Global Dodecanedioic Acid Market

Market Size in USD Million

CAGR :

%

USD

552.58 Million

USD

851.25 Million

2024

2032

USD

552.58 Million

USD

851.25 Million

2024

2032

| 2025 –2032 | |

| USD 552.58 Million | |

| USD 851.25 Million | |

|

|

|

|

Dodecanedioic Acid Market Size

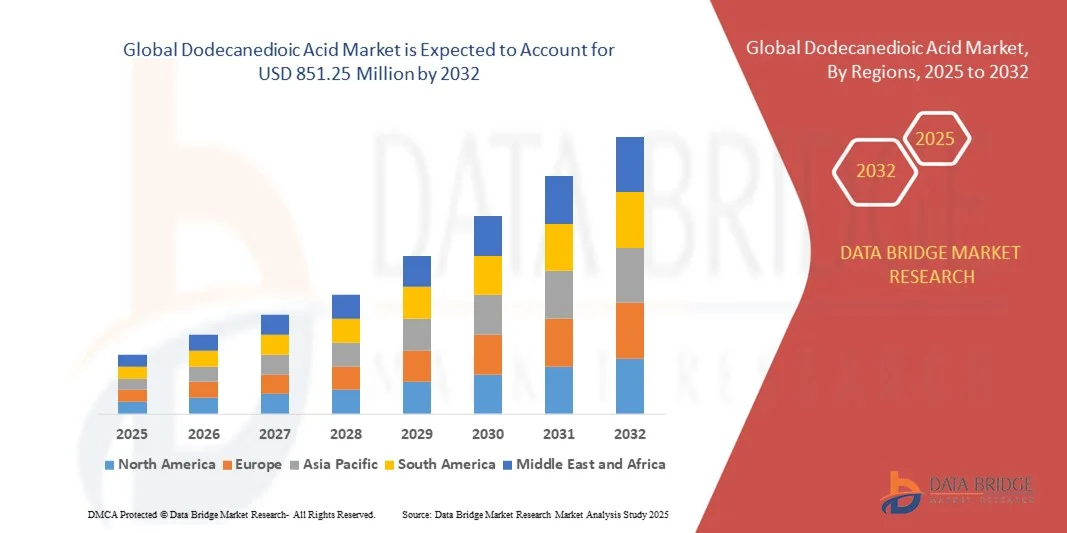

- The global dodecanedioic acid market size was valued at USD 552.58 million in 2024 and is expected to reach USD 851.25 million by 2032, at a CAGR of 5.55% during the forecast period

- The market growth is largely fueled by the increasing demand for high-performance polymers, resins, adhesives, and coatings across industries such as automotive, electronics, construction, and industrial manufacturing. Rising industrialization, especially in emerging economies, is further driving consumption of Dodecanedioic Acid as a key chemical intermediate

- Furthermore, the shift toward sustainable and bio-based chemical production, combined with advancements in chemical and biological synthesis processes, is creating new growth opportunities. The growing emphasis on eco-friendly and high-purity materials in specialty applications is accelerating adoption, thereby significantly boosting the Dodecanedioic Acid market

Dodecanedioic Acid Market Analysis

- Dodecanedioic Acid, a critical dicarboxylic acid, is increasingly utilized in producing nylon 6,6, high-performance coatings, lubricants, and adhesives, making it a vital component for modern industrial and specialty chemical applications. Its versatility, compatibility with renewable feedstocks, and ability to enhance material performance are driving higher demand

- The market’s expansion is also supported by technological progress in production methods, rising investments in specialty chemical manufacturing, and favorable government policies promoting industrial and chemical sector growth, particularly in Asia-Pacific and Europe. These converging factors collectively strengthen the market’s growth trajectory

- Asia-Pacific dominated the dodecanedioic acid market with a share of more than 35% in 2024, due to expanding polymer and resin manufacturing, increasing demand for high-performance coatings and adhesives, and a strong presence of chemical production hubs

- North America is expected to be the fastest growing region in the dodecanedioic acid market during the forecast period due to rising demand for DDDA in resins, coatings, adhesives, and lubricants

