Global Distributed Acoustic Sensing Market

Market Size in USD Billion

CAGR :

%

USD

2.71 Billion

USD

7.46 Billion

2025

2033

USD

2.71 Billion

USD

7.46 Billion

2025

2033

| 2026 –2033 | |

| USD 2.71 Billion | |

| USD 7.46 Billion | |

|

|

|

|

Distributed Acoustic Sensing Market Size

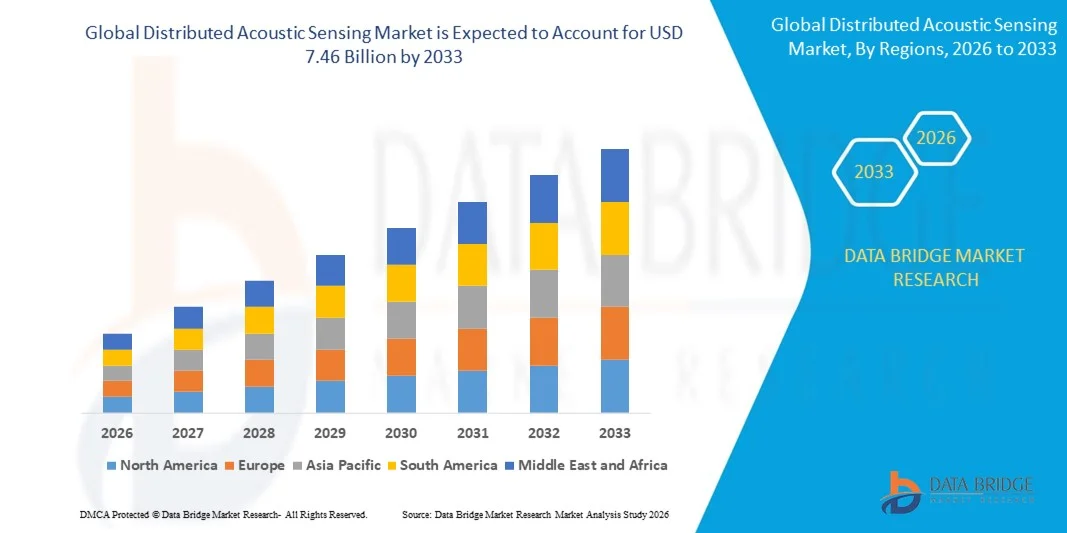

- The global distributed acoustic sensing market size was valued at USD 2.71 billion in 2025 and is expected to reach USD 7.46 billion by 2033, at a CAGR of 13.49% during the forecast period

- The market growth is largely fuelled by the increasing adoption of fiber optic sensing technologies for real-time monitoring across oil & gas, transportation, and utility sectors

- Rising demand for enhanced safety, operational efficiency, and predictive maintenance solutions is further driving market expansion

Distributed Acoustic Sensing Market Analysis

- Distributed acoustic sensing offers real-time, continuous monitoring capabilities, enabling early detection of faults, leaks, and unauthorized activities along pipelines and transportation networks

- Technological advancements, such as integration with AI and IoT platforms, are enhancing the accuracy and reliability of sensing systems, supporting widespread adoption across multiple industries

- North America dominated the distributed acoustic sensing market with the largest revenue share of 38.47% in 2025, driven by the increasing deployment of monitoring solutions across oil and gas pipelines, power grids, and transportation networks

- Asia-Pacific region is expected to witness the highest growth rate in the global distributed acoustic sensing market, driven by increasing infrastructure development, government initiatives for smart cities, rising investments in transportation and energy sectors, and growing awareness of safety and operational efficiency benefits

- The Hardware segment held the largest market revenue share in 2025, driven by the increasing deployment of fiber optic cables, interrogators, and sensor devices across oil and gas pipelines, power grids, and transportation infrastructure. Hardware systems form the backbone of DAS solutions, enabling real-time monitoring, data collection, and anomaly detection across critical assets

Report Scope and Distributed Acoustic Sensing Market Segmentation

|

Attributes |

Distributed Acoustic Sensing Key Market Insights |

|

Segments Covered |

• By Component: Hardware, Visualization Software, and Services |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Distributed Acoustic Sensing Market Trends

