Global Drug Discovery Services Market

Market Size in USD Billion

CAGR :

%

USD

14.68 Billion

USD

44.91 Billion

2022

2030

USD

14.68 Billion

USD

44.91 Billion

2022

2030

| 2023 –2030 | |

| USD 14.68 Billion | |

| USD 44.91 Billion | |

|

|

|

|

Drug Discovery Services Market Analysis and Size

According to the American Cancer Society, approximately 1.8 million new cancer cases were diagnosed in 2020, with an estimated 606,520 cancer deaths occurring in the United States. Thus, the increasing burden of diseases and its global burden drive demand for drug discovery services. For better drug candidate identification, there has been an increase in the use of advanced technologies such as bioinformatics, high throughput, and combinatorial chemistry. With emerging technologies, drug discovery has evolved significantly, making the process more refined, accurate, and time-consuming.

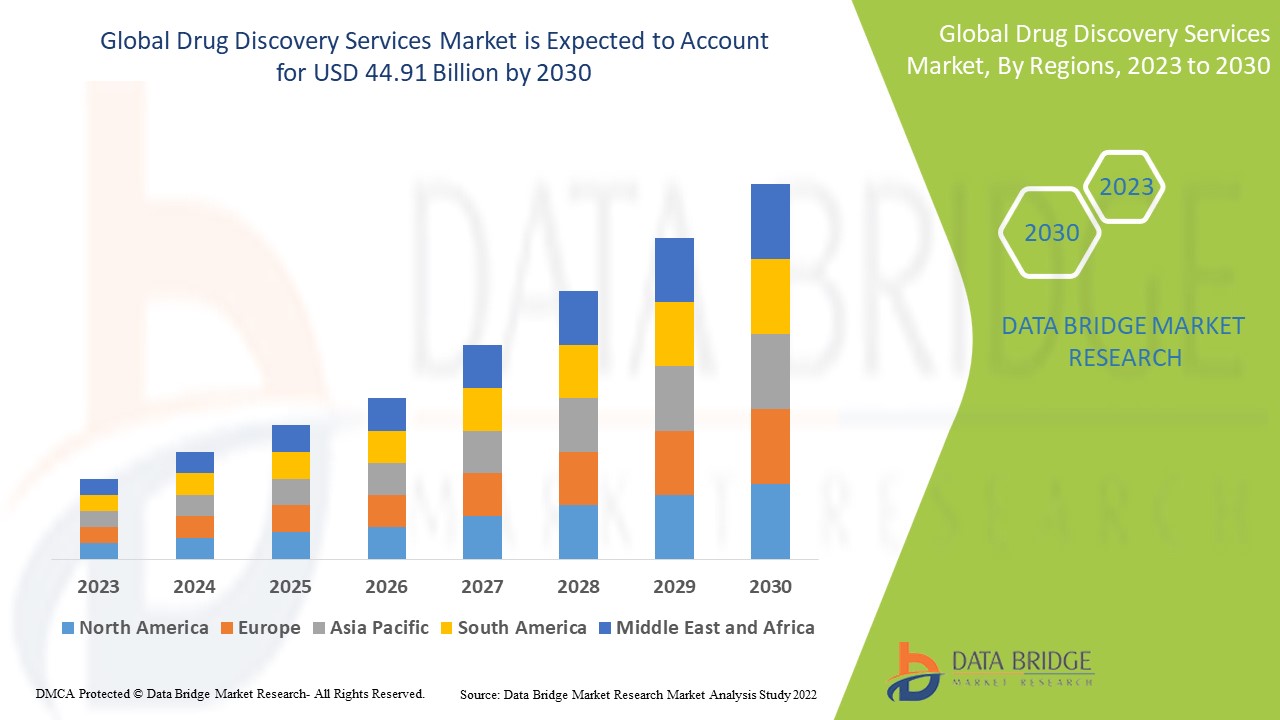

Data Bridge Market Research analyses that the drug discovery services market, which was USD 14.68 billion in 2022, is expected to reach USD 44.91 billion by 2030, at a CAGR of 15.00% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Drug Discovery Services Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Medicinal Chemistry Services, Biology Services, Drug Metabolism and Pharmacokinetics), Process (Target Validation, Target Selection, Hit-To-Lead Identification, Candidate Validation, Lead Optimization), Drug Type (Biologics, Small Molecules), Therapeutic Area (Neurology, Diabetes, Oncology, Respiratory Diseases, Cardiovascular Diseases, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

