Global Drilling Fluids Market

Market Size in USD Billion

CAGR :

%

USD

12.50 Billion

USD

20.07 Billion

2024

2032

USD

12.50 Billion

USD

20.07 Billion

2024

2032

| 2025 –2032 | |

| USD 12.50 Billion | |

| USD 20.07 Billion | |

|

|

|

|

Drilling Fluids Market Size

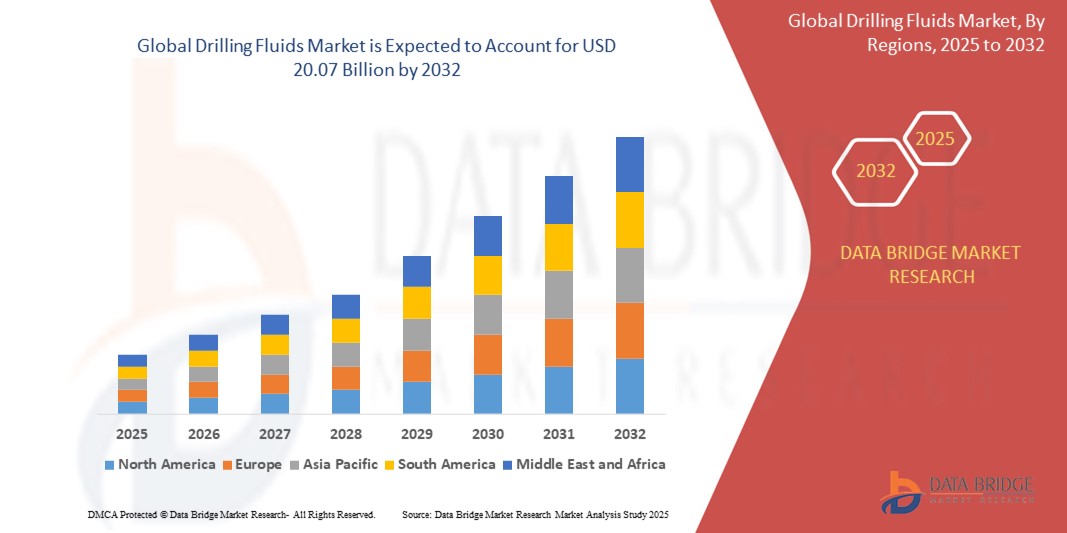

- The Global Drilling Fluids Market size was valued at USD 12.50 Billion in 2024 and is expected to reach USD 20.07 Billion by 2032, at a CAGR of 5.4% during the forecast period

- The market growth is largely fueled by growth of the heavy machinery industry and increasing demand of these fluids owning to their important role metal removal and forming

- Furthermore, the increase in popularity of these fluids as they comprise of high-performance soluble oil and semi-synthetic emulsion technology and they provide numerous high-performance soluble oil and semi-synthetic emulsion technology, are further anticipated to propel the growth of the Drilling Fluids Market

Drilling Fluids Market Analysis

- Drilling Fluids are defined as category of oils and lubricants which are utilized in several fabrication and metal construction processes.

- These fluids are known to reduce the friction thereby reducing the heat caused by the same when the fabrication processing is underway. They are also highly used for removing any extruding chips from the surface of the metal.

- The design of these fluids specifically made for a variety of hard and soft water qualities and offerings by them such as low foam and long-term corrosion protection for machines and components further influence the Drilling Fluids market.

- Asia-Pacific dominates the drilling fluids market with the largest revenue share of 33.26% in 2024, characterized by increasing energy demand and exploration activities in countries like China, India, and Indonesia.

- Asia-Pacific is expected to be the fastest growing region in the Drilling Fluids Market during the forecast period as it explores deepwater and tight oil reserves

- The water-based fluids (WBF) segment is expected to dominate the Drilling Fluids Market with a market share of 46.2% in 2024, driven by their cost-effectiveness, low toxicity, and easy disposal properties

Report Scope and Drilling Fluids Market Segmentation

|

Attributes |

Drilling Fluids Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drilling Fluids Market Trends

“Surge in Water-Based Drilling Fluids Adoption Due to Eco-Friendly Exploration”

- A prominent trend gaining momentum in the Global Drilling Fluids Market is the rising adoption of water-based drilling fluids (WBDFs), driven by environmental regulations and sustainability goals. These fluids are less toxic, cost-effective, and easier to dispose of than oil-based alternatives.

