Global Drone Based Gas Leak Detection In Oil And Gas Market

Market Size in USD Billion

CAGR :

%

USD

5.90 Billion

USD

8.98 Billion

2024

2032

USD

5.90 Billion

USD

8.98 Billion

2024

2032

| 2025 –2032 | |

| USD 5.90 Billion | |

| USD 8.98 Billion | |

|

|

|

|

Global Drone-Based Gas Leak Detection in Oil and Gas Market Size

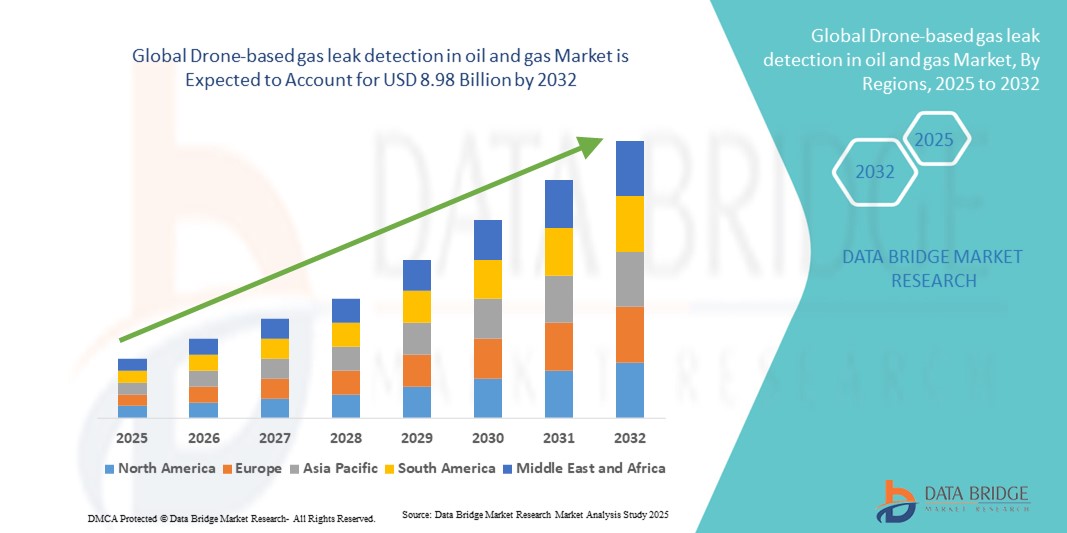

- The global drone-based gas leak detection in oil and gas market size was valued at USD 5.90 billion in 2024 and is expected to reach USD 8.98 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is largely fuelled by the increasing need for enhanced safety and operational efficiency in oil and gas facilities, minimizing human exposure to hazardous gases

- Rising adoption of drones equipped with advanced sensors for real-time leak detection and monitoring is further driving market expansion

Global Drone-Based Gas Leak Detection in Oil and Gas Market Analysis

- The market is witnessing steady growth due to technological advancements in drone sensors, imaging systems, and AI-powered analytics, allowing faster and more accurate detection of gas leaks

- Increased focus on reducing operational risks, downtime, and financial losses caused by undetected leaks is contributing to market adoption

- North America dominated the drone-based gas leak detection market with the largest revenue share of 42% in 2024, driven by increasing safety regulations, advanced refinery infrastructure, and widespread adoption of drone technologies for inspection and monitoring

- Asia-Pacific region is expected to witness the highest growth rate in the global drone-based gas leak detection in oil and gas market, driven by expanding oil and gas infrastructure, technological advancements in drone sensors, and government initiatives promoting industrial safety and environmental monitoring

- The Battery segment held the largest market revenue share in 2024, driven by its reliability, ease of use, and compatibility with automated inspection software. Battery-powered drones offer longer flight times, lower maintenance costs, and flexibility for both onshore and offshore operations

Report Scope and Global Drone-Based Gas Leak Detection in Oil and Gas Market Segmentation

|

Attributes |

Drone-Based Gas Leak Detection in Oil and Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drone-Based Gas Leak Detection in Oil and Gas Market Trends