General Electric (U.S.), Eurofins Scientific (U.S.), PPD Inc. (U.S.), Syngene International Limited (India), Wuxi AppTec (China), Frontage Labs (U.S.), Galapagos NV (Belgium), Aurigene Discovery Technologies (India), Genscript (U.S.), Domainex (U.K.), WIL Research Laboratories LLC (U.S.), Shanghai Medicilon, Inc. (China), Labcorp Drug Development (U.S.), Jubilant Biosys Ltd. (India), Evotec (Germany), Shanghai ChemPartner (China), Charles River Laboratories (U.S.), Merck & Co. Inc. (U.S.), and Thermo Fisher Scientific Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Drug discovery is the process of identifying a compound that can be used to treat and cure diseases. A drug discovery effort typically addresses a biological target that has been shown to play a role in disease development or begins with a molecule with interesting biological activities. Drug discovery has recently evolved significantly as a result of emerging technologies, allowing the process to become more refined, accurate, and time-consuming. Drugs were discovered by identifying the active ingredient in traditional remedies or by chance, as in the case of penicillin.

Global Drug Discovery Services Market Dynamics

Drivers

- Rising demand for novel therapies for various therapeutic purposes

Drug discovery services market growth is expected to be driven by rising demand for novel medicine for chronic diseases and development in the global healthcare sector. Pharmaceutical and biopharma companies continue to outsource their research and development activities to contract research organisations (CROs), which provides R&D services and develop engagement models to maximise R&D productivity. The rising burden of chronic diseases is compelling governments and pharmaceutical companies to seek solutions and increase investment in clinical trials. As a result, the demand for drug discovery services will increase.

- Rising chronic disease burden

Chronic conditions such as diabetes, dementia, and cardiovascular disease have high socioeconomic costs and a high and rising patient illness burden. They cause seven out of every ten fatalities worldwide, accounting for more than 40 million deaths yearly. Chronic diseases, which are the leading causes of death and disability in the United States, account for the majority of healthcare costs. As a result, the global market for drug discovery services is expected to be driven by the prevalence of chronic diseases over the forecast period, resulting in an increase in R&D spending and research activities for developing novel drugs. There is a high demand for medications due to the increased prevalence of these chronic diseases which creates new economic opportunities for companies that provide drug discovery services.

Opportunities

- Increasing spending on R&D activities

The biopharmaceutical industry's increased R&D spending is driving demand for clinical trial and analytical test outsourcing. The global drug discovery services market is being propelled forward by increased research efforts on orphan pharmaceuticals and uncommon research diseases. The growing demand for biopharmaceutical treatments is propelling the biologics industry forward globally. Biopharmaceuticals alone account for approximately 20% of the pharmaceutical industry. The development of numerous novels and effective life-saving biologics treatments has increased demand. Biologics companies are encouraged to invest in developing new drugs for a wide range of common and uncommon diseases. Furthermore, patent expiration and rising demand for biologics in emerging markets propel the global drug discovery services market.

Restraints/Challenges

- High cost of drug molecules

A lack of skilled labor and a high target drug molecule failure rate will be the major impediments to the market. The drug development costs are high as millions of dollars are spent in preclinical research to identify a compound or design a drug.

