Global Drug Repurposing For Mitochondrial Disorders Market

Market Size in USD Million

CAGR :

%

USD

71.23 Million

USD

110.14 Million

2024

2032

USD

71.23 Million

USD

110.14 Million

2024

2032

| 2025 –2032 | |

| USD 71.23 Million | |

| USD 110.14 Million | |

|

|

|

|

Drug Repurposing for Mitochondrial Disorders Market Size

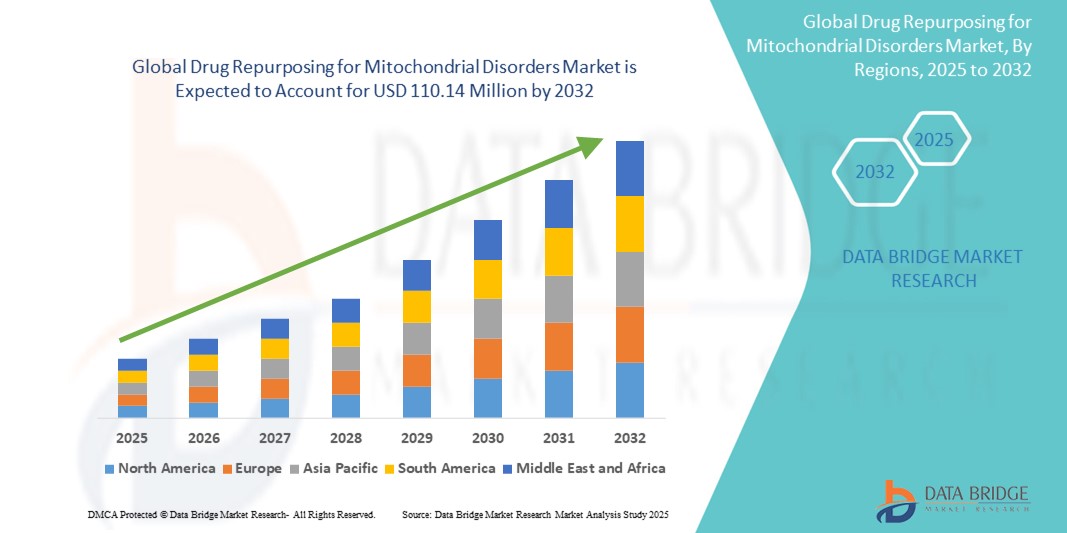

- The global drug repurposing for mitochondrial disorders market size was valued at USD 71.23 million in 2024 and is expected to reach USD 110.14 million by 2032, at a CAGR of 5.60% during the forecast period

- The market growth is largely fueled by the increasing exploration of drug repurposing strategies as a faster, cost-effective alternative to traditional drug development for mitochondrial disorders, leveraging existing safety and efficacy profiles of approved therapies.

- Technological advancements in genomics, bioinformatics, and high-throughput screening are further supporting the identification of new therapeutic uses for existing drugs, accelerating research into mitochondrial dysfunction-related diseases such as MELAS, Leigh syndrome, and mitochondrial myopathy. Moreover, rising awareness about rare and orphan mitochondrial diseases among healthcare providers, researchers, and patient advocacy groups is creating favorable conditions for investments in repurposing initiatives and clinical trials

Drug Repurposing for Mitochondrial Disorders Market Analysis

- Drug repurposing, which involves finding new therapeutic uses for existing medications, is emerging as a vital strategy in the treatment of mitochondrial disorders, offering faster development timelines, reduced costs, and lower risks compared to de novo drug development

- The growing demand for repurposed drugs is primarily fueled by increased awareness of mitochondrial diseases, unmet clinical needs, and advancements in genomic and metabolic research enabling better disease targeting

- North America dominated the drug repurposing for mitochondrial disorders market, capturing the largest revenue share of 41.7% in 2024, driven by early adoption of precision medicine approaches, strong research infrastructure, supportive regulatory frameworks, and the presence of key players actively engaged in drug repositioning trials for mitochondrial dysfunctions, especially in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the drug repurposing for mitochondrial disorders market during the forecast period, propelled by rising healthcare expenditures, increasing diagnosis rates of rare diseases, and growing collaborations between local biotech firms and global pharmaceutical companies

- Approved Drugs segment dominated the drug repurposing for mitochondrial disorders market, accounting for the largest market share of 58.4% in 2024, primarily due to the availability of regulatory-approved therapies for managing mitochondrial symptoms, increased clinician trust, and reimbursement eligibility. These drugs are often backed by clinical evidence and offer more predictable safety profiles, further fueling their preference among healthcare professionals

