Global Drone Uav Battery Market

Market Size in USD Billion

CAGR :

%

USD

1.13 Billion

USD

2.10 Billion

2024

2032

USD

1.13 Billion

USD

2.10 Billion

2024

2032

| 2025 –2032 | |

| USD 1.13 Billion | |

| USD 2.10 Billion | |

|

|

|

|

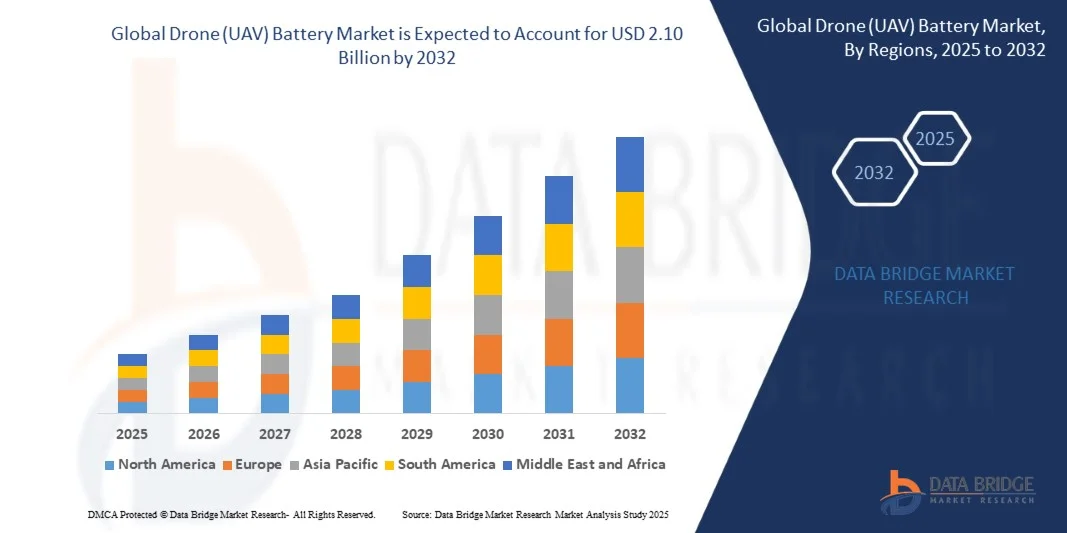

What is the Global Drone (UAV) Battery Market Size and Growth Rate?

- The global Drone (UAV) Battery market size was valued at USD 1.13 billion in 2024 and is expected to reach USD 2.10 billion by 2032, at a CAGR of 8.11% during the forecast period

- Market growth is primarily driven by the rapid adoption of commercial and consumer drones across industries such as agriculture, logistics, defense, and surveying, along with the rising need for high-performance and long-lasting battery solutions

- Increasing investments in drone technology, advancements in lithium-based battery efficiency, and the growing use of drones in automated applications are further contributing to the expansion of the Drone (UAV) Battery market. These factors collectively propel the market’s growth trajectory

What are the Major Takeaways of Drone (UAV) Battery Market?

- Drone (UAV) Batteries are essential for powering UAVs across diverse applications, offering long flight times, reliability, and quick recharge capabilities, making them critical for both commercial and industrial operations

- The market is fueled by rising demand for drones in logistics, agriculture monitoring, surveillance, and defense, coupled with advancements in lightweight, energy-dense battery technologies that enhance UAV performance

- North America dominated the Drone (UAV) Battery market with the largest revenue share of 42.5% in 2024, driven by the growing adoption of commercial, industrial, and defense UAVs, alongside advanced technological integration in drone battery solutions

- The Asia-Pacific Drone (UAV) Battery market is poised to grow at the fastest CAGR of 11.02% during 2025–2032, driven by rapid urbanization, increasing industrial UAV applications, and rising adoption of drones in agriculture, logistics, and commercial sectors in China, Japan, and India

- The Commercial segment dominated the market with the largest revenue share of 45.3% in 2024, driven by the rising adoption of drones in industrial inspection, logistics, agriculture, and surveying applications

Report Scope and Drone (UAV) Battery Market Segmentation

|

Attributes |

Drone (UAV) Battery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Drone (UAV) Battery Market?

