Global Drip Irrigation Market

Market Size in USD Billion

CAGR :

%

USD

1.63 Billion

USD

2.69 Billion

2024

2032

USD

1.63 Billion

USD

2.69 Billion

2024

2032

| 2025 –2032 | |

| USD 1.63 Billion | |

| USD 2.69 Billion | |

|

|

|

|

Drip Irrigation Market Size

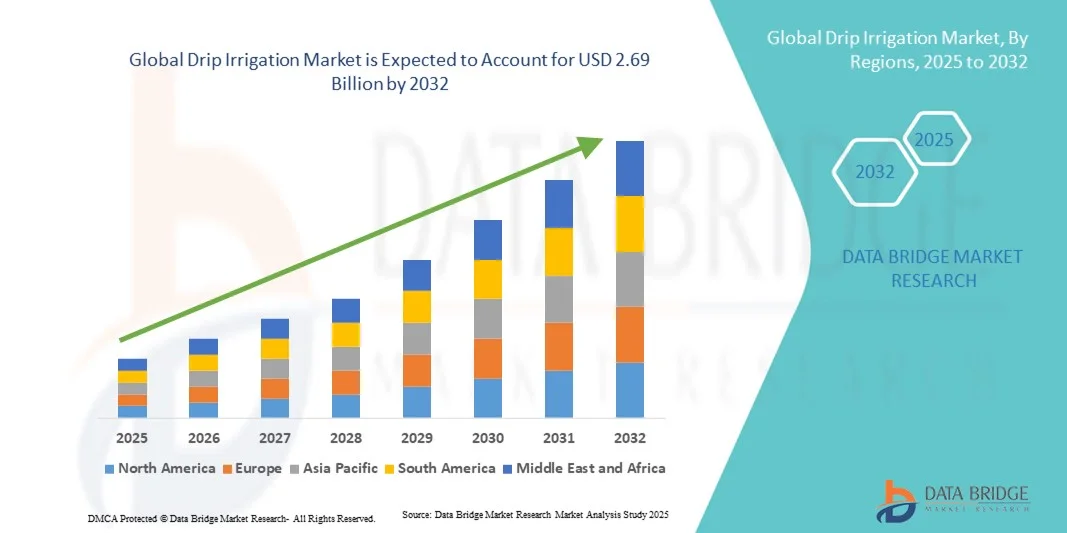

- The global drip irrigation market size was valued at USD 1.63 billion in 2024 and is expected to reach USD 2.69 billion by 2032, at a CAGR of 9.80% during the forecast period

- The market growth is largely fuelled by the increasing need for efficient water management in agriculture and the rising adoption of precision farming techniques

- Growing government support for sustainable irrigation practices and subsidies promoting drip irrigation systems are further driving market expansion

Drip Irrigation Market Analysis

- The global drip irrigation market is witnessing robust growth due to escalating concerns over water scarcity and the need to optimize agricultural productivity. The system’s ability to deliver water directly to plant roots minimizes wastage and boosts yield efficiency

- Farmers are increasingly shifting from traditional irrigation methods to drip systems owing to their cost-effectiveness, precision, and adaptability across varied crop types such as fruits, vegetables, and field crops

- Asia-Pacific dominated the drip irrigation market with the largest revenue share of 38.62% in 2024, driven by rapid agricultural modernization, expanding population, and the growing adoption of precision irrigation practices

- North America region is expected to witness the highest growth rate in the global drip irrigation market, driven by growing water scarcity concerns, modernization of agricultural practices, and increasing government incentives for efficient irrigation technologies

- The drip tubes/drip lines segment held the largest market revenue share in 2024, driven by their critical role in ensuring efficient water distribution across large cultivation areas. These components are widely used due to their flexibility, durability, and ability to deliver water uniformly to plant roots, making them essential for both open-field and protected farming applications

Report Scope and Drip Irrigation Market Segmentation

|

Attributes |

Drip Irrigation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drip Irrigation Market Trends

Integration of Smart Technologies and Automation in Drip Irrigation Systems

The growing integration of smart technologies such as IoT-based sensors, automated controllers, and real-time monitoring systems is revolutionizing the drip irrigation landscape. These technologies enable precise water and nutrient delivery, optimizing crop yield while conserving resources. The shift toward digital farming is helping farmers monitor soil moisture, weather conditions, and irrigation schedules remotely through mobile and web applications, leading to improved decision-making and reduced human error

