Global Distributed Temperature Sensing Market

Market Size in USD Million

CAGR :

%

USD

770.00 Million

USD

1,352.57 Million

2024

2032

USD

770.00 Million

USD

1,352.57 Million

2024

2032

| 2025 –2032 | |

| USD 770.00 Million | |

| USD 1,352.57 Million | |

|

|

|

|

Distributed Temperature Sensing Market Size

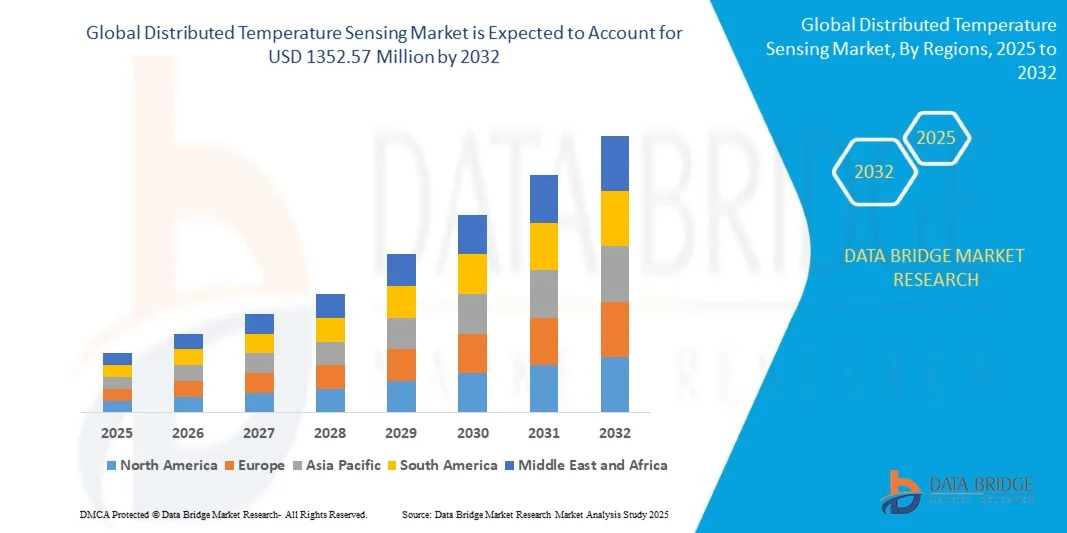

- The global distributed temperature sensing market size was valued at USD 770 million in 2024 and is expected to reach USD 1352.57 million by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely fueled by the increasing deployment of fiber-optic sensing technologies across industries such as oil and gas, power, and environmental monitoring, driven by the need for precise, real-time temperature measurement and safety assurance in critical infrastructure

- Furthermore, growing emphasis on asset integrity, predictive maintenance, and early fault detection is accelerating the adoption of distributed temperature sensing systems in industrial and energy applications, thereby significantly enhancing the market’s expansion

Distributed Temperature Sensing Market Analysis

- Distributed temperature sensing (DTS) systems utilize optical fibers to measure temperature variations along their length, providing continuous, real-time thermal profiles across pipelines, power cables, and structural systems. These sensors are highly valued for their accuracy, durability, and ability to function in harsh environments where traditional sensors are ineffective

- The rising demand for DTS technology is primarily driven by its ability to enhance safety, reduce downtime, and optimize operational efficiency across industries. As companies increasingly focus on digital monitoring, automation, and environmental compliance, DTS solutions are becoming integral to modern industrial monitoring and energy management systems

- North America dominated the distributed temperature sensing market with a share of 33.3% in 2024, due to the increasing adoption of advanced monitoring technologies in oil and gas, power, and industrial sectors

- Asia-Pacific is expected to be the fastest growing region in the distributed temperature sensing market during the forecast period due to rapid industrialization, expansion of oil and gas networks, and infrastructure modernization across China, Japan, and India

