Global Doy Pouch Packaging Market

Market Size in USD Billion

CAGR :

%

USD

20.44 Billion

USD

24.32 Billion

2024

2032

USD

20.44 Billion

USD

24.32 Billion

2024

2032

| 2025 –2032 | |

| USD 20.44 Billion | |

| USD 24.32 Billion | |

|

|

|

|

Doy Pouch Packaging Market Size

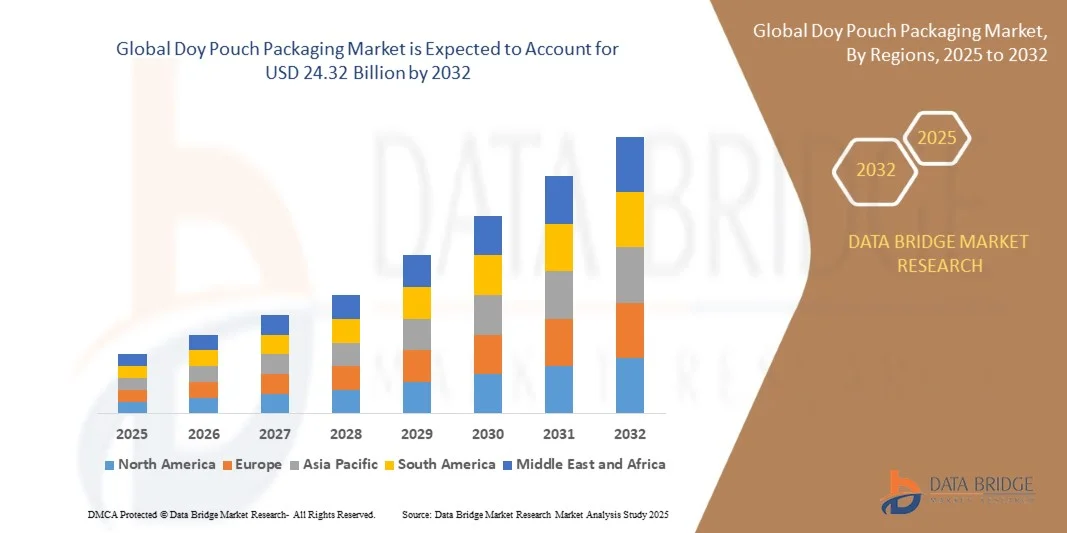

- The global doy pouch packaging market size was valued at USD 20.44 billion in 2024 and is expected to reach USD 24.32 billion by 2032, at a CAGR of 2.20% during the forecast period

- The market growth is largely fueled by the increasing demand for flexible, lightweight, and sustainable packaging solutions across food, beverage, and personal care industries. Rising consumer preference for convenience packaging and advancements in material innovation such as recyclable and mono-material laminates are driving the widespread adoption of doy pouch packaging in both developed and emerging markets

- Furthermore, growing awareness of environmental sustainability and the shift toward reducing plastic waste are encouraging manufacturers to introduce eco-friendly, paper-based, and biodegradable doy pouches. These trends, supported by technological progress in barrier coatings and sealing mechanisms, are accelerating the global expansion of the doy pouch packaging industry

Doy Pouch Packaging Market Analysis

- Doy pouch packaging, designed for superior shelf stability and visual appeal, is becoming a preferred choice across multiple end-use sectors such as food, beverages, cosmetics, and home care. Its lightweight design, resealability, and reduced material usage offer brands cost efficiency while appealing to environmentally conscious consumers

- The escalating demand for doy pouches is primarily driven by rapid growth in packaged and processed food consumption, rising e-commerce activity, and advancements in packaging sustainability standards. As manufacturers focus on improving recyclability and extending product shelf life, doy pouch packaging continues to emerge as one of the most versatile and eco-efficient formats in the global flexible packaging landscape

- Asia-Pacific dominated the doy pouch packaging market in 2024, due to the expanding food and beverage industry, rising consumption of packaged goods, and the increasing adoption of flexible packaging solutions across emerging economies

- North America is expected to be the fastest growing region in the doy pouch packaging market during the forecast period due to increasing demand for convenient, resealable, and sustainable packaging in food and personal care products

- Plastic segment dominated the market with a market share of 47.3% in 2024, due to its cost-effectiveness, lightweight properties, and excellent barrier protection against moisture and contaminants. Plastic-based Doy pouches are widely used across food, beverage, and home care sectors due to their flexibility and ease of manufacturing. The material’s compatibility with advanced printing technologies further enhances product branding and shelf appeal, boosting its demand across both retail and e-commerce packaging applications

Report Scope and Doy Pouch Packaging Market Segmentation

|

Attributes |

Doy Pouch Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Doy Pouch Packaging Market Trends

“Rising Adoption of Recyclable and Mono-Material Doy Pouches”