Rise of Real-Time Monitoring in Critical Infrastructure

- The growing adoption of distributed acoustic sensing (DAS) technology is transforming infrastructure monitoring by enabling continuous, real-time detection of vibrations, leaks, and structural anomalies. The ability to monitor pipelines, railways, and industrial equipment in real time helps prevent costly downtime, enhance safety, and reduce maintenance expenses. DAS systems also provide predictive maintenance insights, allowing operators to proactively address potential failures before they escalate into critical issues

- Increasing demand for remote and wide-area monitoring is accelerating the deployment of DAS systems across oil and gas pipelines, power grids, and transportation networks. These systems provide extensive coverage with minimal personnel, making them especially effective in challenging or hazardous environments. In addition, they reduce human exposure to dangerous work sites and help organizations meet strict safety and regulatory compliance requirements

- The affordability and scalability of modern DAS solutions are making them attractive for both large enterprises and small-to-medium operators. Users benefit from reduced operational risks, early threat detection, and simplified data collection and analysis. Integration with advanced analytics platforms and IoT systems further enhances the ability to optimize asset performance and operational efficiency

- For instance, in 2023, several oil and gas companies in North America implemented DAS systems along long-distance pipelines, reporting faster detection of leaks, reduced operational losses, and enhanced safety measures for employees and surrounding communities. Operators also noted improvements in regulatory reporting, risk mitigation, and maintenance planning through real-time data insights

- While DAS technology is advancing rapidly, its impact depends on continued sensor innovation, data analysis capabilities, and ease of integration. Manufacturers must focus on robust, high-resolution, and cost-effective systems to fully capitalize on growing demand. Collaboration with software providers to improve visualization, alarm management, and predictive analytics remains key for long-term adoption

Distributed Acoustic Sensing Market Dynamics

Driver

Growing Need for Continuous, Real-Time Monitoring in Critical Industries

- The increasing emphasis on safety, operational efficiency, and risk mitigation is driving adoption of DAS technology in oil and gas, power, transportation, and infrastructure sectors. Continuous monitoring ensures timely detection of anomalies, minimizing downtime and losses. Advanced DAS solutions also facilitate predictive maintenance, helping reduce unplanned shutdowns and associated operational costs

- Enterprises are becoming increasingly aware of the operational and financial benefits of DAS systems, including reduced maintenance costs, enhanced reliability, and extended equipment lifespan. This awareness is boosting adoption across multiple industries. Companies are leveraging DAS data to improve decision-making, optimize workforce allocation, and increase asset utilization rates

- Regulatory compliance and government initiatives for infrastructure monitoring are encouraging investment in advanced DAS solutions. Many industries require real-time monitoring to meet safety and environmental standards, further driving market growth. Incentives for adopting innovative monitoring technologies are also motivating early adoption and modernization of existing assets

- For instance, in 2022, several European pipeline operators installed DAS systems to comply with stricter safety and environmental regulations, improving leak detection and operational efficiency. Operators reported enhanced monitoring capabilities, timely maintenance interventions, and better resource allocation, reinforcing the strategic value of DAS investments

- While rising awareness and regulatory support are driving growth, there remains a need for improved data analytics, sensor accuracy, and system integration to sustain market expansion. Partnerships with technology providers and ongoing R&D investments are essential to create next-generation, high-resolution DAS systems that meet the evolving demands of critical industries

Restraint/Challenge

High Equipment Costs and Technical Complexity Limiting Adoption

- The high capital investment required for advanced DAS systems, including fiber optic cables, interrogators, and software, limits accessibility for small and mid-sized operators. Cost remains a significant barrier for widespread adoption. In addition, the long payback period and upfront infrastructure requirements can deter investment despite potential long-term benefits

- In many regions, a shortage of trained personnel and technical support restricts effective implementation. Improper handling or installation can reduce system accuracy, delay detection, and increase maintenance requirements. Operators often require specialized training programs and ongoing technical assistance to maximize system performance and reliability

- Limited availability of high-quality fiber optic components and connectivity solutions in remote or underdeveloped areas further constrains market penetration. Many operators continue to rely on conventional monitoring methods, which are less efficient and more labor-intensive. Supply chain disruptions and regional logistical challenges can exacerbate delays in deployment and scaling of DAS systems

- For instance, in 2023, several transport and utility companies in Asia-Pacific delayed DAS deployments due to high equipment costs and insufficient technical expertise. These challenges affected project timelines, limited real-time monitoring capabilities, and highlighted the need for modular and easy-to-deploy solutions in emerging markets

