encouraging a shift toward eco-efficient systems. Manufacturers are increasingly investing in technologies that minimize energy waste while maximizing output quality.

- Although the industry is steadily adopting greener and more affordable solutions, the upfront costs and energy-related challenges continue to pose short-term restraints. Overcoming these barriers through technological innovation, government incentives, and increased adoption of sustainable designs will be critical for maintaining long-term market growth.

Global Distillation Systems in Food and Beverage Application Market Scope

Distillation systems in food and beverage application market is segmented on the basis of component, technique, type, application, operation, and process.

- By Component

On the basis of component, the Global Distillation Systems in Food and Beverage Application Market is segmented into column shells, plates (or trays) and packings, reboilers and heaters, condensers, and others. The column shells segment dominated the market with the largest revenue share of 38.5% in 2024, driven by their crucial role as the primary structural element of distillation systems, ensuring operational stability and efficiency. High-quality materials such as stainless steel and specialized alloys enhance corrosion resistance and longevity, making them preferred in food and beverage production.

The plates (or trays) and packings segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by growing demand for advanced internal components that improve mass transfer efficiency, reduce energy consumption, and enhance separation performance in both large-scale and small-batch distillation processes.

- By Technique

On the basis of technique, the market is segmented into fractional, steam, vacuum, multiple-effect (MED), and others. The fractional distillation segment dominated the market with a market share of 41.2% in 2024, due to its widespread use in alcohol purification and flavor concentration applications. It provides precise separation of components with varying boiling points, making it essential for producing high-quality beverages and food-grade ingredients.

The multiple-effect distillation (MED) segment is projected to record the fastest growth rate during 2025–2032, driven by the increasing focus on energy-efficient and sustainable distillation solutions. MED systems utilize waste heat recovery and sequential vaporization, significantly reducing operational costs and energy consumption in large-scale food and beverage manufacturing facilities.

- By Type

On the basis of type, the market is segmented into pot still and column still. The column still segment dominated the market with the largest revenue share of 43.2% in 2024, owing to its superior efficiency, scalability, and suitability for continuous operation in high-volume beverage production. Column stills are widely used in the production of spirits, essential oils, and food-grade extracts, providing consistent purity and throughput.

The pot still segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by its rising use in craft distilleries and small-batch production setups focused on premium and artisanal beverages. Its flexibility and ability to preserve distinct flavor profiles make it highly preferred among boutique producers.

- By Application

On the basis of application, the market is segmented into alcoholic and non-alcoholic. The alcoholic segment dominated the market with a revenue share of 57.6% in 2024, attributed to the growing global demand for premium spirits, wines, and craft liquors requiring advanced distillation technologies for flavor refinement and purity control.

The non-alcoholic segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the expanding production of distilled water, plant extracts, and essential oils used in functional beverages and food flavoring. Increasing consumer preference for health-oriented and low-alcohol beverages further stimulates innovation in non-alcoholic distillation applications.

- By Operation

On the basis of operation, the market is categorized into continuous and batch. The continuous distillation segment dominated the market with a market share of 61.8% in 2024, owing to its widespread adoption in large-scale beverage and ingredient manufacturing facilities for its efficiency, automation, and consistent output quality. Continuous systems allow steady operation and minimal downtime, making them ideal for high-volume production lines.

The batch distillation segment is projected to grow at the fastest CAGR during 2025–2032, driven by the growing popularity of small-scale and specialty producers focusing on craft spirits, unique flavors, and customized beverage profiles that benefit from batch precision and flexibility.

- By Process

on the basis of process, the market is segmented into multicomponent and binary. The multicomponent distillation segment dominated the market with the largest revenue share of 54.4% in 2024, as it enables simultaneous separation of multiple volatile compounds, which is essential in complex food and beverage formulations. Its application in flavor extraction and multi-ingredient purification has made it integral to advanced processing setups.

The binary distillation segment is forecast to record the fastest growth rate during 2025–2032, driven by its simplicity, cost-effectiveness, and increasing use in smaller facilities focusing on specific ingredient purification and alcohol-water separation processes.