- Optical Time Domain Reflectometry (OTDR) segment dominated the market with a market share of 79.2% in 2024, due to its wide adoption across oil and gas, power, and pipeline monitoring applications. OTDR-based systems offer long-distance sensing capabilities, cost-effectiveness, and proven reliability in harsh industrial environments. Their ability to detect temperature changes along extended fiber lengths makes them suitable for real-time asset monitoring, leakage detection, and safety assurance in large-scale infrastructure. The technology’s maturity and ease of integration with existing fiber networks further strengthen its market dominance

Report Scope and Distributed Temperature Sensing Market Segmentation

|

Attributes |

Distributed Temperature Sensing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Distributed Temperature Sensing Market Trends

“Integration of AI and IoT in Fiber-Optic Sensing Systems”

- The integration of artificial intelligence (AI) and the Internet of Things (IoT) in distributed temperature sensing (DTS) systems is transforming real-time temperature monitoring across industrial applications. By combining these technologies, DTS systems can provide predictive insights, automated anomaly detection, and efficient asset management, resulting in improved operational reliability and safety in critical infrastructure environments

- For instance, companies such as Halliburton and Schlumberger have begun implementing AI-powered fiber-optic monitoring solutions to enhance the performance of oil wells and pipelines. These systems use IoT connectivity and machine learning algorithms to detect minute temperature fluctuations, allowing early identification of potential leaks or flow disturbances

- AI algorithms integrated within DTS networks enable continuous learning from vast temperature data streams and pattern recognition to optimize system performance. This supports predictive maintenance operations, where temperature anomalies can trigger automated alerts before faults occur, reducing downtime and associated costs across energy and industrial facilities

- The integration of IoT enhances the remote accessibility and management of DTS systems, enabling operators to monitor assets from centralized control centers across multiple sites. Such smart connectivity provides end-to-end visibility into temperature profiles, pressure variations, and system health in real time through cloud-enabled analytics platforms

- In sectors such as power transmission, chemical processing, and environmental monitoring, combining AI and IoT in DTS technologies is expanding data-driven operational decision-making. Companies are increasingly adopting connected sensing infrastructures that enable intelligent temperature mapping, enhancing asset protection and reliability across extended geographic networks

- The rising convergence of AI analytics and IoT-enabled fiber-optic networks in DTS solutions is revolutionizing industrial temperature monitoring. This integration is setting new performance benchmarks, enhancing safety standards, and driving innovation toward autonomous, self-adaptive temperature sensing systems globally

Distributed Temperature Sensing Market Dynamics

Driver

“Rising Demand for Real-Time Monitoring in Oil and Gas Operations”

- The increasing deployment of distributed temperature sensing systems in oil and gas operations is driven by the growing need for real-time monitoring of wells, pipelines, and reservoirs. DTS systems offer critical insights into thermal variations that directly affect production efficiency and equipment integrity, helping operators maximize output while minimizing safety risks

- For instance, Schlumberger Limited has implemented advanced DTS solutions to enhance thermal monitoring during hydraulic fracturing operations. Using fiber-optic cables embedded along wellbores, the company obtains continuous temperature data to optimize flow distribution and detect irregularities during fluid injection or production cycles

- The oil and gas industry's focus on preventive maintenance and operational efficiency under extreme environmental conditions has made DTS an indispensable tool. It enables early detection of leaks, blockages, or temperature changes that could compromise system stability or lead to costly shutdowns

- In addition, the integration of DTS with supervisory control and data acquisition (SCADA) systems allows oilfield operators to monitor and manage operations from remote centers. This real-time connectivity reduces human intervention and enhances safety compliance through immediate response to critical thermal deviations

- The increasing global investment in energy infrastructure modernization and enhanced well integrity programs is projected to continue driving the demand for DTS systems. As oil and gas companies pursue digital transformation, the adoption of intelligent thermal monitoring will remain a cornerstone of operational excellence and safety assurance

Restraint/Challenge

“High Installation and Maintenance Costs”