- The global Doy pouch packaging market is witnessing rapid growth driven by increasing adoption of recyclable and mono-material pouches that support sustainability and packaging circularity goals. Doy pouches—characterized by their functional stand-up design and extended shelf-life protection—are gaining traction across food, beverage, personal care, and household product categories due to their eco-friendly composition and consumer convenience

- For instance, Amcor plc and Mondi Group have introduced fully recyclable mono-material Doy pouches made from polyethylene (PE) and polypropylene (PP) laminates. These innovations enable enhanced barrier properties, heat resistance, and sealability while reducing multilayer complexity that hinders recyclability in traditional pouches

- The transition from mixed plastic laminates to single-polymer packaging aligns with regulatory pressures and brand commitments to reduce plastic waste. Major FMCG and pet food companies are adopting recyclable stand-up Doy pouches to meet circular economy requirements and minimize environmental footprint

- Advancements in high-barrier coatings, solvent-free adhesives, and digital printing technologies are further enhancing the performance and aesthetics of Doy packaging. These developments deliver superior product preservation and flexible design customization without compromising recyclability or cost efficiency

- The lightweight structure of modern Doy pouches significantly reduces logistics costs and carbon emissions compared with rigid alternatives. Their efficient shape optimizes storage and display capabilities, making them a preferred choice for e-commerce-ready packaging formats

- As consumer demand for sustainable, portable, and visually appealing packaging continues to rise, mono-material and recyclable Doy pouches are setting new industry benchmarks. Their sustainability-driven adoption underscores a global packaging transformation focused on innovation, material efficiency, and lifecycle responsibility

Doy Pouch Packaging Market Dynamics

Driver

“Growing Demand for Convenient and Lightweight Packaging Solutions”

- The consumer-driven shift toward convenient, portable, and user-friendly packaging formats is a key driver of Doy pouch adoption across industries. Stand-up pouches provide excellent functionality, combining durability, resealability, and space efficiency that cater to modern on-the-go lifestyles and single-serve consumption trends

- For instance, ProAmpac and Glenroy Inc. have expanded their Doy pouch portfolios featuring zipper closures and spout attachments for easy dispensing across snack foods, beverages, and personal care products. These innovations provide ergonomic handling and minimal material use, responding to both consumer and manufacturer needs

- The food and beverage sector remains a primary growth area, where Doy pouches are replacing rigid bottles, jars, and cans due to their lightweight form and cost-saving logistics. They offer superior shelf impact, efficient filling compatibility, and reduced transportation emissions, aligning with sustainability initiatives across global retailers

- Brand owners are leveraging digitally printed Doy pouches for customization and limited-edition offerings, enhancing brand differentiation and marketing agility. The versatility in design and size enables manufacturers to cater to diverse product categories from baby food to detergents with a consistent, efficient packaging format

- As packaging innovations continue to focus on convenience, lightweight construction, and extended product shelf life, Doy pouches are becoming a core element of modern flexible packaging strategies, bridging functionality with sustainability

Restraint/Challenge

“High Initial Investment in Advanced Packaging Machinery”

- The high initial capital required for installing advanced flexible packaging machinery tailored for Doy pouches poses a significant challenge, especially for small and medium-sized producers. Specialized equipment for forming, filling, and sealing flexible laminate materials requires considerable upfront expenditure and technical expertise

- For instance, companies adopting multilayer or mono-material pouches need to invest in high-speed horizontal form-fill-seal (HFFS) machines with precise lamination, cutting, and sealing capabilities. Global equipment manufacturers such as Bosch Packaging Technology and Mespack engineer specialized systems that demand substantial investment to achieve production reliability and scalability

- Maintenance, calibration, and operator training add to total costs, as advanced machinery relies on automation components such as servo motors and PLC-controlled systems. These requirements increase operational complexity and prolong ROI periods for new entrants in the flexible packaging space

- In addition, integrating renewable and recyclable materials with existing production lines may require machine modifications or compatibility upgrades, raising technical and financial barriers for conventional packaging facilities. Emerging manufacturers face challenges balancing sustainability goals with investment feasibility

- To overcome these cost constraints, producers are focusing on modular machinery, leasing models, and collaborative packaging partnerships. As equipment technology matures and the market for sustainable packaging expands, the cost of Doy pouch manufacturing equipment is expected to decline, enabling broader adoption across global industries

Doy Pouch Packaging Market Scope

The market is segmented on the basis of material type, capacity, and application.

