Global Dna Based Food Testing Market

Market Size in USD Billion

CAGR :

%

USD

12.36 Billion

USD

19.85 Billion

2025

2033

USD

12.36 Billion

USD

19.85 Billion

2025

2033

| 2026 –2033 | |

| USD 12.36 Billion | |

| USD 19.85 Billion | |

|

|

|

|

DNA-Based Food Testing Market Size

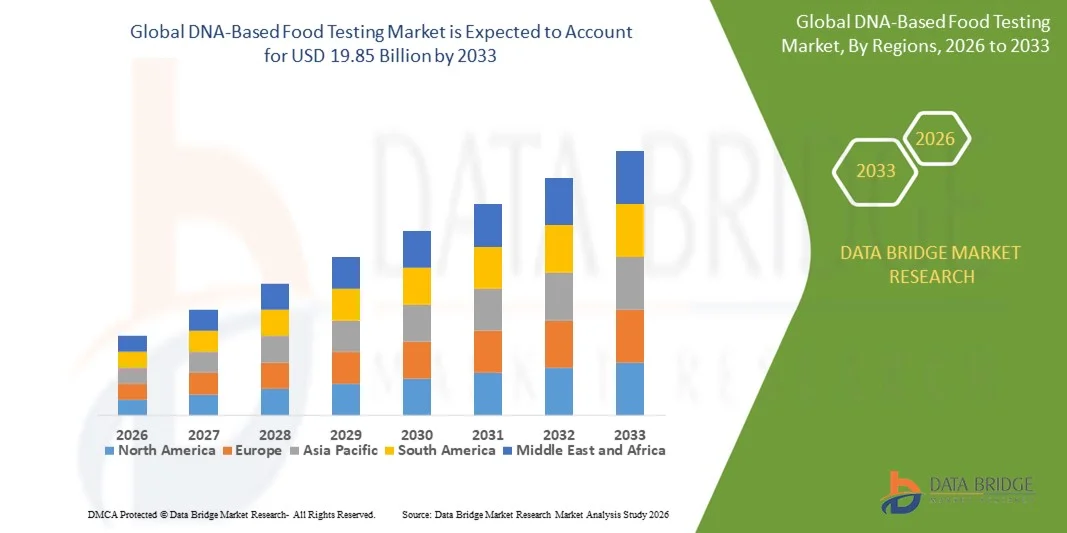

- The global DNA-based food testing market size was valued at USD 12.36 billion in 2025 and is expected to reach USD 19.85 billion by 2033, at a CAGR of 6.10% during the forecast period

- The market growth is largely fueled by the increasing emphasis on food safety, rising incidences of foodborne illnesses, and the strengthening of regulatory frameworks governing food quality and traceability across global supply chains

- Furthermore, growing demand from food manufacturers for rapid, accurate, and reliable testing solutions to detect pathogens, allergens, GMOs, and contaminants is accelerating the adoption of DNA-based testing methods. These converging factors are driving widespread implementation of advanced molecular diagnostics in food processing and quality control, thereby significantly boosting the market’s growth

DNA-Based Food Testing Market Analysis

- DNA-based food testing refers to molecular diagnostic techniques used to identify and quantify pathogens, allergens, genetically modified organisms, and adulterants in food products through precise genetic analysis. These testing solutions enhance food safety, support regulatory compliance, and enable traceability across raw materials, processing stages, and finished products

- The escalating demand for DNA-based food testing is primarily driven by stringent food safety regulations, increasing consumer awareness regarding food quality, and the growing need for rapid detection methods that reduce contamination risks and costly product recalls

- North America dominated the DNA-based food testing market with a share of 37.7% in 2025, due to stringent food safety regulations, increasing awareness of foodborne illnesses, and the presence of advanced testing laboratories

- Asia-Pacific is expected to be the fastest growing region in the DNA-based food testing market during the forecast period due to increasing food safety awareness, rapid urbanization, and growing regulatory oversight in countries such as China, Japan, and India

