Global Docking Station Market

Market Size in USD Billion

CAGR :

%

USD

2.33 Billion

USD

3.50 Billion

2025

2033

USD

2.33 Billion

USD

3.50 Billion

2025

2033

| 2026 –2033 | |

| USD 2.33 Billion | |

| USD 3.50 Billion | |

|

|

|

|

Docking Station Market Size

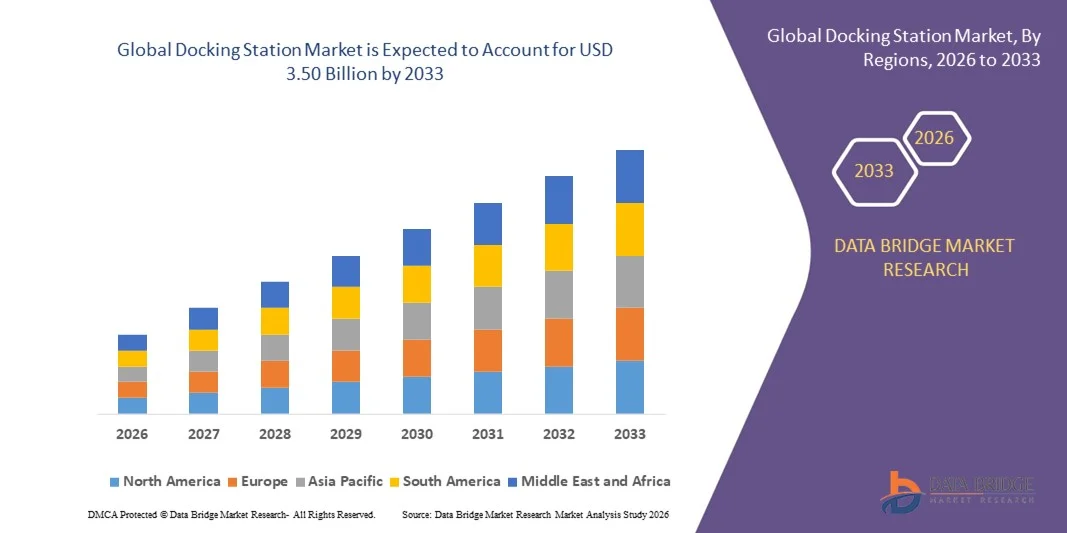

- The global docking station market size was valued at USD 2.33 billion in 2025 and is expected to reach USD 3.50 billion by 2033, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the increasing adoption of hybrid work models and the surge in demand for multi-device connectivity solutions across both commercial and residential settings. The growing dependence on laptops, tablets, and mobile devices for work and entertainment has led to a higher need for efficient docking solutions that enhance productivity and connectivity

- Furthermore, the rapid advancement of USB-C, Thunderbolt, and wireless docking technologies is driving innovation and enabling faster data transfer, high-resolution display support, and power delivery capabilities. These developments are transforming docking stations into essential workspace accessories, significantly boosting the market’s growth

Docking Station Market Analysis

- Docking stations, which serve as centralized connectivity hubs for linking multiple peripherals to laptops and mobile devices, are becoming critical in modern digital work environments. Their ability to streamline device connections, improve workflow efficiency, and support flexible workspace setups makes them indispensable across corporate, educational, and home offices

- The rising trend of remote and hybrid work, combined with the increasing use of portable devices, is accelerating the demand for versatile docking solutions. As consumers and businesses prioritize convenience, performance, and adaptability, the docking station market continues to experience robust expansion worldwide

- North America dominated docking station market with a share of 37.9% in 2025, due to the increasing penetration of hybrid work models and the widespread use of multiple computing devices

- Asia-Pacific is expected to be the fastest growing region in the docking station market during the forecast period due to rapid digital transformation, expansion of the IT sector, and increasing use of portable devices in countries such as China, Japan, and India