“Advanced Efficiency and Longer Flight Duration”

- A key trend in the global Drone (UAV) Battery market is the development of high-energy-density batteries that provide extended flight times and improved overall efficiency. Manufacturers are focusing on lithium-based, nickel-based, and emerging fuel cell technologies to meet the rising demand for longer, uninterrupted UAV operations

- For instance, LG Chem and Panasonic are producing lightweight lithium-ion packs that allow drones to stay airborne for significantly longer periods, catering to applications in surveying, delivery, and defense

- Innovations such as modular and swappable battery designs enable quicker charging cycles, enhanced reliability, and easier maintenance for commercial and industrial UAV fleets. This reduces downtime and increases operational efficiency for professional drone operators

- The integration of smart Battery Management Systems (BMS) with IoT-enabled monitoring allows real-time tracking of battery health, optimizing performance, and preventing failures during critical operations

- This trend toward higher energy density, smarter monitoring, and operational reliability is reshaping expectations for UAV performance. Companies such as DJI and MaxAmps are leading innovations that enable drones to operate longer while maintaining safety and efficiency

- The growing demand for high-performance Drone (UAV) Batteries across commercial, defense, and logistics sectors is driving investment in next-generation battery technologies, reflecting a shift toward more robust and reliable aerial systems

What are the Key Drivers of Drone (UAV) Battery Market?

- The surging adoption of drones in commercial, agricultural, logistics, and defense applications is a primary driver for Drone (UAV) Battery demand, as longer flight durations are critical for productivity

- For instance, in 2024, DJI launched higher-capacity batteries for its industrial drones, addressing the need for extended inspection and mapping operations. This initiative highlights the importance of battery innovation for market growth

- The increasing integration of drones in delivery services, surveillance, and precision agriculture further fuels demand for reliable, long-lasting power sources. Batteries with rapid charging and modular designs offer operators operational flexibility and reduced downtime

- Furthermore, technological advancements in energy density, lightweight materials, and smart battery management systems are making UAV batteries safer and more efficient, enhancing the overall appeal of drones in commercial and industrial sectors

- The growing focus on renewable energy-powered drones and the expansion of the logistics, inspection, and defense sectors are accelerating the demand for specialized UAV batteries, reinforcing their significance as a critical component of drone performance and reliability

Which Factor is Challenging the Growth of the Drone (UAV) Battery Market?

- High costs associated with advanced, high-capacity drone batteries remain a significant barrier for widespread adoption, particularly for small commercial operators and hobbyists

- For instance, lithium-ion UAV batteries from premium brands such as Panasonic and LG Chem come at a premium, making them less accessible to budget-conscious users

- Safety concerns, including overheating, fire risks, and degradation over time, also pose challenges, requiring stringent quality control and regulatory compliance. Companies such as DJI and Amperex have implemented advanced thermal management and protective casing designs to mitigate these risks

- In addition, limited recycling infrastructure for lithium and nickel-based batteries adds to environmental concerns, influencing procurement decisions and operational costs

- Addressing these challenges through cost-effective production, robust safety features, and sustainable recycling initiatives will be critical for the sustained growth and mainstream adoption of Drone (UAV) Batteries in both commercial and recreational markets

How is the Drone (UAV) Battery Market Segmented?

The market is segmented on the basis of platform, technology, component, and capacity.

• By Platform

On the basis of platform, the drone (UAV) battery market is segmented into Consumer, Commercial, Government & Law Enforcement, and Military. The Commercial segment dominated the market with the largest revenue share of 45.3% in 2024, driven by the rising adoption of drones in industrial inspection, logistics, agriculture, and surveying applications. Businesses and enterprises prioritize high-performance batteries for reliable and extended drone operations, ensuring efficiency and productivity.

The Military segment is anticipated to witness the fastest CAGR of 23.5% from 2025 to 2032, fueled by increasing investments in UAV surveillance, reconnaissance, and defense applications. Military drones require robust, long-duration power sources capable of operating in challenging environments, and this rising demand is propelling growth in this segment. The surge in government-backed drone programs and strategic defense modernization further accelerates market adoption in military UAV battery solutions.