Increasing adoption of automation in drip irrigation is enhancing operational efficiency by reducing manual intervention and ensuring uniform water distribution. Automated systems are particularly beneficial for large-scale farms and water-scarce regions, where precision irrigation supports sustainability and cost-effectiveness. Moreover, integration with cloud platforms and predictive analytics enables farmers to forecast irrigation needs accurately, reducing wastage and maximizing resource utilization

Government initiatives promoting smart agriculture and subsidies for water-efficient irrigation systems are accelerating the deployment of sensor-based and AI-integrated drip irrigation solutions. These programs aim to improve water use efficiency while boosting rural incomes and agricultural resilience against climate change. In addition, public-private partnerships are facilitating the transfer of advanced irrigation technologies to developing economies, enhancing productivity and environmental sustainability

For instance, in 2024, several Indian states introduced precision irrigation projects equipped with IoT-enabled drip systems to support water conservation efforts in drought-prone areas. These initiatives helped farmers reduce water consumption by up to 40% while increasing crop yield and profitability. The success of these projects has inspired similar implementations across Southeast Asia, where governments are emphasizing digital agriculture adoption for climate-smart farming

While the integration of technology is transforming the sector, ensuring affordability and accessibility for small-scale farmers remains key. Manufacturers must focus on offering cost-effective and scalable automation solutions to promote widespread adoption across developing markets. Strengthening digital literacy among rural farmers and expanding local service networks will also play a critical role in ensuring long-term system reliability and user satisfaction

Drip Irrigation Market Dynamics

Driver

Rising Water Scarcity and Growing Need for Efficient Irrigation Systems

The increasing global water scarcity and depleting freshwater resources are major drivers fueling the adoption of drip irrigation systems. As agriculture consumes nearly 70% of global freshwater, efficient irrigation solutions such as drip systems are critical for sustainable farming practices. These systems deliver water directly to the root zone, minimizing evaporation and runoff losses, which is vital in arid and semi-arid regions facing severe water stress

Farmers are becoming more aware of the economic and environmental benefits of drip irrigation, such as improved water efficiency, enhanced crop yield, and reduced fertilizer waste. This awareness, combined with government support programs and incentives, is promoting large-scale adoption in both developing and developed regions. Increased participation of agritech startups and NGOs is also helping raise awareness among smallholder farmers about the long-term profitability of drip irrigation

Technological innovations, such as pressure-compensating emitters and inline drip systems, are improving performance and enabling efficient irrigation even in uneven terrains. The demand is particularly strong in regions facing erratic rainfall and water scarcity, where traditional irrigation methods are no longer viable. New product developments, including solar-powered and modular systems, are further supporting adoption in energy-deficient and low-income rural areas

For instance, in 2023, Israel’s Ministry of Agriculture reported that drip irrigation helped reduce national agricultural water consumption by over 30%, highlighting its effectiveness in arid environments. This success has encouraged global replication of Israeli irrigation technologies across Asia and Africa, where similar climate challenges persist. The widespread recognition of these systems has established Israel as a global model for efficient irrigation practices

While drip irrigation continues to gain traction, sustained growth depends on effective training programs and technical support for farmers to ensure proper system maintenance and long-term operational efficiency. Collaborative initiatives between governments, manufacturers, and local cooperatives are crucial to ensuring that both small and large-scale farmers benefit from this technology-driven irrigation transformation

Restraint/Challenge

High Initial Installation Costs and Maintenance Requirements

Despite its long-term benefits, the high initial investment required for drip irrigation systems, including emitters, filters, pumps, and tubing, remains a significant barrier for small and medium-scale farmers. The cost factor limits adoption in developing countries where farmers often rely on traditional, low-cost irrigation methods. High-interest rates on agricultural loans and limited access to subsidies further exacerbate this financial burden, slowing down technology diffusion

Maintenance challenges such as clogging of emitters and regular filter cleaning also add to operational costs. Inadequate technical knowledge and limited access to spare parts in rural areas often result in system inefficiencies and reduced lifespan of equipment, deterring widespread use. Over time, these issues can lead to uneven water distribution and reduced productivity, especially in farms with poor-quality water sources or insufficient filtration systems

The lack of financing options and limited availability of government subsidies for micro-irrigation systems further constrain adoption in regions with weak institutional support. Farmers with fragmented landholdings find it challenging to justify the cost-to-benefit ratio without sufficient assistance. This issue is compounded by the absence of organized drip system dealers in certain regions, reducing after-sales service quality and farmer confidence in long-term investments

For instance, in 2024, studies conducted across African and Southeast Asian agricultural regions revealed that over 50% of farmers cited installation and maintenance costs as primary obstacles to adopting drip irrigation technology, despite acknowledging its benefits in water conservation. The lack of proper infrastructure and financing remains a key challenge for scaling such technologies in water-scarce economies

Addressing these challenges requires increased financial support, training programs, and locally manufactured components to lower system costs and promote accessibility, ensuring that drip irrigation becomes a viable and sustainable solution for all farming scales globally. Governments must also promote awareness campaigns highlighting long-term savings to encourage adoption among resource-limited farmers

Drip Irrigation Market Scope

The market is segmented on the basis of component, crop type, application, and emitter type.