- Laptops segment dominated the market with a market share of 72.5% in 2025, due to the rising adoption of hybrid work models and the growing need for enhanced connectivity in professional environments. Docking stations for laptops enable users to connect multiple peripherals such as monitors, keyboards, and network cables seamlessly, boosting productivity and workflow efficiency. The increasing demand for high-performance laptops among IT professionals, gamers, and designers further drives the segment’s dominance, as docking solutions simplify transitions between mobile and desktop setups

Report Scope and Docking Station Market Segmentation

|

Attributes |

Docking Station Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Docking Station Market Trends

Rising Adoption of Wireless and Thunderbolt Docks

- The docking station market is witnessing strong growth due to the rapid adoption of wireless and Thunderbolt-based docking solutions that offer faster data transfer rates, higher bandwidth, and improved device connectivity. Businesses and consumers are increasingly shifting to these advanced docks to streamline workflow efficiency, reduce cable clutter, and enable seamless multi-device operation across workstations and remote setups

- For instance, Dell Technologies introduced its Thunderbolt Dock WD22TB4, which supports both USB-C and Thunderbolt interfaces and delivers high-speed data transfer and multi-monitor connectivity. Such innovations are driving greater adoption of next-generation docking solutions among corporate users, creative professionals, and gamers seeking enhanced performance and simplified connectivity

- Wireless docking stations leveraging Wi-Fi 6 and Bluetooth 5.0 technologies are gaining traction as they eliminate physical connection limitations. These systems allow users to connect multiple peripherals such as monitors, keyboards, and external storage devices without direct cabling, creating a more flexible workspace environment

- The increase in hybrid and remote working models has further accelerated demand for high-speed, plug-and-play docking systems compatible with laptops, tablets, and smartphones. Thunderbolt-based docks are particularly favored for their ability to transfer large data volumes and support ultra-HD displays, benefiting content creators and enterprise setups

- In addition, rapid growth in USB4 and Thunderbolt 5 technologies has encouraged manufacturers to launch advanced docking solutions with backward compatibility and power delivery features. This integration supports users with high-performance needs while maintaining compatibility with older devices

- The transition toward wireless and Thunderbolt docking solutions signifies a broader market trend focused on connectivity optimization, minimal setup, and universal compatibility. As digital workspaces evolve, these advanced docking systems are expected to dominate commercial and consumer markets through enhanced functionality and smarter integration

Docking Station Market Dynamics

Driver

Growing Demand for Multi-Device Connectivity

- The increasing need to connect multiple devices simultaneously in both professional and personal environments is driving strong growth in the docking station market. Modern workspaces require seamless integration between laptops, monitors, printers, and other peripherals, making multifunctional docking stations a vital component of digital infrastructure

- For instance, Lenovo Group Limited expanded its docking lineup with the ThinkPad Universal USB-C Dock, providing simultaneous connectivity for up to three displays and several USB peripherals. This allows professionals to enhance productivity and efficiency by managing multiple tasks across interconnected systems

- The expansion of hybrid working models and BYOD (Bring Your Own Device) culture has increased the requirement for docks compatible with diverse operating systems and connection interfaces. This has led to the development of universal docking solutions that support USB-C, Thunderbolt, and DisplayPort standards for flexible multi-device usage

- In addition, the development of high-performance docking solutions with integrated power delivery and high-speed data transfer capabilities has further expanded their utility. As devices become more compact and ports more limited, multi-device docking stations are emerging as essential enablers of digital efficiency and convenience

- The accelerating need for interoperability, flexibility, and productivity in connected environments continues to drive the consistent adoption of docking solutions. Ongoing technological advancement and the integration of advanced connectivity protocols will reinforce market momentum globally

Restraint/Challenge

Compatibility Across Varied Devices

- Despite their growing adoption, docking stations face notable challenges related to compatibility across different devices, brands, and operating systems. Variations in port configurations, power requirements, and driver support create limitations for universal docking solutions, often resulting in performance inconsistencies and user dissatisfaction