• By Technology

On the basis of technology, the drone (UAV) battery market is segmented into Lithium-based, Nickel-based, Fuel Cell, and Sodium-ion. The Lithium-based segment dominated the market with a revenue share of 62.4% in 2024, driven by its high energy density, lightweight design, and long cycle life, which are critical for commercial and industrial UAVs. Lithium batteries also support longer flight durations, faster charging, and better performance at varying altitudes, making them the preferred choice for most drone operators.

The Fuel Cell segment is expected to witness the fastest CAGR of 21.8% from 2025 to 2032, owing to its ability to deliver extended flight times, rapid refueling capabilities, and environmentally friendly operation. Increasing R&D in hydrogen fuel cells for UAVs and government initiatives supporting clean energy are key growth factors for this segment.

• By Component

On the basis of component, the drone (UAV) battery market is segmented into Cells, Battery Management Systems (BMS), Enclosures, and Connectors. The Cells segment dominated the market with the largest revenue share of 50.2% in 2024, as battery cells are the core component determining the energy density, flight time, and performance of UAVs. The segment benefits from continuous innovation in lithium-ion chemistry, higher energy densities, and lightweight designs.

The Battery Management Systems segment is expected to witness the fastest CAGR of 22.3% from 2025 to 2032, driven by the rising adoption of smart BMS solutions that monitor battery health, optimize charge-discharge cycles, and ensure safe operation. The integration of BMS with IoT-enabled monitoring and predictive maintenance solutions is boosting growth in commercial, military, and industrial applications.

• By Capacity

On the basis of capacity, the drone (UAV) battery market is segmented into <5 Ah and 5–20 Ah. The 5–20 Ah segment dominated the market with the largest revenue share of 58.7% in 2024, supported by its ability to provide extended flight durations and support high-performance commercial, industrial, and military drones. Batteries in this range are ideal for long-distance inspections, mapping, delivery services, and tactical UAV missions.

The <5 Ah segment is expected to witness the fastest CAGR of 20.5% from 2025 to 2032, as lightweight consumer drones and small commercial drones increasingly rely on compact, portable batteries for short-duration flights. The growth of hobbyist drone applications and lightweight UAVs is driving this segment’s expansion globally.

Which Region Holds the Largest Share of the Drone (UAV) Battery Market?

- North America dominated the Drone (UAV) Battery market with the largest revenue share of 42.5% in 2024, driven by the growing adoption of commercial, industrial, and defense UAVs, alongside advanced technological integration in drone battery solutions

- The region benefits from the presence of key market players, high investments in R&D, and strong consumer preference for high-performance, long-duration drone batteries

- This widespread adoption is further supported by favorable government policies, extensive UAV applications across logistics, surveillance, agriculture, and commercial sectors, establishing North America as the dominant market for Drone (UAV) Battery solutions

U.S. Drone (UAV) Battery Market Insight

The U.S. Drone (UAV) Battery market captured the largest revenue share of 80% in North America in 2024, driven by rapid commercialization of UAVs and high demand from industrial, military, and consumer drone applications. The U.S. continues to witness growth in autonomous UAV operations, drone delivery systems, and defense programs. Rising investments in battery R&D, advanced lithium-ion solutions, and energy-efficient UAV platforms are fueling market expansion. Integration with IoT and AI-enabled drones further strengthens market adoption across commercial, agricultural, and public safety applications.

Europe Drone (UAV) Battery Market Insight

The Europe Drone (UAV) Battery market is expected to expand at a substantial CAGR throughout the forecast period, driven by the increasing adoption of drones in commercial, agricultural, and industrial sectors. Stringent aviation regulations and focus on eco-friendly battery solutions are fostering growth. European countries are witnessing investments in smart battery technologies, longer-duration UAV operations, and integration of drone batteries in emerging applications such as logistics and urban air mobility. Germany, France, and the U.K. remain key markets supporting both innovation and adoption.

