Global Drill Bit Market

Market Size in USD Billion

CAGR :

%

USD

2.57 Billion

USD

3.21 Billion

2024

2032

USD

2.57 Billion

USD

3.21 Billion

2024

2032

| 2025 –2032 | |

| USD 2.57 Billion | |

| USD 3.21 Billion | |

|

|

|

|

What is the Global Drill Bit Market Size and Growth Rate?

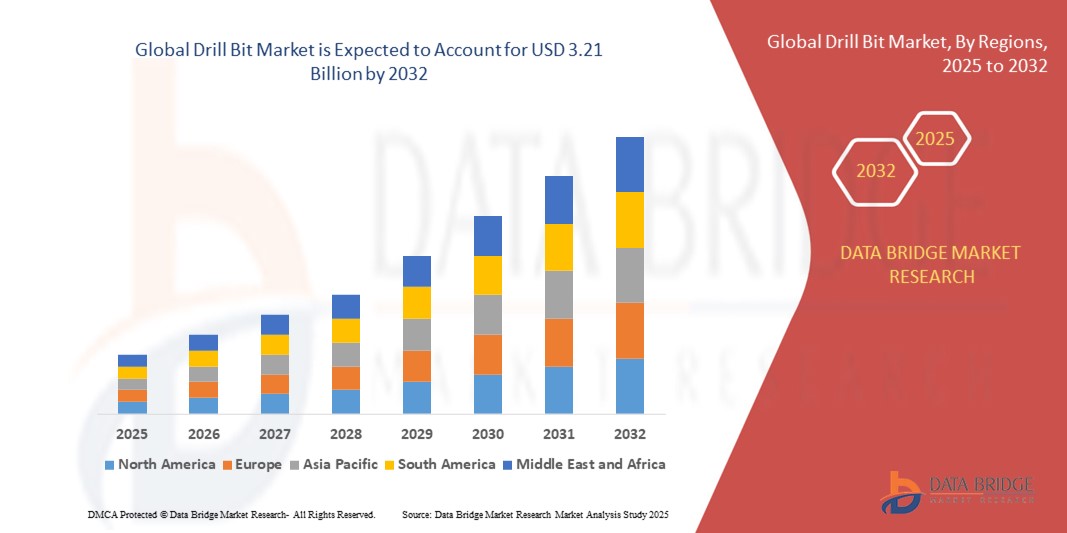

- The global drill bit market size was valued at USD 2.57 billion in 2024 and is expected to reach USD 3.21 billion by 2032, at a CAGR of 3.2% during the forecast period

- Drill bits are used to drill and make holes for oil and gas extraction in oil and gas operations. Drill bits are revolving devices composed of the most complex materials with a sharp texture that are used to cut into rocks and sediments. The drill bits' primary function is to grind, chop, scrape, and crush the rock at the well's bottom

- The global drilling business is being driven by an increase in demand for oil and gas in growing nations as a result of industrialization, urbanization, and population growth. This is expected to boost the demand for drill bit market. Furthermore, the drill bit market is being driven by increase in demand for fast drilling with little wear and tear in hard and medium-hard formations. The market is also benefiting from an increase in investments in the oil and gas sector

What are the Major Takeaways of Drill Bit Market?

- Rapid advancement in unconventional drilling techniques such as horizontal and vertical drilling activities is expected to witness further increase, which creates ample opportunities for the drill bit market

- North America dominated the drill bit market with the largest revenue share of 38.12% in 2024, driven by strong oil & gas exploration activity, the presence of shale reserves, and the rapid adoption of advanced drilling technologies

- The Asia-Pacific drill bit market is projected to grow at the fastest CAGR of 11.69% between 2025 and 2032, supported by rapid industrialization, urban infrastructure development, and expanding oil & gas exploration in China, India, and Southeast Asia

- The roller cone cutter bits segment dominated the market with the largest revenue share of 38.5% in 2024, owing to their versatility across soft to medium-hard formations and cost-effectiveness in both onshore and offshore drilling projects

Report Scope and Drill Bit Market Segmentation

|

Attributes |

Drill Bit Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Drill Bit Market?