- For instance, HP Inc. and Dell Technologies have encountered compatibility concerns with certain USB-C docking models when connected to non-brand laptops, leading to issues such as partial display recognition or reduced charging efficiency. Such problems deter users seeking seamless plug-and-play connectivity across varied device ecosystems

- The rapid evolution of connectivity standards such as USB-C, Thunderbolt, and HDMI versions adds complexity to maintaining universal compatibility. Users frequently experience connectivity disruptions or firmware conflicts when interfacing devices of differing generations or specifications

- In addition, manufacturers face the challenge of balancing high performance with cross-platform adaptability. Ensuring compatibility across Windows, macOS, and Linux systems requires continuous software updates and driver coordination, which increases product development costs and time to market

- Overcoming compatibility challenges will require closer collaboration between hardware manufacturers and software developers to establish universal standards and integrated certification frameworks. As interoperability improves, the docking station market will likely achieve broader global acceptance and customer satisfaction across business and consumer segments

Docking Station Market Scope

The market is segmented on the basis of product, port, distribution channel, technology, application, and price range.

- By Product

On the basis of product, the docking station market is segmented into laptops, mobiles, tablets, hard drives, and others. The laptop segment dominated the market with the largest revenue share of 72.5% in 2025, driven by the rising adoption of hybrid work models and the growing need for enhanced connectivity in professional environments. Docking stations for laptops enable users to connect multiple peripherals such as monitors, keyboards, and network cables seamlessly, boosting productivity and workflow efficiency. The increasing demand for high-performance laptops among IT professionals, gamers, and designers further drives the segment’s dominance, as docking solutions simplify transitions between mobile and desktop setups.

The mobile segment is projected to witness the fastest growth rate from 2026 to 2033, supported by the increasing use of smartphones for business operations and content creation. Mobile docking stations are gaining traction as they allow users to transform their phones into desktop-like workstations, offering enhanced versatility. The rise in mobile gaming, video editing, and 5G-enabled devices also contributes to the growing adoption of docking solutions designed specifically for smartphones.

- By Port

On the basis of port, the market is segmented into single, double, and multiple. The multiple port segment held the largest market revenue share in 2025, attributed to the rising preference for multifunctional connectivity solutions among enterprises and home offices. Docking stations with multiple ports allow users to connect monitors, USB devices, Ethernet, and audio peripherals simultaneously, enhancing device compatibility. The increasing demand for high-speed data transfer and efficient multitasking in professional setups continues to fuel the growth of this segment.

The double port segment is anticipated to grow at the fastest rate from 2026 to 2033, driven by the demand for compact and cost-effective solutions that balance connectivity and portability. Double port docks appeal to users who require moderate connectivity options without compromising on performance, particularly in remote and small office environments.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline. The offline segment dominated the market in 2025, owing to consumers’ preference for physical verification of product quality and compatibility before purchase. Electronic retailers, IT stores, and corporate suppliers play a key role in distributing docking stations, especially in the commercial sector where bulk purchases are common. Personalized consultation and after-sales support offered through offline channels further strengthen their position.

The online segment is expected to witness the fastest growth from 2026 to 2033, driven by the expansion of e-commerce platforms and the convenience of doorstep delivery. Online sales benefit from wider product visibility, promotional discounts, and direct-to-consumer strategies by manufacturers.

- By Technology

On the basis of technology, the docking station market is segmented into wired docks and wireless docks. The wired docks segment accounted for the largest share in 2025, primarily due to their reliability, stable data transfer rates, and compatibility with a wide range of devices. Wired docks are preferred in professional and gaming environments where consistent performance is essential, making them the go-to choice for enterprises. The affordability and plug-and-play nature of wired docking stations further contribute to their widespread adoption.

The wireless docks segment is expected to record the fastest CAGR from 2026 to 2033, fueled by advancements in wireless standards such as WiGig and Bluetooth 5. Wireless docking stations eliminate cable clutter, offering flexibility and mobility for modern workspaces. The shift toward minimalist, cable-free office environments and the integration of wireless charging capabilities are key growth factors for this segment.