This drug discovery services market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the drug discovery services market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Drug Discovery Services Market

The SARS-sudden CoV-2's emergence and spread prompted international multilateral organizations and private funders to pool their resources to support the development of an effective vaccine to combat the coronavirus and its variants. Around the world, a large number of scientists, technologists, and data managers are involved in everything from laboratory investigations to clinical trials. The COVID-19 intervention has assisted the government and healthcare sectors in understanding the importance of drug discovery in developing effective medications. As a result, many businesses have increased their R&D spending, and the government has prioritized drug discovery and development, which positively impacts the market for drug discovery services.

Countries' health systems are rapidly investing in research and development to combat the COVID-19 pandemic. Potential compounds were selected from the CHEMBL, ZINC, FDA-approved drugs, and clinical trial molecules. Worldwide, research teams are identifying drugs for the treatment of COVID-19 by screening both novel and existing drugs for their ability to alleviate symptoms and halt viral replication. As a result of the ongoing pandemic, the drug discovery services market is expected to benefit from the desire to find a cure for COVID-19.

Recent developments

- On December 3, 2021, Toxikon Corporation, a contract research company, acquired by Labcorp. Toxikon's acquisition is expected to broaden the company's product portfolio.

- On January 25, 2022, Evotec and Boehringer Ingelheim formed a target and drug development collaboration focused on iPSC-based disease modelling for ophthalmologic illnesses.

Global Drug Discovery Services Market Scope

The drug discovery services market is segmented on the basis of type, process, drug type and therapeutic area. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Medicinal Chemistry Services

- Biology Services

- Drug Metabolism and Pharmacokinetics

Process

- Target Validation

- Target Selection

- Hit-To-Lead Identification

- Candidate Validation

- Lead Optimization

Drug Type

- Biologics

- Small Molecules

Therapeutic Area

- Neurology

- Diabetes

- Oncology

- Respiratory Diseases

- Cardiovascular Diseases

- Others

Drug Discovery Services Market Regional Analysis/Insights

The drug discovery services market is analysed and market size insights and trends are provided by country, type, process, drug type and therapeutic area as referenced above.

The countries covered in the drug discovery services market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the drug discovery services market because of the availability of cutting-edge techniques, instruments, and facilities for drug discovery research in this region due to many qualified researchers and low-cost operations in emerging countries such as India and China.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2023 to 2030 owing to the strong presence of well-established CROs, and rising R&D expenditure by pharmaceutical and biopharmaceutical companies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Drug Discovery Services Market Share Analysis

The drug discovery services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to drug discovery services market.

Some of the major players operating in the drug discovery services market are:

- General Electric (U.S.)

- Eurofins Scientific (U.S.)

- PPD Inc. (U.S.)

- Syngene International Limited (India)

- Wuxi AppTec (China)

- Frontage Labs (U.S.)

- Galapagos NV (Belgium)

- Aurigene Discovery Technologies (India)

- Genscript (U.S.)

- Domainex (U.K.)

- WIL Research Laboratories LLC (U.S.)

- Shanghai Medicilon, Inc. (China)

- Labcorp Drug Development (U.S.)

- Jubilant Biosys Ltd. (India)

- Evotec (Germany)

- Shanghai ChemPartner (China)

- Charles River Laboratories (U.S.)

- Merck & Co. Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DRUG DISCOVERY SERVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DRUG DISCOVERY SERVICES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DRUG DISCOVERY SERVICES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S 5 FORCES MODEL