- By Component

On the basis of component, the global drip irrigation market is segmented into emitters/drippers, pressure gauge, drip tubes/drip lines, valves, filters, fittings and accessories, and others. The drip tubes/drip lines segment held the largest market revenue share in 2024, driven by their critical role in ensuring efficient water distribution across large cultivation areas. These components are widely used due to their flexibility, durability, and ability to deliver water uniformly to plant roots, making them essential for both open-field and protected farming applications.

The emitters/drippers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of precision irrigation techniques and innovations such as pressure-compensating emitters. These components help maintain consistent water output even under variable pressure conditions, improving crop yield and water-use efficiency. Their growing usage in arid and semi-arid regions further strengthens their market growth outlook.

- By Crop Type

On the basis of crop type, the market is segmented into cereals and pulses, fruits and vegetables, oilseeds and pulses, turf and ornamentals, and other crops. The fruits and vegetables segment held the largest market revenue share in 2024, owing to the high demand for uniform irrigation in water-sensitive and high-value crops. Drip systems are particularly preferred for horticultural farming due to their ability to maintain soil moisture balance and improve crop quality.

The cereals and pulses segment is expected to register the fastest growth rate from 2025 to 2032, supported by government initiatives promoting micro-irrigation for staple crops. Increasing adoption of drip systems in large-scale cereal cultivation helps reduce water consumption and enhance productivity, especially in water-scarce regions of Asia and Africa.

- By Application

On the basis of application, the market is segmented into agriculture, landscape, greenhouse, and others. The agriculture segment held the largest market revenue share in 2024, attributed to the extensive adoption of drip irrigation for field crops and horticultural produce. Rising awareness regarding sustainable water management and productivity improvement continues to drive system installation across farmlands.

The greenhouse segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising trend of protected cultivation and precision farming. Drip irrigation systems in greenhouses provide controlled water and nutrient delivery, optimizing plant growth and minimizing resource wastage, particularly in high-value vegetable and flower production.

- By Emitter Type

On the basis of emitter type, the market is segmented into inline emitters and outline emitters. The inline emitters segment held the largest market revenue share in 2024, due to their widespread use in large-scale agricultural operations requiring uniform water distribution across extensive field areas. Inline systems are known for their ease of installation, lower maintenance needs, and cost-effectiveness in drip line irrigation setups.

The outline emitters segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by their flexibility in installation and suitability for orchards, vineyards, and uneven terrains. These emitters allow precise control over water flow to individual plants, enhancing efficiency in areas with varied crop spacing and topography.

Drip Irrigation Market Regional Analysis

- Asia-Pacific dominated the drip irrigation market with the largest revenue share of 38.62% in 2024, driven by rapid agricultural modernization, expanding population, and the growing adoption of precision irrigation practices

- Governments in the region are implementing initiatives to promote water-efficient irrigation systems, providing subsidies and training programs to farmers

- The high demand for sustainable farming techniques, combined with the need to improve crop yield under limited water availability, has made drip irrigation a preferred choice for both small and large-scale farmers across the region

China Drip Irrigation Market Insight

The China drip irrigation market dominated in Asia-Pacific, fuelled by agricultural reforms and large-scale investments in modern irrigation infrastructure. The Chinese government’s focus on sustainable farming practices and rural modernization programs has increased the use of efficient irrigation systems in both traditional and greenhouse cultivation. The integration of automation and sensor-based irrigation systems, coupled with the rise of smart agriculture, is further enhancing market expansion.

Japan Drip Irrigation Market Insight

The Japan drip irrigation market is expected to witness significant growth from 2025 to 2032, driven by the country’s strong emphasis on advanced agricultural technologies and efficient water management practices. Japan’s limited arable land and focus on high-value crops have accelerated the adoption of precision irrigation systems. The integration of smart sensors, automation, and IoT-based monitoring in drip irrigation is gaining traction, particularly in greenhouse and urban farming applications. Moreover, government initiatives promoting sustainable agriculture and technological innovation are further supporting market expansion.

