Global Document Camera Market

Market Size in USD Million

CAGR :

%

USD

459.74 Million

USD

826.06 Million

2024

2032

USD

459.74 Million

USD

826.06 Million

2024

2032

| 2025 –2032 | |

| USD 459.74 Million | |

| USD 826.06 Million | |

|

|

|

|

Document Camera Market Size

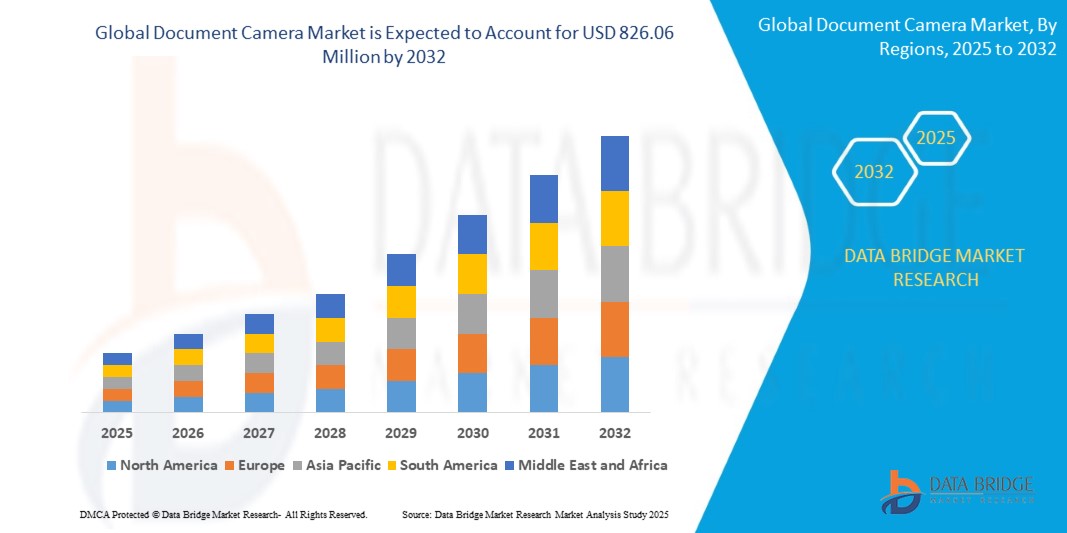

- The global document camera market size was valued at USD 459.74 million in 2024 and is expected to reach USD 826.06 million by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fuelled by the rising demand for real-time content sharing in education and corporate sectors, increasing adoption of digital classrooms, and the expanding need for remote and hybrid collaboration tools

- In addition, growing investments in interactive learning infrastructure and the integration of document cameras with smart whiteboards and conferencing systems are further supporting market expansion

Document Camera Market Analysis

- Educational institutions are widely adopting document cameras to enhance visual learning and ensure dynamic classroom engagement, especially in STEM subjects

- The corporate sector is increasingly using document cameras in meetings and presentations for their ability to display documents, prototypes, and annotations in real time

- North America dominated the document camera market with the largest revenue share of 38.25% in 2024, driven by strong demand for interactive teaching tools and presentation systems across educational and corporate environments

- Asia-Pacific region is expected to witness the highest growth rate in the global document camera market, driven by increasing investment in digital learning platforms, expansion of online and hybrid education, and rising adoption of presentation tools in developing economies

- The portable segment dominated the market with the largest revenue share in 2024, driven by its compact design, ease of mobility, and growing use in flexible classroom and office environments. These models are favored in education due to their plug-and-play capabilities and compatibility with various display tools, making them ideal for dynamic and hybrid teaching setups

Report Scope and Document Camera Market Segmentation

|

Attributes |

Document Camera Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Document Camera Market Trends

“Integration With Interactive and Smart Classroom Technologies”

- Educational institutions are increasingly integrating document cameras with smartboards, digital displays, and touch-enabled projectors to enhance classroom interactivity

- These integrations enable real-time content sharing, annotation, and collaboration between teachers and students in both physical and virtual settings

- Document cameras are being adopted as essential components of hybrid learning setups, supporting seamless transitions between online and offline teaching

- Manufacturers are developing plug-and-play document cameras that are compatible with popular conferencing platforms and educational software

- For instance, In South Korea, smart classrooms widely use document cameras alongside digital blackboards to deliver high-quality visual learning in both in-person and remote formats

Document Camera Market Dynamics

Driver

“Rising Demand from Educational Institutions for Interactive Teaching Tools”

- The increasing adoption of STEM-based curricula is pushing educational institutions to adopt visual teaching tools such as document cameras

- Document cameras enhance comprehension by allowing real-time demonstrations of experiments, books, and diagrams to large or remote audiences

- Hybrid and remote learning models require versatile teaching tools, and document cameras provide clarity and flexibility in content delivery

- High compatibility with video conferencing platforms such as Zoom and Google Meet makes document cameras essential in post-pandemic classrooms

- For instance, Under India’s DIKSHA initiative, document cameras have been introduced in government schools to enrich digital learning environments