- By Application

On the basis of application, the market is categorized into commercial and residential. The commercial segment dominated the market in 2025, driven by widespread adoption in corporate offices, educational institutions, and co-working spaces. Docking stations support seamless connectivity and device management for employees, facilitating flexible and hot-desking environments. The increasing investment by enterprises in digital transformation and IT infrastructure continues to bolster this segment’s dominance.

The residential segment is poised to witness the fastest growth from 2026 to 2033, supported by the rise of remote working, online learning, and home-based businesses. Consumers are increasingly setting up multi-device workstations at home, enhancing demand for docking stations that support multiple screens and peripherals.

- By Price Range

On the basis of price range, the market is segmented into high, medium, and low. The medium price range segment dominated the market in 2025, offering a balance between affordability and performance for both personal and professional users. These docking stations provide essential features such as multiple USB ports, HDMI connectivity, and charging support, appealing to mid-tier consumers and SMEs. The demand is also boosted by their compatibility with both Windows and macOS devices.

The high-price segment is expected to grow at the fastest rate from 2026 to 2033, driven by increasing adoption of premium docks integrated with Thunderbolt technology, high-speed data transfer, and advanced display capabilities. Professionals in design, finance, and IT sectors prefer these premium docks for their superior performance and durability.

Docking Station Market Regional Analysis

- North America dominated the docking station market with the largest revenue share of 37.9% in 2025, driven by the increasing penetration of hybrid work models and the widespread use of multiple computing devices

- The growing adoption of laptops and tablets across enterprises and educational institutions has significantly boosted the need for connectivity hubs

- Consumers in the region prefer docking stations that enable multi-device integration, seamless data transfer, and enhanced workspace efficiency. Strong presence of leading technology manufacturers and rapid innovation in USB-C and Thunderbolt ports further strengthen the regional market

U.S. Docking Station Market Insight

The U.S. docking station market captured the largest revenue share in 2025 within North America, fueled by the growing number of remote workers and professionals seeking enhanced workstation functionality. The rising trend of multi-monitor setups and flexible office environments is driving demand for high-performance docks. Companies are increasingly investing in advanced docking solutions to improve employee productivity and device compatibility. The market is also supported by the growing adoption of USB-C docks across corporate, educational, and home office setups.

Europe Docking Station Market Insight

The Europe docking station market is projected to grow at a significant CAGR throughout the forecast period, supported by the strong adoption of digital workspaces and BYOD (Bring Your Own Device) practices across industries. Businesses in the region are integrating docking stations to enable secure, efficient, and connected work environments. Demand is also rising among creative professionals and IT users who require seamless connectivity between multiple devices. Sustainability initiatives and the shift toward energy-efficient tech accessories are further contributing to the region’s market growth.

U.K. Docking Station Market Insight

The U.K. docking station market is expected to register a healthy CAGR during the forecast period, driven by the rapid shift to remote and hybrid work structures. Increasing preference for flexible, cable-free office setups is fueling adoption among both commercial and residential users. The strong presence of e-commerce platforms offering diverse product ranges and the rising demand for USB-C and wireless docks are shaping market expansion. Moreover, corporate adoption of docking stations to streamline IT infrastructure continues to boost regional growth.

Germany Docking Station Market Insight

The Germany docking station market is anticipated to expand steadily through the forecast period, driven by the country’s technological advancements and growing demand for efficient workspace solutions. Enterprises are increasingly focusing on productivity-enhancing tools such as docking stations to support flexible and collaborative work environments. Germany’s emphasis on innovation and quality manufacturing supports the development of durable, high-speed, and eco-friendly docks. Growing adoption of Thunderbolt-enabled and wireless docking systems is further accelerating market growth.