- Resin segment dominated the market with a market share of 60.5% in 2024, due to its extensive use in producing high-performance polyamides and specialty polymers. DDDA-based resins offer superior thermal stability, chemical resistance, and mechanical strength, making them ideal for automotive, electronics, and industrial applications. The segment benefits from consistent demand from large-scale manufacturers of engineering plastics and performance materials. Furthermore, innovations in resin formulations and growing industrialization in emerging economies continue to bolster market adoption

Report Scope and Dodecanedioic Acid Market Segmentation

|

Attributes |

Dodecanedioic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dodecanedioic Acid Market Trends

Growing Adoption of Sustainable Dodecanedioic Acid Production

- The global dodecanedioic acid (DDDA) market is increasingly moving toward sustainable and bio-based production methods as industries prioritize low-environmental-impact raw materials. Traditional petroleum-derived DDDA is gradually being replaced by biologically sourced alternatives produced through fermentation processes using renewable feedstocks such as plant oils and sugars, aligning with global sustainability initiatives and carbon reduction goals

- For instance, Cathay Biotech Inc. has developed bio-based DDDA through proprietary fermentation technology utilizing renewable plant-based sources. The company’s efforts to scale up bio-derived monomer production highlight how industrial biotechnology is transforming the DDDA sector by reducing dependence on fossil resources while maintaining identical performance characteristics

- Bio-based DDDA is gaining traction as an environmentally superior alternative used in engineering plastics, adhesives, and powder coatings. These products not only meet industrial functionality standards but also enable manufacturers to meet green certification requirements and improve their environmental footprint across supply chains

- In addition, advancements in fermentation yield optimization and downstream purification are improving production efficiency and competitiveness of bio-DDDA compared to conventional routes. Continuous research toward enhanced microbial strains and process integration is supporting scalable, cost-effective, and sustainable DDDA production across multiple applications

- Major markets such as automotive, construction, and textiles are increasingly demanding sustainable materials with equivalent durability and performance to petrochemical-based counterparts. Bio-based DDDA addresses these needs while contributing to overall lifecycle carbon footprint reduction for end products

- The transition toward bio-based dodecanedioic acid production represents a key milestone in sustainable chemical manufacturing. As regulatory pressures on carbon emissions intensify and supply chains embrace renewable chemistry, the adoption of bio-DDDA is expected to accelerate, driving a greener and more resilient materials ecosystem globally

Dodecanedioic Acid Market Dynamics

Driver

Rising Demand for High-Performance Polymers and Coatings

- The growing demand for high-performance polymers and coatings across industries such as automotive, electronics, and construction is driving the expansion of the dodecanedioic acid market. DDDA serves as a crucial intermediate in the production of specialty polymers, polyamides, and polyester resins known for superior mechanical strength, thermal stability, and chemical resistance

- For instance, BASF SE utilizes DDDA as a key component in the creation of engineering-grade nylon 6,12 and specialty coatings tailored for automotive and industrial use. These applications exemplify the increasing importance of DDDA in manufacturing lightweight, durable, and corrosion-resistant materials suited for demanding environments

- The rising adoption of high-performance polymer-based components in automotive and electronics manufacturing has intensified the need for stability and endurance under extreme operating conditions. DDDA-derived resins support these performance requirements by offering enhanced flexibility, creep resistance, and low moisture absorption in finished products

- In addition, coating formulations utilizing DDDA provide superior adhesion, gloss retention, and weather resistance, making them ideal for industrial equipment, marine structures, and metal protection applications. These benefits align with market expectations for long-lasting coatings amid rising sustainability and quality standards

- As industries continue advancing toward energy-efficient, durable, and environmentally compliant materials, DDDA-based polymers and coatings are expected to occupy a central role in specialty materials development. This steady shift toward performance-oriented materials ensures consistent demand growth for DDDA in global manufacturing ecosystems

