Global Downstream Processing Market

Market Size in USD Billion

CAGR :

%

USD

36.41 Billion

USD

85.76 Billion

2025

2033

USD

36.41 Billion

USD

85.76 Billion

2025

2033

| 2026 –2033 | |

| USD 36.41 Billion | |

| USD 85.76 Billion | |

|

|

|

|

Downstream Processing Market Size

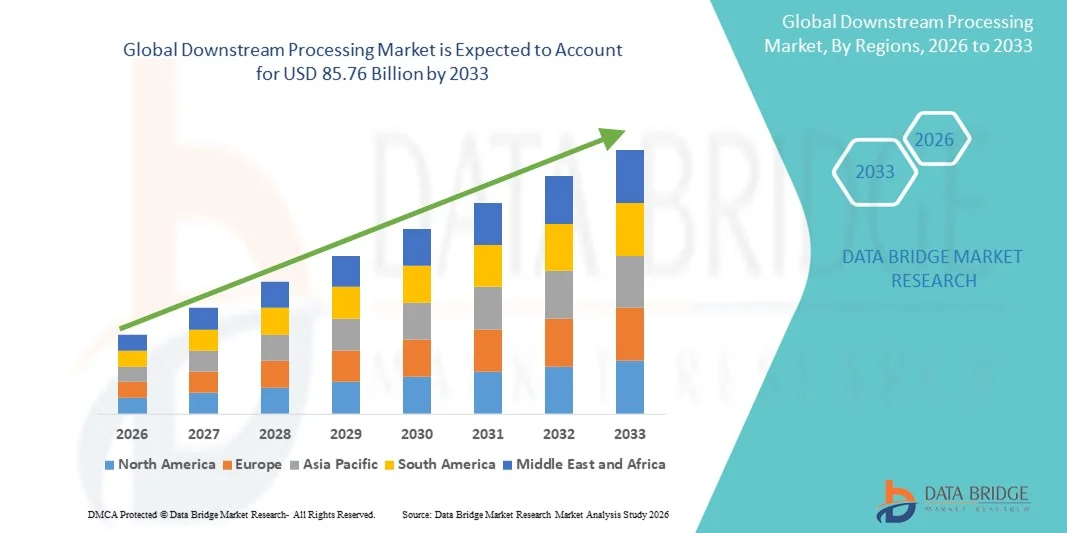

- The global downstream processing market size was valued at USD 36.41 billion in 2025 and is expected to reach USD 85.76 billion by 2033, at a CAGR of 11.30% during the forecast period

- The market growth is largely driven by the increasing biopharmaceutical production, rising demand for purified biologics, and technological advancements in separation and purification techniques, leading to enhanced efficiency and yield in production processes

- Furthermore, growing adoption of advanced filtration, chromatography, and crystallization methods across pharmaceutical, biotech, and industrial applications is establishing downstream processing as a critical component of the biomanufacturing workflow. These converging factors are accelerating the deployment of downstream processing solutions, thereby significantly boosting the industry's growth

Downstream Processing Market Analysis

- Downstream processing, encompassing purification and recovery of biomolecules, is a crucial step in biopharmaceutical and biotechnology manufacturing, ensuring high-quality, safe, and efficacious end products. Its adoption is increasingly driven by the need for efficiency, scalability, and compliance with stringent regulatory standards

- The growing demand for biologics, vaccines, and recombinant proteins is fueling the uptake of downstream processing technologies, supported by investments in advanced separation, filtration, and purification solutions, which enhance yield and product consistency

- North America dominated the downstream processing market with the largest revenue share of 39.4% in 2025, owing to the presence of leading biopharmaceutical manufacturers, early adoption of innovative purification techniques, and strong R&D infrastructure, with the U.S. leading in the implementation of single-use systems and advanced chromatography methods

- Asia-Pacific is expected to be the fastest-growing region in the downstream processing market during the forecast period due to the expansion of biopharmaceutical manufacturing facilities, increased contract manufacturing activities, and government support for biotechnology development

- Purification segment dominated the downstream processing market with a market share of 42.8% in 2025, driven by its critical role in cell separation, filtration, and product recovery to ensure high purity and yield of biologics across multiple applications

