Global Dried Apricots Market

Market Size in USD Million

CAGR :

%

USD

870.06 Million

USD

1,330.21 Million

2024

2032

USD

870.06 Million

USD

1,330.21 Million

2024

2032

| 2025 –2032 | |

| USD 870.06 Million | |

| USD 1,330.21 Million | |

|

|

|

|

Dried Apricots Market Size

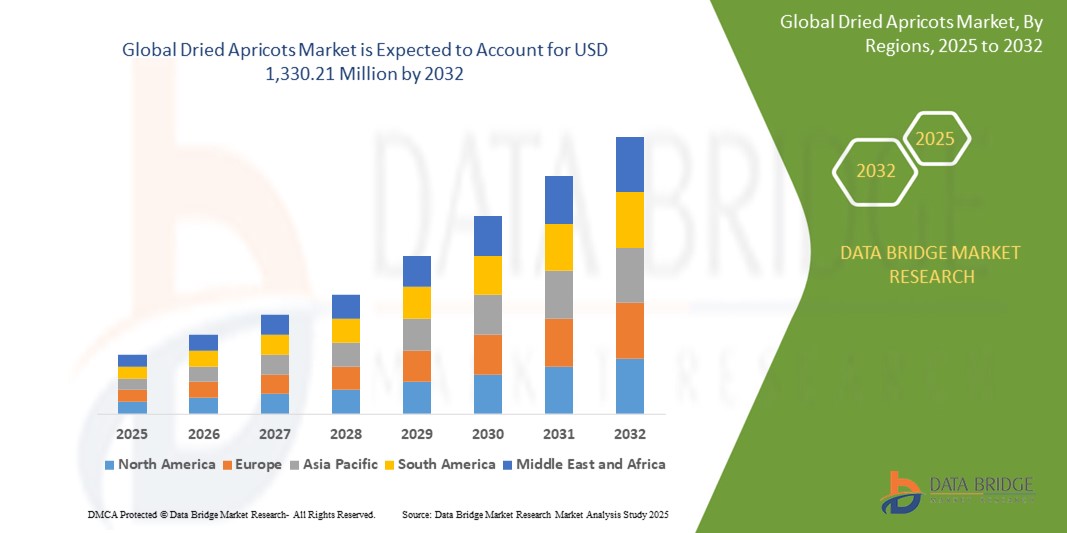

- The global dried apricots market size was valued at USD 870.06 million in 2024 and is expected to reach USD 1,330.21 million by 2032, at a CAGR of 5.45% during the forecast period

- The market growth is largely fueled by increasing health consciousness and shifting consumer preferences toward natural, nutrient-rich snacks, with dried apricots gaining popularity for their high fiber, vitamin, and antioxidant content

- Furthermore, rising demand for clean-label, organic, and plant-based food products across various demographics is establishing dried apricots as a preferred choice in both retail and foodservice sectors. These converging factors are accelerating the consumption of dried fruits, thereby significantly boosting the market's expansion

Dried Apricots Market Analysis

- Dried apricots, valued for their extended shelf life and dense nutritional profile, are increasingly incorporated into modern diets as convenient, healthy snacking options and versatile ingredients across food, bakery, and confectionery applications in both household and commercial settings

- The escalating demand for dried apricots is primarily fueled by rising health awareness, growing consumer inclination toward natural and functional foods, and the expanding availability of organic and clean-label variants across global retail and e-commerce channels

- Europe dominated the dried apricots market with a share of 25.3% in 2024, due to strong consumer demand for healthy snacking options and a long-standing cultural preference for dried fruits in daily diets

- Asia-Pacific is expected to be the fastest growing region in the dried apricots market during the forecast period due to rising disposable incomes, changing dietary habits, and growing awareness of health and wellness in countries such as China, India, and Japan

- Whole dried segment dominated the market with a market share of 62.2% in 2024, due to its direct consumption appeal and strong presence in both retail and bulk food service applications. Consumers prefer whole dried apricots for snacking, gifting, and home usage, particularly for their nutritional value, flavor retention, and traditional familiarity

Report Scope and Dried Apricots Market Segmentation

|

Attributes |

Dried Apricots Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dried Apricots Market Trends

