Global Drone Logistics And Transportation Market

Market Size in USD Billion

CAGR :

%

USD

1.46 Billion

USD

33.42 Billion

2024

2032

USD

1.46 Billion

USD

33.42 Billion

2024

2032

| 2025 –2032 | |

| USD 1.46 Billion | |

| USD 33.42 Billion | |

|

|

|

|

Drone Logistics and Transportation Market Size

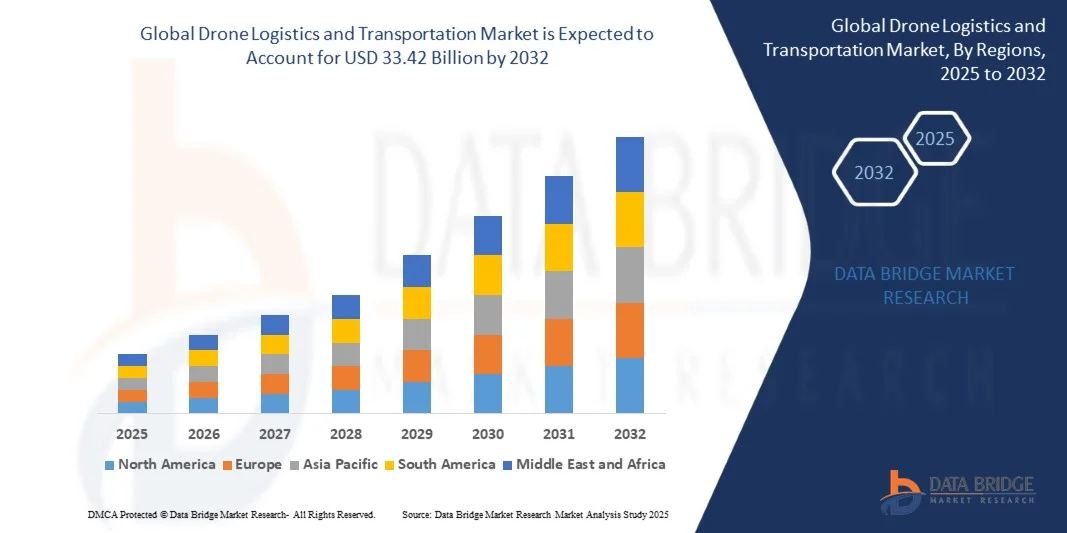

- The Drone Logistics and Transportation Market size was valued at USD 1.46 billion in 2024 and is expected to reach USD 33.42 billion by 2032, growing at a CAGR of 47.90% during the forecast period.

- Market growth is primarily driven by the rising demand for faster, contactless, and cost-efficient delivery solutions, especially across e-commerce, healthcare, and defense sectors.

- Additionally, advancements in autonomous navigation, AI integration, and regulatory support are enabling safe and scalable drone operations, significantly accelerating market expansion across global logistics networks.

Drone Logistics and Transportation Market Analysis

- Drones, serving as autonomous or remotely piloted aerial vehicles, are becoming increasingly vital in modern logistics and transportation due to their ability to deliver goods quickly, reduce human intervention, and access remote or congested areas with ease.

- The growing demand for rapid, contactless delivery, especially in e-commerce, healthcare, and disaster relief, is fueling the adoption of drone logistics, supported by ongoing technological advancements in AI, battery efficiency, and air traffic management systems.

- North America dominated the drone logistics and transportation market with the largest revenue share of 34.2% in 2024, driven by strong government support, advanced infrastructure, and early adoption by logistics giants and tech companies conducting large-scale delivery trials across urban and rural areas.

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, propelled by increasing urbanization, supportive regulatory frameworks, and significant investments in drone startups across China, Japan, and India.