Rise of Drone-Based Inspection and Leak Detection Solutions

- The growing adoption of drone-based solutions is transforming oil and gas operations by enabling real-time, remote detection of gas leaks and hazardous emissions. The mobility and speed of drones allow for immediate identification and mitigation of potential risks, especially in large and offshore facilities. This results in improved operational safety, reduced downtime, and minimized environmental impact

- Increasing demand for rapid inspections in remote or difficult-to-access areas is accelerating the deployment of drones equipped with infrared, laser-based, and chemical sensors. These tools are particularly effective where traditional inspection methods are time-consuming or risky, helping companies reduce response times and operational hazards

- The affordability, automation, and ease of integration of modern drone systems are making them attractive for routine inspections and monitoring. Oil and gas operators can perform frequent surveillance without significant logistical challenges or workforce risks, ultimately enhancing safety compliance and operational efficiency

- For instance, in 2023, several North Sea offshore operators reported a significant reduction in undetected gas leaks after integrating drone-based inspection systems into their routine monitoring. These systems allowed early detection of pipeline leaks and equipment faults, reducing environmental risk and operational losses

- While drones are accelerating early detection and supporting environmental and safety compliance, their impact depends on continuous technological advancement, operator training, and regulatory support. Manufacturers and service providers must focus on localized solutions and scalable deployment strategies to fully leverage this growing demand

Drone-Based Gas Leak Detection in Oil and Gas Market Dynamics

Driver

Increasing Safety Regulations and Operational Efficiency Demands

- Rising global safety and environmental regulations are compelling oil and gas operators to adopt advanced leak detection solutions, with drones becoming a frontline tool. Drones enable rapid inspections while minimizing human exposure to hazardous gases and confined environments. This trend also drives investments in AI and automated monitoring systems for real-time safety compliance

- Operators are increasingly aware of the financial and reputational risks associated with undetected leaks, including environmental penalties, downtime, and asset damage. This awareness has driven the regular use of drones for preventive monitoring, even among smaller oil and gas facilities. In addition, drone adoption helps reduce insurance premiums and liability risks

- Government incentives and industry initiatives promoting environmental monitoring and emission reduction are further supporting drone adoption. Subsidized programs and regulatory frameworks encourage operators to integrate drones into their inspection schedules. These policies are fostering innovation and creating opportunities for service providers

- For instance, in 2022, several U.S. and European offshore operators reported increased adoption of drone-based leak detection systems following stricter environmental and safety compliance mandates. These systems improved inspection frequency, reduced operational delays, and enhanced overall safety performance

- While regulatory support and operational benefits are driving market growth, companies must continue to enhance data analytics, AI integration, and remote monitoring capabilities to maximize drone efficiency. Continuous upgrades in sensor technology and autonomous navigation are also key to maintaining competitive advantage

Restraint/Challenge

High Equipment Costs and Technical Expertise Requirements

- The high cost of advanced drones and specialized sensors, such as infrared and laser-based systems, limits adoption for small and mid-sized operators. These systems often require significant upfront investment and ongoing maintenance, which can be a barrier in cost-sensitive operations. The total cost of ownership, including software and training, further affects adoption rates

- Many oil and gas sites, particularly offshore or remote installations, lack trained personnel capable of operating, maintaining, or analyzing drone-based inspection data. Insufficient technical expertise can reduce the effectiveness of drone deployment and delay corrective actions. Training programs and skill development initiatives are necessary to bridge this gap

- Supply chain and logistical challenges, such as access to spare parts, sensor calibration, and regulatory approvals, can also restrict market penetration in remote regions. These limitations may result in delayed inspections and increased operational risk. Geographic constraints and limited infrastructure exacerbate the challenges in timely deployment

- For instance, in 2023, several operators in Sub-Saharan Africa and Southeast Asia reported limited drone utilization due to high costs and a lack of skilled operators, highlighting access and infrastructure gaps. This hindered regular inspection schedules and affected operational safety standards

- While drone technologies continue to evolve, overcoming cost, training, and infrastructure challenges remains critical. Market stakeholders must focus on scalable, user-friendly, and cost-effective solutions to bridge operational gaps and unlock long-term market potential. Adoption of modular drones and remote support services can help mitigate these barriers

Drone-Based Gas Leak Detection in Oil and Gas Market Scope

The market is segmented on the basis of energy source, sensor type, application, technology, service type, and end use.