6 INDUSTRY INSIGHTS

7 REGULATORY FRAMEWORK

8 GLOBAL DRUG DISCOVERY SERVICES MARKET, BY PROCESS

8.1 OVERVIEW

8.2 HIT-TO-LEAD SERVICES

8.2.1 TARGET VALIDATION

8.2.2 ASSAY DEVELOPMENT

8.2.3 HIGH-THROUGHPUT SCREENING STUDIES

8.2.4 OTHER

8.3 TARGET IDENTIFICATION & VALIDATION

8.3.1 TARGET DECONVOLUTION

8.3.2 TARGET DISCOVERY

8.3.3 OTHER

8.4 HIT IDENTIFICATION

8.4.1 VIRTUAL SCREENING

8.4.2 MEDIUM OR HIGH-THROUGHPUT SCREENING

8.4.3 FRAGMENT SCREENING

8.4.4 KNOWLEDGE-BASED DESIGN

8.4.5 OTHER

8.5 LEAD OPTIMIZATION

8.5.1 TARGET OR PATHWAY ENGAGEMENT

8.5.2 HUMAN DOSE PREDICTIONS

8.5.3 PATENT FILINGS

8.5.4 TOXICITY STUDIES

8.6 CANDIDATE VALIDATION

8.6.1 IN SILICO SERVICES

8.6.2 IN VITRO SERVICES

8.6.3 IN VIVO SERVICES

8.6.4 OTHER

8.7 BIOINFORMATICS SERVICES

8.7.1 ANALYSIS OF PROTEOMICS

8.7.2 BIOMARKER DISCOVERY

8.7.3 PHARMACOGENOMICS AND TOXICOGENOMICS

8.7.4 OTHER

8.8 OTHERS

9 GLOBAL DRUG DISCOVERY SERVICES MARKET, BY TYPE

9.1 OVERVIEW

9.2 CHEMISTRY SERVICES

9.2.1 SYNTHETIC CHEMISTRY

9.2.2 MEDICINAL CHEMISTRY

9.2.3 COMPUTATIONAL CHEMISTRY

9.2.4 ANALYTICAL CHEMISTRY

9.2.5 OTHER

9.3 BIOLOGY DISCOVERY

9.3.1 MOLECULAR BIOLOGY

9.3.2 PROTEIN SCIENCES

9.3.3 CELL LINE DEVELOPMENT & ANALYSIS

9.3.4 ASSAY BIOLOGY & SCREENING

9.3.5 IN VIVO PHARMACOLOGY

9.3.6 TRANSLATION & GENOMICS BIOLOGY

9.3.7 ANTIBODY PRODUCTION & PURIFICATION

9.3.8 DRUG METABOLISM AND PHARMACOKINETICS (DMPK)

9.3.9 ABSORPTION, DISTRIBUTION, METABOLISM, AND EXCRETION (ADME)

9.3.10 OTHERS

9.4 SAFETY ASSESSMENT

9.4.1 IN VITRO CYTOTOXICITY

9.4.2 SKIN IRRITATION

9.4.3 PHOTOTOXICITY

9.4.4 SKIN SENSITIZATION

9.4.5 OTHERS

9.5 ANALYTICAL SUPPORT SERVICES

10 GLOBAL DRUG DISCOVERY SERVICES MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 SMALL MOLECULES DRUGS

10.2.1 FULL TIME EQUIVALENT (FTE) BASED

10.2.2 FEE FOR SERVICE (FFS) BASED

10.2.3 INTEGRATED DRUG DISCOVERY PROGRAMS

10.2.4 MILESTONE AND HYBRID MODELS

10.2.5 SHARED RISK MODEL

10.2.6 OTHER

10.3 BIOLOGICS

10.3.1 FULL TIME EQUIVALENT (FTE) BASED

10.3.2 FEE FOR SERVICE (FFS) BASED

10.3.3 INTEGRATED DRUG DISCOVERY PROGRAMS

10.3.4 MILESTONE AND HYBRID MODELS

10.3.5 SHARED RISK MODEL

10.3.6 OTHER

11 GLOBAL DRUG DISCOVERY SERVICES MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ONCOLOGY

11.3 NEUROLOGY

11.4 INFECTIOUS AND IMMUNE SYSTEM DISEASES

11.5 DIGESTIVE SYSTEM DISEASES

11.6 CARDIOVASCULAR DISEASES

11.7 IMMUNOLOGICAL DISEASES

11.8 GENITOURINARY DISEASE

11.9 OTHERS APPLICATIONS

11.9.1 ORPHAN & RARE DISEASES

11.9.2 PSYCHIATRY

11.9.3 DERMATOLOGY

11.9.4 OTHER

12 GLOBAL DRUG DISCOVERY SERVICES MARKET, BY SERVICE MODEL

12.1 OVERVIEW

12.2 FULL TIME EQUIVALENT (FTE) BASED

12.3 FEE FOR SERVICE (FFS) BASED

