Global Doppler Radar Market

Market Size in USD Billion

CAGR :

%

USD

12.98 Billion

USD

21.98 Billion

2024

2032

USD

12.98 Billion

USD

21.98 Billion

2024

2032

| 2025 –2032 | |

| USD 12.98 Billion | |

| USD 21.98 Billion | |

|

|

|

|

Doppler Radar Market Size

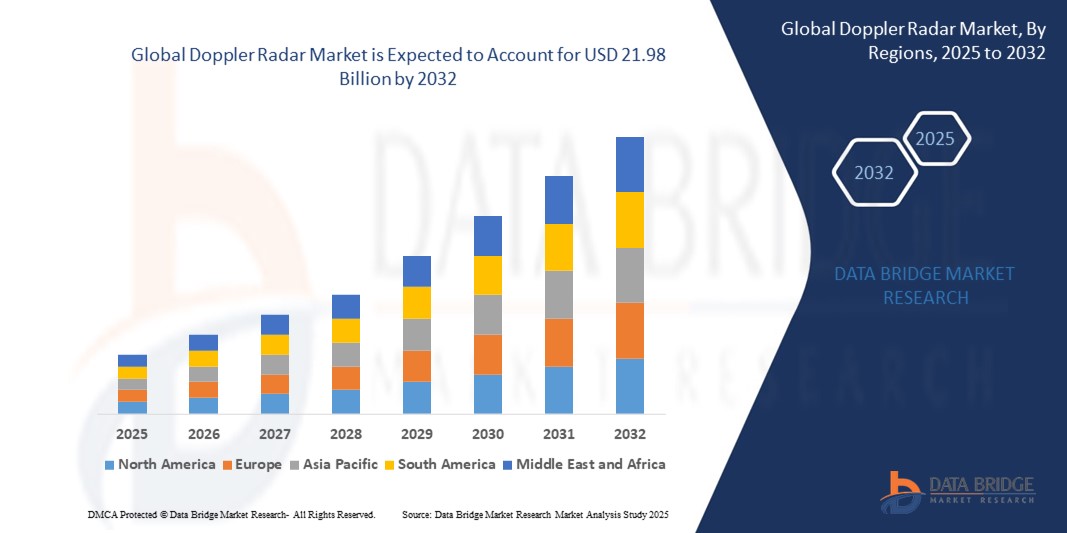

- The global doppler radar market size was valued at USD 12.98 billion in 2024 and is expected to reach USD 21.98 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by increasing demand for advanced surveillance, weather forecasting, and defense systems, alongside continuous advancements in radar technology and signal processing capabilities across civilian and military sectors

- Furthermore, rising investments in meteorological infrastructure, defense modernization, and the adoption of radar in autonomous vehicles, aviation safety, and disaster management are significantly accelerating the deployment of Doppler radar systems, thereby propelling market expansion

Doppler Radar Market Analysis

- Doppler radar systems use the Doppler effect to measure velocity and movement of objects, making them essential for applications such as weather monitoring, air traffic control, automotive safety, and military target tracking

- The growing demand for Doppler radar is primarily driven by its ability to deliver real-time, high-precision data in dynamic environments, rising concerns over climate-related disasters, and the need for reliable, long-range detection in defense and transportation sectors

- North America dominated the doppler radar market with a share of 30.06% in 2024, due to rising defense expenditures, widespread radar system upgrades, and growing demand for advanced surveillance solutions

- Asia-Pacific is expected to be the fastest growing region in the doppler radar market during the forecast period due to rising defense budgets, growing aviation traffic, and escalating demand for weather prediction systems

- Coherent pulsed segment dominated the market with a market share of 44.6% in 2024, due to its precise measurement of velocity and range, which makes it a preferred choice in aerospace and defense sectors. This technology uses phase coherence between transmitted and received pulses, enabling high-resolution imaging and effective target separation in complex operational environments such as cluttered terrain or congested airspaces

Report Scope and Doppler Radar Market Segmentation

|

Attributes |

Doppler Radar Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Doppler Radar Market Trends

“Increasing Demand for Accurate Weather Forecasting”

