Global Drippers Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

4.14 Billion

2025

2033

USD

2.50 Billion

USD

4.14 Billion

2025

2033

| 2026 –2033 | |

| USD 2.50 Billion | |

| USD 4.14 Billion | |

|

|

|

|

Drippers Market Size

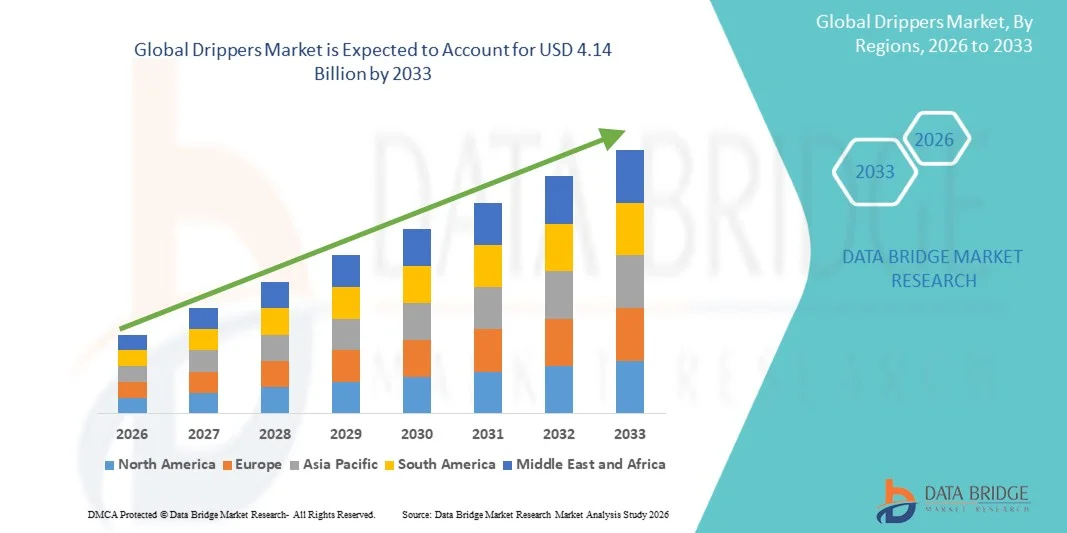

- The global drippers market size was valued at USD 2.5 billion in 2025 and is expected to reach USD 4.14 billion by 2033, at a CAGR of 6.53% during the forecast period

- The market growth is largely driven by increasing adoption of micro-irrigation systems and continuous technological advancements in dripper design, enabling precise and efficient water delivery across diverse agricultural applications

- Furthermore, rising pressure on water resources, growing awareness of sustainable farming practices, and the need to improve crop yield and input efficiency are positioning drippers as a preferred irrigation solution. These combined factors are accelerating the adoption of drip irrigation systems, thereby significantly supporting overall market growth

Drippers Market Analysis

- Drippers are essential components of drip irrigation systems that deliver controlled and uniform water directly to the plant root zone, minimizing evaporation and runoff while improving water-use efficiency

- The growing demand for drippers is primarily supported by increasing water scarcity, expansion of high-value crop cultivation, and strong government initiatives promoting efficient irrigation technologies to enhance agricultural productivity

- Asia-Pacific dominated the drippers market with a share of 35.9% in 2025, due to extensive agricultural activities, rising adoption of micro-irrigation systems, and increasing awareness of water conservation practices across farming communities

- North America is expected to be the fastest growing region in the drippers market during the forecast period due to increasing adoption of precision agriculture, high awareness of water conservation, and growing use of drip irrigation in large-scale farms

- Inline drippers segment dominated the market with a market share of 45.6% in 2025, due to their uniform water distribution, durability, and suitability for long lateral lengths in large-scale farming operations. Farmers prefer inline drippers for row crops and plantations due to reduced clogging risk and lower maintenance requirements over extended usage periods. Their compatibility with automated irrigation systems and cost efficiency for high-density installations further supports their dominant position across commercial agriculture

Report Scope and Drippers Market Segmentation

|

Attributes |

Drippers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drippers Market Trends

“Rising Adoption of Precision and Smart Drip Irrigation Systems”

- A major trend in the drippers market is the growing adoption of precision and smart drip irrigation systems, driven by the need to optimize water usage and improve crop productivity under varying climatic conditions. Advanced drippers integrated with sensors, automation, and digital monitoring are enabling farmers to deliver water accurately to the root zone, reducing losses due to evaporation and runoff