- While technology continues to advance, addressing cost, complexity, and skill gaps remains critical. Market stakeholders must focus on modular, user-friendly, and scalable solutions to maximize adoption and long-term market potential. Collaboration with training providers, technology integrators, and local partners is vital to overcome barriers and expand the global DAS market

Distributed Acoustic Sensing Market Scope

The market is segmented on the basis of component, fiber type, application, and end user

- By Component

On the basis of component, the distributed acoustic sensing market is segmented into Hardware, Visualization Software, and Services. The Hardware segment held the largest market revenue share in 2025, driven by the increasing deployment of fiber optic cables, interrogators, and sensor devices across oil and gas pipelines, power grids, and transportation infrastructure. Hardware systems form the backbone of DAS solutions, enabling real-time monitoring, data collection, and anomaly detection across critical assets.

The Visualization Software segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the need for advanced analytics, intuitive dashboards, and data interpretation tools. Visualization software allows operators to quickly analyze acoustic signals, detect potential issues, and make informed maintenance and operational decisions, enhancing safety and reducing downtime.

- By Fiber Type

On the basis of fiber type, the market is segmented into Single Mode Fiber and Multimode Fibers. The Single Mode Fiber segment held the largest market revenue share in 2025, attributed to its long-distance transmission capabilities, higher accuracy, and lower signal attenuation. Single mode fibers are widely used in pipeline monitoring, cross-well analysis, and long-range transportation networks.

The Multimode Fiber segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its cost-effectiveness, ease of deployment, and suitability for short- to medium-range monitoring applications. Multimode fibers are gaining popularity for industrial facilities, urban infrastructure monitoring, and other localized deployments where high resolution is still required.

- By Application

On the basis of application, the market is segmented into Injection Flow, Production Flow, Wellbore Integrity Monitoring, Cross Well Analysis, Transport Tracking and Health Monitoring, and Others. The Wellbore Integrity Monitoring segment held the largest revenue share in 2025, fueled by the increasing need to prevent leaks, optimize production, and ensure safety in oil and gas operations. DAS enables early detection of structural anomalies, reducing maintenance costs and operational risks.

The Transport Tracking and Health Monitoring segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising demand for real-time monitoring of railways, pipelines, and industrial equipment. Continuous acoustic monitoring enhances predictive maintenance, asset utilization, and operational efficiency in transportation and logistics sectors.

- By End User

On the basis of end user, the market is segmented into Oil and Gas, Power and Utility, Security and Surveillance, Environmental and Infrastructure, Transportation, and Other. The Oil and Gas segment held the largest market revenue share in 2025, owing to the widespread adoption of DAS for pipeline monitoring, leak detection, and safety compliance across upstream and midstream operations.

The Power and Utility segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing investments in smart grids, renewable energy infrastructure, and high-voltage transmission networks. DAS solutions help prevent equipment failures, improve grid reliability, and support real-time monitoring for critical energy assets.

Distributed Acoustic Sensing Market Regional Analysis

- North America dominated the distributed acoustic sensing market with the largest revenue share of 38.47% in 2025, driven by the increasing deployment of monitoring solutions across oil and gas pipelines, power grids, and transportation networks

- Enterprises in the region highly value the ability of DAS systems to provide continuous, real-time monitoring, early threat detection, and operational efficiency, making them a preferred choice for critical infrastructure applications

- This widespread adoption is further supported by advanced technological infrastructure, high capital investment capability, and regulatory requirements for safety and environmental compliance, establishing DAS as a critical monitoring solution across industries

U.S. Distributed Acoustic Sensing Market Insight

The U.S. distributed acoustic sensing market captured the largest revenue share in 2025 within North America, fueled by extensive adoption in oil and gas, utilities, and transportation sectors. Companies are increasingly prioritizing continuous monitoring for leak detection, structural integrity, and equipment performance. The rising integration of DAS with advanced analytics and remote monitoring platforms further propels market expansion. Moreover, government regulations and industrial safety standards are driving investments in real-time monitoring technologies, boosting adoption of DAS solutions.

Europe Distributed Acoustic Sensing Market Insight

The Europe distributed acoustic sensing market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by stringent safety and environmental regulations and the rising demand for advanced infrastructure monitoring. Increasing urbanization and industrialization are fostering adoption across pipelines, railways, and energy networks. European operators are also motivated by operational efficiency and cost savings offered by DAS systems. The region is experiencing significant growth in both new infrastructure projects and retrofitting of existing assets with DAS technology.