Restraint/Challenge

High Production Costs Limiting Large-Scale Use

- Despite rising industrial demand, the high production cost associated with dodecanedioic acid remains a primary constraint to market expansion, particularly in cost-sensitive sectors. Conventional chemical synthesis involves complex catalytic reactions requiring significant energy input and expensive raw materials, thereby increasing overall manufacturing expenses

- For instance, Ube Industries Ltd. has reported that the synthesis of DDDA from petrochemical pathways demands high operational costs due to feedstock volatility and catalyst inefficiency. This cost challenge has encouraged the firm and industry peers to explore bio-based alternatives and process optimization to enhance cost competitiveness

- The energy-intensive production process and lengthy separation stages further increase the total cost of ownership, limiting DDDA penetration into lower-margin applications. Manufacturers face difficulties balancing high performance benefits with pricing expectations from downstream industries such as packaging and consumer goods

- In addition, the limited availability of sustainable feedstocks and high cost of fermentation-based biotechnologies present another barrier to scale-up. Small-scale producers often encounter economic hurdles in achieving economies of scale while maintaining quality consistency in bio-based DDDA

- Addressing these production cost barriers will rely on technological innovation and improved process efficiencies. Strategic investments in bioprocess research, optimized catalysts, and renewable feedstock utilization are expected to lower production costs over time, enabling broader adoption of dodecanedioic acid across mainstream industrial sectors

Dodecanedioic Acid Market Scope

The market is segmented on the basis of process, raw materials, purity, and application.

- By Process

On the basis of process, the Dodecanedioic Acid market is segmented into chemical process and biological process. The chemical process segment dominated the market with the largest revenue share in 2024, driven by its well-established production techniques, higher yields, and consistent product quality. Manufacturers prefer chemical synthesis due to its scalability and cost-effectiveness, allowing efficient production of DDDA for industrial applications. The chemical process also benefits from established supply chains for feedstock and raw materials, ensuring reliable production continuity. Its ability to produce DDDA at high purity levels further strengthens its adoption across applications such as resins and coatings. Regulatory familiarity with chemical processes also reduces compliance complexities, enhancing market confidence in this segment.

The biological process segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by increasing interest in sustainable and eco-friendly production methods. Biological production, often using microbial fermentation, appeals to industries focusing on green chemistry and reducing carbon footprint. Technological advancements in bioprocessing have improved yields and lowered costs, making this method increasingly competitive. The segment’s growth is also supported by rising consumer and industrial demand for bio-based chemicals and renewable alternatives, positioning it as a promising segment in the DDDA market.

- By Raw Materials

On the basis of raw materials, the market is segmented into butadiene, paraffin wax, and others. The butadiene segment dominated the market in 2024, owing to its high reactivity and efficiency in DDDA synthesis, resulting in superior product quality and yield. Butadiene-derived DDDA is widely preferred for industrial applications such as resin, adhesives, and coatings due to its consistent chemical properties and scalability. The segment’s dominance is reinforced by established supply chains, cost advantages, and technical familiarity among manufacturers. Furthermore, its compatibility with chemical synthesis methods ensures widespread adoption in large-scale production facilities.

The paraffin wax segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its renewable nature and increasing use in bio-based DDDA production. Paraffin wax provides a sustainable alternative to petroleum-based feedstocks, aligning with the growing global emphasis on environmentally friendly industrial chemicals. Technological innovations in catalytic conversion and oxidation processes have made paraffin-based DDDA production more efficient. The rising adoption of green chemistry principles and regulatory incentives for sustainable manufacturing further support the rapid growth of this segment.

- By Purity

On the basis of purity, the market is segmented into Purity 99%, Purity 98%, and others. The Purity 99% segment dominated the market in 2024, driven by its high demand in critical applications such as resin synthesis, powder coatings, and high-performance lubricants where superior product quality is essential. High-purity DDDA ensures better performance, longer durability, and chemical stability in downstream applications. Industries prefer this segment as it minimizes impurities, enhances reaction efficiency, and supports compliance with stringent industrial standards. The availability of advanced purification technologies further reinforces its dominance, making it a preferred choice for premium applications.