Adoption of Advanced Materials and Automation-Driven Designs

- A major trend shaping the global Drill Bit market is the growing use of advanced materials such as polycrystalline diamond compact (PDC), tungsten carbide, and diamond-enhanced cutters. These innovations are enabling higher durability, longer lifespan, and improved drilling efficiency in demanding environments such as shale formations and offshore reserves

- For instance, Halliburton introduced its Cruzer Depth Control Technology integrated into drill bits, which helps optimize drilling performance by reducing vibration and extending bit life in complex formations. Similarly, NOV Inc. is innovating hybrid drill bits that combine the cutting strengths of PDC and roller cones

- Automation and digital technologies are also being integrated into drilling systems. Smart drill bits equipped with sensors allow for real-time performance monitoring, improving wellbore placement accuracy and minimizing downtime. Companies such as Baker Hughes are leveraging AI-driven bit designs to reduce drilling costs and improve operational safety

- This shift toward smarter, more durable, and automation-ready drill bits is fundamentally transforming drilling operations, making them more efficient, cost-effective, and sustainable

What are the Key Drivers of Drill Bit Market?

- Rising global energy demand, especially for oil and natural gas, is a significant driver of the drill bit industry, as exploration and production activities expand in both conventional and unconventional reserves

- For instance, in February 2024, Saudi Aramco announced expanded drilling operations in the Middle East, fueling demand for advanced drill bits capable of handling extreme drilling conditions

- Technological innovations such as hybrid drill bits, rotary steerable systems, and diamond-impregnated bits are enhancing efficiency, reducing non-productive time (NPT), and lowering operational costs for drilling contractors

- The increasing adoption of horizontal and directional drilling in shale gas and tight oil reserves is driving the use of advanced PDC and fixed cutter drill bits that can deliver superior performance in hard formations

- In addition, the rise in offshore exploration projects, supported by favorable government investments, is expanding opportunities for high-performance drill bits designed for deepwater and ultra-deepwater operations

Which Factor is Challenging the Growth of the Drill Bit Market?

- The high operational costs and fluctuating crude oil prices remain significant challenges for the drill bit market, directly impacting exploration budgets and limiting large-scale investments in new drilling projects

- For instance, during oil price downturns, companies such as Schlumberger and Halliburton have reported reduced drilling activities, leading to lower demand for premium drill bits

- Another challenge lies in the wear and tear of drill bits during high-pressure, high-temperature (HPHT) drilling, which results in frequent replacements and added operational costs. Even with advanced PDC materials, bit durability in abrasive formations remains a concern

- Environmental regulations and the global shift toward renewable energy sources also pose challenges, as governments and corporations scale back fossil fuel exploration in favor of sustainable alternatives

- Addressing these barriers will require cost-optimized bit designs, durability improvements, and diversification into geothermal and mining applications, enabling drill bit manufacturers to maintain growth despite industry fluctuations

How is the Drill Bit Market Segmented?

The market is segmented on the basis of product type, application, and end-user industry.

- By Product Type

On the basis of product type, the Drill Bit market is segmented into fixed cutter bits, polycrystalline diamond compact (PDC) bits, natural diamond bits, roller cone cutter bits, milled-tooth bits, and tungsten carbide inserts. The roller cone cutter bits segment dominated the market with the largest revenue share of 38.5% in 2024, owing to their versatility across soft to medium-hard formations and cost-effectiveness in both onshore and offshore drilling projects. Roller cones remain the preferred choice for oil & gas exploration due to their durability and adaptability.

The polycrystalline diamond compact (PDC) bits segment is expected to register the fastest CAGR from 2025 to 2032, fueled by their superior wear resistance, ability to drill at higher speeds, and growing adoption in unconventional resource extraction such as shale gas and tight oil. Increasing demand for deepwater and horizontal drilling further drives PDC bit adoption, positioning them as the next-generation solution in high-performance drilling.