North America Drip Irrigation Market Insight

The North America drip irrigation market is expected to witness significant growth from 2025 to 2032, driven by technological advancements and widespread adoption of smart irrigation systems across the U.S. and Canada. Farmers in the region are increasingly relying on data-driven irrigation methods to optimize water use and improve crop yield, particularly in drought-prone areas. High awareness regarding water conservation and the strong presence of established irrigation system manufacturers are supporting consistent market growth.

U.S. Drip Irrigation Market Insight

The U.S. drip irrigation market is expected to witness significant growth from 2025 to 2032, driven by the growing trend of sustainable agriculture and the adoption of precision irrigation in water-scarce states such as California and Arizona. Farmers are increasingly investing in automated drip systems integrated with IoT sensors and weather-based controllers to enhance water efficiency and crop productivity. Government initiatives promoting water conservation and subsidies for micro-irrigation systems are further propelling market demand.

Europe Drip Irrigation Market Insight

The Europe drip irrigation market is expected to witness steady growth from 2025 to 2032, supported by increasing awareness about sustainable farming and the need to address water scarcity challenges. Countries such as Spain, Italy, and France are leading adopters of drip irrigation systems, especially in vineyards, fruit farms, and greenhouse cultivation. The integration of precision farming technologies, alongside the European Union’s focus on resource-efficient agriculture, continues to strengthen the regional market outlook.

Germany Drip Irrigation Market Insight

The Germany drip irrigation market is projected to grow steadily from 2025 to 2032, supported by the increasing adoption of sustainable farming techniques and the rising need to optimize water use in agriculture. German farmers are increasingly investing in precision irrigation systems to enhance productivity while meeting environmental standards. The growing popularity of greenhouse cultivation and horticulture, combined with technological innovations in automation and water control, is further boosting market growth across the country.

U.K. Drip Irrigation Market Insight

The U.K. drip irrigation market is anticipated to experience consistent growth from 2025 to 2032, driven by the growing demand for efficient water management solutions amid unpredictable weather patterns and rising environmental concerns. The adoption of drip irrigation systems is increasing in horticulture, greenhouse, and landscaping applications. Furthermore, government support for sustainable agriculture and the integration of digital farming technologies are encouraging farmers to transition toward water-efficient irrigation methods, fostering market expansion across the region.

Drip Irrigation Market Share

The Drip Irrigation industry is primarily led by well-established companies, including:

• Jain Irrigation Systems Ltd (India)

• Lindsay Corporation (U.S.)

• The Toro Company (U.S.)

• NETAFIM (Israel)

• Rain Bird Corporation (U.S.)

• Chinadrip Irrigation Equipment Co., Ltd. (China)

• Elgo Irrigation Ltd. (Israel)

• Antelco (Australia)

• Samriddhi by Mahindra (India)

• Microjet (South Africa)

• KSNM Drip (India)

• AZUD (Spain)

• Metzer (Israel)

• Chamsa - Grupo Chamartin (Spain)

• Dripworks, Inc. (U.S.)

• Hunter Industries (U.S.)

• Eurodrip A.V.E.G.E. (Greece)

• Rivulis (Israel)

• Shanghai Irrist Corp. (China)

Latest Developments in Global Drip Irrigation Market

- In September 2024, Netafim introduced GrowSphere, a digital farm management platform integrating hydraulic diagnostics with agronomic decision support to optimize water and nutrient management. This innovation aims to enhance precision irrigation, improve crop yields, and promote sustainable farming practices, thereby strengthening Netafim’s position in the smart irrigation technology market

- In February 2024, Hunter Industries Inc. entered into a strategic partnership with Saudi Drip Irrigation Company to co-manufacture irrigation products for agricultural, residential, commercial, and golf applications. The collaboration focuses on developing water- and energy-efficient irrigation solutions, supporting sustainability goals and expanding Hunter’s market presence across the Middle East

- In January 2024, Rain Bird Corporation partnered with Pinehurst Resort to supply advanced irrigation systems, equipment, and maintenance support. Recognized as the resort’s Official Irrigation Partner, Rain Bird aims to enhance water efficiency and promote sustainable turf management practices, further elevating its brand visibility in the commercial irrigation segment

- In October 2023, Netafim Limited launched an advanced irrigation system in India equipped with anti-clogging technology to ensure optimal water and nutrient distribution. The initiative targets over 35,000 farmers cultivating 25,000 hectares by 2025, driving improved agricultural productivity and expanding the company’s footprint in emerging markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.