- For instance, Netafim has introduced smart drip irrigation solutions integrated with digital platforms that allow real-time monitoring of soil moisture and irrigation scheduling. These solutions are widely adopted in horticulture and plantation crops, supporting precision farming practices and efficient resource management

- The integration of drippers with weather-based advisory systems is gaining traction as it allows irrigation to be adjusted according to rainfall patterns and evapotranspiration levels. This approach is helping farmers minimize over-irrigation and enhance water-use efficiency across diverse crop cycles

- Greenhouse and protected cultivation systems are increasingly deploying precision drippers to ensure uniform water and nutrient distribution for high-value crops. This trend is strengthening demand for high-quality drippers capable of consistent performance under controlled environments

- Large commercial farms are also adopting smart drippers as part of broader precision agriculture strategies aimed at improving yield predictability and reducing operational costs. This continued shift toward data-driven irrigation is reinforcing the role of advanced drippers in modern agricultural practices

- Overall, the increasing reliance on precision and smart irrigation technologies is shaping a strong growth trajectory for the drippers market by aligning irrigation efficiency with sustainability and productivity goals

Drippers Market Dynamics

Driver

“Increasing Water Scarcity and Demand for Efficient Irrigation Solutions”

- Rising water scarcity across key agricultural regions is a primary driver for the drippers market, as farmers seek efficient irrigation methods that maximize crop output with limited water resources. Drippers enable controlled water application directly to plant roots, significantly reducing wastage compared to traditional irrigation methods

- For instance, government-backed programs in India have supported companies such as Jain Irrigation Systems in deploying drip irrigation solutions to address declining groundwater levels. These initiatives have encouraged widespread adoption of drippers among small and medium farmers seeking to conserve water while maintaining yields

- The growing cultivation of water-intensive crops such as fruits, vegetables, and cash crops is increasing reliance on drip irrigation to ensure consistent moisture levels. Drippers help maintain optimal soil conditions, supporting healthier crop growth and improved quality

- Climate variability and irregular rainfall patterns are further amplifying the need for efficient irrigation systems that provide reliability and control. Drippers offer farmers greater resilience against drought conditions and unpredictable weather events

- Agricultural modernization efforts and the push toward sustainable farming practices are reinforcing this driver, as efficient irrigation is increasingly viewed as essential for long-term food security. The continued emphasis on water efficiency is strongly supporting the expansion of the drippers market

Restraint/Challenge

“High Initial Installation Cost and Maintenance Complexity”

- The drippers market faces challenges related to the high initial cost of installing drip irrigation systems, which can limit adoption among resource-constrained farmers. Expenses associated with piping networks, filtration systems, and quality drippers create financial barriers, particularly for small-scale agricultural operations

- For instance, despite the proven efficiency of drip irrigation systems offered by companies such as Rivulis Irrigation, upfront investment requirements remain a concern in regions with limited access to financing. This cost sensitivity can slow adoption in developing agricultural economies

- Maintenance complexity is another challenge, as drippers are susceptible to clogging due to sediments, algae, or mineral deposits in water sources. Regular filtration and system upkeep are required to ensure consistent performance, increasing operational demands on farmers

- Inadequate technical knowledge and limited access to after-sales service in rural areas further complicate system maintenance. These factors can reduce system efficiency over time and discourage long-term use

- The challenge of balancing affordability, durability, and ease of maintenance continues to influence market dynamics. Addressing these constraints through cost-effective designs and improved support infrastructure remains critical for sustaining growth in the drippers market

Drippers Market Scope

The market is segmented on the basis of product type, flow rate, crop type, end user, and distribution channel.

• By Product Type

On the basis of product type, the drippers market is segmented into inline drippers and online drippers. The inline drippers segment dominated the largest market revenue share of 45.6% in 2025, driven by their uniform water distribution, durability, and suitability for long lateral lengths in large-scale farming operations. Farmers prefer inline drippers for row crops and plantations due to reduced clogging risk and lower maintenance requirements over extended usage periods. Their compatibility with automated irrigation systems and cost efficiency for high-density installations further supports their dominant position across commercial agriculture.

The online drippers segment is anticipated to witness the fastest growth rate during the forecast period, supported by rising adoption in diversified crop patterns and uneven field terrains. Online drippers offer flexible placement and adjustable flow rates, enabling precise irrigation tailored to individual plant needs. This flexibility makes them increasingly attractive for horticulture, orchards, and greenhouse applications where crop spacing and water demand vary significantly.