- By Application

On the basis of application, the Drill Bit market is segmented into metal drilling, wood drilling, concrete drilling, and plastic drilling. The metal drilling segment accounted for the largest revenue share of 42.1% in 2024, driven by widespread use in manufacturing, automotive, aerospace, and heavy engineering industries where precision and durability are critical. The rising global demand for fabricated metal products and machinery continues to sustain the dominance of this segment.

The concrete drilling segment is projected to grow at the fastest CAGR from 2025 to 2032, supported by the expansion of construction and infrastructure projects across emerging economies. Growing urbanization, coupled with the demand for advanced hammer drill bits and carbide-tipped solutions, fuels this growth. In addition, innovations in concrete drill bits designed for reduced vibration and longer tool life are encouraging adoption in both residential and commercial construction projects, strengthening its market potential over the forecast period.

- By End-User Industry

On the basis of end-user industry, the Drill Bit market is segmented into construction, manufacturing, oil & gas, and mining. The oil & gas segment dominated the market with the largest revenue share of 46.8% in 2024, owing to continuous exploration and production (E&P) activities worldwide. Drill bits play a critical role in drilling efficiency, and increasing global energy demand ensures sustained investment in both onshore and offshore projects. Premium-grade bits, such as PDC and hybrid designs, are particularly popular in this sector.

The mining segment is expected to register the fastest CAGR from 2025 to 2032, driven by the rising demand for minerals and metals essential for renewable energy technologies, electric vehicles, and infrastructure. Advancements in tungsten carbide inserts and diamond drill bits tailored for hard rock formations are propelling adoption in mining operations. As mineral exploration expands into deeper and harsher environments, the reliance on specialized, high-performance drill bits is set to accelerate.

Which Region Holds the Largest Share of the Drill Bit Market?

- North America dominated the drill bit market with the largest revenue share of 38.12% in 2024, driven by strong oil & gas exploration activity, the presence of shale reserves, and the rapid adoption of advanced drilling technologies

- The region benefits from established industry players such as Baker Hughes, Halliburton, and NOV Inc., who are investing heavily in advanced drill bit designs, including polycrystalline diamond compact (PDC) and hybrid bits, to improve drilling efficiency

- In addition, government support for energy projects, along with high capital investment in unconventional drilling, strengthens the dominance of North America in the global market

U.S. Drill Bit Market Insight

The U.S. drill bit market captured 81% of the North American revenue share in 2024, fueled by its shale gas boom, increased deepwater exploration in the Gulf of Mexico, and a shift toward horizontal and directional drilling. The country’s robust oilfield services sector and strong innovation ecosystem drive continuous improvements in drill bit technology, from diamond-impregnated to hybrid bits. Investments in renewable energy drilling, such as geothermal, are also opening new avenues for drill bit manufacturers in the U.S.

Europe Drill Bit Market Insight

The Europe drill bit market is projected to grow steadily throughout the forecast period, supported by rising oilfield activities in the North Sea, growing geothermal drilling projects, and heightened demand for advanced industrial drilling in construction and manufacturing. Environmental regulations are encouraging the development of eco-efficient drill bits, while the adoption of PDC bits in complex formations is gaining traction. Europe’s focus on sustainability and innovation further drives demand across both energy and non-energy applications.

U.K. Drill Bit Market Insight

The U.K. drill bit market is anticipated to expand at a healthy CAGR during 2025–2032, supported by the revival of North Sea oil exploration and the government’s support for energy security. The construction sector’s increasing demand for concrete and metal drilling also contributes to growth. Advanced drilling solutions, particularly PDC and tungsten carbide inserts, are gaining traction as companies emphasize efficiency and cost savings in both energy and non-energy projects.

Germany Drill Bit Market Insight

The Germany drill bit market is expected to witness significant growth, driven by a strong industrial base in manufacturing, engineering, and automotive sectors, alongside increasing adoption of energy-efficient and precision drilling tools. Demand for advanced bits in metal and concrete drilling is expanding, while ongoing investments in renewable energy projects such as geothermal drilling are providing new opportunities. Germany’s focus on high-quality engineering and innovation aligns well with the rising adoption of premium-grade drill bits.