- The Doppler radar market is growing rapidly due to heightened global demand for precise weather forecasts, with weather agencies and governments investing in radar systems for improved disaster prediction, early warning, and climate resilience

- For instance, leading manufacturers such as Vaisala and Raytheon have introduced next-generation Doppler radar networks in North America and Europe, delivering real-time precipitation, storm, and wind data—crucial for accurate public safety alerts and aviation operations

- Severe weather events, such as hurricanes, floods, and tornados, are occurring more frequently, compelling investment in advanced Doppler radar for reliable storm tracking and mitigation efforts

- Integration with AI, IoT, and data analytics platforms allows Doppler radars to provide higher-resolution, continuous monitoring and predictive insights, which are leveraged by meteorologists and utilities for actionable decision-making

- Growth in the private and commercial aviation sector drives the deployment of Doppler radar for air traffic management, improving safety and operational efficiency under varied weather conditions

- Adoption is also rising in emerging markets such as Asia-Pacific, where rapid urbanization, infrastructure development, and regional climate risks necessitate robust weather surveillance capabilities

Doppler Radar Market Dynamics

Driver

“Increasing Investments in Defense and Security”

- Escalating defense and security budgets worldwide fuel demand for Doppler radar systems to support surveillance, missile guidance, and border monitoring due to their unparalleled ability to detect movement, speed, and threats across land, sea, and air

- For instance, major OEMs such as Thales Group and Lockheed Martin have secured government contracts to deliver advanced Doppler radar solutions for air defense, coastal surveillance, and early-warning systems, enhancing national security and tactical response

- Technological enhancements in pulse-Doppler, solid-state, and phased array radars enable military users to track faster and stealthier targets with better precision and reduced false alarms

- Defense applications are expanding to include drone detection, space situational awareness, and support for autonomous systems, further amplifying the market potential for Doppler radar technology

- The need for interoperability, network-centric defense, and rapid deployment capabilities in modern warfare is motivating sustained R&D and procurement of Doppler radar assets worldwide

Restraint/Challenge

“High Initial Investment”

- The high capital requirement for deploying Doppler radar—covering advanced equipment, installation, calibration, and training—remains a significant barrier, especially for emerging markets and budget-constrained sectors

- For instance, regulatory and budgetary hurdles have delayed some Doppler radar adoption projects in Asia-Pacific and Africa, as public sector buyers struggle to fund the upfront costs of networked, high-resolution radar installations

- Ongoing operational expenses include maintenance, software updates, and skilled personnel, further elevating the total cost of ownership and stretching payback periods for end-users

- Competitive pricing pressure and rapid technological innovation can make legacy systems obsolete more quickly, challenging smaller agencies and operators to keep up without continuous reinvestment

- Variability in procurement cycles, long sales lead times, and regional compliance requirements add complexity, sometimes slowing overall market penetration for new Doppler radar implementations

Doppler Radar Market Scope

The market is segmented on the basis of type, technology, and end-use industry.

- By Type

On the basis of type, the Doppler radar market is segmented into Pulse Doppler Radar, Ground-Based Doppler Radar, Naval Doppler Radar, and Airborne Doppler Radar. The Pulse Doppler Radar segment held the largest market revenue share in 2024, owing to its superior capability to detect moving targets even in environments with clutter. This radar type combines the benefits of pulse radar and Doppler shift analysis, enabling high-resolution detection, which is crucial in defense and aviation applications. Its ability to distinguish between stationary and moving objects has made it integral to modern military surveillance and air traffic control systems.

The Airborne Doppler Radar segment is projected to experience the fastest growth rate from 2025 to 2032, driven by the increasing deployment in fighter aircraft, UAVs, and commercial aircraft. The airborne variant offers enhanced target tracking and real-time situational awareness, making it essential for both offensive and defensive aerial missions. Rising global defense budgets, increasing geopolitical tensions, and the growing integration of advanced avionics are further fueling this segment's adoption across tactical and strategic operations.

- By Technology

On the basis of technology, the Doppler radar market is segmented into Coherent Pulsed, Continuous Wave, and Frequency Modulation. The Coherent Pulsed segment accounted for the highest market share of 44.6% in 2024, attributed to its precise measurement of velocity and range, which makes it a preferred choice in aerospace and defense sectors. This technology uses phase coherence between transmitted and received pulses, enabling high-resolution imaging and effective target separation in complex operational environments such as cluttered terrain or congested airspaces.