- By Material Type

On the basis of material type, the Doy Pouch Packaging Market is segmented into Plastic, PET (Polyethylene Terephthalate), PP (Polypropylene), PE (Polyethylene), PVC (Poly Vinyl Chloride), PA (Polyamide), EVOH (Ethylene-vinyl Alcohol), Paper, and Aluminum Foil. The plastic segment dominated the market with the largest revenue share of 47.3% in 2024, driven by its cost-effectiveness, lightweight properties, and excellent barrier protection against moisture and contaminants. Plastic-based Doy pouches are widely used across food, beverage, and home care sectors due to their flexibility and ease of manufacturing. The material’s compatibility with advanced printing technologies further enhances product branding and shelf appeal, boosting its demand across both retail and e-commerce packaging applications.

The PET segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its superior strength, recyclability, and resistance to heat and impact. PET Doy pouches are increasingly preferred by manufacturers seeking sustainable and durable packaging solutions for beverages, cosmetics, and personal care products. Their transparency and ability to maintain product freshness also make them ideal for premium packaging applications. In addition, the growing consumer shift toward eco-friendly and recyclable materials positions PET as a key driver of innovation within the flexible packaging industry.

- By Capacity

On the basis of capacity, the Doy Pouch Packaging Market is segmented into Less than 100 ml, 100–200 ml, 201–400 ml, and More than 400 ml. The 201–400 ml segment dominated the market with the largest revenue share in 2024, attributed to its widespread use in single-use food items, beverages, sauces, and personal care products. This capacity range offers the perfect balance between convenience and portability, aligning with consumer preferences for on-the-go lifestyles. Manufacturers favor this segment for its efficient material utilization, cost savings, and ability to maintain product integrity during transportation and storage.

The More than 400 ml segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing applications in bulk food packaging, detergents, and refill packs. As sustainability concerns rise, brands are focusing on larger-capacity pouches that reduce plastic waste and improve logistics efficiency. These high-volume Doy pouches are gaining traction for household and industrial packaging due to their robustness and compatibility with resealable closures. The trend toward refillable and value-size packaging formats is expected to further accelerate the demand for this segment.

- By Application

On the basis of application, the Doy Pouch Packaging Market is segmented into Food and Beverages, Automotive, Dairy, Cosmetics and Personal Care, Home Care, Electrical and Electronics, and Others. The Food and Beverages segment dominated the market with the largest revenue share in 2024, owing to the extensive adoption of flexible packaging for snacks, frozen foods, juices, and ready-to-eat meals. Doy pouches offer superior shelf visibility, extended product shelf life, and leak-proof sealing, making them a preferred choice among food manufacturers. Their lightweight design reduces transportation costs and supports sustainable packaging initiatives in the food sector.

The Cosmetics and Personal Care segment is expected to register the fastest growth rate from 2025 to 2032, driven by rising demand for portable, aesthetic, and resealable packaging solutions. Doy pouches in this category are gaining popularity for products such as lotions, shampoos, creams, and gels due to their premium appearance and user convenience. The segment also benefits from the growing focus on refillable pouch designs that align with sustainability trends and brand transparency. Increasing innovations in materials and printing techniques are further enhancing product differentiation in the personal care packaging space.

Doy Pouch Packaging Market Regional Analysis

- Asia-Pacific dominated the doy pouch packaging market with the largest revenue share in 2024, driven by the expanding food and beverage industry, rising consumption of packaged goods, and the increasing adoption of flexible packaging solutions across emerging economies

- The region’s cost-effective manufacturing base, high population density, and growing e-commerce activities are boosting demand for durable and lightweight packaging formats

- Rapid urbanization, evolving consumer lifestyles, and the growing shift toward sustainable and recyclable pouch materials are further accelerating market growth across Asia-Pacific

China Doy Pouch Packaging Market Insight

China held the largest share in the Asia-Pacific doy pouch packaging market in 2024, supported by its vast food processing industry, strong manufacturing ecosystem, and rapid growth of e-commerce. The country’s leadership in plastic and flexible packaging production, coupled with advancements in printing and barrier technologies, has strengthened its market dominance. Increasing demand for ready-to-eat meals and convenience packaging is driving further adoption across both domestic and export-oriented sectors.

India Doy Pouch Packaging Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by the booming food, beverage, and personal care sectors. Rising disposable incomes, urbanization, and growing awareness of sustainable packaging are major factors supporting this expansion. The government’s focus on reducing plastic waste and promoting recyclable materials is encouraging manufacturers to adopt eco-friendly doy pouches. The rapid expansion of retail and e-commerce channels is also contributing significantly to market growth.

Europe Doy Pouch Packaging Market Insight

The Europe doy pouch packaging market is expanding steadily, supported by growing demand for sustainable, recyclable, and lightweight packaging materials. Stringent regulations on single-use plastics and the shift toward circular economy models are prompting brands to adopt environmentally friendly pouch solutions. Strong consumer preference for convenience packaging in food, cosmetics, and personal care products is fueling the market, while technological advancements in biodegradable materials enhance product innovation.