- The delivery drones segment dominated the market with the largest revenue share of 46.7% in 2024, driven by the rising demand for fast, last-mile delivery services, particularly in the e-commerce and healthcare sectors

Report Scope and Drone Logistics and Transportation Market Segmentation

|

Attributes |

Drone Logistics and Transportation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drone Logistics and Transportation Market Trends

“Enhanced Convenience Through AI and Autonomous Integration”

- A significant and accelerating trend in the Drone Logistics and Transportation Market is the deepening integration of artificial intelligence (AI) and autonomous technologies to enhance operational efficiency, delivery accuracy, and user convenience across both commercial and governmental applications.

- For Instance, companies like Zipline and Wing are leveraging AI-powered flight algorithms to enable autonomous navigation, route optimization, and dynamic obstacle avoidance, allowing drones to operate with minimal human intervention while maintaining high reliability and safety.

- AI integration in drone logistics enables capabilities such as predictive maintenance, real-time traffic and weather analysis, and autonomous decision-making during in-flight operations. For instance, Matternet's M2 drones use onboard AI systems to automatically adjust routes in response to unexpected environmental changes or airspace restrictions.

- These intelligent systems also allow for automated load balancing and delivery scheduling, significantly reducing last-mile delivery times and operational costs. In some logistics operations, AI-based platforms are integrated with warehouse management systems to coordinate drone dispatch, package tracking, and delivery confirmation seamlessly.

- The synergy between AI and drone technology also supports remote monitoring and centralized control, enabling logistics managers to oversee entire drone fleets through unified dashboards. This mirrors how smart home ecosystems centralize control over various connected devices, enhancing visibility and responsiveness.

- This trend toward more intelligent, self-learning, and autonomous drone systems is fundamentally reshaping logistics strategies. Consequently, companies such as Wingcopter and Elroy Air are developing next-generation drones capable of long-range autonomous flights with integrated AI for situational awareness, route adaptation, and even self-landing in dynamic environments.

- The demand for drone solutions that offer autonomous capabilities, AI-based insights, and minimal human intervention is rapidly growing across e-commerce, healthcare, and disaster relief sectors, as businesses prioritize speed, efficiency, and adaptability in a digitized logistics ecosystem.

Drone Logistics and Transportation Market Dynamics

Driver

Growing Need Due to Demand for Faster, Contactless, and Efficient Delivery

- The increasing demand for faster, contactless, and cost-effective delivery solutions across sectors such as e-commerce, healthcare, and emergency response is a significant driver for the rising adoption of drone logistics and transportation.

- For instance, in March 2024, Zipline announced the expansion of its Platform 2 delivery system in the U.S., enabling ultra-precise, low-noise deliveries directly to homes and businesses, significantly reducing delivery times and operational costs. Such strategic advancements are accelerating industry growth during the forecast period.

- As consumers and enterprises seek on-demand, same-day, or even instant deliveries, drones offer a powerful alternative to traditional ground-based logistics, especially in congested urban centers or hard-to-reach rural areas.

- Moreover, the growing focus on sustainability and the push for reducing carbon emissions are making electric drones an attractive solution for last-mile delivery, aligning with global environmental goals.

- Features such as automated route planning, remote operation, real-time tracking, and integration with logistics management systems make drone delivery highly scalable and efficient for a wide range of commercial applications. The increasing involvement of logistics giants, healthcare providers, and government agencies is further propelling adoption.

- In addition, the rapid development of drone-friendly airspace regulations in key markets and pilot projects in urban air mobility (UAM) are making drones a central part of future logistics networks. Companies like Wingcopter and Flytrex are already demonstrating the viability of drone delivery systems at scale across various industries.

Restraint/Challenge

Regulatory Hurdles and Infrastructure Limitations

- Despite rapid technological advancements, stringent airspace regulations, varying global drone policies, and lack of standardized drone traffic management systems pose major challenges to broader market expansion. Regulatory uncertainty often delays commercial deployments and increases operational risks for drone companies.

- For instance, while the U.S. Federal Aviation Administration (FAA) has approved several drone delivery trials, restrictions on beyond visual line of sight (BVLOS) operations still limit scalability. In other regions, drone operations face additional hurdles such as complex licensing, no-fly zones, and privacy concerns.