• By Flow Rate

On the basis of flow rate, the drippers market is segmented into up to 2 L/h, 2.1 to 4 L/h, 4.1 to 8 L/h, and above 8 L/h. The up to 2 L/h segment accounted for the largest market share in 2025, driven by its widespread use in water-scarce regions and suitability for crops requiring frequent and controlled irrigation. These low-flow drippers help minimize water wastage, improve soil moisture retention, and support sustainable farming practices. Their adoption is particularly strong in regions promoting micro-irrigation subsidies and water conservation programs.

The 4.1 to 8 L/h segment is expected to register the fastest growth over the forecast period, owing to increasing demand from orchards and vineyards with higher water requirements. These drippers provide efficient water delivery for deep-rooted crops, supporting healthier plant growth and improved yield outcomes. Expansion of high-value perennial crop cultivation further accelerates demand for higher flow rate drippers.

• By Crop Type

On the basis of crop type, the drippers market is segmented into field crops, fruits and vegetables, orchards and vineyards, and ornamentals and turf. The field crops segment dominated the market in 2025, supported by the extensive cultivation area and growing emphasis on improving irrigation efficiency for staple crops. Drip irrigation adoption in field crops helps reduce input costs, optimize fertilizer usage through fertigation, and enhance overall productivity. Government initiatives encouraging efficient irrigation systems have further strengthened this segment’s dominance.

The fruits and vegetables segment is projected to witness the fastest growth during the forecast period, driven by rising demand for high-quality produce and increasing cultivation of cash crops. Drippers enable precise water and nutrient delivery, which is critical for improving crop quality, size uniformity, and yield consistency. Growth in protected farming and export-oriented horticulture continues to fuel adoption in this segment.

• By End User

On the basis of end user, the drippers market is segmented into large corporate farms, small and medium farms, and greenhouses and nurseries. Large corporate farms held the largest market revenue share in 2025, driven by their higher capital investment capacity and focus on large-scale, technology-driven irrigation systems. These farms prioritize operational efficiency, yield optimization, and long-term cost savings, making drippers a preferred solution. Integration with automated monitoring and control systems further enhances adoption among corporate agricultural enterprises.

The greenhouses and nurseries segment is expected to grow at the fastest rate during the forecast period, supported by rapid expansion of controlled environment agriculture. Drippers provide precise and consistent irrigation essential for sensitive plants, seedlings, and ornamental crops. Increasing urban farming initiatives and demand for high-value plants continue to drive growth in this segment.

• By Distribution Channel

On the basis of distribution channel, the drippers market is segmented into direct OEM sales, dealer/distributor network, and e-commerce. The dealer/distributor network segment dominated the market in 2025, owing to its extensive rural reach and strong after-sales support services. Farmers rely on local distributors for technical guidance, installation support, and timely availability of irrigation components. Established relationships between manufacturers and regional dealers play a key role in sustaining this channel’s dominance.

The e-commerce segment is anticipated to witness the fastest growth over the forecast period, driven by increasing digital adoption among farmers and agribusinesses. Online platforms offer price transparency, wider product selection, and convenient access to technical specifications and reviews. Growing penetration of smartphones and digital payment systems in rural areas further supports the rapid expansion of this channel.

Drippers Market Regional Analysis

- Asia-Pacific dominated the drippers market with the largest revenue share of 35.9% in 2025, driven by extensive agricultural activities, rising adoption of micro-irrigation systems, and increasing awareness of water conservation practices across farming communities

- The region benefits from a large base of small and medium farms, government subsidies for drip irrigation, and growing cultivation of water-intensive crops such as fruits, vegetables, and cash crops

- Rapid population growth, pressure on water resources, and strong policy support for efficient irrigation technologies across developing economies are accelerating widespread deployment of drippers

China Drippers Market Insight

China held the largest share in the Asia-Pacific drippers market in 2025, supported by its vast agricultural land, strong domestic manufacturing capacity for irrigation equipment, and government initiatives promoting water-saving irrigation methods. Large-scale adoption in field crops, orchards, and greenhouse farming has been a key growth driver. Continued investments in modern agriculture and smart irrigation infrastructure are further strengthening market demand.

India Drippers Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing water scarcity, expansion of horticulture crops, and strong government programs promoting drip irrigation adoption. Schemes encouraging micro-irrigation for small and medium farmers are significantly boosting market penetration. Rising focus on improving crop yields and reducing input costs is accelerating the use of drippers across diverse agro-climatic zones.