Scope and Drug Repurposing for Mitochondrial Disorders Market Segmentation

|

Attributes |

Drug Repurposing for Mitochondrial Disorders Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Drug Repurposing for Mitochondrial Disorders Market Trends

“Accelerated Innovation in Therapeutic Development and Treatment Personalization”

- A significant and accelerating trend in the global drug repurposing for mitochondrial disorders market is the growing focus on identifying novel uses for approved drugs, especially in the treatment of rare and difficult-to-treat mitochondrial conditions like Leigh Syndrome, MELAS, and LHON. This approach offers a faster and more cost-effective path to therapy development compared to traditional drug discovery

- For instance, the repurposing of idebenone, originally developed for neurological disorders, has shown promise in treating Leber’s Hereditary Optic Neuropathy (LHON), offering hope for vision preservation in affected individuals. Similarly, dichloroacetate (DCA)—once explored for cancer—has shown mitochondrial activity that makes it a candidate for treating metabolic disorders

- Drug repurposing enables healthcare providers and researchers to bypass early-phase safety trials, significantly shortening time-to-market and reducing development costs. This is crucial for mitochondrial disorders, where patient populations are small and traditional R&D may be economically unviable

- The integration of genomic profiling and biomarker-based stratification is also aiding the repurposing process. By identifying patient subgroups who are most likely to respond to existing drugs, companies are increasingly able to tailor therapies, improving outcomes and minimizing adverse effects

- Pharmaceutical companies are collaborating with academic and nonprofit organizations to establish centralized databases and patient registries, making it easier to evaluate drug efficacy in real-world settings. These alliances enhance transparency and accelerate clinical insights

- As a result, the demand for effective, accessible, and timely treatments for mitochondrial disorders is driving investments in drug repurposing strategies, unlocking new opportunities for improving patient care and expanding therapeutic pipelines globally

Drug Repurposing for Mitochondrial Disorders Market Dynamics

Driver

“Growing Need Due to Rising Prevalence of Rare Diseases and Unmet Medical Needs”

- The increasing global prevalence of mitochondrial disorders such as MELAS, Leigh Syndrome, and LHON, coupled with limited approved treatment options, is significantly driving the demand for drug repurposing strategies. This unmet clinical need has led researchers and pharmaceutical companies to explore new indications for already approved drugs to offer timely and cost-effective therapeutic solutions

- For instance, in 2024, the use of EPI-743 (vatiquinone), a redox-active small molecule initially developed for inherited mitochondrial diseases, showed promise in expanded indications such as pediatric mitochondrial epilepsy. Such initiatives by key players are expected to contribute significantly to market growth during the forecast period

- As patients and healthcare providers become more aware of the potential of repurposed drugs to offer quicker access to treatment, there is an increasing reliance on clinical trials, real-world evidence, and collaborative frameworks to validate off-label uses. This approach also reduces the time and cost associated with traditional drug discovery and development

- Furthermore, growing global attention toward orphan diseases and the availability of regulatory incentives—such as fast-track approvals, orphan drug designations, and extended exclusivity periods—are encouraging drug manufacturers to invest in the repurposing of known compounds for mitochondrial disorders

- The efficiency of repositioning drugs originally developed for conditions like cancer, cardiovascular disease, and neurodegeneration—now being tested for mitochondrial dysfunction—highlights the strategic importance of drug repurposing in both academic and pharmaceutical settings. This expanding trend is expected to enhance patient access and broaden therapeutic pipelines

Restraint/Challenge

“Limited Commercial Incentives and Complex Regulatory Pathways”

- Despite its advantages, drug repurposing for mitochondrial disorders faces significant challenges, including unclear regulatory pathways and limited commercial incentives. As many repurposed drugs are already off-patent, companies often struggle to justify the investment needed for additional clinical trials due to low return on investment

- For instance, while compounds like dichloroacetate (DCA) have shown potential in mitochondrial disease models, the lack of patent protection deters many pharmaceutical firms from pursuing full-scale development and commercialization

- In addition, obtaining regulatory approval for off-label or new indications requires substantial evidence, including new clinical data and safety profiles, which can be both time-consuming and expensive. The absence of streamlined global guidelines often adds complexity to multinational trials

- Reimbursement uncertainties and the hesitance of payers to cover off-label uses without sufficient supporting data further hinder patient access. This is especially prevalent in developing countries, where healthcare budgets are constrained and awareness of mitochondrial disorders remains low

- Overcoming these barriers will require policy reforms, new business models for public-private partnerships, and stronger funding mechanisms to incentivize drug repurposing. Increased collaboration between academia, biotech firms, and regulatory bodies will be crucial to navigating these challenges and ensuring broader market adoption

Drug Repurposing for Mitochondrial Disorders Market Scope

The drug repurposing for mitochondrial disorders market is segmented into four notable segments based on drug type, indication, route of administration, and end user.