“Growing Health Consciousness”

- A significant and accelerating trend in the global dried apricots market is the rising health consciousness among consumers, driving demand for nutrient-rich, minimally processed, and naturally sweet food options. Dried apricots are gaining popularity as a functional snack, rich in fiber, vitamins A and C, and antioxidants, making them a preferred choice among health-focused demographics

- For instance, Sun-Maid Growers of California has expanded its product line with no-added-sugar dried apricot variants to cater to health-conscious consumers, while BATA FOOD offers organic and sulfite-free options that appeal to clean-label and wellness-driven markets

- Health trends have also influenced packaging and marketing strategies, with companies emphasizing the benefits of dried apricots for digestive health, immunity, and energy. Anatolia A.S., for instance, promotes its natural dried apricots as a healthy alternative to sugary snacks, aligning with the global shift toward better-for-you food choices

- This emphasis on health is further driving innovation in the use of dried apricots across various segments, including energy bars, breakfast cereals, and wellness-focused bakery items. The growing popularity of vegan and plant-based diets has also elevated dried apricots as a versatile, fruit-based ingredient

- Consequently, leading companies such as Red River Foods and National Raisin Company are investing in product development and expanding their organic portfolios to align with these evolving consumer expectations

- The demand for dried apricots positioned as health-promoting, natural, and convenient snacks is growing rapidly across global markets, particularly as consumers increasingly prioritize nutrition, clean labels, and functional ingredients in their daily diets

Dried Apricots Market Dynamics

Driver

“Growing Vegan and Plant-Based Trends”

- The growing vegan and plant-based trends, coupled with increased consumer focus on clean eating and natural food sources, is a significant driver for the heightened demand for dried apricots

- For instance, Sun-Maid Growers of California and Anatolia A.S. have expanded their dried fruit offerings to include certified vegan and organic apricots, aligning their portfolios with the dietary preferences of plant-based consumers. Such strategic moves by leading companies are expected to drive dried apricot market growth in the forecast period

- As more consumers adopt vegan or flexitarian lifestyles and reduce their intake of animal-based products, dried apricots serve as a convenient, naturally sweet, and nutrient-dense alternative, often used in energy bars, plant-based desserts, and trail mixes

- Furthermore, the emphasis on clean-label and sustainable food choices makes dried apricots—especially those free from added sugars and preservatives—a compelling option in health food aisles and online platforms

- The versatility of dried apricots in plant-based applications, ease of incorporation into vegan recipes, and their alignment with wellness trends are key factors propelling their adoption across retail, foodservice, and food manufacturing sectors. The rise of veganism and dietary shifts toward fruit-rich snacking further contribute to the market’s expansion

Restraint/Challenge

“High Production Costs”

- High production costs pose a significant challenge to the broader expansion of the dried apricots market. From labor-intensive harvesting to energy-demanding drying processes, the cost of producing high-quality dried apricots remains considerably high, particularly for exporters competing in price-sensitive markets

- For instance, companies such as BATA FOOD and Anatolia A.S. face cost pressures due to fluctuating raw material prices, increased energy costs, and the need for advanced food safety compliance and quality certifications for international trade

- Maintaining consistency in texture, color, and nutrient retention requires controlled drying environments and advanced packaging solutions, which further elevate production expenditures. These costs are especially burdensome for organic or sulphur-free varieties, where artificial preservatives cannot be used to reduce losses

- In addition, supply chain disruptions, including labor shortages and rising transportation costs, exacerbate the challenge, often forcing companies to pass costs to consumers or limit production volumes. Sun-Maid Growers of California and National Raisin Company have invested in automation and facility upgrades to enhance efficiency, but smaller players struggle to compete on cost

- While innovations in solar drying and cooperative farming models may offer long-term relief, high production costs continue to limit profit margins and restrict market penetration in low-income regions, requiring strategic cost optimization and technology investment for sustainable growth

Dried Apricots Market Scope

The market is segmented on the basis of product, form, end-users, and distribution channel.