Global Distillation Systems in Food and Beverage Application Market Regional Analysis

- North America dominated the Global Distillation Systems in Food and Beverage Application Market with the largest revenue share of 34.3% in 2024, driven by the strong presence of leading food and beverage manufacturers, advanced processing infrastructure, and early adoption of automation and energy-efficient distillation technologies.

- Producers in the region place high value on process optimization, product purity, and sustainability, leveraging modern distillation systems integrated with digital monitoring and control features to enhance production efficiency and ensure regulatory compliance.

- This dominance is further supported by high investments in technological innovation, skilled workforce availability, and strong demand for premium beverages and food ingredients, positioning North America as a global hub for innovation in distillation technology across both alcoholic and non-alcoholic beverage segments.

U.S. Distillation Systems in Food and Beverage Application Market Insight

The U.S. distillation systems market captured the largest revenue share of 81% in 2024 within North America, driven by strong demand from the beverage, dairy, and flavor manufacturing industries. The country’s extensive production of alcoholic beverages—particularly spirits and craft liquors—along with a growing focus on sustainability and energy efficiency, fuels widespread adoption of advanced distillation systems. The U.S. market also benefits from the presence of major players such as GEA Group, SPX FLOW, and The Dupps Company, who are investing in automation and digital process control solutions. Additionally, the integration of AI-driven monitoring and energy recovery technologies is reshaping operational efficiency across food and beverage facilities nationwide.

Europe Distillation Systems in Food and Beverage Application Market Insight

The Europe distillation systems market is projected to grow at a substantial CAGR throughout the forecast period, driven by stringent environmental regulations and the region’s commitment to sustainable food and beverage production. The growing demand for high-quality alcoholic beverages, essential oils, and purified ingredients is fostering adoption across breweries, wineries, and food processing facilities. European producers value energy-efficient and low-emission distillation systems that align with the EU’s green manufacturing directives. Moreover, advancements in vacuum and multiple-effect distillation technologies are supporting broader adoption across both new installations and retrofitting projects in existing plants.

U.K. Distillation Systems in Food and Beverage Application Market Insight

The U.K. distillation systems market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by the country’s robust alcoholic beverage sector and increasing investments in sustainable distillation solutions. Rising consumer demand for premium craft spirits and artisanal beverages is encouraging small and mid-sized producers to adopt modern, compact distillation technologies. Additionally, government emphasis on carbon reduction and energy efficiency is promoting the transition from conventional to eco-friendly distillation systems. The U.K.’s strong research infrastructure and presence of local manufacturers also contribute to the market’s continuous expansion.

Germany Distillation Systems in Food and Beverage Application Market Insight

The Germany distillation systems market is expected to expand at a considerable CAGR during the forecast period, driven by technological innovation, precision engineering, and sustainability goals. As a leader in process automation and industrial equipment manufacturing, Germany is witnessing rising demand for digitally controlled and energy-optimized distillation units. The country’s emphasis on circular economy principles and environmentally responsible production supports the deployment of advanced systems across breweries, distilleries, and flavor extraction industries. The growing integration of IIoT (Industrial Internet of Things) technologies enables German manufacturers to monitor performance and optimize energy use in real time.

Asia-Pacific Distillation Systems in Food and Beverage Application Market Insight

The Asia-Pacific distillation systems market is projected to grow at the fastest CAGR of 24% from 2025 to 2032, driven by rapid industrialization, urbanization, and growing beverage consumption in countries such as China, India, and Japan. The expanding food processing sector and increasing investments in modern manufacturing infrastructure are supporting market growth. Government initiatives promoting sustainable and energy-efficient technologies are also fueling adoption. Additionally, APAC’s emergence as a manufacturing hub for distillation equipment components is improving affordability and accessibility, making advanced distillation technologies more available to regional producers.

Japan Distillation Systems in Food and Beverage Application Market Insight

The Japan distillation systems market is gaining momentum due to the country’s technological sophistication, premium beverage culture, and focus on product quality. Japanese producers prioritize precision, energy conservation, and automation, leading to the adoption of advanced fractional and vacuum distillation systems. The market is also influenced by growing demand for non-alcoholic and functional beverages, driving innovation in ingredient purification and extraction. Additionally, Japan’s focus on sustainable, space-efficient production solutions aligns with the trend toward miniaturized and AI-assisted distillation systems for both traditional and modern beverage applications.