- Furthermore, the infrastructure needed to support wide-scale drone logistics—such as droneports, charging stations, and maintenance hubs—is still in its infancy, particularly in developing nations or remote regions.

- Public perception and concerns about safety, noise pollution, and airspace congestion also present challenges, especially in densely populated urban areas. High-profile drone crashes or privacy violations could lead to increased scrutiny and regulatory pushback.

- Additionally, the high upfront costs of drone systems, especially for advanced long-range or heavy-payload models, can be a barrier to entry for small- and medium-sized logistics companies. While prices are expected to decline over time, affordability and return on investment remain key considerations for market adoption.

- Overcoming these challenges will require collaborative efforts between drone manufacturers, regulatory bodies, logistics providers, and governments to establish safe, scalable, and cost-effective drone logistics infrastructure. Initiatives focused on airspace integration, public engagement, and infrastructure development will be critical to unlocking the full potential of drone-based logistics globally.

Drone Logistics and Transportation Market Scope

The market is segmented on the basis of type, operation mode, range, and end use.

• By Type

On the basis of type, the drone logistics and transportation market is segmented into freight drones, passenger drones, delivery drones, ambulance drones, and others. The delivery drones segment dominated the market with the largest revenue share of 46.7% in 2024, driven by the rising demand for fast, last-mile delivery services, particularly in the e-commerce and healthcare sectors. Delivery drones offer a cost-effective and efficient solution for transporting lightweight goods, often bypassing road congestion and reducing delivery time significantly. Major retailers and logistics providers are actively piloting or deploying delivery drone fleets to improve customer satisfaction and operational efficiency.

The ambulance drones segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by growing applications in emergency medical services and disaster response. These drones can deliver critical supplies like defibrillators or medications to remote or inaccessible areas, making them increasingly valuable in life-saving scenarios where every second counts.

• By Operation Mode

Based on operation mode, the drone logistics and transportation market is segmented into fully autonomous, semi-autonomous, and remote operated drones. The fully autonomous segment accounted for the largest market share of 41.5% in 2024, reflecting growing confidence in advanced AI systems and navigation technologies that enable drones to operate without constant human input. These drones are ideal for repetitive delivery routes and can be deployed at scale, minimizing labor costs and improving delivery speed and reliability.

The semi-autonomous segment is projected to be the fastest-growing from 2025 to 2032, as it offers a balance between automation and human oversight, making it a suitable choice in regions with strict regulatory requirements or complex airspace. Semi-autonomous systems are increasingly used in defense and logistics applications where human judgment is still needed in specific operational scenarios but automation is leveraged for efficiency and precision.

• By Range

On the basis of range, the drone logistics and transportation market is categorized into short-range, medium-range, and long-range. The short-range segment dominated the market in 2024, holding a market revenue share of 52.3%, primarily due to its widespread use in last-mile delivery within urban and suburban environments. Short-range drones are highly effective for intra-city transport and are favored by e-commerce and food delivery services for their agility and quick turnaround times.

The long-range segment is expected to witness the highest CAGR from 2025 to 2032, driven by increasing applications in cross-border logistics, rural healthcare supply chains, and military operations. Long-range drones are essential for delivering goods to remote or difficult-to-access areas and are being increasingly adopted by humanitarian organizations and national defense agencies for high-value or critical deliveries over vast distances.

• By End-Use

On the basis of end use, drone logistics and transportation market is segmented by end-use into e-commerce, healthcare, defense, logistics & warehousing, agriculture, and others. The e-commerce segment led the market with the largest revenue share of 35.6% in 2024, driven by the explosive growth of online shopping and the need for rapid, scalable delivery solutions. Major e-commerce players are heavily investing in drone delivery infrastructure to gain a competitive edge in last-mile fulfillment and reduce operational costs.

The healthcare segment is expected to be the fastest-growing end-use category from 2025 to 2032, owing to the increasing deployment of drones to deliver vaccines, blood, medications, and lab samples, particularly in underserved and remote areas. Drones in healthcare are proving vital for time-sensitive deliveries, such as during pandemics or medical emergencies, where speed and reliability can directly impact patient outcomes.