- By Drug Type

On the basis of drug type, the drug repurposing for mitochondrial disorders market is segmented into approved drugs and off-label drugs. The approved drugs segment held the largest market revenue share of 58.4% in 2024, primarily due to the availability of regulatory-approved therapies for managing mitochondrial symptoms, increased clinician trust, and reimbursement eligibility. These drugs are often backed by clinical evidence and offer more predictable safety profiles, further fueling their preference among healthcare professionals.

The off-label drugs segment is projected to witness the fastest growth rate of 21.3% from 2025 to 2032, as researchers and clinicians continue exploring the repurposing of existing drugs—like antiepileptics, antioxidants, and metabolic modifiers—for rare mitochondrial indications that lack targeted therapies.

- By Indication

On the basis of indication, the market is segmented into Leigh Syndrome, MELAS (Mitochondrial Encephalomyopathy, Lactic Acidosis, and Stroke-like episodes), LHON (Leber Hereditary Optic Neuropathy), MERRF (Myoclonic Epilepsy with Ragged Red Fibers), and Others. The MELAS segment accounted for the largest market revenue share of 31.6% in 2024, owing to its relatively higher diagnosis rate and active clinical trial pipeline involving drugs such as arginine and dichloroacetate.

The Leigh Syndrome segment is expected to register the fastest CAGR of 22.8% during the forecast period due to the severe, early-onset nature of the disease and the growing number of research initiatives aimed at repurposing therapies for pediatric neurodegenerative conditions.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, injectable, and others. The oral segment held the largest market share of 64.2% in 2024, favored for its ease of administration, better patient compliance, and the availability of many repurposed drugs in oral form.

The injectable segment is expected to witness the highest growth, with a CAGR of 20.9% from 2025 to 2032, as some mitochondrial-targeting drugs, especially antioxidants and metabolic agents, are more effective in parenteral formulations.

- By End User

On the basis of end user, the drug repurposing for mitochondrial disorders market is segmented into hospitals, specialty clinics, homecare, and others. The hospitals segment dominated the market with a revenue share of 47.9% in 2024, driven by the concentration of rare disease diagnostic and treatment capabilities within large medical centers and academic institutions.

The homecare segment is projected to experience the fastest growth, with a CAGR of 23.1%, owing to increasing adoption of oral repurposed therapies and patient-centered models for long-term mitochondrial disorder management.

Drug Repurposing for Mitochondrial Disorders Market Regional Analysis

- North America dominated the drug repurposing for mitochondrial disorders market with the largest revenue share of 41.7% in 2024, driven by a strong presence of pharmaceutical innovators, robust research infrastructure, and substantial government and private funding for rare disease research

- The region benefits from early regulatory pathways such as FDA’s orphan drug designation and accelerated approval mechanisms, which are encouraging companies to invest in repurposing existing drugs for mitochondrial disorders

- Furthermore, high disease awareness, supportive reimbursement frameworks, and a growing number of clinical trials are strengthening North America's leadership in the drug repurposing domain. Institutions such as the NIH and MITOAction continue to promote collaborations, patient registries, and precision medicine approaches aimed at unlocking the therapeutic potential of existing compounds

U.S. Drug Repurposing for Mitochondrial Disorders Market Insight

The U.S. drug repurposing for mitochondrial disorders market accounted for 61% of North America's revenue share in 2024, owing to increased research grants, strong academic-industry partnerships, and the presence of leading players such as Stealth BioTherapeutics and Reneo Pharmaceuticals. The country’s active clinical trial pipeline and the FDA’s fast-track and orphan drug programs are enabling faster development and market entry of repurposed treatments. The demand is also fueled by patient advocacy groups pushing for access to novel therapies and improved diagnostic rates through newborn screening and genetic testing programs.

Europe Drug Repurposing for Mitochondrial Disorders Market Insight

The Europe drug repurposing for mitochondrial disorders market is projected to grow at a notable CAGR through 2032, driven by supportive regulatory initiatives such as the European Medicines Agency's (EMA) orphan designation and PRIME (Priority Medicines) scheme. Countries like Germany, the U.K., and France are investing in mitochondrial disease research, backed by biopharma collaborations and public health institutions. Moreover, EU-based rare disease consortiums are actively promoting data sharing and biomarker discovery to accelerate repurposing efforts.