The Frequency Modulation segment is anticipated to witness the fastest growth rate from 2025 to 2032 due to its increasing usage in weather monitoring, automotive safety systems, and surveillance applications. Frequency-modulated continuous wave (FMCW) radars offer high sensitivity and resolution, and are particularly effective at short to medium ranges, making them suitable for advanced driver-assistance systems (ADAS) and precision weather radars. Their compact size and lower cost also drive adoption in emerging commercial applications.

- By End-Use Industry

On the basis of end-use industry, the Doppler radar market is categorized into Space, Marine, Aviation, and Military & Defense. The Military & Defense segment dominated the market in 2024, supported by growing investments in border surveillance, threat detection systems, and battlefield awareness. Doppler radars are widely used in this sector for tracking projectiles, guiding missiles, and monitoring enemy movement, offering high-speed data processing and reliable performance under extreme conditions. Governments worldwide are increasingly modernizing their radar infrastructure, which further boosts demand.

The Aviation segment is forecasted to register the highest CAGR from 2025 to 2032, propelled by the growing need for enhanced air traffic management and in-flight weather detection. Doppler radars in aviation provide accurate velocity and storm tracking data, essential for improving flight safety and minimizing delays. With increasing global air traffic, commercial and private airlines are investing in advanced radar systems to support operational efficiency and ensure passenger safety in adverse weather conditions.

Doppler Radar Market Regional Analysis

- North America dominated the doppler radar market with the largest revenue share of 30.06% in 2024, driven by rising defense expenditures, widespread radar system upgrades, and growing demand for advanced surveillance solutions

- The region’s strong military infrastructure and emphasis on technological innovation support the deployment of Doppler radar across sectors including aviation, space, and border security

- Furthermore, favorable government initiatives, continuous R&D investment, and the integration of radar systems in both public and private applications are reinforcing market leadership in this region

U.S. Doppler Radar Market Insight

The U.S. Doppler radar market captured the largest revenue share in 2024 within North America, fueled by the country’s dominant role in defense modernization and aviation safety. A strong presence of leading radar system manufacturers, along with sustained federal investments in weather forecasting, missile detection, and air traffic control, is driving market expansion. The demand for multi-functional radar technologies supporting real-time tracking, object discrimination, and threat detection continues to grow. Moreover, the rapid adoption of Doppler radar across commercial aviation and meteorological departments is reinforcing the U.S. market’s strength.

Europe Doppler Radar Market Insight

The Europe Doppler radar market is projected to expand at a substantial CAGR throughout the forecast period, supported by growing investments in aerospace innovation, weather monitoring infrastructure, and naval defense capabilities. The European Union’s emphasis on cross-border security and disaster preparedness is contributing to radar technology upgrades across key member nations. As air traffic continues to rise, Doppler radar systems are being increasingly adopted for efficient traffic management and improved flight safety. The region’s robust regulatory environment and growing demand for precision surveillance tools are enhancing market adoption across aviation, marine, and military domains.

U.K. Doppler Radar Market Insight

The U.K. Doppler radar market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by defense modernization programs and expanding application in maritime safety and environmental monitoring. The U.K.'s growing focus on airspace management, early warning systems, and research-based weather analytics is fueling demand for Doppler radar technologies. Strategic collaborations between government agencies and private defense firms, coupled with a rising emphasis on national security, continue to propel the market forward.

Germany Doppler Radar Market Insight

The Germany Doppler radar market is expected to expand at a considerable CAGR during the forecast period, supported by advancements in aerospace engineering, renewable energy integration, and border surveillance solutions. Germany’s industrial focus on automation, safety, and innovation underpins the increasing implementation of Doppler radar in both civilian and military applications. Additionally, its strong manufacturing base and emphasis on high-performance technologies are facilitating the development and deployment of radar systems that meet stringent operational requirements.