- Pathogen segment dominated the market with a market share of 39% in 2025, due to rising foodborne illness concerns and stringent food safety regulations across key regions. Pathogen testing is widely adopted by food manufacturers and regulatory bodies to ensure product safety and prevent outbreaks, providing reliable detection of bacteria, viruses, and other harmful microorganisms

Report Scope and DNA-Based Food Testing Market Segmentation

|

Attributes |

DNA-Based Food Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

DNA-Based Food Testing Market Trends

Growing Use of Rapid DNA-Based Food Testing Technologies

- A significant trend in the DNA-based food testing market is the growing use of rapid molecular testing technologies that enable faster and more accurate detection of pathogens, allergens, GMOs, and contaminants across food supply chains. This trend is driven by the increasing need to reduce testing turnaround times while maintaining high sensitivity and reliability, particularly for perishable and high-risk food products

- For instance, bioMérieux has introduced advanced GENE-UP PCR solutions that significantly shorten detection timelines for foodborne pathogens and spoilage organisms, enabling food manufacturers to accelerate product release and improve operational efficiency. Such rapid DNA-based systems are strengthening quality control practices and reducing the risk of large-scale recalls

- Food manufacturers are increasingly adopting real-time PCR and multiplex DNA testing platforms to simultaneously screen for multiple targets within a single test cycle. This approach improves laboratory productivity and supports comprehensive food safety monitoring without extending testing durations

- The trend is also supported by the integration of automation and digital data management within DNA-based testing workflows, allowing laboratories to handle higher sample volumes with consistent accuracy. Automated systems reduce human error and enhance reproducibility across routine testing operations

- Regulatory authorities and certification bodies are encouraging the adoption of rapid DNA-based methods to ensure timely compliance with food safety standards. This is further reinforcing the shift away from conventional culture-based testing toward faster molecular diagnostics

- The growing emphasis on supply chain transparency and traceability is accelerating the use of rapid DNA-based testing technologies, positioning them as essential tools for modern food safety management and reinforcing long-term market expansion

DNA-Based Food Testing Market Dynamics

Driver

Strict Food Safety Regulations Worldwide

- Strict food safety regulations across global markets are a primary driver for the DNA-based food testing market, as governments enforce rigorous standards to prevent food contamination and protect public health. Regulatory frameworks increasingly require sensitive and validated testing methods capable of detecting low levels of pathogens, allergens, and GMOs

- For instance, regulatory agencies such as the U.S. Food and Drug Administration and the European Food Safety Authority emphasize the use of scientifically validated molecular testing methods to ensure compliance with food safety and labeling requirements. This regulatory pressure is driving widespread adoption of DNA-based testing solutions by food producers and laboratories

- Global food trade expansion has intensified regulatory scrutiny, requiring exporters to meet stringent safety and traceability standards imposed by importing countries. DNA-based testing provides reliable verification, supporting smoother cross-border trade and reducing rejection risks

- The enforcement of mandatory allergen labeling and pathogen monitoring regulations is pushing manufacturers to adopt advanced DNA testing to avoid penalties and costly recalls. This regulatory environment is strengthening demand for accurate and standardized testing platforms

- Food safety audits and certification programs increasingly rely on molecular diagnostics to validate compliance, reinforcing the importance of DNA-based food testing in routine quality assurance. These factors collectively continue to drive sustained market growth

Restraint/Challenge

High Cost of Advanced Testing Solutions

- The DNA-based food testing market faces challenges due to the high cost associated with advanced testing instruments, reagents, and laboratory infrastructure required for molecular diagnostics. These cost barriers can limit adoption, particularly among small and medium-sized food manufacturers and regional testing laboratories

- For instance, high-throughput PCR and sequencing platforms supplied by companies such as Thermo Fisher Scientific and Illumina require significant capital investment, along with ongoing expenses for consumables and maintenance. This financial burden can restrict access to advanced DNA testing technologies

- The need for skilled personnel to operate complex molecular testing systems further increases operational costs. Training requirements and workforce availability remain critical challenges, especially in developing regions

- In addition, frequent technology upgrades and validation requirements add to long-term expenditure for laboratories striving to remain compliant with evolving regulatory standards. This can strain budgets and slow adoption rates

- The challenge of balancing cost efficiency with testing accuracy and speed continues to impact market penetration. These financial and operational constraints remain key considerations for stakeholders as the market expands, shaping investment decisions and adoption strategies

DNA-Based Food Testing Market Scope

The market is segmented on the basis of targets tested, technology, and application.