Asia-Pacific Docking Station Market Insight

The Asia-Pacific docking station market is poised to grow at the fastest CAGR from 2026 to 2033, driven by rapid digital transformation, expansion of the IT sector, and increasing use of portable devices in countries such as China, Japan, and India. The rise of remote work, e-learning, and start-up ecosystems has amplified the need for cost-effective connectivity solutions. APAC’s large manufacturing base and availability of affordable electronic components also make the region a key hub for docking station production and export.

China Docking Station Market Insight

The China docking station market accounted for the largest revenue share in Asia-Pacific in 2025, supported by high demand for consumer electronics, rising disposable incomes, and robust domestic manufacturing. Chinese consumers are increasingly adopting docking stations for laptops, tablets, and smartphones to enhance productivity. The growth of the gaming and creative industries, coupled with the nation’s large base of tech-savvy professionals, continues to drive market expansion. Strong local production and competitive pricing give China a leading position in the regional market.

Japan Docking Station Market Insight

The Japan docking station market is growing steadily, driven by increasing adoption of advanced digital infrastructure and smart office technologies. Japanese enterprises prioritize compact, multifunctional, and high-quality docking solutions to support space-efficient work environments. The country’s technological sophistication and focus on user-friendly, high-speed connectivity devices encourage the adoption of modern docking stations. The ongoing shift toward wireless docking technologies further strengthens Japan’s position as a major contributor to regional growth.

Docking Station Market Share

The docking station industry is primarily led by well-established companies, including:

- Targus (U.S.)

- Dell Inc. (U.S.)

- HP Development Company, L.P. (U.S.)

- ACCO Brands (U.S.)

- Lenovo (China)

- Plugable Technologies (U.S.)

- Apple Inc. (U.S.)

- TOSHIBA CORPORATION (Japan)

- SAMSUNG (South Korea)

- Acer Inc. (Taiwan)

- ASUSTeK Computer Inc. (Taiwan)

- FUJITSU (Japan)

- IBM Corporation (U.S.)

- Sony Singapore (Singapore)

- Microsoft (U.S.)

- Panasonic Corporation (Japan)

- IOGEAR (U.S.)

- SilverStone Technology Co., Ltd. (Taiwan)

- Powever Technology (Shenzhen) Co., Ltd. (China)

- Architonic AG (Switzerland)

Latest Developments in Global Docking Station Market

- In August 2023, HP Inc. introduced its Universal USB-C Multiport Hub, designed to support high-speed data transfer and 4K display output for hybrid work environments. This launch reinforced HP’s position in the docking station market by catering to the growing demand for compact, all-in-one connectivity solutions. The innovation addressed the increasing need for portable and efficient docking options among professionals working across multiple devices and platforms, enhancing overall user flexibility and productivity

- In January 2023, Lenovo Group Limited unveiled its ThinkPad Universal Thunderbolt 4 Dock, offering advanced connectivity, faster charging, and improved compatibility across multiple operating systems. This development significantly strengthened Lenovo’s product portfolio in the enterprise segment and aligned with the rising trend of USB-C standardization. The product’s versatility and performance positioned Lenovo as a key player meeting the evolving connectivity demands of corporate and remote users

- In April 2022, Targus, a leading manufacturer of laptop covers and mobile computing accessories, announced the release of two new Thunderbolt 3 Docks, featuring Thunderbolt speed for high-resolution graphics. The development enhanced Targus’s market presence by addressing the specific needs of creative professionals and design studios seeking superior performance and seamless device integration

- In April 2022, Kensington, a sub-brand of ACCO Brands, launched the Blackbelt Rugged Case with an integrated Mobile Dock for Surface Pro 8. This innovation combined a full-featured docking station with military-grade protection, advancing the market for durable and multifunctional docking solutions. It effectively expanded Kensington’s footprint in enterprise and educational sectors demanding portability and protection

- In March 2022, Dell Technologies Inc. introduced the world’s first docking station with a wireless charging stand for Qi-enabled smartphones and earbuds. This breakthrough strengthened Dell’s position as a pioneer in workspace innovation, meeting the growing demand for wire-free and energy-efficient docking solutions tailored for business professionals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.