Report Scope and Downstream Processing Market Segmentation

|

Attributes |

Downstream Processing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Downstream Processing Market Trends

Adoption of Single-Use and Modular Processing Systems

- A key and rapidly growing trend in the global downstream processing market is the increasing adoption of single-use and modular processing systems, which enhance flexibility, reduce contamination risks, and lower operational costs

- For instance, Cytiva’s single-use chromatography systems allow manufacturers to quickly switch production lines without extensive cleaning and validation, streamlining biologics manufacturing

- Modular systems enable manufacturers to scale production efficiently and adapt to varying batch sizes, facilitating faster development timelines and reduced facility footprints

- The integration of modular and single-use technologies with digital monitoring systems allows real-time process control and data analytics, enhancing operational efficiency and product consistency

- This trend towards flexible, contamination-resistant, and digitally monitored downstream processing solutions is transforming expectations for biopharmaceutical production, with companies such as Sartorius developing fully integrated single-use downstream processing platforms

- The demand for streamlined, scalable, and adaptive downstream processing technologies is accelerating across contract manufacturing organizations and biopharmaceutical manufacturers as they seek higher efficiency and reduced production risks

- Increasing adoption of continuous downstream processing is enhancing throughput and reducing production bottlenecks, enabling manufacturers to meet higher demand without major facility expansions

- Integration with AI-driven process analytics is enabling predictive maintenance and optimization, further improving yield, reducing downtime, and ensuring consistent product quality

Downstream Processing Market Dynamics

Driver

Increasing Demand for Biologics and High-Purity Therapeutics

- The rising global demand for monoclonal antibodies, vaccines, and other biologics is a major driver of the downstream processing market, emphasizing the need for efficient purification and recovery technologies

- For instance, in March 2025, Merck announced the expansion of its single-use filtration systems to support increased monoclonal antibody production at contract manufacturing facilities

- Biopharmaceutical manufacturers require advanced downstream processing methods to maintain product quality, safety, and consistency in large-scale production

- Furthermore, stringent regulatory requirements for biologics, including purity, yield, and contamination control, are pushing companies to adopt advanced separation and purification technologies

- Integration of automated and high-throughput downstream processing systems enables manufacturers to meet growing biologics demand efficiently while reducing operational costs

- The increasing adoption of high-efficiency purification and recovery methods is significantly propelling the market growth across both established manufacturers and emerging biopharmaceutical companies

- Rising collaborations between biotech startups and contract manufacturing organizations (CMOs) are driving investment in advanced downstream processing capabilities to accelerate biologics commercialization

- Innovations in membrane-based and affinity purification technologies are enabling faster processing times and higher product yields, boosting overall market growth

Restraint/Challenge

High Capital Costs and Technical Complexity

- The relatively high initial investment for advanced downstream processing systems, including chromatography, filtration, and single-use platforms, is a key challenge limiting broader market adoption

- For instance, implementing fully automated chromatography systems in a mid-sized manufacturing facility can require substantial capital outlay, deterring smaller manufacturers

- The technical complexity of operating and maintaining sophisticated downstream processing equipment requires highly trained personnel and robust process monitoring

- Furthermore, process optimization and scale-up challenges can increase production timelines and operational costs, particularly for novel biologics or small-batch production

- While modular and single-use systems reduce some barriers, the perceived premium for high-efficiency downstream processing solutions may hinder adoption among cost-sensitive manufacturers, especially in emerging regions

- Addressing these challenges through training, process standardization, and cost-effective system designs is essential for sustained market growth and wider implementation of advanced downstream processing technologies

- Limited availability of high-quality raw materials and consumables for downstream processes can disrupt production schedules and affect product consistency

- Regulatory compliance complexity across multiple regions poses challenges in standardizing processes and implementing new technologies, slowing market adoption

Downstream Processing Market Scope

The market is segmented on the basis of technique, product, end user, and application.