12.4 INTEGRATED DRUG DISCOVERY PROGRAMS

12.5 MILESTONE AND HYBRID MODELS

12.6 SHARED RISK MODEL

12.7 OTHER

13 GLOBAL DRUG DISCOVERY SERVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 ACADEMIC & RESEARCH INSTITUTES

13.3 CONTRACT RESEARCH ORGANIZATION

13.4 PHARMACEUTICALS & BIOPHARMACEUTICAL COMPANIES

13.5 BIOTECHNOLOGY COMPANIES

13.6 IN VITRO DIAGNOSTICS (IVD) COMPANIES

13.7 CLINICAL LABORATORIES

13.8 OTHERS

14 GLOBAL DRUG DISCOVERY SERVICES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT & APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL DRUG DISCOVERY SERVICES MARKET, BY GEOGRAPHY

GLOBAL DRUG DISCOVERY SERVICES MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

15.2 EUROPE

15.2.1 GERMANY

15.2.2 U.K.

15.2.3 ITALY

15.2.4 FRANCE

15.2.5 SPAIN

15.2.6 RUSSIA

15.2.7 SWITZERLAND

15.2.8 TURKEY

15.2.9 BELGIUM

15.2.10 NETHERLANDS

15.2.11 DENMARK

15.2.12 SWEDEN

15.2.13 POLAND

15.2.14 NORWAY

15.2.15 FINLAND

15.2.16 REST OF EUROPE

15.3 ASIA-PACIFIC

15.3.1 JAPAN

15.3.2 CHINA

15.3.3 SOUTH KOREA

15.3.4 INDIA

15.3.5 SINGAPORE

15.3.6 THAILAND

15.3.7 INDONESIA

15.3.8 MALAYSIA

15.3.9 PHILIPPINES

15.3.10 AUSTRALIA

15.3.11 NEW ZEALAND

15.3.12 VIETNAM

15.3.13 TAIWAN

15.3.14 REST OF ASIA-PACIFIC

15.4 SOUTH AMERICA

15.4.1 BRAZIL

15.4.2 ARGENTINA

15.4.3 REST OF SOUTH AMERICA

15.5 MIDDLE EAST AND AFRICA

15.5.1 SOUTH AFRICA

15.5.2 EGYPT

15.5.3 BAHRAIN

15.5.4 UNITED ARAB EMIRATES

15.5.5 KUWAIT

15.5.6 OMAN

15.5.7 QATAR

15.5.8 SAUDI ARABIA

15.5.9 REST OF MEA

15.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL DRUG DISCOVERY SERVICES MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL DRUG DISCOVERY SERVICES MARKET, COMPANY PROFILE

17.1 LABCORP DRUG DEVELOPMENT

17.1.1 COMPANY OVERVIEW

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 EUROFINS SCIENTIFIC

17.2.1 COMPANY OVERVIEW

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CHARLES RIVER LABORATORIES

17.3.1 COMPANY OVERVIEW

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 EVOTEC

17.4.1 COMPANY OVERVIEW

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 WUXI APPTEC

17.5.1 COMPANY OVERVIEW

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 SYNGENE INTERNATIONAL LIMITED

17.6.1 COMPANY OVERVIEW

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 CURIA GLOBAL, INC.

17.7.1 COMPANY OVERVIEW

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 AURIGENE PHARMACEUTICAL SERVICES LTD.

17.8.1 COMPANY OVERVIEW

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 PHARMARON

17.9.1 COMPANY OVERVIEW

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 PIRAMAL PHARMA SOLUTIONS

17.10.1 COMPANY OVERVIEW

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 THERMO FISHER SCIENTIFIC INC.