• By Product

On the basis of product, the dried apricots market is segmented into sulphured dried apricot, natural dried apricot, and organic dried apricot. The sulphured dried apricot segment accounted for the largest market revenue share in 2024, driven by its longer shelf life and appealing bright orange color, which attracts both retailers and consumers. The use of sulfur dioxide as a preservative enhances microbial stability and visual freshness, making it a preferred choice for large-scale food processors and retailers aiming for extended product display periods.

The organic dried apricot segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the global shift toward clean-label, chemical-free, and environmentally sustainable products. Rising consumer awareness regarding health, pesticide exposure, and sustainability has led to increasing demand for organically cultivated dried fruits, especially among health-conscious individuals and premium food brands.

• By Form

On the basis of form, the dried apricots market is segmented into powdered, whole dried, and diced. The whole dried segment dominated the market with a share of 62.2% in 2024 due to its direct consumption appeal and strong presence in both retail and bulk food service applications. Consumers prefer whole dried apricots for snacking, gifting, and home usage, particularly for their nutritional value, flavor retention, and traditional familiarity.

The powdered form is projected to register the highest CAGR from 2025 to 2032, driven by rising application in health supplements, infant food, and bakery premixes. Powdered dried apricots are increasingly used for their concentrated nutrient content, ease of formulation, and longer usability across processed food, nutraceuticals, and dietary products.

• By End-Users

On the basis of end-users, the dried apricots market is segmented into business to business, cosmetics, food and beverage, bakery, confectionery, and business to customer. The food and beverage segment accounted for the highest revenue share in 2024 due to widespread use in snacks, breakfast cereals, beverages, and dairy applications. Dried apricots enhance both flavor and nutritional profile, aligning with consumer preferences for functional, fruit-based ingredients in daily consumption.

The cosmetics segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by increased adoption of natural fruit-based ingredients in skincare and personal care formulations. Rich in antioxidants, beta-carotene, and vitamin A, dried apricot extracts are becoming increasingly popular in moisturizing, anti-aging, and exfoliating products.

• By Distribution Channel

On the basis of distribution channel, the dried apricots market is segmented into store-based retailing, modern grocery retailers, convenience store, forecourt retailers, hypermarkets, supermarkets, traditional grocery retailers, food specialist, independent small grocers, other grocery retailers, and online. Supermarkets held the largest market revenue share in 2024 owing to their strong presence in urban areas, extensive product variety, and consumer preference for inspecting product quality before purchase. Supermarkets offer greater visibility and convenience, promoting impulse buying of dried fruit products.

The online segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growth of e-commerce platforms and changing shopping behaviors. Digital convenience, availability of organic and international variants, doorstep delivery, and targeted marketing have significantly boosted the online sales of dried apricots, especially among younger and tech-savvy consumers.

Dried Apricots Market Regional Analysis

- Europe dominated the dried apricots market with the largest revenue share of 25.3% in 2024, driven by strong consumer demand for healthy snacking options and a long-standing cultural preference for dried fruits in daily diets

- Consumers across the region show high acceptance of sulphured and organic dried apricots due to their taste, nutritional value, and alignment with clean-label and natural product trends

- The market is further supported by well-established retail infrastructure, rising interest in plant-based diets, and the increasing use of dried apricots in bakery, confectionery, and gourmet culinary applications

U.K. Dried Apricots Market Insight

The U.K. dried apricots market is expected to expand at a steady CAGR, fueled by a growing preference for healthy, convenient snacking and the rising popularity of vegan and vegetarian diets. Dried apricots are increasingly featured in both on-the-go snack offerings and health-focused product lines. The country's robust online grocery and health food retail ecosystem, along with consumer preference for naturally sweet, additive-free options, is supporting market penetration and growth.

Germany Dried Apricots Market Insight

The Germany dried apricots market captured the largest share in Europe, supported by strong consumer awareness of natural nutrition and a well-established organic food culture. German consumers prioritize high-quality, minimally processed foods, making both organic and natural dried apricots popular across multiple channels. The market benefits from demand in retail, bakery, and confectionery sectors, with dried apricots commonly used in premium health snacks and traditional recipes.