- By Technique

On the basis of technique, the downstream processing market is segmented into purification, solid-liquid separation, and clarification & concentration. The Purification segment dominated the market with the largest revenue share of 42.8% in 2025, driven by its critical role in cell separation, filtration, and product recovery to ensure high purity and yield of biologics. Purification processes are indispensable in the production of monoclonal antibodies, vaccines, and recombinant proteins, where product quality and regulatory compliance are paramount. The segment benefits from innovations in automated chromatography and membrane-based purification technologies, which improve process efficiency and reduce human error. Biopharmaceutical manufacturers prefer purification techniques for their scalability and ability to maintain consistent output across batches. In addition, Purification integrates well with digital monitoring systems, enabling real-time process optimization and predictive maintenance. The segment’s strong adoption is also supported by the need for high-purity biologics in therapeutic applications.

The Solid-Liquid Separation segment is anticipated to witness the fastest growth rate of 20.5% from 2026 to 2033, fueled by its application in filtration and centrifugation processes that remove cellular debris and other impurities efficiently. Solid-Liquid Separation methods are critical in early-stage downstream processing to prepare feed streams for further purification, particularly in large-scale biomanufacturing. Increasing investments in high-throughput filtration and continuous centrifugation technologies are enhancing throughput and reducing production bottlenecks. The growing demand for cost-effective and scalable processing solutions is also driving adoption across contract manufacturing organizations (CMOs). Advances in single-use filtration systems further contribute to this growth by enabling flexible and contamination-free operations. The segment’s growth is In addition supported by rising biologics production in emerging markets and expanding vaccine manufacturing capacities.

- By Product

On the basis of product, the downstream processing market is segmented into chromatography columns and resins, filters, membrane adsorbers, single-use products, and other products. The Chromatography Columns and Resins segment dominated the market with a revenue share of 39.8% in 2025, due to its essential role in achieving high-purity separation for monoclonal antibodies, vaccines, and insulin production. Chromatography is highly versatile, supporting multiple purification modes, including affinity, ion exchange, and size exclusion, which enhances its adoption. Manufacturers rely on advanced columns and resins to ensure consistent yield and compliance with stringent regulatory standards. The segment also benefits from technological advancements that reduce process time and increase binding capacity. Moreover, the scalability and reusability of chromatography systems make them cost-effective for both large-scale and small-batch production. High adoption in North America and Europe is driven by established biopharmaceutical infrastructure and a focus on therapeutic biologics production.

The Single-Use Products segment is expected to witness the fastest CAGR of 21.2% from 2026 to 2033, driven by their ability to reduce cross-contamination, cleaning requirements, and facility downtime. Single-use products such as disposable filters, tubing, and membranes offer flexibility for manufacturers switching between different biologics or production scales. Their adoption is particularly high among CMOs, which require adaptable production lines to handle multiple clients and products efficiently. The trend is also supported by regulatory encouragement for contamination-free operations and faster product turnaround. In addition, single-use systems integrate seamlessly with modular and automated processing platforms, enhancing overall production efficiency. Emerging markets are increasingly adopting single-use technologies due to lower upfront infrastructure investment requirements.

- By End User

On the basis of end user, the downstream processing market is segmented into Biopharmaceutical Manufacturers And Contract Manufacturing Organizations (CMOs). The Biopharmaceutical Manufacturers segment dominated the market with a 60.2% share in 2025, due to their extensive in-house biologics production and investments in high-efficiency downstream processing technologies. These manufacturers prioritize integrated systems that ensure high purity, reproducibility, and compliance with international regulatory standards. They benefit from automation and digital monitoring that streamline purification and recovery processes, improving yield and reducing operational costs. In addition, established manufacturers often have long-term contracts with suppliers for chromatography columns, filters, and other critical downstream processing products. The focus on monoclonal antibodies, vaccines, and recombinant proteins further reinforces the segment’s dominance.

The Contract Manufacturing Organizations (CMOs) segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing outsourcing of biologics production to specialized facilities. CMOs require flexible, scalable, and cost-effective downstream processing solutions to handle multiple clients and product types. Single-use technologies, modular systems, and automated purification platforms are particularly popular among CMOs to reduce changeover times and contamination risks. Growth is also fueled by the expansion of CMOs in emerging markets, catering to global biologics demand. The rising trend of biotech startups outsourcing manufacturing instead of building in-house facilities further accelerates this segment’s adoption.