Europe Drippers Market Insight

The Europe drippers market is growing steadily, driven by stringent water management regulations, high adoption of precision agriculture, and increasing emphasis on sustainable farming practices. The region shows strong demand for advanced and durable dripper systems in greenhouse cultivation and high-value crops. Focus on reducing water wastage and improving resource efficiency continues to support market expansion.

Germany Drippers Market Insight

Germany’s drippers market is supported by advanced agricultural technologies, strong adoption of automated irrigation systems, and a focus on high-efficiency farming practices. The country emphasizes precision irrigation in greenhouse farming, specialty crops, and research-driven agriculture. Strong engineering capabilities and innovation in irrigation equipment contribute to consistent market growth.

U.K. Drippers Market Insight

The U.K. market is driven by increasing adoption of controlled environment agriculture, rising focus on water efficiency, and growth in greenhouse and nursery farming. Demand is supported by modern farming practices and investments in sustainable irrigation solutions. Expansion of horticulture and ornamental crop cultivation further supports the use of drippers across the country.

North America Drippers Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing adoption of precision agriculture, high awareness of water conservation, and growing use of drip irrigation in large-scale farms. Technological advancements in irrigation systems and rising demand for efficient water management solutions are key growth factors. Expansion of high-value crop farming is further accelerating market growth.

U.S. Drippers Market Insight

The U.S. accounted for the largest share in the North America drippers market in 2025, supported by widespread adoption of advanced irrigation technologies and large corporate farming operations. Strong focus on optimizing water usage, improving crop productivity, and integrating irrigation systems with digital monitoring tools drives demand. Presence of established irrigation manufacturers and well-developed distribution networks further strengthens the U.S. market position.

Drippers Market Share

The drippers industry is primarily led by well-established companies, including:

- Irritec S.p.A. (Italy)

- The Toro Company (U.S.)

- Dayu Water-Saving Group Co., Ltd. (China)

- Netafim Ltd. (Israel)

- Antelco Pty Ltd. (Australia)

- Rain Bird Corporation (U.S.)

- Chinadrip Irrigation Equipment (Xiamen) Co., Ltd. (China)

- Grupo Chamartín, S.A. (Spain)

- Lindsay Corporation (U.S.)

- Metzerplas Cooperative Agricultural Organization Ltd. (Israel)

- Nelson Irrigation Corporation (U.S.)

- Rivulis Irrigation Ltd. (Israel)

- Valmont Industries, Inc. (U.S.)

- Hunter Industries, Inc. (U.S.)

Latest Developments in Global Drippers Market

- In August 2025, Netafim India introduced the all-in-one Portable Crop Kit in the Indian market, strengthening the penetration of drip irrigation among small and medium farmers through affordable and easy-to-deploy solutions. This launch directly supports market expansion by lowering adoption barriers, improving accessibility to micro-irrigation, and accelerating the shift toward water-efficient farming practices in price-sensitive regions

- In June 2025, McCain Foods partnered with Orbia Netafim to deploy drip irrigation systems in potato cultivation, demonstrating the measurable agronomic and efficiency benefits of advanced irrigation technologies. The collaboration highlighted water savings of around 20% and yield improvements ranging from 4% to 23%, reinforcing the value proposition of drippers for large-scale commercial farming and driving adoption across high-value crop segments

- In August 2024, Rain Bird completed the acquisition of Adritec Group assets in Jordan and Mexico, significantly enhancing its PET tape production capabilities and strengthening its regional dealer network. This strategic move expanded Rain Bird’s manufacturing footprint and distribution reach across the Middle East and North America, improving supply chain resilience and supporting faster market penetration for drip irrigation products

- In September 2024, Netafim rolled out the GrowSphere digital suite, integrating pump control, valve sequencing, and weather station data to deliver comprehensive irrigation management for multi-crop enterprises. This development advanced the drippers market by enabling precision irrigation, improving water-use efficiency, and supporting the integration of digital agriculture solutions with physical irrigation infrastructure

- In September 2024, N-Drip partnered with local farmers and Google to deploy gravity-based drip irrigation systems aimed at replenishing 120% of the freshwater used by Google’s data centers. This initiative strengthened the market’s sustainability narrative, showcasing drippers as a critical solution for water conservation, climate resilience, and corporate sustainability commitments in agriculture-linked ecosystems

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.