Restraint/Challenge

“High Cost of Advanced Document Cameras and Budget Constraints in Schools”

- Advanced document cameras with 4K imaging, wireless capabilities, and smart features remain unaffordable for many public and rural schools

- Budget limitations often force schools to prioritize basic infrastructure over high-end visual aids, slowing technology adoption

- Ongoing maintenance and periodic software updates add to the long-term costs, discouraging long-term use in low-income regions

- Limited awareness and lack of trained staff to operate modern teaching tools also hinder adoption in smaller institutions

- For instance, In various parts of Southeast Asia, rural schools have been unable to implement advanced EdTech tools such as document cameras due to tight educational funding

Document Camera Market Scope

The market is segmented on the basis of product type, components, interface, pixels range, connection type, application, end-user, and weight range.

• By Product Type

On the basis of product type, the document camera market is segmented into portable, desktop model, and ceiling models. The portable segment dominated the market with the largest revenue share in 2024, driven by its compact design, ease of mobility, and growing use in flexible classroom and office environments. These models are favored in education due to their plug-and-play capabilities and compatibility with various display tools, making them ideal for dynamic and hybrid teaching setups.

The ceiling models segment is expected to witness the fastest growth from 2025 to 2032, fuelled by their increasing deployment in large lecture halls and auditoriums. These models offer unobstructed views, wide-angle capture, and permanent installation, which enhances instructional efficiency and supports real-time presentation without desktop clutter.

• By Components

On the basis of components, the market is segmented into optics camera, lighting systems, motherboard and firmware, and others. The optics camera segment held the largest revenue share in 2024, attributed to rising demand for high-resolution imaging and detailed visual presentations in education and business sectors. The continuous innovation in optical zoom and autofocus functions makes this component essential for delivering precise and clear images.

The motherboard and firmware segment is expected to witness the fastest growth from 2025 to 2032, supported by advancements in real-time processing, smart integrations, and software-driven upgrades that improve device performance and versatility.

• By Interface

On the basis of interface, the market is segmented into input and output. The output interface segment captured the largest revenue share in 2024, owing to growing demand for HDMI, USB, and VGA outputs that allow easy connection with a wide range of display and recording devices.

The input interface segment is expected to witness the fastest growth from 2025 to 2032, driven by the need for multiple source inputs to support interactivity, including annotation devices and sensors for real-time feedback during presentations.

• By Pixels Range

On the basis of pixels range, the market is segmented into less than 5MP, 5 to 10MP, 10.1 to 15MP, and more than 15MP. The 5 to 10MP segment held the largest market share in 2024, as it offers a balanced combination of image clarity and cost-effectiveness for educational and business applications.

The more than 15MP segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand for ultra-high-definition visuals in telemedicine, courtroom evidence presentation, and detailed academic demonstrations.

• By Connection Type

On the basis of connection type, the market is segmented into wired and wireless. The wired segment held the largest revenue share in 2024 due to its reliability, stable transmission, and preference in traditional setups such as classrooms and conference rooms.

The wireless segment is expected to witness the fastest growth from 2025 to 2032, fuelled by the shift toward untethered mobility, BYOD environments, and the growing use of cloud-connected and app-controlled devices.

• By Application

On the basis of application, the market is segmented into lecture hall or classroom use, presentation of material in conferences, meetings and training sessions, videoconferencing and telepresence, presentation of evidence in courtrooms, telepathology, and medical applications. The classroom use segment accounted for the highest revenue share in 2024, driven by widespread adoption in K–12 and higher education settings for real-time demonstrations and collaborative learning.

The videoconferencing and telepresence segment is expected to witness the fastest growth from 2025 to 2032, driven by the rise of hybrid work and learning models requiring clear visual communication across remote participants.

• By End-User

On the basis of end-user, the market is segmented into education, corporate, and others. The education segment dominated the market with the largest share in 2024, fuelled by global digitization of classrooms, government-backed initiatives, and growing use of multimedia in curricula.

The corporate segment is expected to witness the fastest growth from 2025 to 2032, supported by increasing use of document cameras in training sessions, product showcases, and virtual collaboration meetings.

• By Weight Range

On the basis of weight range, the market is segmented into less than 3kg and more than 3kg. The less than 3kg segment led the market in 2024, attributed to rising demand for lightweight, portable models that suit mobile teaching and work environments.

The more than 3kg segment is expected to witness the fastest growth from 2025 to 2032, driven by demand for high-performance, stable models used in large venues, permanent installations, and applications requiring advanced optics and mechanics.