- By Application

On the basis of application, the downstream processing market is segmented into monoclonal antibody production, vaccine production, insulin production, immunoglobulin production, erythropoietin production, and other applications. The Monoclonal Antibody Production segment dominated the market with a 35.7% share in 2025, owing to the rapid growth of therapeutic antibodies in oncology, immunology, and infectious disease treatment. Downstream processing techniques such as chromatography and filtration are critical in achieving high-purity antibodies, maintaining efficacy, and meeting regulatory standards. Advanced purification technologies reduce process time and improve yield, which is essential given the high demand and complex structure of antibodies. The segment also benefits from strong investment in research and development, particularly in North America and Europe. The expansion of CMOs supporting monoclonal antibody manufacturing further reinforces its dominance.

The Vaccine Production segment is expected to witness the fastest CAGR of 22.0% from 2026 to 2033, driven by increasing global vaccination programs, pandemic preparedness, and new vaccine development initiatives. Downstream processing for vaccines involves complex purification and concentration steps to ensure safety and potency, necessitating advanced filtration and chromatography solutions. The rising demand in emerging markets and government-backed vaccine production projects further accelerates growth. Single-use and modular processing systems are increasingly adopted to enhance production speed, scalability, and contamination control. In addition, innovations in continuous downstream processing are improving efficiency and throughput for vaccine manufacturers.

Downstream Processing Market Regional Analysis

- North America dominated the downstream processing market with the largest revenue share of 39.4% in 2025, owing to the presence of leading biopharmaceutical manufacturers, early adoption of innovative purification techniques, and strong R&D infrastructure, with the U.S. leading in the implementation of single-use systems and advanced chromatography methods

- Companies in the region prioritize high-efficiency downstream processing solutions to ensure consistent product quality, regulatory compliance, and high yield in monoclonal antibody, vaccine, and recombinant protein production

- This widespread adoption is further supported by strong R&D capabilities, substantial investments in automation and single-use systems, and a well-established contract manufacturing ecosystem, establishing North America as a key hub for biopharmaceutical production and innovation

U.S. Downstream Processing Market Insight

The U.S. downstream processing market captured the largest revenue share of 82% in 2025 within North America, fueled by the country’s advanced biopharmaceutical manufacturing infrastructure and early adoption of cutting-edge purification technologies. Manufacturers are increasingly prioritizing high-efficiency downstream solutions, including single-use systems and automated chromatography platforms, to meet growing demand for monoclonal antibodies, vaccines, and other biologics. The strong presence of contract manufacturing organizations (CMOs) and biotech startups further accelerates the adoption of flexible and scalable downstream processing solutions. Moreover, stringent regulatory standards and investments in process optimization drive continuous innovation, establishing the U.S. as a global hub for biopharmaceutical production.

Europe Downstream Processing Market Insight

The Europe downstream processing market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing biologics production, stringent regulatory requirements, and growing adoption of advanced purification and filtration technologies. Countries such as Germany, France, and Switzerland are witnessing high investment in automated and modular downstream processing systems. The demand for high-purity therapeutic proteins and vaccines in both clinical and commercial-scale manufacturing is fostering growth. In addition, Europe’s emphasis on sustainability and green manufacturing practices is promoting single-use and energy-efficient processing technologies.

U.K. Downstream Processing Market Insight

The U.K. downstream processing market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the country’s strong biopharmaceutical R&D ecosystem and increasing focus on contract manufacturing partnerships. Manufacturers are adopting flexible and high-throughput downstream processing technologies to optimize biologics production efficiency and meet regulatory compliance. The rising number of monoclonal antibody and vaccine production projects, combined with government incentives for biotechnology and innovation, further fuels market expansion. The U.K.’s established infrastructure and skilled workforce enhance adoption of automated purification and filtration platforms.

