Global Dna And Mrna Veterinary Vaccines Market

Market Size in USD Million

CAGR :

%

USD

343.15 Million

USD

862.45 Million

2024

2032

USD

343.15 Million

USD

862.45 Million

2024

2032

| 2025 –2032 | |

| USD 343.15 Million | |

| USD 862.45 Million | |

|

|

|

|

DNA and mRNA Veterinary Vaccines Market Analysis

The DNA and mRNA veterinary vaccines market has experienced substantial growth, propelled by advancements in biotechnology and the increasing demand for effective, safe vaccines for both companion animals and livestock. These DNA and mRNA-based vaccines provide several advantages, including faster development timelines, improved safety profiles, and the ability to target a broad spectrum of pathogens. Their effectiveness in preventing and managing diseases is crucial for improving overall animal health and mitigating the risk of disease outbreaks that can negatively impact the agricultural industry. Several key factors are driving the market’s expansion, such as the growing need for more efficient vaccines, particularly for emerging diseases, and the increasing recognition of the importance of veterinary vaccines in animal health management. Furthermore, the rising adoption of innovative vaccine technologies, including gene editing and RNA-based therapies, is fueling market progress.

The veterinary sector is increasingly focused on preventative care, with vaccines playing a central role in controlling animal diseases before they spread. This shift, combined with the rising demand for protein-based food and the need to ensure livestock productivity, is further supporting the growth of the DNA and mRNA veterinary vaccines market.

Looking ahead, the market is expected to maintain strong growth as companies continue to invest in the research and development of innovative vaccines to address the unmet needs of both companion animals and livestock.

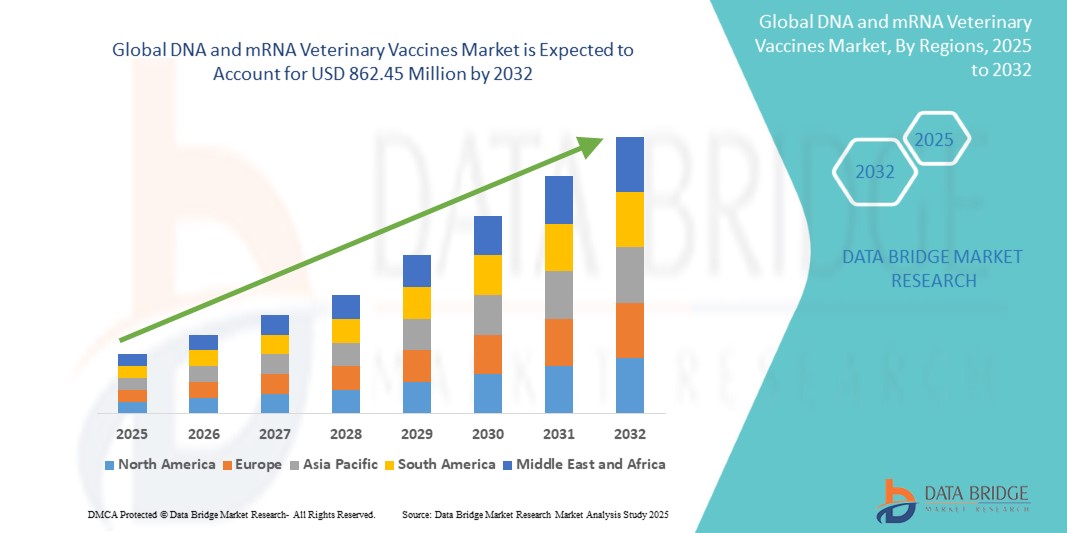

DNA and mRNA Veterinary Vaccines Market Size

The global DNA and mRNA veterinary vaccines market size was valued at USD 343.15 million in 2024 and is projected to reach USD 862.45 million by 2032, with a CAGR of 12.21% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

DNA and mRNA Veterinary Vaccines Market Trends

“Advancements in DNA and mRNA Veterinary Vaccines Driving Market Growth”