Drone Logistics and Transportation Market Regional Analysis

- North America dominated the drone logistics and transportation market with the largest revenue share of 34.2% in 2024, driven by rapid technological advancements, regulatory support, and increasing investments from both private and public sectors in autonomous delivery systems.

- Consumers and businesses in the region value the speed, efficiency, and contactless nature of drone deliveries, particularly in sectors like e-commerce, healthcare, and defense, where time-sensitive logistics are critical.

- The widespread adoption of drone technologies is further supported by favorable FAA regulations, strong infrastructure, a highly digitized supply chain environment, and the presence of major industry players such as Zipline, Wing, and UPS Flight Forward. These factors collectively establish North America as a key hub for drone logistics innovation and large-scale deployment across both urban and rural areas.

U.S. Drone Logistics and Transportation Market Insight

The U.S. drone logistics and transportation market captured the largest revenue share of 79% in North America in 2024, driven by strong federal support, robust innovation ecosystems, and significant investment from both public and private sectors. The widespread use of drones for last-mile delivery, medical supply distribution, and military logistics is reshaping transportation strategies across industries. Major players such as Wing, Zipline, and UPS Flight Forward are conducting large-scale deployments and pilot programs across multiple states. Moreover, favorable FAA regulatory frameworks and the proliferation of AI-enabled autonomous systems are driving rapid adoption in both urban and rural regions.

Europe Drone Logistics and Transportation Market Insight

The Europe drone logistics market is projected to grow at a substantial CAGR throughout the forecast period, driven by supportive EU policies, investment in urban air mobility (UAM), and growing demand for sustainable, tech-driven logistics. European nations are emphasizing drone use in healthcare, disaster response, and rural delivery services. The region is also seeing increased partnerships between drone tech firms and traditional logistics providers, particularly in Germany, France, and the U.K., where regulatory testing zones and innovation corridors support experimentation and scaling. Europe’s focus on green logistics and reducing emissions positions drone technology as a key enabler of future transport systems.

U.K. Drone Logistics and Transportation Market Insight

The U.K. drone logistics market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by national drone delivery trials and a proactive regulatory environment. The Civil Aviation Authority (CAA) is facilitating sandbox testing for drone corridors, enabling real-world applications across healthcare, postal services, and emergency response. The country’s rising interest in urban air mobility and smart city integration also contributes to growing investments in drone infrastructure. Moreover, strong public and private collaborations, including trials for BVLOS (Beyond Visual Line of Sight) operations, are accelerating commercial use of drones in logistics.

Germany Drone Logistics and Transportation Market Insight

The Germany drone logistics market is expected to expand at a considerable CAGR, fueled by the country’s emphasis on technological innovation, automation, and sustainable logistics solutions. As a global leader in industrial engineering and manufacturing, Germany is leveraging drones to streamline warehouse operations, improve last-mile delivery, and enhance logistics efficiency. The government's support for digital transformation in supply chains, along with initiatives like drone corridors and smart logistics zones, encourages adoption. The strong presence of drone tech startups and partnerships with logistics giants are also contributing to Germany’s growing footprint in the global drone logistics space.

Asia-Pacific Drone Logistics and Transportation Market Insight

The Asia-Pacific drone logistics market is set to grow at the fastest CAGR of 25.3% during 2025–2032, driven by rapid urbanization, large-scale government digitalization initiatives, and increasing investment in drone infrastructure across China, Japan, India, and South Korea. The region’s need for efficient last-mile delivery in densely populated cities, coupled with remote area access in rural regions, creates an ideal environment for drone-based logistics. The presence of leading drone manufacturers and increasing commercial drone pilot programs are accelerating adoption. APAC’s role as a manufacturing hub also supports affordability and rapid scalability across various end-use industries.