Germany Downstream Processing Market Insight

The Germany downstream processing market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s robust biopharmaceutical manufacturing base and focus on precision, quality, and compliance. Germany’s manufacturers are increasingly deploying single-use systems, modular purification platforms, and advanced chromatography solutions to improve yield and reduce contamination risks. High adoption is observed in both monoclonal antibody and vaccine production, supported by strong investments in R&D and process automation. Emphasis on sustainability and efficient resource utilization further promotes advanced downstream processing adoption across the country.

Asia-Pacific Downstream Processing Market Insight

The Asia-Pacific downstream processing market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, fueled by rapid expansion of biopharmaceutical manufacturing facilities and increasing outsourcing to contract manufacturing organizations. Countries such as China, India, and Japan are witnessing strong demand for monoclonal antibodies, vaccines, and other biologics, prompting investments in scalable and efficient downstream processing systems. Government initiatives promoting biotechnology development, coupled with rising urbanization and disposable incomes, are driving adoption. Moreover, the growing local manufacturing base for downstream processing equipment and consumables is improving accessibility and reducing costs.

Japan Downstream Processing Market Insight

The Japan downstream processing market is gaining momentum due to the country’s advanced biopharmaceutical R&D infrastructure, high regulatory standards, and demand for process efficiency. Adoption is driven by manufacturers’ need for high-purity monoclonal antibodies and vaccines, as well as integration of automated purification and single-use platforms. Japan’s focus on quality, precision, and innovation, alongside the aging population’s increasing healthcare needs, is spurring investments in scalable and efficient downstream solutions. The integration of advanced analytics and process monitoring further supports market growth.

India Downstream Processing Market Insight

The India downstream processing market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid expansion of biopharmaceutical manufacturing facilities and the country’s growing contract manufacturing ecosystem. Rising demand for vaccines, monoclonal antibodies, and biosimilars, coupled with increasing government initiatives for biotechnology and healthcare infrastructure, is fueling adoption. Affordable single-use and modular processing systems, along with strong domestic equipment manufacturing capabilities, enhance market growth. In addition, rapid urbanization and increasing disposable incomes are boosting investment in high-efficiency downstream processing solutions for both domestic and export-oriented biomanufacturing.

Downstream Processing Market Share

The Downstream Processing industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Danaher (U.S.)

- Repligen Corporation (U.S.)

- 3M (U.S.)

- Boehringer Ingelheim International GmbH. (Germany)

- Lonza (Switzerland)

- Eppendorf AG (Germany)

- Corning Incorporated (U.S.)

- Asahi Kasei Corporation (Japan)

- Waters Corporation (U.S.)

- Novasep (France)

- Purolite Life Sciences (U.K.)

- Tosoh Bioscience (Japan)

- Agilent Technologies, Inc. (U.S.)

- Bio Rad Laboratories, Inc. (U.S.)

- Meissner Filtration Products (U.S.)

- PerkinElmer (U.S.)

What are the Recent Developments in Global Downstream Processing Market?

- In July 2025, Cytiva launched the ÄKTA readyflux TFF system 500, a tangential flow filtration system optimized for smaller-scale manufacturing. The system is tailored for low-volume applications such as viral vectors, mAbs, antibody-drug conjugates (ADCs), and mRNA therapeutics

- In March 2025, Cytiva described a connected automated downstream process for mAb screening and evaluation. This process combines continuous Protein A capture, pH/conductivity conditioning, and polishing in a single automated workflow

- In March 2025, Hamilton Bonaduz AG introduced its Flow Cell COND 4UPtF, a process analytical technology (PAT) tool designed for downstream purification monitoring. The device measures conductivity with very high accuracy (±3%) and has a fast response time (T90 < 22 seconds), making it ideal for inline monitoring during chromatography

- In February 2025, Thermo Fisher Scientific announced a deal to acquire Solventum’s Purification & Filtration business for USD 4.1 billion. This acquisition significantly strengthens Thermo Fisher’s downstream bioprocessing portfolio by adding advanced filtration and membrane technologies

- In September 2021, Repligen and Navigo Proteins launched a novel Protein A ligand called NGL Impact A Hi pH, specifically designed to reduce aggregation in pH-sensitive antibodies. This ligand is unique because it allows elution at higher pH, mitigating the risk of antibody aggregation that typically happens in low-pH elution steps

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.