The Purity 98% segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by cost-sensitive applications where slightly lower purity levels are acceptable without compromising performance. The segment benefits from more economical production methods and faster manufacturing cycles, making it attractive for large-scale industrial uses. Growing demand from bulk applications in adhesives, lubricants, and coatings, combined with technological improvements in purification techniques, is expected to drive this segment’s expansion over the forecast period.

- By Application

On the basis of application, the market is segmented into resin, powder coatings, adhesives, lubricants, and others. The resin segment dominated the market with a share of 60.5% in 2024, driven by its extensive use in producing high-performance polyamides and specialty polymers. DDDA-based resins offer superior thermal stability, chemical resistance, and mechanical strength, making them ideal for automotive, electronics, and industrial applications. The segment benefits from consistent demand from large-scale manufacturers of engineering plastics and performance materials. Furthermore, innovations in resin formulations and growing industrialization in emerging economies continue to bolster market adoption.

The powder coatings segment is expected to witness the fastest growth from 2025 to 2032, fueled by increasing demand for eco-friendly, solvent-free coating solutions. DDDA enhances the thermal and chemical resistance of powder coatings, making them suitable for automotive, construction, and appliance industries. The segment’s growth is also supported by stricter environmental regulations promoting low-VOC coatings and the rising preference for durable, sustainable surface finishes. Technological advancements in coating formulations and rising investments in industrial finishing processes further accelerate the expansion of this segment.

Dodecanedioic Acid Market Regional Analysis

- Asia-Pacific dominated the dodecanedioic acid market with the largest revenue share of more than 35% in 2024, driven by expanding polymer and resin manufacturing, increasing demand for high-performance coatings and adhesives, and a strong presence of chemical production hubs

- The region’s cost-effective manufacturing landscape, rising investments in specialty chemical production, and growing exports of DDDA-based intermediates are accelerating market expansion

- The availability of skilled labor, favorable government policies, and rapid industrialization across developing economies are contributing to increased consumption of DDDA in both industrial and specialty chemical sectors

China Dodecanedioic Acid Market Insight

China held the largest share in the Asia-Pacific DDDA market in 2024, owing to its strong industrial base in polymer, resin, and coating production. The country’s supportive government policies for chemical manufacturing, robust export capabilities, and active investment in specialty chemicals are major growth drivers. Rising domestic demand for adhesives, high-performance lubricants, and engineering polymers further reinforces market growth, alongside increasing R&D in bio-based DDDA production technologies.

India Dodecanedioic Acid Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by rapidly expanding chemical manufacturing and polymer industries. Government initiatives promoting local production of specialty chemicals and renewable feedstocks are boosting DDDA demand. Increasing industrialization, rising exports of resins and coatings, and growing focus on sustainable and bio-based chemical production are key factors driving robust market expansion.

Europe Dodecanedioic Acid Market Insight

The Europe DDDA market is expanding steadily, supported by stringent regulatory frameworks, high demand for high-purity intermediates, and growing investments in sustainable and specialty chemical production. The region emphasizes quality, environmental compliance, and advanced formulations, particularly in automotive, electronics, and industrial coatings. Rising adoption of green chemistry and bio-based DDDA solutions is further enhancing market growth.

Germany Dodecanedioic Acid Market Insight

Germany’s DDDA market is driven by its leadership in high-precision chemical manufacturing, strong polymer and resin industries, and export-oriented production model. Established R&D networks and partnerships between academic institutions and chemical manufacturers foster innovation in specialty chemical production. Demand is particularly strong for high-purity DDDA in adhesives, coatings, and engineering polymers.

U.K. Dodecanedioic Acid Market Insight

The U.K. market is supported by a mature chemicals and materials sector, growing efforts to localize specialty chemical production post-Brexit, and increasing demand for high-performance intermediates. Focus on R&D, academic-industry collaboration, and investments in lab-scale and pilot-scale DDDA production are strengthening the region’s position in the specialty chemicals market.