The DNA and mRNA veterinary vaccines market is gaining traction due to the substantial benefits these advanced vaccine platforms offer over conventional methods. DNA and mRNA technologies enable rapid antigen production and vaccine development timelines, facilitating swift responses to emerging zoonotic pathogens and epizootic diseases in animals, which is crucial for controlling potential outbreaks. These vaccines exhibit superior safety profiles by leveraging genetic encoding to induce specific immune responses without the risk of live pathogen exposure. Furthermore, DNA and mRNA vaccines can target a wide array of pathogenic microorganisms, addressing infectious diseases in both companion animals and livestock, thereby enhancing animal health, immune modulation, and overall agricultural productivity. The increasing emphasis on preventative veterinary care and the escalating demand for efficacious and innovative immunization strategies are key drivers of market expansion. As industry stakeholders intensify research and development efforts to advance genomic immunotherapies, the market is expected to experience robust growth.

Report Scope and DNA and mRNA Veterinary Vaccines Market Segmentation

|

Attributes |

DNA and mRNA Veterinary Vaccines Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico, Germany, France, U.K., Italy, Russia, Spain, Denmark, Sweden, Norway, Rest of Europe, China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Nigeria, Egypt, Kuwait, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America |

|

Key Market Players |

Bayer AG (Germany), BioNTech SE (Germany), Boehringer Ingelheim International GmbH (Germany), Biogénesis Bagó S.A. (Argentina), Ceva (France), Elanco or its affiliates (U.S.), FeedVax, Inc. (Argentina), HESTER BIOSCIENCES LIMITED (India), Heska Corporation (U.S.), INOVIO Pharmaceuticals (U.S.), Indian Immunologicals Ltd. (India), LABORATORIO AVI-MEX, SA DE CV (Mexico), Merck & Co., Inc. (U.S.), Phibro Animal Health Corporation (U.S.), Virbac (France), VAKSINDO ANIMAL HEALTH PVT. LTD (India), Virbac (France), Vetoquinol (France), Vaccine Valley (Egypt) and Zoetis Services LLC (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

DNA and mRNA Veterinary Vaccines Market Definition

DNA and mRNA veterinary vaccines are advanced vaccine technologies that use genetic material to induce an immune response in animals. DNA vaccines introduce a segment of DNA containing the genetic code for a pathogen's antigen into the animal’s cells, prompting the immune system to recognize and attack the pathogen. Similarly, mRNA vaccines use messenger RNA to instruct the animal’s cells to produce a specific antigen, triggering an immune response. Both types of vaccines offer significant advantages over traditional methods, including faster development, improved safety profiles, and greater precision in targeting specific pathogens. These innovative vaccines are increasingly utilized in the prevention of infectious diseases in both companion animals and livestock, making them a key tool in managing animal health and controlling disease outbreaks. Their ability to address emerging pathogens quickly and effectively has made them an important advancement in veterinary medicine.

DNA and mRNA Veterinary Vaccines Market Dynamics

Drivers

- Increasing Demand for Preventative Animal Health Care

The growing focus on preventative veterinary care is a major driver of the DNA and mRNA veterinary vaccines market. As veterinary professionals and pet owners recognize the importance of preventing diseases before they occur, the demand for effective vaccines has surged. DNA and mRNA vaccines offer a faster, more precise approach to immunization, providing protection against a broad spectrum of pathogens. For instance, the mRNA vaccine for canine influenza, developed using these technologies, represents a significant advancement in vaccine development, offering rapid protection to companion animals. This shift towards preventative care, along with a focus on improving animal health outcomes, has significantly contributed to the growth of the market, as these technologies can address both existing and emerging infectious diseases in a more efficient manner. As pet owners and farmers prioritize long-term health, the market is poised for continued expansion. The rising demand for preventative care accelerates the adoption of advanced vaccine technologies, boosting market growth.