- For instance, operators in Europe and the Middle East have shifted nearly 60% of their land-based drilling operations to water-based systems as regulatory pressures tighten. In the U.S., the EPA’s offshore guidelines have further incentivized eco-compliant fluid usage.

- Innovations in WBDF formulations now allow for enhanced lubricity, shale inhibition, and thermal stability, making them viable even in high-pressure, high-temperature wells.

- This trend aligns with global efforts to reduce the carbon footprint of oil and gas operations while complying with zero-discharge policies in sensitive ecosystems.

Drilling Fluids Market Dynamics

Driver

“Rising Demand for Energy and Advanced Drilling Technologies”

- The increasing global demand for energy, particularly from developing countries, is a key driver in the growth of the drilling fluids market. Oil and gas exploration activities are on the rise, with offshore drilling activities growing at a rate of approximately 35% due to advancements in deepwater and ultra-deepwater drilling technologies.

- As exploration activities become more complex and deeper, the need for specialized drilling fluids, especially oil-based and water-based fluids, is expanding.

- Onshore drilling, which continues to account for 59.8% of the market, is also experiencing significant demand due to new exploration sites and an increase in production rates, especially in North America.

- This trend is further supported by the development of functional additives, which can be used in several applications related to oil and gas explorations, helping reduce disruptions in the production area and thus improving productivity.

Restraint/Challenge

“High Costs of Specialty Fluids and Environmental Regulations”

- While high-performance synthetic-based and nanotechnology-enhanced fluids offer superior efficiency, they come at a 40% premium compared to traditional oil-based alternatives. The high cost of production and specialized chemical compositions limit their adoption, particularly among smaller operators with tight budgets.

- Additionally, environmental regulations have intensified, restricting the use of oil-based and synthetic-based fluids in several drilling operations. Compliance with zero-discharge and low-toxicity mandates has led to a 40% reduction in traditional oil-based fluids, forcing companies to invest in expensive biodegradable alternatives.

- These factors pose significant challenges for the market, especially for small and medium enterprises (SMEs), limiting adoption despite long-term benefits such as enhanced durability, reduced maintenance, and supply chain transparency.

Drilling Fluids Market Scope

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the Global Drilling Fluids Market is segmented into Oil-Based Fluids (OBF), Water-Based Fluids (WBF), and Synthetic-Based Fluids (SBF). The Water-Based Fluids (WBF) segment dominates the largest market revenue share of 46.2% in 2025, driven by their cost-effectiveness, low toxicity, and easy disposal properties. WBFs are widely used in environmentally sensitive areas and support a wide range of drilling conditions in both conventional and unconventional wells. Their compatibility with water-soluble additives and ease of handling reinforce their continued adoption.

The Synthetic-Based Fluids (SBF) segment is anticipated to witness the fastest growth rate of 8.7% from 2025 to 2032, fueled by increasing demand for high-performance drilling in deepwater and high-pressure environments. SBFs offer superior lubricity, thermal stability, and reduced formation damage, making them ideal for extended-reach and complex well operations. Environmental regulations favoring low-toxicity alternatives also support growth.

- By Application

On the basis of application, the Global Drilling Fluids Market is segmented into Onshore and Offshore. The Onshore segment held the largest market revenue share in 2025, driven by the dominance of onshore drilling operations across regions such as North America, the Middle East, and Asia Pacific. Lower operational costs, established infrastructure, and large untapped reserves contribute to continued fluid demand in land-based drilling projects.

The Offshore segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing investments in deepwater and ultra-deepwater exploration activities. Offshore drilling fluids must perform reliably under extreme pressure and temperature conditions while complying with strict environmental standards. Market expansion is supported by technological advancements, rising global energy demand, and the push for new offshore resource development.

Drilling Fluids Market Regional Analysis

- Asia-Pacific dominates the Drilling Fluids Market with the largest revenue share of 33.26% in 2024, driven by increasing energy demand and exploration activities in countries like China, India, and Indonesia.

- The region's vast untapped reserves, particularly in offshore areas, present lucrative opportunities for market players.

China Drilling Fluids Market Insight

China Drilling Fluids Market captured the largest revenue share of 81.27% in 2025 within Asia-Pacific, fueled by increased investments in oil and gas exploration, particularly in offshore and unconventional reserves. The government's emphasis on energy security and the development of domestic resources further bolster market expansion. Additionally, China's focus on environmentally friendly drilling practices is leading to the adoption of advanced, non-toxic drilling fluid formulations.

