Global Distillers Dried Grains With Solubles Ddgs Feed Market

Market Size in USD Billion

CAGR :

%

USD

17.18 Billion

USD

31.33 Billion

2024

2032

USD

17.18 Billion

USD

31.33 Billion

2024

2032

| 2025 –2032 | |

| USD 17.18 Billion | |

| USD 31.33 Billion | |

|

|

|

|

Distiller’s Dried Grains with Solubles (DDGS) Feed Market Size

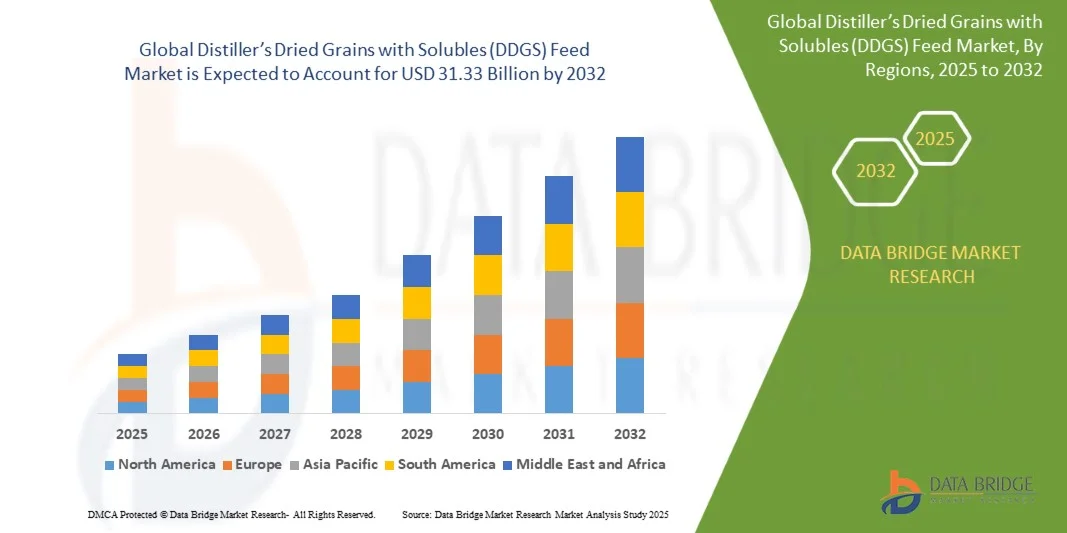

- The global distiller’s dried grains with solubles (DDGS) feed market size was valued at USD 17.18 billion in 2024 and is expected to reach USD 31.33 billion by 2032, at a CAGR of 7.8% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-protein and cost-effective livestock feed, driven by the expansion of the poultry, swine, and aquaculture industries globally

- Rising ethanol production, particularly from corn, generates a steady supply of DDGS, making it an affordable and sustainable feed ingredient for livestock and poultry

Distiller’s Dried Grains with Solubles (DDGS) Feed Market Analysis

- The market is witnessing robust growth due to its application as a protein-rich supplement in livestock diets, particularly in poultry, swine, and ruminant feed formulations

- Increasing investments in large-scale livestock and poultry farms globally are driving the steady demand for cost-effective, high-quality feed ingredients such as DDGS

- North America dominated the DDGS feed market with the largest revenue share of 38.5% in 2024, driven by the rising demand for high-protein, cost-effective livestock feed and well-established livestock farming infrastructure

- Asia-Pacific region is expected to witness the highest growth rate in the global distiller’s dried grains with solubles (DDGS) feed market, driven by rapid urbanization, expanding poultry and dairy sectors, and increasing adoption of cost-efficient and high-protein feed solutions

- The Corn segment held the largest market revenue share in 2024, driven by its wide availability, high protein content, and cost-effectiveness for livestock feed. Corn-based DDGS is highly preferred in both developed and emerging regions due to its consistent nutrient profile and ease of incorporation into feed formulations