- By Energy Source

On the basis of energy source, the drone-based gas leak detection market is segmented into Battery, Gasoline, Hydrogen Fuel Cell, and Solar Drones. The Battery segment held the largest market revenue share in 2024, driven by its reliability, ease of use, and compatibility with automated inspection software. Battery-powered drones offer longer flight times, lower maintenance costs, and flexibility for both onshore and offshore operations.

The Hydrogen Fuel Cell segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its high energy efficiency and extended flight endurance, making it suitable for long-range inspections and continuous monitoring in remote areas. Hydrogen-powered drones are increasingly being adopted for large-scale pipeline and offshore platform inspections.

- By Sensor Type

On the basis of sensor type, the market is segmented into Visual (RGB), Infrared (IR), and Lidar (Light Detection and Ranging). The Infrared segment held the largest market share in 2024 due to its ability to detect invisible gas leaks and provide real-time thermal imaging. IR-equipped drones enhance safety by enabling early leak detection and reducing human exposure to hazardous gases.

The Lidar segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its accuracy in mapping complex industrial structures and detecting gas concentrations over large areas. Lidar sensors improve inspection efficiency and are increasingly integrated into automated monitoring systems.

- By Application

On the basis of application, the market is segmented into Offshore Platforms Inspection, Refining Equipment, Leak Detection in Midstream Assets, Emergency Response, and Material Handling. The Leak Detection in Midstream Assets segment held the largest revenue share in 2024, driven by the critical need for pipeline safety and regulatory compliance. Drones allow operators to detect leaks quickly and prevent operational downtime.

The Offshore Platforms Inspection segment is expected to witness the fastest growth rate from 2025 to 2032, due to rising offshore exploration activities and the need for frequent safety inspections. Drone-based inspections reduce risks, minimize costs, and ensure timely detection of structural or operational anomalies.

- By Technology

On the basis of technology, the market is segmented into Infrared Sensors, Laser-based Sensors, Ultrasonic Sensors, and Chemical Sensors. The Infrared Sensors segment dominated the market in 2024 due to its ability to detect invisible gases and support predictive maintenance. These sensors are widely adopted for continuous monitoring in hazardous zones.

The Chemical Sensors segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for precise detection of specific hydrocarbon gases and enhanced leak identification in complex industrial setups.

- By Service Type

On the basis of service type, the market is segmented into Inspection Services, Maintenance Services, and Consultation Services. The Inspection Services segment held the largest market revenue share in 2024, fueled by the widespread adoption of drone-based inspections for pipelines, refineries, and offshore facilities.

Maintenance Services is expected to witness the fastest growth rate from 2025 to 2032, supported by the increasing need for preventive maintenance and real-time monitoring to reduce operational risks.

- By End Use

On the basis of end use, the market is segmented into Onshore and Offshore. The Onshore segment held the largest revenue share in 2024, driven by the higher number of onshore oil and gas facilities and pipelines requiring frequent monitoring.

The Offshore segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the rising adoption of drones for safety and efficiency in remote offshore installations, where manual inspection is costly and risky.