Europe Drilling Fluids Market Insight

The European Drilling Fluids Market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region's focus on offshore drilling operations, particularly in the North Sea, and the increasing exploration of unconventional resources are contributing to market demand.

U.K. Drilling Fluids Market Insight

The U.K. Drilling Fluids Market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by significant demand for drilling fluids in horizontal wells and offshore drilling activities. The country's investments in deepwater and offshore drilling projects are driving the need for high-performance drilling fluids.

Germany Drilling Fluids Market Insight

The German Drilling Fluids Market is expected to expand at a considerable CAGR during the forecast period, fueled by the country's commitment to reducing carbon emissions and increasing the use of renewable energy sources. The exploration of unconventional resources and investment in deepwater drilling are contributing to market growth.

Asia-Pacific Drilling Fluids Market Insight

The Asia-Pacific Drilling Fluids Market is poised to grow at the fastest CAGR of over 17.3% during the forecast period of 2025 to 2032, as it explores deepwater and tight oil reserves. Implementing advanced technologies aimed at reducing production costs and improving efficiency plays a crucial role in the growth of the regional market.

Japan Drilling Fluids Market Insight

The Japan Drilling Fluids Market is gaining momentum due to technological innovation and a strong culture of environmental responsibility. The country's machinery and precision tools industries are turning to high-performance bio-lubricants for efficiency and lower toxicity.

India Drilling Fluids Market Insight

India Drilling Fluids Market accounted for the largest market revenue share in Asia Pacific in 2025, driven by massive industrial output and supportive green manufacturing policies. The government's focus on reducing pollution and the availability of local raw materials are boosting domestic production.

Drilling Fluids Market Share

The Drilling Fluids Industry is primarily led by well-established companies, including:

- Schlumberger Limited (U.S.)

- Halliburton (U.S.)

- Baker Hughes Company (U.S.)

- National Oilwell Varco (U.S.)

- Newpark Resources Inc. (U.S.)

- TETRA Technologies, Inc. (U.S.)

- Weatherford (U.S.)

- Scomi Group Bhd (Malaysia)

- GENERAL ELECTRIC (U.S.)

- Gumpro Drilling Fluids Pvt. Ltd. (India)

- Akzo Nobel N.V. (Netherlands)

- National Energy Services Reunited Corp. (U.S.)

- Shell (United Kingdom/Netherlands – dual headquarters; officially listed in UK since 2022)

- TRANSOCEAN LTD. (Switzerland)

- Valaris plc (United Kingdom)

- SECURE ENERGY (Canada)

- Exxon Mobil Corporation (U.S.)

- Yara (Norway)

- China Oilfield Services Limited (China)

- ASAP Fluids Pvt. Ltd. (India)

Latest Developments in Global Drilling Fluids Market

-

In October 2024, Azure Holding Group Corp. completed a strategic merger with CST Drilling Fluids, a fourth-generation oilfield services firm. The partnership is expected to leverage extensive expertise and deliver high-quality solutions across drilling operations.

- In August 2024, Angarsk Petrochemical Company, part of Rosneft’s refining and petrochemical division, began manufacturing Rosneft Drilltec B2Ih drilling fluids. These fluids, based on low-viscosity hydrocarbons, are designed to be environmentally friendly.

- In April 2023, ADNOC Drilling secured a major contract to deliver drilling services for the Upper Zakum field, ADNOC’s largest offshore production site. The agreement involves the deployment of state-of-the-art drilling units and is part of ADNOC’s broader strategy to enhance production capacity, improve operational efficiency, and promote sustainable offshore development.

- In March 2022, Repsol introduced a riserless mud recovery system at the Yme field to enhance drilling performance and minimize environmental risks. This advanced system enables the collection and reuse of drilling fluids without using a riser, resulting in reduced environmental impact and smoother drilling operations with minimal downtime.

- In March 2022, NOV and Chevron entered a joint development initiative focused on enhancing offshore processing efficiency. Similarly, in May 2022, Halliburton and Norwegian oil and gas firm Aker BP announced a collaboration to develop next-generation software for field development planning.

- In March 2022, Weatherford International plc revealed that its Memory Raptor cased-hole evaluation system was recognized with a Spotlight on New Technology Award at the Offshore Technology Conference Asia (OTC Asia 2022), highlighting its innovation and performance in cased-hole evaluations.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Drilling Fluids Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Drilling Fluids Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Drilling Fluids Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.