China Distillation Systems in Food and Beverage Application Market Insight

The China distillation systems market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s vast beverage industry, rapid industrial expansion, and growing consumption of both alcoholic and non-alcoholic products. China’s strong base of domestic distillation system manufacturers, combined with rising exports of beverage processing equipment, contributes to its dominance. The government’s push toward smart manufacturing and energy conservation is also boosting adoption of automated and high-efficiency distillation units. Moreover, the increasing popularity of traditional spirits such as baijiu and the expansion of functional drink production are driving continuous innovation and system upgrades across the nation’s food and beverage facilities.

Global Distillation Systems in Food and Beverage Application Market Share

The Distillation Systems in Food and Beverage Application industry is primarily led by well-established companies, including:

• GEA Group AG (Germany)

• Alfa Laval AB (Sweden)

• SPX FLOW, Inc. (U.S.)

• Praj Industries Ltd. (India)

• The Dupps Company (U.S.)

• Bühler Group (Switzerland)

• Hyde Engineering + Consulting (U.S.)

• Lenntech B.V. (Netherlands)

• Fenix Process Technologies Pvt. Ltd. (India)

• Körting Hannover AG (Germany)

• Sulzer Ltd. (Switzerland)

• Thermax Limited (India)

• Distillation Group, Inc. (U.S.)

• Vendome Copper & Brass Works, Inc. (U.S.)

• Pilodist GmbH (Germany)

• HAT International Ltd. (U.K.)

• Borosil Limited (India)

• De Dietrich Process Systems (France)

• Chem Process Systems Pvt. Ltd. (India)

• Luwa Air Engineering AG (Switzerland)

What are the Recent Developments in Global Distillation Systems in Food and Beverage Application Market?

- In April 2023, GEA Group, a global leader in process technology and equipment for the food and beverage industry, launched a strategic initiative in South Africa to strengthen the efficiency and sustainability of distillation processes in local beverage and dairy production facilities. By deploying advanced column stills and energy-optimized reboilers, GEA Group is helping manufacturers achieve higher purity outputs while reducing energy consumption, reinforcing its position in the rapidly expanding Global Distillation Systems in Food and Beverage Application Market.

- In March 2023, SPX FLOW Inc., a veteran-led company specializing in fluid handling and separation technologies, introduced the NextGen Multi-Effect Distillation System designed specifically for industrial beverage and flavor processing applications. The system enhances energy efficiency, improves yield, and ensures precise separation of components, showcasing SPX FLOW’s commitment to delivering cutting-edge, sustainable solutions that optimize production for commercial facilities.

- In March 2023, The Dupps Company successfully deployed a high-capacity fractional distillation system for a large-scale spirits producer in Bengaluru, India, aimed at improving production efficiency and product consistency. This initiative highlights the increasing adoption of advanced distillation technologies in emerging markets and underscores The Dupps Company’s dedication to providing tailored solutions for high-quality beverage production.

- In February 2023, Alfa Laval, a leading provider of heat transfer, separation, and fluid handling solutions, announced a strategic partnership with Asia-Pacific beverage manufacturers to develop smart column and vacuum distillation systems with integrated IoT monitoring. This collaboration is designed to enhance operational efficiency, optimize energy use, and ensure consistent product quality across the supply chain, demonstrating Alfa Laval’s focus on innovation and digital integration in the distillation market.

- In January 2023, Flottweg SE, a key player in separation and clarification technology for the food and beverage sector, unveiled its high-performance distillation system with automated plate and packing adjustments at the DrinkTech International Expo 2023. The system allows operators to precisely control separation parameters and maximize throughput while reducing operational costs. This launch emphasizes Flottweg’s commitment to integrating advanced automation and efficiency-focused technologies in modern distillation processes.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Distillation Systems In Food And Beverage Application Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Distillation Systems In Food And Beverage Application Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Distillation Systems In Food And Beverage Application Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.