Report Scope and Distiller’s Dried Grains with Solubles (DDGS) Feed Market Segmentation

|

Attributes |

Distiller’s Dried Grains with Solubles (DDGS) Feed Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Distiller’s Dried Grains with Solubles (DDGS) Feed Market Trends

“Increasing Adoption of DDGS as Sustainable High-Protein Livestock Feed”

- The growing use of distiller’s dried grains with solubles (DDGS) is transforming the livestock feed industry by providing a high-protein, cost-effective alternative to traditional feed. Its nutrient-rich composition supports improved animal growth, health, and productivity, particularly in large-scale farming operations. DDGS also contributes to environmental sustainability by reducing feed waste and lowering reliance on conventional protein sources

- The rising demand for sustainable feed ingredients in emerging and under-resourced regions is accelerating the adoption of DDGS in poultry, cattle, and aquaculture feed formulations. The ease of storage, transport, and integration into feed blends makes DDGS a practical option for farmers with limited access to conventional feed sources. This trend is further strengthened by growing awareness of animal nutrition and efficiency-focused farming practices

- DDGS feed is increasingly preferred due to its affordability compared to conventional feed ingredients, allowing farmers to maintain nutritional balance while managing costs. Regular incorporation of DDGS into livestock diets enhances feed efficiency and overall herd and flock performance. In addition, its consistent protein and energy content helps reduce supplemental feed costs and improve farm profitability

- For instance, in 2023, several feed mills across the U.S. Midwest reported improved feed conversion ratios and reduced feed costs after incorporating DDGS into cattle and poultry rations, highlighting both economic and productivity benefits. The adoption also contributed to reduced reliance on imported protein sources, further strengthening local feed supply chains

- While DDGS adoption is accelerating, its impact depends on supply consistency, nutritional standardization, and regulatory compliance. Producers must focus on quality assurance, logistics optimization, and tailored feed formulations to fully capitalize on market demand. Efforts in certification, traceability, and proper storage are increasingly becoming critical to ensure product integrity and farmer confidence

Distiller’s Dried Grains with Solubles (DDGS) Feed Market Dynamics

Driver

“Rising Global Demand for Cost-Effective, High-Protein Livestock Feed”

- Increasing global meat, dairy, and poultry consumption is driving demand for affordable, nutrient-rich feed options such as DDGS. Farmers are seeking efficient feed solutions that support growth, production, and profitability, accelerating DDGS adoption across multiple livestock sectors. This trend is particularly strong in regions with rapidly expanding animal farming industries

- DDGS is particularly attractive in regions with growing ethanol production, as it provides a sustainable byproduct from biofuel operations. The integration of DDGS into feed helps meet protein requirements while reducing reliance on conventional soy- or corn-based feeds. Its dual benefit of being a renewable byproduct and a high-protein feed ingredient encourages wider adoption among environmentally conscious farmers

- Government incentives promoting sustainable agriculture and renewable energy production indirectly support DDGS availability and utilization, encouraging feed manufacturers to incorporate it into formulations. Policy support, subsidies, and initiatives to optimize ethanol co-product use further strengthen the market by making DDGS more accessible and cost-effective for livestock producers

- For instance, in 2022, U.S. ethanol plants increased DDGS production to supply regional feed mills, improving feed affordability and consistency for livestock operations while enhancing the sustainability of ethanol co-products. This move helped stabilize feed costs, improve nutrient availability, and reduce dependency on traditional protein feeds

- While the protein-rich feed drives market growth, challenges in storage, transportation, and quality consistency remain. Market players must invest in supply chain optimization, standardization, and farmer education for sustained adoption. In addition, innovations in pelletization, moisture control, and packaging can further expand the usability and shelf-life of DDGS

Restraint/Challenge

“Price Volatility, Quality Inconsistencies, and Supply Chain Limitations”

- Fluctuations in raw material costs and ethanol production outputs can impact DDGS pricing and availability, creating uncertainty for livestock producers who rely on consistent feed supply. Price volatility remains a key barrier to widespread adoption. Seasonal changes, energy prices, and competition for grains add further instability, making long-term planning difficult for feed manufacturers and farmers