Which Region is the Fastest Growing Region in the Drill Bit Market?

The Asia-Pacific drill bit market is projected to grow at the fastest CAGR of 11.69% between 2025 and 2032, supported by rapid industrialization, urban infrastructure development, and expanding oil & gas exploration in China, India, and Southeast Asia. APAC’s role as a global manufacturing hub further fuels demand for metal, wood, and plastic drilling tools. Rising investment in renewable projects, such as geothermal and hydropower, along with strong government support for industrial growth, positions the region as the fastest-growing market.

Japan Drill Bit Market Insight

The Japan drill bit market is gaining momentum, backed by advanced manufacturing industries, precision engineering requirements, and infrastructure modernization. Japan’s push toward geothermal energy projects and smart construction practices fuels drill bit demand. The country’s emphasis on high-performance, durable, and eco-friendly tools aligns with its technologically advanced market landscape, making it a promising growth area.

China Drill Bit Market Insight

The China drill bit market accounted for the largest share in Asia-Pacific in 2024, driven by rapid urbanization, large-scale infrastructure development, and ongoing oil & gas exploration projects. Domestic manufacturers play a key role in making drill bits more affordable, fueling adoption across construction, mining, and manufacturing sectors. China’s focus on energy diversification, including geothermal exploration, and its status as a leading producer and consumer of drilling tools ensures continued market expansion.

Which are the Top Companies in Drill Bit Market?

The drill bit industry is primarily led by well-established companies, including:

- Atlas Copco (Sweden)

- Baker Hughes Inc. (U.S.)

- Cangzhou Great Drill Bits Co., Ltd. (China)

- ESCO Corporation (U.S.)

- Halliburton Company (U.S.)

- Irwin Industrial Tool Company (U.S.)

- NewTech Drilling Products LLC (U.S.)

- National Oilwell Varco Inc. (NOV Inc.) (U.S.)

- Scientific Drilling International Inc. (U.S.)

- Kingdream Public Limited Company (China)

- Varel International, Inc. (U.S.)

- Torquato Drilling Accessories, Inc. (U.S.)

- Ulterra Drilling Technologies (U.S.)

What are the Recent Developments in Global Drill Bit Market?

- In February 2024, Baker Hughes Company announced securing a contract with Petrobras in Brazil for comprehensive well construction services, including drill bits, drilling, cementing, wireline, fishing, and well clean-up, with operations scheduled to begin in 2025. This agreement highlights Baker Hughes’ strong market positioning in offshore drilling and reinforces its long-term growth strategy

- In March 2023, Sandvik AB introduced an opt-out recycling initiative for carbide-based drill bits, aimed at addressing the potential scarcity of tungsten and reducing environmental impact. The company set a target to recycle 90% of its used drill bits by 2025, reducing CO₂ emissions by 64%. This move underscores Sandvik’s commitment to sustainability and circular economy practices

- In January 2023, Toolant launched a new series of four spiral step drills, designed to deliver four times higher efficiency compared to conventional straight flute step drills, offering smoother and faster cutting. The launch reflects Toolant’s dedication to innovation and providing advanced drilling solutions for industrial users

- In January 2022, China’s state-owned CNOOC Ltd announced plans to drill 227 offshore exploration wells and 132 onshore unconventional wells, alongside acquiring 17,000 sq km of 3D seismic data. With capital expenditures budgeted at CNY 90–100 billion, the initiative emphasized China’s aggressive energy expansion and exploration growth strategy

- In March 2021, Saudi Aramco revealed plans to boost upstream capital expenditure to USD 35 billion in 2021, up from USD 27 billion in 2020, marking a strong rebound in drilling activity. This decision reinforced Aramco’s commitment to increasing production capacity and supporting global energy demands

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Drill Bit Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Drill Bit Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Drill Bit Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.