17.11.1 COMPANY OVERVIEW

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 JUBILANT BIOSYS LTD. (JUBILANT PHARMOVA LIMITED COMPANY)

17.12.1 COMPANY OVERVIEW

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 GENSCRIPT

17.13.1 COMPANY OVERVIEW

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 ONCODESIGN SERVICES

17.14.1 COMPANY OVERVIEW

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 SELVITA

17.15.1 COMPANY OVERVIEW

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 VIVA BIOTECH

17.16.1 COMPANY OVERVIEW

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 SHANGHAI MEDICILON INC.

17.17.1 COMPANY OVERVIEW

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 ARAGEN LIFE SCIENCES LTD.

17.18.1 COMPANY OVERVIEW

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 DALTON PHARMA SERVICES

17.19.1 COMPANY OVERVIEW

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 TCG LIFESCIENCES PRIVATE LIMITED.

17.20.1 COMPANY OVERVIEW

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

17.21 FRONTAGE LABS

17.21.1 COMPANY OVERVIEW

17.21.2 REVENUE ANALYSIS

17.21.3 GEOGRAPHIC PRESENCE

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENTS

17.22 NUVISAN PHARMA HOLDING GMBH

17.22.1 COMPANY OVERVIEW

17.22.2 REVENUE ANALYSIS

17.22.3 GEOGRAPHIC PRESENCE

17.22.4 PRODUCT PORTFOLIO

17.22.5 RECENT DEVELOPMENTS

17.23 CREATIVE BIOSTRUCTURE

17.23.1 COMPANY OVERVIEW

17.23.2 REVENUE ANALYSIS

17.23.3 GEOGRAPHIC PRESENCE

17.23.4 PRODUCT PORTFOLIO

17.23.5 RECENT DEVELOPMENTS

17.24 BIOASCENT

17.24.1 COMPANY OVERVIEW

17.24.2 REVENUE ANALYSIS

17.24.3 GEOGRAPHIC PRESENCE

17.24.4 PRODUCT PORTFOLIO

17.24.5 RECENT DEVELOPMENTS

17.25 ALBANY MOLECULAR RESEARCH INC. (AMRI)

17.25.1 COMPANY OVERVIEW

17.25.2 REVENUE ANALYSIS

17.25.3 GEOGRAPHIC PRESENCE

17.25.4 PRODUCT PORTFOLIO

17.25.5 RECENT DEVELOPMENTS

17.26 SAI LIFE SCIENCES LTD.

17.26.1 COMPANY OVERVIEW

17.26.2 REVENUE ANALYSIS

17.26.3 GEOGRAPHIC PRESENCE

17.26.4 PRODUCT PORTFOLIO

17.26.5 RECENT DEVELOPMENTS

17.27 BIODURO-SUNDIA

17.27.1 COMPANY OVERVIEW

17.27.2 REVENUE ANALYSIS

17.27.3 GEOGRAPHIC PRESENCE

17.27.4 PRODUCT PORTFOLIO

17.27.5 RECENT DEVELOPMENTS

17.28 BELLBROOK LABS

17.28.1 COMPANY OVERVIEW

17.28.2 REVENUE ANALYSIS

17.28.3 GEOGRAPHIC PRESENCE

17.28.4 PRODUCT PORTFOLIO

17.28.5 RECENT DEVELOPMENTS

17.29 SHANGHAI CHEMPARTNER

17.29.1 COMPANY OVERVIEW

17.29.2 REVENUE ANALYSIS

17.29.3 GEOGRAPHIC PRESENCE

17.29.4 PRODUCT PORTFOLIO

17.29.5 RECENT DEVELOPMENTS

17.3 DOMAINEX

17.30.1 COMPANY OVERVIEW

17.30.2 REVENUE ANALYSIS

17.30.3 GEOGRAPHIC PRESENCE

17.30.4 PRODUCT PORTFOLIO

17.30.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 CONCLUSION

20 QUESTIONNAIRE

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.