Japan Drone Logistics and Transportation Market Insight

The Japan drone logistics market is gaining momentum, supported by its advanced technology landscape and government-led drone integration policies. The country’s strong focus on urban air mobility (UAM) and infrastructure modernization aligns with the growing demand for drones in sectors like medical transport, elderly care support, and emergency response. Japan’s aging population further drives the need for autonomous delivery solutions, especially in rural and remote areas. Collaboration between drone manufacturers and logistics firms is helping integrate drones into existing supply chains, while public trust in automation supports wider acceptance.

China Drone Logistics and Transportation Market Insight

The China drone logistics market held the largest revenue share in Asia-Pacific in 2024, driven by the country’s massive e-commerce industry, strong manufacturing base, and rapid urban expansion. Supported by favorable government policies and aggressive adoption of smart city infrastructure, drones are being increasingly deployed for package delivery, food services, and industrial logistics. Major Chinese companies are investing heavily in BVLOS drone delivery networks, autonomous drone fleets, and AI-based logistics management platforms. With domestic tech giants and startups pushing innovation at scale, China is poised to remain a global leader in drone logistics.

Drone Logistics and Transportation Market Share

The Drone Logistics and Transportation industry is primarily led by well-established companies, including:

- PINC Solutions (U.S.)

- Matternet (U.S.)

- Drone Delivery Canada (Canada)

- Hardis Group (France)

- CANA Advisors (U.S.)

- Infinium Robotics (Singapore)

- Workhorse Group (U.S.)

- AeroVironment (U.S.)

- DroneScan (South Africa)

- Skycart (U.S.)

- Zipline (U.S.)

- United Parcel Service of America, Inc. (UPS) (U.S.)

- Drone Delivery Canada (Canada) – (duplicate entry)

- Hardis Group (France) – (duplicate entry)

- Wing Aviation LLC (U.S.)

- Flytrex Inc. (Israel)

- Zing (United States)

- Wingcopter (Germany)

- Elroy Air (U.S.)

- Joby Aviation (U.S.)

What are the Recent Developments in Drone Logistics and Transportation Market?

- In April 2023, Zipline, a global leader in drone delivery services, expanded its operations in Ghana by launching a new medical drone delivery network aimed at improving healthcare access in remote areas. This initiative highlights Zipline’s commitment to leveraging advanced drone technology to enhance critical supply chains and save lives. By combining cutting-edge autonomous drone fleets with robust logistics infrastructure, Zipline is reinforcing its leadership position in the rapidly growing Drone Logistics and Transportation Market.

- In March 2023, Wing Aviation LLC, a subsidiary of Alphabet Inc., announced the successful completion of its drone delivery pilot program in Australia, focused on delivering food and essential items to suburban communities. The program demonstrated Wing’s capability to provide fast, reliable, and eco-friendly last-mile delivery solutions. This milestone underscores Wing’s dedication to advancing autonomous drone logistics and expanding the commercial adoption of drone delivery services worldwide.

- In March 2023, Honeywell International Inc. deployed a drone-enabled inspection and delivery system in Bengaluru, India, as part of the Safe City Project. Utilizing advanced drones for security surveillance and rapid logistics, this project aims to create smarter, safer urban environments. Honeywell’s involvement illustrates the increasing role of drone technologies in urban safety and infrastructure resilience, contributing to the broader adoption of drone logistics solutions in global markets.

- In February 2023, Drone Delivery Canada entered into a strategic partnership with a leading Canadian logistics firm to develop an integrated drone delivery platform targeting the healthcare and e-commerce sectors. This collaboration is designed to enhance delivery speed, reduce operational costs, and improve accessibility in hard-to-reach areas. The partnership highlights Drone Delivery Canada’s focus on innovation and market expansion within the evolving drone logistics ecosystem.

- In January 2023, UPS Flight Forward, a subsidiary of United Parcel Service, launched an expanded drone delivery service in select U.S. markets, focusing on critical medical supplies and commercial packages. Equipped with advanced autonomous navigation and fleet management systems, UPS Flight Forward’s service offers increased efficiency and reliability in last-mile logistics. This expansion reflects UPS’s commitment to integrating drone technology into its broader logistics network, enhancing service capabilities in the global drone transportation market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.