U.K. Drone (UAV) Battery Market Insight

The U.K. Drone (UAV) Battery market is anticipated to grow at a notable CAGR during the forecast period, supported by government initiatives promoting UAV technology, investments in drone startups, and increased applications in commercial delivery, public safety, and industrial inspections. Rising awareness about high-performance, long-flight batteries is driving adoption among businesses and hobbyist users.

Germany Drone (UAV) Battery Market Insight

The Germany Drone (UAV) Battery market is expected to grow steadily, fueled by advanced manufacturing infrastructure, strong R&D focus, and adoption of energy-efficient lithium-based battery solutions. Integration of drone batteries with AI-enabled UAVs for industrial and surveillance applications is contributing to sustained growth. Demand for secure, high-capacity batteries aligns with consumer and industrial expectations for reliable drone operations.

Which Region is the Fastest Growing Region in the Drone (UAV) Battery Market?

The Asia-Pacific Drone (UAV) Battery market is poised to grow at the fastest CAGR of 11.02% during 2025–2032, driven by rapid urbanization, increasing industrial UAV applications, and rising adoption of drones in agriculture, logistics, and commercial sectors in China, Japan, and India. Government incentives supporting UAV adoption and the presence of domestic battery manufacturers are boosting affordability and accessibility of drone batteries.

Japan Drone (UAV) Battery Market Insight

The Japan Drone (UAV) Battery market is gaining traction due to the country’s emphasis on high-tech manufacturing, advanced robotics, and autonomous UAV integration. Adoption is driven by industrial inspections, logistics, and smart city projects. Integration of high-capacity, energy-efficient batteries with AI-driven drones is enhancing operational efficiency.

China Drone (UAV) Battery Market Insight

The China Drone (UAV) Battery market accounted for the largest revenue share in Asia-Pacific in 2024, supported by rapid technological adoption, a growing UAV manufacturing ecosystem, and demand for commercial and consumer drones. Government initiatives promoting drone applications, smart city projects, and affordable battery solutions are key drivers of market expansion, positioning China as a critical hub for both production and consumption.

Which are the Top Companies in Drone (UAV) Battery Market?

The Drone (UAV) Battery industry is primarily led by well-established companies, including:

- Amperex Technology Limited (China)

- Autel Robotics (China)

- DJI (China)

- LG Chem (South Korea)

- MaxAmps (U.S.)

- Panasonic (Japan)

- Parrot (France)

- Samsung SDI (South Korea)

- Tadiran Batteries (Israel)

- Tattu (Shenzhen Grepow Battery Co., Ltd) (China)

- Ballard Power Systems (Canada)

- Cella Energy Limited (U.K.)

- Denchi Power Ltd (U.K.)

- EaglePicher Technologies (U.S.)

- H3 Dynamics (Singapore)

- Kokam (South Korea)

- OXIS Energy Ltd. (U.K.)

- Sion Power Corporation (U.S.)

- Tadiran Batteries GmbH (Germany)

What are the Recent Developments in Drone (UAV) Battery Market?

- In June 2025, Sion Power Corporation installed a new large-format battery cell production line, developed in partnership with Mühlbauer Group, enhancing its manufacturing capabilities and strengthening its position in the high-performance battery market

- In May 2025, Intelligent Energy Limited signed an agreement with IBT to develop a 100 kW fuel cell generator, based on Intelligent Energy's evaporatively cooled IE-DRIVE fuel cell technology, aiming to advance high-efficiency fuel cell solutions for industrial and commercial applications

- In March 2025, Plug Power Inc. collaborated with Southwire, a global leader in hydrogen solutions, to introduce a clean hydrogen ecosystem in Texas, creating innovative pathways for sustainable energy and hydrogen-powered applications

- In January 2025, SES AI Corporation unveiled a brand-new AI-enhanced 2170 cylindrical cell for emerging humanoid robotics and drone applications at the 2025 CES Show in Las Vegas, Nevada, boosting performance and efficiency in next-generation robotics and UAV technologies

- In September 2024, H3 Dynamics partnered with Oxford's Qdot Technology to develop a hydrogen-powered, long-range vertical takeoff and landing (VTOL) aircraft, advancing sustainable aviation and next-generation VTOL innovations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.