Asia-Pacific Dried Apricots Market Insight

The Asia-Pacific dried apricots market is poised to register the fastest CAGR of 8.6% from 2025 to 2032, driven by rising disposable incomes, changing dietary habits, and growing awareness of health and wellness in countries such as China, India, and Japan. The increasing influence of Western diets, expanding modern retail chains, and growth in food processing industries are contributing to dried apricot demand. In addition, the region’s expanding middle class is becoming more inclined toward natural snacks and nutrient-rich ingredients.

Japan Dried Apricots Market Insight

The Japan dried apricots market is growing steadily due to increasing interest in nutrient-dense foods and the integration of dried fruits into both traditional and modern diets. Health-conscious consumers and a preference for quality, portion-controlled snacks are driving the market, with dried apricots commonly used in confectionery, breakfast products, and packaged healthy snacks. Demand is also supported by the country’s aging population, which values fiber-rich, easy-to-consume food products.

China Dried Apricots Market Insight

The China dried apricots market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rising consumer spending, rapid urbanization, and expanding health and wellness trends. Chinese consumers are increasingly adopting dried fruits as healthy alternatives to traditional sugary snacks. Domestic production, supported by strong supply chain capabilities and local distribution networks, is boosting availability across various retail formats including supermarkets, specialty food stores, and online platforms.

North America Dried Apricots Market Insight

The North America dried apricots market is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing consumer focus on health and wellness, rising demand for natural snacks, and growing popularity of plant-based diets. The market is benefiting from expanding product visibility in supermarkets, health food stores, and e-commerce platforms. Rising awareness of the nutritional benefits of dried apricots, such as fiber, antioxidants, and vitamins, along with a trend toward clean-label and functional foods, is further fueling market expansion across both the U.S. and Canada.

U.S. Dried Apricots Market Insight

The U.S. dried apricots market captured the largest revenue share in 2024 within North America, supported by the strong presence of health-conscious consumers and growing demand for convenient, nutrient-dense snacking options. Dried apricots are increasingly used in cereals, trail mixes, baked goods, and as standalone snacks. The rise of online health food retail, increased availability of organic and non-GMO variants, and product innovation in packaging and flavors are further driving market growth.

Dried Apricots Market Share

The dried apricots industry is primarily led by well-established companies, including:

- KENKKO CORPORATION (Japan)

- ApricotKing (U.S.)

- BATA FOOD (Turkey)

- National Raisin Company (U.S.)

- Anatolia A.S. (Turkey)

- ZIBA FOODS (U.S.)

- Kayisicioglu Apricot (Turkey)

- Traina Home Grown (U.S.)

- Sun-Maid Growers of California (U.S.)

- Red River Foods (U.S.)

- PURCELL MOUNTAIN FARMS (Canada)

- B & R Farms (U.S.)

- Jutai Foods Group Limited (China)

- Retaj Agro Farms (Turkey)

Latest Developments in Global Dried Apricots Market

- In November 2021, ILG International Trading, based in Brooklyn, New York, recalled certain imported dried apricots due to excessively high sulfite levels, highlighting growing regulatory scrutiny and consumer concerns over food safety. The recall emphasized the importance of clear labeling and compliance, as sulfites can trigger severe allergic reactions, potentially affecting market trust and prompting stricter quality controls in the dried fruit segment

- In July 2021, Michigan-based Lipari Foods recalled dried apricots across multiple U.S. states after failing to disclose the presence of sulfites on the packaging, underscoring the critical role of ingredient transparency in maintaining consumer safety. The move reflected heightened FDA enforcement and is likely to drive increased accountability in labeling practices among dried fruit distributors

- In March 2021, California-based Sun-Maid Growers announced its acquisition of Organic Plum from Campbell Soup Company, signaling strategic expansion into the organic and health-focused snack market. The acquisition is expected to strengthen Sun-Maid’s position in the dried fruit industry by diversifying its product offerings and tapping into the growing demand for organic and clean-label snacks

- In July 2021, Enko, a crop health company, unveiled a multi-year partnership with Syngenta Crop Protection to address resistant pests and emerging diseases affecting global agriculture. This collaboration focuses on targeted product development to accelerate solutions for farmers, aiming to generate significant economic benefits throughout the agricultural value chain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dried Apricots Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dried Apricots Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dried Apricots Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.