North America Dodecanedioic Acid Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for DDDA in resins, coatings, adhesives, and lubricants. A strong focus on sustainable chemical production, advancements in high-performance polymers, and growing reshoring of specialty chemical manufacturing are boosting market adoption. Collaboration between chemical manufacturers and end-user industries further supports market expansion.

U.S. Dodecanedioic Acid Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its mature polymer and specialty chemical industries, extensive R&D infrastructure, and significant investment in high-purity DDDA production. The country’s focus on innovation, sustainability, and regulatory compliance is driving demand for DDDA in advanced coatings, adhesives, and engineering polymers. Presence of key market players and an established distribution network reinforce the U.S.'s leading position in the region.

Dodecanedioic Acid Market Share

The dodecanedioic acid industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Thermo Fisher Scientific (U.S.)

- Avantor, Inc. (U.S.)

- Santa Cruz Biotechnology, Inc. (U.S.)

- Evonik Industries AG (Germany)

- Sinopec Qingdao Petrochemical Co., Ltd. (China)

- BEYO Chemical Co., Ltd. (China)

- Acadechem Company Limited (U.K.)

- ChemTik (U.S.)

- Labseeker (U.S.)

- BLD Pharmatech Ltd. (China)

- ChemScence (U.S.)

- Alichem Inc. (U.S.)

- LGC Limited (U.K.)

- Hairuichem (China)

- TCI Chemicals (India) Pvt. Ltd. (India)

- INVISTA (U.S.)

- BASF SE (Germany)

- UBE INDUSTRIES, LTD. (Japan)

Latest Developments in Global Dodecanedioic Acid Market

- In July 2025, BASF acquired full ownership of the Alsachimie joint venture in France, gaining complete control over the production of key polyamide 6.6 precursors, including Dodecanedioic Acid. This acquisition strengthens BASF’s ability to manage its supply chain efficiently, ensuring consistent availability of high-purity DDDA for industrial applications. By consolidating operations, BASF can better meet the growing demand across Europe for high-performance polymers used in adhesives, coatings, and engineering plastics, while also supporting innovation in specialty materials

- In June 2025, BASF announced that it was nearing the completion of its PA 6.6 production expansion in Freiburg, Germany. The expansion is expected to significantly increase the output of Dodecanedioic Acid, a critical component in nylon 6,6 production. This development allows BASF to respond to rising demand from automotive, electronics, and industrial sectors, where high-performance polymers are increasingly required for lightweight, durable, and chemically resistant applications. The expansion also reinforces BASF’s position as a key supplier in the European market and strengthens its global competitiveness

- In June 2025, INVISTA completed the expansion of its nylon 6,6 polymer facility at the Shanghai Chemical Industry Park in China. The facility’s increased production capacity is expected to support higher demand for Dodecanedioic Acid used in nylon manufacturing for automotive, electronics, and industrial applications across China and the wider Asia-Pacific region. This expansion not only addresses regional supply needs but also enhances INVISTA’s ability to cater to export markets, contributing to the growth of the DDDA market in Asia-Pacific and reinforcing the company’s leadership in high-performance polymer production

- In May 2025, BASF announced plans to further expand its PA 6.6 and hexamethylenediamine production capacities. This planned increase in output is anticipated to drive higher consumption of Dodecanedioic Acid, facilitating the production of advanced polymers, resins, and coatings. The expansion is particularly significant in meeting the growing industrial demand for durable, high-performance materials used in automotive, electronics, and specialty applications, and supports BASF’s strategic focus on sustainable and efficient chemical production

- In January 2025, INVISTA expanded its sustainable nylon 6,6 production program to include traceable and renewable feedstocks. This initiative is expected to increase the demand for bio-based Dodecanedioic Acid, reflecting the growing industry emphasis on sustainability and environmentally friendly chemical processes. By promoting the use of renewable feedstocks, INVISTA is aligning with global trends toward green chemistry and eco-conscious manufacturing, thereby driving adoption of DDDA in applications requiring sustainable high-performance polymers and supporting long-term market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dodecanedioic Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dodecanedioic Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dodecanedioic Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.