- Advancements in Vaccine Technology and Speed of Development

Advances in DNA and mRNA vaccine technologies have revolutionized the speed and efficiency of vaccine development, contributing significantly to the market's growth. Unlike traditional vaccines that require time-consuming processes such as culturing pathogens, DNA and mRNA vaccines can be designed and produced more quickly, which is critical when addressing new or emerging diseases. A notable instance is the development of mRNA vaccines for COVID-19 in humans, which demonstrated the potential for rapid development and scalability. In veterinary medicine, these technologies are now being applied to address diseases such as canine distemper and avian influenza, with faster vaccine production reducing the risk of disease outbreaks. As these technologies continue to evolve, they offer the potential for quicker responses to outbreaks, ensuring timely protection for livestock and companion animals. This innovation enhances vaccine availability and accessibility, driving market growth. The rapid development capability enhances vaccine availability, driving widespread adoption and market expansion.

Opportunities

- Expanding Applications in Livestock and Agriculture

One significant opportunity for the DNA and mRNA veterinary vaccines market lies in expanding their application within livestock and agriculture, particularly for preventing outbreaks in large animal populations. Traditional vaccines for livestock, such as cattle and poultry, have been slow to evolve, often relying on older technologies. However, DNA and mRNA vaccines offer faster, more scalable solutions. For instance, mRNA vaccines could be used to target diseases such as avian influenza or foot-and-mouth disease, which can have devastating impacts on the agricultural industry. These technologies allow for rapid development and mass production, offering an effective way to prevent outbreaks and maintain productivity in agriculture. As demand for protein-based food continues to rise globally, there is significant potential to utilize these advanced vaccines to ensure the health of livestock populations, making this a key opportunity for market growth. The growing need for efficient livestock disease prevention drives adoption, accelerating market expansion.

- Personalized Veterinary Medicine for Companion Animals

Another opportunity in the DNA and mRNA veterinary vaccines market is the growing trend of personalized veterinary medicine for companion animals. As more pet owners seek customized care for their pets, there is an increasing demand for vaccines tailored to specific genetic profiles or individual health needs. DNA and mRNA vaccines offer the flexibility to develop targeted therapies for animals based on their unique immune systems. For instance, cancer vaccines using personalized mRNA technology are being explored to address specific tumors in dogs and cats. This customization can enhance vaccine efficacy, improve pet health, and extend the lives of pets. As the pet care industry continues to evolve towards more personalized, precision medicine, the demand for DNA and mRNA vaccines is expected to increase significantly, creating a lucrative opportunity in the market. The shift toward personalized pet care enhances demand for specialized vaccines, driving growth in the market.

Restraints/Challenges

- High Development and Production Costs

One significant restraint in the DNA and mRNA veterinary vaccines market is the high development and production costs associated with these advanced vaccine technologies. Unlike traditional vaccines, DNA and mRNA vaccines require sophisticated technology, expertise, and infrastructure for their creation and large-scale production. For instance, the production of mRNA vaccines for COVID-19 has been costly due to the need for specialized manufacturing facilities and cold-chain storage. The veterinary sector faces similar challenges, particularly in developing vaccines for diseases in livestock, which may not justify the investment for small-scale or emerging markets. These high costs can limit accessibility for smaller veterinary practices or farmers in low-resource regions. As a result, the adoption of these vaccines may be slower than anticipated, especially in developing countries where cost constraints are more significant, hindering the overall market growth.

- Regulatory Hurdles and Approval Process

A major challenge facing the DNA and mRNA veterinary vaccines market is the regulatory hurdles and lengthy approval process for these novel vaccine technologies. Regulatory bodies such as the U.S. FDA and European Medicines Agency require extensive safety and efficacy data before granting approval for new veterinary vaccines. This process can be particularly time-consuming for DNA and mRNA vaccines, as they are newer technologies and require rigorous clinical trials to ensure their safety and effectiveness in animals. For instance, mRNA vaccines for livestock diseases such as avian influenza or Bovine Respiratory Disease must undergo a series of preclinical and clinical trials before reaching the market, which can delay their availability. These regulatory delays pose a challenge to the timely introduction of these vaccines, affecting their widespread adoption and slowing the market’s growth.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