U.K. Distributed Acoustic Sensing Market Insight

The U.K. distributed acoustic sensing market is expected to witness rapid growth from 2026 to 2033, driven by government initiatives for infrastructure safety, rising adoption in oil and gas pipelines, and the growing focus on operational efficiency. Companies are investing in DAS solutions for continuous monitoring and predictive maintenance. Concerns about environmental safety, regulatory compliance, and industrial risk mitigation are further encouraging adoption of real-time sensing technologies.

Germany Distributed Acoustic Sensing Market Insight

The Germany distributed acoustic sensing market is expected to witness robust growth from 2026 to 2033, fueled by the country’s strong industrial base, emphasis on safety, and adoption of advanced technologies. DAS systems are increasingly deployed for monitoring pipelines, railways, and critical industrial infrastructure. Integration with analytics platforms and automation solutions is becoming common, supporting predictive maintenance and reducing operational risks. The demand for energy-efficient and scalable monitoring solutions further contributes to market expansion.

Asia-Pacific Distributed Acoustic Sensing Market Insight

The Asia-Pacific distributed acoustic sensing market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, urbanization, and technological advancements in countries such as China, Japan, and India. Governments are promoting advanced monitoring solutions for energy, transportation, and critical infrastructure. The region’s growing manufacturing capability for DAS components also makes solutions more affordable and accessible to a wider customer base.

Japan Distributed Acoustic Sensing Market Insight

The Japan distributed acoustic sensing market is expected to witness strong growth from 2026 to 2033 due to the country’s high adoption of advanced technologies, extensive infrastructure networks, and focus on industrial safety. DAS systems are increasingly integrated with IoT-based analytics and automation platforms to enhance predictive maintenance and operational efficiency. The aging workforce also supports adoption of automated monitoring solutions for safer and more reliable infrastructure management.

China Distributed Acoustic Sensing Market Insight

The China distributed acoustic sensing market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to rapid industrial growth, extensive pipeline and railway networks, and strong government initiatives for smart and safe infrastructure. Widespread adoption of DAS in oil, gas, and power sectors, along with growing domestic manufacturing of components, is driving market growth. The focus on real-time monitoring, predictive maintenance, and infrastructure security further accelerates demand across commercial and industrial applications.

Distributed Acoustic Sensing Market Share

The Distributed Acoustic Sensing industry is primarily led by well-established companies, including:

• Banweaver (U.S.)

• Fotech Solutions (U.K.)

• OptaSense Ltd (U.K.)

• Future Fibre Technologies (Australia)

• Halliburton (U.S.)

• Hifi Engineering (India)

• Omnisens (Switzerland)

• OPTROMIX (Germany)

• AP Sensing (Germany)

• fibrisTerre Systems GmbH (Germany)

• Schlumberger Limited (U.S.)

• Baker Hughes Company (U.S.)

• Silixa Ltd (U.K.)

• OFS Fitel, LLC (U.S.)

• Proximion AB (Sweden)

• Lumenci Inc. (U.S.)

• Fiber Optic Sensing Association (U.S.)

• Ziebel (U.K.)

Latest Developments in Global Distributed Acoustic Sensing Market

- In April 2024, NASA announced the deployment of Distributed Acoustic Sensing (DAS) systems to monitor lunar seismic activity, enabling precise detection of moonquakes. This initiative aims to enhance scientific understanding of the Moon’s internal structure and geological behavior, supporting future lunar exploration missions. The adoption of DAS technology in space applications demonstrates its versatility and opens opportunities for advanced monitoring in extreme and remote environments, potentially driving broader interest and investment in high-resolution fiber optic sensing solution

- In December 2023, Luna Innovations completed the acquisition of Silixa, a U.K.-based fiber optic sensing solutions provider, to strengthen its DAS technology offerings. This strategic move is expected to enhance Luna’s capabilities in high-precision monitoring for oil and gas, infrastructure, and transportation sectors. The integration of Silixa’s expertise and technologies expands market reach, improves service offerings, and positions Luna Innovations as a leading provider of advanced DAS solutions globally, driving adoption across critical infrastructure monitoring application

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Distributed Acoustic Sensing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Distributed Acoustic Sensing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Distributed Acoustic Sensing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.