U.K. Drug Repurposing for Mitochondrial Disorders Market Insight

The U.K. drug repurposing for mitochondrial disorders market is expected to register strong growth due to the increasing prioritization of rare disease treatment within the NHS and by regulatory agencies. The presence of organizations like the Mitochondrial Research Group (MRG) and the Wellcome Trust is fostering innovation in identifying and validating off-label drugs for rare mitochondrial syndromes. Favorable funding and fast-track access programs also contribute to market development.

Germany Drug Repurposing for Mitochondrial Disorders Market Insight

Germany’s drug repurposing for mitochondrial disorders market is expanding steadily, backed by a well-established biopharmaceutical sector, government-supported orphan drug research, and high healthcare spending. German biotech companies are actively exploring mitochondrial bioenergetics and oxidative stress pathways for potential drug repurposing. The country's focus on personalized medicine and access to advanced diagnostic platforms further supports early intervention and targeted therapy trials.

Asia-Pacific Drug Repurposing for Mitochondrial Disorders Market Insight

The Asia-Pacific drug repurposing for mitochondrial disorders market region is forecasted to grow at the fastest CAGR of 24% from 2025 to 2032, propelled by increasing investments in healthcare R&D, rising rare disease awareness, and government-driven initiatives for affordable treatments. Countries like China, Japan, and India are emerging as hubs for clinical trials and biosimilar development, with growing interest in repositioning affordable generics and traditional molecules for mitochondrial applications.

Japan Drug Repurposing for Mitochondrial Disorders Market Insight

Japan drug repurposing for mitochondrial disorders market is gaining traction in the field of drug repurposing, especially in neurometabolic and mitochondrial disorders. Backed by strong governmental support via the Pharmaceuticals and Medical Devices Agency (PMDA), Japanese companies are engaging in global partnerships to explore compounds for MELAS and LHON. An aging population and a focus on neurodegenerative conditions are aligning with repurposing opportunities for mitochondrial-related diseases.

China Drug Repurposing for Mitochondrial Disorders Market Insight

China drug repurposing for mitochondrial disorders market captured the largest revenue share in Asia-Pacific in 2024, supported by government-led rare disease programs and a robust pipeline of generics being explored for new indications. The Chinese market benefits from low-cost clinical trial capabilities, an expanding biotech ecosystem, and the rapid inclusion of mitochondrial conditions in national health policy. Research institutions and companies are increasingly collaborating on AI-driven drug repurposing to identify mitochondrial disease solutions from existing pharmaceutical libraries.

Drug Repurposing for Mitochondrial Disorders Market Share

The drug repurposing for mitochondrial disorders industry is primarily led by well-established companies, including:

- Retrotope, Inc. (U.S.)

- SOM Biotech (Spain)

- Khondrion (Netherlands)

- Stealth BioTherapeutics (U.S.)

- Minovia Therapeutics (Israel)

- Camurus AB (Sweden)

- Neuropathix, Inc. (U.S.)

- Reata Pharmaceuticals (U.S.)

- Astellas Pharma Inc. (Japan)

- Axcella Therapeutics (U.S.)

Latest Developments in Global Drug Repurposing for Mitochondrial Disorders Market

- In April 2025, researchers at the Gladstone Institutes in the U.S. reported promising results from a study involving a repurposed compound named HypoxyStat, which mimics the physiological effects of low-oxygen environments. Used in mice with Leigh syndrome, the drug extended lifespan by more than threefold and significantly improved neurological symptoms. This breakthrough points to a new therapeutic avenue for mitochondrial diseases and underscores the potential of hypoxia-mimicking agents in drug repurposing strategies

- In March 2025, Japanese scientists developed an innovative enzyme-based gene-editing system (mpTALENs) to correct mutations in mitochondrial DNA using patient-derived stem cells. This technology offers precision correction and presents a new frontier for mitochondrial drug repurposing and therapeutic interventions, especially for conditions like MELAS and MERRF syndromes

- In February 2025, NeuroVive Pharmaceutical advanced the development of KL1333, a repurposed NAD+ modulator, into early-phase clinical trials. The drug demonstrated improvements in muscle endurance and reduced fatigue in patients with mitochondrial myopathy, reinforcing its potential as a key treatment for multiple mitochondrial disorders

- In January 2025, the United Mitochondrial Disease Foundation (UMDF), in collaboration with Mayo Clinic, launched a screening project evaluating hundreds of approved compounds in cardiac cell models derived from MELAS patients. The aim is to identify off-label drugs that can reverse mitochondrial dysfunction, with selected candidates advancing toward clinical trials

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.