- By Targets Tested

On the basis of targets tested, the DNA-based food testing market is segmented into pathogen, GMO, allergen, and mycotoxin. The pathogen testing segment dominated the largest market revenue share of 39% in 2025, driven by rising foodborne illness concerns and stringent food safety regulations across key regions. Pathogen testing is widely adopted by food manufacturers and regulatory bodies to ensure product safety and prevent outbreaks, providing reliable detection of bacteria, viruses, and other harmful microorganisms. Laboratories and testing service providers increasingly rely on advanced DNA-based pathogen tests for their high sensitivity, accuracy, and rapid turnaround time, which are critical for perishable food products. The segment’s dominance is further strengthened by growing awareness among consumers regarding food safety and traceability, prompting businesses to adopt pathogen testing as a standard quality measure.

The allergen testing segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising incidences of food allergies and increasing regulatory mandates for allergen labeling. For instance, companies such as Eurofins Scientific are expanding their DNA-based allergen testing services to cater to the rising demand from food manufacturers and restaurants. The adoption of allergen testing ensures consumer safety, reduces recall risks, and supports brand reputation management. The growing trend of processed and ready-to-eat food products also drives the need for accurate allergen detection to comply with global standards. Advanced technologies in allergen testing, including multiplex PCR, provide efficient and simultaneous detection of multiple allergens, enhancing throughput and reliability for laboratories.

- By Technology

On the basis of technology, the DNA-based food testing market is segmented into HPLC-based, LC-MS/MS-based, immunoassay-based, and other technologies. The LC-MS/MS-based segment dominated the largest market revenue share in 2025, driven by its high accuracy, sensitivity, and ability to quantify complex food matrices. LC-MS/MS technologies are preferred by laboratories for detecting multiple contaminants simultaneously, providing comprehensive testing solutions for pathogens, GMOs, and toxins. Regulatory bodies and large-scale food manufacturers often adopt LC-MS/MS-based DNA testing to comply with strict safety standards and labeling requirements. The segment’s growth is reinforced by continuous technological advancements improving detection speed and reducing sample preparation time. It also offers compatibility with high-throughput testing workflows, making it suitable for industrial-scale food safety operations.

The immunoassay-based segment is expected to witness the fastest CAGR from 2026 to 2033, driven by the growing demand for rapid, cost-effective, and user-friendly DNA-based food testing methods. For instance, Thermo Fisher Scientific has been actively promoting immunoassay-based DNA tests for pathogen and allergen detection in food processing facilities. Immunoassays allow real-time monitoring, on-site testing, and simpler workflow integration compared with traditional lab-based methods. The growing preference for point-of-need testing in food manufacturing and retail sectors also supports rapid adoption of immunoassay-based technologies.

- By Application

On the basis of application, the DNA-based food testing market is segmented into feed, pet food, and food. The food segment dominated the largest market revenue share in 2025, driven by stringent government regulations, growing consumer awareness, and increasing international trade requiring rigorous quality checks. DNA-based testing in food ensures accurate detection of pathogens, allergens, GMOs, and mycotoxins, safeguarding public health and minimizing product recalls. Large food manufacturers and retailers prioritize these tests to maintain compliance, enhance traceability, and protect brand reputation. The segment’s dominance is reinforced by the rising demand for processed, packaged, and ready-to-eat foods, which require comprehensive safety monitoring. DNA-based food testing also supports global supply chains by providing standardized, rapid, and reliable detection methods across regions.