Drone-Based Gas Leak Detection in Oil and Gas Market Regional Analysis

- North America dominated the drone-based gas leak detection market with the largest revenue share of 42% in 2024, driven by increasing safety regulations, advanced refinery infrastructure, and widespread adoption of drone technologies for inspection and monitoring

- Operators in the region highly value the ability of drones to provide real-time leak detection, reduce human exposure to hazardous environments, and enhance operational efficiency across onshore and offshore facilities

- This adoption is further supported by high investment in oil and gas infrastructure, technological innovation, and growing preference for automated monitoring solutions, positioning drones as a critical tool for operational safety

U.S. Drone-Based Gas Leak Detection Market Insight

The U.S. drone-based gas leak detection market captured the largest revenue share in 2024 within North America, fueled by the extensive adoption of drones for pipeline monitoring, refinery inspection, and offshore platform safety. Operators increasingly prioritize preventive leak detection to reduce environmental impact and operational downtime. The growing integration of AI, thermal imaging, and chemical sensors into drone platforms is further driving market expansion, while government regulations and safety standards reinforce the need for frequent, automated inspections.

Europe Drone-Based Gas Leak Detection Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, primarily driven by stringent environmental and safety regulations, along with the rising need to reduce operational risks in oil and gas facilities. The growth of offshore and onshore energy projects, coupled with advancements in drone technologies and sensor integration, is supporting adoption. European operators are increasingly relying on drones for leak detection, emergency response, and pipeline inspections to enhance safety compliance.

U.K. Drone-Based Gas Leak Detection Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing emphasis on operational safety, environmental monitoring, and reducing human exposure to hazardous conditions. Rising offshore exploration and the need for continuous surveillance encourage the adoption of drones. Government initiatives and investment in oil and gas infrastructure are also boosting market penetration.

Germany Drone-Based Gas Leak Detection Market Insight

The Germany market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of operational safety, digital monitoring solutions, and environmental compliance requirements. Germany’s well-developed energy infrastructure, focus on industrial innovation, and investment in AI-enabled inspection systems are promoting drone adoption for both onshore and offshore operations.

Asia-Pacific Drone-Based Gas Leak Detection Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid industrialization, growing energy demand, and expansion of oil and gas infrastructure in countries such as China, Japan, and India. The region’s inclination toward digitalization, smart monitoring technologies, and safety automation is accelerating adoption. Furthermore, APAC’s emergence as a manufacturing hub for drones and sensors is enhancing affordability and accessibility.

Japan Drone-Based Gas Leak Detection Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032 due to the country’s high focus on industrial safety, advanced technological infrastructure, and demand for operational efficiency. Increasing offshore and onshore energy projects, coupled with the integration of drones with IoT-enabled monitoring systems, are driving growth. In addition, Japan’s aging workforce is encouraging the adoption of automated drone inspections to reduce human labor in hazardous environments.

China Drone-Based Gas Leak Detection Market Insight

The China market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid industrialization, expanding oil and gas infrastructure, and rising adoption of drones for leak detection and pipeline monitoring. Government initiatives promoting environmental safety, along with affordable drone solutions and strong domestic manufacturing, are supporting market growth. The push toward smart oil and gas facilities and automated monitoring systems is further propelling demand.

Drone-Based Gas Leak Detection in Oil and Gas Market Share

The Drone-based gas leak detection in oil and gas industry is primarily led by well-established companies, including:

- Flyability SA (Switzerland)

- DJI (China)

- Teledyne FLIR LLC (U.S.)

- Aerodyne Group (Malaysia)

- Lockheed Martin Corporation (U.S.)

- Elios Robotics (Switzerland)

- ideaForge Technology Ltd (India)

- SeekOps (U.S.)

- Volatus Aerospace Corp. (Canada)

Latest Developments in Global Drone-Based Gas Leak Detection in Oil and Gas Market

- In April 2021, Pipelines frequently traversed inaccessible terrain to deliver industrial and residential gas. Operators of these networks had to guarantee the safety, integrity, and reliability of their pipelines. However, pinpointing odourless and invisible gas leaks accurately proved to be a challenging and costly endeavour. ABB addressed this challenge with its ABB Ability Mobile Gas Leak Detection System's newest enhancement, HoverGuard, which offered a solution by detecting leaks faster and more reliably than ever before

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.