- One of the major restraints hindering the widespread adoption of distributed temperature sensing systems is their high installation and maintenance cost. The deployment process involves the integration of specialized fiber-optic cables, sophisticated interrogator units, and durable protective housings, all of which add to significant upfront expenditure

- For instance, companies such as Yokogawa Electric Corporation and AP Sensing GmbH face challenges when deploying extensive fiber-optic networks across long-distance infrastructures such as oil pipelines and power cables. The cost of installation, calibration, and periodic maintenance often acts as a limiting factor for small- and mid-sized enterprises in adopting DTS technologies

- The installation of DTS systems in harsh and inaccessible environments, such as offshore rigs and deep wells, demands robust designs and extensive safety measures. These factors contribute to the overall project cost and extend deployment timelines, impacting return on investment for many operators

- In addition, maintenance activities such as recalibration, fiber replacement, or cleaning can incur recurring costs and operational downtime. For industries where continuous temperature monitoring is critical, these interruptions can influence long-term efficiency and profitability

- Overcoming the cost-related challenges through advancements in fiber technology, modular installation methods, and cloud-based monitoring architectures will be essential for broader adoption. As technological innovations improve cost-efficiency, the DTS market is expected to expand sustainably across energy, utility, and industrial domains

Distributed Temperature Sensing Market Scope

The market is segmented on the basis of operating principle, fiber, and application.

• By Operating Principle

On the basis of operating principle, the distributed temperature sensing market is segmented into Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR). The OTDR segment dominated the largest market revenue share of 79.2% in 2024, attributed to its wide adoption across oil and gas, power, and pipeline monitoring applications. OTDR-based systems offer long-distance sensing capabilities, cost-effectiveness, and proven reliability in harsh industrial environments. Their ability to detect temperature changes along extended fiber lengths makes them suitable for real-time asset monitoring, leakage detection, and safety assurance in large-scale infrastructure. The technology’s maturity and ease of integration with existing fiber networks further strengthen its market dominance.

The OFDR segment is projected to witness the fastest growth rate from 2025 to 2032, driven by its superior spatial resolution and precision in short-range applications. OFDR technology enables highly detailed temperature profiling, making it ideal for advanced applications such as structural health monitoring, aerospace, and industrial process optimization. As industries increasingly adopt high-performance sensing systems for accurate thermal analysis and fault localization, demand for OFDR-based solutions is expected to surge. The growing use of high-resolution monitoring in renewable energy and smart grid systems also supports this segment’s rapid growth.

• By Fiber

On the basis of fiber, the distributed temperature sensing market is categorized into single-mode fiber and multi-mode fiber. The single-mode fiber segment accounted for the largest market share in 2024, primarily due to its suitability for long-distance sensing applications and high signal accuracy. Single-mode fibers provide low signal attenuation, making them ideal for monitoring pipelines, oil wells, and power cables over several kilometers. Their compatibility with OTDR-based systems and cost-effectiveness in extensive network setups drive their widespread use. The increasing adoption of single-mode fibers in energy and infrastructure projects reinforces their dominant position in the market.

The multi-mode fiber segment is anticipated to register the fastest growth rate during 2025–2032, supported by its efficiency in short-range and high-resolution applications. Multi-mode fibers are widely preferred for laboratory testing, building monitoring, and fire detection systems where shorter sensing distances are required. The fiber’s larger core size allows for simplified installation and reduced equipment costs in controlled environments. As demand rises for precise thermal monitoring in compact industrial setups and data centers, multi-mode fiber-based sensing systems are expected to gain notable traction.

• By Application

On the basis of application, the distributed temperature sensing market is segmented into oil and gas, power cable monitoring, fire detection, process & pipeline monitoring, environmental monitoring, and others. The oil and gas segment held the dominant revenue share in 2024, owing to extensive utilization of DTS systems for wellbore monitoring, leak detection, and reservoir management. Continuous temperature profiling enhances operational efficiency, ensures safety, and minimizes environmental risks. The technology’s reliability under high pressure and temperature conditions positions it as a critical tool for optimizing exploration and production processes across upstream and midstream operations.