DNA and mRNA Veterinary Vaccines Market Scope

The market is segmented on the basis of animal type, route of administration, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Animal Type

- Cattle

- Sheep and Goat

- Pigs

- Horse

- Camel

- Poultry

Route of Administration

- Subcutaneous

- Intramuscular

- Intranasal

- Others

By End User

- Hospital

- Clinics

DNA and mRNA Veterinary Vaccines Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, animal type, route of administration, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico, Germany, France, U.K., Italy, Russia, Spain, Denmark, Sweden, Norway, Rest of Europe, China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Nigeria, Egypt, Kuwait, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America is expected to dominate the DNA and mRNA veterinary vaccines market. This region has a well-established veterinary healthcare infrastructure, strong research and development capabilities, and high adoption rates of innovative technologies. The U.S. and Canada are particularly focused on advancing veterinary medicine, with significant investments in the development and regulatory approval of DNA and mRNA vaccines for both companion animals and livestock.

Asia-Pacific is expected to witness the highest growth rate in the DNA and mRNA veterinary vaccines market. This growth is driven by advancements in veterinary healthcare, increasing agricultural activities, a rising livestock population, and a growing demand for innovative veterinary solutions. Countries such as China, India, and Japan are making notable progress in adopting cutting-edge vaccine technologies to tackle issues such as livestock diseases, food security, and enhancing animal health. The growing awareness of the importance of preventative animal care, combined with government efforts to modernize veterinary healthcare systems, is accelerating the adoption of DNA and mRNA vaccines in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

DNA and mRNA Veterinary Vaccines Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

DNA and mRNA Veterinary Vaccines Market Leaders Operating in the Market Are:

- Bayer AG (Germany)

- BioNTech SE (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Biogénesis Bagó S.A. (Argentina)

- Ceva (France)

- Elanco or its affiliates (U.S.)

- FeedVax, Inc. (Argentina)

- HESTER BIOSCIENCES LIMITED (India)

- Heska Corporation (U.S.)

- INOVIO Pharmaceuticals (U.S.)

- Indian Immunologicals Ltd. (India)

- LABORATORIO AVI-MEX, SA DE CV (Mexico)

- Merck & Co., Inc. (U.S.)

- Phibro Animal Health Corporation (U.S.)

- Virbac (France)

- VAKSINDO ANIMAL HEALTH PVT. LTD (India)

- Virbac (France)

- Vetoquinol (France)

- Vaccine Valley (Egypt)

- Zoetis Services LLC (U.S.)

Latest Developments in DNA and mRNA Veterinary Vaccines Market

- In September 2024, Merck Animal Health announced the expansion of its newly USDA-approved NOBIVAC NXT vaccine platform to include a top-tier solution for protecting cats against feline leukemia virus (FeLV), one of the most prevalent infectious diseases in felines. The vaccine is expected to be available at veterinary clinics and hospitals across the country this fall. NOBIVAC NXT FeLV is the first and only vaccine for feline leukemia virus developed using Merck Animal Health’s RNA-particle technology platform, designed to provide enhanced protection

- In June 2024, Merck Animal Health announced the launch and availability of the NOBIVAC NXT Rabies portfolio in Canada, which includes NOBIVAC NXT Feline-3 Rabies and NOBIVAC NXT Canine-3 Rabies. This release is part of the company’s ongoing commitment to rabies prevention. The NOBIVAC NXT rabies portfolio is the first-ever line of vaccines that utilizes advanced RNA-particle technology to protect cats and dogs from rabies

- In February 2024, the University of Pennsylvania School of Veterinary Medicine (Penn Vet) unveiled the launch of its mRNA Research Initiative. This initiative aims to accelerate the development of mRNA-based veterinary vaccines and host-directed therapies. Not only will it make a significant contribution to mRNA research, but it will also help apply the mRNA platform to create innovative veterinary vaccine solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.