The pet food segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising awareness of pet health and stringent regulations for pet food safety. For instance, Mars Petcare has increasingly integrated DNA-based testing to ensure product safety and nutritional accuracy in its pet food products. The adoption of DNA testing in pet food helps detect contaminants, allergens, and GMOs, ensuring safety for pets and compliance with regulatory standards. Growth is also supported by the increasing trend of premium and specialized pet foods, which require rigorous quality assurance. DNA-based testing offers fast, accurate, and reliable results, supporting both manufacturers and consumers in ensuring pet food safety and quality.

DNA-Based Food Testing Market Regional Analysis

- North America dominated the DNA-based food testing market with the largest revenue share of 37.7% in 2025, driven by stringent food safety regulations, increasing awareness of foodborne illnesses, and the presence of advanced testing laboratories

- Consumers and food manufacturers in the region highly value the reliability, rapid results, and accuracy offered by DNA-based testing solutions for pathogens, allergens, and GMOs

- This widespread adoption is further supported by high disposable incomes, technologically advanced food processing infrastructure, and the growing preference for preventive food safety measures, establishing DNA-based food testing as a standard in both residential and commercial food production

U.S. DNA-Based Food Testing Market Insight

The U.S. DNA-based food testing market captured the largest revenue share in 2025 within North America, fueled by the robust implementation of food safety regulations and increasing adoption of advanced molecular testing techniques. Food manufacturers and service providers are prioritizing DNA-based testing to ensure compliance, prevent recalls, and safeguard consumer health. The rising demand for processed and packaged foods, combined with the adoption of automated testing systems and integration with laboratory information management systems (LIMS), is further propelling the market. Moreover, leading companies such as Eurofins Scientific and SGS are expanding their DNA testing services, driving growth across both small-scale and large-scale food enterprises.

Europe DNA-Based Food Testing Market Insight

The Europe DNA-based food testing market is projected to expand at a substantial CAGR throughout the forecast period, driven by strict EU food safety regulations and the rising demand for traceability in food supply chains. Increasing urbanization and the growth of processed and imported foods are fostering adoption of DNA-based testing solutions. European consumers are particularly focused on allergen labeling and GMO-free products, prompting manufacturers to adopt highly sensitive testing methods. The region is witnessing notable growth across food production, processing, and retail sectors, with DNA-based testing integrated into routine quality assurance and compliance procedures.

U.K. DNA-Based Food Testing Market Insight

The U.K. DNA-based food testing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by growing awareness of food allergens, pathogen outbreaks, and the need for accurate GMO detection. Rising consumer concerns regarding food safety and regulatory compliance are encouraging food manufacturers and retailers to implement advanced DNA-based testing solutions. The U.K.’s well-established laboratory infrastructure and strong e-commerce and food service sectors further support market growth. Leading laboratories and service providers, including ALS Limited and Intertek Group, are expanding their testing capabilities to meet the increasing demand.

Germany DNA-Based Food Testing Market Insight

The Germany DNA-based food testing market is expected to expand at a considerable CAGR during the forecast period, driven by strict national and EU food safety standards and rising adoption of advanced molecular testing technologies. Germany’s emphasis on quality, innovation, and sustainable food production promotes the use of DNA-based food testing in both industrial and small-scale food manufacturing. Laboratories increasingly integrate automated and high-throughput DNA testing platforms to improve efficiency and accuracy. Strong consumer demand for safe, allergen-free, and traceable foods further strengthens market growth across residential, commercial, and export-oriented food sectors.

Asia-Pacific DNA-Based Food Testing Market Insight

The Asia-Pacific DNA-based food testing market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing food safety awareness, rapid urbanization, and growing regulatory oversight in countries such as China, Japan, and India. Rising demand for processed and packaged foods, coupled with government initiatives to enhance food safety standards, is fueling adoption. Furthermore, as APAC emerges as a hub for food manufacturing and export, DNA-based testing is becoming more accessible and cost-effective for producers and service providers.