Germany Doy Pouch Packaging Market Insight

Germany’s doy pouch packaging market is driven by its strong manufacturing base, innovation in eco-friendly packaging materials, and emphasis on product quality and sustainability. The country’s packaging producers are investing in recyclable laminates and mono-material pouches to comply with EU sustainability goals. Demand is particularly strong in the food, beverage, and pharmaceutical sectors, where flexible, resealable packaging offers extended shelf life and consumer convenience.

U.K. Doy Pouch Packaging Market Insight

The U.K. market is supported by rising adoption of flexible packaging across food, household, and personal care applications. Growing environmental awareness and government initiatives promoting recyclable materials are shaping market trends. The country’s strong retail presence and the rise in online grocery delivery are driving higher consumption of lightweight doy pouches that reduce logistics costs and environmental impact.

North America Doy Pouch Packaging Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing demand for convenient, resealable, and sustainable packaging in food and personal care products. The growing popularity of flexible packaging over rigid containers, coupled with advancements in material innovation, is propelling market expansion. Rising consumer preference for on-the-go packaging and brand efforts toward reducing carbon footprints are key regional growth drivers.

U.S. Doy Pouch Packaging Market Insight

The U.S. accounted for the largest share in the North America market in 2024, supported by a mature packaging industry, technological advancements, and a strong presence of leading flexible packaging manufacturers. The growing trend toward sustainable materials and increasing adoption of recyclable and bio-based pouches are key market catalysts. Demand from sectors such as food, beverages, pet food, and personal care continues to strengthen the U.S.'s leadership position in the region.

Doy Pouch Packaging Market Share

The doy pouch packaging industry is primarily led by well-established companies, including:

- Amcor plc (Switzerland)

- KUREHA CORPORATION (Japan)

- Mondi (U.K.)

- Sealed Air (U.S.)

- Bemis Company, Inc. (U.S.)

- Astar Packaging Pte Ltd (Singapore)

- Rosenflex (UK) Limited (U.K.)

- AZ Pack (U.S.)

- Glenroy, Inc. (U.S.)

- WINPAK LTD (Canada)

- Sonoco Products Company (U.S.)

- Smurfit Kappa (Ireland)

- LPS Industries (U.S.)

- Swiss Pack (Switzerland)

- NNZ Group (Netherlands)

- Huhtamaki (Finland)

- Bryce Corporation (U.S.)

- FFP Packaging Ltd. (U.K.)

- Printpack (U.S.)

- TedPack Company Limited (China)

Latest Developments in Global Doy Pouch Packaging Market

- In August 2025, Mondi ramped up production of its FunctionalBarrier Paper Ultimate high-barrier paper solution, reinforcing its leadership in sustainable packaging innovation. This development significantly impacts the doy pouch packaging market by introducing a recyclable alternative to multi-layer plastic and foil pouches. The solution provides excellent oxygen and moisture resistance while reducing cradle-to-gate CO₂ emissions, encouraging greater adoption of paper-based doy pouches across the food and personal care industries seeking to meet evolving sustainability goals

- In June 2025, Mondi introduced its re/cycle PaperPlus Bag Advanced for humidity-sensitive industrial goods, signaling a broader market shift toward barrier-capable, paper-based flexible packaging. Although primarily targeting industrial use, this innovation demonstrates cross-sector technological advancement applicable to doy pouch designs. Its enhanced moisture protection and recyclability are setting new performance benchmarks, influencing future development of eco-efficient doy pouches for consumer applications

- In May 2025, Mondi partnered with ZARELO to launch a paper-based flexible packaging solution for fire starters, replacing rigid or plastic formats. This collaboration marks a pivotal move toward circular-economy-compatible solutions, reducing material waste and carbon emissions. The project showcases the increasing potential of functional paper in doy pouch applications, driving innovation in barrier coatings and heat-sealable papers that meet sustainability and performance standards

- In February 2025, Mondi collaborated with Proquimia to launch paper-based stand-up pouches for dishwashing tabs in Spain and Portugal. The pouches contain over 85% paper content, significantly lowering plastic dependency while maintaining strength and durability. This product launch emphasizes the growing consumer and regulatory demand for recyclable, lightweight, and high-performance packaging, reinforcing Europe’s position as a hub for sustainable doy pouch innovation

- In March 2024, Amcor, Stonyfield Organic, and Cheer Pack North America jointly launched the world’s first all-polyethylene (PE) spouted pouch for yogurt under the YoBaby brand. The recyclable mono-material design replaces complex multi-laminate structures, minimizing plastic waste and simplifying recycling streams. This milestone demonstrates how global brands are accelerating the transition toward circular flexible packaging, reshaping the competitive landscape of the doy pouch packaging market with scalable, sustainability-focused solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Doy Pouch Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Doy Pouch Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Doy Pouch Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.