- Variability in nutrient composition across different DDGS batches can affect feed formulation, requiring additional testing and quality control measures to ensure livestock performance targets are met. Inconsistent quality may limit confidence among farmers. Producers are increasingly investing in standardized processing and blending techniques to reduce nutrient variability and enhance product reliability

- Supply chain challenges, including storage, transport, and regional accessibility, can restrict timely delivery of DDGS to remote or underdeveloped farming regions. Inadequate infrastructure may result in feed spoilage or reduced nutritional value. Cold storage limitations, poor road connectivity, and fragmented distribution networks further exacerbate supply chain inefficiencies in certain regions

- For instance, in 2023, several feed mills in Sub-Saharan Africa reported intermittent DDGS supply due to transportation and storage limitations, highlighting logistical constraints affecting market penetration. This impacted livestock productivity and forced farmers to revert temporarily to conventional feed sources, affecting operational costs

- While DDGS feed remains a sustainable and high-protein solution, addressing cost stability, quality standardization, and supply chain efficiency is crucial. Stakeholders must focus on process optimization, local sourcing, and education to unlock long-term growth potential. Emphasis on cold chain logistics, digital tracking, and regional partnerships can further enhance distribution efficiency and farmer trust

Distiller’s Dried Grains with Solubles (DDGS) Feed Market Scope

The market is segmented on the basis of type and animal type.

• By Type

On the basis of type, the DDGS feed market is segmented into Corn, Wheat, Rice, Blended Grains, and Other Types. The Corn segment held the largest market revenue share in 2024, driven by its wide availability, high protein content, and cost-effectiveness for livestock feed. Corn-based DDGS is highly preferred in both developed and emerging regions due to its consistent nutrient profile and ease of incorporation into feed formulations.

The Blended Grains segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its enhanced nutritional balance and adaptability for various livestock species. Blended grain DDGS allows feed manufacturers to optimize protein, fiber, and energy levels, making it a flexible and efficient feed solution for dairy, poultry, and swine operations.

• By Animal Type

On the basis of animal type, the DDGS feed market is segmented into Dairy Cattle, Beef Cattle, Swine, Poultry, and Other Animal Types. The Dairy Cattle segment accounted for the largest revenue share in 2024 due to the high demand for protein-rich feed to improve milk yield and overall herd health.

The Poultry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing adoption of DDGS in broiler and layer feed formulations. Poultry farmers are increasingly integrating DDGS to enhance feed efficiency, reduce costs, and support rapid growth in large-scale poultry production systems.

Distiller’s Dried Grains with Solubles (DDGS) Feed Market Regional Analysis

- North America dominated the DDGS feed market with the largest revenue share of 38.5% in 2024, driven by the rising demand for high-protein, cost-effective livestock feed and well-established livestock farming infrastructure

- Farmers and feed manufacturers in the region highly value the nutritional benefits, affordability, and ease of integrating DDGS into feed formulations for cattle, poultry, and swine

- This widespread adoption is further supported by technological advancements in feed processing, strong ethanol production, and government incentives promoting sustainable livestock nutrition

U.S. DDGS Feed Market Insight

The U.S. DDGS feed market captured the largest revenue share in 2024 within North America, fueled by the country’s strong ethanol industry and the high availability of DDGS as a byproduct. Livestock producers are increasingly prioritizing protein-rich feed options to enhance growth performance and feed efficiency. The integration of DDGS into commercial feed mills and on-farm feed programs is further driving market expansion, alongside innovations in feed formulation and storage technologies.

Europe DDGS Feed Market Insight

The Europe DDGS feed market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by the demand for sustainable, alternative feed ingredients and rising protein requirements for livestock. The increase in livestock production, coupled with strict feed quality regulations, is fostering DDGS adoption. European farmers are also adopting DDGS to reduce feed costs while maintaining animal performance and nutritional standards across cattle, poultry, and swine operations.