The power cable monitoring segment is expected to witness the fastest growth during 2025–2032, driven by the rising need for efficient thermal management and fault detection in underground and submarine power cables. DTS technology enables real-time monitoring of temperature variations along the cable length, preventing overheating and reducing maintenance downtime. Growing investments in smart grid infrastructure and renewable energy integration further propel demand for temperature sensing solutions in power transmission systems. The increasing focus on grid reliability and safety compliance across utilities strengthens this segment’s growth potential.

Distributed Temperature Sensing Market Regional Analysis

- North America dominated the distributed temperature sensing market with the largest revenue share of 33.3% in 2024, driven by the increasing adoption of advanced monitoring technologies in oil and gas, power, and industrial sectors

- The region’s strong focus on infrastructure safety, regulatory compliance, and operational efficiency continues to support DTS deployment across pipelines and power grids\

- The presence of key technology providers and widespread investment in fiber-optic sensing infrastructure further strengthen the regional market growth

U.S. Distributed Temperature Sensing Market Insight

The U.S. distributed temperature sensing market captured the largest share within North America in 2024, owing to extensive utilization in upstream and midstream oil and gas operations. The need for continuous temperature monitoring in drilling, wellbore analysis, and leakage detection is driving adoption. Furthermore, rising investments in renewable energy and smart grid projects are boosting DTS installations for power cable and environmental monitoring. The strong presence of major service providers and technological advancements in optical sensing support sustained market expansion.

Europe Distributed Temperature Sensing Market Insight

The Europe distributed temperature sensing market is projected to expand at a notable CAGR during the forecast period, fueled by the growing emphasis on energy efficiency, industrial safety, and environmental monitoring. Stringent government regulations mandating leak detection and cable integrity checks across industries such as oil and gas and power are driving adoption. The region’s strong technological base and focus on smart infrastructure integration contribute to a steady rise in DTS applications across both industrial and environmental domains.

U.K. Distributed Temperature Sensing Market Insight

The U.K. distributed temperature sensing market is expected to witness considerable growth, supported by investments in offshore energy, pipeline safety, and renewable power transmission networks. The country’s shift toward low-carbon energy solutions and enhanced monitoring systems to ensure operational safety across subsea and onshore assets are key market drivers. Rising adoption in utilities and environmental surveillance further contributes to the market’s expansion.

Germany Distributed Temperature Sensing Market Insight

The Germany distributed temperature sensing market is set to grow at a significant pace during the forecast period, underpinned by its strong industrial base and focus on process automation. The technology’s integration into manufacturing and energy infrastructure supports Germany’s sustainability and efficiency goals. Increasing use in industrial process control, chemical plants, and high-voltage power cable systems strengthens market development in the country.

Asia-Pacific Distributed Temperature Sensing Market Insight

The Asia-Pacific distributed temperature sensing market is poised to grow at the fastest CAGR from 2025 to 2032, attributed to rapid industrialization, expansion of oil and gas networks, and infrastructure modernization across China, Japan, and India. The region’s growing investment in smart grid and energy management systems fuels DTS adoption for power and pipeline monitoring. Government initiatives promoting renewable energy and safety monitoring also play a pivotal role in driving market expansion.

China Distributed Temperature Sensing Market Insight

China accounted for the largest market share in the Asia-Pacific region in 2024, driven by expanding energy infrastructure, increased pipeline monitoring activities, and advancements in fiber-optic technologies. The country’s strong manufacturing ecosystem and focus on industrial automation further promote DTS integration across sectors. The rise of smart city projects and the emphasis on safety monitoring across utilities continue to accelerate market growth.