Document Camera Market Regional Analysis

- North America dominated the document camera market with the largest revenue share of 38.25% in 2024, driven by strong demand for interactive teaching tools and presentation systems across educational and corporate environments

- Institutions and organizations across the region prioritize high-quality visual communication and hybrid learning tools, fostering the rapid adoption of document cameras

- The presence of leading educational technology providers, combined with high digital infrastructure and funding for smart classrooms, continues to support widespread deployment of document cameras across schools, universities, and conference settings

U.S. Document Camera Market Insight

The U.S. document camera market captured the largest revenue share of 79% within North America in 2024, driven by the increasing emphasis on digital learning and corporate training solutions. With classrooms embracing smart technology and enterprises shifting toward remote collaboration, document cameras are increasingly used to support dynamic content sharing. The growing investment in EdTech initiatives, combined with the integration of document cameras with platforms such as Zoom and Microsoft Teams, is enhancing their role across K–12, higher education, and corporate training environments.

Europe Document Camera Market Insight

The Europe document camera market is expected to witness the fastest growth from 2025 to 2032, supported by the expansion of digital education programs and rising demand for efficient visual communication systems in offices and institutions. Educational reform and modernization projects, particularly in Western and Northern Europe, are promoting the adoption of document cameras. These tools are increasingly used to facilitate remote instruction, detailed visual demonstrations, and blended learning in both public and private institutions across the region.

U.K. Document Camera Market Insight

The U.K. document camera market is expected to witness the fastest growth from 2025 to 2032, driven by the rising demand for smart classroom technology and virtual presentation tools. British schools and universities are rapidly digitizing teaching methods, while businesses are integrating document cameras into hybrid meetings and training modules. Government funding for digital transformation in education and widespread use of online learning platforms continue to support the increasing adoption of document cameras.

Germany Document Camera Market Insight

The Germany document camera market is expected to witness the fastest growth from 2025 to 2032, fuelled by the country’s focus on innovation, high-quality education, and advanced corporate infrastructure. German educational institutions are deploying document cameras to support interactive STEM learning and live demonstrations, while businesses use them for virtual presentations and training. Integration with existing audiovisual and automation systems is also gaining traction, as demand grows for multifunctional and scalable visual solutions.

Asia-Pacific Document Camera Market Insight

The Asia-Pacific document camera market is expected to witness the fastest growth from 2025 to 2032, driven by widespread adoption of smart education systems and corporate digitalization across countries such as China, India, Japan, and South Korea. Governments and private institutions are increasingly investing in advanced teaching aids, with document cameras becoming a vital tool for virtual classrooms, e-learning platforms, and professional communication. The region’s large student population, improving internet penetration, and growing EdTech ecosystem further contribute to market growth.

Japan Document Camera Market Insight

The Japan document camera market is expected to witness the fastest growth from 2025 to 2032, underpinned by the country's advanced educational infrastructure and high acceptance of digital teaching tools. Japanese schools and universities are leveraging document cameras for visual content sharing, remote demonstrations, and live experimentation. In the corporate space, businesses use document cameras to support telepresence meetings and detailed product briefings. The integration of document cameras into multifunctional AV setups and IoT-based education systems continues to enhance their utility across sectors.

China Document Camera Market Insight

The China document camera market accounted for the largest revenue share within Asia Pacific in 2024, driven by rapid digitization of the education sector, high government investment in smart classrooms, and a growing EdTech manufacturing base. Chinese schools, especially in urban regions, are increasingly adopting document cameras to enhance hybrid learning outcomes. The strong presence of domestic technology manufacturers and aggressive promotion of online education platforms are key factors contributing to the expansion of the market in China.

Document Camera Market Share

The document camera industry is primarily led by well-established companies, including:

- AVer Information Inc. (Taiwan)

- ELMO USA CORP. (U.S.)

- WolfVision GmbH (Austria)

- Seiko Epson Corporation (Japan)

- IPEVO Inc. (U.S.)

- Lumens (Taiwan)

- Pathway Innovations and Technologies (U.S.)

- QOMO (U.S.)

- HUE (U.K.)

- TTS (U.K.)

- Acco Brands (U.S.)

- SMART Technologies ULC (Canada)

- Hong Kong Codis Electronic Co. Ltd (Hong Kong)

- Boxlight (U.S.)

- Shenzhen Eloam Technology Co., Ltd. (China)

- Longjoy Technology Inc. (China)

- Guangzhou Osoto Electronic Equipment Co., Ltd (China)

- Eastman Kodak Company (U.S.)

- Dukane AV (U.S.)

- CZUR TECH CO., LTD. (China)

Latest Developments in Global Document Camera Market

- In July 2021, Boxlight (Clevertouch) teamed up with Intel under its market-ready solution scheme. This partnership is geared towards offering enhanced products that leverage Intel's technology, catering to the evolving needs of hybrid work environments post-COVID-19. Clevertouch aims to expand its presence in sectors such as education and enterprise, as well as penetrate new markets such as retail and healthcare, positioning itself as a leading provider of integrated technology solutions

- In April 2021, Lumens partnered with Bosch to integrate PTZ cameras with Bosch conference systems. This collaboration aims to enhance event coverage, from small local gatherings to large international summits, by delivering superior image quality and seamless integration. Bosch's expertise in flexible solutions and easy installation complements Lumens' product portfolio, potentially boosting their market competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Document Camera Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Document Camera Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Document Camera Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.