U.K. DDGS Feed Market Insight

The U.K. DDGS feed market is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising need for cost-effective, high-protein feed and the adoption of sustainable livestock nutrition practices. The demand is particularly high among dairy and poultry producers seeking to optimize feed conversion ratios. The country’s robust feed manufacturing sector and growing awareness of feed efficiency benefits are further stimulating market growth.

Germany DDGS Feed Market Insight

The Germany DDGS feed market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the increasing livestock population and the emphasis on sustainable feed ingredients. Germany’s well-developed livestock sector, combined with feed quality standards and research initiatives, promotes DDGS adoption in dairy, beef, and poultry feed. Regular use of DDGS is improving feed efficiency and reducing dependence on conventional protein sources.

Asia-Pacific DDGS Feed Market Insight

The Asia-Pacific DDGS feed market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for animal protein, growing livestock farming, and expanding ethanol production in countries such as China, India, and Japan. Government initiatives promoting sustainable agriculture and feed optimization are accelerating DDGS adoption. Furthermore, the region’s increasing livestock population and cost-sensitive feed requirements are expanding the use of DDGS in both large-scale commercial and smallholder farms.

Japan DDGS Feed Market Insight

The Japan DDGS feed market is expected to witness the fastest growth rate from 2025 to 2032 due to high demand for protein-rich feed for cattle, poultry, and swine. The country’s focus on efficient livestock production and quality meat output drives the adoption of DDGS. Integration with feed formulations for dairy and beef cattle, along with technological support for feed storage and mixing, is fueling market growth.

China DDGS Feed Market Insight

The China DDGS feed market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s growing livestock population, rapid urbanization, and rising demand for affordable, high-protein feed. China’s ethanol industry produces a substantial volume of DDGS, making it a key ingredient for poultry, swine, and cattle feed. Efforts to enhance livestock productivity and sustainable feed practices, alongside domestic DDGS manufacturing capabilities, are propelling market expansion.

Distiller’s Dried Grains with Solubles (DDGS) Feed Market Share

The Distiller’s Dried Grains with Solubles (DDGS) Feed industry is primarily led by well-established companies, including:

- Green Plains Inc. (U.S.)

- Archer Daniels Midland Company (ADM) (U.S.)

- Cargill, Incorporated (U.S.)

- POET, LLC (U.S.)

- Louis Dreyfus Company (Netherlands)

- Fylfot Geoworks (India)

- Tereos SA (France)

- Bunge Limited (U.S.)

- Green Biologics Ltd. (U.K.)

- Southwest Iowa Renewable Energy (SIRE) (U.S.)

Latest Developments in Distiller’s Dried Grains with Solubles (DDGS) Feed Market

- In January 2025, Green Plains Inc. announced a major development in its Tallgrass carbon capture and sequestration project in Nebraska, securing all rights-of-way for laterals and obtaining Class VI sequestration well permits. The project is set to permanently sequester approximately 800,000 tons of biogenic CO2 annually from its Central City, Wood River, and York facilities. This initiative enables the company to participate in 45Z Clean Fuel Production Credits and low-carbon fuel markets, promoting sustainable ethanol production and strengthening the market for environmentally friendly DDGS feed by supporting low-carbon certification and demand

- In October 2024, ADM launched its Digital Grain Elevator's FOB Ag Logistics Platform to optimize grain transportation and delivery operations. The platform provides real-time delivery tracking, simplified dispatching, and automated invoicing, enhancing operational efficiency and supply chain transparency. This innovation supports consistent DDGS product sourcing, reduces delays, and strengthens traceability, thereby improving reliability for feed manufacturers and livestock producers

- In October 2022, Fylfot Geoworks established an ethanol production plant in Haryana, India, with a daily capacity of 100 kiloliters. The facility produces DDGS as a byproduct, addressing the growing demand for sustainable, high-protein livestock feed in the region. This development not only boosts local feed supply but also supports the expansion of the Indian DDGS feed market by providing an affordable, nutrient-rich feed alternative for poultry, cattle, and swine operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.