Japan Distributed Temperature Sensing Market Insight

Japan’s distributed temperature sensing market is gaining traction due to high demand for precision monitoring in industrial and environmental applications. The country’s strong focus on technological innovation and disaster prevention drives DTS deployment in structural health monitoring, power systems, and environmental protection. Japan’s advanced infrastructure and commitment to safety and automation are key contributors to its expanding market share.

Distributed Temperature Sensing Market Share

The distributed temperature sensing industry is primarily led by well-established companies, including:

- Schlumberger Limited (U.S.)

- Halliburton Company (U.S.)

- Yokogawa Electric Corporation (Japan)

- Weatherford International PLC (U.S.)

- Sumitomo Electric Industries Ltd. (Japan)

- Banner Engineering Corp. (U.S.)

- AP Sensing GmbH (Germany)

- OMICRON Electronics GmbH (Austria)

- OFS Fitel LLC (U.S.)

- Bandweaver Technologies Ltd. (U.K.)

- GESO GmbH & Co. KG (Germany)

- NKT Photonics A/S (Denmark)

- Micron Optics Inc. (U.S.)

- Sensornet Ltd. (U.K.)

- Silixa Ltd. (U.K.)

- Febus Optics (France)

- Luna Innovations Inc. (U.S.)

- OptaSense Ltd. (U.K.)

- DarkPulse Inc. (U.S.)

- Fotech Solutions Ltd. (U.K.)

Latest Developments in Global Distributed Temperature Sensing Market

- In April 2025, SLB partnered with Shell to globalize the Petrel subsurface software and jointly develop AI-based seismic interpretation modules, marking a strategic leap in digital oilfield innovation. This collaboration enables the integration of distributed temperature sensing (DTS) and fiber monitoring with real-time analytics, improving reservoir visualization, operational efficiency, and data accuracy. The partnership strengthens SLB’s leadership in intelligent well systems, supporting faster decision-making and safer drilling operations across complex exploration environments, thereby expanding its footprint in the global DTS market

- In March 2025, SLB secured a multi-well ultra-deepwater drilling contract from Woodside Energy for the Trion project offshore Mexico, deploying AI-enabled drilling and fiber monitoring technologies. This initiative showcases the company’s ability to combine DTS solutions with digital drilling systems to enhance wellbore monitoring, detect anomalies, and ensure safety in extreme subsea conditions. The project demonstrates the growing importance of real-time temperature and acoustic data in optimizing drilling efficiency and reducing environmental risk, reinforcing the adoption of DTS in offshore oil and gas applications

- In January 2025, Luna Innovations announced strong bookings and initiated a strategic review process, engaging financial advisors to explore potential mergers and acquisitions as part of its growth strategy. This move reflects Luna’s commitment to strengthening its market position, expanding its product portfolio, and scaling its fiber sensing technologies globally. By exploring M&A opportunities, Luna aims to enhance its technological depth in distributed sensing, boost its R&D capabilities, and accelerate innovation across multiple industrial sectors

- In August 2024, Luna Innovations appointed Kevin Ilcisin as CEO and secured a USD 15 million term loan, supplementing a USD 50 million investment to support its long-term expansion strategy. These developments provide the company with substantial capital to accelerate product innovation and strengthen its DTS and DAS technology lines. The leadership transition, coupled with financial reinforcement, is expected to drive operational efficiency, advance research in fiber-optic sensing, and expand Luna’s market penetration across energy, defense, and infrastructure monitoring applications

- In August 2024, NKT announced an upgrade to its distributed temperature sensing (DTS) technology, introducing enhanced hotspot detection and dynamic cable overload management features. This upgrade underscores NKT’s focus on preventive maintenance and energy reliability in power transmission systems. By improving early fault detection and optimizing cable performance, the company supports utilities in ensuring grid stability, reducing downtime, and meeting growing energy demands. These advancements further solidify NKT’s position as a key innovator in the power monitoring segment of the DTS market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Distributed Temperature Sensing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Distributed Temperature Sensing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Distributed Temperature Sensing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.