Japan DNA-Based Food Testing Market Insight

The Japan DNA-based food testing market is gaining momentum due to the country’s high-tech culture, strict food safety regulations, and increasing demand for allergen and pathogen detection. Japanese consumers emphasize safe and traceable food products, driving manufacturers to adopt rapid and accurate DNA-based testing solutions. Integration of testing services with laboratory automation and IoT-enabled monitoring systems is fueling market growth. In addition, Japan’s aging population is expected to increase demand for reliable, user-friendly food safety solutions in both retail and institutional food sectors.

China DNA-Based Food Testing Market Insight

The China DNA-based food testing market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the expanding food manufacturing sector, rapid urbanization, and increasing regulatory oversight. China’s growing middle class and rising consumption of processed and imported foods are boosting the adoption of DNA-based testing. The development of domestic testing laboratories, government-led food safety initiatives, and the presence of key service providers such as BGI Group and Eurofins are driving market expansion. Affordable testing solutions and large-scale implementation in food export and domestic supply chains further contribute to growth in the region.

DNA-Based Food Testing Market Share

The DNA-based food testing industry is primarily led by well-established companies, including:

- Agilent Technologies Inc. (U.S.)

- Illumina Inc. (U.S.)

- Beckman Coulter Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Applied Biosystems (U.S.)

- Cepheid (U.S.)

- Siemens Healthcare (Germany)

- Roche Diagnostics (Switzerland)

- Qiagen (Germany)

- GE Healthcare (U.S.)

- Alere Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Hologic, Inc. (U.S.)

Latest Developments in Global DNA-Based Food Testing Market

- In August 2025, Bio-Rad Laboratories launched the EZ-Check Salmonella spp. Kit for the detection of Salmonella spp. in food and environmental samples, strengthening rapid pathogen monitoring across food production facilities. This launch supports faster contamination identification, enabling manufacturers to minimize recall risks and improve regulatory compliance. The solution enhances operational efficiency by offering reliable, DNA-based detection suitable for routine quality control. Its introduction reflects growing industry demand for standardized, high-accuracy pathogen testing solutions to safeguard public health and maintain brand trust

- In July 2025, bioMérieux introduced the GENE-UP PRO HRM testing solution for viable heat-resistant molds, marking a significant advancement in DNA-based food testing capabilities. As the only DNA-based solution capable of detecting viable HRMs, including ascospore forms, the innovation dramatically reduces testing time from 15 days to just three days. This accelerated turnaround improves operational efficiency, shortens product release cycles, and enhances shelf-life management for food manufacturers. The development directly supports profitability by reducing storage costs and minimizing production delays

- In October 2024, Eurofins Botanicals partnered with LeafWorks to launch the industry’s first Mushroom DNA Species Identification Tests, expanding DNA-based testing into the rapidly growing functional and natural products segment. This development enables precise species-level authentication of mushrooms used in dietary supplements, foods, and cosmetics, addressing rising concerns around adulteration and mislabeling. The collaboration strengthens quality assurance and regulatory compliance for manufacturers, reinforcing DNA testing as a critical tool for product validation and supply chain transparency

- In May 2024, Thermo Fisher Scientific expanded its SureTect real-time PCR portfolio with enhanced DNA-based assays for foodborne pathogen detection, targeting high-throughput food safety laboratories. The upgraded solutions improve sensitivity and workflow efficiency while supporting automation and laboratory information management system integration. This development accelerates routine testing processes and supports large-scale food manufacturers in meeting stringent safety standards. The expansion reinforces the growing role of advanced PCR-based technologies in ensuring global food safety compliance

- In September 2020, SwissDeCode launched a rapid, on-site DNA-based solution enabling dairy companies to identify A1 beta-casein in milk within 50 minutes. This innovation supports the verification of A2 milk purity, addressing growing consumer demand for differentiated and health-oriented dairy products. The solution reduces reliance on centralized laboratories, allowing faster decision-making at production sites. Its adoption enhances traceability and authenticity in dairy supply chains, contributing to improved consumer confidence

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dna Based Food Testing Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dna Based Food Testing Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dna Based Food Testing Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.