Asia-Pacific Doppler Radar Market Insight

The Asia-Pacific Doppler radar market is poised to grow at the fastest CAGR during 2025 to 2032, driven by rising defense budgets, growing aviation traffic, and escalating demand for weather prediction systems. Rapid infrastructure development and national security initiatives in countries such as China, Japan, and India are bolstering radar procurement and deployment. The expanding presence of regional radar manufacturers and the incorporation of Doppler radar in disaster management, meteorology, and military operations are broadening its application scope across the region.

Japan Doppler Radar Market Insight

The Japan Doppler radar market is gaining momentum due to the country’s emphasis on advanced weather forecasting, aerospace innovation, and seismic monitoring. Japan's vulnerability to natural disasters has led to increased investment in early warning systems, where Doppler radar plays a vital role. The integration of Doppler radar with other high-tech platforms in both government-led and private sector initiatives is driving consistent growth in the Japanese market.

China Doppler Radar Market Insight

The China Doppler radar market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its aggressive defense spending, expanding aerospace sector, and large-scale weather monitoring programs. China’s emphasis on domestic production and deployment of advanced radar systems across military, meteorological, and infrastructure sectors supports strong market growth. Initiatives under its smart city and national security frameworks are further accelerating the integration of Doppler radar technologies across a wide range of public and commercial applications.

Doppler Radar Market Share

The doppler radar industry is primarily led by well-established companies, including:

- Robert Bosch GmbH (Germany)

- Continental AG (Germany)

- DENSO CORPORATION (Japan)

- HELLA GmbH & Co. KGaA (Germany)

- Infineon Technologies AG (Germany)

- Autoliv Inc. (Sweden)

- Lockheed Martin Corporation (U.S.)

- NXP Semiconductors (Netherlands)

- s.m.s, smart microwave sensors GmbH (Germany)

- Oculii Corporation (U.S.)

- SRC, Inc. (U.S.)

- Arbe (Israel)

- Echodyne Corp. (U.S.)

- Saab AB (Sweden)

- Northrop Grumman (U.S.)

- ZF Friedrichshafen AG (Germany)

- InnoSenT - Innovative Radar Sensor Technology (Germany)

- Kestrel Radar Sensors (U.K.)

Latest Developments in Global Doppler Radar Market

- In April 2023, Honeywell International Inc. was selected by the U.S. Coast Guard (USCG) to upgrade its Sikorsky MH-60 Jayhawk and Eurocopter MH-65 Dolphin multi-mission helicopters with the IntuVue RDR-7000 weather surveillance radar system. This strategic upgrade is expected to drive demand for advanced Doppler radar technologies in aerospace and defense applications, reinforcing the importance of real-time weather tracking and situational awareness in mission-critical operations

- In January 2023, the Indian government announced plans to install 25 additional Doppler radars over the next two to three years, targeting nationwide radar coverage by 2025. The expansion of India's Doppler radar network from 15 units in 2013 to a projected 62 by 2025 highlights a strong governmental commitment to strengthening meteorological capabilities. This initiative is likely to significantly boost the Doppler radar market in India by accelerating domestic demand for weather surveillance systems and supporting infrastructure development

- In October 2022, Enterprise Electronics Corporation (EEC) was awarded a contract to supply three new Defender C350 Doppler radar systems and related services to the Meteorological Service of New Caledonia (SMNC). This replacement of legacy systems, in operation since 1998, signifies a strategic modernization effort, reinforcing EEC’s position in the Asia-Pacific weather surveillance market and supporting increased demand for advanced, high-resolution Doppler radar solutions in regional meteorological applications

- In September 2022, Enterprise Electronics Corporation (EEC) entered a partnership with Germany-based GAMIC to develop enhanced solutions for weather surveillance radar projects in Europe. This collaboration is expected to strengthen EEC’s presence in the European market by combining EEC’s radar manufacturing expertise with GAMIC’s advanced radar hardware and software services, boosting the competitiveness and innovation in Doppler radar offerings across the region

- In July 2022, Ontic Engineering & Manufacturing Inc. signed an exclusive license agreement with Honeywell to produce and distribute the RDR4A/B Weather Surveillance Radar Systems. This agreement enhances Ontic’s capabilities in the aerospace radar segment and expands its global footprint in supplying critical Doppler radar technology for aviation safety, strengthening its role in supporting long-term radar system lifecycle management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.